Did you know that becoming a mortgage broker can open the door to a lucrative career, allowing you to help people achieve their dream of homeownership? A mortgage broker is essentially a middleman between borrowers and lenders, helping clients find the best mortgage options available. This complete guide will equip you with the knowledge and practical examples to kickstart your own mortgage broker business. Here’s what you’ll learn:

- The role and responsibilities of a mortgage broker

- Steps to become a successful mortgage broker

- Pros and cons of using a mortgage broker

- Tips for finding the right clients

- Common challenges and how to overcome them

What Does a Mortgage Broker Do?

So, what exactly does a mortgage broker do? Picture this: You’re looking to buy your first home, but the mortgage landscape seems overwhelming. That’s where a mortgage broker steps in! They help you navigate through different loan options, terms, and lenders to find a deal that fits your financial situation.

Mortgage brokers do a lot more than just connecting buyers with lenders. They analyze your financial profile, assist in gathering necessary documentation, and even negotiate better terms on your behalf. For example, if you have a unique financial situation, like being self-employed, a good broker can find lenders who are more flexible with their requirements. This personalized approach can save clients a significant amount of money and time, making the home-buying process less stressful.

Additionally, a mortgage broker has access to a wide range of lenders and mortgage products that may not be available to the average consumer. This means they can often find better rates and terms tailored to a client’s specific needs. Imagine having someone who not only understands the market but also has relationships with various lenders, which can lead to better deals that you might miss on your own.

| Responsibilities | Description |

|---|---|

| Assessing financial situations | Understanding the client’s financial background |

| Finding suitable lenders | Matching clients with the right mortgage options |

| Negotiating terms | Securing better rates and terms for clients |

| Providing ongoing support | Assisting clients throughout the mortgage process |

- Key points to remember:

- Mortgage brokers are intermediaries.

- They help clients find the best loan options.

- They negotiate on behalf of clients.

“A good mortgage broker is like a compass in the world of loans.” 🧭

How to Become a Mortgage Broker

Thinking about becoming a mortgage broker? The journey may seem daunting, but it’s totally achievable! First, you’ll need to meet specific licensing requirements that vary by state. Generally, you’ll need to complete a pre-licensing course and pass a state exam. This is a crucial step, as it not only prepares you for the practical aspects of the job but also ensures that you understand the legal and ethical responsibilities that come with being a mortgage broker.

For instance, I remember when I started my journey; I enrolled in a local course that offered hands-on training and networking opportunities. That course not only prepared me for the exam but also helped me build valuable relationships with industry professionals. These connections can be incredibly beneficial as you begin your career, providing insights into the market and potential job leads. Networking is a key component of becoming a successful mortgage broker, as it opens doors to referrals and partnerships that can significantly boost your business.

Once you’re licensed, it’s time to establish your business. You can choose to work independently or join a brokerage. Starting on your own can be risky but rewarding, as you’ll have full control over your business model and client relationships. If you decide to join a brokerage, you may have access to established systems and resources, which can help you get started more quickly. However, working independently allows for greater flexibility and the opportunity to create a brand that reflects your personal values and business philosophy.

| Step | Description |

|---|---|

| Complete a pre-licensing course | Acquire necessary knowledge and skills |

| Pass the state exam | Obtain your mortgage broker license |

| Choose your business model | Decide between independent or brokerage work |

| Build your network | Connect with real estate agents and lenders |

- Steps to keep in mind:

- Get licensed.

- Decide on your business model.

- Network with industry professionals.

“The journey of a thousand miles begins with a single step.” 🚶♂️

Pros and Cons of Using a Mortgage Broker

Using a mortgage broker has its ups and downs. On the plus side, they can save you time and money by doing the legwork for you. They know the ins and outs of the mortgage market, which means they can often find deals that you might miss if you go solo. This expertise is invaluable, especially for first-time homebuyers who may not be familiar with the complexities of mortgage products.

Moreover, a mortgage broker can provide personalized advice tailored to your financial situation. They take the time to understand your needs and goals, helping you navigate through various loan options that align with your long-term plans. For example, if you’re a first-time buyer with limited funds for a down payment, a broker can guide you toward programs that offer assistance or favorable terms. This level of support can be a game changer in your home-buying experience.

