Insurance Broker Competition Study is a critical component for anyone looking to navigate the complex world of insurance brokerage. With the industry undergoing rapid changes, understanding the dynamics of competition can make all the difference between success and failure. Did you know that the competition among insurance brokers has intensified due to the emergence of digital platforms and InsurTech companies? These innovations are reshaping consumer expectations and altering the way insurance products are marketed and sold. In this guide, we will explore the key elements that define competition within the insurance brokerage sector, offering insights that can help brokers not only survive but thrive in this challenging environment.

In this article, you will learn about:

– The competitive landscape of insurance brokers

– Market trends that are reshaping the industry

– How to benchmark your performance against competitors

– The challenges brokers face and strategies to overcome them

– The role of technology in enhancing brokerage services

– Customer expectations that brokers must meet

– The future outlook for insurance brokers

Understanding the Competitive Landscape in Insurance Brokerage

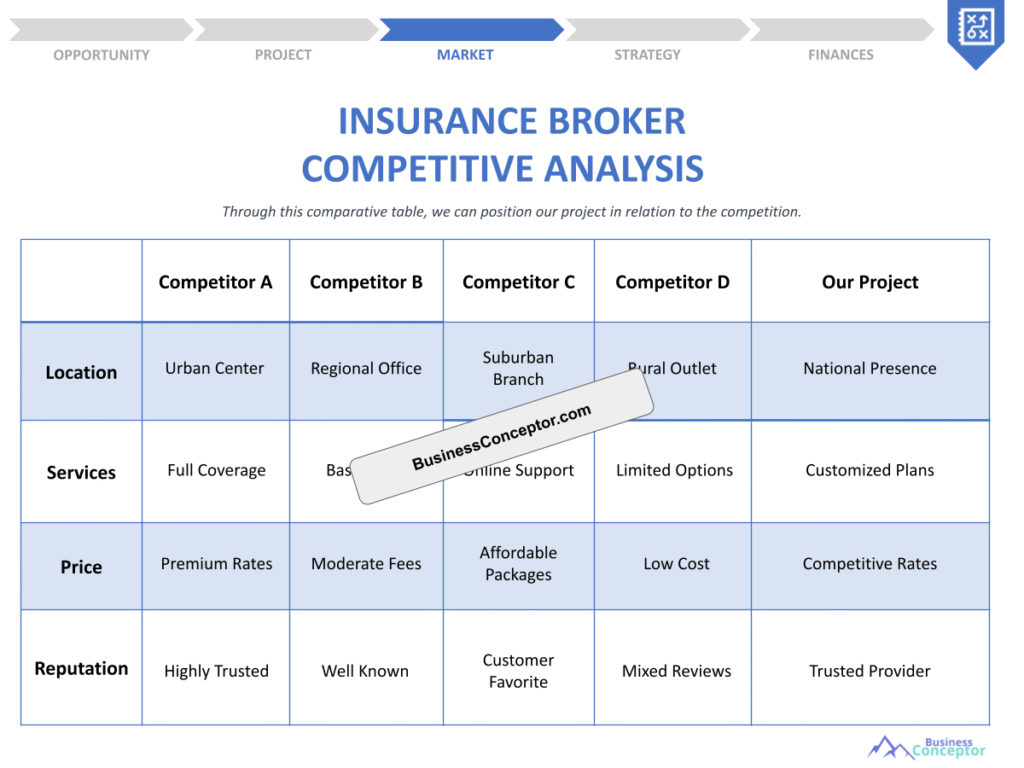

The competitive landscape in insurance brokerage is a complex web of traditional firms, emerging InsurTech companies, and direct insurers. Each player brings something unique to the table, making it essential for brokers to understand who their competitors are and what strategies they employ. For instance, traditional brokers often rely on long-established relationships with clients, while InsurTech firms leverage technology to offer more streamlined services and lower costs. This diversity in competition presents both challenges and opportunities for brokers.

