Did you know that almost 70% of customers switch banks due to poor service? This staggering statistic highlights the importance of conducting a Savings Bank Competition Study to understand customer needs and market dynamics better. A thorough competition study is essential for savings banks to not only retain existing customers but also attract new ones in an increasingly competitive financial landscape. In this article, we will delve into the steps necessary to start your own competition study, focusing on how to analyze competitors, evaluate customer preferences, and leverage insights for strategic advantages.

In essence, a Savings Bank Competition Study involves assessing the competitive landscape of savings banks, identifying key competitors, analyzing customer preferences, and evaluating market trends to improve service offerings and customer satisfaction. By understanding what drives customers to choose one bank over another, banks can craft targeted strategies that resonate with their clientele.

- Understanding the purpose of a competition study

- Identifying key competitors in the savings bank sector

- Analyzing customer needs and preferences

- Evaluating market trends and performance metrics

- Utilizing digital tools for data collection

- Crafting effective strategies based on research findings

- Implementing changes to improve customer satisfaction

- Monitoring ongoing competition and market shifts

- Leveraging insights for marketing strategies

- Preparing for future challenges in banking

Understanding Competition Studies in Savings Banks

A competition study is a vital process for savings banks to assess their position in the market. It involves analyzing competitors, understanding customer expectations, and evaluating market conditions. By conducting this study, banks can identify gaps in their services and make informed decisions to enhance their offerings. For instance, if a bank discovers that its competitors are offering better interest rates on savings accounts, it can take steps to adjust its rates or improve its marketing strategies to attract new customers.

Moreover, understanding what competitors are doing well allows banks to innovate and improve their services. For example, a bank might learn that a competitor has successfully implemented a user-friendly mobile banking app, prompting it to develop a similar solution to meet customer expectations. This knowledge not only helps in refining existing services but also aids in identifying new opportunities for growth.

In summary, a Savings Bank Competition Study is not just about knowing what others are doing; it’s about learning how to do it better. This foundational understanding sets the stage for deeper analysis in the following sections, where we will explore key competitors in the savings bank sector and the factors that drive customer preferences.

| Key Aspects of Competition Study | Description |

| Competitor Identification | Recognizing who your main competitors are |

| Customer Preferences | Understanding what customers want |

- Identifying main competitors

- Analyzing customer needs

- Evaluating market conditions

“Knowledge is power in the competitive banking landscape.”

