Did you know that over 90% of millionaires have invested in real estate at some point in their lives? Launching a real estate investment business can seem overwhelming, but it’s not as complicated as it sounds. Real estate investment involves purchasing properties to earn a return on investment (ROI) through rental income, resale, or both. This guide will walk you through everything you need to know to kickstart your journey into real estate investment.

- Understand the basics of real estate investment.

- Explore different investment strategies.

- Learn how to analyze and choose the right properties.

- Discover financing options and tax benefits.

- Get practical examples to guide your decisions.

Understanding Real Estate Investment Strategies

Real estate investment strategies vary widely, and each has its own pros and cons. Whether you want to flip houses, buy rental properties, or invest in commercial real estate, it’s essential to understand these strategies before diving in. For instance, flipping houses involves buying a property, renovating it, and selling it for a profit. It’s fast-paced and can yield high returns, but it also comes with significant risks if the market turns or renovations go over budget. On the other hand, rental properties provide a steady stream of income and can appreciate over time, but they require ongoing management and maintenance.

One of the major advantages of real estate investment is the ability to leverage your money. With a relatively small down payment, you can control a much larger asset. This means that if the property appreciates in value, your return on investment can be significantly higher than if you had bought the property outright. For example, if you purchase a property worth $200,000 with a 20% down payment, you only invest $40,000, but if the property value increases to $250,000, you gain $50,000 in equity. This leverage can lead to wealth accumulation faster than many other investment types.

Understanding these differences helps you align your investment goals with the right strategy. Additionally, real estate investment can provide tax benefits, such as deductions for mortgage interest and property depreciation, which can further enhance your profitability. Moreover, real estate tends to be less volatile compared to stocks, providing a more stable investment option for those looking to build long-term wealth.

| Strategy | Key Features |

|---|---|

| Flipping Houses | Quick profit, high risk, renovation needed |

| Rental Properties | Steady income, property management required |

| Commercial Real Estate | Long-term leases, higher investment needed |

- Real estate investing can be a great way to build wealth.

- Different strategies cater to varying risk tolerances.

- Researching each strategy is crucial for success.

“Investing in real estate is not just about properties; it’s about creating wealth and securing your financial future!” 🏡💰

Choosing the Right Property

Choosing the right property is one of the most critical aspects of launching a successful real estate investment business. Factors such as location, property type, and market trends play a significant role in your investment’s success. When considering location, look for areas with good schools, low crime rates, and potential for growth. For example, properties near upcoming transportation projects often see increased demand. Investing in a property located in a developing neighborhood can lead to substantial appreciation over time, making it a smart choice for long-term investment.

Additionally, understanding the local market trends can help you determine whether it’s a buyer’s or seller’s market, influencing your negotiation strategy. In a buyer’s market, there are more homes for sale than buyers, which can lead to lower prices and better deals. Conversely, in a seller’s market, properties may sell quickly, often above the asking price. Knowing these dynamics can significantly impact your purchasing decisions. Furthermore, looking into future development plans in the area can provide insights into how property values may change, offering opportunities for savvy investors.

When evaluating specific properties, consider their condition and the potential costs of renovations. A fixer-upper may be cheaper upfront but can incur significant expenses if the renovations are extensive. On the other hand, a well-maintained property may require less immediate investment, allowing you to start generating income sooner. Always conduct thorough due diligence, including inspections and market analysis, to ensure you make informed decisions.

| Property Type | Considerations |

|---|---|

| Single-Family Homes | Easier management, ideal for beginners |

| Multi-Family Units | Higher income potential, more tenants |

| Commercial Properties | Long-term leases, higher capital required |

- Location is key to property value appreciation.

- Researching local market trends can aid decision-making.

- Different property types come with unique challenges and rewards.

“The right property can change your investment game!” 🔑🏠

Financing Your Real Estate Investment

Financing your real estate investment can be one of the most daunting tasks. However, there are several options available, from traditional mortgages to creative financing solutions. A conventional mortgage is a common choice for many investors, offering competitive interest rates and predictable payments. However, it often requires a good credit score and a substantial down payment, which can be a barrier for some. For those looking to get into the market with less upfront cash, options like FHA loans allow for lower down payments, making homeownership more accessible.

