Did you know that the global investment banking sector generates trillions in revenue every year? It’s a staggering figure that reflects the diverse and complex nature of financial services. Investment Bank Customer Segments are a critical component in understanding how these institutions operate and thrive. By categorizing clients into distinct groups, banks can tailor their offerings, ensuring each segment receives the specific services it needs. In this article, we will dive into various customer segments in investment banking, providing real-world examples and detailed analyses.

- Investment banking serves a variety of customer segments.

- High-net-worth individuals are a significant focus.

- Corporate clients require specialized financial services.

- Retail banking customers have different needs.

- Institutional investors play a crucial role in market dynamics.

- Client relationship management is essential for retention.

- Technology is reshaping customer interactions.

- Market segmentation strategies enhance service delivery.

- Understanding customer behavior aids in product development.

- Effective communication is vital for successful banking relationships.

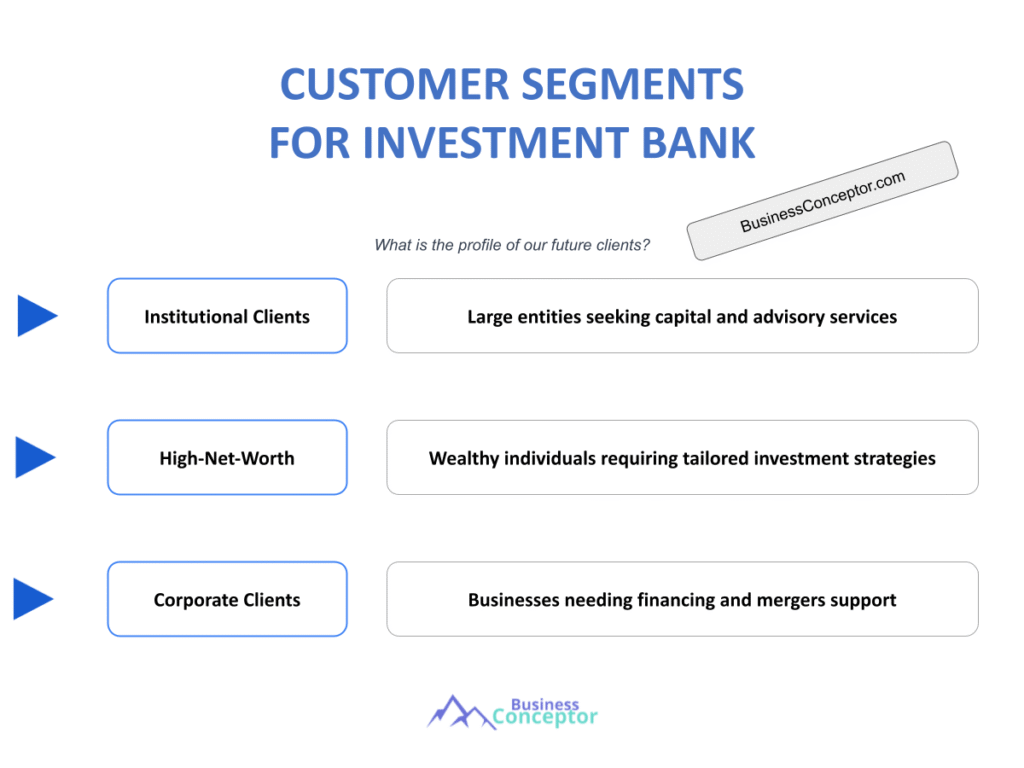

Understanding Investment Bank Customer Segments

Investment banks serve various customer segments, each with unique needs and preferences. Understanding these segments is crucial for developing effective financial products and services. For instance, high-net-worth individuals typically seek wealth management services, while corporate clients may require capital raising and advisory services. Each segment demands a tailored approach to meet their specific goals.

For example, corporate clients often engage investment banks for mergers and acquisitions, requiring in-depth market analysis and strategic insights. On the other hand, retail banking customers might seek straightforward savings and investment options. The differentiation between these segments allows investment banks to streamline their offerings and enhance customer satisfaction.

