The Real Estate Investment Competition Study is an essential analysis that delves into the intricate dynamics of property investment. Understanding this study can significantly impact your success in the real estate market. It highlights how different players, from individual investors to large firms, compete for the same limited resources and opportunities. This study is not merely an academic exercise; it’s a practical guide that can help you navigate the complexities of real estate investment. By grasping the competitive landscape, you can make informed decisions that maximize your returns and minimize risks.

Here’s what you need to know about the Real Estate Investment Competition Study:

– **Understanding the Competitive Landscape:** Recognize who your competitors are and the strategies they employ.

– **Investment Trends:** Stay updated on the latest trends shaping the real estate investment market.

– **Market Analysis Tools:** Discover the tools that can help you analyze real estate data effectively.

– **Risk Assessment:** Learn how to identify and mitigate risks in your investments.

– **Emerging Opportunities:** Pinpoint new markets and investment opportunities before they become mainstream.

Understanding Real Estate Market Analysis

Real estate market analysis is the cornerstone of any successful investment strategy. It involves a thorough examination of various factors that influence property values and market conditions. By conducting a solid market analysis, investors can identify the best locations to invest in, determine which types of properties are in demand, and assess the overall economic indicators that signify market health.

When I first dipped my toes into the real estate waters, I underestimated the importance of market analysis. I thought I could simply buy a property and watch my investment grow. However, after a few months of struggling to find tenants and facing unexpected costs, I realized that I had neglected to understand the market dynamics. Utilizing market analysis tools opened my eyes to trends in housing prices, rental demand, and even the demographics of potential tenants. Armed with this information, I was able to make more strategic decisions, ultimately leading to more successful investments.

| Factor | Description |

|---|---|

| Supply and Demand | The balance between available properties and buyers. |

| Economic Indicators | Job growth, income levels, and population growth. |

| Location Trends | Understanding neighborhood dynamics and desirability. |

| Property Types | Analyzing which types of properties are most sought after. |

- Market analysis is vital for identifying investment opportunities.

- It provides insights into property value trends.

- A thorough analysis can reduce risks and enhance profitability.

“Knowledge is power in real estate investing! 📈”

In summary, understanding real estate market analysis equips you with the necessary tools to navigate the investment landscape effectively. It allows you to make data-driven decisions that can lead to higher returns and lower risks. As you continue your journey in real estate investing, keep in mind that a well-informed investor is a successful investor. The more you understand the market, the better positioned you will be to capitalize on opportunities and avoid pitfalls.