Moreover, if you’re in need of quick cash to secure a property, you might consider hard money loans. These loans are typically provided by private lenders and are based on the value of the property rather than the borrower’s creditworthiness. While the interest rates are higher than traditional loans, they can be a viable option for investors who need to act quickly in a competitive market. However, it’s crucial to carefully assess the costs associated with these loans, as they can add up quickly.

Another key advantage of real estate investing is the ability to leverage your investment. This means you can use borrowed funds to increase your purchasing power, allowing you to acquire more properties than you could with cash alone. For instance, if you buy a property worth $200,000 with a 20% down payment, you’re only investing $40,000, but if the property value increases, your return on investment can be significantly higher than if you had paid cash. This leverage can lead to wealth accumulation faster than many other investment types.

| Financing Option | Pros | Cons |

|---|---|---|

| Conventional Mortgage | Lower interest rates, predictable payments | Requires good credit and down payment |

| FHA Loans | Lower down payment, accessible for beginners | Requires mortgage insurance |

| Hard Money Loans | Fast approval, less stringent requirements | Higher interest rates |

- Understanding your financing options is crucial for success.

- Each option has its benefits and drawbacks.

- Always evaluate your financial capacity before choosing a financing method.

“Financing is the backbone of real estate investing—choose wisely!” 💳🏘️

Understanding Tax Benefits of Real Estate Investing

Real estate investing comes with numerous tax benefits that can significantly improve your bottom line. One of the most notable advantages is the ability to deduct expenses associated with your investment properties. This includes mortgage interest, property taxes, and even certain costs related to property management and maintenance. For instance, if you own a rental property, you can deduct expenses for repairs, advertising for tenants, and even travel costs associated with managing the property. These deductions can lower your taxable income, allowing you to keep more of your hard-earned money.

Another key benefit is depreciation. The IRS allows property owners to depreciate the value of their properties over time. This means that even if the market value of your property increases, you can still claim a depreciation expense on your tax return, which further reduces your taxable income. For example, if you purchase a rental property for $300,000, you can deduct a portion of that amount each year, providing a significant tax shield. This can be particularly advantageous for long-term investors looking to build wealth through real estate.

Moreover, understanding strategies like the 1031 exchange can provide additional tax advantages. This strategy allows you to defer paying capital gains taxes on an investment property when you sell it, as long as you reinvest the proceeds into a similar property. This can be a powerful tool for real estate investors, enabling them to grow their portfolios without the immediate tax burden that typically accompanies property sales. This means that by strategically planning your investments, you can maximize your growth potential while minimizing tax liabilities.

| Tax Benefit | Description |

|---|---|

| Mortgage Interest Deduction | Reduces taxable income |

| Depreciation | Allows deduction for property wear and tear |

| 1031 Exchange | Defers capital gains taxes on property sales |

- Tax benefits can enhance your investment returns.

- Keeping accurate records is essential for claiming deductions.

- Consult with a tax professional to navigate complex regulations.

“Understanding tax benefits can keep more money in your pocket!” 📊💵

Building Your Real Estate Investment Portfolio

Once you’ve successfully launched your real estate investment business, the next step is building a diverse portfolio. Diversification is crucial as it helps mitigate risks associated with market fluctuations. By investing in various property types, such as residential, commercial, and vacation rentals, you can benefit from different income streams and market dynamics. For instance, while residential properties often provide consistent rental income, commercial properties can yield higher returns due to longer lease terms.

Additionally, investing in different geographic locations can also spread your risk. For example, if one market experiences a downturn, properties in another area may still perform well, providing stability to your overall portfolio. This geographic diversification allows you to capitalize on varying market conditions and economic cycles, ensuring that your investments are not overly reliant on a single location.

Another advantage of building a diverse portfolio is the ability to leverage different market opportunities. For example, during times of economic growth, commercial properties may thrive, while during downturns, affordable housing options may see increased demand. By keeping a balanced mix of properties, you can adjust your strategy based on market conditions and maximize your overall returns.

| Portfolio Type | Benefits |

|---|---|

| Residential Properties | Consistent rental income, easier to manage |

| Commercial Properties | Higher returns, long-term leases |

| Vacation Rentals | Seasonal income potential, higher rates |

- Diversifying your portfolio can reduce risk.

- Continuous learning is vital for long-term success.

- Evaluate your investments regularly to ensure they align with your goals.

