Did you know that nearly 90% of new B2C businesses fail within the first five years due to mismanaged costs? B2C costs play a crucial role in determining the success or failure of your business. Establishing a B2C business isn’t just about having a great product; it’s also about understanding the financial implications that come with it. So, what exactly does “B2C costs” mean? In simple terms, it refers to the expenses incurred when selling products or services directly to consumers. These costs can range from marketing and operational expenses to customer service and logistics.

- Understanding B2C costs is essential for business success.

- Various factors contribute to overall costs in B2C.

- Marketing expenses can significantly impact profitability.

- Customer acquisition costs are a key consideration.

- Legal and operational costs must be factored in.

- Technology investments can be a game-changer.

- Analyzing profit margins helps in pricing strategies.

- Continuous monitoring of costs is vital.

- Learning from case studies can provide valuable insights.

- Effective budgeting can lead to long-term sustainability.

Understanding B2C Costs

When diving into the world of B2C, it’s essential to understand the various costs that come into play. B2C costs are not just a one-time expense; they evolve as your business grows. From the initial setup costs to ongoing operational expenses, knowing what you’re getting into is crucial. Many entrepreneurs overlook these costs, thinking that a great product will sell itself. But the reality is that without a solid understanding of your expenses, your business could be on shaky ground.

For instance, consider a new online clothing store. The owner needs to account for website development, inventory purchases, and marketing strategies to attract customers. Each of these elements contributes to the overall B2C costs. Additionally, customer service plays a vital role. If your customers have questions or issues, you’ll need to allocate funds for a support team. These examples highlight that B2C costs are multi-faceted and require careful consideration.

In summary, understanding B2C costs is foundational for any aspiring business owner. As we delve deeper, we’ll explore specific areas like customer acquisition costs, operational expenses, and marketing strategies, all of which are integral to your financial planning.

| Aspect | Description |

|---|---|

| Initial Setup Costs | Expenses for launching the business |

| Ongoing Operational Costs | Monthly expenses for running the business |

- Initial setup costs can be high.

- Ongoing operational costs need regular monitoring.

- Customer service is a critical expense.

“Understanding your costs is the first step to success.”

Customer Acquisition Costs

Customer acquisition costs (CAC) are vital to any B2C business model. These costs represent the total expenses incurred to attract a new customer, including marketing, advertising, and sales expenses. A high CAC can be a red flag, indicating that your marketing strategies may not be effective. Knowing how to calculate and optimize these costs is essential for sustaining your business.

For example, if a company spends $1,000 on marketing and gains 10 new customers, their CAC is $100. This figure helps businesses understand how much they need to spend to grow their customer base. Moreover, analyzing CAC alongside customer lifetime value (CLV) can provide insights into long-term profitability. If your CAC is higher than your CLV, it’s time to rethink your marketing approach.

Thus, understanding and optimizing your customer acquisition costs is crucial for a thriving B2C business. As we continue, we’ll explore additional expenses that may arise as your business scales, including operational costs and marketing budgets.

- Calculate your CAC regularly.

- Analyze marketing channels for effectiveness.

- Adjust your strategies based on CAC and CLV.

– The above steps must be followed rigorously for optimal success.

Operational Costs

Operational costs are another critical component of B2C costs. These expenses encompass everything necessary to run your business daily, from rent and utilities to employee salaries and technology investments. It’s easy to overlook these costs, but they can add up quickly and eat into your profits.

Consider a small B2C startup that rents a warehouse for inventory storage. The rent is a recurring cost that must be factored into the overall budget. Similarly, if the business employs a small team for customer service, their salaries will also contribute to operational costs. Understanding these expenses helps business owners create a more accurate financial forecast.

Therefore, keeping a close eye on operational costs is essential for long-term sustainability. In the next section, we’ll delve into marketing expenses and how they impact your overall B2C costs.

| Cost Type | Description |

|---|---|

| Rent and Utilities | Recurring expenses for business operations |

| Employee Salaries | Wages paid to staff for their work |

- Operational costs include rent and utilities.

- Employee salaries must be accounted for.