However, not all brokers are created equal. Some may charge higher fees or have less-than-stellar reputations. It’s crucial to do your research and find a broker who is transparent about their services and fees. A good broker will provide a clear breakdown of costs and explain how they are compensated, whether through lender fees or borrower charges. This transparency builds trust and ensures that you are making informed decisions about your mortgage options.

| Pros | Cons |

|---|---|

| Access to a wider range of options | Potential for higher fees |

| Expertise in mortgage market | Quality of service can vary |

| Time-saving | May have limited access to certain lenders |

- Considerations:

- Weigh the benefits against the costs.

- Research brokers thoroughly.

“Trust is built through transparency.” 🤝

How to Find Reliable Mortgage Brokers

Finding a reliable mortgage broker is crucial for a smooth home-buying experience. Start by asking for recommendations from friends and family who have recently purchased homes. Personal experiences can often lead you to brokers who have proven their worth. Additionally, online reviews can provide insights into a broker’s reputation, giving you a glimpse of what to expect based on other clients’ experiences.

When you have a few names, it’s essential to interview them. Ask questions like, “What lenders do you work with?” and “How do you get paid?” A good broker will be happy to provide answers and explain their process. This initial conversation is not just about gathering information; it’s also about gauging how comfortable you feel with the broker. Trust is a fundamental part of the relationship, and you want to ensure that you are working with someone who has your best interests at heart.

During your interviews, pay attention to how they communicate. Are they patient and willing to explain complex concepts in simple terms? Do they seem genuinely interested in your needs? For example, when I was searching for my broker, I made a list of questions and scheduled meetings. It was eye-opening to see how different brokers approached the same question. Some were quick to respond, while others took the time to ensure I understood every detail, which made a significant difference in my decision-making process.

| Method | Description |

|---|---|

| Ask for recommendations | Seek advice from friends and family |

| Check online reviews | Look at ratings and feedback on platforms |

| Conduct interviews | Meet with potential brokers and ask questions |

- Tips for finding the right broker:

- Get multiple recommendations.

- Look for transparency and experience.

“The best brokers are those who listen and adapt.” 👂

Common Challenges Mortgage Brokers Face

Every business has its challenges, and mortgage brokers are no exception. One common hurdle is keeping up with changing regulations and market trends. Staying informed is vital to providing the best service to your clients. Regulations can shift based on economic conditions, and a knowledgeable broker will be able to navigate these changes effectively, ensuring compliance and protecting clients’ interests.

Another challenge is managing client expectations. Sometimes, clients may want to secure a loan that’s beyond their means or have unrealistic timelines for closing. It’s essential to communicate clearly about what’s feasible and what isn’t. For instance, I had a client once who was set on a luxury home, but their financial profile didn’t support it. By having an open conversation, we found a more suitable option that still met their needs. This not only preserved the client’s trust but also led to a more satisfying outcome for everyone involved.

Additionally, the competition in the mortgage industry can be fierce. With numerous brokers vying for clients, standing out is crucial. Developing a unique selling proposition (USP) can help. This could be a specialized service, like focusing on first-time homebuyers or offering personalized consultations. When I first entered the market, I found that emphasizing my commitment to education helped me connect with clients. I offered free workshops on the mortgage process, which positioned me as an expert and attracted new clients.

| Challenge | Description |

|---|---|

| Keeping up with regulations | Constantly changing mortgage laws |

| Managing client expectations | Aligning client dreams with financial realities |

| Fierce competition | Standing out among numerous brokers |

- Challenges to be aware of:

- Stay updated on industry changes.

- Communicate openly with clients.

“Challenges are opportunities in disguise.” 🌟

Marketing Your Mortgage Broker Business

Once you’re up and running, marketing your mortgage broker business is essential for growth. Building a solid online presence through social media and a professional website can attract potential clients. In today’s digital age, many homebuyers start their search online, so having a well-designed website that showcases your services, client testimonials, and educational content is crucial. Consider creating a blog where you can share tips, market updates, and mortgage advice. This not only positions you as an expert but also helps in improving your search engine rankings.

