Did you know that the mortgage broker competition study reveals significant shifts in how brokers operate today? This study dives deep into the heart of the mortgage broker landscape, exploring the strategies that brokers use to navigate a constantly changing market. Simply put, this analysis looks at how mortgage brokers compete in a world where technology, consumer preferences, and regulatory environments are in a state of flux. Here are some key points to look forward to:

- Insights into current market trends

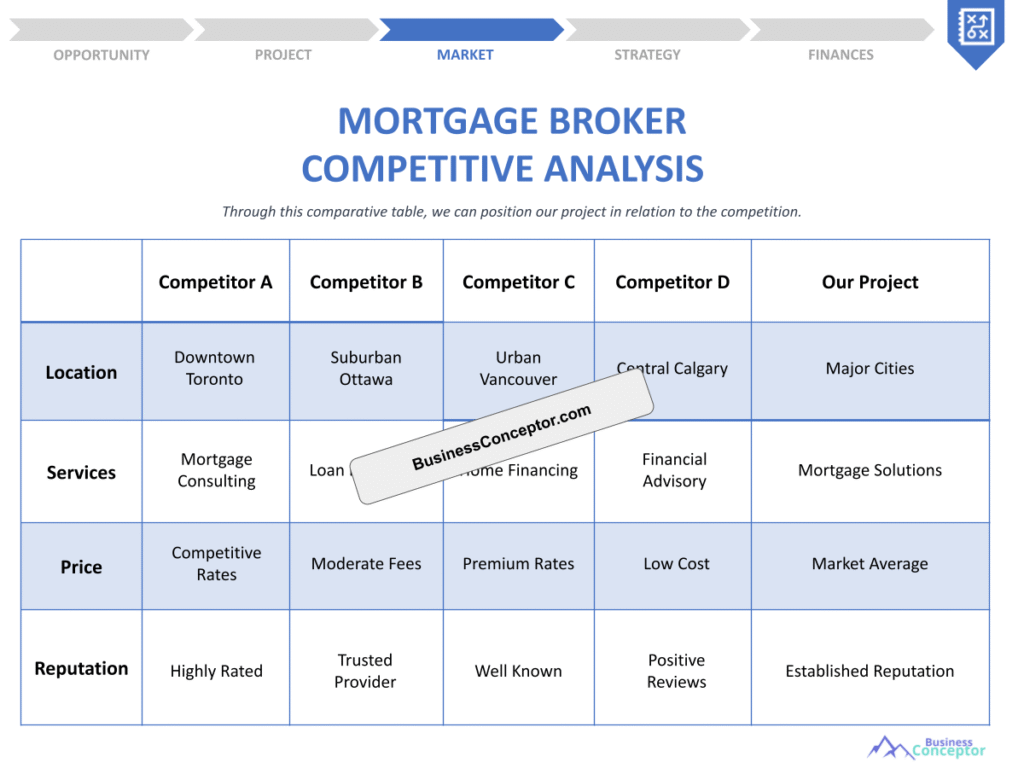

- Analysis of competitive strategies among brokers

- A look at technology’s role in shaping the industry

- Statistics on market shares and growth potential

- Real-life examples of successful brokers adapting to changes

Understanding the Competitive Landscape of Mortgage Brokers

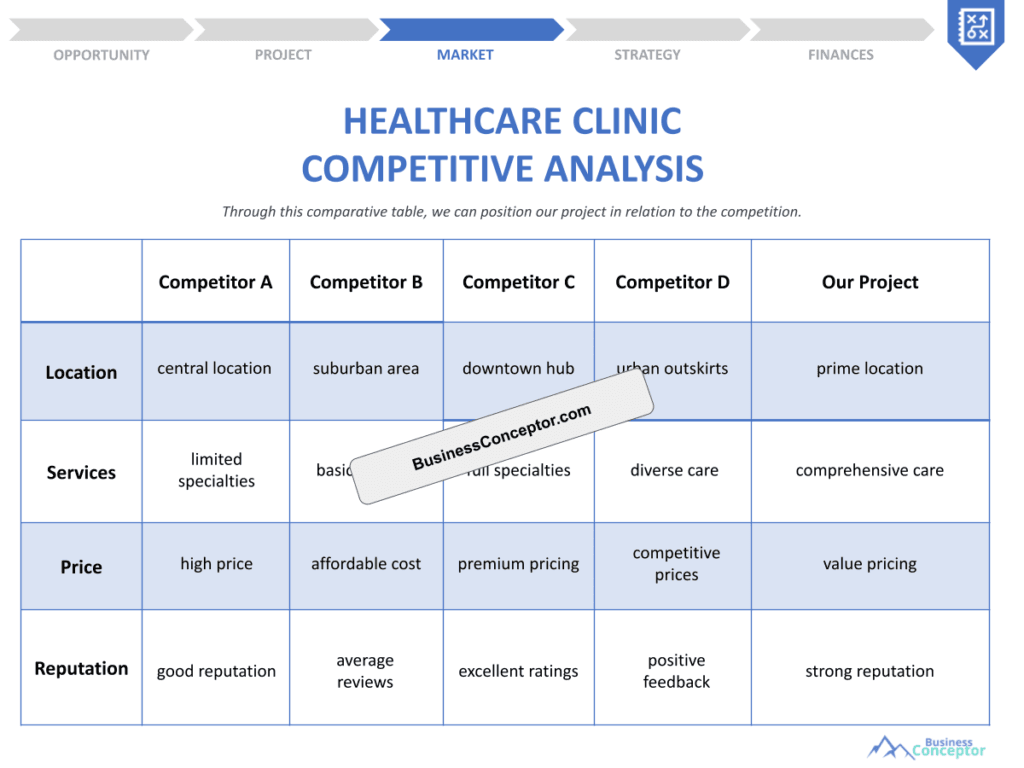

When we talk about the competitive landscape of mortgage brokers, we’re diving into the unique dynamics that define this industry. The mortgage broker industry is filled with various players, from traditional banks to innovative fintech startups, each vying for a piece of the pie. Brokers are constantly looking for ways to differentiate themselves and attract clients in this crowded marketplace.

Take, for example, the brokers who focus on personalized service. They take the time to understand their clients’ needs, offering tailored solutions that big banks may overlook. In contrast, some brokers leverage technology to streamline the mortgage process, making it easier for clients to access information and compare rates. This differentiation is crucial because it helps brokers carve out a niche in a competitive environment.

As we delve deeper into this section, we must consider the various factors influencing competition. The regulatory environment is one such factor; changes in regulations can either open new opportunities or create barriers for brokers. Additionally, consumer preferences are shifting. Today’s buyers are looking for convenience and speed, pushing brokers to adapt their services accordingly. Brokers who can pivot quickly in response to these changes often find themselves leading the pack.

| Factor | Impact on Competition |

|---|---|

| Regulatory Changes | Can create new opportunities or barriers |

| Technology Adoption | Enhances efficiency and client experience |

| Consumer Preferences | Shifts demand towards personalized services |

- Brokers need to adapt to regulations to stay competitive.

- Technology is increasingly becoming a key differentiator.

- Understanding consumer preferences is crucial for success.

“In a world of constant change, adaptability is the key to survival.” 🌟

Moreover, successful brokers often find ways to leverage their strengths. For instance, brokers who specialize in certain markets, such as first-time homebuyers or investors, can position themselves as experts in those fields. This specialization allows them to build trust with clients, which is invaluable in a relationship-driven industry like this one. By understanding the specific needs of their target market, these brokers can tailor their offerings and communication strategies effectively.

