The microlending competition study reveals how diverse and dynamic the microfinance landscape has become. Microlending refers to the practice of providing small loans to individuals or groups who typically lack access to traditional banking services. This essential guide will navigate through the intricacies of microlending competition, highlighting its significance in empowering underserved communities and fostering economic growth.

- Understanding the microlending landscape

- Key players in the microlending sector

- Trends affecting microlending competition

- Challenges faced by microlenders

- The impact of technology on microlending

- Future of microlending and competition dynamics

Understanding the Microlending Landscape

The microlending landscape is a fascinating area of finance that plays a crucial role in economic development. It primarily aims to provide financial services to those who are traditionally excluded from the financial system. From farmers in rural areas to aspiring entrepreneurs in urban settings, microlending helps individuals take their first steps toward financial independence. The ability to access even a small amount of credit can be life-changing for many, allowing them to invest in their businesses, purchase essential goods, or manage unforeseen expenses.

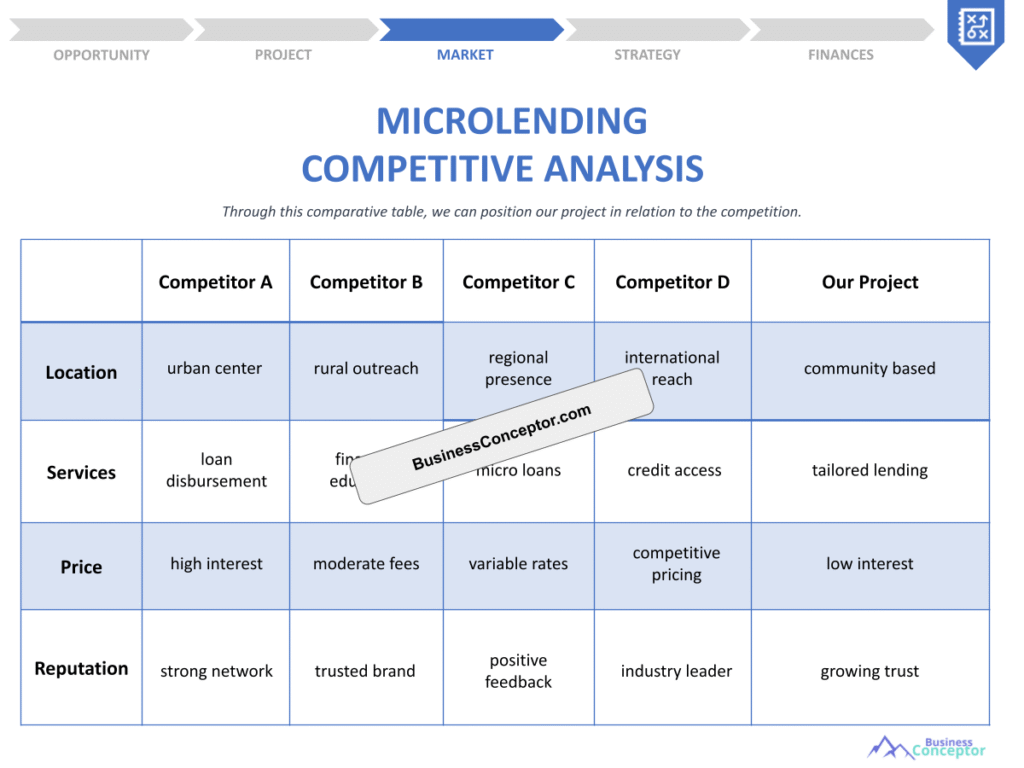

The microlending competition study sheds light on various players, from non-profits to fintech companies, all vying for a piece of the market. For example, Grameen Bank, one of the pioneers in microlending, has inspired countless institutions globally with its innovative approach to lending. The microfinance industry trends indicate a growing demand for financial inclusion, emphasizing the importance of understanding how competition among these institutions shapes the market.