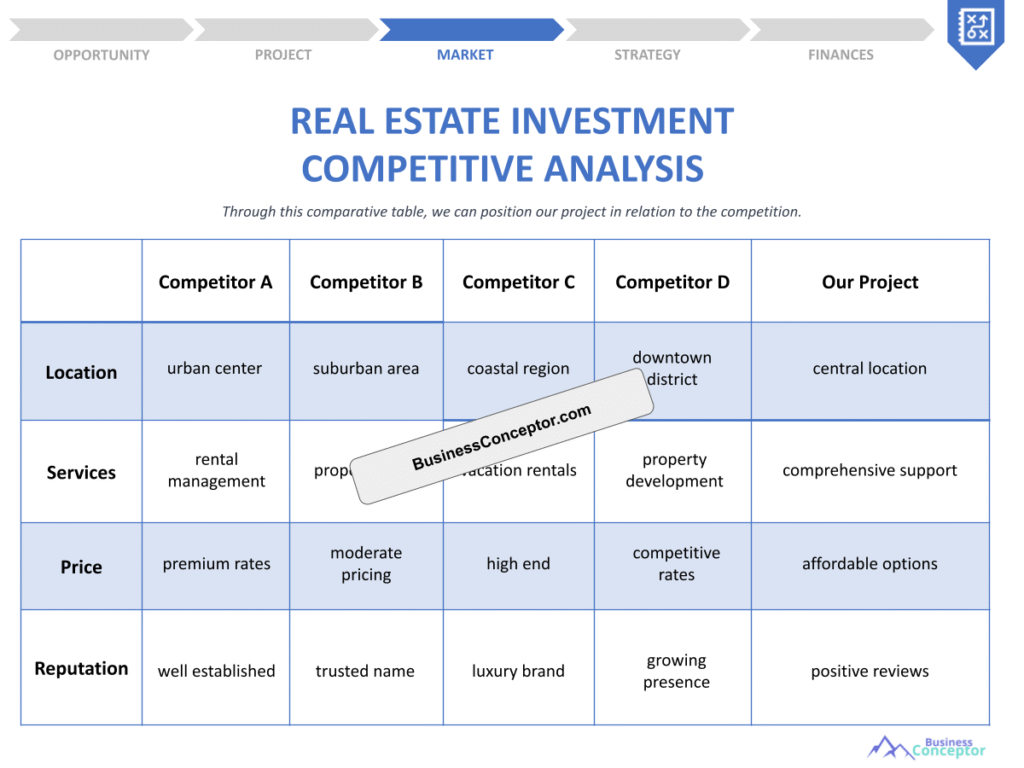

Competitive Analysis in Real Estate

Competitive analysis in real estate is not just about knowing who your competitors are; it involves a comprehensive examination of their strategies, strengths, and weaknesses. This analysis allows you to position yourself effectively in the market, making it easier to attract tenants or buyers and optimize your investment returns. By understanding your competition, you can identify gaps in the market and discover opportunities that others may overlook.

When I first started in real estate, I focused solely on my properties without paying much attention to what others were doing. It wasn’t until I faced challenges in filling my units that I realized the importance of competitive analysis. For example, I noticed that many of my competitors were offering luxury amenities, while I was sticking to basic features. By conducting a thorough competitive analysis, I decided to enhance my properties with features that appealed to my target demographic, such as energy-efficient appliances and modern finishes. This strategic move allowed me to fill my units faster and at higher rental rates.

| Aspect | Description |

|---|---|

| Strengths | What advantages do your competitors have? |

| Weaknesses | Where do they fall short? |

| Market Position | How do they rank in terms of market share? |

| Target Audience | Who are they aiming to attract? |

- Understanding your competition helps you carve out a niche.

- It allows for strategic positioning in the market.

- Recognizing competitors’ weaknesses can turn into opportunities for you.

“In competition, knowledge is your greatest ally! 🏆”

In essence, conducting a competitive analysis in real estate empowers you to make informed decisions. It provides a clearer picture of the market landscape, allowing you to adjust your strategies accordingly. By leveraging the insights gained from analyzing your competitors, you can enhance your offerings, attract the right tenants or buyers, and ultimately boost your investment’s profitability.

Investment Property Performance Metrics

When diving into real estate investing, understanding investment property performance metrics is crucial. These metrics help you evaluate the success of your investments and guide your decision-making process. Key performance indicators (KPIs) such as cash flow, return on investment (ROI), and occupancy rates offer valuable insights into how well your properties are performing.

Reflecting on my own experiences, I remember purchasing a property that seemed like a steal based on its price alone. However, after digging deeper into the performance metrics, I discovered that the occupancy rate was significantly lower than the market average. This oversight cost me dearly, as I struggled to maintain a positive cash flow. Since then, I’ve made it a point to meticulously analyze these metrics before finalizing any investment decisions. For instance, understanding the average cash flow in a particular area can help you set realistic rental rates and ensure your investment remains profitable.

| Metric | Importance |

|---|---|

| Cash Flow | Determines the income generated after expenses. |

| Return on Investment | Measures profitability relative to costs. |

| Occupancy Rate | Indicates demand for rental units. |

| Capitalization Rate | Reflects the expected rate of return on investment. |

- Performance metrics provide insights into property profitability.

- They help assess risks and inform investment decisions.

- Regular analysis can highlight potential issues early.

“Invest smart, measure often! 📊”

In summary, a solid grasp of investment property performance metrics is essential for any real estate investor. These metrics not only help you gauge the effectiveness of your investments but also enable you to make adjustments as needed to enhance your returns. By keeping a close eye on your property’s performance, you can identify areas for improvement, capitalize on opportunities, and ultimately achieve long-term success in the competitive world of real estate investment.

Market Saturation in Property Investing

Market saturation occurs when the supply of properties exceeds the demand in a specific area. Understanding this concept is crucial for any investor because it can significantly impact property values and rental income. In a saturated market, you might find yourself competing with numerous landlords, which can lead to decreased rental prices and longer vacancy periods. Therefore, knowing the saturation levels of a market before investing can save you from potential losses.

