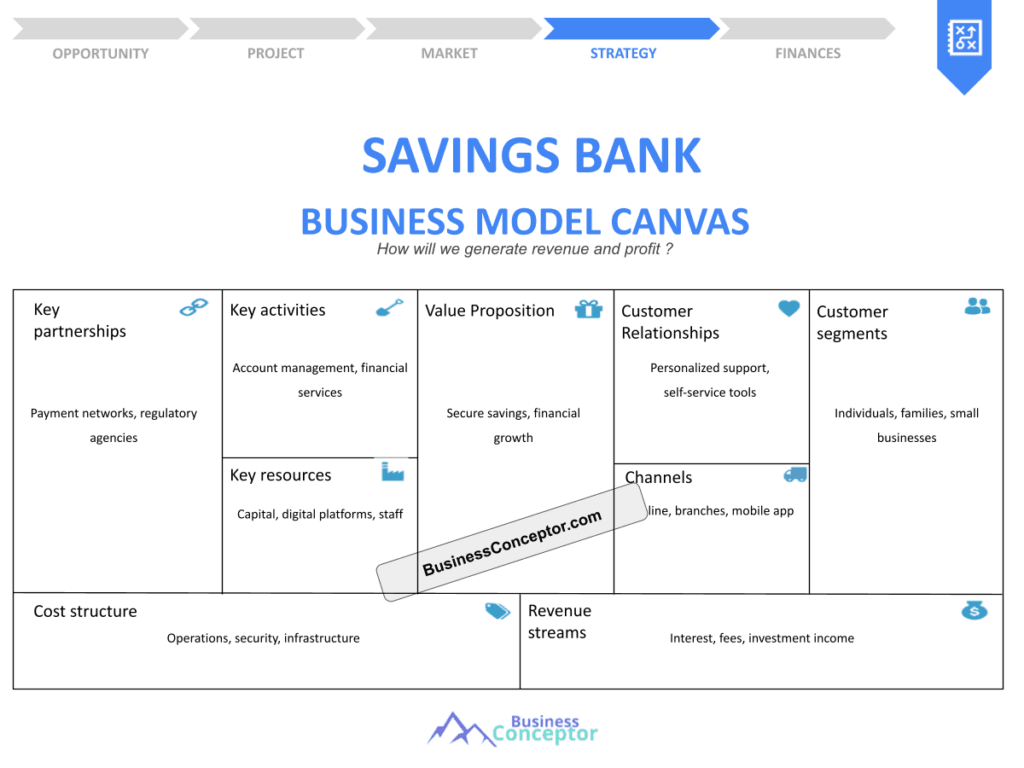

Did you know that nearly 50% of small banks have adopted a savings bank business model canvas to streamline their operations and enhance customer satisfaction? Savings Bank Business Model Canvas is a crucial tool for financial institutions looking to innovate and grow in a competitive market. This framework allows banks to visualize their business strategies on a single page, making it easier to communicate ideas and strategies. A business model canvas is essentially a strategic management tool that outlines a company’s value proposition, infrastructure, customers, and finances. By the end of this guide, you’ll have a clear understanding of how to create your own business model canvas tailored specifically for a savings bank.

- Understand the concept of a business model canvas.

- Explore the essential components of a savings bank model.

- Learn step-by-step how to create your canvas.

- Discover key strategies for enhancing customer value.

- Analyze market trends affecting savings banks.

- Identify potential revenue streams for your bank.

- Explore risk management strategies in banking.

- Understand the importance of customer relationships.

- Review case studies of successful savings banks.

- Get practical tips for implementing your business model canvas.

