The Microlending Business Model Canvas is a powerful framework that’s reshaping how we think about finance, especially for those who often find themselves overlooked by traditional banking systems. Did you know that millions of people around the world lack access to basic financial services? This gap is where microlending steps in, providing crucial support to individuals and small businesses. At its core, the microlending business model is about more than just lending money; it’s about empowering individuals to create change in their lives and communities.

With this article, you will explore the essential components of the Microlending Business Model Canvas and how to effectively implement it. You’ll learn about the key elements such as customer segments, value propositions, revenue streams, and more. Plus, we’ll delve into real-world examples that demonstrate the success of this model in action. Here’s what you can expect to gain:

– A clear understanding of what a Microlending Business Model Canvas is.

– Insight into how to identify your target customer segments.

– Strategies for crafting a compelling value proposition.

– Practical steps to implement your own microlending model.

Understanding the Microlending Business Model Canvas

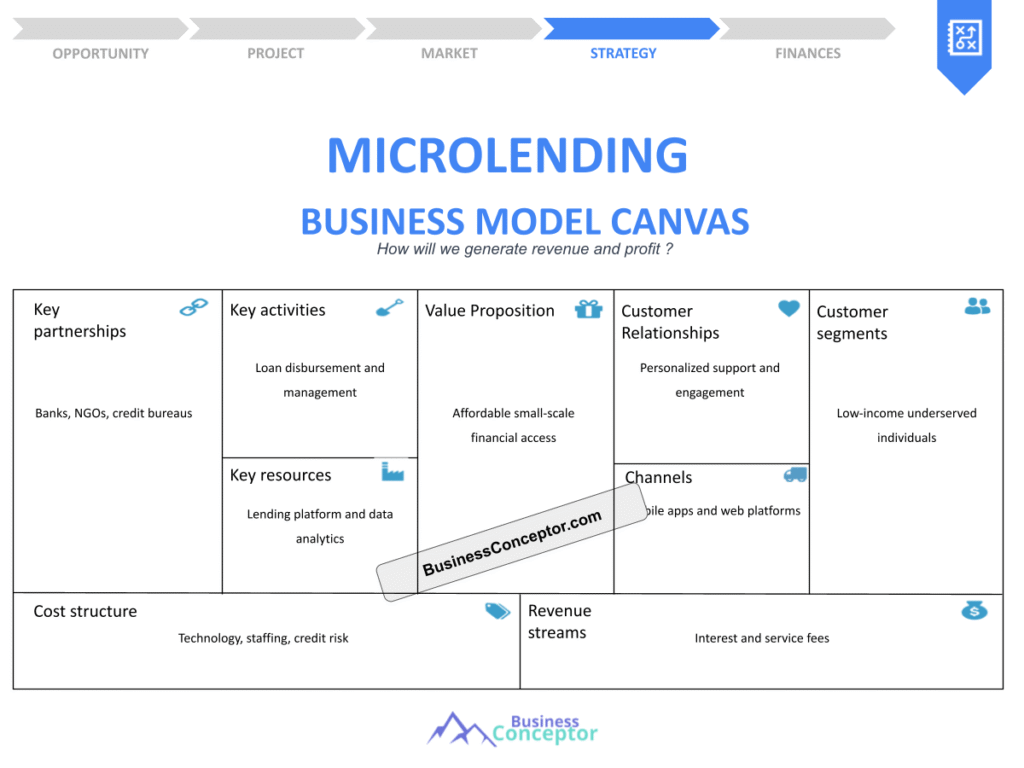

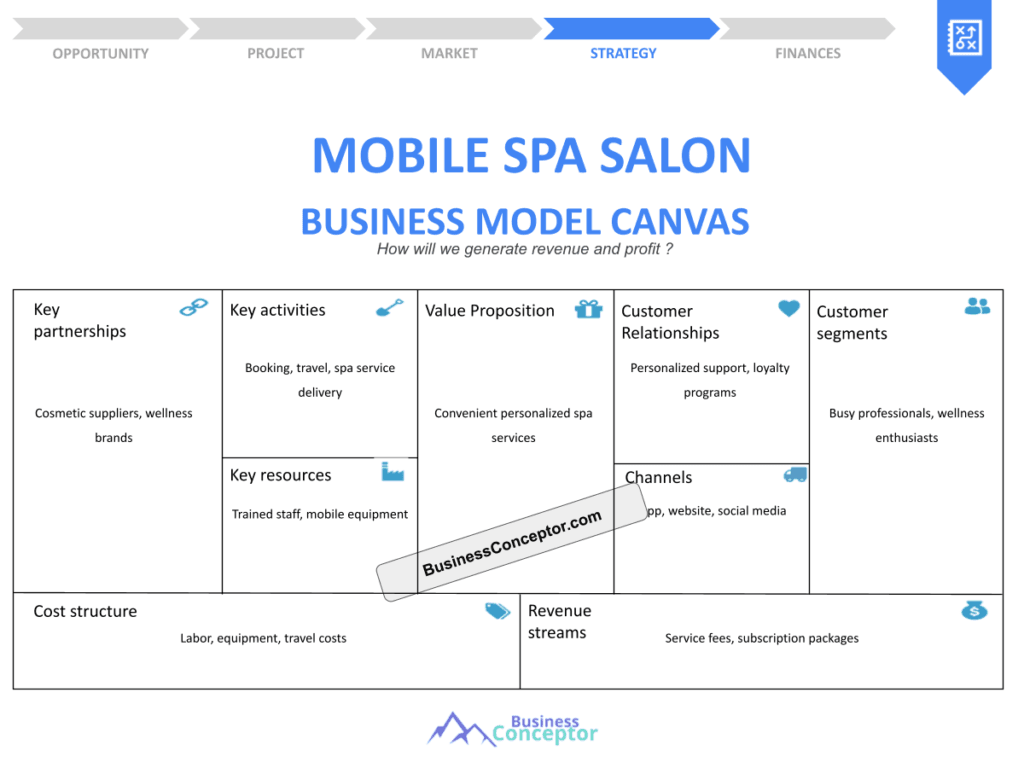

The Microlending Business Model Canvas serves as a visual representation of your business strategy, detailing the essential elements that will drive your microlending initiative. It’s a dynamic tool that helps you see how each component interacts and supports the overall mission of your business. By mapping out these elements, you can ensure that all aspects of your operation are aligned and working towards a common goal.

One of the most significant advantages of using a business model canvas for microloans is its simplicity. Instead of getting lost in complex business plans, you can outline your strategy on a single page. This makes it easier to communicate your vision to stakeholders, investors, and team members. Additionally, it allows for flexibility, enabling you to adapt your model as you learn more about your market and customers.

Let’s break down the key components of the Microlending Business Model Canvas to better understand how they contribute to the success of your microlending venture:

| Component | Description |

|---|---|

| Customer Segments | Identifying specific groups of borrowers, such as low-income individuals or small business owners, helps tailor services to meet their unique needs. |

| Value Proposition | What makes your microlending service stand out? This could include lower interest rates, faster loan approvals, or added support services. |