- Technology investments can lead to increased efficiency.

“To succeed, always move forward with a clear vision.”

Marketing Expenses

Marketing expenses are a significant factor in B2C costs. These costs can vary widely depending on your business model and target audience. From digital advertising and social media marketing to traditional print ads, understanding where to allocate your budget is crucial for success.

For instance, an online retailer may invest heavily in social media ads, while a brick-and-mortar store might focus on local print advertising. The key is to track the return on investment (ROI) for each marketing channel to ensure that you’re getting the most bang for your buck. Failing to do so can lead to wasted resources and missed opportunities.

Thus, a well-planned marketing budget is essential for any B2C business. Moving forward, we’ll discuss how technology investments can further impact your B2C costs.

| Marketing Channel | Typical Costs |

|---|---|

| Social Media Ads | Varies based on platform and reach |

| Print Advertising | Costs depend on publication and placement |

- Identify your target audience.

- Allocate budget based on effective channels.

- Monitor ROI for continuous improvement.

– The above steps must be followed rigorously for optimal success.

Technology Investments

In today’s digital age, technology investments are a critical aspect of B2C costs. From e-commerce platforms to customer relationship management (CRM) software, technology can streamline operations and enhance customer experiences. However, it also comes with its own set of costs.

For example, a business may need to invest in a robust e-commerce platform that charges monthly fees. Additionally, they might consider implementing a CRM system to manage customer interactions, which can also incur subscription fees. While these investments can seem daunting, they often lead to increased efficiency and revenue over time.

Therefore, while technology investments can initially raise your B2C costs, they are often necessary for long-term growth. In the next section, we’ll explore the importance of analyzing profit margins.

| Technology Type | Typical Costs |

|---|---|

| E-commerce Platforms | Monthly subscription fees |

| CRM Systems | Subscription costs vary by provider |

- Technology can enhance customer experience.

- Initial costs can lead to long-term savings.

- Invest in tools that fit your business needs.

“To succeed, always move forward with a clear vision.”

Analyzing Profit Margins

Analyzing profit margins is essential for understanding the overall health of your B2C business. Profit margins represent the difference between your sales revenue and your total costs, providing insight into how efficiently your business operates. A strong profit margin indicates that your business is generating enough revenue to cover its costs and still make a profit.

For instance, if your total costs are $70 for a product sold at $100, your profit margin is 30%. Keeping an eye on these margins helps identify areas where costs can be reduced, ultimately improving profitability. Moreover, understanding your margins can guide pricing strategies and promotional offers. If your profit margins are too low, you may need to reconsider your pricing or cut costs elsewhere.

In conclusion, profit margin analysis is a vital practice for any B2C business. As we move forward, we’ll explore how continuous monitoring of costs can ensure sustainability.

| Cost Type | Impact on Profit Margin |

|---|---|

| High Marketing Costs | Can reduce overall profit margins |

| Operational Inefficiencies | Can significantly impact profitability |

- Monitor profit margins regularly.

- Adjust pricing strategies based on margins.

- Identify cost-saving opportunities.

“Success comes to those who persevere.”

Continuous Monitoring of Costs

Continuous monitoring of costs is crucial for any B2C business. The market is always changing, and costs can fluctuate due to various factors, including supplier pricing, consumer demand, and marketing effectiveness. Keeping a close eye on these expenses helps businesses adapt and thrive.

For example, if the cost of raw materials suddenly rises, businesses may need to adjust their pricing or seek alternative suppliers. Similarly, if a marketing campaign isn’t yielding the expected results, reevaluating the strategy can save valuable resources. Regularly reviewing costs ensures that businesses remain agile and competitive.

Thus, continuous cost monitoring is a best practice for long-term success in B2C. In the next section, we’ll discuss practical recommendations for managing your B2C costs effectively.

| Monitoring Aspect | Benefits |

|---|---|

| Regular Cost Reviews | Helps identify opportunities for savings |

| Market Adaptability | Ensures competitiveness in changing conditions |

- Regularly evaluate all expenses.

- Be adaptable to market changes.

- Implement cost-saving strategies.

“To succeed, always move forward with a clear vision.”

