Did you know that nearly 70% of consumers have switched banks at least once in their lives? That staggering number highlights the importance of understanding Savings Bank Customer Segments. In a world where customer loyalty is increasingly fleeting, recognizing different customer segments allows banks to tailor their services and marketing strategies effectively. Savings bank customer segments refer to the various groups of customers that banks identify based on shared characteristics such as demographics, financial behaviors, and needs.

- Overview of savings bank customer segments.

- Importance of understanding customer demographics.

- Examples of different customer segments.

- Analysis of banking trends influencing segments.

- Strategies for targeting diverse customer groups.

- The role of technology in banking segmentation.

- Importance of customer feedback in service improvement.

- Key statistics on banking customer behavior.

- Future trends in customer segmentation.

- Conclusion and call to action for banks.

Understanding Customer Demographics in Savings Banks

Understanding customer demographics is essential for savings banks to develop effective strategies. Demographics include age, income, education, and geographic location. By analyzing these factors, banks can create tailored offerings that resonate with specific segments. For instance, young professionals may prioritize mobile banking features, while seniors might value personalized customer service.

Take, for example, a bank targeting millennials. This group often seeks digital solutions and user-friendly interfaces. By offering mobile apps with budgeting tools and instant transfers, banks can attract this segment. On the other hand, affluent customers may be more interested in wealth management services and exclusive benefits. Thus, recognizing these differences helps banks optimize their product offerings.

In summary, understanding customer demographics not only aids in attracting new clients but also in retaining existing ones. As we move forward, let’s explore how financial behaviors further define these segments.

| Demographic Factor | Importance in Banking Strategy |

|---|---|

| Age | Tailors product offerings |

| Income | Determines service levels |

- Tailored offerings based on age

- Importance of income levels

- Geographic factors influencing banking needs

– “Understanding your customer is the key to success.”

Analyzing Financial Behaviors

Financial behaviors provide insight into how customers interact with their savings banks. These behaviors include spending habits, saving patterns, and investment interests. By analyzing these factors, banks can design products that align with their customers’ financial goals. For example, customers who frequently save might appreciate higher interest rates on savings accounts.

According to recent studies, 55% of consumers report being more likely to stay with a bank that offers personalized savings plans. This statistic emphasizes the need for banks to understand their customers’ financial behaviors. If a bank recognizes that a segment prefers short-term savings, they can tailor their offerings accordingly, providing options that yield quick returns.

As we delve deeper into the topic, the next section will examine specific customer segments within savings banks and how they can be targeted effectively.

- Identify customer financial behaviors.

- Tailor products to meet specific needs.

- Monitor and adapt strategies based on feedback.

– The above steps must be followed rigorously for optimal success.