In summary, recognizing the diversity among customer segments is vital for investment banks. It sets the stage for more in-depth analysis of each segment’s characteristics and needs in the following sections.

| Customer Segment | Key Characteristics |

|---|---|

| High-Net-Worth Individuals | Focus on wealth management |

| Corporate Clients | Seek M&A and capital raising services |

| Retail Banking Customers | Demand simple financial products |

| Institutional Investors | Require in-depth market analysis |

- High-net-worth individuals focus on investment growth.

- Corporate clients prioritize strategic financial advice.

- Retail customers seek accessible banking solutions.

“Understanding your client is the key to success in investment banking.”

High-Net-Worth Individuals as a Customer Segment

High-net-worth individuals (HNWIs) represent a lucrative segment in investment banking. These clients generally possess investable assets exceeding $1 million, making them prime targets for wealth management services. Investment banks design personalized financial strategies to cater to their specific needs, such as estate planning, tax optimization, and investment diversification.

Statistics indicate that HNWIs are increasingly interested in sustainable investments. In fact, a recent survey showed that over 70% of wealthy investors prioritize environmental, social, and governance (ESG) factors when making investment decisions. This shift presents an opportunity for investment banks to develop tailored ESG-focused investment products, thereby attracting and retaining these clients.

In conclusion, high-net-worth individuals are a vital customer segment for investment banks. Understanding their preferences and behaviors can lead to more effective engagement strategies.

- Identify HNWI needs and preferences.

- Develop tailored investment products.

- Enhance client communication and service delivery.

- The above steps must be followed rigorously for optimal success.

Corporate Clients and Their Unique Needs

Corporate clients represent another significant segment in investment banking, often requiring more complex financial services. These businesses seek assistance in capital raising, mergers and acquisitions, and financial advisory. Their needs can vary greatly depending on their size, industry, and growth stage.

For example, a startup may require seed funding and strategic guidance, while a well-established corporation might seek assistance with an initial public offering (IPO). Investment banks need to adapt their approaches based on these varying requirements, ensuring that they provide tailored solutions that align with each client’s business objectives.

An illustrative case study involves a major tech firm that sought investment banking services for its IPO. By collaborating closely with the investment bank, the company successfully navigated the complex regulatory landscape, resulting in a successful market launch.

- Corporate clients need tailored financial solutions.

- Services include M&A, capital raising, and advisory.

- Adaptability is crucial for meeting diverse client needs.

“To succeed, always move forward with a clear vision.”

