Did you know that nearly 80% of investment banks struggle to maintain their market share in today’s fast-paced financial environment? That’s a staggering fact that underscores the importance of a well-structured Investment Bank Competition Study. This study is crucial for understanding not just where your bank stands but also how it can outperform its rivals. An Investment Bank Competition Study involves a detailed analysis of competitors, market dynamics, and strategic positioning to gain valuable insights that can drive decision-making.

- Importance of competition studies in investment banking.

- Key components of a successful competition study.

- Methods for data collection and analysis.

- Utilizing SWOT analysis for strategic insights.

- Understanding market trends and dynamics.

- How to benchmark against competitors.

- Case studies of successful competition studies.

- Recommendations for ongoing market analysis.

- The role of technology in competitive analysis.

- Future trends in investment banking competition.

The Importance of an Investment Bank Competition Study

When it comes to the world of investment banking, competition is fierce. Every bank aims to attract high-net-worth clients and secure lucrative deals. A comprehensive competition study allows banks to identify their strengths and weaknesses compared to their rivals, helping them make informed strategic decisions. This section will delve into why such a study is essential for any investment bank looking to thrive in a crowded market.

For instance, many banks have found that their unique selling propositions (USPs) aren’t resonating with clients. By conducting a competition study, they can gather insights on client preferences and market gaps. For example, a bank might discover that their competitors are offering more personalized services, prompting them to adjust their approach. Such insights can lead to improved client satisfaction and loyalty.

In conclusion, the importance of a thorough Investment Bank Competition Study cannot be overstated. It serves as a foundation for strategic planning and market positioning. As we move forward, we’ll explore the key components that make up an effective competition study.

| Key Aspect | Description |

|---|---|

| Market Insights | Understanding the competitive landscape |

| Strategic Planning | Informing future strategies |

| Client Preferences | Tailoring services to meet demands |

| Performance Benchmarking | Measuring success against competitors |

- Understanding the competitive landscape

- Informing future strategies

- Tailoring services to meet demands

- Measuring success against competitors

- Enhancing client satisfaction

– “In the competitive world of investment banking, knowledge is power.”