Targeting Specific Customer Segments

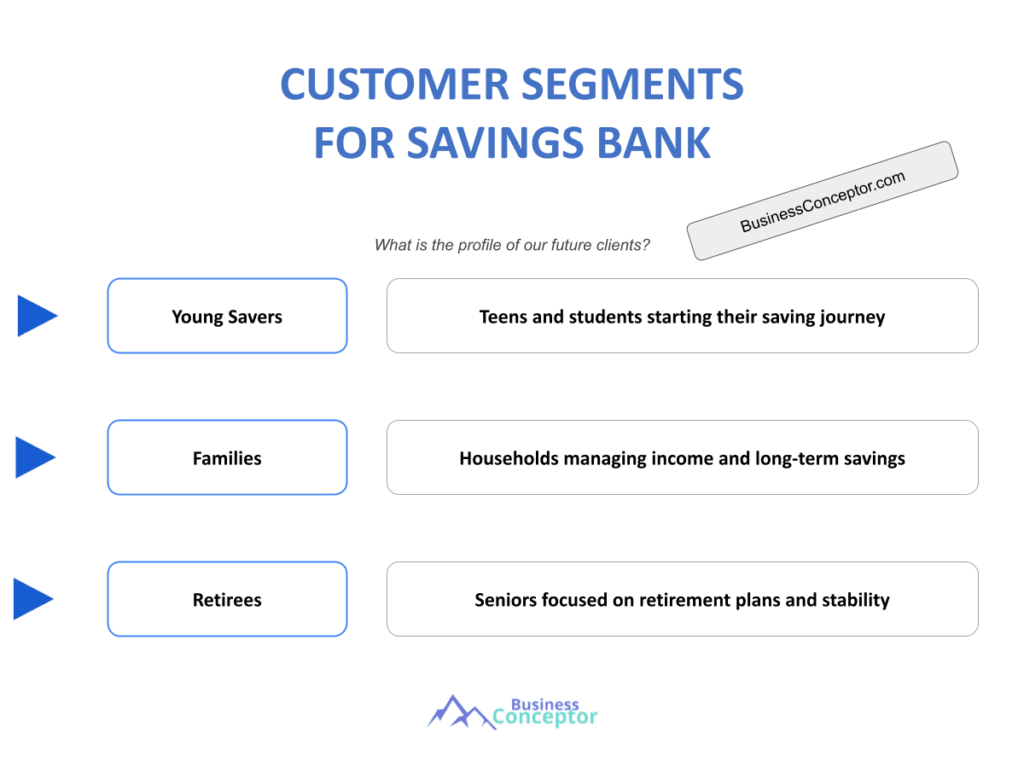

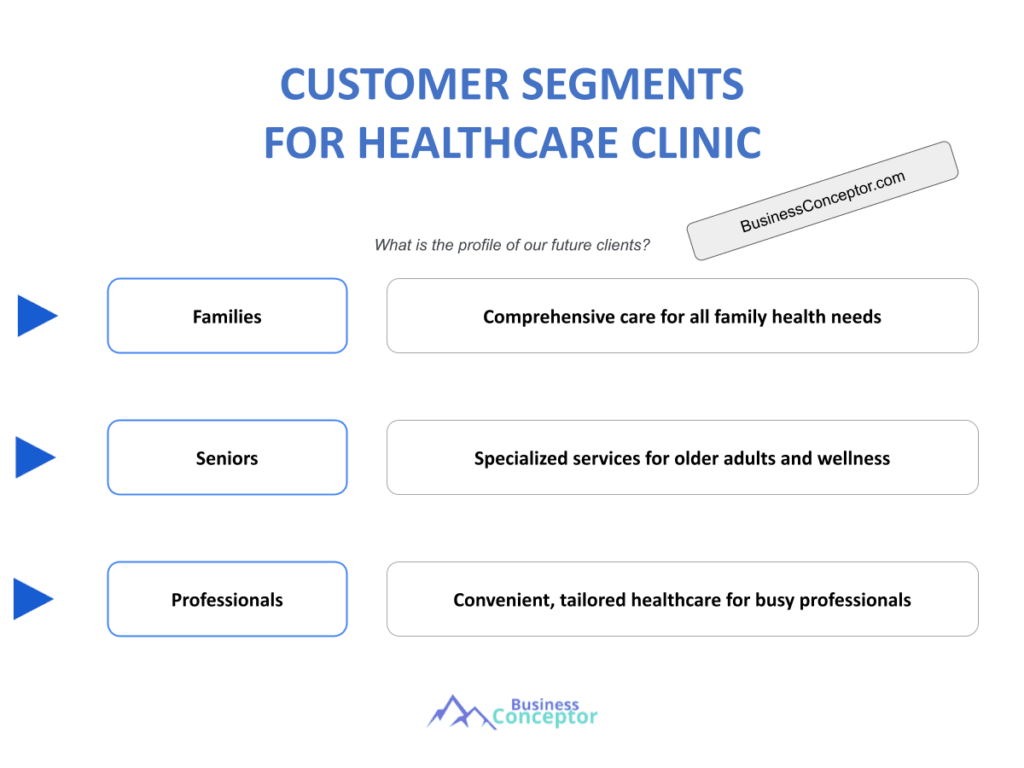

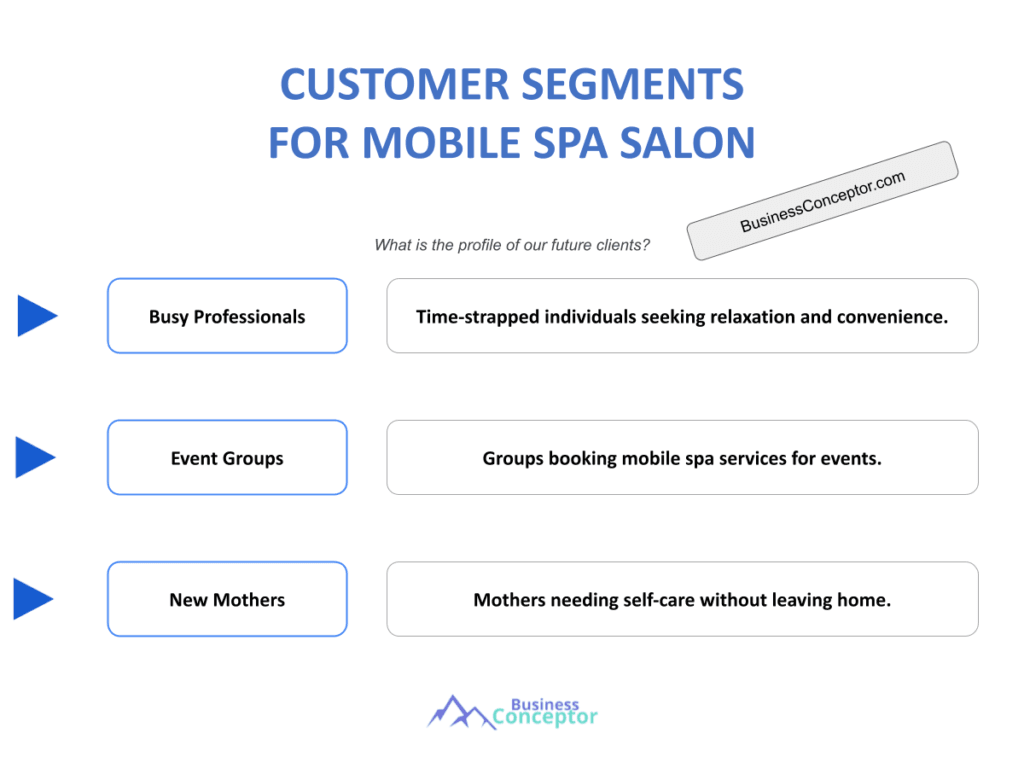

Targeting specific customer segments is a crucial strategy for savings banks. This involves understanding the unique needs of each group, such as young professionals, families, or retirees. Each segment has different priorities; for instance, families may prioritize savings accounts with low fees, while retirees may look for accounts with higher interest rates to sustain their income.

A practical example is a bank that launches a special savings account for students. By offering lower fees and educational resources about financial management, the bank can attract young customers who might later become lifelong clients. This approach not only helps in customer acquisition but also builds brand loyalty from an early age.

In conclusion, effectively targeting customer segments is vital for banks to remain competitive. The next section will explore how technology plays a role in understanding and reaching these segments.

- Importance of segmenting customer groups

- Tailored services for each segment

- Building loyalty through targeted marketing

– “To succeed, always move forward with a clear vision.”

The Role of Technology in Banking Segmentation

Technology has revolutionized how savings banks understand and serve their customers. With data analytics and customer relationship management (CRM) systems, banks can gain insights into customer preferences and behaviors. This information enables them to tailor their marketing strategies and improve customer service.

