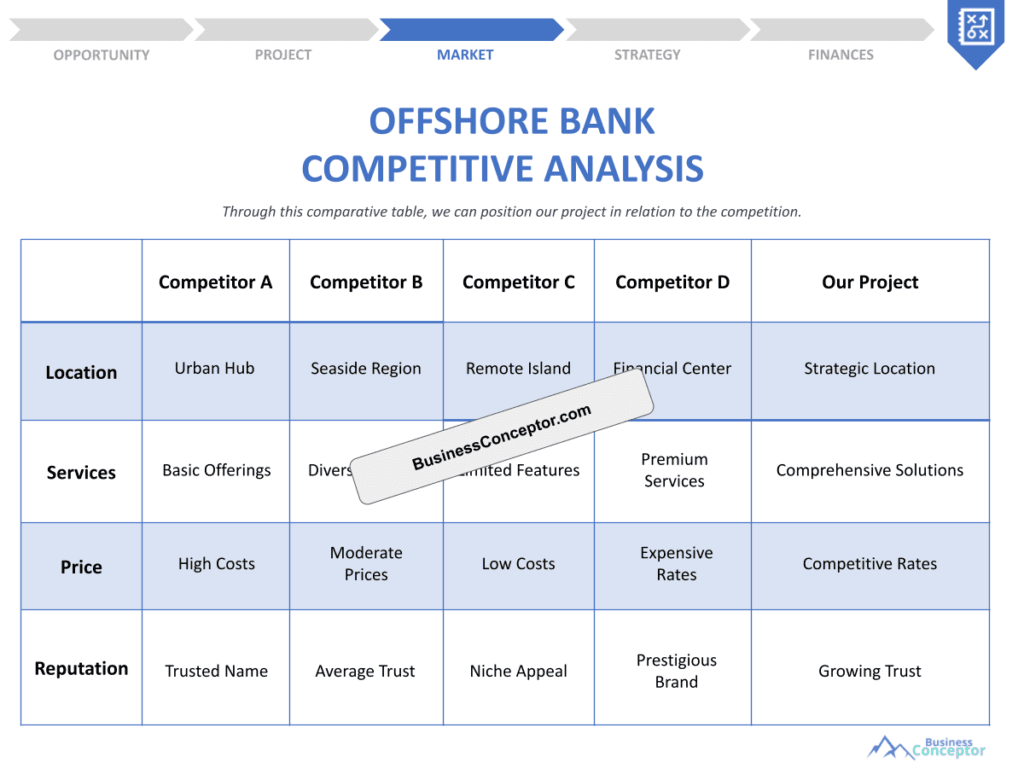

Did you know that the offshore banking sector is worth trillions of dollars? That’s right! The competition among offshore banks is fierce, and understanding how to analyze this competition is crucial for anyone looking to maximize their financial opportunities. In this article, we will explore the ins and outs of conducting an Offshore Bank Competition Study. Offshore banking refers to the process of managing your finances through banks located outside your home country, often for reasons such as tax benefits, asset protection, or privacy.

- Importance of competition analysis in offshore banking.

- Key metrics to consider.

- Understanding the regulatory environment.

- Strategies for effective analysis.

- Tools and resources for competitive analysis.

- Case studies of successful offshore banks.

- Common pitfalls to avoid.

- Future trends in offshore banking.

- How to position your bank in the market.

- Conclusion and next steps.

Understanding the Offshore Banking Landscape

The offshore banking landscape is unique and multifaceted. It comprises various financial institutions that offer a range of services designed to meet the needs of international clients. The competition is not just about the services offered but also about how these banks position themselves in a crowded market. Understanding this landscape is essential for anyone conducting an offshore bank competition study.

For example, banks in jurisdictions like the Cayman Islands or Switzerland may compete on privacy, while those in Singapore might focus on regulatory compliance and transparency. Each jurisdiction has its unique selling points, and recognizing these can help banks tailor their offerings to attract specific clientele.