Reflecting on my own experiences, I once invested in a neighborhood that was rapidly becoming a hotspot for new developments. Initially, I was excited about the growth potential. However, I soon realized that the influx of new apartment complexes created a competitive landscape that I hadn’t anticipated. As more properties entered the market, I struggled to keep my rental units filled, and the rental rates began to drop. This experience taught me the importance of assessing market saturation before making investment decisions. By evaluating the number of available properties compared to the demand, I could better gauge whether an area was worth investing in.

| Effect | Description |

|---|---|

| Decreased Property Values | Overabundance leads to falling prices. |

| Increased Competition | More landlords vying for tenants. |

| Longer Vacancy Periods | Units take longer to rent. |

| Reduced Rental Income | Lower demand results in reduced rental rates. |

- Recognizing market saturation can save you from bad investments.

- It helps in identifying potential areas for growth.

- A strategic approach can mitigate risks associated with saturation.

“Stay ahead of the curve, avoid saturation! 🌊”

In conclusion, understanding market saturation is essential for successful real estate investing. By conducting thorough research and analysis, you can identify saturated markets and make informed decisions about where to invest. This knowledge can help you avoid potential pitfalls and instead focus on areas with strong demand and growth potential, ultimately enhancing your investment strategy.

Factors Affecting Real Estate ROI

The return on investment (ROI) is a critical metric for any real estate investor, as it measures the profitability of an investment relative to its costs. Several factors influence ROI, including location, property management efficiency, and market conditions. A deep understanding of these elements can help you maximize your returns and make smarter investment decisions.

For instance, I once invested in a property located in a developing area. Initially, the ROI was lower than I expected, but I knew that the neighborhood was on the rise. By keeping a close watch on economic developments, such as new businesses opening and infrastructure improvements, I was able to hold onto the property long enough for its value to appreciate significantly. Understanding the factors that affect ROI allowed me to make a calculated decision that ultimately paid off. Factors such as local job growth, the overall economic climate, and the demand for housing in the area are all crucial components that can enhance or diminish your ROI.

| Factor | Description |

|---|---|

| Location | Desirable areas yield higher returns. |

| Property Management | Effective management can enhance profitability. |

| Market Conditions | Economic trends impact rental demand and prices. |

| Property Type | Different property types yield varying returns. |

- ROI is influenced by multiple factors.

- Strategic investment decisions can enhance returns.

- Regular assessment of ROI is crucial for long-term success.

“Maximize your returns with smart choices! 💰”

In summary, a clear understanding of the factors affecting real estate ROI is essential for successful investing. By analyzing these factors, you can make informed decisions that lead to higher returns and greater profitability. As you continue to grow your real estate portfolio, remember that staying informed and adaptable is key to navigating the ever-changing landscape of real estate investment.

Emerging Property Markets

Emerging property markets present unique opportunities for investors looking to maximize their returns. These markets often experience rapid growth due to factors such as population influx, job creation, and infrastructure development. Identifying and investing in these areas before they become saturated can yield significant profits and long-term benefits.

I remember when I first heard about a small town that was set to become the next tech hub. Major companies were planning to establish offices there, and I recognized the potential for growth. I decided to invest in rental properties before the wave of new residents arrived. As the demand for housing increased, so did my property values and rental income. This experience taught me the importance of being proactive in seeking out emerging markets and understanding the factors that drive their growth.

| Characteristic | Description |

|---|---|

| Economic Growth | Rapid job creation and population influx. |

| Development Projects | Infrastructure improvements attracting investors. |

| Affordability | Lower property prices compared to established markets. |

| Demand for Rentals | Increased need for housing as populations grow. |

- Emerging markets can yield high returns if timed correctly.

- Investing early can lead to substantial property appreciation.

- Continuous monitoring of trends helps identify new opportunities.

“Seize the moment in emerging markets! 🚀”

In conclusion, understanding emerging property markets is essential for any savvy investor. By keeping an eye on economic trends, population growth, and infrastructure developments, you can position yourself to take advantage of new opportunities. This proactive approach will not only enhance your investment strategy but also lead to substantial financial rewards in the long run.

Real Estate Risk Assessment Strategies

Risk assessment is a critical component of successful real estate investing. Understanding the risks involved in your investments and developing strategies to mitigate them can save you from significant financial loss. Common risks include market fluctuations, property damage, and tenant issues, and being aware of these risks is the first step in protecting your investment.

