Did you know that nearly 80% of consumers switch banks due to poor customer service? Retail Bank Competition Study is essential for understanding the dynamics that govern this industry. In an era where customer loyalty is fleeting, knowing how to analyze competition effectively can be a game-changer for your bank. This article will delve into the strategies, tools, and insights needed to conduct a thorough analysis of the retail banking landscape.

- Importance of understanding competition

- Key metrics to analyze

- Tools for conducting a competition study

- Steps to implement findings

- Real-world examples of competitive analysis

- How technology is shaping competition

- Best practices for customer engagement

- Future trends in retail banking

- Common mistakes to avoid

- Summary of actionable insights

Understanding the Competitive Landscape in Retail Banking

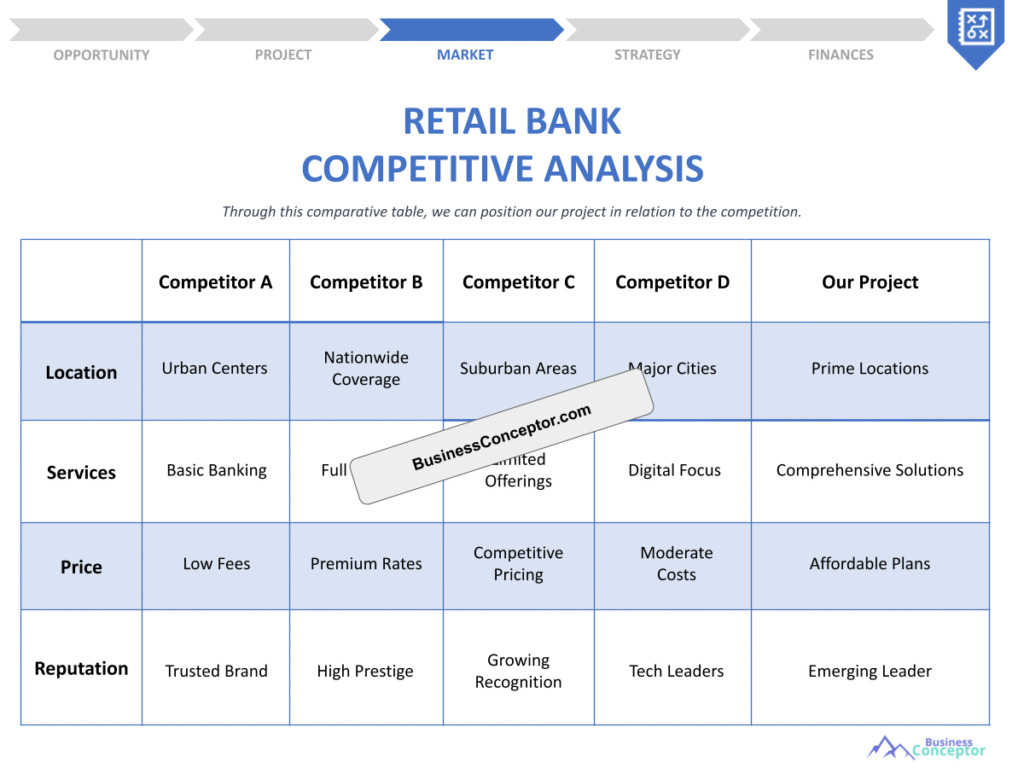

Analyzing the competitive landscape in retail banking involves understanding the market dynamics that affect customer choices and bank performance. The retail banking sector is not just about interest rates and fees; it encompasses customer experience, service quality, and innovative product offerings. Knowing who your competitors are and what they offer is crucial to staying relevant in this fast-paced environment.

For instance, banks like Chase and Bank of America have invested heavily in digital services to attract tech-savvy customers. They offer user-friendly apps, online banking features, and personalized financial advice. Analyzing how these banks position themselves can provide valuable insights into what works and what doesn’t in capturing market share.

Ultimately, understanding the competitive landscape sets the stage for more in-depth analysis and strategy formulation. This foundational knowledge will guide you in identifying the strengths and weaknesses of your bank relative to its competitors.

| Factors to Consider | Description |

|---|---|

| Key Competitors | Major banks and their market positions |

| Customer Preferences | Trends in consumer banking choices |

- Importance of competition analysis

- Key metrics to evaluate

- Impact of digital banking trends

– “In the world of banking, knowledge is power.”

Key Metrics for Analyzing Retail Bank Competition

When it comes to analyzing competition in retail banking, several key metrics can help you gauge performance. Market share, customer satisfaction, and product offerings are just a few of the essential elements to consider. These metrics provide a clear picture of where your bank stands in relation to its competitors.