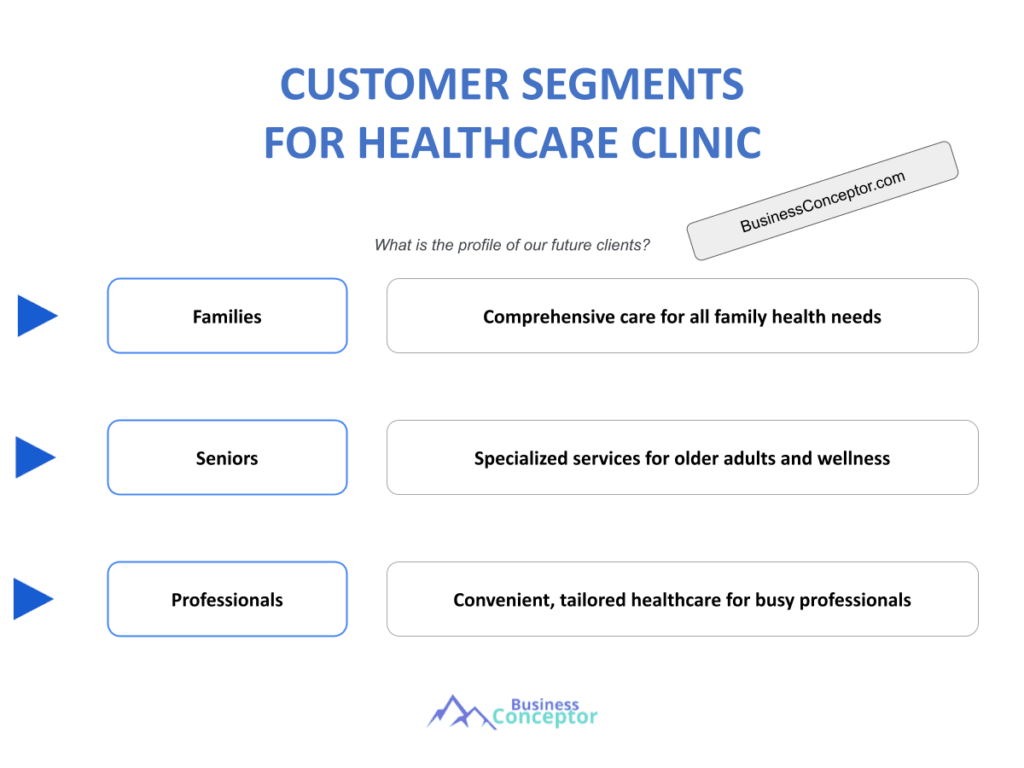

Retail Banking Customers: A Different Approach

Retail banking customers form a distinct segment within the investment banking landscape. Unlike high-net-worth individuals and corporate clients, retail customers seek straightforward financial services, such as savings accounts, personal loans, and investment products. Their preferences often lean towards accessibility and ease of use.

Investment banks must prioritize user-friendly platforms and educational resources to cater to retail customers. For instance, offering online banking services and mobile apps can significantly enhance the customer experience. Additionally, providing financial literacy resources can empower retail clients to make informed decisions regarding their finances.

In summary, retail banking customers present unique challenges and opportunities for investment banks. Developing targeted strategies to engage this segment can lead to increased satisfaction and loyalty.

| Key Characteristics of Retail Banking Customers | Description |

|---|---|

| Accessibility | Demand easy-to-use banking services |

| Education | Seek financial literacy resources |

| Simple Solutions | Prefer straightforward products |

- Retail customers value convenience.

- Financial education is key to engagement.

- User-friendly platforms enhance satisfaction.

“Understanding your client is the key to success in investment banking.”

Institutional Investors: Their Role in the Market

Institutional investors are a critical customer segment in investment banking. These clients include pension funds, insurance companies, and mutual funds, often managing substantial amounts of capital. Their investment strategies tend to be more sophisticated, requiring in-depth analysis and tailored financial products.

Investment banks play a pivotal role in facilitating transactions for institutional investors, providing insights on market trends and investment opportunities. Additionally, they often assist with portfolio management, helping these clients achieve their financial objectives while managing risks.

Understanding the dynamics of institutional investors is essential for investment banks. By offering specialized services and insights, they can build long-lasting relationships with these clients.

| Characteristics of Institutional Investors | Description |

|---|---|

| Sophisticated Strategies | Engage in complex investment approaches |

| Large Capital | Manage significant assets |

| Risk Management | Prioritize risk assessment strategies |

- Institutional investors require tailored insights.

- Investment banks facilitate complex transactions.

- Strong relationships are built on trust and expertise.

The Impact of Technology on Customer Segments

Technology is reshaping the landscape of investment banking and customer segmentation. With the rise of fintech, investment banks are leveraging advanced analytics and digital platforms to better understand their clients’ needs. Data-driven insights enable banks to create personalized experiences, enhancing customer satisfaction.

For instance, AI algorithms can analyze customer behavior, allowing investment banks to offer customized financial products based on individual preferences. Additionally, digital platforms facilitate seamless communication between banks and their clients, improving engagement and service delivery.

As technology continues to evolve, investment banks must adapt their strategies to remain competitive. Embracing innovation will be crucial for meeting the demands of diverse customer segments.

| Benefits of Technology in Investment Banking | Description |

|---|---|

| Enhanced Insights | Data analytics provide deeper understanding of customer needs |

| Improved Communication | Digital platforms facilitate better engagement |

| Personalized Services | Tailored products based on client behavior analysis |

- Leverage technology for customer insights.

- Embrace digital platforms for communication.

- Adapt to changes for competitive advantage.

Best Practices for Engaging Customer Segments

Engaging various customer segments in investment banking requires a strategic approach. Banks must prioritize understanding their clients’ needs and preferences to provide tailored solutions. Here are some best practices for effectively engaging different segments:

- Conduct regular client feedback sessions to understand their evolving needs.

- Utilize data analytics to personalize offerings and improve customer experiences.

- Invest in staff training to enhance relationship management skills.

By following these practices, investment banks can build strong relationships with their clients, leading to increased satisfaction and loyalty.

“Success comes to those who persevere.”

- Regularly assess client needs.

- Personalize offerings based on data.

- Train staff for better client interactions.

