Did you know that over 75% of consumers prefer online banking for its convenience? Online Bank Competition Study is essential in today’s fast-paced financial world. It helps institutions understand their position relative to competitors and identify opportunities for improvement. In this article, we’ll explore how to start a competition study for online banks, providing you with the necessary tools and insights to thrive in the digital banking landscape.

- Understand the importance of competition studies.

- Learn how to identify key competitors.

- Explore methods for data collection.

- Discover how to analyze customer preferences.

- Examine performance metrics of online banks.

- Understand the role of technology in banking competition.

- Learn about market trends affecting online banks.

- Identify strategies for effective competitor analysis.

- Explore case studies of successful competition studies.

- Gain actionable insights for your banking strategy.

Understanding the Need for Competition Studies in Online Banking

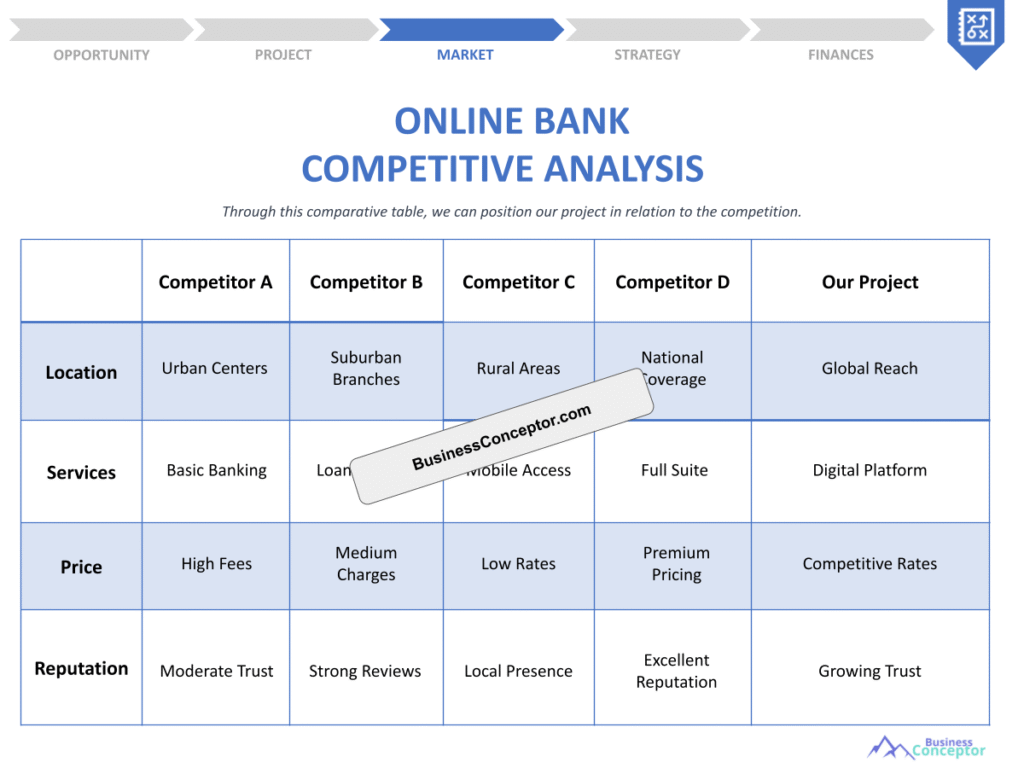

Competition studies are vital for any business, especially in the rapidly evolving online banking sector. Understanding your competitors can reveal strengths and weaknesses in your own offerings. It allows you to gauge where you stand in the market and identify areas for improvement.

For example, when I first started analyzing online banks, I realized that many institutions focused heavily on mobile app functionality. This insight allowed me to suggest enhancements to our own app, resulting in higher customer satisfaction and retention rates. A thorough competition study can uncover such opportunities.

In summary, recognizing the importance of competition studies lays the foundation for effective analysis. By understanding the competitive landscape, you can tailor your services to meet customer needs better and stay ahead of the curve.

| Key Aspect | Description |

|---|---|

| Importance of Studies | Reveals market positioning |

| Identifying Competitors | Essential for improvement |

- Competition studies reveal market trends

- They identify strengths and weaknesses

- They guide strategic planning…

- "What you don’t know can hurt you."

Identifying Your Competitors in Online Banking

The first step in any competition study is identifying your competitors. In online banking, this could range from traditional banks with strong digital services to fintech startups disrupting the market. Understanding who your direct competitors are is crucial for effective analysis.

