Did you know that concierge services can significantly boost their profitability through tailored financial planning? Concierge Service Financial Plan isn’t just a fancy term; it’s a vital strategy for success in the luxury market. This article will break down what a concierge service financial plan entails and why it’s crucial for any business in this niche. With personalized approaches, concierge services can effectively manage their finances and cater to high-end clients’ needs.

- Understanding the importance of a financial plan for concierge services

- Key components of a successful financial strategy

- Real-life examples of concierge service financial planning

- Steps to develop a personalized financial plan

- The role of technology in financial management for concierge services

- Common challenges and solutions in concierge financial planning

- Best practices for maintaining financial health in concierge services

- Strategies for measuring the success of your financial plan

- Future trends in concierge service financial planning

- Call to action for implementing a concierge service financial plan

The Importance of Financial Planning in Concierge Services

Financial planning is critical for concierge services to thrive in a competitive market. It sets the foundation for budgeting, forecasting, and strategic decision-making. Without a solid financial plan, concierge businesses may struggle to maintain profitability and meet client expectations.

For instance, a luxury concierge service that fails to budget effectively could overlook potential costs associated with high-end client requests. This oversight can lead to financial strain and a diminished reputation. By implementing a well-structured financial plan, concierge services can anticipate expenses and allocate resources more efficiently.

In summary, financial planning is not just a back-office function; it’s an essential part of the concierge service‘s strategy to deliver exceptional client experiences while ensuring sustainability.

| Key Aspect | Description |

|---|---|

| Budgeting | Essential for managing expenses |

| Forecasting | Helps predict future revenue |

| Strategic Planning | Aligns financial goals with business objectives |

- Financial planning enhances profitability.

- It allows for better resource allocation.

- Helps in anticipating market changes.

– “A good plan today is better than a perfect plan tomorrow.”

Key Components of a Concierge Service Financial Plan

A comprehensive financial plan for concierge services includes various components, such as budgeting, cash flow management, and investment strategies. Each element plays a crucial role in the overall financial health of the business.

For example, effective budgeting allows concierge services to allocate funds appropriately for various aspects of the business, from staffing to marketing. Cash flow management ensures that the service can meet its obligations without interruption, while investment strategies can help grow the business over time.

By understanding these components, concierge services can create a robust financial framework that supports growth and enhances client satisfaction.

- Establish a realistic budget

- Monitor cash flow regularly

- Develop an investment strategy

- Review financial goals periodically

– The above steps must be followed rigorously for optimal success.

Real-Life Examples of Concierge Service Financial Planning

Analyzing real-life examples can provide valuable insights into how effective financial planning can transform a concierge service. One luxury concierge company increased its revenue by 25% after implementing a structured financial plan that focused on client retention and upselling services.

Another example involves a concierge service that faced cash flow issues due to seasonal fluctuations. By analyzing its financial data, the business adjusted its pricing strategy and developed targeted marketing campaigns during off-peak seasons, stabilizing its revenue stream.

These examples highlight the importance of adapting financial plans to meet specific business needs and market conditions.

- Case study: 25% revenue increase

- Seasonal strategies for cash flow stability

- Importance of client retention in financial success

– “To succeed, always move forward with a clear vision.”

Steps to Develop a Personalized Financial Plan

Creating a personalized financial plan for concierge services involves several critical steps. First, business owners should conduct a thorough financial assessment to understand their current financial situation. This assessment includes analyzing revenue streams, operational costs, and existing financial obligations.

Next, setting clear financial goals is essential. Whether it’s increasing revenue, reducing costs, or improving client satisfaction, having measurable objectives will guide the financial planning process. This focus helps ensure that all financial activities align with the overarching business strategy.

Finally, implementing the plan and regularly reviewing its effectiveness ensures that the concierge service remains on track to achieve its goals. Continuous monitoring allows for adjustments based on performance metrics and market changes, keeping the business agile and responsive.

| Step | Action |

|---|---|

| Assessment | Evaluate current finances |

| Goal Setting | Define measurable objectives |

| Implementation | Execute the financial plan |

- Conduct quarterly financial reviews.

- Adjust strategies based on performance metrics.

The Role of Technology in Financial Management for Concierge Services

Technology plays a pivotal role in modern financial management for concierge services. Tools like financial planning software can streamline budgeting, forecasting, and reporting processes, allowing businesses to focus on delivering exceptional services. These tools provide real-time data, enabling quick adjustments to financial strategies as needed.

Additionally, customer relationship management (CRM) systems can help track client interactions and preferences, informing financial decisions and marketing strategies. By leveraging technology, concierge services can enhance their financial planning efforts and improve overall efficiency.

In summary, embracing technology is no longer optional; it’s a necessity for concierge services looking to thrive in a digital world. Adopting the right tools can lead to better resource management and increased profitability.

| Technology | Benefit |

|---|---|

| Financial Software | Streamlines budgeting and forecasting |

| CRM Systems | Enhances client management and insights |

- Invest in reliable financial software.