Practical Recommendations

To effectively manage B2C costs, there are several practical recommendations that business owners should consider. Developing a comprehensive budget is the first step. This budget should encompass all projected costs, including marketing, operational, and technology expenses. A well-structured budget helps identify potential financial pitfalls before they become significant issues.

Additionally, leveraging technology for cost management can provide valuable insights. Tools like accounting software can track expenses in real-time, allowing for informed decision-making. This proactive approach enables business owners to stay on top of their financial health. Finally, conducting regular financial reviews can help identify areas for improvement and ensure that the business stays on track.

In conclusion, implementing these practical recommendations can lead to improved financial health for your B2C business. As we wrap up, let’s summarize the key actions for effective cost management.

| Recommendation | Purpose |

|---|---|

| Develop a Comprehensive Budget | Helps track all costs efficiently |

| Utilize Technology for Tracking | Provides real-time financial insights |

- Create a detailed budget.

- Use technology for tracking.

- Conduct regular financial reviews.

“To succeed, always move forward with a clear vision.”

Key Actions and Recommendations

As we’ve discussed, managing B2C costs is essential for ensuring the success of your business. It requires a proactive approach and a willingness to adapt to changing market conditions. Regularly assessing your expenses and making informed decisions can lead to a healthier bottom line.

Practical tips include optimizing your marketing strategies, monitoring customer acquisition costs, and investing wisely in technology. By following these recommendations, you can create a sustainable and profitable B2C business.

In conclusion, the key to managing B2C costs lies in continuous monitoring and strategic planning. With the right approach, your business can thrive in the competitive B2C landscape.

“Success comes to those who persevere.”

- Develop a budget and track expenses.

- Optimize marketing strategies for cost-effectiveness.

- Invest in technology that enhances efficiency.

Conclusion

In summary, understanding and managing B2C costs is fundamental to establishing a successful business. By analyzing customer acquisition costs, operational expenses, and marketing budgets, you can create a comprehensive financial plan that supports your business goals. This proactive approach ensures that your B2C business remains competitive and profitable in a dynamic market.