Social media platforms like Facebook, Instagram, and LinkedIn can be powerful tools for connecting with potential clients. Share informative posts, success stories, and even short videos explaining common mortgage terms or processes. Engaging with your audience through comments and messages can build trust and encourage referrals. For instance, when I started using social media actively, I began to receive inquiries directly from posts I made about first-time homebuyer programs. This direct interaction not only generated leads but also fostered a community of followers who viewed me as a resource.

Networking is also crucial. Attend local real estate events, join professional organizations, and collaborate with real estate agents. These connections can lead to referrals and new clients. Building relationships with real estate agents can be particularly beneficial, as they often have clients who need mortgage services. When I began collaborating with local agents, we developed a referral system where we both benefited. They would refer clients to me for mortgage advice, and I would send clients their way for property listings. This symbiotic relationship not only increased our client bases but also enhanced our reputations in the community.

| Method | Description |

|---|---|

| Build an online presence | Create a website and use social media |

| Network with real estate agents | Collaborate for mutual referrals |

| Host workshops | Educate potential clients and showcase expertise |

- Marketing tips:

- Utilize social media effectively.

- Engage with the community through events.

“Marketing is about connecting, not selling.” 🔗

Technology in Mortgage Brokerage

In today’s digital age, technology plays a significant role in the mortgage industry. Tools like loan origination software can streamline the application process and improve efficiency. This technology can automate many of the tedious tasks associated with processing loans, allowing brokers to focus on client relationships and closing deals. For example, using a software system that tracks applications and automates communication can significantly reduce the time it takes to process a loan. This not only improves client satisfaction but also enhances your reputation as a broker who gets things done.

Embracing technology can set you apart from competitors. For instance, using automated systems to track leads and manage client communications can save time and reduce errors. I remember implementing a Customer Relationship Management (CRM) system that allowed me to keep track of client interactions. It made follow-ups easier and improved my overall service. With features like reminders for follow-ups and easy access to client information, I was able to provide a more personalized experience, which clients greatly appreciated.

Moreover, online tools and resources can help clients better understand their mortgage options. Providing calculators for monthly payments, interest rates, and affordability can empower clients to make informed decisions. By integrating these tools into your website, you not only enhance the user experience but also position yourself as a knowledgeable resource. For example, when I added a mortgage calculator to my site, I noticed an increase in engagement, as potential clients spent more time exploring their options and reaching out for personalized advice.

| Benefit | Description |

|---|---|

| Streamlined processes | Faster loan processing |

| Improved client management | Better tracking of client interactions |

| Enhanced communication | Automated follow-ups and reminders |

- Tech tips:

- Invest in reliable software solutions.

- Stay updated on industry tech trends.

“Technology is the backbone of modern business.” 💻

Continuing Education and Growth

The mortgage industry is constantly evolving, and continuing education is vital for success. As a mortgage broker, staying informed about new trends, regulations, and market conditions can significantly enhance your ability to serve clients effectively. Attending workshops, webinars, and conferences can keep you updated on best practices and innovative strategies in the mortgage field. Many organizations offer ongoing education specifically designed for mortgage brokers, providing valuable insights into the latest lending products and industry changes.

Moreover, pursuing additional certifications can enhance your credibility and attract more clients. For example, becoming certified in specific loan types, like FHA or VA loans, can expand your market reach and allow you to assist a broader range of clients. When I decided to pursue additional certifications, I found that it not only boosted my confidence but also made me a more attractive option for clients seeking specialized advice. Clients appreciate working with brokers who have a deeper understanding of their unique financial situations and the products available to them.

Networking opportunities at educational events can also lead to valuable connections. Meeting other professionals in the industry can provide you with new ideas, potential partnerships, and even mentorship opportunities. For instance, I attended a regional conference where I met several successful brokers who shared their experiences and strategies. These conversations sparked new ideas for my business and helped me implement changes that improved my services. Engaging with peers allows you to learn from their successes and challenges, ultimately helping you grow as a broker.

| Method | Description |

|---|---|

| Attend workshops and webinars | Stay informed about industry changes |

| Pursue additional certifications | Enhance credibility and expertise |

| Join professional associations | Network and learn from peers |

- Education tips:

- Prioritize ongoing learning.

- Engage with industry professionals.