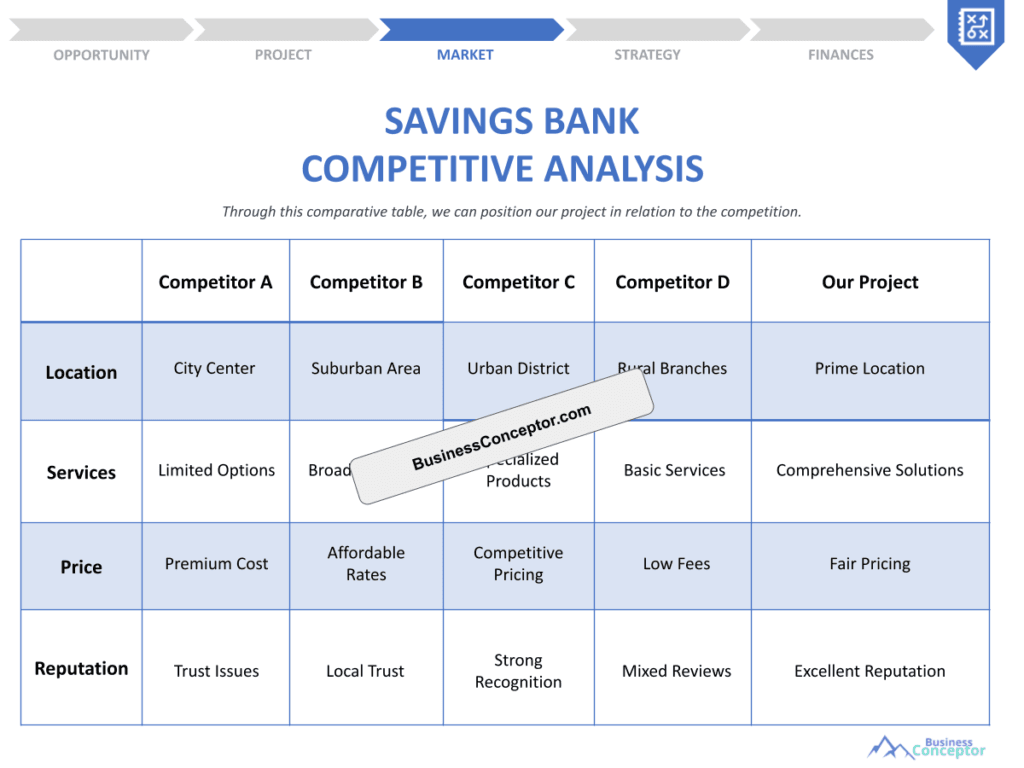

Key Competitors in the Savings Bank Sector

Identifying key competitors is the first step in conducting a competition study for savings banks. This process involves looking at both direct competitors, such as other savings banks, and indirect competitors like credit unions and online banks. Understanding who you are up against allows you to tailor your strategies effectively and position your bank favorably in the market.

For instance, recent data shows that over 30% of consumers prefer online banking due to its convenience and accessibility. This statistic highlights the need for traditional savings banks to consider not only their direct competitors but also alternative banking options that are gaining traction in the industry. By recognizing these competitors, banks can better strategize their offerings and marketing efforts to attract customers who may be tempted to switch.

Understanding your competitors’ strengths and weaknesses will help you carve out your niche in the market. This foundational knowledge is crucial as we move on to the next section about analyzing customer preferences and how they shape your offerings in a competitive landscape.

| Competitor Identification | Description |

| Direct Competitors | Other savings banks in the market |

| Indirect Competitors | Credit unions and online banks |

- Identify direct competitors

- Analyze indirect competitors

- Research competitor offerings

“In the world of banking, knowledge is your greatest asset.”

Analyzing Customer Preferences

Customer preferences are essential to a successful competition study. This involves gathering data on what customers value in a savings bank, such as interest rates, fees, and customer service. Understanding these preferences allows banks to develop tailored services that meet the needs of their clients.

For example, a bank may find that customers prefer online access to their accounts over in-person service. This insight can guide the bank in developing a more robust digital platform that caters to this demand. By understanding what drives customer satisfaction, savings banks can create services that not only attract new clients but also retain existing ones.

By connecting with customers and understanding their needs, banks can create tailored services that meet those demands. This insight is crucial as we move on to evaluating market trends, which will further inform how banks can position themselves to succeed.

- Importance of customer feedback

- Factors influencing customer choices

- Trends in customer behavior

“The customer is always right; listen and adapt.”

Evaluating Market Trends

Evaluating market trends is another critical aspect of a competition study for savings banks. This involves analyzing economic factors, technological advancements, and shifts in consumer behavior that could affect how banks operate. By staying aware of these trends, banks can position themselves to adapt quickly and effectively to changing market conditions.

For example, the rise of mobile banking apps has significantly changed how consumers interact with their banks. Many customers now prefer to manage their finances through their smartphones rather than visiting a physical branch. Understanding this trend can help savings banks develop their own mobile solutions to remain competitive and relevant in the eyes of tech-savvy consumers.

By keeping an eye on these trends, banks can position themselves to adapt quickly to changes in the market. This adaptability is key to staying competitive in a rapidly evolving financial landscape, and it leads us to the discussion of utilizing digital tools for data collection, which can enhance the research process.

| Market Trend | Impact on Savings Banks |

| Rise of digital banking | Increased competition |

| Consumer preference for convenience | Need for enhanced online services |

- Analyze economic conditions

- Monitor technological advancements

- Track shifts in consumer behavior

“Adaptability is the key to survival in the banking industry.”