By understanding the competitive landscape, you can identify gaps in the market, allowing your institution to capitalize on opportunities. This knowledge sets the stage for deeper analysis in the following sections.

| Aspect | Description |

| Services Offered | Variety of banking products |

| Jurisdiction | Regulatory environment |

- Different jurisdictions offer unique advantages

- Privacy vs. transparency debate

- Importance of understanding client needs…

– “In the world of finance, knowledge is power.”

Key Metrics for Competitive Analysis

When analyzing competition in offshore banking, it’s crucial to focus on specific metrics. These include market share, growth rate, customer satisfaction, and service quality. By examining these metrics, banks can gauge their performance relative to competitors and identify areas for improvement.

For instance, a bank might discover that its customer satisfaction ratings are significantly lower than those of its competitors. This could prompt a review of service delivery processes or customer engagement strategies. Statistics show that banks with high customer satisfaction tend to retain clients better and attract new ones through referrals.

Understanding these metrics not only helps banks refine their strategies but also prepares them for the next step: developing actionable plans based on their findings.

- Identify key performance indicators (KPIs)

- Gather competitive intelligence

- Analyze and compare metrics

– The above steps must be followed rigorously for optimal success.

Tools and Resources for Competitive Analysis

In today’s digital age, several tools can assist banks in conducting a thorough competition analysis. From market research databases to analytical software, these resources can streamline the process and enhance accuracy.

For example, tools like Bloomberg Terminal provide real-time financial data and analytics, which can be invaluable for competitive analysis. Additionally, platforms like Statista offer insights into market trends and consumer behavior, allowing banks to make data-driven decisions.

By leveraging these tools, banks can enhance their analytical capabilities, leading to more informed strategies and better positioning in the market.

- Bloomberg Terminal for real-time data

- Statista for market trends

- CRM systems for customer insights…

– “Data is the new oil; refine it wisely.”

The Role of Regulations in Competition

Regulations play a significant role in shaping competition among offshore banks. Different jurisdictions have varying regulations that can either facilitate or hinder banking operations.

For instance, banks in jurisdictions with stringent regulations may face higher compliance costs but can benefit from a reputation of safety and security. On the other hand, banks in less regulated environments may have lower operational costs but could face reputational risks. Understanding these regulatory landscapes is crucial for banks to navigate their competitive strategies effectively.

By being aware of the regulatory environment, banks can better position themselves to take advantage of opportunities and mitigate potential risks associated with non-compliance.

| Regulation Type | Impact on Competition |

| Compliance Costs | Higher costs vs. safety |

| Tax Benefits | Attraction of clients |

- Monitor regulatory changes

- Assess compliance costs

- Adapt strategies accordingly…

Case Studies of Successful Offshore Banks

Analyzing successful offshore banks can provide valuable insights into effective competition strategies. For example, a bank that focuses on exceptional customer service may differentiate itself in a crowded market.

Case studies can reveal the strategies that led to success. For instance, a bank that implemented a personalized service model saw a significant increase in customer retention rates. Such insights can guide other banks in refining their approaches and improving their market position.

By learning from these examples, banks can adopt best practices and avoid common pitfalls, enhancing their competitive edge in the offshore banking landscape.

| Bank Name | Key Strategy |

| Bank A | Personalized service |

| Bank B | Innovative financial products |

- Analyze best practices

- Implement successful strategies

- Avoid common mistakes…

Future Trends in Offshore Banking Competition

The offshore banking sector is constantly evolving, and staying ahead of trends is vital for maintaining a competitive edge. Emerging technologies, changing regulations, and shifting customer preferences all play a role in shaping the future of offshore banking competition.

For example, the rise of fintech has disrupted traditional banking models, pushing banks to innovate and adapt. Banks that embrace technology are likely to thrive, while those that resist change may struggle to keep up with competitors that offer digital solutions.