For example, banks can use algorithms to analyze transaction data, identifying spending habits and suggesting personalized savings plans. This level of customization not only enhances customer satisfaction but also drives engagement. Moreover, the rise of mobile banking apps has made it easier for customers to manage their accounts and access tailored financial advice.

As we transition to the next section, let’s discuss the significance of customer feedback in refining banking services and strategies.

| Technology | Impact on Customer Segmentation |

|---|---|

| Data Analytics | Personalized offerings |

| CRM Systems | Improved customer relationships |

- Implement data-driven strategies

- Utilize CRM for better insights

- Leverage mobile technology for engagement

– “Understanding your customer is the key to success.”

Importance of Customer Feedback

Customer feedback is invaluable for savings banks seeking to improve their services. By actively soliciting opinions through surveys and reviews, banks can identify areas for improvement and adapt their offerings. This feedback loop fosters a sense of community and shows customers that their opinions matter.

For instance, a bank that receives feedback about long wait times can implement changes to enhance customer service. Additionally, by addressing customer concerns, banks can build trust and loyalty, which is crucial in a competitive market. Engaging customers in this way not only helps in refining services but also encourages positive word-of-mouth marketing.

In summary, prioritizing customer feedback is essential for banks looking to maintain relevance and meet the evolving needs of their customer segments. The next section will examine current trends in customer segmentation.

| Benefit | Description |

|---|---|

| Improved Services | Direct response to customer needs |

| Increased Loyalty | Building trust and rapport |

- Solicit regular customer feedback

- Implement changes based on input

- Communicate improvements to customers

Current Trends in Customer Segmentation

Current trends in customer segmentation are shaping the future of savings banks. With the rise of digital banking, banks are increasingly focusing on behavioral segmentation, which groups customers based on their interactions and engagement with banking services. This approach allows for more tailored marketing and product development.

Moreover, the increasing importance of financial inclusion means that banks are expanding their offerings to underbanked populations. By creating products that cater to these segments, banks can tap into new markets and foster financial literacy. This trend not only benefits the banks but also promotes economic stability within communities.

As we explore the final aspects of savings bank customer segments, we will reflect on the key actions banks can take to implement these trends effectively.

| Trend | Impact on Savings Banks |

|---|---|

| Behavioral Segmentation | Tailored marketing strategies |

| Financial Inclusion | Access to new markets |

- Focus on behavioral segmentation

- Develop products for underbanked populations

- Enhance digital banking experiences

Key Actions for Savings Banks

To effectively cater to various customer segments, savings banks must adopt key actions that enhance their service delivery. These actions involve regularly updating their understanding of customer needs and preferences through market research and data analysis.

Additionally, banks should invest in training staff to recognize and respond to the diverse needs of customers. This training can empower employees to provide better service, fostering a customer-centric culture within the organization. Ultimately, these actions lead to improved customer satisfaction and loyalty.

In conclusion, implementing these key actions will help savings banks navigate the complexities of customer segmentation. Let’s now summarize the vital points discussed throughout the article.

| Action | Purpose |

|---|---|

| Market Research | Understand customer needs |

| Staff Training | Improve customer service |

- Conduct regular market research

- Invest in staff training programs

- Focus on customer-centric service

Future Directions for Savings Banks

Looking ahead, savings banks must remain agile and responsive to emerging trends in customer segmentation. This includes embracing technological advancements and adapting to the changing financial landscape. Staying ahead of these trends will be essential for maintaining a competitive edge.

Moreover, banks should prioritize sustainability and ethical banking practices, as consumers increasingly seek to align their values with their financial institutions. By promoting transparency and responsible lending, banks can attract socially conscious customers and build long-lasting relationships.