Key Components of a Competition Study

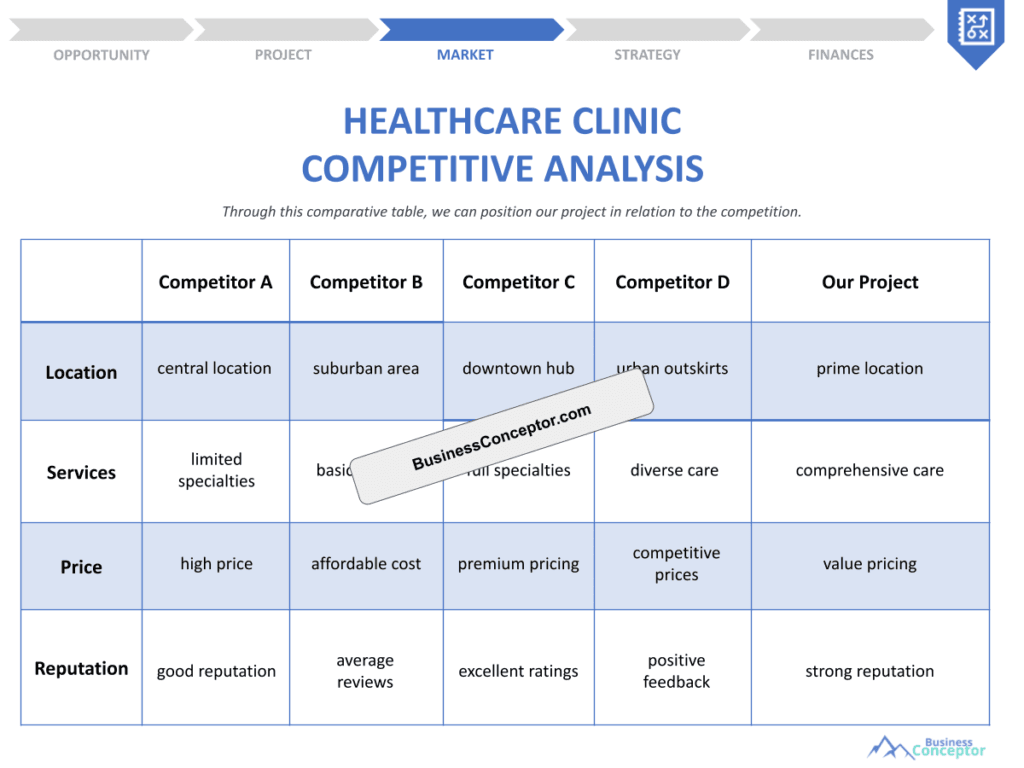

To create a robust competition study, several critical components must be considered. These include market analysis, competitor profiling, and performance metrics. Each of these elements plays a vital role in shaping the overall understanding of the competitive landscape. This section will break down these components for clarity.

Market analysis involves looking at broader industry trends and economic factors that could impact the investment banking sector. For example, understanding shifts in client demographics or emerging technologies can provide a competitive edge. Competitor profiling, on the other hand, focuses on identifying key players in the market and analyzing their strengths, weaknesses, and strategic approaches. This data is often gathered through public records, market reports, and direct competitor engagement.

By synthesizing these components, banks can form a well-rounded picture of their competitive environment. This understanding allows them to identify opportunities for growth and areas needing improvement, setting the stage for strategic initiatives. Next, we’ll explore the methodologies used in gathering and analyzing this critical data.

| Key Component | Description |

|---|---|

| Market Analysis | Understanding broader industry trends and economic factors |

| Competitor Profiling | Identifying and analyzing key players in the market |

| Performance Metrics | Measuring success and effectiveness of strategies |

| SWOT Analysis | Identifying strengths, weaknesses, opportunities, and threats |

- Market analysis

- Competitor profiling

- Performance metrics

- SWOT analysis

- Client feedback analysis

– The above steps must be followed rigorously for optimal success.

Data Collection Methods

Collecting data for an Investment Bank Competition Study can be daunting, but it’s essential for gaining accurate insights. Various methods can be employed, such as surveys, interviews, and secondary research. This section will discuss these methods and their effectiveness.

Surveys and interviews can provide first-hand information from clients and industry experts, revealing insights that secondary research might miss. For instance, a bank might conduct a survey to gauge client satisfaction with their services compared to competitors. On the other hand, secondary research involves analyzing existing reports and studies to gather relevant data. This combination of qualitative and quantitative data can yield a comprehensive view of the competitive landscape.

Ultimately, the choice of data collection methods will depend on the specific objectives of the competition study. By utilizing a mix of approaches, banks can ensure they have a well-rounded perspective. The next section will focus on how to analyze and interpret this data effectively.

| Data Collection Method | Description |

|---|---|

| Surveys | Gathering direct feedback from clients |

| Interviews | Obtaining insights from industry experts |

| Secondary Research | Analyzing existing reports and studies |

| Focus Groups | Gathering qualitative insights from selected clients |

- Surveys

- Interviews

- Secondary research

- Focus groups

- Market reports

– “Data is the new oil; refining it is the key.”

Analyzing Competition Data

Once data has been collected, the next step is analysis. This is where the real insights emerge. Analyzing competition data involves not just looking at numbers but interpreting what they mean for your bank’s strategy. This section will explore various analytical techniques and tools that can be utilized.

Techniques such as SWOT analysis can be incredibly effective in breaking down the competitive landscape. By identifying strengths, weaknesses, opportunities, and threats, banks can formulate strategies that leverage their advantages while addressing potential challenges. Additionally, benchmarking against industry standards can help banks gauge their performance relative to competitors.

After analysis, it’s crucial to synthesize the findings into actionable insights. This synthesis can inform strategic decisions and operational adjustments. Moving forward, we’ll discuss how to implement these insights into a cohesive strategy.

| Technique | Description |

|---|---|

| SWOT Analysis | Identifying strengths and weaknesses |

| Benchmarking | Measuring performance against competitors |

| Trend Analysis | Observing market trends over time |

| Data Visualization | Using graphs and charts to present findings |

- Collect data from various sources

- Conduct SWOT analysis

- Benchmark against industry standards

- Identify key insights

- Formulate actionable strategies

– The above steps must be followed rigorously for optimal success.

