Did you know that over 70% of consumers prefer online banking services over traditional banking methods? This shift towards digital banking is not just a trend; it’s a revolution that’s reshaping the financial landscape. In this Internet Bank Competition Study, we will explore how internet banks are competing against each other and traditional banks to capture the attention and loyalty of tech-savvy customers. An internet bank is a financial institution that operates solely online, offering services like checking accounts, savings accounts, and loans without physical branches. As we delve deeper, you’ll discover key insights into strategies, challenges, and the future of internet banking.

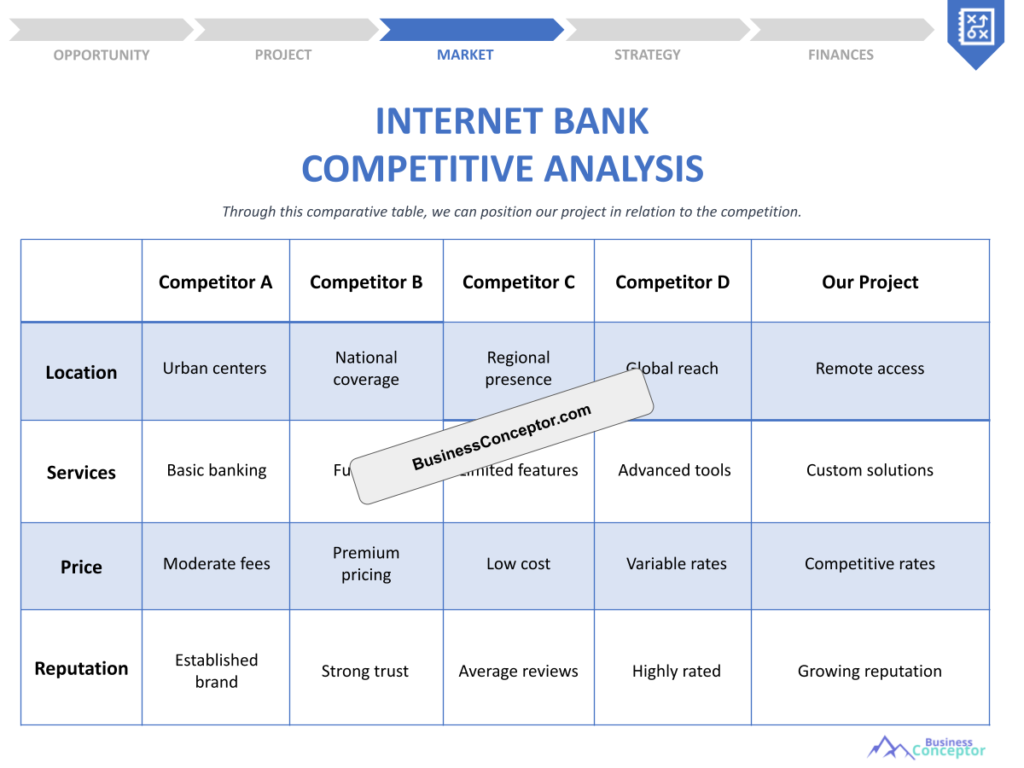

- Overview of the competitive landscape in internet banking

- Key strategies used by leading digital banks

- Analysis of consumer preferences and behaviors

- Examination of the impact of fintech on traditional banking

- Insights into regulatory challenges facing internet banks

- Future trends in the online banking sector

- Case studies of successful internet banks

- Tools and metrics for measuring bank performance

- Recommendations for improving customer engagement

The Competitive Landscape of Internet Banking

The landscape of internet banking has changed dramatically in recent years. With the rise of technology and the increasing reliance on digital solutions, banks that operate online are gaining a significant edge. This section introduces the various players in the market, from established banks that have embraced digital services to new entrants that are solely focused on online banking.

For example, banks like Ally and Chime have disrupted the traditional banking model by offering higher interest rates on savings accounts and lower fees. They cater to a younger demographic that values convenience and technology over physical branches. Additionally, the competition has led to innovations such as mobile check deposits and instant fund transfers, which enhance customer experience.

As we move forward, understanding the dynamics of this competitive environment is crucial. The next section will dive into specific strategies employed by internet banks to attract and retain customers.

| Key Players | Established banks, fintech startups |

| Competitive Strategies | Higher interest rates, lower fees |

- Increased reliance on digital banking

- Rise of fintech companies

- Innovations in customer service

- "In the digital age, convenience is king."

Strategies for Success in Digital Banking

Successful internet banks implement various strategies to differentiate themselves from competitors. This section will explore the most effective tactics that have proven successful in attracting and retaining customers. One of the primary strategies is investing in user-friendly technology. By ensuring that their apps and websites are intuitive and easy to navigate, banks can significantly enhance the customer experience. This focus on technology is particularly important as more consumers turn to their smartphones and computers for banking needs.