Additionally, brokers who prioritize technology can streamline their operations, making it easier to serve clients. With tools like customer relationship management (CRM) systems, brokers can manage their leads and client interactions more efficiently. This not only saves time but also ensures that clients receive the attention they deserve throughout the mortgage process.

In summary, the competitive landscape of mortgage brokers is shaped by various factors, including regulations, technology, and consumer behavior. Brokers who can navigate these complexities and leverage their unique advantages will likely thrive in the evolving market. The key lies in adaptability and a willingness to embrace change.

Analyzing Market Trends Affecting Mortgage Brokers

The mortgage industry is always in motion, and understanding the current market trends is vital for brokers who want to thrive. As the dynamics of the market shift, brokers must adapt their strategies to meet changing consumer demands. One significant trend is the rise of digital mortgage platforms, which have transformed how consumers approach the mortgage process. These platforms often provide users with the ability to compare rates and terms quickly, making it easier than ever for them to make informed decisions.

As a broker, recognizing this trend means understanding the competitive landscape. Brokers who leverage technology to enhance their service offerings can attract more clients. For instance, a broker who utilizes online tools to provide instant rate comparisons or to facilitate the application process can appeal to tech-savvy clients who value convenience. By offering streamlined digital solutions, brokers can not only save time but also improve the overall client experience.

Another notable trend is the increasing focus on sustainability. Many consumers today are not just interested in finding the best mortgage rates; they also want to invest in eco-friendly homes. Brokers who educate themselves on green financing options can tap into this growing market. By offering specialized products that cater to environmentally conscious buyers, brokers can differentiate themselves from competitors who may not be as informed about these options.

| Trend | Description |

|---|---|

| Digital Transformation | Brokers leveraging technology for efficiency |

| Eco-Friendly Financing | Increased demand for sustainable home options |

- Digital solutions are reshaping how brokers engage with clients.

- Understanding niche markets can provide a competitive edge.

- Keeping up with trends is essential for long-term success.

“Embrace change, or be left behind.” 🚀

Moreover, the impact of the housing market itself cannot be overlooked. As housing prices fluctuate, brokers must stay informed about local market conditions to provide accurate advice to clients. For instance, during periods of rising home prices, buyers may feel pressured to act quickly, making it crucial for brokers to be proactive in their communication. By being a reliable source of information, brokers can build trust and foster long-lasting relationships with their clients.

In summary, the ability to analyze and respond to market trends is essential for mortgage brokers. By embracing technology and understanding consumer preferences, brokers can position themselves as leaders in the industry. Those who can pivot and adapt to these changes will not only survive but also thrive in the competitive landscape.

The Role of Technology in Mortgage Broker Competition

Technology has become a driving force in the mortgage broker competition. As the industry evolves, brokers must harness the power of technology to enhance their services and remain competitive. One of the most significant advantages of technology is its ability to streamline processes, making it easier for brokers to serve their clients efficiently. For example, using automated underwriting systems can significantly speed up the approval process, allowing brokers to provide timely responses to their clients.

Furthermore, the implementation of customer relationship management (CRM) systems has transformed how brokers interact with clients. These systems enable brokers to track leads, manage client interactions, and analyze data to improve their marketing strategies. A broker who effectively utilizes a CRM can ensure that no client is overlooked, ultimately leading to higher conversion rates and increased client satisfaction.

Social media platforms also play a crucial role in modern mortgage broking. Brokers who actively engage with potential clients through platforms like Facebook, Instagram, and LinkedIn can build their brand and establish trust. Sharing valuable content, such as tips on the mortgage process or updates on market trends, can position a broker as an industry expert, attracting more clients to their services.

| Technology | Benefits |

|---|---|

| AI in Underwriting | Faster approvals and reduced processing time |

| CRM Systems | Improved client relationship management |

- Technology enhances service speed and efficiency.

- Social media is a powerful tool for engagement and marketing.

- Adopting new tech can lead to significant competitive advantages.