In summary, the future of savings banks lies in their ability to adapt and innovate. As we conclude this article, let’s reflect on the critical aspects of customer segmentation that can drive success.

| Direction | Focus Area |

|---|---|

| Technological Adaptation | Enhance customer experience |

| Ethical Banking Practices | Build trust and loyalty |

- Embrace technological advancements

- Promote ethical banking practices

- Stay responsive to market changes

Final Recommendations

In closing, understanding savings bank customer segments is a dynamic process that requires ongoing attention and adaptation. By implementing the strategies discussed, banks can better meet the needs of their diverse clientele.

Practical advice for banks includes regularly reviewing customer feedback, investing in employee training, and staying informed about industry trends. These steps will enhance customer satisfaction and loyalty, ultimately leading to increased profitability for the bank.

As we wrap up, remember that success in banking comes from a commitment to understanding and serving your customers. By focusing on their needs, banks can foster meaningful relationships that stand the test of time.

– “Success comes to those who persevere.”

- Regularly review customer feedback

- Invest in employee training

- Stay informed about industry trends

Conclusion

In summary, understanding savings bank customer segments is vital for banks to effectively meet the diverse needs of their clientele. By analyzing customer demographics, financial behaviors, and leveraging technology, banks can create tailored services that enhance customer satisfaction and loyalty. As the banking landscape continues to evolve, staying responsive to trends and prioritizing customer feedback will be crucial for success.

For those looking to start or improve their operations, consider using the Savings Bank Business Plan Template to guide your planning process.

Additionally, explore our other insightful articles on savings banks to further enhance your understanding and strategies:

- SWOT Analysis for Savings Bank: Strategies for Financial Growth

- Savings Bank Profitability: Tips for Maximizing Revenue

- Savings Bank Business Plan: Essential Steps and Examples

- Building a Financial Plan for Your Savings Bank: A Comprehensive Guide (+ Template)

- How to Create a Savings Bank: Complete Guide and Examples

- Create a Marketing Plan for Your Savings Bank (+ Example)

- How to Begin a Business Model Canvas for a Savings Bank: Step-by-Step Guide

- How Much Does It Cost to Establish a Savings Bank?

- How to Start a Feasibility Study for Savings Bank?

- How to Build a Risk Management Plan for Savings Bank?

- How to Start a Competition Study for Savings Bank?

- What Legal Considerations Should You Be Aware of for Savings Bank?

- What Funding Options Should You Consider for Savings Bank?

- Savings Bank Growth Strategies: Scaling Guide

FAQ Section

What are the main customer segments in savings banks?

The main customer segments in savings banks include young professionals, families, seniors, and small business owners. Each group has unique financial needs and preferences.

How can savings banks improve their customer retention?

Savings banks can improve customer retention by offering personalized services, regularly soliciting feedback, and adapting their products to meet the changing needs of their customers.

What role does technology play in banking?

Technology plays a crucial role in banking by providing data analytics, enhancing customer relationship management, and enabling mobile banking solutions that cater to customer preferences.

Why is financial inclusion important for savings banks?

Financial inclusion is important for savings banks as it allows them to serve underbanked populations, expand their market reach, and contribute to economic stability in communities.

What are some effective marketing strategies for savings banks?

Effective marketing strategies for savings banks include targeted advertising, community engagement, digital marketing, and educational initiatives to enhance financial literacy.

How can banks assess customer behavior?

Banks can assess customer behavior through data analysis, customer surveys, and monitoring transaction patterns to understand spending habits and preferences.

What are common pain points for savings bank customers?

Common pain points for savings bank customers include long wait times, lack of personalized service, and difficulty accessing online banking features.

How do demographics affect banking strategies?

Demographics affect banking strategies by influencing product offerings, marketing approaches, and customer service practices tailored to specific age groups or income levels.

What is the significance of customer feedback?

The significance of customer feedback lies in its ability to guide banks in improving services, enhancing customer satisfaction, and building loyalty through responsive actions.

How can savings banks ensure customer satisfaction?

Savings banks can ensure customer satisfaction by providing high-quality services, addressing concerns promptly, and continuously adapting to meet customer needs.