The fintech landscape is evolving at breakneck speed, driven by innovation and fierce competition. A Fintech Competition Study delves into the dynamics of this sector, offering insights into how companies are positioning themselves in an ever-changing market. Understanding the nuances of fintech competition is crucial for businesses aiming to thrive in the financial technology space. The industry is characterized by the rapid emergence of new technologies, shifting consumer preferences, and evolving regulatory frameworks, all of which contribute to a highly competitive environment.

One of the most fascinating aspects of this competition is the way it challenges traditional banking norms. With the rise of neobanks and digital financial solutions, consumers now have more choices than ever before. This shift has prompted traditional banks to rethink their strategies and embrace digital transformation. As a result, many are investing heavily in technology to enhance their offerings and improve customer experience. The competitive pressure is not just limited to the product offerings but extends to customer service, user experience, and pricing.

What You’ll Learn:

- Key players in the fintech industry.

- Trends shaping the fintech ecosystem.

- The impact of regulation and consumer behavior.

- Competitive strategies among fintech firms.

- Future growth projections and challenges.

Overview of Fintech Competition

The fintech industry is a vibrant tapestry of startups and established firms vying for market share. This section introduces the core concepts of fintech competition and the various forces at play. With the rise of digital banking, peer-to-peer lending, and robo-advisors, traditional financial institutions are being challenged like never before. The competitive landscape is defined not just by products and services but also by customer experience and technological advancements. For instance, many neobanks have gained traction by offering user-friendly apps and lower fees compared to traditional banks.

Moreover, the growth of technology in finance has paved the way for innovative solutions that cater to diverse consumer needs. Many fintech companies are leveraging big data and artificial intelligence to analyze customer preferences and tailor their offerings accordingly. This focus on personalization is crucial, as today’s consumers expect financial services that align with their lifestyles. In this rapidly changing environment, firms that fail to adapt may find themselves struggling to keep up.

A quick glance at the current players reveals a mix of traditional banks, fintech startups, and tech giants like Apple and Google entering the financial services space. The competition is fierce, and companies are constantly seeking ways to differentiate themselves. Whether through unique product features, superior customer service, or innovative marketing strategies, each player is trying to carve out their niche in this dynamic market.

In this context, understanding the competitive landscape becomes essential for businesses looking to thrive. By analyzing key players, market trends, and consumer behavior, companies can develop strategies that position them for success in the ever-evolving fintech ecosystem.

| Key Players | Market Share |

|---|---|

| Traditional Banks | 40% |

| Neobanks | 20% |

| Payment Platforms | 15% |

| Robo-Advisors | 10% |

| Others | 15% |

- The fintech ecosystem is diverse, encompassing various segments such as payments, lending, and wealth management.

- Consumer preferences are shifting towards digital solutions that offer convenience and efficiency.

- Regulatory frameworks are evolving to keep pace with innovation and ensure consumer protection.

“In a world of fintech, adaptability is the name of the game!” 🚀

Trends Shaping Fintech Competition

As we look deeper into fintech competition, it’s essential to explore the trends that are shaping the industry. One of the most significant trends is the increasing integration of artificial intelligence (AI) in financial services. Companies are leveraging AI for everything from customer service chatbots to fraud detection. This not only streamlines operations but also enhances the customer experience by providing timely and personalized support.

For instance, several fintech firms utilize machine learning algorithms to analyze customer data, allowing them to offer tailored financial advice based on individual spending habits and preferences. This approach not only enhances customer satisfaction but also fosters loyalty, as consumers feel more understood and valued. Moreover, AI-driven analytics enable firms to identify trends and patterns in consumer behavior, empowering them to adapt their offerings swiftly to meet changing demands.

Additionally, open banking initiatives are fostering collaboration between banks and fintech companies, leading to innovative financial products that cater to a broader audience. Open banking allows third-party developers to build applications and services around financial institutions, thus creating a more interconnected financial ecosystem. This trend is particularly beneficial for consumers, as it promotes competition and transparency, often resulting in lower fees and better services. For example, consumers can now easily switch between different financial service providers, ensuring they always get the best deal.

Another noteworthy trend is the increasing focus on sustainability within the fintech sector. With growing awareness of environmental issues, many fintech companies are developing solutions that promote sustainable practices. This could include anything from green investment platforms to apps that help users track and reduce their carbon footprint. By aligning with consumer values, fintech firms can tap into a burgeoning market of eco-conscious consumers, further enhancing their competitive edge.

| Trend | Impact |

|---|---|

| AI Integration | Personalized Services |

| Open Banking | Enhanced Collaboration |

| Regulatory Changes | New Market Opportunities |

| Consumer Demand for Speed | Faster Services |

| Sustainability Focus | Green Financial Products |

- AI is revolutionizing customer interactions and improving operational efficiency.

- Open banking is reshaping how consumers access and manage their finances.

- Sustainability in fintech is becoming increasingly important as consumers seek eco-friendly options.