“Technology is best when it brings people together.” 💻

Moreover, brokers who invest in data analytics can gain valuable insights into consumer behavior and market trends. By understanding what drives clients’ decisions, brokers can tailor their services and marketing strategies accordingly. For example, if data shows that clients prefer digital communication, brokers can adjust their approach to meet those expectations, ultimately leading to higher satisfaction rates.

In conclusion, the role of technology in the mortgage broker competition cannot be overstated. Brokers who embrace technological advancements not only improve their operational efficiency but also enhance the client experience. By leveraging technology effectively, brokers can differentiate themselves in a crowded market and position themselves for long-term success.

Competitive Advantages of Successful Mortgage Brokers

In the fast-paced world of mortgage brokers, identifying and leveraging competitive advantages is critical for success. Brokers who can effectively showcase their unique strengths often stand out in a crowded marketplace. One significant advantage is the ability to build and maintain strong relationships with lenders. By nurturing these connections, brokers can negotiate better terms for their clients, which can lead to more favorable mortgage rates and conditions.

For instance, a broker who has established a rapport with a variety of lenders can provide clients with a wider array of options, catering to their specific financial situations. This flexibility can be particularly beneficial for clients with unique needs, such as self-employed individuals or first-time homebuyers. When brokers can offer tailored solutions, it not only enhances their credibility but also increases the likelihood of client referrals.

Another competitive edge comes from specialization. Brokers who focus on specific niches, such as first-time homebuyers or veteran financing, can position themselves as experts in those areas. This specialization allows them to provide invaluable insights and advice, setting them apart from generalist brokers. For example, a broker specializing in veteran financing might be well-versed in the intricacies of VA loans, enabling them to guide clients through the process effectively and confidently.

| Competitive Advantage | Impact on Success |

|---|---|

| Strong Lender Relationships | Better terms and options for clients |

| Niche Specialization | Attracts targeted demographics |

- Building relationships is key to negotiating better deals.

- Specialization can make a broker an expert in their field.

- Excellent customer service leads to referrals and repeat business.

“Your reputation is more important than your paycheck.” 🌟

Moreover, successful brokers recognize the importance of providing exceptional customer service. In an industry where trust and reliability are paramount, brokers who prioritize communication and transparency often see higher levels of client satisfaction. For example, keeping clients informed throughout the mortgage process—from application to closing—can foster a sense of security and build lasting relationships. This approach not only encourages repeat business but also generates positive word-of-mouth referrals.

Additionally, brokers who actively solicit feedback from clients can use this information to refine their services further. By understanding what clients appreciate and what areas may need improvement, brokers can adapt their offerings to better meet consumer expectations. This continuous improvement cycle can lead to a significant competitive advantage in the long run.

Understanding Consumer Behavior in Mortgage Shopping

Consumer behavior plays a pivotal role in shaping the strategies of mortgage brokers. Understanding what drives consumers to choose one broker over another can provide invaluable insights for improving services. Today’s consumers are increasingly informed and often conduct extensive research before engaging with brokers. They want to find the best mortgage rates while ensuring a smooth and efficient process.

One major trend is the demand for convenience and speed. Clients want to complete their mortgage applications quickly and with minimal hassle. Brokers who streamline the application process and offer digital solutions can meet these expectations effectively. For instance, implementing online application forms and e-signature capabilities can significantly reduce processing times, enhancing the overall client experience.

Moreover, clients are looking for personalized service. Brokers who take the time to understand their clients’ specific needs and financial situations can provide tailored solutions that resonate more with potential borrowers. This level of personalized attention can be a key differentiator in a competitive market. For example, a broker who offers customized mortgage options based on a client’s unique financial profile is likely to earn their trust and loyalty.

| Consumer Behavior | Implications for Brokers |

|---|---|

| Demand for Convenience | Streamlining processes is essential |

| Increased Research Online | A strong online presence is crucial |

- Consumers value convenience and speed in the mortgage process.