| Channels | How will you reach your customers? This includes online platforms, community events, and partnerships with local organizations. |

| Customer Relationships | Building trust and maintaining connections with your clients is essential for retention and loyalty. |

| Revenue Streams | Understanding how your business will generate income through interest on loans, fees, or grants. |

| Key Resources | What assets do you need to operate effectively? This can include technology, skilled staff, and financial backing. |

| Key Activities | The essential actions required to run your microlending business, such as processing loans and marketing your services. |

| Key Partnerships | Collaborating with other organizations, NGOs, and local businesses to enhance your service offerings and reach. |

| Cost Structure | Identifying both fixed and variable costs associated with running your business to ensure profitability. |

By understanding these components, you can create a comprehensive strategy that addresses the specific challenges of your target market. For example, knowing your target demographics allows you to tailor your marketing efforts effectively, ensuring that your services reach those who need them most.

Moreover, the microlending value proposition is crucial; it defines why potential borrowers should choose your services over competitors. By articulating this clearly, you not only attract customers but also build lasting relationships based on trust and mutual benefit. As you craft your Microlending Business Model Canvas, remember that it’s a living document that should evolve as your business grows and adapts to the changing market landscape.

In essence, the Microlending Business Model Canvas is not just a blueprint for your business; it’s a roadmap to creating a sustainable and impactful microlending initiative. With the right strategy in place, you can empower individuals and communities, driving positive social change while achieving your business goals.

Customer Segments in Microlending

Identifying your customer segments is a critical step in developing a successful Microlending Business Model Canvas. These segments represent the specific groups of individuals or businesses that will benefit from your microlending services. By understanding who your borrowers are, you can tailor your offerings to meet their unique needs and challenges. This targeted approach not only enhances customer satisfaction but also increases the likelihood of repayment, ultimately leading to the sustainability of your microlending operation.