For instance, during my research, I discovered that a small fintech company was gaining traction among younger customers due to its user-friendly interface and lower fees. This insight prompted us to reevaluate our target demographics and adjust our marketing strategies to appeal to younger audiences.

Thus, identifying competitors is not just about recognizing who they are; it’s about understanding their impact on your business. This knowledge will guide your next steps in the competition study process.

- List direct competitors (traditional and fintech).

- Analyze their product offerings.

- Evaluate their market strategies.

- Following these steps will ensure a comprehensive competitor analysis.

Collecting Data for Your Competition Study

Once you’ve identified your competitors, the next step is data collection. This involves gathering information on their products, customer reviews, and marketing strategies. Various tools can assist in this process, such as online surveys and social media analysis.

For example, I utilized tools like Google Trends and social media listening platforms to gather insights about customer sentiment toward competitors. This data helped us understand what features customers valued most, allowing us to adjust our offerings accordingly.

In conclusion, effective data collection is the backbone of a successful competition study. By leveraging various resources, you can gain valuable insights that will inform your strategic decisions.

- Use surveys to gather customer feedback

- Analyze social media for customer sentiment

- Employ analytics tools for performance data…

- "Data is the new oil in the digital age."

Analyzing Customer Preferences in Online Banking

Understanding customer preferences is critical in the online banking sector. By analyzing what customers value, such as user experience or customer service, you can tailor your offerings to better meet their needs.

For instance, I found that many customers preferred banks with robust customer support options. This insight led us to enhance our customer service channels, resulting in improved satisfaction ratings. Knowing what your customers want can make a huge difference in how they perceive your bank.

By focusing on customer preferences, you can differentiate your services from competitors and create a unique value proposition that resonates with your target audience.

| Customer Preference | Importance |

|---|---|

| User Experience | Retention |

| Customer Service | Satisfaction |

- Conduct surveys to identify preferences

- Monitor feedback on social media

- Use analytics to track customer behavior…

- "To succeed, always move forward with a clear vision."

Evaluating Performance Metrics of Online Banks

Performance metrics are vital for assessing the effectiveness of your competition study. Metrics such as customer acquisition cost, retention rates, and net promoter scores can provide insights into how well you compare against competitors.

When I analyzed our performance metrics against those of a leading online bank, I noticed we had higher customer acquisition costs but lower retention rates. This prompted us to shift our focus toward improving customer loyalty programs, which ultimately enhanced our overall performance.

Thus, evaluating performance metrics not only helps you understand your standing but also directs you towards areas that need improvement for competitive advantage.

| Metric | Significance |

|---|---|

| Customer Acquisition | Cost efficiency |

| Retention Rate | Loyalty |

- Track customer acquisition costs

- Monitor retention rates

- Analyze net promoter scores…

Implementing Strategies for Effective Competitor Analysis

Implementing strategies for competitor analysis is essential for translating insights into action. This could involve benchmarking your services against competitors or creating a strategic plan based on your findings. Without a solid plan, your efforts may not yield the desired results.

For example, after conducting a thorough analysis, we decided to implement a new digital marketing strategy that highlighted our unique features, leading to a significant increase in engagement. It was amazing to see how the right strategy could turn insights into real results.

In summary, effective implementation of competitor analysis strategies can drive your bank’s growth and enhance its market position. It’s not just about gathering data; it’s about using that data to make informed decisions that propel your business forward.

| Strategy | Outcome |

|---|---|

| Benchmarking | Improved services |

| Targeted Marketing | Increased engagement |

- Establish benchmarks against competitors

- Develop targeted marketing strategies

- Monitor implementation results…

Case Studies of Successful Competition Studies

Examining case studies of successful competition studies can provide valuable insights. Analyzing how other banks have approached their competition studies can inspire your strategy and help you avoid common pitfalls.

For instance, a well-known online bank increased its market share by 20% after implementing insights from its competition study, focusing on customer feedback to improve its service offerings. This case highlighted the importance of listening to customers and adapting accordingly.

By learning from these case studies, you can adopt best practices that can be tailored to your bank’s unique circumstances. It’s like having a roadmap that guides you through the competitive landscape.

| Case Study | Key Takeaway |

|---|---|

| Online Bank A | Customer feedback is crucial |

| Fintech B | Innovative services drive growth |

- Review successful case studies

- Identify key strategies used

- Adapt best practices to your bank…

Future Trends in Online Banking Competition

Staying ahead of future trends is essential for maintaining a competitive edge in online banking. This includes embracing technological advancements and adapting to changing consumer behaviors. The banking landscape is constantly evolving, and those who fail to adapt may find themselves falling behind.