One of the most significant advantages of understanding the competitive landscape is the ability to identify gaps in the market. By analyzing competitors, brokers can pinpoint areas where they can excel, whether it’s through superior customer service, specialized products, or innovative marketing strategies. For example, if a broker notices that their competitors are lacking in personalized service, they can seize this opportunity to differentiate themselves by focusing on building strong, long-term relationships with clients.

Furthermore, recognizing the strengths and weaknesses of competitors can guide brokers in refining their own business strategies. If a competitor is excelling in digital marketing but lacking in customer retention, a broker can choose to enhance their digital presence while also implementing customer loyalty programs. This dual approach not only improves competitiveness but also builds a robust business model that can withstand market fluctuations.

Additionally, understanding the competitive landscape allows brokers to stay ahead of industry trends. For example, the rise of consumer demand for personalized insurance solutions is a trend that brokers cannot afford to ignore. By offering tailored products that meet specific needs, brokers can attract a broader client base and foster customer loyalty.

To summarize, the competitive landscape is not just about knowing who your competitors are; it’s about leveraging this knowledge to create a unique value proposition that resonates with clients. Brokers who take the time to analyze the market will find themselves better equipped to make informed decisions that lead to sustained growth and profitability.

| Key Competitors | Strengths |

|---|---|

| Traditional Brokers | Established relationships |

| InsurTech Firms | Innovative solutions |

| Direct Insurers | Competitive pricing |

- Identify your key competitors.

- Analyze their strengths and weaknesses.

- Develop a unique selling proposition.

“Competition is not just about being better; it's about being different.” 🌟

Market Trends Affecting Insurance Brokers

In the fast-paced world of insurance brokerage, staying updated on market trends is crucial for any broker looking to maintain a competitive edge. The insurance industry is continuously evolving, driven by changing consumer preferences, technological advancements, and regulatory shifts. One significant trend is the increasing demand for personalized insurance solutions. Today’s consumers are not just looking for generic policies; they want options tailored to their unique needs and circumstances. This shift presents a golden opportunity for brokers who can adapt their offerings accordingly.

For instance, brokers who take the time to understand their clients’ specific requirements can offer customized packages that resonate with their audience. This level of personalization fosters trust and loyalty, making clients more likely to choose a broker who understands their individual needs over a faceless online platform. Moreover, by leveraging data analytics, brokers can gain insights into customer behaviors and preferences, enabling them to craft more appealing product offerings.

Another trend impacting the industry is the rise of digital platforms and InsurTech companies. These tech-driven firms are redefining how insurance products are marketed and sold. They often provide streamlined online experiences, allowing consumers to compare quotes and purchase policies with just a few clicks. Brokers who fail to embrace digital transformation risk falling behind their competitors. However, this challenge also opens doors for innovation. By investing in technology and improving their online presence, brokers can enhance customer engagement and attract a tech-savvy clientele.

Additionally, regulatory changes are continually reshaping the landscape. With new laws and compliance requirements emerging regularly, brokers must stay informed to avoid penalties and maintain credibility. Understanding these regulations can also serve as a competitive advantage. Brokers who proactively adapt their practices to meet compliance standards are more likely to build trust with clients, further solidifying their market position.

| Trend | Impact |

|---|---|

| Personalized Solutions | Higher customer satisfaction |

| Online Platforms | Increased competition |

| Regulatory Changes | Need for compliance |

- Monitor consumer preferences.

- Adapt to regulatory changes.

- Strengthen your online presence.

“Trends are like waves; ride them or get swept away.” 🌊

Performance Benchmarking for Insurance Brokers

Performance benchmarking is a vital tool for insurance brokers seeking to understand their standing in a competitive marketplace. By comparing their performance against industry standards, brokers can identify areas for improvement and growth. Key performance indicators (KPIs) such as customer retention rates, conversion rates, and revenue growth are essential metrics for this analysis. For example, if a broker discovers that their customer retention rate is significantly lower than the industry average, it may indicate a need to enhance customer service or engagement strategies.