“A well-rounded portfolio is your best defense against market ups and downs!” 📈🏘️

The Role of Property Management

Property management plays a crucial role in the success of your real estate investment business. Whether you manage properties yourself or hire a property management company, understanding the responsibilities involved is essential for maximizing your investment returns. If you choose to manage properties on your own, you will need to handle various tasks such as tenant screening, maintenance, rent collection, and addressing tenant complaints. This hands-on approach can save you money on management fees, but it requires a significant time commitment and a willingness to deal with potential issues that may arise.

One of the key advantages of effective property management is the ability to maintain high occupancy rates. Happy tenants are more likely to renew their leases, which translates to consistent cash flow. By providing excellent customer service and promptly addressing maintenance requests, you can create a positive living environment that encourages tenant retention. Additionally, regular property inspections can help identify maintenance issues before they escalate, ultimately saving you money and ensuring your property remains in good condition.

If managing properties yourself seems overwhelming, hiring a property management company can be a smart choice. These companies have the expertise and resources to handle the day-to-day operations of your rental properties. They can manage tenant relations, handle evictions, and ensure compliance with local regulations, allowing you to focus on expanding your investment portfolio. While there is a cost associated with these services, the peace of mind and potential increase in profitability can make it a worthwhile investment.

| Management Approach | Pros | Cons |

|---|---|---|

| Self-Management | Full control, no management fees | Time-consuming, requires hands-on effort |

| Hiring a Management Company | Professional expertise, saves time | Management fees can reduce profit |

- Effective property management is key to maximizing returns.

- Choose the approach that aligns with your lifestyle and investment goals.

- Regular communication with tenants can foster better relationships.

“Good property management can make or break your investment!” 🛠️🏡

Navigating Real Estate Market Trends

Staying informed about real estate market trends is essential for making strategic investment decisions. The real estate market can shift rapidly, influenced by economic factors, interest rates, and demographic changes. For example, understanding whether the market is in a buyer’s or seller’s phase can guide your buying and selling strategies. In a buyer’s market, there are more homes for sale than buyers, which can lead to lower prices and better deals. Conversely, in a seller’s market, properties may sell quickly, often above the asking price. Knowing these dynamics can significantly impact your purchasing decisions and overall investment success.

Additionally, keeping an eye on economic indicators, such as employment rates and wage growth, can provide insights into the potential demand for housing in a given area. When the economy is strong and job opportunities are plentiful, more people are likely to seek housing, driving up property values and rental prices. Conversely, during economic downturns, demand may decrease, leading to lower prices. By staying informed about these trends, you can make timely decisions to buy or sell properties based on market conditions.

Networking with local real estate professionals and attending industry seminars can also provide valuable insights into market dynamics. Engaging with other investors, agents, and property managers can help you stay ahead of trends and uncover opportunities that may not be widely known. Furthermore, utilizing technology and data analytics can enhance your ability to track market trends and make informed decisions. Many investors now use online platforms to analyze real estate data, allowing them to identify emerging neighborhoods and investment opportunities quickly.

| Market Trend | Impact on Investment |

|---|---|

| Economic Growth | Increased demand for housing |

| Interest Rate Changes | Affects affordability and investment strategy |

| Demographic Shifts | Influences rental demand and property types |

- Market awareness is crucial for successful investing.

- Networking can provide valuable insights and opportunities.

- Analyze trends regularly to adjust your strategies.

“The market is always changing; stay informed to stay ahead!” 📈🔍

Evaluating Your Investment Performance

Regularly evaluating your real estate investment performance is vital for long-term success. By assessing your portfolio’s performance, you can identify areas for improvement and growth, ensuring your investments align with your financial goals. One of the primary tools for this evaluation is understanding key performance indicators (KPIs) such as cash flow, occupancy rates, and return on investment (ROI). These metrics provide insights into how well your investments are performing and can highlight trends that may require your attention.

For instance, cash flow analysis allows you to determine whether your rental properties are generating enough income to cover expenses. A positive cash flow means you’re making money, while a negative cash flow can signal trouble. If you notice consistent negative cash flow, it may be time to reassess your rental pricing, reduce expenses, or improve property management. Additionally, tracking occupancy rates is crucial. High occupancy rates typically indicate strong demand for your properties, while low rates may suggest issues that need addressing, such as property condition or location factors.

