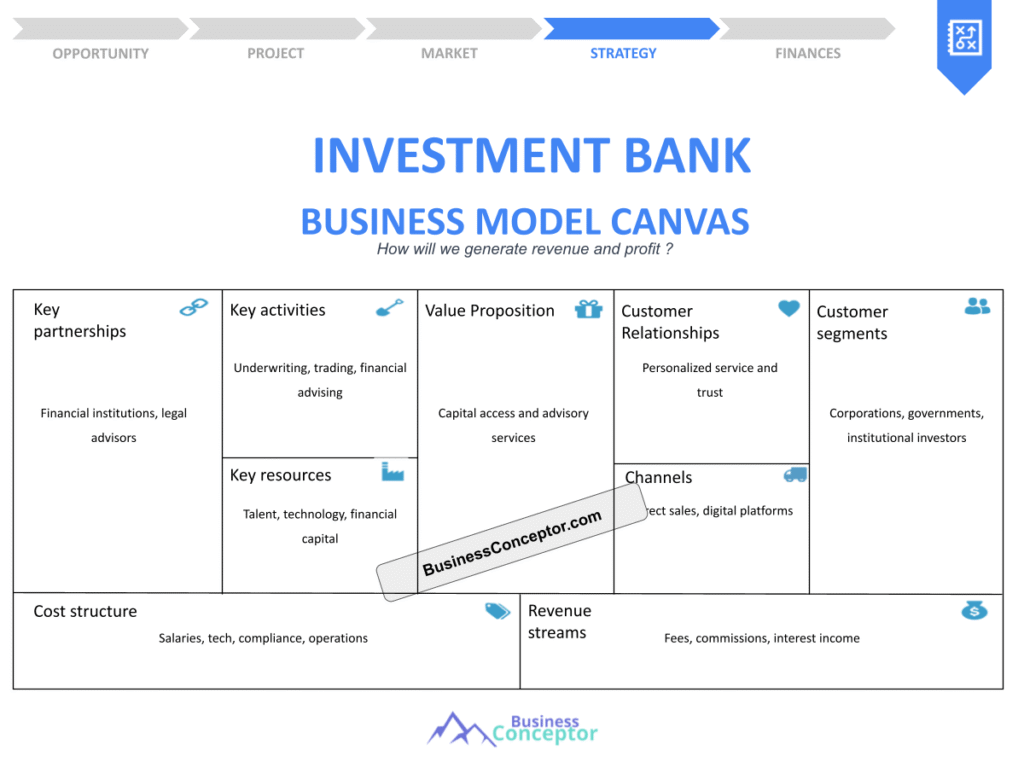

Did you know that the investment banking sector has undergone massive transformations in the last decade? With the rise of fintech and evolving regulations, understanding the Investment Bank Business Model Canvas is more critical than ever. This article aims to equip you with the knowledge to craft a robust business model for your investment bank. The Investment Bank Business Model Canvas is a strategic tool that allows you to visualize the key components of your banking operations, such as customer segments, value propositions, and revenue streams. By the end of this guide, you’ll have a comprehensive understanding of how to leverage this model for success.

- Understand the core components of the Investment Bank Business Model Canvas.

- Learn how to identify key partners and resources.

- Explore revenue streams specific to investment banking.

- Analyze customer segments and their needs.

- Discover the importance of value propositions.

- Gain insights into cost structures in banking.

- Examine real-life examples of successful investment banks.

- Learn about digital transformation in finance.

- Understand the regulatory landscape affecting investment banking.

- Get practical tips for implementing your business model.

Understanding the Investment Bank Business Model Canvas

Investment banks operate in a complex environment that requires a clear understanding of their business model. The Investment Bank Business Model Canvas serves as a visual representation of the different elements that contribute to the bank’s success. This section will delve into the essential components of the canvas, such as customer segments, key partners, and revenue streams.

The first step in creating your canvas is to identify your target customer segments. For instance, are you focusing on institutional clients, high-net-worth individuals, or corporations? Each segment has unique needs and preferences that shape your offerings. Additionally, understanding your key partners, like hedge funds or asset managers, can enhance your service delivery and client satisfaction.

By clearly defining these elements, you set the stage for a successful investment banking operation. The next section will explore how to analyze these components further to identify growth opportunities.

| Component | Description |

|---|---|

| Customer Segments | Different groups your bank serves |

| Key Partners | Important alliances that support growth |

- Point 1: Identify your customer segments.

- Point 2: Understand your key partners.

- Point 3: Define your value propositions.

– “The foundation of a successful investment bank lies in understanding its customers.”

Identifying Key Partners and Resources

The second aspect of the Investment Bank Business Model Canvas focuses on identifying key partners and resources. Key partners can include other financial institutions, regulatory bodies, and technology providers. These partnerships are crucial for expanding your service offerings and enhancing your competitive edge.