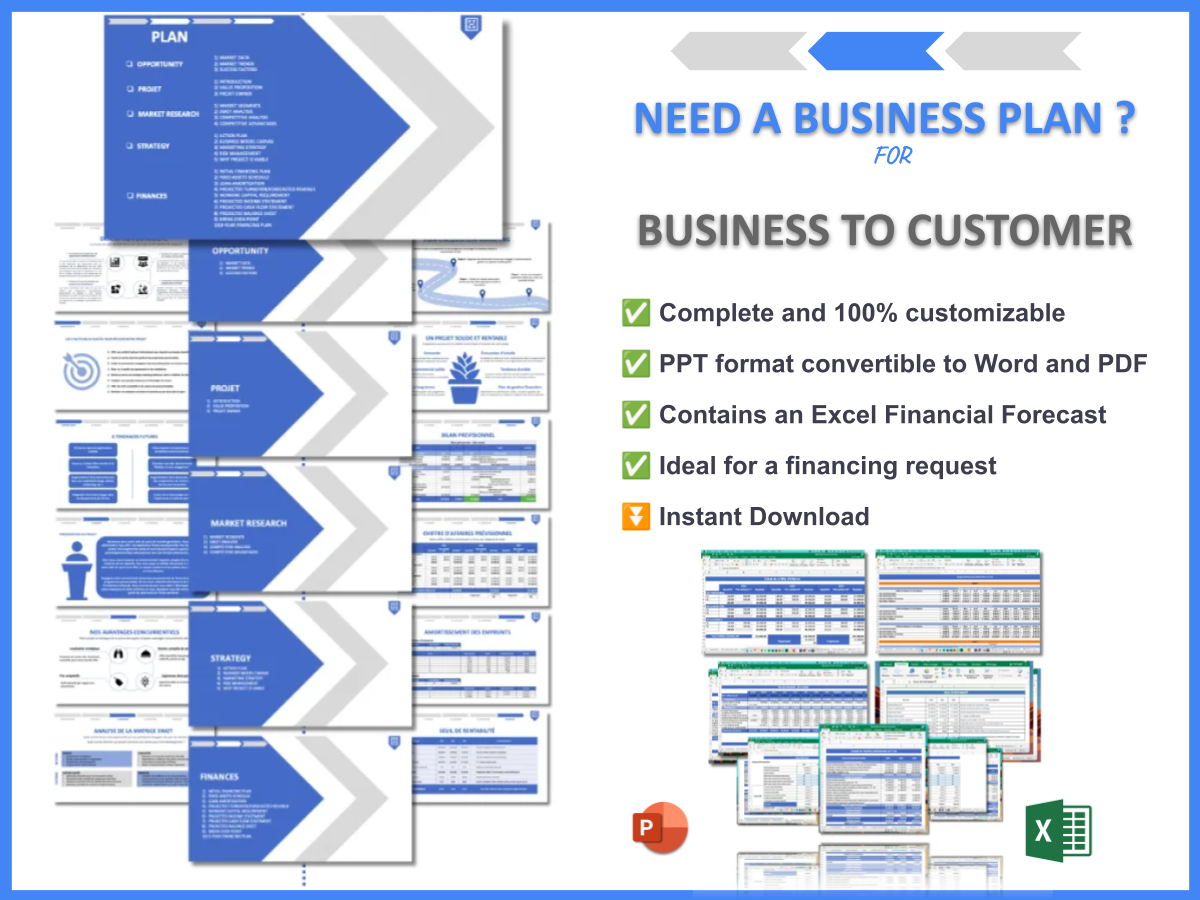

For those looking to streamline their planning process, consider utilizing the Business To Customer Business Plan Template. This resource can guide you through the essential components of a successful B2C business strategy.

Additionally, we invite you to explore our other articles focused on Business To Customer strategies:

- SWOT Analysis for Business To Customer: Maximizing Business Potential

- How to Create a Business Plan for Your B2C Business: Example Included

- Developing a Financial Plan for Business To Customer: Key Steps (+ Template)

- Comprehensive Guide to Launching a Business To Customer Venture

- Building a Successful B2C Marketing Plan: Strategies and Examples

- How to Build a Business Model Canvas for B2C: Examples and Tips

- Who Are Your B2C Customer Segments? A Comprehensive Guide with Examples

- Business To Customer Profitability: Maximizing Your Revenue

- Business To Customer Feasibility Study: Comprehensive Guide

- Business To Customer Risk Management: Comprehensive Strategies

- Business To Customer Competition Study: Comprehensive Analysis

- Business To Customer Legal Considerations: Comprehensive Guide

- Business To Customer Funding Options: Comprehensive Guide

- Growth Strategies for B2C: Scaling Examples

FAQ Section

What are the main components of B2C costs?

The primary components of B2C costs include customer acquisition costs, operational expenses, marketing expenses, and technology investments.

How can I calculate my customer acquisition cost?

To calculate your customer acquisition cost, divide your total marketing expenses by the number of new customers acquired during a specific period.

Why is understanding operational costs important?

Understanding operational costs helps you manage your budget effectively and ensure profitability in your B2C business.

What role does technology play in B2C costs?

Technology investments can streamline operations and enhance customer experiences, although they come with their own costs.

How can I reduce marketing expenses?

Focusing on cost-effective channels, tracking ROI, and adjusting strategies based on performance can significantly reduce your marketing expenses.

What is a good customer acquisition cost?

A good customer acquisition cost varies by industry, but it should ideally be lower than the customer lifetime value.

How often should I review my B2C costs?

Regular reviews, ideally quarterly, can help identify trends and areas for improvement in your B2C costs.

What are the risks of not monitoring B2C costs?

Failing to monitor costs can lead to overspending, reduced profitability, and potential business failure in the B2C sector.

Can I use software to manage B2C costs?

Yes, various accounting and budgeting software can help track expenses and improve financial management in your B2C business.

How can I ensure my B2C business remains profitable?

By continuously monitoring costs, optimizing marketing strategies, and adapting to market changes, you can maintain profitability in your B2C business.