Understanding the Business Model Canvas

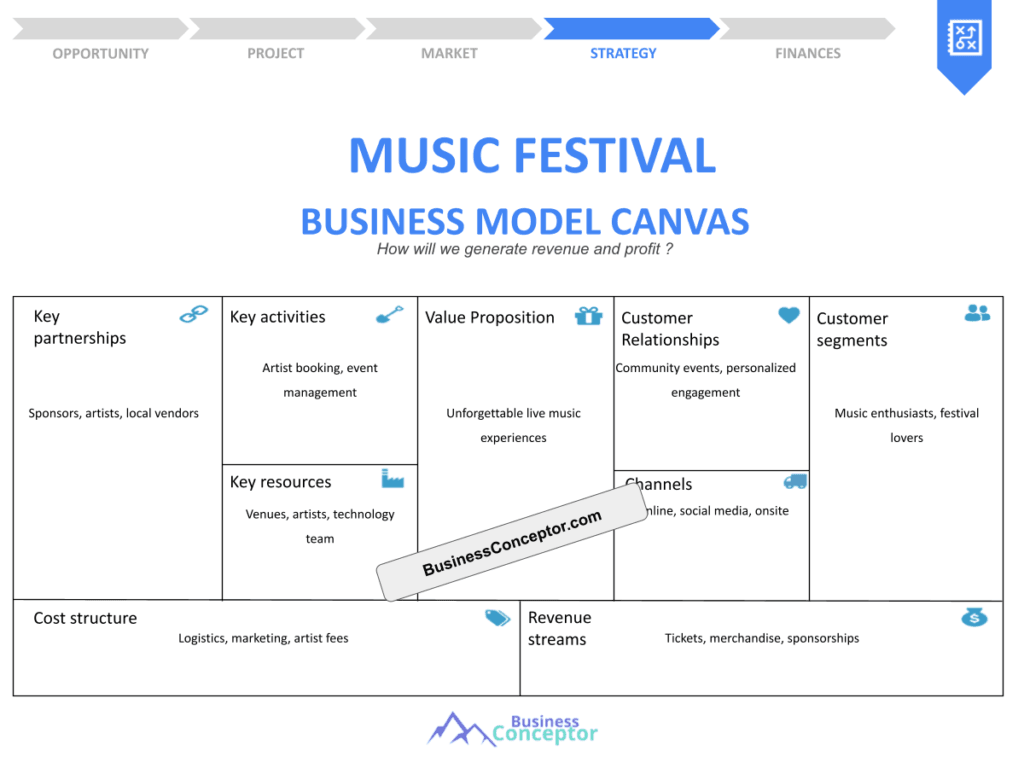

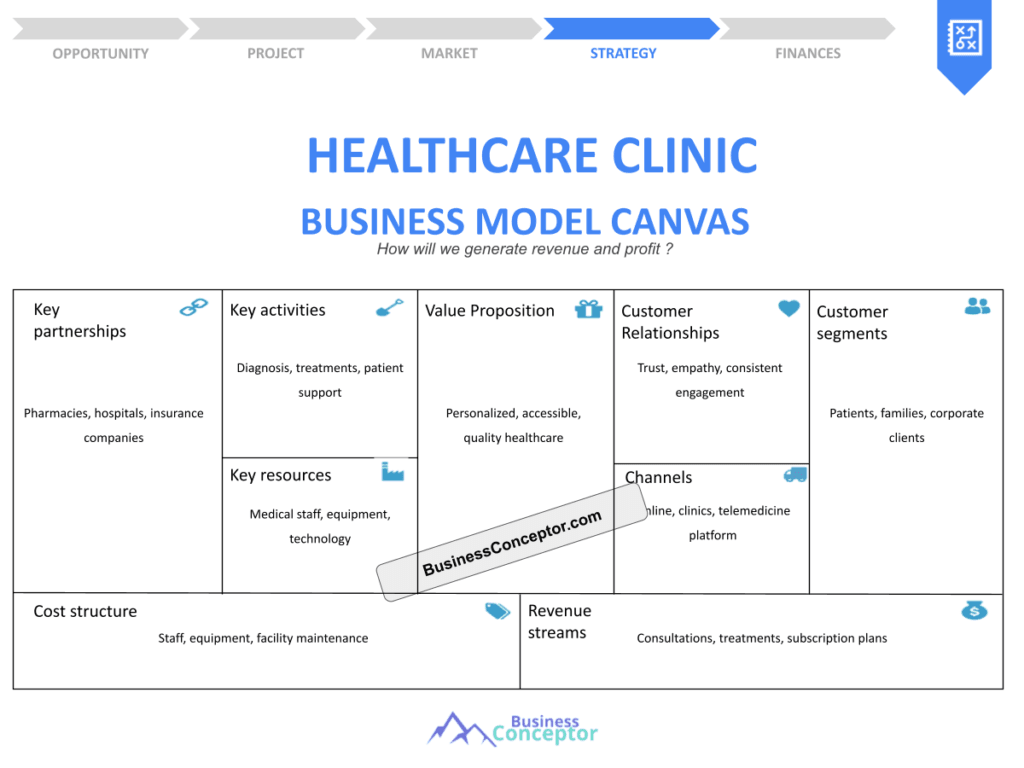

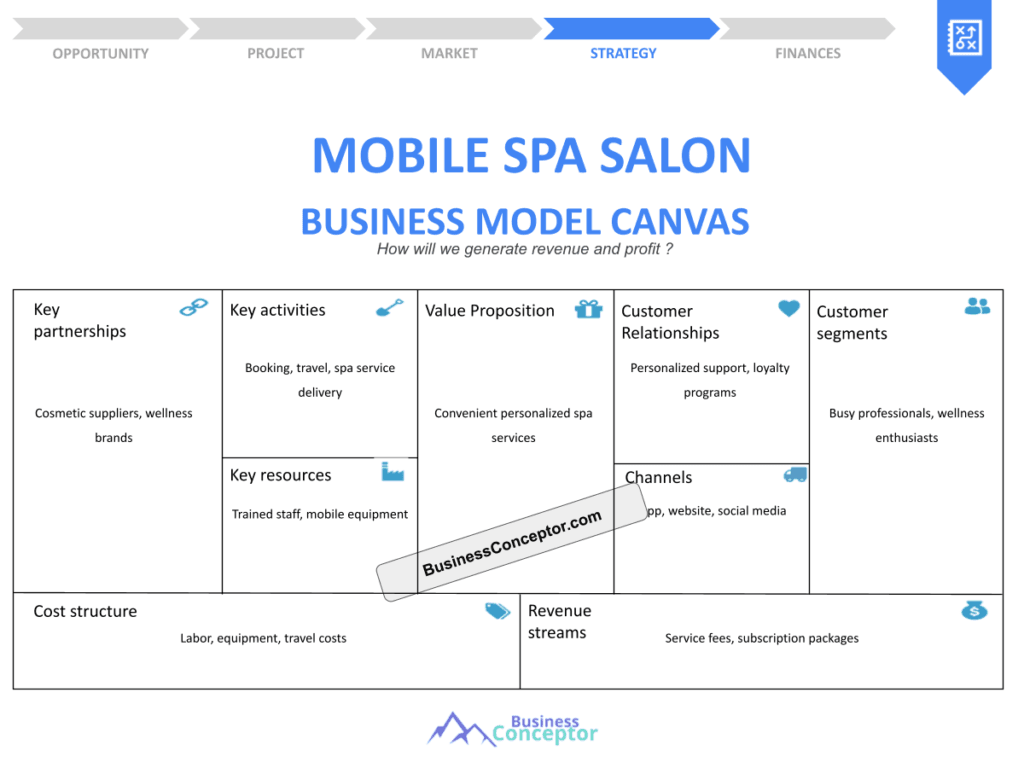

The business model canvas is a powerful tool that helps businesses visualize their operations. It’s particularly useful for savings banks as it allows them to outline their value proposition, customer segments, and revenue streams. By breaking down these components, banks can identify opportunities for growth and improvement.

For instance, let’s consider a small community savings bank. They might use their canvas to emphasize their commitment to local businesses and the unique services they offer. This approach can differentiate them from larger banks that may not provide the same level of personalized service.

Overall, understanding the business model canvas is essential for savings banks. It sets the stage for the detailed steps that follow in creating an effective model. This foundation allows banks to strategically plan their future operations.

| Component | Description |

|---|---|

| Value Proposition | What value does the bank provide? |

| Customer Segments | Who are the target customers? |

| Revenue Streams | How does the bank make money? |

- The business model canvas visualizes business strategies.

- It helps identify customer segments and value propositions.

- It’s a critical tool for operational efficiency.

A clear vision leads to successful execution.

Key Components of the Savings Bank Business Model

When creating a savings bank business model, it’s vital to identify its key components. These components include customer segments, value propositions, and revenue streams. Each of these elements plays a critical role in how the bank operates and serves its customers.

For example, a bank may target young professionals as a primary customer segment. By offering tailored savings accounts and financial education, the bank can enhance its value proposition, ultimately leading to increased customer loyalty. According to recent studies, banks that understand their customer segments can improve their service offerings significantly.

By focusing on these key components, savings banks can build a robust business model that meets the needs of their customers while ensuring financial sustainability. This focus prepares the way for the next steps in developing the model.

- Define your customer segments.