- Being informed helps brokers engage more effectively.

- Providing value-added services can enhance client relationships.

“Understand your customer’s journey to guide them better.” 🌍

Additionally, the impact of social proof cannot be ignored. Clients often rely on reviews and testimonials when selecting a mortgage broker. Brokers who actively seek positive feedback from past clients and showcase these testimonials on their websites and social media can enhance their credibility. A strong online reputation can significantly influence potential clients’ decisions, making it imperative for brokers to manage their digital presence effectively.

In summary, understanding consumer behavior is essential for mortgage brokers aiming to succeed in a competitive landscape. By recognizing the importance of convenience, personalization, and social proof, brokers can tailor their services to meet the evolving needs of clients. This focus on consumer behavior not only enhances client satisfaction but also leads to increased referrals and long-term success in the mortgage industry.

The Future of Mortgage Broker Competition

As we look towards the future, the mortgage broker competition landscape is poised for significant transformation. Several key trends are shaping how brokers operate, and understanding these shifts is crucial for long-term success. One of the most prominent changes is the increasing reliance on technology. Brokers who embrace digital solutions will likely find themselves ahead of the curve, as more consumers expect seamless online experiences when searching for mortgage options.

For instance, the rise of artificial intelligence (AI) in the mortgage industry is changing the way brokers engage with clients. AI-driven tools can analyze vast amounts of data to provide personalized recommendations, helping brokers offer tailored mortgage solutions that meet individual client needs. This level of personalization not only enhances the client experience but also increases the likelihood of closing deals. Brokers who invest in AI technologies will have a competitive advantage in providing quick, accurate, and relevant mortgage options to their clients.

Another critical factor in the future of mortgage broking is the ongoing evolution of consumer expectations. Today’s clients are more informed than ever, thanks to access to online resources and comparison tools. They demand transparency, speed, and flexibility in their mortgage processes. Brokers who can adapt to these expectations by offering streamlined services, clear communication, and quick responses will stand out in a crowded market. For example, providing clients with online portals where they can track their application status in real-time can significantly enhance customer satisfaction.

| Future Trends | Considerations for Brokers |

|---|---|

| Emphasis on Digital Solutions | Need for continuous adaptation |

| Regulatory Changes | Staying informed is key |

- The industry will continue to evolve with technology and regulation.

- Differentiation will be crucial for long-term success.

- Adapting to changes quickly can provide a competitive advantage.

“The future belongs to those who believe in the beauty of their dreams.” 🌟

Moreover, regulatory changes will continue to impact the mortgage broker industry. As governments implement new policies and regulations, brokers must stay informed and compliant to avoid potential pitfalls. This proactive approach not only helps brokers navigate challenges but can also position them as trusted advisors in the eyes of their clients. For instance, brokers who keep abreast of changes in lending standards or interest rate adjustments can provide timely advice that benefits their clients.

In conclusion, the future of mortgage broker competition will be defined by technological advancements, changing consumer expectations, and evolving regulations. Brokers who can adapt to these trends and leverage their unique strengths will thrive in this dynamic environment.

Conclusion and Takeaways from the Mortgage Broker Competition Study

The insights gained from the mortgage broker competition study provide a comprehensive understanding of the evolving landscape in which brokers operate. As the industry continues to change, brokers must remain agile and responsive to both market dynamics and consumer behavior. One of the most significant takeaways is the importance of leveraging technology. By adopting tools that enhance efficiency and improve client interactions, brokers can set themselves apart from their competitors.

Additionally, understanding and responding to consumer needs is essential. Brokers who prioritize customer service and create personalized experiences are more likely to earn trust and loyalty from clients. This focus on client relationships can lead to increased referrals and repeat business, which are vital for long-term success in the mortgage industry.