Benchmarking allows brokers to set realistic goals and track their progress over time. By understanding what top-performing brokers are doing differently, they can adopt similar strategies to improve their own operations. For instance, if a broker learns that a competitor has successfully implemented a customer loyalty program that has boosted retention rates, they might consider launching a similar initiative to enhance their own client relationships.

Furthermore, utilizing benchmarking tools and software can provide deeper insights into industry standards and best practices. These tools often aggregate data from multiple sources, allowing brokers to see how they stack up against their peers. By identifying gaps in performance, brokers can develop targeted strategies to improve their service offerings and overall business practices.

It’s important to remember that benchmarking is not a one-time activity; it should be an ongoing process. As market conditions change and new competitors emerge, brokers need to continuously assess their performance and adapt their strategies accordingly. By making benchmarking a regular part of their business operations, brokers can stay ahead of the competition and ensure long-term success.

| KPI | Industry Average |

|---|---|

| Customer Retention Rate | 85% |

| Conversion Rate | 20% |

| Revenue Growth | 10% |

- Identify relevant KPIs for your business.

- Use benchmarking tools for insights.

- Implement best practices from top performers.

“What gets measured gets improved.” 📈

Challenges Facing Insurance Brokers Today

In the competitive world of insurance brokerage, brokers face a variety of challenges that can impact their success. One of the most pressing challenges is the increasing competition from InsurTech companies. These tech-driven firms are changing the game by offering lower-cost solutions and streamlined services that appeal to price-sensitive consumers. As a result, traditional brokers must find ways to differentiate themselves and demonstrate the unique value they provide. This challenge also presents an opportunity for brokers to enhance their service offerings, focusing on aspects that technology cannot replicate, such as personalized service and expert advice.

Another significant challenge is navigating the complex regulatory landscape. Insurance regulations are continually evolving, and brokers must stay informed to ensure compliance. Failing to do so can lead to penalties and damage to their reputation. However, brokers who proactively adapt to regulatory changes can use this knowledge as a selling point to build trust with clients. By demonstrating their commitment to compliance and ethical practices, brokers can distinguish themselves in a crowded market.

Additionally, the rise of consumer expectations presents another hurdle for insurance brokers. Today’s clients are not just looking for policies; they want transparency, responsiveness, and a high level of service. Brokers must prioritize clear communication and be readily available to address client inquiries. This level of service builds trust and loyalty among clients, making them more likely to return for future needs. Brokers who can exceed customer expectations will not only retain existing clients but also attract new ones through positive word-of-mouth referrals.

To overcome these challenges, brokers should focus on continuous improvement and innovation. Investing in training and professional development can equip brokers with the skills needed to adapt to market changes and meet client expectations effectively. Moreover, fostering a culture of adaptability within the organization can help brokers respond quickly to emerging trends and challenges, ensuring long-term success.

| Challenge | Solution |

|---|---|

| Competition from InsurTech | Enhance customer service |

| Regulatory Compliance | Ongoing education |

| High Consumer Expectations | Prioritize client communication |

- Focus on customer experience.

- Stay updated on regulations.

- Differentiating from tech competitors.

“Every challenge is an opportunity in disguise.” 💪

The Role of Technology in Insurance Brokerage

Technology is playing an increasingly pivotal role in the insurance brokerage industry, transforming how brokers operate and interact with clients. One of the most significant advantages of embracing technology is the ability to streamline administrative tasks. Automation tools can handle time-consuming processes such as data entry, policy renewals, and claims processing, allowing brokers to focus more on building relationships with clients. This efficiency not only saves time but also reduces the likelihood of errors, enhancing overall service quality.