Implementing Insights into Strategy

After analyzing the data and extracting insights, the next step is implementing these findings into your bank’s strategy. This is where many banks falter, failing to translate insights into action. This section will discuss effective strategies for implementation.

A common approach is to set specific, measurable goals based on the insights gathered. For example, if a competition study reveals that clients prefer personalized services, a bank might implement a client relationship management system to enhance personalized interactions. Additionally, regular review meetings should be scheduled to assess progress and make adjustments as necessary.

By actively integrating insights into strategy, banks can remain agile and responsive to market changes. The next section will delve into the importance of continuous monitoring and adjustment of strategies based on ongoing competition studies.

| Step | Description |

|---|---|

| Set Measurable Goals | Define specific objectives based on insights |

| Develop Action Plans | Create detailed plans for achieving goals |

| Schedule Review Meetings | Regularly assess progress and adjust strategies |

| Ensure Team Alignment | Make sure all team members are on the same page |

- Set measurable goals

- Develop action plans

- Schedule review meetings

- Ensure team alignment

- Monitor market changes

– “Success comes to those who persevere.”

Continuous Monitoring and Adjustment

The financial market is not static; it evolves constantly. Therefore, continuous monitoring of the competitive landscape is essential for investment banks. This section emphasizes the need for ongoing analysis and the adjustment of strategies based on new data.

One effective method for continuous monitoring is establishing key performance indicators (KPIs) that can signal when a strategy is underperforming. For instance, if client retention rates drop, it may indicate a need to revisit service offerings. Moreover, regular competitor analysis can reveal new entrants or shifts in market dynamics that require immediate action.

By fostering a culture of agility and responsiveness, banks can adapt more quickly to changes and maintain their competitive edge. In the final section, we will summarize the key takeaways from conducting an Investment Bank Competition Study.

| Technique | Description |

|---|---|

| KPI Tracking | Establishing metrics to monitor performance |

| Regular Competitor Analysis | Keeping an eye on market shifts |

| Client Feedback Loops | Gathering ongoing client insights |

| Market Trends Monitoring | Identifying emerging trends and threats |

- Establish KPIs

- Conduct regular competitor analysis

- Create client feedback mechanisms

- Adjust strategies based on findings

- Foster a culture of adaptability

– The above steps must be followed rigorously for optimal success.

Real-Life Case Studies

To truly understand the impact of an Investment Bank Competition Study, examining real-life case studies can provide invaluable lessons. This section will highlight notable examples of banks that successfully utilized competition studies to enhance their market position.

For instance, a prominent investment bank identified through their competition study that clients were increasingly gravitating towards firms with a strong digital presence. As a result, they invested heavily in digital marketing and online services, leading to a significant increase in client acquisition and retention. Such case studies illustrate the tangible benefits of conducting thorough competition analyses.

These examples serve as powerful reminders of the importance of staying informed about competitive dynamics. They also highlight how proactive adjustments can lead to substantial improvements in performance. Next, we’ll summarize the critical elements of building a successful competition study.

| Bank Name | Key Insight |

|---|---|

| Bank A | Digital investment led to increased client acquisition |

| Bank B | Personalized services boosted client retention |

- Importance of digital presence

- Value of personalized services

- Proactive strategy adjustments

- Continuous market monitoring

- Leveraging data for decision-making

– “To succeed, always move forward with a clear vision.”

Future Trends in Investment Banking Competition

As we look toward the future, several trends are shaping the investment banking landscape. Understanding these trends is crucial for any bank looking to stay competitive. This section will explore emerging trends that could impact competition in the industry.

One significant trend is the rise of fintech companies, which are disrupting traditional banking models with innovative solutions. These companies often provide faster, more efficient services that appeal to tech-savvy clients. Additionally, sustainability and ethical investing are becoming increasingly important to clients, prompting banks to adapt their services accordingly. Keeping an eye on these trends will be vital for maintaining relevance in a rapidly changing market.