“Knowledge is power in the mortgage world.” 📚

Creating a Successful Mortgage Broker Business

Building a successful mortgage broker business requires a combination of industry knowledge, marketing savvy, and exceptional customer service. One of the keys to success is developing a strong brand identity. Your brand should reflect your values, mission, and the unique services you offer. A well-defined brand helps differentiate you from competitors and builds trust with clients. Consider creating a logo, a professional website, and marketing materials that consistently communicate your brand message.

Additionally, providing exceptional customer service can set you apart in a competitive market. Building strong relationships with clients fosters loyalty and encourages referrals. It’s essential to be responsive to inquiries and proactive in communication throughout the mortgage process. For example, I make it a point to follow up with clients after closing to ensure they are satisfied and to answer any lingering questions. This not only reinforces the relationship but also opens the door for future business or referrals.

Moreover, leveraging technology can enhance your efficiency and improve the client experience. Implementing a Customer Relationship Management (CRM) system can help you manage leads, track client interactions, and automate follow-ups. This ensures that no potential client falls through the cracks and that you maintain consistent communication. When I integrated a CRM into my operations, I noticed a significant improvement in my ability to manage multiple clients simultaneously without compromising service quality.

| Strategy | Description |

|---|---|

| Develop a strong brand identity | Differentiate from competitors |

| Provide exceptional customer service | Foster loyalty and referrals |

| Leverage technology | Enhance efficiency and client experience |

- Success strategies:

- Focus on building strong client relationships.

- Utilize technology to streamline operations.

“Success is not just about what you accomplish; it's about what you inspire others to do.” 🌟