For instance, many digital banks prioritize seamless onboarding processes and offer features like instant account setup. According to a recent study, 80% of consumers are more likely to choose a bank based on their digital experience alone. Furthermore, the implementation of advanced security measures, such as two-factor authentication, helps build trust with users who are increasingly concerned about online banking security.

These strategies not only improve customer satisfaction but also foster loyalty. As we move to the next section, understanding consumer preferences is essential for internet banks to tailor their offerings effectively.

- Invest in user-friendly technology

- Offer competitive interest rates

- Focus on customer service excellence

- The above steps must be followed rigorously for optimal success.

Understanding Consumer Preferences in Online Banking

Consumer preferences play a significant role in shaping the strategies of internet banks. This section will delve into what customers value most in their online banking experience. Research indicates that security is a top concern for consumers, with 65% prioritizing it when choosing a bank. Customers are increasingly aware of the risks associated with digital banking, and they expect their banks to implement robust security measures to protect their personal and financial information.

Additionally, many users appreciate personalized services and the ability to manage their accounts seamlessly through mobile devices. Features like customized financial advice and tailored product recommendations can significantly enhance the customer experience. This personalization not only meets the expectations of tech-savvy consumers but also strengthens their loyalty to the bank.

Understanding these preferences is essential for internet banks to tailor their offerings effectively. The next section will discuss the role of fintech in transforming these consumer preferences into actionable strategies.

- Security as a priority

- Demand for personalized services

- Importance of mobile access

- "Customer preferences shape the future of banking."

The Impact of Fintech on Traditional Banking

Fintech has revolutionized the banking industry, presenting both challenges and opportunities for traditional banks. This section will analyze how fintech companies are influencing consumer choices and banking operations. One significant impact is the emergence of new financial products that are more accessible to consumers. Services like peer-to-peer lending and robo-advisors have made it easier for individuals to manage their finances and invest without needing to visit a bank branch.

Moreover, traditional banks are responding to this disruption by adopting similar technologies and enhancing their digital offerings. Many established banks are investing in their own digital banking platforms to compete with agile fintech startups. This shift not only improves their service offerings but also attracts a younger demographic that prefers online banking solutions.

The evolution of fintech continues to reshape the banking landscape, and understanding this impact is vital for all stakeholders. In the next section, we will explore the regulatory challenges that internet banks face as they navigate this rapidly changing environment.

| Fintech Impact | Details |

| Enhanced Accessibility | Peer-to-peer lending, robo-advisors |

| Traditional Bank Responses | Adoption of new technologies |

- Monitor fintech trends

- Adapt to new technologies

- Collaborate with fintech companies

- "Success in banking requires adaptability."

Regulatory Challenges for Internet Banks

Regulatory challenges present significant hurdles for internet banks. This section will provide an overview of the key regulations that affect their operations. For instance, internet banks must comply with the Bank Secrecy Act, which requires them to implement anti-money laundering measures. This legislation is crucial for maintaining the integrity of the financial system, but it can also be a burden for smaller, agile banks that may lack the resources to fully comply.

Additionally, internet banks face stringent data protection regulations that require them to safeguard customer information. Failure to comply can result in hefty fines and loss of customer trust, making it essential for these banks to prioritize compliance in their operations. The regulatory landscape is constantly evolving, and internet banks must stay informed to navigate these complexities successfully.

Navigating these regulations is crucial for the sustainability of internet banks. The next section will highlight successful case studies of internet banks that have effectively managed these challenges.

| Regulation | Description |

| Bank Secrecy Act | Anti-money laundering requirements |

- Stay informed about regulations

- Implement compliance measures

- Educate staff on regulatory requirements

Case Studies of Successful Internet Banks

Examining successful internet banks provides valuable insights into effective strategies. This section will highlight notable case studies that illustrate how some banks have thrived in a competitive environment. For example, banks like Monzo and N26 have gained significant market share by focusing on customer experience and transparency. Their innovative approaches to banking, such as offering instant notifications for transactions and no-fee foreign currency exchanges, have garnered a loyal customer base.

These banks have also utilized social media and digital marketing effectively to reach their target audiences. By engaging with customers on platforms like Instagram and Twitter, they create a community that fosters brand loyalty. Additionally, their user-friendly apps allow customers to manage their finances easily, which enhances overall satisfaction and retention rates.

These case studies illustrate that success in internet banking is achievable through strategic planning and execution. In the next section, we will discuss tools and metrics for measuring performance in the competitive landscape of online banking.

| Bank Name | Key Success Factor |

| Monzo | Focus on customer experience |

| N26 | Transparency in fees |

- Analyze successful case studies

- Identify key strategies

- Adapt lessons learned to your bank

- "Innovation is the key to staying relevant."