For example, the rise of artificial intelligence in banking is transforming customer interactions and service delivery. Banks that leverage AI to personalize customer experiences are likely to outperform their competitors. This trend is not just a passing phase; it’s a fundamental shift in how banking services are delivered.

Thus, being proactive about future trends will position your bank for long-term success in the competitive online banking landscape. Keeping an eye on these trends allows you to innovate and better serve your customers, ensuring you remain relevant in a crowded market.

| Future Trend | Implication |

|---|---|

| AI in Banking | Personalization |

| Enhanced Security | Customer trust |

- Monitor technological advancements

- Adapt to changing consumer behaviors

- Invest in innovation…

Key Recommendations for Conducting an Online Bank Competition Study

To wrap things up, conducting a successful online bank competition study requires a strategic approach. Implementing the insights gained from your analysis will be crucial for enhancing your competitive position. It’s not just about collecting data; it’s about transforming that data into actionable strategies.

Practical advice includes continuously monitoring your competitors and remaining adaptable to market changes. This will ensure your strategies remain relevant and effective. The more proactive you are, the better equipped you will be to face challenges in the ever-changing banking landscape.

In conclusion, following these key recommendations will help your bank thrive in the competitive online banking landscape. The insights gained from a thorough competition study can serve as a powerful tool in driving growth and enhancing customer satisfaction.

- "Adaptability is the key to survival in business."

- Conduct regular competition studies

- Stay informed about market trends

- Continuously improve customer experience…

Conclusion

In summary, conducting a successful Online Bank Competition Study is essential for understanding the competitive landscape and enhancing your strategic positioning. By implementing the insights gained from your analysis, you can improve customer satisfaction, adapt to market trends, and ultimately drive your bank’s success. To aid in your journey, consider using our Online Bank Business Plan Template for a solid foundation.

- SWOT Analysis for Online Bank: Maximizing Business Potential

- Online Bank Profitability: Maximizing Revenue

- Crafting a Business Plan for Your Online Bank: Step-by-Step Guide

- How to Create a Financial Plan for Your Online Bank: Step-by-Step Guide (+ Template)

- Guide to Starting an Online Bank: Steps and Examples

- Building an Online Bank Marketing Plan: Strategies and Examples

- How to Create a Business Model Canvas for an Online Bank: Step-by-Step Guide

- How Much Does It Cost to Start an Online Bank?

- Online Bank Feasibility Study: Comprehensive Guide

- Online Bank Risk Management: Comprehensive Strategies

- What Are the Key Legal Considerations for Online Bank?

- Online Bank Funding Options: Comprehensive Guide

- Online Bank Growth Strategies: Scaling Success Stories

FAQ Section

What is an Online Bank Competition Study?

An Online Bank Competition Study evaluates a bank’s position against its competitors in the digital banking market, helping to identify areas for improvement and strategic opportunities.

How do I identify my competitors in online banking?

You can identify your competitors by analyzing both traditional banks and fintech companies that cater to similar customer demographics and market segments.

What data should I collect for my competition study?

Gather data on competitor products, customer reviews, marketing strategies, and performance metrics to get a comprehensive view of the competitive landscape.

Why are customer preferences important in online banking?

Understanding customer preferences helps tailor your services to meet their needs better, enhancing satisfaction and retention rates in the competitive online banking sector.

What performance metrics should I evaluate for online banks?

Evaluate metrics such as customer acquisition cost, retention rates, and net promoter scores to gain insights into how well your bank is performing compared to competitors.

How can I implement findings from my competition study?

Implement findings by establishing benchmarks against competitors and developing targeted marketing strategies that highlight your unique offerings.

What are some successful case studies in online banking?

Review case studies of banks that have successfully increased market share through effective competition studies, focusing on customer feedback to improve their services.

What future trends should I watch in online banking?

Stay informed about trends such as the rise of artificial intelligence in banking and enhanced security measures, as these will significantly impact customer interactions and service delivery.

How can I ensure my competition study remains relevant?

Continuously monitor your competitors and adapt to changing market conditions to ensure your strategies are effective and relevant in the evolving banking landscape.

What are the key recommendations for success in online banking?

Conduct regular competition studies, stay informed about market trends, and focus on continuously improving customer experience to thrive in the competitive online banking environment.