Recommendations

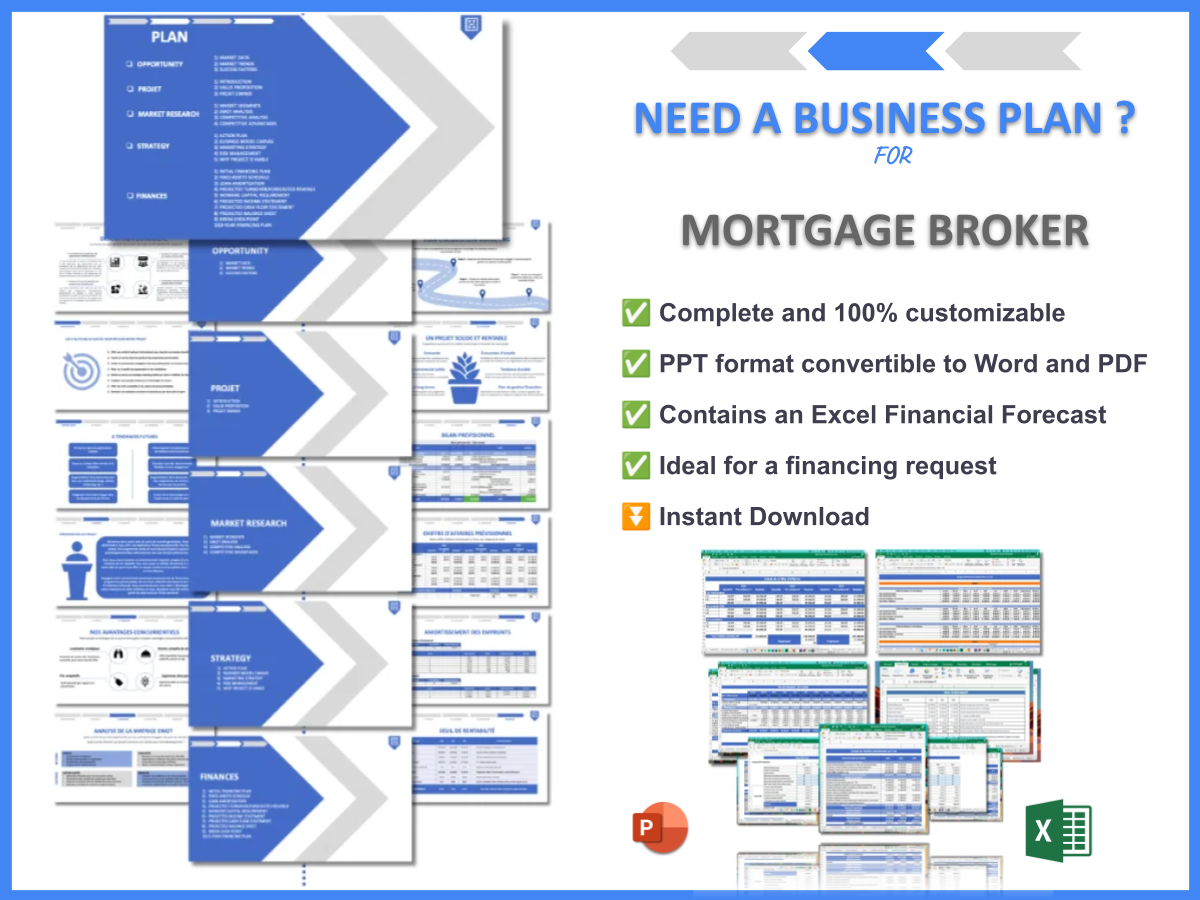

In this article, we explored the ins and outs of becoming a successful mortgage broker. From understanding the role of a mortgage broker to navigating the challenges of the industry, we provided a comprehensive guide to help you start and grow your own mortgage broker business. To further assist you in your entrepreneurial journey, consider utilizing the Mortgage Broker Business Plan Template, which offers an excellent framework for establishing your business.

Additionally, we invite you to explore our related articles to deepen your knowledge and enhance your skills as a mortgage broker:

- Article 1 on Mortgage Broker SWOT Analysis Insights

- Article 2 on Mortgage Brokers: Secrets to High Profitability

- Article 3 on Mortgage Broker Business Plan: Essential Steps and Examples

- Article 4 on Mortgage Broker Financial Plan: Essential Steps and Example

- Article 5 on Crafting a Marketing Plan for Your Mortgage Broker Business (+ Example)

- Article 6 on Building a Business Model Canvas for Mortgage Broker: Examples and Tips

- Article 7 on Customer Segments for Mortgage Brokers: Who Are Your Potential Clients?

- Article 8 on How Much Does It Cost to Establish a Mortgage Broker Business?

- Article 9 on How to Conduct a Feasibility Study for Mortgage Broker?

- Article 10 on How to Implement Effective Risk Management for Mortgage Broker?

- Article 11 on Mortgage Broker Competition Study: Comprehensive Analysis

- Article 12 on Mortgage Broker Legal Considerations: Comprehensive Guide

- Article 13 on What Funding Options Are Available for Mortgage Broker?

- Article 14 on How to Scale a Mortgage Broker: Proven Growth Strategies

FAQ

What does a mortgage broker do?

A mortgage broker acts as an intermediary between borrowers and lenders. They help clients find the best mortgage options based on their financial situations and needs. Brokers assess clients’ financial profiles, gather necessary documentation, and negotiate favorable terms with lenders.

How to become a mortgage broker?

To become a mortgage broker, you need to complete a pre-licensing course and pass a state exam. After obtaining your license, you can choose to work independently or join an established brokerage. Building a network of real estate professionals can also help you succeed in this field.

What are the pros and cons of using a mortgage broker?

Using a mortgage broker has several advantages, such as access to a wider range of loan options and expertise in navigating the mortgage market. However, there may be drawbacks, including potential fees and varying levels of service quality among brokers.

How do mortgage brokers make money?

Mortgage brokers typically earn money through commissions paid by lenders when they close a loan. They may also charge fees to clients for their services. It’s important for brokers to be transparent about their compensation structure to build trust with clients.

When should I use a mortgage broker?

You should consider using a mortgage broker if you are a first-time homebuyer, have a unique financial situation, or simply want to save time in the mortgage search process. Brokers can help you navigate complex loan options and negotiate better terms.

What are the licensing requirements for mortgage brokers?

Licensing requirements for mortgage brokers vary by state, but generally include completing a pre-licensing education course, passing a state exam, and undergoing a background check. It’s essential to check your state’s specific requirements before starting your journey.

How can I find a reliable mortgage broker?

To find a reliable mortgage broker, ask for recommendations from friends and family, check online reviews, and conduct interviews with potential brokers. Look for transparency in their processes and ensure they have a good understanding of your needs.