Tools and Metrics for Measuring Bank Performance

To ensure success, internet banks must measure their performance using appropriate tools and metrics. This section will outline key performance indicators (KPIs) relevant to online banking. Metrics such as customer acquisition cost, churn rate, and net promoter score provide insights into customer satisfaction and loyalty. Regularly analyzing these metrics allows banks to adjust their strategies accordingly and remain competitive in the fast-paced digital landscape.

For example, tracking the customer acquisition cost helps banks evaluate the effectiveness of their marketing strategies. A high customer acquisition cost may indicate the need for a more efficient approach to attracting new clients. Similarly, monitoring churn rates can help identify potential issues in customer satisfaction, prompting banks to take corrective action before losing valuable customers.

Implementing these measurement tools can lead to improved decision-making and enhanced customer experiences. The next section will provide actionable recommendations for improving customer engagement within internet banks.

| Metric | Importance |

| Customer Acquisition Cost | Measures marketing efficiency |

| Churn Rate | Indicates customer retention |

- Establish key performance metrics

- Regularly analyze performance data

- Adjust strategies based on findings

Recommendations for Improving Customer Engagement

Engaging customers effectively is essential for the success of internet banks. This section will offer practical recommendations for enhancing customer interaction and satisfaction. One effective strategy is to implement personalized services that cater to individual customer needs. By utilizing data analytics, banks can provide tailored financial advice and product recommendations, creating a more relevant experience for each user.

Additionally, using technology such as chatbots and AI-driven customer service can significantly improve response times and enhance customer support. This not only helps in addressing customer queries quickly but also provides a seamless experience that customers expect from digital banking. Furthermore, establishing regular feedback loops through surveys and user reviews can help banks understand their customers’ preferences and areas for improvement.

By implementing these recommendations, internet banks can build stronger relationships with their customers, leading to increased loyalty and retention. The final section will summarize the key points and encourage actionable steps for stakeholders in the banking industry.

| Recommendation | Benefit |

| Personalized communication | Enhances customer satisfaction |

| Utilize technology | Improves customer support |

- Implement personalized services

- Use technology to enhance engagement

- Create feedback mechanisms

- "Building relationships is the foundation of banking success."

Conclusion

In summary, the internet banking sector is undergoing significant transformation, driven by competitive pressures and evolving consumer preferences. By understanding the competitive landscape, embracing fintech innovations, and effectively navigating regulatory challenges, internet banks can position themselves for success. The strategies discussed throughout this article highlight the importance of customer engagement, personalized services, and performance metrics.

To further assist in your journey, consider utilizing our Internet Bank Business Plan Template to help you outline a clear roadmap for your banking venture. Additionally, explore our other articles related to internet banking for more insights:

- SWOT Analysis for Internet Bank: Maximizing Business Potential

- Internet Bank Profitability: Ensuring Financial Success

- How to Create a Business Plan for Your Internet Bank: Example Included

- Developing a Financial Plan for Internet Bank: Key Steps (+ Template)

- Guide to Starting an Internet Bank

- Create an Internet Bank Marketing Plan: Tips and Example

- Building a Business Model Canvas for an Internet Bank: A Comprehensive Guide

- How Much Does It Cost to Start an Internet Bank?

- Internet Bank Feasibility Study: Comprehensive Guide

- Internet Bank Risk Management: Comprehensive Strategies

- Internet Bank Legal Considerations: Comprehensive Guide

- Internet Bank Funding Options: Expert Insights

- Internet Bank Growth Strategies: Scaling Guide

FAQ

What is an internet bank?

An internet bank is a financial institution that operates exclusively online, providing services like checking accounts, savings accounts, and loans without physical branches.

How do internet banks compete with traditional banks?

Internet banks compete by offering lower fees, higher interest rates, and enhanced digital services that appeal to tech-savvy customers.

What are the advantages of using an internet bank?

The benefits of internet banking include better interest rates, convenience, and access to innovative financial tools compared to traditional banks.

How has fintech impacted internet banking?

Fintech has introduced new technologies and services that enhance customer experience, leading to increased competition in the banking sector.

What regulatory challenges do internet banks face?

Internet banks must comply with various regulations, including anti-money laundering laws and data protection requirements, which can be complex and costly.

How can internet banks enhance customer engagement?

By implementing personalized services, utilizing technology for customer support, and creating feedback mechanisms, internet banks can improve customer engagement.

What metrics should internet banks track for success?

Key performance indicators (KPIs) such as customer acquisition cost, churn rate, and net promoter score are essential for measuring success in online banking.

Can internet banks provide the same services as traditional banks?

Yes, internet banks offer a wide range of financial services, often with more competitive terms and better technology compared to traditional banks.

What strategies can internet banks use to attract customers?

Effective strategies include investing in user-friendly technology, offering competitive rates, and focusing on exceptional customer service.

What is the future of internet banking?

The future of internet banking will likely involve increased digitalization, more fintech integration, and a greater emphasis on customer experience.