Moreover, technology enables brokers to leverage data analytics to gain valuable insights into customer behavior and market trends. By analyzing data, brokers can identify patterns that inform their marketing strategies and product offerings. For instance, understanding which policies are most popular among specific demographics allows brokers to tailor their marketing efforts accordingly, increasing the likelihood of conversion. This data-driven approach can significantly enhance a broker’s competitive edge in the marketplace.

Additionally, the rise of digital marketing strategies offers brokers new avenues to reach potential clients. By utilizing social media, email marketing, and search engine optimization (SEO), brokers can enhance their online visibility and attract a broader audience. A strong online presence is essential in today’s digital age, as many consumers begin their insurance search online. Brokers who invest in their digital marketing efforts will likely see a higher engagement rate and an increase in leads.

However, while technology offers numerous advantages, it is essential for brokers to maintain a balance. Personal touch and human interaction remain crucial in the insurance industry. Clients still value the expertise and personalized service that only a knowledgeable broker can provide. Therefore, brokers should aim to integrate technology in ways that enhance, rather than replace, their personal interactions with clients.

| Technology | Benefit |

|---|---|

| Automation Tools | Increased efficiency |

| Data Analytics | Improved customer insights |

| Digital Marketing | Enhanced visibility |

- Embrace automation for efficiency.

- Utilize data for personalized offerings.

- Enhance digital marketing efforts.

“Technology is the great equalizer.” 🔧

Customer Expectations in Insurance Brokerage

In today’s competitive insurance landscape, understanding customer expectations is more critical than ever for brokers. Clients are no longer satisfied with just any insurance policy; they seek transparency, responsiveness, and a high level of personalized service. With the rise of digital platforms, consumers have become accustomed to instant access to information and quick responses to their inquiries. As a result, brokers must prioritize clear communication and be readily available to address client needs to build trust and foster loyalty.

One major aspect of meeting customer expectations is providing a seamless experience throughout the insurance journey. This includes everything from the initial consultation to policy renewal and claims processing. Clients appreciate brokers who take the time to explain complex insurance terms and conditions in simple language. By demystifying the process, brokers can empower clients to make informed decisions, which in turn enhances customer satisfaction and loyalty.

Additionally, brokers should leverage technology to improve customer interactions. Implementing customer relationship management (CRM) systems can help brokers track client communications and preferences, allowing for more personalized service. For instance, if a broker knows that a client prefers email communication over phone calls, they can tailor their approach accordingly. This level of customization not only meets client expectations but also strengthens the broker-client relationship.

Furthermore, providing timely updates and proactive communication is essential. Clients appreciate being kept informed about changes to their policies, upcoming renewals, and any claims they have filed. By proactively reaching out to clients, brokers can demonstrate their commitment to exceptional service and build a sense of trust. In a world where clients have numerous options, brokers who excel in customer service will stand out and retain their clientele.

| Expectation | Brokers’ Response |

|---|---|

| Transparency | Clear communication |

| Responsiveness | Timely responses |

| Personalized Service | Tailored offerings |

- Prioritize client communication.

- Offer digital solutions.

- Build trust through transparency.

“Happy clients are the best marketing strategy.” 😊

Future Outlook for Insurance Brokers

As the insurance industry continues to evolve, the future outlook for insurance brokers is filled with both challenges and opportunities. Brokers must remain agile and adaptable to navigate the shifting landscape successfully. One significant trend shaping the future is the increasing importance of technology in enhancing service delivery. Brokers who invest in the latest tools and platforms will likely find themselves at a competitive advantage. For instance, adopting advanced analytics can help brokers gain deeper insights into market trends and customer behaviors, allowing them to tailor their offerings more effectively.

Another critical factor influencing the future of insurance brokerage is the ongoing demand for personalized solutions. As clients become more aware of their options, they will expect brokers to provide tailored insurance products that meet their unique needs. This trend emphasizes the importance of building strong relationships with clients to understand their specific requirements fully. Brokers who can deliver customized solutions will not only retain existing clients but also attract new ones through referrals and positive reviews.