One effective way to identify your customer segments is to consider the various demographics that typically seek microloans. For instance, you might focus on low-income individuals who require capital to start small businesses or improve their living conditions. Additionally, women entrepreneurs, especially in developing regions, often face barriers to accessing traditional financing. By specifically targeting this group, you can create customized solutions that cater to their specific challenges, such as providing lower interest rates or offering financial literacy programs alongside loans.

Another important aspect of defining your customer segments is understanding their geographic location. Urban areas may have different needs compared to rural communities. For example, urban entrepreneurs might seek microloans for tech startups, while rural borrowers may need funds for agricultural projects. By recognizing these differences, you can better tailor your marketing strategies and service offerings to address the unique demands of each segment.

| Customer Segment | Key Characteristics |

|---|---|

| Women Entrepreneurs | Often face challenges in accessing capital; may benefit from targeted financial education. |

| Small Business Owners | Require funds for inventory, equipment, or expansion; value quick access to capital. |

| Low-Income Individuals | Need support for personal expenses or to start micro-enterprises; may lack credit history. |

By understanding these key characteristics, you can craft a compelling value proposition that resonates with your target audience. For example, if your primary customer segment is women entrepreneurs, you could emphasize how your microlending services are designed to empower women by providing not just financial support, but also mentorship and networking opportunities. This holistic approach can significantly enhance your appeal and build a loyal customer base.

Engaging with your customers through surveys or community events can provide valuable insights into their needs and preferences. This feedback loop will allow you to continuously refine your offerings, ensuring that they align with your customers’ evolving demands. Ultimately, a well-defined customer segment strategy can lead to higher customer retention rates and better overall business performance.

Value Proposition in Microlending

Your value proposition is the cornerstone of your microlending business. It clearly articulates why potential borrowers should choose your services over others. In the world of microlending, where competition can be fierce, having a strong value proposition is essential for attracting and retaining customers.

One of the primary advantages of a well-defined value proposition is that it allows you to differentiate your microlending services from traditional financial institutions. For instance, traditional banks often impose strict eligibility criteria, making it difficult for low-income individuals or small business owners to secure loans. In contrast, your microlending business can position itself as a more accessible and inclusive alternative. By offering flexible loan terms, lower interest rates, and personalized support, you can appeal to those who may feel marginalized by the conventional banking system.

Moreover, your value proposition can encompass additional services that enhance the borrower experience. For example, providing financial education workshops or resources can empower borrowers to make informed financial decisions. This added value not only builds trust but also fosters long-term relationships with your clients. When borrowers feel supported and educated, they are more likely to repay their loans, benefiting both parties in the long run.

| Unique Offering | Benefit to Customers |

|---|---|

| Lower Interest Rates | Makes loans more affordable and accessible for underserved populations. |

| Financial Education | Empowers borrowers with the knowledge to manage their finances effectively. |

| Quick Approval Processes | Provides faster access to funds, crucial for time-sensitive business needs. |

To effectively communicate your value proposition, consider using testimonials and success stories from past borrowers. Sharing real-life examples of how your microlending services have positively impacted individuals or communities can create an emotional connection with potential clients. This storytelling approach not only illustrates your commitment to social impact but also builds credibility and trust in your brand.

In summary, your value proposition is not just a statement; it’s a promise to your customers. By clearly defining and effectively communicating this promise, you can attract and retain borrowers who align with your mission. Remember, the stronger your value proposition, the more likely you are to succeed in the competitive world of microlending.

Channels for Reaching Customers

Identifying the right channels to reach your customers is a vital component of your Microlending Business Model Canvas. These channels are the various methods through which you will connect with potential borrowers and deliver your services. A well-thought-out channel strategy not only increases visibility but also enhances customer engagement, leading to higher loan uptake and better repayment rates.

In today’s digital age, online channels play a significant role in reaching potential customers. Social media platforms, websites, and mobile applications can be powerful tools for marketing your microlending services. For instance, creating engaging content on platforms like Facebook or Instagram can help raise awareness about your offerings and attract a younger demographic looking for flexible financing options. Additionally, a user-friendly website can serve as a central hub for information, allowing potential borrowers to learn about your services, apply for loans, and access educational resources.