Moreover, the advantages of microlending extend beyond mere financial transactions. By offering loans to individuals who lack access to traditional banking services, these institutions foster entrepreneurship, encourage savings, and promote community development. The social impact is profound, as families are empowered to improve their living conditions and contribute to local economies.

| Type | Examples |

|---|---|

| Non-profit organizations | Grameen Bank, Kiva |

| Fintech companies | Branch, Tala |

| Traditional banks | Some banks offering microloans |

- The microlending landscape is diverse.

- Key players include non-profits and fintech companies.

- Understanding this landscape is vital for stakeholders.

“Empowerment through finance is the key to unlocking potential.” 🌟

Key Players in the Microlending Sector

Diving deeper, let’s explore the key players in the microlending sector. Non-profit organizations have been at the forefront, often working closely with communities to provide loans without the burden of high-interest rates. These organizations are not only focused on profit but also on social impact, which is crucial for fostering community development. For instance, Kiva allows individuals to lend money to entrepreneurs across the globe, making a significant social impact by connecting lenders with borrowers directly. This direct connection fosters trust and transparency, which are essential in the microlending ecosystem.

On the other hand, fintech companies are revolutionizing the way microlending operates. With the rise of technology, these companies offer innovative solutions that make it easier for borrowers to access funds quickly. For example, companies like Branch and Tala provide quick loans directly to users’ phones, utilizing mobile technology to enhance accessibility. This has transformed the traditional lending model, allowing for faster approval times and lower operational costs. The efficiency and convenience of these platforms attract a new generation of borrowers who prefer digital solutions.

Furthermore, traditional banks are beginning to recognize the potential of microlending and are starting to offer microloans as part of their broader services. This can lead to increased competition in the sector, pushing all players to improve their offerings and customer service. The collaboration between traditional banks and fintech companies can also create a more robust framework for lending, allowing for better risk assessment and improved borrower experiences.

| Category | Description |

|---|---|

| Non-profits | Focus on social impact and community support |

| Fintech companies | Leverage technology for fast and accessible loans |

| Traditional banks | Offer microloans as part of broader financial services |

- Non-profits focus on social impact.

- Fintech companies use technology to enhance access.

- Traditional banks are beginning to enter the space.

“Innovation is the bridge between need and opportunity.” 🚀

Trends Affecting Microlending Competition

The microlending sector is not static; it evolves with trends that significantly influence competition. One notable trend is the rise of mobile banking, which has changed how borrowers interact with lenders. People now expect quick responses and easy access to funds, which has pushed traditional microlenders to adapt. For instance, many institutions have developed mobile applications that allow borrowers to apply for loans, check their balances, and make repayments all from their smartphones. This shift towards mobile accessibility is crucial in reaching underserved populations who may not have easy access to physical bank branches.

Moreover, the growing emphasis on sustainable finance has led to more socially responsible lending practices. Lenders are increasingly focusing on the social impact of their loans, not just the financial return. This trend is fostering a competitive edge for those who prioritize ethical lending. For example, some microlenders are now incorporating environmental, social, and governance (ESG) criteria into their lending decisions. This not only attracts socially conscious borrowers but also enhances the lender’s reputation in the market.

Additionally, data analytics is becoming an integral part of the microlending process. By utilizing data, lenders can gain insights into borrower behavior and preferences, allowing them to tailor their offerings accordingly. This data-driven approach helps in identifying potential risks and improving repayment rates, ultimately leading to a more sustainable lending model. With the right tools, microlenders can enhance their competitive strategies and better serve their clients.

| Trend | Impact on Competition |

|---|---|

| Mobile banking | Increased accessibility and faster loan approvals |

| Sustainable finance | Greater emphasis on social responsibility |

- Mobile banking enhances borrower accessibility.

- Sustainability trends are reshaping lender priorities.

- Competition is driven by innovation and social impact.

“Change is the only constant in the world of finance.” 🔄

Challenges Faced by Microlenders

While the opportunities in microlending are vast, challenges abound. One significant issue is over-indebtedness among borrowers. Many individuals take out multiple loans from different lenders, leading to financial strain and an inability to repay. This situation not only affects the borrowers but also poses risks for microlenders, as high default rates can jeopardize their sustainability. To combat this, microlenders need to develop better strategies to assess borrowers’ ability to repay. Implementing thorough credit assessments and offering financial education can help borrowers make informed decisions about taking on debt.