- Train staff on technology usage for better results.

Common Challenges in Concierge Financial Planning

Concierge services often face unique challenges in financial planning. Seasonal fluctuations in demand can complicate cash flow management, while maintaining high service standards can lead to increased operational costs. These factors create a complex environment where financial stability can be difficult to achieve.

Furthermore, competition in the luxury market can drive prices down, making it essential for concierge services to find a balance between affordability and profitability. Identifying these challenges early on allows businesses to develop strategies to mitigate their impact, such as adjusting service offerings or implementing more flexible pricing structures.

Ultimately, addressing these challenges head-on can lead to stronger financial performance and a more resilient business model. By being proactive and adaptable, concierge services can navigate the complexities of the market and ensure long-term success.

| Challenge | Solution |

|---|---|

| Seasonal Demand | Implement flexible pricing strategies |

| High Operational Costs | Optimize resource allocation |

- Regularly assess market trends.

- Adjust strategies based on competitive analysis.

Best Practices for Maintaining Financial Health in Concierge Services

Maintaining financial health is crucial for the long-term success of concierge services. Best practices include regular financial audits, clear communication of financial goals to staff, and ongoing training on financial literacy. These practices help ensure that everyone in the organization is aligned with the financial objectives.

Another essential practice is to establish a reserve fund to manage unexpected expenses or fluctuations in revenue. This financial cushion can help ensure stability during challenging times, providing peace of mind for business owners and their clients alike.

By adopting these best practices, concierge services can build a robust financial foundation that supports growth and sustainability. A well-prepared financial strategy not only enhances operational efficiency but also increases client trust and satisfaction.

| Best Practice | Description |

|---|---|

| Regular Audits | Ensure financial accuracy |

| Staff Communication | Align team with financial goals |

- Schedule biannual financial audits.

- Foster a culture of financial awareness among staff.

Strategies for Measuring the Success of Your Financial Plan

Measuring the success of a financial plan involves tracking key performance indicators (KPIs) relevant to concierge services. Metrics such as revenue growth, client retention rates, and profitability margins provide valuable insights into financial performance. Regularly reviewing these metrics allows businesses to adjust their strategies as needed, ensuring they remain aligned with their financial goals.

For example, if client retention rates drop, it may signal a need for improved service offerings or client engagement strategies. Conversely, consistent revenue growth may indicate that the current financial plan is effective and should be further developed. By staying vigilant and responsive to these indicators, concierge services can ensure ongoing success.

In summary, consistent measurement and analysis are essential for maintaining financial health and achieving long-term success. Implementing a robust system for tracking KPIs enables concierge services to make informed decisions that drive profitability and client satisfaction.

| KPI | Importance |

|---|---|

| Revenue Growth | Indicates overall business health |

| Client Retention | Reflects service quality and satisfaction |

- Set quarterly reviews of KPIs.

- Adjust financial strategies based on performance data.

Future Trends in Concierge Service Financial Planning

The future of financial planning for concierge services is likely to be shaped by technological advancements and evolving client expectations. Automation and artificial intelligence may play significant roles in streamlining financial processes and enhancing client interactions. These technologies can help reduce human error and increase efficiency, allowing concierge services to focus on providing exceptional experiences.

Additionally, as clients increasingly seek personalized experiences, concierge services will need to adapt their financial strategies to meet these demands while maintaining profitability. This may involve offering tailored services based on detailed client profiles and preferences, ensuring that the financial aspect aligns with the overall client experience.

Staying ahead of these trends will be crucial for concierge services aiming to thrive in a competitive market. By embracing innovation and adapting to changing client needs, businesses can secure their position and enhance their financial performance.

| Trend | Implication |

|---|---|

| Automation | Streamlined financial processes |

| Personalization | Tailored financial strategies |

- Invest in AI-driven financial tools.

- Monitor client feedback for service improvements.