- Outline your value propositions.

- Identify potential revenue streams.

The above steps must be followed rigorously for optimal success.

Crafting Your Value Proposition

The value proposition is arguably the most crucial aspect of the business model canvas. It defines what makes your savings bank unique and why customers should choose your services over competitors. Crafting a compelling value proposition requires a deep understanding of customer needs and market trends.

For instance, a savings bank may position itself as a community-focused institution that prioritizes local investments. By showcasing their commitment to the community, they can attract customers who value supporting local businesses. This strategy not only differentiates the bank but also fosters a sense of trust and loyalty among customers.

Ultimately, a strong value proposition is essential for attracting and retaining customers. It creates a solid foundation for the bank’s marketing and operational strategies, paving the way for the next section on customer relationship management.

- The value proposition defines your bank’s uniqueness.

- Understanding customer needs is vital for crafting it.

- A strong value proposition builds customer loyalty.

To succeed, always move forward with a clear vision.

Customer Segments and Targeting Strategies

Identifying customer segments is a critical part of developing your savings bank business model. Different segments may have varying needs and preferences, which can significantly impact your bank’s offerings and marketing strategies.

For instance, a savings bank may cater to millennials by offering mobile banking solutions and financial literacy programs. By understanding the unique characteristics of this segment, the bank can tailor its services to meet their expectations and build a strong customer base. According to surveys, banks that effectively target their customer segments see higher engagement and satisfaction rates.

By focusing on specific customer segments, savings banks can enhance their marketing efforts and create products that resonate with their target audience. This targeted approach sets the stage for discussing revenue streams in the next section.

| Segment | Needs & Preferences |

|---|---|

| Young Professionals | Mobile banking, financial education |

| Families | Savings accounts, investment products |

- Research customer demographics.

- Tailor products to meet specific needs.

- Implement targeted marketing campaigns.

Revenue Streams for Savings Banks

Understanding the various revenue streams is essential for the sustainability of any savings bank. These streams can include interest from loans, fees for services, and investment income. Identifying and optimizing these revenue streams is key to ensuring long-term profitability.

For example, a savings bank might offer competitive interest rates on savings accounts to attract more deposits. In turn, they can use these deposits to fund loans, generating interest income. By diversifying their revenue streams, banks can minimize risks and maximize profits, which is crucial for financial stability.

Exploring revenue streams will help banks develop a robust financial strategy. This understanding is vital as we move into discussing risk management strategies in the next section.

| Stream | Description |

|---|---|

| Interest Income | Earnings from loans and credit products |

| Fees and Charges | Income from account maintenance and services |

- Diversify income sources.

- Offer competitive rates.

- Implement fee structures wisely.

Risk Management Strategies in Banking

Risk management is a fundamental aspect of any banking operation. Savings banks face various risks, including credit risk, operational risk, and market risk. Developing effective risk management strategies is crucial for maintaining stability and protecting customer assets.

For instance, a savings bank might implement strict credit evaluation processes to mitigate credit risk. By assessing the creditworthiness of borrowers, the bank can minimize defaults and maintain healthy loan portfolios. This proactive approach can significantly reduce potential losses and foster customer trust.

As savings banks navigate risks, they must also consider the impact of these strategies on their overall business model. A robust risk management plan not only protects the bank but also builds trust with customers, leading to stronger relationships and better customer retention.

| Risk Type | Mitigation Strategy |

|---|---|

| Credit Risk | Implement strict credit evaluations |

| Operational Risk | Regular audits and staff training |

- Assess potential risks regularly.

- Develop mitigation plans.

- Train staff on risk awareness.

Building Strong Customer Relationships

Building and maintaining strong customer relationships is vital for the success of a savings bank. A loyal customer base not only ensures consistent revenue but also fosters positive word-of-mouth marketing.

A bank can enhance customer relationships by implementing personalized communication strategies. For example, sending tailored financial advice and updates can make customers feel valued and understood. According to recent studies, personalized communication can significantly increase customer satisfaction and retention rates.

As we explore the importance of customer relationships, it becomes clear that this area is closely linked to all aspects of the business model. Strong relationships can lead to better customer retention and higher profitability, creating a win-win situation for both the bank and its clients.

| Strategy | Description |

|---|---|

| Personalized Service | Tailored communication and support |

| Feedback Mechanisms | Regular surveys and customer feedback |

- Implement personalized communication.