In my early investing days, I didn’t focus much on risk assessment and ended up with a property that had severe structural issues, which cost me thousands in repairs. This experience opened my eyes to the importance of conducting thorough inspections and research before finalizing any purchase. Now, I always ensure that I have a comprehensive understanding of the risks associated with a property and have strategies in place to mitigate them. For example, I utilize professional property inspections, stay informed about market trends, and conduct thorough tenant screenings to ensure I’m making sound investment decisions.

| Strategy | Description |

|---|---|

| Property Inspections | Regular checks to identify issues early. |

| Market Research | Understanding market trends and fluctuations. |

| Tenant Screening | Thorough checks to ensure reliable tenants. |

| Insurance Coverage | Adequate insurance to protect against damages. |

- Risk assessment is essential for successful investing.

- Strategies can mitigate potential losses.

- Continuous monitoring of risks is necessary for long-term success.

“Protect your investment with smart risk strategies! 🛡️”

In summary, effective real estate risk assessment strategies are vital for any investor looking to succeed in the competitive market. By understanding the risks involved and implementing strategies to mitigate them, you can protect your investments and enhance your profitability. As you continue to grow your real estate portfolio, remember that proactive risk management is key to navigating the challenges and seizing the opportunities that lie ahead.

Competitive Real Estate Investment Packages

Competitive investment packages can offer real estate investors unique opportunities to diversify their portfolios and maximize returns. These packages typically bundle multiple properties or investment types, allowing investors to spread their risk and benefit from various income streams. By understanding what’s available in the market, you can make informed decisions that align with your investment strategy.

When I first explored the idea of investment packages, I was surprised by the variety available. I came across a package that included several rental properties in different neighborhoods, each with distinct characteristics and target demographics. This diversification was appealing, as it not only spread my risk but also allowed me to capitalize on various market trends. For instance, while one property in a suburban area had steady rental demand, another in a growing urban market was experiencing rapid appreciation. This strategic combination helped ensure that I had a balanced portfolio, reducing the impact of market fluctuations on my overall returns.

| Package Type | Description |

|---|---|

| Diversified Properties | Multiple properties across various markets. |

| REITs | Investment in real estate trusts for passive income. |

| Crowdfunding | Pooling resources with other investors for larger projects. |

| Turnkey Investments | Fully managed properties ready for immediate rental. |

- Competitive packages enhance investment strategies through diversification.

- They provide opportunities to invest in multiple markets simultaneously.

- Exploring different options can lead to better returns.

“Explore diverse packages for smarter investments! 📦”

In conclusion, understanding competitive real estate investment packages can significantly enhance your investment strategy. By leveraging the benefits of diversification and exploring various options, you can better position yourself for success in the ever-evolving real estate market. This approach not only mitigates risks but also opens doors to new opportunities that can lead to substantial financial growth.

Conclusion and Future Outlook

As we navigate the complexities of the real estate investment competition study, it’s essential to recognize the critical components that contribute to successful investing. From understanding market dynamics and conducting competitive analyses to evaluating investment performance metrics and identifying emerging markets, each aspect plays a vital role in shaping your investment strategy.

Reflecting on my journey, I’ve learned that the real estate market is ever-changing, influenced by economic trends, population shifts, and technological advancements. Staying informed about these factors allows you to adapt your strategies and seize new opportunities. For instance, the rise of remote work has led to increased demand for properties in suburban areas, presenting unique investment prospects that may not have existed before.

| Key Takeaway | Description |

|---|---|

| Continuous Learning | Stay updated on market trends and investment strategies. |

| Diversification | Spread your investments across various properties and markets. |

| Risk Management | Implement strategies to assess and mitigate potential risks. |

| Adaptability | Be prepared to adjust your strategy based on market conditions. |

- Continuous education is essential for long-term success.

- Diversification can help reduce risks and enhance returns.

- Proactive risk management safeguards your investments.

“Stay ahead of the curve to secure your future! 🌟”

In summary, the real estate investment competition study provides invaluable insights that can guide your investment decisions. By applying the knowledge gained from understanding market dynamics, competitive analysis, performance metrics, and emerging opportunities, you can navigate the complexities of real estate investing with confidence and success. Embrace the journey, stay informed, and watch your investments flourish.