By anticipating and adapting to these trends, banks can position themselves as leaders rather than followers. In the next section, we’ll conclude with actionable steps for creating a comprehensive Investment Bank Competition Study.

| Trend | Description |

|---|---|

| Fintech Disruption | Innovative solutions challenging traditional banks |

| Sustainability | Increased demand for ethical investment options |

| Client Preferences | Shift towards personalized and tech-driven services |

| Regulatory Changes | Impact of new regulations on banking practices |

- Monitor fintech developments

- Incorporate sustainability into offerings

- Engage with clients about evolving preferences

- Innovate services to meet new demands

- Stay ahead of regulatory changes

– The above steps must be followed rigorously for optimal success.

Key Takeaways for a Successful Competition Study

In summary, conducting a thorough Investment Bank Competition Study is essential for any bank aiming to thrive in a competitive landscape. The insights gained from such a study can inform strategic decisions and improve overall performance.

By following the outlined steps—from data collection and analysis to implementation and continuous monitoring—banks can build a robust framework for understanding their competitive environment. Practical advice and real-life examples can further enhance the effectiveness of these studies.

As we conclude, it’s important to remember that the financial landscape is always evolving. Banks must remain vigilant and adaptable to sustain their competitive edge.

| Key Point | Action |

|---|---|

| Importance of competition studies | Conduct regularly |

| Data collection methods | Utilize diverse techniques |

| Analysis techniques | Implement actionable insights |

| Continuous monitoring | Establish KPIs and feedback loops |

- Conduct regular competition studies

- Implement findings into strategic planning

- Stay updated on market trends

- Foster a culture of continuous improvement

- Engage clients for feedback and insights

– “Success comes to those who persevere.”

Conclusion

In conclusion, conducting a thorough Investment Bank Competition Study is essential for any bank aiming to thrive in a competitive landscape. This guide has outlined the key components, data collection methods, analysis techniques, and implementation strategies necessary for a successful study. By understanding the competitive environment and adapting to market changes, banks can enhance their performance and achieve long-term success.

For those looking to create a solid foundation for their business, consider using the Investment Bank Business Plan Template to streamline your planning process. Additionally, explore our other insightful articles for further guidance on various aspects of running an investment bank:

- SWOT Analysis for Investment Bank: Ensuring Business Success

- Investment Bank Profitability: Key Considerations

- Writing a Business Plan for Your Investment Bank: Template Included

- Financial Planning for Your Investment Bank: A Comprehensive Guide (+ Example)

- Guide to Starting an Investment Bank: Steps and Examples

- Starting an Investment Bank Marketing Plan: Strategies and Examples

- Start Your Investment Bank Business Model Canvas: A Comprehensive Guide

- How Much Does It Cost to Establish an Investment Bank?

- How to Build a Feasibility Study for Investment Bank?

- How to Build a Risk Management Plan for Investment Bank?

- What Legal Considerations Should You Be Aware of for Investment Bank?

- What Funding Options Should You Consider for Investment Bank?

- Growth Strategies for Investment Bank: Scaling Examples

FAQ Section

What is an Investment Bank Competition Study?

An Investment Bank Competition Study is an analysis that evaluates a bank’s position relative to its competitors, identifying strengths, weaknesses, and market opportunities.

Why is a competition study important for investment banks?

It helps banks understand their competitive landscape, allowing for informed strategic decisions and improved client services.

What key components should be included in a competition study?

Key components include market analysis, competitor profiling, performance metrics, and SWOT analysis.

How can data be collected for a competition study?

Data can be collected through surveys, interviews, secondary research, and market reports.

What analytical techniques can be used in a competition study?

Techniques like SWOT analysis, benchmarking, and trend analysis are commonly used.

How often should a competition study be conducted?

It should be conducted regularly, ideally at least annually or whenever significant market changes occur.

What role does technology play in competition studies?

Technology facilitates data collection, analysis, and monitoring, making competition studies more efficient and effective.

How can insights from a competition study be implemented?

Insights can be implemented by setting measurable goals, developing action plans, and aligning team efforts.

What are some future trends in investment banking competition?

Emerging trends include fintech disruption and a growing emphasis on sustainability and ethical investing.

What are the key takeaways for conducting a successful competition study?

Key takeaways include understanding the competitive landscape, utilizing diverse data sources, and remaining adaptable to market changes.