Another essential metric is the return on investment (ROI), which measures the profitability of your investments relative to their costs. A high ROI means that your investments are yielding good returns, while a low ROI may indicate that you need to rethink your strategies or investments. Calculating ROI can help you make informed decisions about whether to hold, sell, or reinvest in your properties. Furthermore, setting clear goals and benchmarks can help you measure progress and adjust your strategies accordingly, ensuring that you remain on track to meet your financial objectives.

| Performance Indicator | Purpose |

|---|---|

| Cash Flow | Measures income vs. expenses |

| Occupancy Rate | Indicates property demand |

| Return on Investment (ROI) | Assesses profitability of investments |

- Regular evaluation helps ensure your investments align with your goals.

- Set clear KPIs to measure success.

- Adjust strategies based on performance data.

“Measuring performance is key to sustained success in real estate!” 📊🏡

Final Thoughts on Launching Your Real Estate Investment Business

Launching a real estate investment business can be an incredibly rewarding venture, but it requires careful planning and a solid understanding of various aspects of the industry. From choosing the right properties to navigating market trends and understanding tax benefits, each step is crucial for your success. Moreover, as you build your portfolio, the importance of continuous education cannot be overstated. The real estate market is dynamic, and staying informed about industry changes, financing options, and property management practices will set you apart from other investors.

Networking with other investors and industry professionals can also provide valuable insights and opportunities. Engaging in local real estate investment groups or attending seminars can help you learn from experienced investors and share your own experiences. This exchange of knowledge can lead to partnerships and collaborations that may enhance your investment strategies.

Finally, remember that patience is key in real estate investing. Building a successful portfolio takes time, and market fluctuations are inevitable. By staying committed to your investment strategy and continuously evaluating your performance, you can achieve long-term financial success. With the right mindset and tools, you can navigate the complexities of real estate investing and create a prosperous business that not only generates income but also builds wealth for the future.

| Key Considerations | Benefits |

|---|---|

| Continuous Education | Staying informed enhances decision-making |

| Networking | Opens doors to new opportunities |

| Patience | Long-term focus leads to greater rewards |

- Continuous education is vital for success.

- Networking can lead to valuable partnerships.

- Patience and commitment are essential for long-term growth.