However, it’s important not to overlook traditional, offline channels. Community outreach programs, local events, and partnerships with local businesses can be highly effective in building trust and rapport with potential borrowers. For example, hosting workshops or informational sessions in local community centers can help demystify the loan process and educate individuals about the benefits of microlending. These face-to-face interactions can create a sense of community and support that online channels may not fully replicate.

| Channel Type | Description |

|---|---|

| Digital Marketing | Utilizing social media and online advertising to engage potential borrowers. |

| Community Events | Building trust through personal interactions and educational workshops. |

| Partnerships | Collaborating with local businesses and organizations to expand reach. |

Another key advantage of having diverse channels is that it allows you to tailor your messaging based on the medium. For example, social media campaigns can focus on visual storytelling to engage younger audiences, while community events might prioritize informative presentations that address common questions and concerns about microlending. By customizing your approach, you can resonate more deeply with each segment of your target audience.

To maximize the effectiveness of your channels, consider implementing a multi-channel marketing strategy. This approach combines both online and offline efforts, ensuring you reach a broader audience. Regularly analyzing the performance of each channel will allow you to adjust your strategy based on what works best, making your outreach efforts more efficient and impactful.

Building Customer Relationships

Establishing strong customer relationships is crucial for the success of your microlending business. These relationships not only foster trust but also encourage loyalty, which is vital for maintaining a steady flow of borrowers. The more connected your customers feel to your brand, the more likely they are to return for future loans and recommend your services to others.

One effective way to build customer relationships is through personalized communication. Regularly reaching out to borrowers with updates, reminders, or even personalized messages can make them feel valued and appreciated. For example, sending a thank-you note after a loan is disbursed or following up with a call to see how they are doing can strengthen the bond between your business and your customers. This level of engagement shows that you care about their success beyond just the financial transaction.

Additionally, providing excellent customer service is a cornerstone of building lasting relationships. Being responsive to inquiries, addressing concerns promptly, and offering support throughout the loan process can significantly enhance the borrower experience. When customers know they can rely on you for assistance, they are more likely to feel comfortable referring friends and family to your microlending services.

| Relationship Strategy | Description |

|---|---|

| Personalized Support | Tailoring interactions to meet individual borrower needs. |

| Regular Communication | Keeping in touch through updates and follow-ups to build rapport. |

| Community Engagement | Hosting events to strengthen ties and promote a sense of belonging. |

Engaging with your customers through community events can also play a significant role in relationship-building. Hosting workshops, seminars, or social gatherings not only provides educational value but also creates a sense of community among your borrowers. When customers feel like they are part of a larger network, they are more likely to remain loyal to your brand and actively participate in promoting your services within their communities.

In summary, strong customer relationships are built on trust, communication, and support. By implementing personalized strategies and engaging with your borrowers on multiple levels, you can create a loyal customer base that will contribute to the long-term success of your microlending business. Remember, the relationships you cultivate today will shape the future of your business and its impact on the community.

Key Resources for Microlending

Identifying and managing your key resources is essential for the successful operation of your Microlending Business Model Canvas. These resources are the assets you need to deliver your services, manage operations, and ultimately achieve your business goals. They can be categorized into several types, including human resources, technological resources, and financial resources.

Human resources are perhaps the most valuable asset in your microlending business. Skilled personnel who understand the nuances of microlending, finance, and customer service are crucial. For instance, having a team of loan officers who can evaluate applications, provide financial advice, and support borrowers through the loan process can enhance the overall customer experience. Additionally, training your staff in cultural competency can help them better understand and meet the needs of diverse borrower populations. This not only improves service quality but also builds trust between your organization and the community.

Technological resources also play a significant role in the efficiency of your microlending operations. Utilizing advanced loan management software can streamline the application process, track repayments, and manage customer data effectively. This technology can automate many administrative tasks, allowing your team to focus on customer engagement and support. Furthermore, implementing secure digital platforms can enhance the borrower experience by making it easier for clients to apply for loans, access information, and communicate with your team.

| Resource Type | Importance |

|---|---|

| Human Resources | Skilled staff who can manage loans and provide customer support. |

| Technology | Software solutions that streamline operations and enhance efficiency. |

| Financial Resources | Capital needed to fund loans and support business operations. |

Financial resources are another critical component of your microlending business. Access to capital is necessary not only for disbursing loans but also for covering operational expenses. This might include seeking funding from investors, grants, or partnerships with financial institutions. Having a diverse range of funding sources can provide greater stability and flexibility, allowing your business to respond effectively to changing market conditions. For example, establishing relationships with local banks or impact investors can open doors to additional funding opportunities and enhance your credibility in the community.

By effectively managing your key resources, you can create a solid foundation for your microlending business. This foundation enables you to provide high-quality services to your borrowers while maintaining operational efficiency. Ultimately, the better you manage these resources, the more successful your microlending initiative will be.