Utilizing Digital Tools for Data Collection

Digital tools play a significant role in collecting and analyzing data for a competition study. From social media analytics to customer feedback platforms, these tools provide valuable insights that can help banks understand their competitive landscape better. Utilizing these resources allows banks to gather and interpret data effectively, leading to informed decision-making.

For instance, customer relationship management (CRM) software can enhance a bank’s understanding of its clientele. By analyzing data collected through a CRM, banks can identify patterns in customer behavior and preferences, which can inform their service offerings. This data-driven approach not only improves customer satisfaction but also helps banks stay ahead of their competitors.

By harnessing these digital tools, savings banks can make data-driven decisions that enhance their services and attract new customers. This leads us to discuss effective strategies based on research findings, which are essential for implementing changes that drive success.

| Digital Tools | Benefits |

| Social media analytics | Insights into customer opinions |

| CRM systems | Improved customer relationship management |

- Importance of CRM systems

- Analyzing social media trends

- Utilizing survey tools

Crafting Effective Strategies Based on Research Findings

Once the data is collected and analyzed, crafting effective strategies is the next logical step in a Savings Bank Competition Study. This means using the insights gained from the competition study to improve services and marketing efforts. By tailoring their strategies based on research findings, banks can better meet customer needs and differentiate themselves from competitors.

For example, if data shows that customers value lower fees, a savings bank might consider revising its fee structure to remain competitive. Additionally, if the analysis reveals a growing demand for online banking services, the bank can invest in developing a user-friendly mobile app or enhancing its online banking platform. These strategic adjustments can lead to increased customer satisfaction and loyalty.

By implementing strategies that are informed by research, banks can better meet customer needs and enhance their market position. This proactive approach is essential as we transition into discussing the importance of monitoring ongoing competition and how it affects strategic planning.

| Strategy | Expected Outcome |

| Adjusting fee structures | Increased customer acquisition |

| Enhancing digital services | Improved customer satisfaction |

- Revising service offerings

- Enhancing customer engagement

- Focusing on marketing initiatives

“Success in banking comes from adapting to the needs of the customer.”

Monitoring Ongoing Competition

Monitoring ongoing competition is essential for any savings bank that wants to stay ahead in the market. This involves regularly reviewing competitor actions and market conditions to ensure that your bank remains competitive. By staying informed about what competitors are doing, banks can quickly adapt their strategies and maintain a strong market position.

Utilizing competitive intelligence tools can help banks track changes in their competitors’ strategies, such as new product launches or promotional offers. For example, if a competitor introduces a high-yield savings account, your bank needs to assess whether it should match or exceed that offer to retain existing customers and attract new ones. This kind of agility is crucial for success in the fast-paced banking industry.

By staying informed about the competition, banks can identify opportunities for improvement and innovation. This ongoing monitoring sets the stage for leveraging insights for marketing strategies, which will be discussed in the next section.

| Monitoring Aspect | Tools to Use |

| Competitor analysis | Competitive intelligence software |

| Market condition reviews | Industry news platforms |

- Regularly check competitor websites

- Follow industry news

- Engage in customer surveys

Leveraging Insights for Marketing Strategies

Leveraging insights from a competition study can significantly enhance marketing strategies for savings banks. This means using data collected during the study to create targeted marketing campaigns that resonate with potential customers. By aligning marketing efforts with customer insights, banks can increase their reach and effectiveness in attracting new clients.

For example, if research indicates that younger customers prefer online banking solutions, marketing efforts should focus on promoting digital services, such as mobile apps and online account management. Additionally, utilizing social media platforms to engage with these customers can further enhance brand visibility and customer loyalty. Tailoring marketing messages based on customer preferences can lead to higher conversion rates and improved customer satisfaction.

By aligning marketing strategies with customer insights, savings banks can increase their reach and effectiveness. This approach not only helps in attracting new clients but also strengthens relationships with existing customers. This brings us to discuss preparing for future challenges in banking, which is essential for long-term success.

| Marketing Strategy | Target Audience |

| Digital marketing campaigns | Tech-savvy customers |

| Social media engagement | Young adults and millennials |

- Tailor messaging to customer segments

- Utilize social media effectively

- Invest in content marketing

“In marketing, understanding your audience is the key to success.”