Moreover, continuous education and professional development will be essential for brokers looking to thrive in the future. As regulations change and new technologies emerge, staying informed will enable brokers to adapt quickly and maintain compliance. Investing in training programs can equip brokers with the skills needed to excel in a competitive environment.

Finally, collaboration with InsurTech companies can offer brokers additional advantages. By partnering with these tech-driven firms, brokers can access innovative solutions and tools that enhance their service offerings. This collaboration can lead to improved efficiency, better customer experiences, and ultimately, increased profitability.

| Future Consideration | Actionable Strategy |

|---|---|

| Consumer Preferences | Adapt service offerings |

| Technology Advancements | Invest in new tools |

| Collaboration Opportunities | Partner with InsurTech |

- Stay flexible and adaptable.

- Invest in continuous education.

- Embrace new technologies.

“The future belongs to those who prepare for it today.” 🌟

Insurance Broker Packages for Businesses

As the insurance landscape continues to evolve, insurance brokers must develop comprehensive packages tailored specifically for businesses. These packages not only address the unique needs of various industries but also provide added value that sets brokers apart from competitors. A well-structured insurance package can include a variety of policies, such as general liability, property, and workers’ compensation insurance, ensuring that businesses are adequately protected against potential risks.

One of the primary advantages of offering customized insurance packages is the ability to meet specific client needs. Different businesses face unique challenges, and a one-size-fits-all approach often falls short. For instance, a construction company may require specialized coverage for equipment and liability, while a tech startup might prioritize data protection and cyber liability insurance. By understanding the specific risks associated with each industry, brokers can create tailored solutions that resonate with clients and enhance their satisfaction.

Furthermore, providing comprehensive insurance packages can foster long-term relationships with clients. When businesses feel that their broker truly understands their needs and offers relevant solutions, they are more likely to remain loyal and refer others. This loyalty can lead to higher retention rates and increased revenue for brokers. Additionally, offering bundled packages can often result in cost savings for clients, as many insurers provide discounts for multiple policies. This financial incentive can further strengthen the broker-client relationship, positioning brokers as trusted advisors rather than just salespeople.

Moreover, brokers who proactively review and adjust these packages as businesses grow and evolve can showcase their commitment to client success. Regular check-ins to assess changing needs and risks allow brokers to maintain relevance and ensure that clients are always adequately protected. This level of service not only enhances client trust but also positions brokers as invaluable partners in their clients’ success.

| Package Type | Key Benefits |

|---|---|

| General Liability | Protection against lawsuits |

| Property Insurance | Coverage for physical assets |

| Workers’ Compensation | Employee injury coverage |

- Tailor packages to specific industries.

- Enhance client loyalty through customization.

- Provide cost savings with bundled policies.

“Your success is our success.” 🤝

Insurance Broker Consultation Services

In a complex and ever-changing insurance landscape, insurance broker consultation services play a pivotal role in guiding businesses and individuals toward making informed decisions. These services encompass a range of offerings, from initial assessments to ongoing support, ensuring clients receive the best possible advice tailored to their unique circumstances. By offering consultation services, brokers can establish themselves as trusted advisors, enhancing their credibility and fostering long-term relationships with clients.

One of the primary benefits of consultation services is that they allow brokers to understand their clients’ needs deeply. Through one-on-one meetings and thorough assessments, brokers can identify potential risks, coverage gaps, and areas for improvement. This personalized approach enables brokers to provide tailored recommendations that align with clients’ specific goals and circumstances. For example, a broker might recommend additional coverage for a business expanding into new markets, ensuring that the client is adequately protected against unforeseen challenges.

Additionally, providing expert consultation can help demystify the often complex world of insurance for clients. Many individuals and businesses struggle to navigate the various policies and options available, leading to confusion and potential missteps. Brokers who take the time to explain these intricacies can empower clients to make informed decisions. This education not only enhances the client’s understanding but also builds trust in the broker’s expertise.