“Innovation is the key to staying ahead in the fintech race!” 💡

The Role of Consumer Behavior

Consumer behavior plays a pivotal role in shaping the competitive landscape of fintech. Today’s consumers are tech-savvy and demand seamless, intuitive experiences. This has led to a surge in the popularity of mobile banking and digital wallets. For example, many consumers now prefer using apps for everyday transactions rather than visiting brick-and-mortar banks. This shift has prompted traditional banks to invest heavily in technology to enhance their digital offerings and retain customers.

Moreover, understanding consumer preferences and pain points is essential for fintech companies looking to capture market share. Data analytics tools are being utilized to gain insights into consumer behavior, allowing firms to tailor their services accordingly. By analyzing spending habits, preferences, and feedback, fintech companies can refine their products to better meet customer needs. This customer-centric approach not only fosters loyalty but also attracts new users who are looking for services that resonate with their lifestyles.

The increasing demand for transparency in financial transactions also influences consumer behavior. Today’s consumers want to know exactly how their data is being used and what fees they are being charged. Fintech firms that prioritize transparency in their operations can build trust and credibility, which are crucial in a sector often viewed with skepticism. Furthermore, companies that provide clear communication regarding their services and fees are more likely to attract and retain customers in this competitive landscape.

As fintech continues to evolve, the ability to adapt to changing consumer behavior will be a key determinant of success. Firms that can anticipate trends, listen to customer feedback, and innovate accordingly will not only survive but thrive in this dynamic environment.

| Consumer Preference | Implication for Fintech |

|---|---|

| Mobile Access | Need for Robust Mobile Apps |

| Personalization | Demand for Customized Solutions |

| Security | Increased Focus on Cybersecurity |

| Transparency | Need for Clear Communication |

| Speed | Expectation for Quick Transactions |

- The shift towards mobile banking is reshaping the competitive dynamics of the industry.

- Personalized financial solutions are becoming essential to attract and retain customers.

- Security concerns are driving fintech companies to enhance their cybersecurity measures.

“Understanding your customer is the first step to winning their loyalty!” ❤️

Regulatory Landscape

Navigating the regulatory landscape is a critical aspect of fintech competition. Regulations are evolving rapidly, and companies must stay compliant while also innovating. This balancing act can be challenging, especially for startups that may lack the resources of established players. The emergence of regulations such as the General Data Protection Regulation (GDPR) and the Revised Payment Services Directive (PSD2) has forced fintech companies to adapt their practices to ensure data protection and transparency.

While these regulations can present challenges, they also create opportunities for companies that can navigate them effectively. For instance, PSD2 encourages competition by mandating that banks open their payment services and customer data to third-party providers, fostering an environment where innovative solutions can flourish. This regulatory push not only enhances consumer choice but also drives traditional banks to innovate their offerings to retain customers.

Furthermore, regulatory bodies are increasingly recognizing the importance of fostering innovation in the fintech sector. This has led to the introduction of regulatory sandboxes, which allow startups to test their products in a controlled environment without the full burden of compliance. Such initiatives are vital for encouraging experimentation and innovation, enabling companies to bring new solutions to market more quickly while ensuring they meet necessary regulatory standards.

However, the rapid pace of change in regulations means that companies must remain vigilant and adaptable. Being proactive about compliance not only mitigates risks but can also be a unique selling point. Firms that demonstrate a commitment to regulatory compliance can build trust with consumers, who are increasingly concerned about the safety and security of their financial data.

| Regulation | Impact on Fintech |

|---|---|

| GDPR | Enhanced Data Protection |

| PSD2 | Open Banking Opportunities |

| MiFID II | Improved Investor Protection |

| AML Regulations | Increased Compliance Costs |

| Regulatory Sandboxes | Innovation Facilitation |

- Understanding regulations is vital for fintech firms to thrive in a competitive environment.

- Regulatory sandboxes offer a unique opportunity for innovation and testing.

- Compliance can be both a challenge and an opportunity for growth.

“In the world of fintech, compliance is not just a necessity; it's a competitive advantage!” ⚖️

Competitive Strategies

Fintech companies are employing various competitive strategies to differentiate themselves in the market. One effective strategy is focusing on niche markets. By targeting specific consumer segments, companies can offer tailored solutions that meet unique needs. For example, some fintech firms specialize in providing services for freelancers and gig workers, offering them tools to manage their finances more effectively. This targeted approach allows them to build a loyal customer base while addressing the specific pain points of those users.

Another strategy gaining traction is leveraging partnerships and collaborations. By teaming up with established financial institutions or tech companies, fintech firms can gain access to resources and expertise that enhance their offerings. Such collaborations can lead to co-branded products or services that combine the strengths of both parties, ultimately benefiting consumers. For instance, a fintech startup might partner with a traditional bank to offer a joint mobile banking app that integrates advanced features like budgeting tools and real-time spending alerts.