For example, collaborating with fintech firms can allow you to offer innovative solutions to your clients, such as robo-advisory services or blockchain-based transactions. Furthermore, understanding your key resources, like proprietary technology and skilled personnel, is essential for delivering exceptional value to your customers.

By leveraging these partnerships and resources effectively, you can streamline operations and improve service quality. In the next section, we will discuss the various revenue streams available to investment banks.

- Identify potential partners in your market.

- Assess the resources needed for your operations.

- Develop strategies for partnership engagement.

– The above steps must be followed rigorously for optimal success.

Revenue Streams in Investment Banking

Revenue streams are a critical component of the Investment Bank Business Model Canvas. Investment banks can generate income through various channels, including advisory fees, underwriting services, and asset management fees. Understanding these revenue streams helps you create a sustainable financial model.

For instance, advisory services for mergers and acquisitions can yield significant fees, while underwriting new securities can provide a steady income stream. Additionally, asset management services can generate ongoing revenue through management fees based on assets under management (AUM).

By diversifying your revenue streams, you can mitigate risks associated with market fluctuations and enhance profitability. In the next section, we will examine customer relationships and how to maintain them effectively.

- Explore various revenue channels.

- Understand the importance of diversification.

- Analyze market trends affecting revenue.

– “Diverse revenue streams create a safety net for investment banks.”

Building Customer Relationships

Customer relationships play a pivotal role in the Investment Bank Business Model Canvas. Establishing trust and rapport with your clients is essential for long-term success. This section will explore strategies for building and maintaining strong customer relationships.

Personalized service is a key factor in fostering these relationships. By understanding your clients’ unique needs, you can tailor your offerings and provide exceptional value. Additionally, regular communication and feedback loops can help strengthen client loyalty. For example, conducting surveys to gather client feedback can reveal insights that allow you to enhance your services.

Moreover, leveraging technology for relationship management, such as CRM systems, can enhance your ability to serve clients effectively. By prioritizing customer satisfaction, you not only retain clients but also attract new ones through positive referrals. In the next section, we will discuss the cost structure associated with running an investment bank.

| Aspect | Description |

|---|---|

| Customer Engagement | Methods to build client trust |

| Feedback Mechanisms | Channels for receiving client input |

- Implement personalized service strategies.

- Regularly communicate with clients.

- Use technology for better relationship management.

– “Building strong relationships is key to retaining clients.”

Cost Structure of Investment Banks

Understanding the cost structure is vital for any investment bank. This section will outline the various costs involved in running an investment bank, including operational costs, employee salaries, and compliance expenses. By analyzing these costs, you can identify areas for improvement and ensure profitability.

Operational costs can vary widely depending on the services offered. For example, a bank focusing on high-frequency trading may have significantly different cost dynamics compared to one specializing in private equity. Additionally, compliance costs are increasingly important due to regulatory pressures, so it’s crucial to allocate resources effectively.

By carefully managing your cost structure, you can improve your bank’s financial health. In the next section, we will explore the importance of innovation in investment banking.

- Analyze your cost structure regularly.

- Identify areas for cost reduction.

- Allocate resources efficiently.

– “A well-managed cost structure is essential for profitability.”

Innovation and Digital Transformation

Innovation is key to staying competitive in the investment banking landscape. This section will discuss the importance of embracing digital transformation and adopting new technologies. In today’s fast-paced environment, banks that fail to innovate risk falling behind.

Implementing technology such as artificial intelligence and big data analytics can enhance decision-making and improve operational efficiency. Furthermore, investing in digital platforms can provide clients with seamless experiences, from onboarding to ongoing service delivery. For instance, many banks are now using chatbots to improve customer service and handle inquiries more efficiently.

By prioritizing innovation, investment banks can adapt to changing market conditions and client expectations. In the next section, we will examine the regulatory landscape affecting investment banks, which is crucial for ensuring compliance and maintaining operational integrity.

| Innovation Area | Impact on Banking |

|---|---|

| Technology Adoption | Enhances efficiency and service quality |

| Client Experience | Improves satisfaction and loyalty |

- Invest in technology and innovation.

- Regularly assess market trends.

- Foster a culture of innovation within the organization.

– “Innovation is the lifeblood of a successful investment bank.”

Navigating Regulatory Challenges

Regulatory compliance is a critical consideration for investment banks. This section will outline the various regulations impacting the banking sector and how to navigate these challenges effectively. Compliance is not just a legal obligation; it also plays a significant role in building trust with clients.

Understanding regulations such as the Dodd-Frank Act or MiFID II is essential for ensuring that your bank operates within the law. Additionally, implementing robust compliance frameworks can help mitigate risks and avoid costly penalties. For instance, regularly conducting compliance audits can identify potential gaps in adherence to regulatory standards.