Recommendations

In summary, understanding the intricacies of the Real Estate Investment Competition Study is essential for making informed decisions in your real estate ventures. By exploring factors such as market analysis, competitive strategies, and investment performance metrics, you can position yourself for success in this dynamic field. For those looking to take their real estate investment journey to the next level, consider utilizing the Real Estate Investment Business Plan Template, which provides a comprehensive framework to guide your investments.

Additionally, we encourage you to explore our other articles related to Real Estate Investment for further insights and strategies:

– Article 1 on Real Estate Investment SWOT Analysis Insights, via this link: https://businessconceptor.com/blog/real-estate-investment-swot/

– Article 2 on Real Estate Investment: The Key to High Profitability, via this link: https://businessconceptor.com/blog/real-estate-investment-profitability/

– Article 3 on Real Estate Investment Business Plan: Template and Tips, via this link: https://businessconceptor.com/blog/real-estate-investment-business-plan/

– Article 4 on Real Estate Investment Financial Plan: Step-by-Step Guide with Template, via this link: https://businessconceptor.com/blog/real-estate-investment-financial-plan/

– Article 5 on Launching a Real Estate Investment Business: A Complete Guide with Practical Examples, via this link: https://businessconceptor.com/blog/real-estate-investment-complete-guide/

– Article 6 on Crafting a Real Estate Investment Marketing Plan: Strategies and Examples, via this link: https://businessconceptor.com/blog/real-estate-investment-marketing-plan/

– Article 7 on Building a Business Model Canvas for Real Estate Investment: Examples Included, via this link: https://businessconceptor.com/blog/real-estate-investment-business-model-canvas/

– Article 8 on Real Estate Investment Customer Segments: Examples and Best Practices, via this link: https://businessconceptor.com/blog/real-estate-investment-customer-segments/

– Article 9 on How Much Does It Cost to Operate a Real Estate Investment Business?, via this link: https://businessconceptor.com/blog/real-estate-investment-costs/

– Article 10 on Real Estate Investment Feasibility Study: Comprehensive Guide, via this link: https://businessconceptor.com/blog/real-estate-investment-feasibility-study/

– Article 11 on Real Estate Investment Risk Management: Comprehensive Strategies, via this link: https://businessconceptor.com/blog/real-estate-developer-risk-management/

– Article 12 on How to Navigate Legal Considerations in Real Estate Investment?, via this link: https://businessconceptor.com/blog/real-estate-investment-legal-considerations/

– Article 13 on What Funding Options Should You Consider for Real Estate Investment?, via this link: https://businessconceptor.com/blog/real-estate-investment-funding-options/

– Article 14 on How to Scale Real Estate Investment: Proven Growth Strategies, via this link: https://businessconceptor.com/blog/real-estate-investment-growth-strategy/

FAQ

What is real estate market analysis?

Real estate market analysis involves evaluating various factors that influence property values and market trends. This analysis helps investors make informed decisions about where and when to invest. It includes assessing supply and demand, economic indicators, and location trends to identify the best investment opportunities.

How does competitive analysis impact real estate investing?

Competitive analysis in real estate helps investors understand the strengths and weaknesses of their competitors. By knowing what others are doing, you can position yourself strategically in the market, identify gaps, and adjust your offerings to attract more tenants or buyers, ultimately increasing your profitability.

What are investment property performance metrics?

Investment property performance metrics are key indicators used to assess the success of real estate investments. These metrics, such as cash flow, return on investment (ROI), and occupancy rates, provide valuable insights into how well a property is performing and help investors make data-driven decisions.

What factors affect real estate ROI?

Factors affecting real estate ROI include location, property management efficiency, market conditions, and the type of property. Understanding these factors allows investors to make informed decisions that can enhance profitability and mitigate risks associated with their investments.

What is market saturation in real estate?

Market saturation occurs when the supply of properties in a given area exceeds the demand. This can lead to decreased property values and increased competition among landlords, making it crucial for investors to evaluate saturation levels before making investment decisions.

How can I identify emerging property markets?

Identifying emerging property markets involves looking for areas experiencing rapid economic growth, infrastructure development, and an influx of new residents. Monitoring trends in job creation, population shifts, and local government initiatives can help you spot opportunities before they become mainstream.

What strategies should I use for risk assessment in real estate?

Risk assessment strategies in real estate include conducting thorough property inspections, performing market research, implementing effective tenant screening processes, and ensuring adequate insurance coverage. These strategies help mitigate potential risks and protect your investments from unforeseen issues.