- Regularly seek customer feedback.

- Offer loyalty programs.

Implementing the Business Model Canvas

Once you’ve gathered all the essential components, it’s time to implement your savings bank business model canvas. This process involves aligning your strategies, operations, and customer engagement efforts to ensure they work harmoniously.

For instance, a savings bank can conduct workshops with staff to ensure everyone understands the business model and their roles in it. This collaborative approach helps reinforce the bank’s mission and values, creating a unified team focused on achieving common goals.

By effectively implementing the business model canvas, savings banks can adapt to changing market conditions and customer needs. This adaptability is crucial for long-term success in the banking industry, allowing banks to thrive in a competitive landscape.

| Step | Description |

|---|---|

| Staff Training | Ensure all employees understand the model |

| Regular Review | Continuously assess and adapt the model |

- Conduct staff workshops.

- Regularly review the business model.

- Gather feedback for continuous improvement.

Evaluating Success and Making Adjustments

After implementing the savings bank business model canvas, it’s essential to evaluate its success. Regular assessments help identify areas for improvement and ensure that the bank is meeting its strategic goals.

Practical advice includes setting measurable goals and key performance indicators (KPIs) to track progress. By analyzing data, banks can make informed decisions about necessary adjustments to their strategies and operations, ultimately enhancing their overall effectiveness.

This ongoing evaluation process ensures that the bank remains competitive and responsive to customer needs. As we conclude, remember that adaptability is key to success in the ever-evolving banking landscape, allowing savings banks to thrive in their communities.

Success comes to those who persevere.

- Set measurable goals.

- Regularly assess performance.

- Be open to making changes.

Conclusion

In summary, creating a Savings Bank Business Model Canvas involves understanding its key components, crafting a strong value proposition, identifying customer segments, and developing effective risk management strategies. By following the outlined steps and continuously evaluating your model, you can build a successful savings bank that meets customer needs and achieves financial sustainability. To further assist you, consider utilizing the Savings Bank Business Plan Template, which can help streamline your planning process.

- Article 1: SWOT Analysis for Savings Bank: Strategies for Financial Growth

- Article 2: Savings Bank Profitability: Tips for Maximizing Revenue

- Article 3: Savings Bank Business Plan: Essential Steps and Examples

- Article 4: Building a Financial Plan for Your Savings Bank: A Comprehensive Guide (+ Template)

- Article 5: How to Create a Savings Bank: Complete Guide and Examples

- Article 6: Create a Marketing Plan for Your Savings Bank (+ Example)

- Article 7: Customer Segments for Savings Banks: Examples and Analysis

- Article 8: How Much Does It Cost to Establish a Savings Bank?

- Article 9: How to Start a Feasibility Study for Savings Bank?

- Article 10: How to Build a Risk Management Plan for Savings Bank?

- Article 11: How to Start a Competition Study for Savings Bank?

- Article 12: What Legal Considerations Should You Be Aware of for Savings Bank?

- Article 13: What Funding Options Should You Consider for Savings Bank?

- Article 14: Savings Bank Growth Strategies: Scaling Guide

FAQ Section

What is a savings bank business model canvas?

A savings bank business model canvas is a strategic framework that outlines a bank’s value propositions, customer segments, and revenue streams, facilitating better planning and communication.

Why is a business model canvas important for savings banks?

The business model canvas helps savings banks visualize their operations, identify growth opportunities, and align strategies with customer needs.

What are the key components of a savings bank business model?

The key components include value propositions, customer segments, revenue streams, and cost structure.

How can savings banks improve their value proposition?

By understanding customer needs and market trends, savings banks can tailor their services and offerings to stand out from competitors.

What are some common revenue streams for savings banks?

Common revenue streams include interest from loans, service fees, and investment income.

What role does risk management play in a savings bank’s business model?

Effective risk management strategies help savings banks mitigate potential losses and protect customer assets.

How can savings banks build strong customer relationships?

By implementing personalized communication strategies and actively seeking customer feedback.

What steps should be taken to implement a business model canvas?

Conduct staff training, regularly review the model, and gather feedback for continuous improvement.

How can savings banks evaluate the success of their business model?

By setting measurable goals and analyzing key performance indicators (KPIs) to track progress.

What is the benefit of adapting the business model canvas over time?

Adaptability ensures that the bank remains competitive and responsive to changing customer needs and market conditions.