By staying informed about regulatory changes, investment banks can adapt their strategies accordingly. In the next section, we will summarize the key points discussed throughout the article, reinforcing the importance of the Investment Bank Business Model Canvas.

- Stay updated on regulatory changes.

- Implement compliance training for staff.

- Develop a strong compliance framework.

– “Navigating regulations is crucial for maintaining client trust.”

Summary of the Investment Bank Business Model Canvas

In summary, the Investment Bank Business Model Canvas is a powerful tool for visualizing and structuring your bank’s operations. By understanding customer segments, key partners, revenue streams, and cost structures, you can create a comprehensive strategy for success. This guide has provided insights into each component, highlighting the importance of innovation and compliance.

Key takeaways from this article include the necessity of identifying your target customers, leveraging partnerships, diversifying revenue streams, and maintaining strong client relationships. Furthermore, understanding the cost structure and embracing digital transformation are essential for adapting to market changes and enhancing your bank’s competitive position.

Now is the time to take action! Start developing your Investment Bank Business Model Canvas today and position your bank for long-term success. In the next section, we will provide a list of key actions and recommendations to follow for effective implementation.

| Key Takeaways | Importance |

|---|---|

| Understanding Clients | Tailors services to meet needs |

| Building Partnerships | Enhances service delivery |

| Innovation | Keeps banks competitive |

- Develop a clear business model.

- Foster strong client relationships.

- Embrace innovation and compliance.

– “A well-structured business model is the key to success.”

Key Actions and Recommendations

As you embark on implementing your Investment Bank Business Model Canvas, consider the following key actions to enhance your operational effectiveness:

- Conduct thorough market research to identify your customer segments.

- Establish strategic partnerships that can enhance your service offerings.

- Diversify your revenue streams to reduce reliance on a single source of income.

- Invest in technology to improve efficiency and client engagement.

- Regularly review your cost structure to identify areas for savings.

– “Success comes to those who persevere.”

Conclusion

In conclusion, the Investment Bank Business Model Canvas is an essential framework for visualizing and structuring your bank’s operations. By understanding customer segments, key partners, revenue streams, and cost structures, you can develop a comprehensive strategy that positions your investment bank for success. This guide has explored the critical components necessary for effective business modeling, emphasizing the importance of innovation and regulatory compliance.

To further assist you in your journey, consider utilizing the Investment Bank Business Plan Template, which provides a structured approach to creating your business plan. Additionally, check out our articles related to investment banking:

- SWOT Analysis for Investment Bank: Ensuring Business Success

- Investment Bank Profitability: Key Considerations

- Writing a Business Plan for Your Investment Bank: Template Included

- Financial Planning for Your Investment Bank: A Comprehensive Guide (+ Example)

- Guide to Starting an Investment Bank: Steps and Examples

- Starting an Investment Bank Marketing Plan: Strategies and Examples

- Customer Segments in Investment Banking: Examples and Analysis

- How Much Does It Cost to Establish an Investment Bank?

- How to Build a Feasibility Study for Investment Bank?

- How to Build a Risk Management Plan for Investment Bank?

- How to Build a Competition Study for Investment Bank?

- What Legal Considerations Should You Be Aware of for Investment Bank?

- What Funding Options Should You Consider for Investment Bank?

- Growth Strategies for Investment Bank: Scaling Examples

FAQ Section

What is an Investment Bank Business Model Canvas?

The Investment Bank Business Model Canvas is a visual tool that outlines the key components of an investment bank’s operations, including customer segments, key partners, and revenue streams.

How can I identify customer segments in investment banking?

You can identify customer segments by analyzing the needs and preferences of different groups, such as institutional clients, corporations, and high-net-worth individuals.

What are the key partners in an investment bank?

Key partners may include other financial institutions, regulatory bodies, and technology providers that support the bank’s operations and service delivery.

What are common revenue streams for investment banks?

Common revenue streams include advisory fees, underwriting services, and asset management fees, which contribute to the bank’s profitability.

How can investment banks build strong customer relationships?

Investment banks can build strong relationships by providing personalized services, maintaining regular communication, and leveraging technology for effective relationship management.

What factors contribute to the cost structure of investment banks?

Factors that contribute to the cost structure include operational costs, employee salaries, compliance expenses, and technology investments.

How important is innovation in investment banking?

Innovation is crucial for staying competitive, as it allows banks to adapt to market changes and meet evolving client expectations.

What are the main regulatory challenges for investment banks?

Main regulatory challenges include compliance with laws such as the Dodd-Frank Act and MiFID II, which require ongoing monitoring and robust compliance frameworks.

How can investment banks diversify their revenue streams?

Investment banks can diversify their revenue streams by exploring new services, expanding into emerging markets, and leveraging technology to create innovative products.

Why is the Investment Bank Business Model Canvas essential?

The Investment Bank Business Model Canvas is essential because it provides a structured approach to understanding and optimizing the bank’s operations, ensuring long-term success.