Key Activities in Microlending

Understanding the key activities required to run your microlending business is crucial for achieving your goals and ensuring operational success. These activities encompass the essential tasks and processes that must be carried out to deliver your services effectively. From loan processing to marketing and customer support, each activity plays a vital role in the overall functioning of your microlending model.

One of the most critical key activities in microlending is the loan application process. This involves assessing borrower applications, conducting credit evaluations, and determining loan eligibility. A streamlined and efficient application process can significantly enhance the borrower experience, leading to higher approval rates and improved customer satisfaction. For instance, utilizing technology to automate parts of this process can reduce the time it takes to evaluate applications, allowing you to disburse funds more quickly. This speed is especially crucial for borrowers who may need funds urgently to seize business opportunities or address personal financial challenges.

Marketing is another essential activity that cannot be overlooked. Effective marketing strategies help raise awareness about your microlending services and attract potential borrowers. This could include online marketing campaigns, community outreach, and partnerships with local organizations. Engaging with your target audience through various channels ensures that your services reach those who need them most. For example, hosting informational workshops or webinars can educate potential borrowers about the benefits of microlending while also promoting your offerings.

| Activity Type | Description |

|---|---|

| Loan Processing | Assessing applications and determining eligibility for loans. |

| Marketing | Promoting services to attract potential borrowers and raise awareness. |

| Customer Support | Providing assistance and guidance throughout the loan process. |

Providing excellent customer support is also a key activity that can greatly influence your microlending success. Being available to answer questions, provide guidance, and address concerns fosters trust and loyalty among your borrowers. A responsive customer support team can help borrowers navigate the loan process more easily and can also provide valuable feedback for improving your services. When borrowers feel supported and valued, they are more likely to repay their loans on time and recommend your services to others.

In conclusion, identifying and effectively managing your key activities is essential for the success of your microlending business. By streamlining processes, implementing effective marketing strategies, and prioritizing customer support, you can create a robust operational framework that not only meets the needs of your borrowers but also drives the growth and sustainability of your business. Remember, each activity contributes to the overall effectiveness of your Microlending Business Model Canvas, so invest time and resources into optimizing these essential tasks.

Cost Structure in Microlending

Understanding the cost structure of your microlending business is crucial for maintaining profitability and ensuring sustainable operations. The cost structure encompasses all expenses associated with running your business, including fixed and variable costs. By carefully analyzing these costs, you can identify areas for improvement, optimize resource allocation, and ultimately enhance your financial performance.

Fixed costs are expenses that remain constant regardless of the number of loans you disburse. These may include salaries for your staff, rent for office space, and technology infrastructure. For instance, investing in a robust loan management system is a fixed cost that can greatly enhance your operational efficiency. While the initial investment may be significant, the long-term savings and improved customer experience can justify the expense.

Variable costs, on the other hand, fluctuate based on the volume of loans you process. These can include costs associated with marketing campaigns, loan processing fees, and customer service expenses. As your microlending business grows, it’s essential to monitor these variable costs closely. For example, a marketing campaign that successfully attracts new borrowers may initially incur higher costs but can lead to increased revenue as more loans are disbursed. By analyzing the return on investment (ROI) for each marketing initiative, you can make informed decisions about where to allocate your budget for maximum impact.

| Cost Type | Description |

|---|---|

| Fixed Costs | Expenses that remain constant, such as salaries and office rent. |

| Variable Costs | Expenses that fluctuate based on loan volume, such as marketing and processing fees. |

One of the advantages of having a clear understanding of your cost structure is that it allows you to set competitive interest rates for your loans. By knowing your costs, you can determine the minimum interest rate required to cover expenses while still generating profit. This transparency can also enhance your credibility with borrowers, as they will appreciate knowing that your rates are fair and justified based on your operational costs.

Moreover, regularly reviewing your cost structure can help you identify opportunities for cost savings. For example, if you notice that a particular marketing channel is yielding a low ROI, you can reallocate those funds to more effective strategies. Additionally, automating certain processes can reduce labor costs and improve efficiency. By continuously optimizing your cost structure, you can ensure the financial health of your microlending business and position yourself for growth.

Creating Your Microlending Business Model Canvas

Now that you have explored the essential components of the Microlending Business Model Canvas, it’s time to bring all of these elements together and create your own canvas. This visual tool will serve as a roadmap for your microlending business, helping you to clearly outline your strategy and identify the key areas that will drive your success.