The Future of Customer Segments in Investment Banking

The future of investment banking customer segments is poised for transformation. As market dynamics shift and technology advances, banks will need to adapt their strategies to meet the changing needs of their clients. Trends such as sustainable investing and digital banking are likely to shape the future landscape.

Investment banks must stay ahead of these trends by continuously innovating and refining their offerings. By anticipating client needs and preferences, they can position themselves as industry leaders in customer engagement. Embracing new technologies and understanding market shifts will be key to attracting and retaining diverse customer segments.

In summary, the ability to adapt to emerging trends will determine the success of investment banks in the coming years. Focusing on client-centric approaches will ensure long-term relationships and sustained growth.

| Emerging Trends in Investment Banking | Description |

|---|---|

| Sustainable Investing | Increased focus on ESG factors |

| Digital Transformation | Rise of fintech and digital banking |

| Personalized Services | Tailored solutions based on client data |

- Stay informed about market trends.

- Innovate offerings to meet client demands.

- Build a culture of adaptability within the organization.

Key Recommendations for Investment Banks

In conclusion, investment banks must prioritize understanding their customer segments to thrive in a competitive landscape. Here are some key recommendations for effectively engaging with clients:

- Focus on personalized communication to build trust.

- Regularly assess and adapt service offerings based on client feedback.

- Embrace technological advancements to enhance customer experiences.

By implementing these strategies, investment banks can foster strong relationships with their clients and drive long-term success.

“To succeed, always move forward with a clear vision.”

- Personalize client communication.

- Adapt offerings based on feedback.

- Invest in technology for enhanced experiences.

Conclusion

In summary, understanding Investment Bank Customer Segments is essential for success in the financial industry. By recognizing the diverse needs of high-net-worth individuals, corporate clients, retail banking customers, and institutional investors, banks can tailor their offerings effectively. Embracing technology and innovative strategies will further enhance client engagement and satisfaction.

For those looking to establish a successful investment bank, consider utilizing an Investment Bank Business Plan Template to guide your efforts.

Additionally, you may find our articles on investment banking beneficial:

- SWOT Analysis for Investment Bank: Ensuring Business Success

- Investment Bank Profitability: Key Considerations

- Writing a Business Plan for Your Investment Bank: Template Included

- Financial Planning for Your Investment Bank: A Comprehensive Guide (+ Example)

- Guide to Starting an Investment Bank: Steps and Examples

- Starting an Investment Bank Marketing Plan: Strategies and Examples

- Start Your Investment Bank Business Model Canvas: A Comprehensive Guide

- How Much Does It Cost to Establish an Investment Bank?

- How to Build a Feasibility Study for Investment Bank?

- How to Build a Risk Management Plan for Investment Bank?

- How to Build a Competition Study for Investment Bank?

- What Legal Considerations Should You Be Aware of for Investment Bank?

- What Funding Options Should You Consider for Investment Bank?

- Growth Strategies for Investment Bank: Scaling Examples

FAQ Section

What are the primary customer segments in investment banking?

Investment banking primarily serves high-net-worth individuals, corporate clients, retail banking customers, and institutional investors.

How do investment banks tailor their services to different customer segments?

Investment banks analyze client needs and preferences, developing personalized financial products and services for each segment.

What role does technology play in customer segmentation?

Technology enables investment banks to leverage data analytics for personalized offerings and improved communication with clients.

Why are high-net-worth individuals important to investment banks?

HNWIs typically possess significant investable assets, making them prime targets for wealth management services.

What services do corporate clients seek from investment banks?

Corporate clients often require capital raising, mergers and acquisitions assistance, and financial advisory services.

How can retail banking customers be effectively engaged?

Retail customers value accessibility and education, so investment banks should provide user-friendly platforms and financial literacy resources.

What are the characteristics of institutional investors?

Institutional investors manage large capital and require sophisticated investment strategies and risk management services.

How can investment banks stay competitive in the future?

By embracing technological advancements and adapting to market trends, investment banks can remain competitive and meet client demands.

What best practices should investment banks follow for client engagement?

Investment banks should conduct regular feedback sessions, utilize data analytics for personalization, and invest in staff training.

How does sustainable investing impact customer segments?

As more investors prioritize ESG factors, investment banks must develop tailored sustainable investment products to meet this growing demand.