Additionally, regulatory changes can create hurdles for microlenders. Adapting to new laws and compliance requirements can be time-consuming and costly. For instance, some countries have introduced stricter lending guidelines to protect consumers, impacting the operations of microlenders. It is crucial for these institutions to stay informed about regulatory developments and ensure they comply with all legal requirements. By doing so, they can avoid penalties and maintain their reputation in the market.

Another challenge is the increasing competition in the microlending sector. As more players enter the market, microlenders must differentiate themselves to attract borrowers. This can lead to a race to the bottom in terms of interest rates, which may not be sustainable in the long run. To overcome this, microlenders should focus on providing exceptional customer service and tailored financial products that meet the unique needs of their clients. By emphasizing value over price, they can build long-term relationships with borrowers and foster loyalty.

| Challenge | Description |

|---|---|

| Over-indebtedness | Borrowers struggling with multiple loans |

| Regulatory changes | Compliance with new laws can be burdensome |

| Increasing competition | Need for differentiation in a crowded market |

- Over-indebtedness is a growing concern.

- Regulatory changes require adaptability from lenders.

- Microlenders must prioritize responsible lending.

“Every challenge is an opportunity in disguise.” 🌈

The Impact of Technology on Microlending

Technology has transformed microlending, making it more efficient and accessible. From online applications to mobile banking, tech innovations are streamlining the lending process. For instance, AI-driven credit scoring models allow microlenders to assess borrowers more accurately, reducing risk. This technology uses data analytics to evaluate a borrower’s creditworthiness based on various factors beyond traditional credit scores. As a result, lenders can extend credit to individuals who may not have qualified under conventional criteria, thus broadening their customer base.

Moreover, blockchain technology is emerging as a game-changer in the microlending space. It offers transparency and security, making transactions more trustworthy. With blockchain, every transaction is recorded on a decentralized ledger, which can help prevent fraud and build trust among borrowers and lenders. This increased security can enhance borrower confidence and potentially lead to higher repayment rates. As the technology matures, it could pave the way for innovative lending solutions, such as smart contracts that automatically execute loan agreements when certain conditions are met.

Furthermore, the rise of mobile applications has allowed microlenders to reach underserved populations effectively. Many people in rural areas may not have access to traditional banking services but own smartphones. By providing lending services through mobile apps, microlenders can facilitate easy access to funds for these individuals. This convenience not only attracts new borrowers but also encourages timely repayments, as borrowers can manage their loans from the palm of their hand.

| Technology | Effect on Microlending |

|---|---|

| AI-driven credit scoring | More accurate assessments of borrower risk |

| Blockchain | Increased transparency and security in transactions |

| Mobile applications | Enhanced accessibility for underserved populations |

- Technology streamlines the lending process.

- AI enhances risk assessment capabilities.

- Blockchain builds trust in microlending.

“Technology is the future of finance.” 💡

Best Practices for Microlenders

To navigate the competitive landscape effectively, microlenders should adopt best practices that not only enhance their operational efficiency but also improve borrower relationships. One crucial practice is ensuring transparency in loan terms and conditions. Clear communication about interest rates, repayment schedules, and any fees involved can build trust with borrowers. When clients understand what they are signing up for, they are more likely to engage positively with the lending process and maintain timely repayments.

Moreover, offering financial education to borrowers can significantly empower them. Many individuals who seek microlending services may lack knowledge about managing debt or budgeting effectively. By providing workshops or online resources, microlenders can equip their clients with the necessary tools to make informed financial decisions. This approach not only enhances the borrower’s ability to repay loans but also contributes to their overall financial literacy, creating a more sustainable lending environment.