For example, a bank with a 25% market share is likely more competitive than one with just 5%. According to recent statistics, customer satisfaction ratings can directly correlate with a bank’s retention rates. Thus, it’s vital to not only track these numbers but also understand the factors that influence them.

By focusing on these metrics, banks can create strategies that leverage their strengths and address weaknesses. This data-driven approach will enhance your competitive analysis and ultimately improve your bank’s market position.

- Analyze market share

- Evaluate customer satisfaction scores

- Assess product offerings

– The above steps must be followed rigorously for optimal success.

Tools for Conducting a Retail Bank Competition Study

In the age of technology, various tools can help streamline your competition study in retail banking. From software that analyzes market data to customer feedback platforms, these tools can provide invaluable insights. Using the right technology can save time and enhance accuracy in your analysis.

For instance, tools like SEMrush or SimilarWeb can help you understand your competitors’ online presence, while customer feedback tools like SurveyMonkey can gauge client satisfaction. By integrating these tools into your analysis process, you can gain a multi-dimensional view of your competitive landscape.

Adopting the right tools not only simplifies the data collection process but also aids in drawing actionable conclusions. As you dive deeper into the analysis, these insights will guide your strategic decisions.

- Data analytics software

- Customer feedback tools

- Market research platforms

– “The right tools can make all the difference in your analysis.”

Implementing Findings from Your Competition Study

Once you’ve gathered and analyzed your data, the next step is implementing your findings effectively. This stage is where many banks falter; they fail to act on insights gained from their competition study. It’s crucial to develop an action plan that addresses the identified gaps and opportunities.

For example, if your analysis reveals that competitors are offering better customer service, consider implementing a training program for your staff. Similarly, if your product offerings are lacking, explore ways to diversify and innovate. The implementation phase is where theoretical insights become practical strategies.

By acting on your findings, you not only enhance your bank’s competitiveness but also demonstrate a commitment to improvement. This proactive approach will resonate with customers, building trust and loyalty.

| Findings | Action Steps |

|---|---|

| Weak customer service | Staff training and development programs |

- Action 1: Staff training

- Action 2: Product diversification

– The above steps must be followed rigorously for optimal success.

Best Practices for Customer Engagement in Retail Banking

Effective customer engagement is vital for maintaining a competitive edge in retail banking. It’s not enough to offer competitive rates; banks must also foster strong relationships with their customers. Engaging customers through personalized communication and tailored services can enhance satisfaction and loyalty.

For instance, banks can use CRM systems to track customer interactions and preferences, allowing them to deliver personalized experiences. A recent study showed that banks that prioritize customer engagement see a significant increase in retention rates, proving that this strategy pays off.

By focusing on best practices for customer engagement, banks can create a loyal customer base that not only returns for services but also advocates for the brand. This positive word-of-mouth can further solidify your market position.

| Strategy | Description |

|---|---|

| Personalized communication | Tailoring messages based on customer data |

- Action 1: Use CRM systems

- Action 2: Develop personalized marketing campaigns

Future Trends in Retail Banking Competition

The landscape of retail banking is constantly evolving, and staying ahead of future trends is crucial for any bank looking to maintain competitiveness. Emerging technologies, changing consumer preferences, and regulatory shifts all play significant roles in shaping the future of banking.

For example, the rise of FinTech companies has forced traditional banks to rethink their strategies. Many are now partnering with tech startups to enhance their digital offerings. As consumers increasingly expect seamless online experiences, banks must adapt to remain relevant.

Understanding these trends will not only prepare your bank for the future but also allow you to leverage opportunities that arise. By being proactive in your approach, you can turn potential challenges into competitive advantages.

| Trend | Impact on Competition |

|---|---|

| Rise of FinTech | Increased competition and innovation |

- Action 1: Monitor FinTech developments

- Action 2: Invest in digital transformation

Common Mistakes to Avoid in Competition Analysis

Conducting a retail bank competition study is not without its pitfalls. Many banks make critical mistakes that can undermine their analysis and subsequent strategies. Recognizing these common errors can help ensure a more effective approach.

One major mistake is relying solely on quantitative data without considering qualitative insights. While numbers are important, understanding customer sentiments and experiences can provide a more comprehensive view. Additionally, failing to act on insights gathered can render the entire analysis pointless.

By being aware of these pitfalls, banks can refine their analysis processes and make more informed decisions. A thoughtful approach to competition analysis can lead to more successful outcomes.

| Mistake | Consequence |

|---|---|

| Ignoring qualitative data | Limited understanding of customer needs |

- Action 1: Incorporate qualitative insights

- Action 2: Develop a clear action plan

Summary of Key Actions for Retail Bank Competition Study

As we wrap up our discussion on analyzing competition in retail banking, it’s important to summarize the key actions that can lead to success. From understanding the competitive landscape to implementing effective customer engagement strategies, each step plays a crucial role in enhancing your bank’s position.