The first step in creating your Microlending Business Model Canvas is to gather input from your team and stakeholders. Collaborative brainstorming sessions can yield valuable insights and diverse perspectives that enhance your canvas. Encourage open dialogue and invite contributions from various departments, such as marketing, finance, and customer service. This collaborative approach will help ensure that your canvas reflects the realities of your business operations and the needs of your target market.

Once you have gathered input, start drafting your canvas by filling in each of the nine components: customer segments, value proposition, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure. It can be helpful to use a template or digital tool that allows you to visualize these elements clearly. As you fill in each section, focus on how these components interconnect and support one another.

| Step | Description |

|---|---|

| Gather Input | Collaborate with team members and stakeholders for diverse insights. |

| Draft the Canvas | Create a visual representation of your business model. |

| Review and Revise | Regularly update the canvas based on feedback and business evolution. |

After drafting your canvas, it’s important to review and revise it regularly. Your microlending business will evolve as you learn more about your customers, market trends, and operational challenges. By treating your Microlending Business Model Canvas as a living document, you can ensure that it remains relevant and effective in guiding your business decisions.

In conclusion, creating your Microlending Business Model Canvas is a critical step in establishing a successful microlending business. By thoughtfully considering each component and fostering collaboration among your team, you can develop a comprehensive strategy that addresses the unique needs of your borrowers while positioning your business for growth. Remember, a well-crafted canvas not only serves as a blueprint for your operations but also inspires confidence among stakeholders and fosters a shared vision for your microlending initiative.

Recommendations

In this article, we explored the essential components of the Microlending Business Model Canvas and how to effectively implement it for success in the microlending industry. From identifying customer segments to defining your value proposition, each element plays a crucial role in shaping your business strategy. To further assist you in building a robust microlending business, we highly recommend checking out the Microlending Business Plan Template. This template provides a structured approach to creating a comprehensive business plan tailored specifically for microlending.

Additionally, you may find our related articles on microlending beneficial for deepening your understanding of this field and refining your strategies:

- Article 1 on Microlending SWOT Analysis Insights & Trends

- Article 2 on Microlending: Profitability and Business Strategies

- Article 3 on Microlending Business Plan: Template and Tips

- Article 4 on Microlending Financial Plan: A Detailed Guide

- Article 5 on Starting a Microlending Business: A Comprehensive Guide with Examples

- Article 6 on Begin Your Microlending Marketing Plan with This Example

- Article 7 on Identifying Customer Segments for Microlending Services (with Examples)

- Article 8 on How Much Does It Cost to Start a Microlending Business?

- Article 9 on Microlending Feasibility Study: Essential Guide

- Article 10 on Microlending Risk Management: Essential Guide

- Article 11 on Microlending Competition Study: Essential Guide

- Article 12 on Microlending Legal Considerations: Ultimate Guide

- Article 13 on Microlending Funding Options: Ultimate Guide

- Article 14 on Microlending Growth Strategies: Scaling Examples

FAQ

What is a Microlending Business Model?

The microlending business model refers to a financial framework that provides small loans to individuals or businesses that lack access to traditional banking services. This model aims to empower borrowers, often in underserved communities, by offering them the capital needed to start or grow their enterprises, thus promoting economic development.

How does Microlending work?

Microlending works by connecting lenders with borrowers who require small amounts of capital. Lenders can be individuals, organizations, or financial institutions that provide funds directly to borrowers. The loan terms typically include a repayment schedule and interest rates that are generally lower than those of traditional loans, making it accessible for those who need it most.

What are the key components of a Microlending Business Plan?

A comprehensive microlending business plan should include the following key components: a clear value proposition, defined customer segments, detailed revenue streams, identified key resources, and a thorough cost structure. Each component should work in harmony to create a sustainable business model that meets the needs of your target market.

What are the benefits of using a Microlending Business Model Canvas?

The Microlending Business Model Canvas offers several benefits, including a visual representation of your business strategy, clarity in identifying key activities, and an organized approach to understanding customer relationships. This framework allows for easier communication among team members and stakeholders, fostering collaboration and innovation.

What should I consider when identifying customer segments for Microlending?

When identifying customer segments for your microlending services, consider factors such as demographics, geographic location, and specific financial needs. Understanding these characteristics will help you tailor your services effectively and create a strong connection with your target audience.

How can I measure the success of my Microlending Business?

To measure the success of your microlending business, track key performance indicators (KPIs) such as loan repayment rates, customer satisfaction scores, and overall profitability. Regularly analyzing these metrics will help you assess your business performance and make necessary adjustments to improve outcomes.