Additionally, utilizing data analytics can help microlenders refine their lending strategies. By analyzing borrower behavior and preferences, lenders can tailor their offerings to meet the specific needs of their clients. For example, if data shows that a certain demographic prefers shorter loan terms, microlenders can adjust their products accordingly. This data-driven approach can lead to higher customer satisfaction and loyalty, as clients feel that their needs are being prioritized.

| Best Practice | Description |

|---|---|

| Transparency | Clear loan terms and conditions |

| Financial education | Empowering borrowers with knowledge |

| Data analytics | Refining lending strategies based on borrower behavior |

- Transparency fosters trust with borrowers.

- Financial education can lead to better outcomes.

- Data analytics enhances service offerings.

“Invest in your borrowers’ success for mutual growth.” 🌱

Future of Microlending and Competition Dynamics

Looking ahead, the future of microlending appears promising yet competitive. As more players enter the market, differentiation will be key. Microlenders will need to innovate continually to meet the evolving needs of borrowers. This could involve developing new financial products that cater to specific sectors, such as agriculture or small businesses. By focusing on niche markets, microlenders can establish themselves as experts in those areas, creating a loyal customer base.

Furthermore, partnerships between traditional banks and fintech companies could reshape the landscape of microlending. By combining resources, these entities can offer comprehensive financial services to underserved populations, enhancing their competitive advantage. For instance, a bank may provide capital while a fintech company handles the technology and customer interface. This collaboration can lead to improved service delivery and better access to funds for borrowers.

Additionally, the growing focus on social impact will likely drive competition in the microlending sector. Lenders that demonstrate a commitment to improving the lives of their clients and their communities will stand out. This could involve implementing socially responsible lending practices or engaging in community development projects. As consumers become more socially conscious, they are likely to favor microlenders that align with their values, further enhancing the importance of social responsibility in the competitive landscape.

| Future Trends | Implications |

|---|---|

| Increased competition | Need for unique offerings and customer service |

| Collaboration between sectors | Potential for better services and outreach |

- The future holds increased competition.

- Collaboration may enhance service offerings.

- Innovation will be essential for success.

“The best way to predict the future is to create it.” 🌍

Future of Microlending and Competition Dynamics

The future of microlending is poised for significant transformation as the sector continues to evolve amidst changing economic landscapes and consumer expectations. With the increasing demand for financial inclusion, microlenders must adapt to remain relevant and competitive. One of the most exciting prospects is the potential for innovation in product offerings. As more people become aware of the benefits of microlending, there is a growing opportunity to tailor financial products to meet specific needs, such as loans for education, healthcare, or sustainable farming practices.

Moreover, as digital technology continues to advance, the integration of artificial intelligence (AI) and machine learning in the microlending process is becoming more prevalent. These technologies can analyze vast amounts of data to assess risk more accurately and determine creditworthiness. This not only streamlines the approval process but also allows microlenders to offer personalized loan products that cater to individual borrower profiles. For example, by analyzing spending habits and repayment history, microlenders can provide loans with tailored terms that better suit the borrower’s financial situation.

Collaboration between traditional financial institutions and fintech companies is another significant trend shaping the future of microlending. By leveraging each other’s strengths, these partnerships can create a more robust lending ecosystem. Traditional banks can provide the capital and regulatory knowledge, while fintech companies offer innovative technology solutions and customer engagement strategies. This synergy can lead to improved access to credit for underserved populations, making it easier for them to obtain the funds they need to improve their lives.

| Future Trends | Implications |

|---|---|

| Innovation in product offerings | Tailored financial products for specific needs |

| AI and machine learning integration | More accurate risk assessment and personalized loans |

| Collaboration between sectors | Enhanced access to credit for underserved populations |

- The future holds exciting opportunities for innovation.

- AI can improve risk assessment in microlending.

- Collaboration can enhance service offerings.

“The future belongs to those who believe in the beauty of their dreams.” 🌟

Best Practices for Microlenders

As microlending continues to evolve, adopting best practices becomes essential for success in a competitive environment. One of the most effective strategies is to maintain a strong focus on customer service. Providing exceptional support throughout the borrowing process can significantly enhance customer satisfaction and loyalty. For instance, offering personalized loan consultations and ongoing communication can help borrowers feel valued and understood, which is crucial in building long-term relationships.