Moreover, ongoing consultation services allow brokers to maintain a continuous relationship with their clients. Regular check-ins can help identify any changes in circumstances that may require adjustments to coverage. This proactive approach demonstrates a broker’s commitment to their clients’ well-being and positions them as a valuable partner in risk management. As clients see the benefits of having a knowledgeable broker by their side, they are more likely to remain loyal and refer others to the broker’s services.

| Consultation Service | Benefit |

|---|---|

| Initial Assessments | Identify coverage needs |

| Ongoing Support | Adjust coverage as needed |

| Expert Advice | Simplify complex options |

- Understand clients’ unique needs.

- Educate clients on insurance options.

- Maintain ongoing relationships for support.

“Knowledge is power, and we’re here to empower you.” 💡

Recommendations

In summary, understanding the dynamics of the insurance broker competition study is essential for brokers aiming to succeed in a rapidly evolving market. By staying informed about market trends, leveraging technology, and meeting customer expectations, brokers can position themselves for long-term success. To further assist you in your journey, consider using our Insurance Broker Business Plan Template. This template offers a structured approach to creating a comprehensive business plan tailored to your needs.

Additionally, explore our related articles to deepen your knowledge about the insurance brokerage industry:

- Insurance Broker SWOT Analysis Essentials

- Insurance Brokers: Unlocking Profit Potential

- Insurance Broker Business Plan: Template and Tips

- Insurance Broker Financial Plan: Step-by-Step Guide with Template

- Building an Insurance Broker Business: A Complete Guide with Practical Examples

- Start Your Insurance Broker Marketing Plan with This Example

- Start Your Insurance Broker Business Model Canvas: A Comprehensive Guide

- Understanding Customer Segments for Insurance Brokers (with Examples)

- How Much Does It Cost to Start an Insurance Broker Business?

- Ultimate Insurance Broker Feasibility Study: Tips and Tricks

- Ultimate Guide to Insurance Broker Risk Management

- Essential Legal Considerations for Insurance Brokers

- Exploring Funding Options for Insurance Brokers

- How to Implement Growth Strategies for Insurance Brokers

FAQ

What are the current market trends affecting insurance brokers?

Understanding insurance broker market trends is crucial for staying competitive. Key trends include the growing demand for personalized insurance solutions, the rise of InsurTech companies, and evolving consumer expectations. By adapting to these trends, brokers can better meet client needs and enhance their service offerings.

How can I benchmark my performance as an insurance broker?

Broker performance benchmarking involves comparing your key performance indicators (KPIs) such as customer retention rates and conversion rates against industry averages. This process helps identify areas for improvement and ensures that you remain competitive within the insurance brokerage market.

What challenges do insurance brokers face today?

Today, insurance brokers encounter several challenges, including increasing competition from InsurTech firms, navigating complex regulatory environments, and meeting high consumer expectations. Addressing these challenges requires ongoing education, adaptability, and a focus on exceptional customer service.

How does technology impact insurance brokerage?

Technology significantly influences the insurance brokerage sector by streamlining processes and enhancing customer interactions. Automation tools improve efficiency, while data analytics provide insights into customer behavior, allowing brokers to tailor their offerings and improve client satisfaction.

Why is understanding customer segments important for insurance brokers?

Understanding customer segments allows insurance brokers to tailor their services and marketing strategies effectively. By identifying the unique needs of different segments, brokers can develop targeted offerings that resonate with clients, leading to improved retention and increased profitability.

What should I include in my insurance broker business plan?

An effective insurance broker business plan should include an overview of your business model, market analysis, marketing strategy, financial projections, and operational plans. This comprehensive approach helps you define your goals and outlines the steps necessary to achieve them.

How can I implement growth strategies as an insurance broker?

To implement growth strategies, brokers should focus on enhancing their service offerings, improving customer engagement, leveraging technology, and exploring new market opportunities. Continuous evaluation and adaptation to market changes are essential for sustained growth in the insurance brokerage industry.