Reviewing the importance of using the right tools, metrics, and strategies can help streamline your analysis process. By avoiding common mistakes and staying abreast of future trends, your bank can remain competitive in an ever-changing market.

Ultimately, conducting a thorough retail bank competition study is an ongoing process that requires diligence and adaptability. The insights gained will not only inform your strategies but also foster growth and customer loyalty.

| Key Takeaways | Action Steps |

|---|---|

| Importance of competition analysis | Conduct regular studies |

- Action 1: Continuous monitoring of competition

- Action 2: Regularly update customer engagement strategies

Practical Tips for Success in Retail Banking

To truly succeed in retail banking, practical tips can make a significant difference. These insights not only enhance your understanding of competition but also empower you to take actionable steps toward improvement.

For example, always stay updated on market trends and consumer preferences. Engaging with customers through feedback channels can provide valuable insights into their needs and expectations. Additionally, fostering a culture of innovation within your bank can lead to creative solutions that set you apart.

By applying these practical tips, you can position your bank for long-term success. Remember, the key to thriving in retail banking is not just about competition but also about creating lasting relationships with your customers.

– “Success comes to those who persevere.”

- Stay updated on market trends

- Engage with customers regularly

- Foster a culture of innovation

Conclusion

In summary, understanding and analyzing competition in retail banking is a multifaceted endeavor. From exploring key metrics and tools to implementing effective strategies, each step is crucial for enhancing your bank’s competitive edge. By leveraging the insights gained from a retail bank competition study, you can foster stronger customer relationships and drive growth.

Don’t miss the opportunity to elevate your business strategy! Consider using the Retail Bank Business Plan Template for a comprehensive framework tailored to your needs.

Additionally, you might find these articles valuable as you navigate the complexities of retail banking:

- SWOT Analysis for Retail Bank: Maximizing Business Potential

- Retail Bank Profitability: Strategies for a Profitable Business

- Developing a Business Plan for Your Retail Bank: Comprehensive Guide

- Crafting a Financial Plan for Your Retail Bank: Essential Steps (+ Example)

- How to Start a Retail Bank: Complete Guide with Example

- Building a Retail Bank Marketing Plan: Strategies and Examples

- How to Create a Business Model Canvas for a Retail Bank: Step-by-Step Guide

- How Much Does It Cost to Operate a Retail Bank?

- How to Calculate the Feasibility Study for Retail Bank?

- How to Calculate Risks in Retail Bank Management?

- How to Address Legal Considerations in Retail Bank?

- How to Choose the Right Funding for Retail Bank?

- How to Implement Growth Strategies for Retail Bank

FAQ Section

What is a retail bank competition study?

A retail bank competition study is an assessment that evaluates the competitive environment within the retail banking sector, focusing on key metrics, customer behavior, and market trends to enhance a bank’s strategic positioning.

Why is customer engagement important in retail banking?

Customer engagement is essential as it cultivates loyalty, enhances customer satisfaction, and ultimately leads to higher retention rates, making it a vital component of competitive success in retail banking.

How can I measure my bank’s performance against competitors?

You can measure your bank’s performance by analyzing key metrics such as market share, customer satisfaction scores, and product offerings, along with utilizing tools for competitor benchmarking.

What tools can help in conducting a competition study?

Tools like SEMrush, SimilarWeb, and customer feedback platforms like SurveyMonkey can provide valuable insights into your competitors’ strategies and customer sentiments.

What are common mistakes in competition analysis?

Common mistakes include relying solely on quantitative data, neglecting qualitative insights, and failing to act on the findings from the analysis.

How can technology impact retail bank competition?

Technology can enhance retail banking competition by enabling better customer service, streamlining operations, and providing innovative financial products that meet consumer demands.

What metrics should I focus on for competition analysis?

Focus on metrics such as market share, customer satisfaction, product offerings, and online presence to gain a comprehensive view of your competitive standing.

How do consumer preferences affect banking competition?

Consumer preferences significantly influence banking competition by dictating what services and products are in demand, thus shaping banks’ strategies and offerings.

What is the role of innovation in retail banking?

Innovation is crucial in retail banking as it allows banks to differentiate themselves through unique products and services, ultimately attracting and retaining customers.

How can I stay updated on banking trends?

To stay updated on banking trends, subscribe to industry publications, attend banking conferences, and follow relevant news sources and thought leaders in the financial sector.