Understanding these trends allows banks to anticipate changes and adjust their strategies proactively, ensuring they remain relevant in an increasingly competitive landscape.

| Trend | Implication for Banks |

| Rise of fintech | Need for innovation |

| Changing regulations | Adaptability required |

- Monitor industry trends

- Invest in technology

- Adapt to changing regulations…

Positioning Your Bank in the Market

After conducting a thorough analysis, the next step is positioning your bank effectively in the offshore market. This involves identifying your unique value proposition and communicating it clearly to potential clients.

For example, if your bank offers superior customer service, emphasize this in your marketing efforts. Highlighting your strengths can attract clients looking for specific benefits, such as personalized attention or innovative financial products.

By effectively positioning your bank, you can differentiate yourself from competitors and establish a strong presence in the offshore banking landscape, ultimately leading to increased client acquisition and retention.

| Positioning Strategy | Description |

| Unique Value Proposition | Clearly defined benefits |

| Target Market | Specific clientele focus |

- Define your unique value proposition

- Target specific markets

- Communicate benefits effectively…

Avoiding Common Pitfalls in Offshore Banking

While analyzing competition and positioning your bank, it’s essential to avoid common pitfalls. Many banks fail to adapt to changing market conditions or overlook customer needs, which can lead to significant setbacks.

For instance, a bank that ignores customer feedback may find itself losing clients to competitors that prioritize service quality and responsiveness. Regularly assessing customer satisfaction can help avoid this pitfall, allowing banks to make necessary adjustments before issues escalate.

By being aware of these potential issues, banks can take proactive steps to mitigate risks and ensure long-term success in the competitive offshore banking landscape.

| Pitfall | Avoidance Strategy |

| Ignoring customer feedback | Regular surveys |

| Resistance to change | Embrace innovation |

- Regularly assess customer feedback

- Stay adaptable to market changes

- Prioritize service quality…

Key Recommendations for Success

To ensure success in the offshore banking sector, banks must implement several key strategies. These include understanding the competitive landscape, leveraging technology, and prioritizing customer service to meet the evolving needs of clients.

Additionally, banks should continuously monitor industry trends and adjust their strategies accordingly. Staying informed about regulatory changes and customer preferences can position banks for growth, helping them to stand out in a crowded market.

By following these recommendations, banks can navigate the complexities of the offshore banking market and achieve sustainable success over the long term.

– “Success comes to those who persevere.”

- Understand your competitive landscape

- Leverage technology for efficiency

- Prioritize customer service…

ability/”>Offshore Bank Profitability: Key Considerations

FAQ Section

What is offshore banking?

Offshore banking involves maintaining bank accounts and financial services in a foreign country, often providing benefits like privacy, asset protection, and tax advantages.

How can I analyze competition in offshore banking?

To analyze competition in offshore banking, research competitors’ services, assess market share, and evaluate customer satisfaction metrics.

What are the benefits of offshore banking?

Benefits of offshore banking include enhanced privacy, protection of assets, tax advantages, and access to diverse investment opportunities.

What metrics should I consider for competitive analysis?

Key metrics for competitive analysis include growth rates, customer satisfaction, and overall service quality.

How do regulations impact offshore banking?

Regulations can affect offshore banking operations by influencing compliance costs and determining the overall attractiveness of different jurisdictions.

What tools can assist in competitive analysis?

Tools like Bloomberg Terminal and Statista provide valuable data and insights for conducting effective competitive analysis in offshore banking.

How can I effectively position my offshore bank?

Effective positioning involves clearly defining your unique value proposition and communicating it to your target audience to attract specific clientele.

What common pitfalls should I avoid in offshore banking?

Common pitfalls include ignoring customer feedback, being resistant to change, and failing to adapt to market dynamics.

How can I ensure long-term success in offshore banking?

To ensure long-term success, banks should continuously monitor industry trends, prioritize customer service, and adapt to changing regulations.

What future trends should I watch in offshore banking?

Key future trends include the rise of fintech, evolving regulations, and shifting customer preferences that impact the competitive landscape.