Conclusion

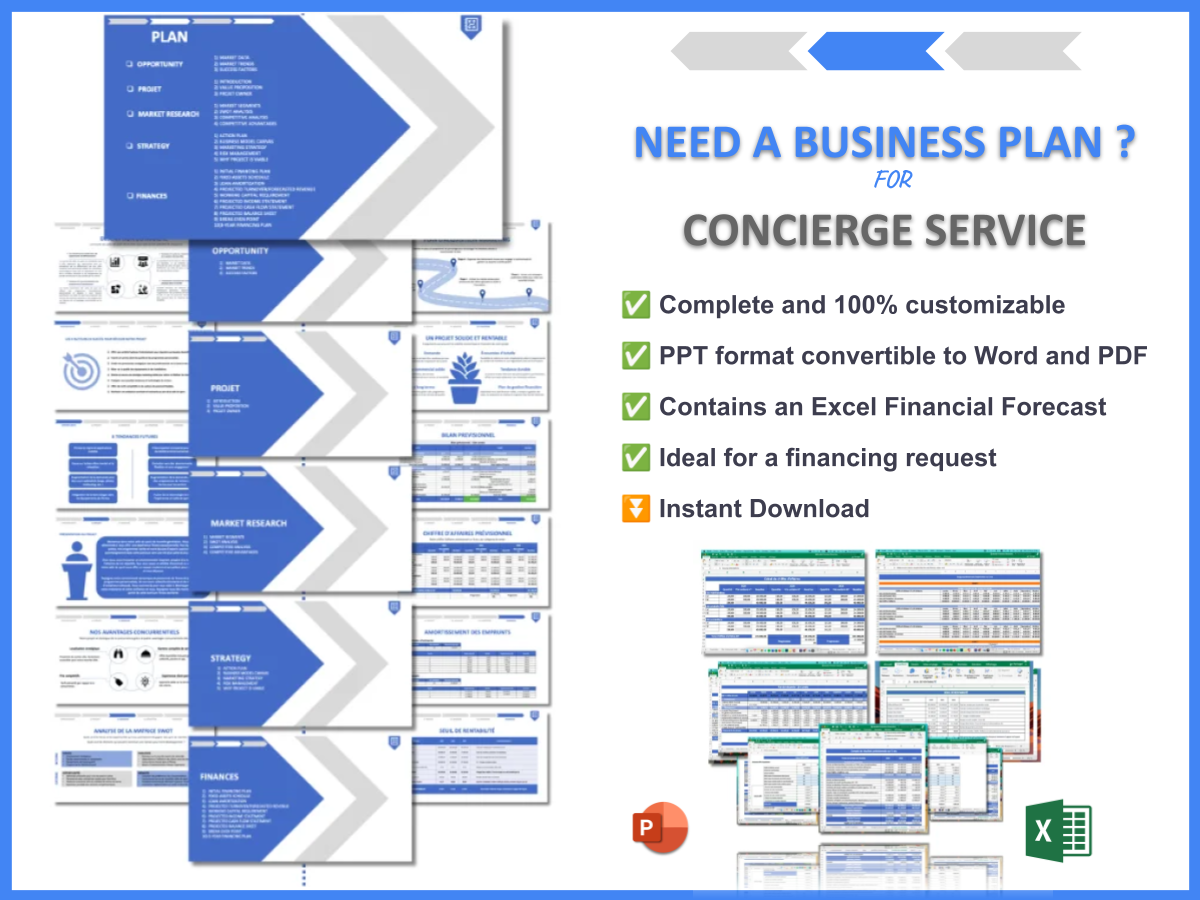

In conclusion, a well-structured Concierge Service Financial Plan is essential for success in the luxury market. By understanding the importance of financial planning, key components, and best practices, concierge services can enhance their profitability and client satisfaction. To assist you in creating an effective strategy, consider utilizing a Concierge Service Business Plan Template that provides a solid foundation for your operations.

For further reading on topics related to concierge services, check out these articles:

- SWOT Analysis for Concierge Service: Ensuring Long-Term Success

- Concierge Service Profitability: Strategies for a Profitable Business

- Crafting a Business Plan for Your Concierge Service: Step-by-Step Guide

- How to Launch a Successful Concierge Service: Complete Guide with Example

- Start Your Concierge Service Marketing Plan with This Example

- How to Create a Business Model Canvas for a Concierge Service: Examples and Tips

- Customer Segments for Concierge Services: Examples and Strategies

- How Much Does It Cost to Start a Concierge Service?

- How to Start a Feasibility Study for Concierge Service?

- Drug Treatment Center Risk Management: Expert Insights

- Drug Treatment Center Competition Study: Detailed Insights

- Drug Treatment Center Legal Considerations: Ultimate Guide

- Drug Treatment Center Funding Options: Detailed Analysis

- Concierge Service Growth Strategies: Scaling Guide

FAQ

What is a concierge financial management plan?

A concierge financial management plan is a strategic approach tailored to effectively manage the finances of a concierge service, focusing on budgeting, cash flow, and investment strategies.

Why is financial planning essential for concierge services?

Financial planning is crucial for concierge services as it helps anticipate expenses, allocate resources efficiently, and maintain profitability in a competitive market.

What are the main components of a concierge financial plan?

The key components include budgeting, cash flow management, investment strategies, and setting clear financial goals.

How can technology enhance financial planning for concierge services?

Technology can streamline financial processes, improve data analysis, and enhance client management through CRM systems, making financial planning more efficient.

What challenges do concierge services face in financial planning?

Challenges include seasonal demand fluctuations, high operational costs, and competition, all of which can complicate cash flow management and profitability.

How can concierge services measure the effectiveness of their financial plan?

Success can be measured using key performance indicators (KPIs) like revenue growth, client retention rates, and profitability margins.

What best practices should concierge services adopt for financial health?

Best practices include conducting regular financial audits, communicating financial goals to staff, and establishing a reserve fund for unexpected expenses.

What future trends should concierge services consider in financial planning?

Future trends include the adoption of automation and artificial intelligence to streamline financial management and the increasing demand for personalized financial strategies to meet client needs.