Moreover, the competitive landscape will be influenced by ongoing market trends, including the growing demand for eco-friendly financing options and the need for transparent communication. Brokers who position themselves as experts in these areas will be well-equipped to meet the demands of a changing market.

| Key Takeaways | Implications for Brokers |

|---|---|

| Stay Informed about Trends | Helps in strategic planning |

| Embrace Technology | Enhances client service and efficiency |

- Knowledge is power in the competitive mortgage landscape.

- Technology and customer focus are essential for growth.

- Adaptability will define successful brokers in the future.

“The best way to predict the future is to create it.” 🌟

In summary, the mortgage broker competition study underscores the importance of being proactive and adaptable in an ever-changing environment. By focusing on technology, consumer behavior, and market trends, brokers can position themselves for success in the future.

Strategies for Mortgage Brokers to Enhance Their Competitive Edge

In the ever-evolving landscape of the mortgage broker industry, having a competitive edge is crucial for long-term success. Brokers need to adopt various strategies that not only help them stand out but also resonate with their target audience. One effective strategy is to leverage advanced digital marketing techniques. With the increasing reliance on online platforms, brokers who invest in search engine optimization (SEO) and targeted advertising can significantly enhance their visibility. This means creating engaging content that addresses potential clients’ questions and concerns, ensuring that brokers appear prominently in search results.

For example, by writing informative blog posts about the mortgage process, market trends, or tips for first-time homebuyers, brokers can establish themselves as trusted authorities in their field. This not only helps in attracting potential clients but also builds credibility and trust. Additionally, utilizing social media platforms to share success stories, testimonials, and valuable insights can further enhance a broker’s online presence. Engaging with clients on these platforms allows brokers to create a community around their services, fostering loyalty and encouraging referrals.

Another strategy that can significantly benefit brokers is the implementation of comprehensive training programs for their staff. As the mortgage industry becomes more complex, having a knowledgeable team that understands the nuances of different mortgage products and regulatory requirements is essential. Brokers who invest in continuous education for their team can provide better service to their clients, ensuring that they receive accurate and timely advice. This level of expertise can set brokers apart from competitors who may not prioritize training.

| Strategy | Benefits |

|---|---|

| Digital Marketing Techniques | Increases visibility and attracts clients |

| Staff Training Programs | Enhances service quality and expertise |

- Investing in digital marketing is essential for attracting clients.

- Training staff improves overall service quality.

- Building a community through social media fosters loyalty.

“Knowledge is power; invest in it.” 📚

Furthermore, embracing technology to improve operational efficiency is a vital strategy. Brokers can utilize customer relationship management (CRM) systems to streamline their processes, manage client interactions, and track leads effectively. A well-implemented CRM can help brokers stay organized, ensuring that no potential client is overlooked. This can lead to higher conversion rates and improved client satisfaction, as timely follow-ups and personalized communication become more manageable.

Moreover, brokers should consider diversifying their service offerings to cater to a broader range of clients. By providing specialized products, such as reverse mortgages or investment property financing, brokers can attract different segments of the market. This diversification not only increases revenue potential but also positions brokers as versatile and knowledgeable professionals who can meet various client needs.

Building Strong Relationships in the Mortgage Industry

In the mortgage broker competition, building strong relationships is a cornerstone of success. Brokers who prioritize relationship-building with clients, lenders, and industry partners often find themselves with a distinct advantage. Establishing trust and rapport with clients is essential, as many people view purchasing a home as one of the most significant financial decisions of their lives. Brokers who take the time to understand their clients’ unique needs and concerns can create lasting bonds that lead to repeat business and referrals.

One effective way to build relationships is through regular communication. Brokers who keep their clients informed throughout the mortgage process, providing updates and answering questions promptly, demonstrate their commitment to excellent service. Additionally, hosting educational workshops or webinars can help brokers engage with potential clients and showcase their expertise. By offering valuable information, brokers can position themselves as go-to resources in the mortgage industry.

