Did you know that nearly 80% of small businesses fail due to mismanaged costs? Import export company costs can be a hefty financial burden if not understood properly. In this article, we’ll dive into the various costs associated with operating an import-export business. Essentially, these costs encompass everything from shipping fees and customs tariffs to operational expenses and marketing. Understanding these expenses is crucial for any entrepreneur looking to navigate the complexities of international trade successfully.

- Overview of import-export costs

- Breakdown of shipping and logistics expenses

- Understanding customs fees and tariffs

- Hidden costs that can surprise you

- Strategies for cost management

- Real-life examples of cost implications

- Importance of budgeting and financial planning

- Tools for tracking expenses

- Tips for reducing operational costs

Understanding Import Export Company Costs

The world of import and export can be incredibly lucrative, but it comes with its own set of challenges. Understanding the costs involved is essential for anyone looking to start or manage an import-export company. From logistics to compliance, each aspect has its price tag. By breaking down these costs, you can better prepare your budget and strategy.

For example, shipping costs can vary widely based on distance, weight, and the mode of transport. If you’re shipping goods from China to the U.S., you might encounter higher freight charges during peak seasons. Similarly, customs fees can add an unexpected layer of expense, especially if you’re unfamiliar with the regulations. Knowing these details upfront can save you from financial surprises later on.

In summary, understanding the various components of import-export costs is critical. This foundational knowledge will pave the way for deeper discussions on specific cost areas in the following sections.

| Cost Category | Estimated Range |

|---|---|

| Shipping Costs | $200 – $5,000+ |

| Customs Fees | $100 – $2,500 |

| Operational Expenses | $1,000 – $10,000+ |

- Shipping costs vary by distance and weight

- Customs fees can be unpredictable

- Operational costs include various overheads…

– “Knowledge is power in the world of trade.”

Shipping and Logistics Costs

Shipping and logistics costs are often the most significant expenses for an import-export company. These costs can encompass freight charges, warehousing fees, and even packaging expenses. The complexity of international shipping can make it challenging to estimate these costs accurately.

For instance, you might find that air freight is faster but more expensive than ocean freight. According to the International Air Transport Association, air freight rates can be up to 10 times higher than sea freight. Understanding the trade-offs can help you make informed decisions that align with your business model.

As we move forward, it’s essential to consider how logistics decisions impact overall costs. Efficient logistics management can lead to significant savings, which we’ll explore in the next section.

- Evaluate shipping options: air vs. sea

- Factor in packaging costs

- Consider warehousing needs

– The above steps must be followed rigorously for optimal success.

Customs Fees and Tariffs

Customs fees and tariffs can be a significant part of your overall import export company costs. These fees are imposed by governments to regulate trade and protect local industries. Understanding how they work is crucial for budgeting.

For example, the U.S. Customs and Border Protection (CBP) has specific tariffs for various goods. If you’re importing textiles, the tariffs can be higher than for electronics. Moreover, the Harmonized System (HS) codes play a vital role in determining the exact duties you’ll owe.

As we delve deeper into tariffs, it’s essential to stay updated on changes in trade agreements and policies, which can directly affect your costs. This leads us smoothly into the next section, where we’ll discuss hidden costs that often catch businesses off guard.

- Customs fees vary by product category

- Tariffs can fluctuate based on trade agreements

- HS codes are crucial for accurate duty assessment…

– “Stay informed to stay ahead in trade.”

Hidden Costs in Import Export Business

Hidden costs can derail your budget if you’re not careful. These are expenses that aren’t immediately obvious but can add up over time. Examples include fees for documentation, insurance, and compliance with regulations.

Did you know that many importers overlook the cost of obtaining necessary permits and licenses? These can range from a few hundred to thousands of dollars depending on the nature of your goods. Additionally, unforeseen delays can lead to extra storage fees, further impacting your bottom line.

Recognizing these hidden costs is vital for accurate financial planning. As we transition to the next section, let’s explore strategies for managing these costs effectively.

| Hidden Cost | Potential Impact |

|---|---|

| Documentation fees | $50 – $1,000 |

| Insurance premiums | $200 – $5,000 |

- Always budget for unexpected fees

- Keep track of documentation requirements

- Regularly review your insurance coverage…

– “Knowledge is power when it comes to managing costs.”

Strategies for Cost Management

Cost management is an essential skill for running a successful import-export company. By implementing effective strategies, you can minimize expenses and maximize profits.