Preparing for Future Challenges in Banking

The banking industry is continually evolving, and preparing for future challenges is crucial for savings banks that want to thrive. This involves staying informed about potential regulatory changes, technological advancements, and shifts in consumer behavior that could impact operations. By being proactive and adaptable, banks can navigate challenges more effectively and seize new opportunities.

Practical advice includes continuously investing in training for staff, adopting new technologies, and maintaining a flexible approach to service offerings. For example, banks that embrace digital transformation and invest in innovative technologies will be better positioned to meet customer demands and stay ahead of competitors. Additionally, fostering a culture of adaptability within the organization can enhance resilience in the face of change.

By being proactive and adaptable, savings banks can not only survive but thrive in a competitive environment. This forward-thinking approach is vital for ensuring long-term success in the dynamic world of banking.

| Future Challenge | Action to Take |

| Regulatory changes | Stay updated on legislation |

| Technological advancements | Invest in new technology |

- Stay updated on regulatory changes

- Invest in technology

- Train staff for adaptability

Conclusion

In conclusion, starting a Savings Bank Competition Study is a crucial step for banks looking to thrive in a competitive market. By understanding competitors, analyzing customer preferences, and leveraging digital tools, banks can craft effective strategies that lead to success. This proactive approach not only enhances customer satisfaction but also positions banks for long-term growth in the financial industry.

For those interested in developing a comprehensive business plan, consider checking out the Savings Bank Business Plan Template. This resource can help you lay a solid foundation for your savings bank.

Additionally, explore our articles for deeper insights on various aspects of savings banks:

- SWOT Analysis for Savings Bank: Strategies for Financial Growth

- Savings Bank Profitability: Tips for Maximizing Revenue

- Savings Bank Business Plan: Essential Steps and Examples

- Building a Financial Plan for Your Savings Bank: A Comprehensive Guide (+ Template)

- How to Create a Savings Bank: Complete Guide and Examples

- Create a Marketing Plan for Your Savings Bank (+ Example)

- How to Begin a Business Model Canvas for a Savings Bank: Step-by-Step Guide

- How Much Does It Cost to Establish a Savings Bank?

- How to Start a Feasibility Study for Savings Bank?

- How to Build a Risk Management Plan for Savings Bank?

- What Legal Considerations Should You Be Aware of for Savings Bank?

- What Funding Options Should You Consider for Savings Bank?

- Savings Bank Growth Strategies: Scaling Guide

FAQ

What is a Savings Bank Competition Study?

A Savings Bank Competition Study is an analysis that helps banks understand their competitive position in the market, focusing on customer preferences and competitor strategies.

Why is it important to identify key competitors?

Identifying key competitors is crucial as it allows savings banks to tailor their strategies and services to meet market demands effectively.

How can customer preferences influence banking strategies?

Understanding customer preferences helps banks adapt their offerings to align with what clients value most, such as low fees or digital services.

What digital tools can assist in data collection?

Digital tools like CRM systems and social media analytics provide insights into customer behavior and preferences, aiding in strategic planning.

How do market trends affect savings banks?

Market trends can indicate shifts in consumer behavior, guiding savings banks to innovate and stay competitive in their service offerings.

What strategies can be crafted from competition study findings?

Strategies may include adjusting service offerings, enhancing digital platforms, and improving customer engagement based on insights gathered from the study.

Why is ongoing monitoring of competition necessary?

Regularly monitoring competition enables banks to adapt quickly to changes in the market and maintain a competitive edge.

How can banks leverage insights for marketing strategies?

Banks can create targeted marketing campaigns based on customer insights, improving engagement and attracting new clients effectively.

What future challenges should banks prepare for?

Future challenges include regulatory changes, technological advancements, and evolving consumer preferences that could impact banking operations.

What is the ultimate goal of a competition study?

The ultimate goal is to enhance customer satisfaction and improve the bank’s market position through informed decision-making and strategic planning.