“Success in real estate is a journey, not a sprint!” 🏘️🚀

Recommendations

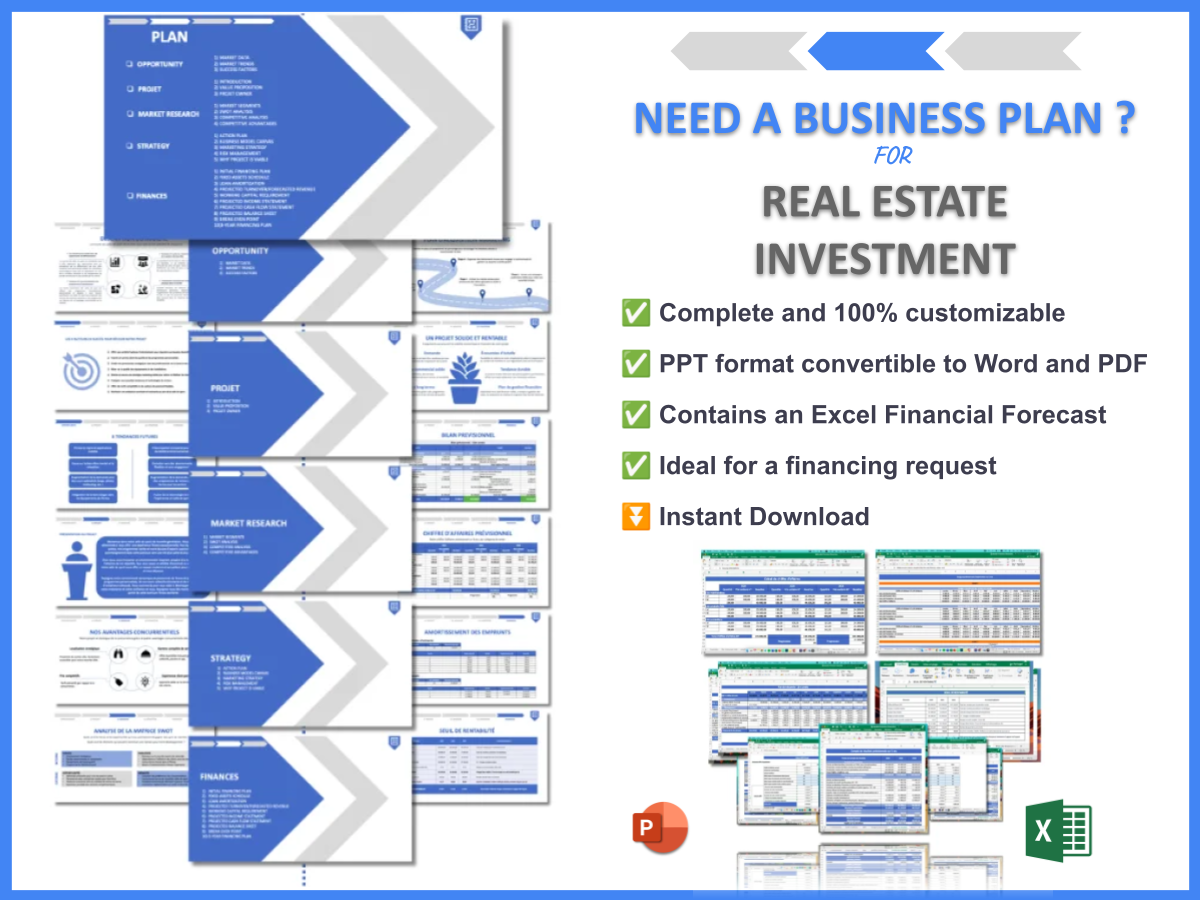

As we’ve explored throughout this article, launching a real estate investment business involves understanding various strategies, financing options, and the importance of property management and market trends. To help streamline your journey, consider utilizing a Real Estate Investment Business Plan Template. This template can guide you through the essential components of creating a comprehensive business plan tailored to your investment goals.

Additionally, we have a wealth of articles related to real estate investment that can further enhance your knowledge and skills:

- Article 1 on Real Estate Investment SWOT Analysis Insights

- Article 2 on Real Estate Investment: The Key to High Profitability

- Article 3 on Real Estate Investment Business Plan: Template and Tips

- Article 4 on Real Estate Investment Financial Plan: Step-by-Step Guide with Template

- Article 5 on Crafting a Real Estate Investment Marketing Plan: Strategies and Examples

- Article 6 on Building a Business Model Canvas for Real Estate Investment: Examples Included

- Article 7 on Real Estate Investment Customer Segments: Examples and Best Practices

- Article 8 on How Much Does It Cost to Operate a Real Estate Investment Business?

- Article 9 on Real Estate Investment Feasibility Study: Comprehensive Guide

- Article 10 on Real Estate Investment Risk Management: Comprehensive Strategies

- Article 11 on Real Estate Investment Competition Study: Detailed Insights

- Article 12 on How to Navigate Legal Considerations in Real Estate Investment?

- Article 13 on What Funding Options Should You Consider for Real Estate Investment?

- Article 14 on How to Scale Real Estate Investment: Proven Growth Strategies

FAQ

What are some effective real estate investment strategies for beginners?

For beginners, it’s essential to start with simple real estate investment strategies such as buying single-family rental homes or engaging in house flipping. These strategies require less capital and allow new investors to learn the market dynamics without overwhelming risk. Additionally, investing in real estate crowdfunding platforms can offer a low-cost entry point into the market.

How can I maximize my real estate investment returns?

To maximize your real estate investment returns, consider leveraging your investments through financing options, improving property value through renovations, and ensuring effective property management to maintain high occupancy rates. Additionally, keeping up with market trends and economic factors can help you make informed decisions about when to buy or sell properties.

What are the tax benefits associated with real estate investing?

Real estate investing offers various tax benefits, including deductions for mortgage interest, property taxes, and depreciation. Investors can also utilize strategies like the 1031 exchange to defer capital gains taxes when selling properties, allowing for reinvestment in new properties without immediate tax liability.

How do I evaluate the performance of my real estate investment portfolio?

Evaluating the performance of your real estate investment portfolio involves tracking key metrics such as cash flow, occupancy rates, and return on investment (ROI). Regularly reviewing these indicators can help you identify areas for improvement and adjust your investment strategies accordingly.

What are some common mistakes to avoid in real estate investing?

Common mistakes in real estate investing include failing to conduct thorough market research, underestimating property management costs, and neglecting to budget for unexpected repairs. It’s also crucial to avoid over-leveraging your investments, as this can lead to financial strain during market downturns.