One proven method is to negotiate better rates with your shipping partners. Many companies are open to adjusting their prices based on volume or long-term contracts. Additionally, using technology to track expenses can reveal patterns and areas for improvement.

As we discuss the importance of technology in cost management, let’s move on to explore tools that can aid in tracking and analyzing your import-export expenses.

| Strategy | Expected Outcome |

|---|---|

| Negotiate shipping rates | Reduced freight costs |

| Use expense tracking tools | Better budget control |

- Research and negotiate with suppliers

- Use software for tracking expenses

- Regularly review your cost structure…

Tools for Tracking Expenses

In today’s digital age, leveraging technology can greatly enhance your ability to manage import-export costs. Various tools and software solutions are available to help you track and analyze your expenses.

For instance, accounting software like QuickBooks can simplify your financial tracking, while logistics platforms can provide real-time updates on shipping costs. These tools can help you identify trends and make informed decisions, ensuring that you stay on top of your budget.

By integrating these tools into your business operations, you can gain better visibility into your costs. This sets the stage for our final section, where we will discuss the importance of ongoing financial analysis.

| Tool | Purpose |

|---|---|

| Accounting software | Track financials |

| Logistics platforms | Manage shipping costs |

- Choose the right accounting software

- Invest in logistics management tools

- Regularly review and update your systems…

The Importance of Financial Analysis

Ongoing financial analysis is crucial for any import-export business. It allows you to assess your performance and make necessary adjustments to your strategies.

Regularly reviewing your financials can help you spot trends, such as rising shipping costs or fluctuating customs fees. By understanding these patterns, you can better prepare for future expenses and adjust your pricing strategies accordingly.

With a solid grasp of your financial landscape, you’re better equipped to make informed decisions. Now, let’s summarize the key takeaways from our discussion and prepare for the conclusion.

| Analysis Type | Benefit |

|---|---|

| Cost analysis | Identify savings |

| Profit margin analysis | Optimize pricing |

- Conduct monthly financial reviews

- Analyze cost vs. revenue regularly

- Adjust strategies based on analysis…

Key Actions for Import Export Success

To ensure success in the import-export business, several key actions should be taken. These actions focus on managing costs effectively and preparing for the future.

Building strong relationships with suppliers and logistics partners can lead to better rates and more reliable service. Additionally, staying informed about market trends can help you anticipate changes that might affect your costs.

By taking these proactive steps, you can position your import-export company for long-term success. In the final section, we will summarize the main points and provide a call to action.

| Action | Expected Outcome |

|---|---|

| Build supplier relationships | Better pricing |

| Stay updated on trends | Increased adaptability |

- Foster relationships with partners

- Keep up with industry news

- Review your strategies regularly

Conclusion

Understanding import export company costs is vital for achieving success in the world of international trade. Throughout this article, we explored various aspects of these costs, including shipping fees, customs tariffs, hidden expenses, and strategies for effective cost management. By taking proactive measures and leveraging technology, you can navigate these challenges with confidence.