Furthermore, maintaining strong relationships with lenders is equally important. Brokers who foster good connections with various lending institutions can negotiate better terms and conditions for their clients. This not only enhances the value they provide but also increases the likelihood of closing deals quickly. By being well-connected in the industry, brokers can offer clients a wider range of options, making them more competitive in the marketplace.

| Relationship Building | Advantages |

|---|---|

| Client Relationships | Leads to repeat business and referrals |

| Lender Relationships | Enables better negotiation and options |

- Regular communication fosters trust and loyalty.

- Educational workshops position brokers as experts.

- Strong lender connections enhance deal-closing opportunities.

“Strong relationships are the foundation of success.” 🤝

In summary, the ability to build and maintain strong relationships is crucial for mortgage brokers aiming to succeed in a competitive environment. By focusing on relationship-building with clients and lenders, brokers can enhance their reputation, attract new business, and ultimately achieve greater success in the mortgage industry.

Recommendations

In summary, the mortgage broker competition study highlights the need for brokers to adapt to an evolving landscape characterized by technological advancements, changing consumer expectations, and competitive strategies. To further enhance your business acumen, consider utilizing our Mortgage Broker Business Plan Template. This template provides a structured approach to developing a solid business plan that can guide you through the complexities of the mortgage industry.

Additionally, we encourage you to explore our related articles that delve deeper into various aspects of being a successful mortgage broker:

- Mortgage Broker SWOT Analysis Insights

- Mortgage Brokers: Secrets to High Profitability

- Mortgage Broker Business Plan: Essential Steps and Examples

- Mortgage Broker Financial Plan: Essential Steps and Example

- Building a Mortgage Broker Business: A Complete Guide with Practical Examples

- Crafting a Marketing Plan for Your Mortgage Broker Business (+ Example)

- Building a Business Model Canvas for Mortgage Broker: Examples and Tips

- Customer Segments for Mortgage Brokers: Who Are Your Potential Clients?

- How Much Does It Cost to Establish a Mortgage Broker Business?

- How to Conduct a Feasibility Study for Mortgage Broker?

- How to Implement Effective Risk Management for Mortgage Broker?

- Mortgage Broker Legal Considerations: Comprehensive Guide

- What Funding Options Are Available for Mortgage Broker?

- How to Scale a Mortgage Broker: Proven Growth Strategies

FAQ

What are the current trends in the mortgage broker industry?

The mortgage broker industry is witnessing several trends, including a greater emphasis on digital solutions and the integration of technology. Brokers are increasingly adopting artificial intelligence tools to enhance client interactions and streamline processes, which improves overall efficiency. Additionally, there is a growing demand for sustainable financing options as more consumers seek eco-friendly homes.

How can mortgage brokers enhance their competitive edge?

To enhance their competitive edge, mortgage brokers should focus on leveraging digital marketing techniques and implementing comprehensive training programs for their staff. By optimizing their online presence and ensuring their team is knowledgeable about the latest mortgage products and regulations, brokers can provide better service and attract more clients.

What role does technology play in mortgage brokering?

Technology plays a pivotal role in mortgage brokering by enabling brokers to streamline their operations, improve client communication, and enhance service delivery. Tools such as customer relationship management (CRM) systems help brokers manage leads and client interactions efficiently, while AI can offer personalized recommendations, making the mortgage process smoother for clients.

How important is client relationship management for mortgage brokers?

Client relationship management is crucial for mortgage brokers as it fosters trust and loyalty. By maintaining open lines of communication and providing personalized service, brokers can enhance the client experience, leading to repeat business and referrals. Strong relationships with clients also enable brokers to better understand their needs and offer tailored solutions.

What are some common challenges faced by mortgage brokers?

Common challenges faced by mortgage brokers include navigating regulatory changes, competing with digital platforms, and managing client expectations. Staying informed about industry regulations and trends is essential for brokers to remain competitive. Additionally, brokers must continually adapt their services to meet the evolving demands of tech-savvy consumers.