Additionally, implementing robust risk management practices is vital for the sustainability of microlenders. By utilizing data analytics and predictive modeling, microlenders can better understand the factors that lead to defaults and take proactive measures to mitigate risks. This might involve refining credit scoring models or developing targeted financial education programs that empower borrowers to make sound financial decisions. When borrowers are educated about managing their finances, they are more likely to repay their loans, which benefits both parties.

Another important aspect is fostering a culture of innovation within the organization. Encouraging employees to think creatively and propose new ideas can lead to the development of unique products and services that differentiate microlenders from their competitors. For example, introducing flexible repayment options or loyalty programs can enhance customer retention and attract new clients. Emphasizing innovation not only keeps the organization competitive but also aligns with the evolving needs of borrowers.

| Best Practice | Description |

|---|---|

| Customer service | Exceptional support throughout the borrowing process |

| Risk management | Utilizing data analytics to mitigate risks |

| Fostering innovation | Encouraging creative ideas and new product development |

- Customer service enhances satisfaction and loyalty.

- Risk management ensures sustainability.

- Innovation keeps microlenders competitive.

“Innovation distinguishes between a leader and a follower.” 🚀

Recommendations

In summary, the microlending competition study provides valuable insights into the evolving landscape of microlending, highlighting the importance of understanding key players, trends, challenges, and best practices. For those looking to dive deeper into the world of microlending, we recommend exploring our Microlending Business Plan Template. This comprehensive template can guide you in creating a robust business strategy tailored to the unique needs of the microlending sector.

Additionally, you may find the following articles useful for further enhancing your knowledge and strategy related to microlending:

- Microlending SWOT Analysis Insights & Trends

- Microlending: Profitability and Business Strategies

- Microlending Business Plan: Template and Tips

- Microlending Financial Plan: A Detailed Guide

- Starting a Microlending Business: A Comprehensive Guide with Examples

- Begin Your Microlending Marketing Plan with This Example

- Crafting a Business Model Canvas for Microlending: Step-by-Step Guide

- Identifying Customer Segments for Microlending Services (with Examples)

- How Much Does It Cost to Start a Microlending Business?

- Microlending Feasibility Study: Essential Guide

- Microlending Risk Management: Essential Guide

- Microlending Legal Considerations: Ultimate Guide

- Microlending Funding Options: Ultimate Guide

- Microlending Growth Strategies: Scaling Examples

FAQ

What are the current trends in the microlending industry?

The microlending industry is experiencing several trends that are reshaping how services are offered. Key trends include the rise of mobile microfinance platforms, which allow borrowers to access loans via their smartphones, and the increased emphasis on sustainable microfinance models. Additionally, the integration of technology, such as AI-driven credit scoring, is enhancing the efficiency and accessibility of lending services.

How does competition impact microlenders?

Competition in the microlending sector can drive innovation and improve service quality. As more players enter the market, microlenders must differentiate themselves by offering unique products and exceptional customer service. This competitive landscape encourages microlenders to adopt best practices and continuously improve their offerings to retain clients and attract new ones.

What are the challenges faced by microlenders?

Some challenges faced by microlenders include over-indebtedness among borrowers, which can lead to higher default rates. Additionally, regulatory changes may impose new compliance requirements that can be costly and time-consuming to navigate. Furthermore, the growing competition necessitates that microlenders constantly innovate and improve their services to stay relevant in the market.

What role does technology play in microlending?

Technology plays a crucial role in transforming microlending by streamlining operations and enhancing borrower access to funds. The use of mobile applications and blockchain technology increases transparency and security, while AI and data analytics improve risk assessment and loan personalization. These technological advancements enable microlenders to serve a broader audience and respond to customer needs more effectively.

How can microlenders ensure responsible lending practices?

To ensure responsible lending practices, microlenders should prioritize transparency in loan terms and provide financial education to borrowers. Implementing robust risk management strategies, such as thorough credit assessments and borrower education programs, can also help mitigate the risk of over-indebtedness. By fostering a culture of responsibility, microlenders can build trust with their clients and promote sustainable financial practices.