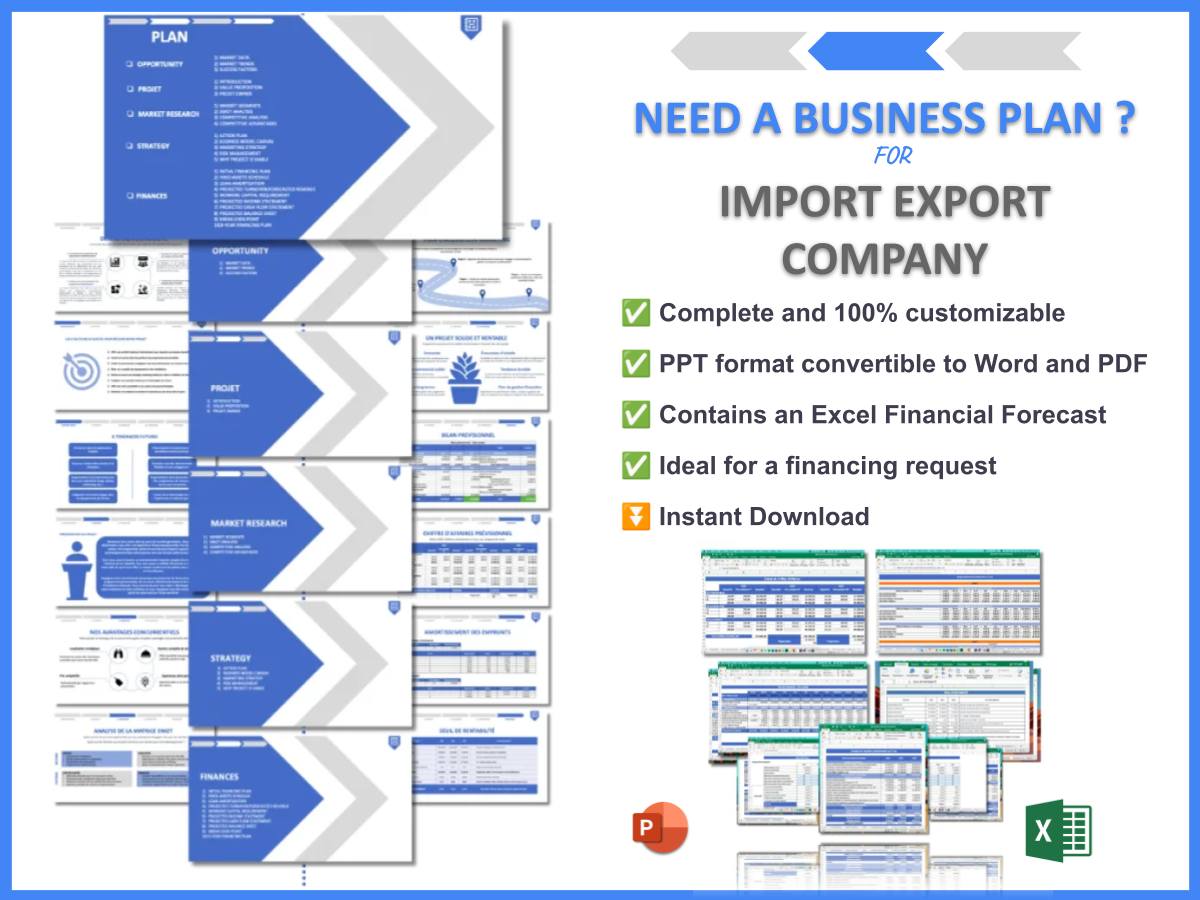

To further support your journey, consider using the Import Export Company Business Plan Template to create a solid foundation for your business. Additionally, check out our other insightful articles to enhance your knowledge and strategy:

- Article 1: Import Export Company SWOT Analysis Insights

- Article 2: Import Export Company Business Plan: Template and Examples

- Article 3: Import Export Company Financial Plan: A Detailed Guide

- Article 4: The Complete Guide to Opening an Import Export Company: Tips and Examples

- Article 5: Start an Import Export Company Marketing Plan: Strategies and Examples

- Article 6: How to Start an Import Export Company with a Robust Business Model Canvas

- Article 7: Import Export Company Customer Segments: Understanding Your Target Audience

- Article 8: Import Export Companies: Maximizing Profits Globally

- Article 9: How to Build a Feasibility Study for an Import Export Company?

- Article 10: How to Build a Risk Management Plan for Import Export Company?

- Article 11: What Are the Steps for a Successful Import Export Company Competition Study?

- Article 12: What Legal Considerations Should You Be Aware of for Import Export Company?

- Article 13: What Funding Options Should You Consider for Import Export Company?

- Article 14: How to Implement Growth Strategies for Import Export Company

FAQ

What are the main costs of running an import-export business?

The primary costs include shipping expenses, customs fees, and operational costs associated with running the business.

How can I reduce shipping costs?

You can lower shipping costs by negotiating better rates with freight forwarders and considering bulk shipping options.

What are some hidden costs in the import-export business?

Hidden costs may include documentation fees, insurance premiums, and unexpected delays that lead to additional charges.

How often should I review my expenses?

It is advisable to conduct regular monthly reviews of your expenses to maintain financial health.

What tools can help me manage import-export costs?

Utilizing accounting software and logistics management platforms can greatly assist in tracking and analyzing your expenses.

Are there specific tariffs for different products?

Yes, tariffs vary based on the product category and can change depending on trade agreements.

What is the importance of HS codes?

HS codes are essential for determining applicable tariffs and ensuring compliance with trade regulations.

How can I prepare for fluctuating costs?

Stay informed about market trends and maintain a flexible pricing strategy to adapt to changing costs.

Can I recover customs duties?

Yes, you may be eligible for refunds on certain import duties through duty drawback programs under specific conditions.

What is the best way to budget for an import-export business?

Creating a detailed budget that includes all expected costs and regularly updating it based on actual expenses is essential.