Moreover, an innovation-focused approach is vital in a rapidly changing market. Companies that prioritize research and development are better positioned to adapt to new technologies and emerging trends. For example, firms that invest in blockchain technology can create secure and efficient payment solutions that appeal to both consumers and businesses. Additionally, companies that maintain a customer-centric approach by continuously gathering feedback and iterating on their products are more likely to succeed in retaining and attracting users.

Finally, a strong marketing strategy is essential for fintech firms looking to stand out. Utilizing digital marketing channels, social media, and content marketing allows companies to build brand awareness and engage with potential customers effectively. By sharing valuable insights and educational content related to financial technology, companies can establish themselves as thought leaders in the industry, further enhancing their competitive position.

| Strategy | Benefits |

|---|---|

| Niche Targeting | Builds Customer Loyalty |

| Strategic Partnerships | Access to Resources |

| Innovation Focus | Differentiation in Offerings |

| Customer-Centric Approach | Enhanced User Experience |

| Technology Integration | Improved Operational Efficiency |

- Focusing on niche markets can help fintech firms stand out in a crowded landscape.

- Partnerships can provide valuable resources and enhance service offerings.

- Innovation and customer-centric strategies are key to long-term success.

“In fintech, the best offense is a good defense—know your competition!” 🛡️

Future Growth Projections

Looking ahead, the fintech industry is poised for significant growth. As technology continues to advance, new opportunities will arise, particularly in areas like blockchain and digital currencies. These innovations are expected to disrupt traditional financial services further, offering more efficient and secure transaction methods. For instance, the adoption of blockchain technology can streamline processes such as cross-border payments and reduce transaction costs significantly, making financial services more accessible to a global audience.

Moreover, as more consumers embrace digital solutions, the demand for fintech services will only increase. Companies that can adapt to changing consumer preferences and leverage emerging technologies will be well-positioned to capitalize on this growth. For example, the rise of decentralized finance (DeFi) platforms is allowing users to lend, borrow, and trade without the need for traditional intermediaries, thus democratizing access to financial services.

However, challenges remain. Increased competition, regulatory scrutiny, and cybersecurity threats are all factors that fintech firms must navigate to succeed in the future. Cybersecurity is particularly critical, as the rise in digital transactions has made financial data a prime target for cybercriminals. Firms that invest in robust security measures not only protect their customers but also build trust, which is essential for long-term success.

In addition, as the market becomes more saturated, differentiation will become increasingly important. Fintech companies must focus on innovation and continuously improve their offerings to stay ahead of the competition. This could involve developing new features that enhance user experience or expanding into underserved markets to capture new customer segments. By anticipating trends and aligning their strategies accordingly, fintech firms can secure their position in a rapidly evolving landscape.

| Growth Area | Potential Impact |

|---|---|

| Blockchain Technology | Revolutionizing Transactions |

| Digital Currencies | Changing Payment Landscapes |

| AI and Machine Learning | Enhancing Customer Experiences |

| Sustainability Initiatives | Attracting Eco-Conscious Consumers |

| Global Expansion | New Market Opportunities |

- The fintech sector is on the brink of transformative growth driven by technology and consumer demand.

- Companies must remain agile and responsive to capitalize on emerging trends.

- Addressing challenges will be crucial for sustained success in the industry.

“The future of fintech is bright—embrace the change!” 🌟

Conclusion

The Fintech Competition Study reveals a dynamic and rapidly evolving industry. As competition intensifies, understanding the key players, trends, consumer behavior, regulatory landscape, competitive strategies, and future growth projections is essential for anyone looking to navigate the fintech space successfully. Embracing innovation and staying attuned to market changes will be the keys to thriving in this exciting sector.

Emerging Technologies in Fintech

The fintech industry is continually evolving, largely due to the rapid advancement of emerging technologies. These technologies are not only reshaping how financial services are delivered but also enhancing the overall customer experience. One of the most transformative technologies is artificial intelligence (AI), which is being utilized to streamline operations, improve customer service, and personalize user experiences. By analyzing vast amounts of data, AI algorithms can provide tailored financial advice, detect fraudulent activities, and predict consumer behavior, making it an invaluable tool for fintech companies.

Another significant technology making waves in the fintech space is blockchain. Originally the backbone of cryptocurrencies, blockchain technology is now being leveraged for various applications in finance, including secure transactions, transparent record-keeping, and efficient cross-border payments. The decentralized nature of blockchain reduces the need for intermediaries, lowering costs and increasing transaction speed. For instance, companies utilizing blockchain for remittances can offer significantly lower fees compared to traditional banking methods, making financial services more accessible to underserved populations.

Furthermore, the rise of Internet of Things (IoT) devices is also impacting the fintech landscape. Smart devices can collect real-time data about consumer spending habits, which can be used to offer personalized financial products. For example, a smart refrigerator could track food purchases and suggest budgeting tips based on spending patterns. This level of personalization not only enhances the customer experience but also helps build brand loyalty as consumers appreciate solutions that cater to their specific needs.

In addition, cloud computing is enabling fintech companies to operate more efficiently by providing scalable solutions that can grow with the business. Cloud-based services allow for easy data storage, improved collaboration, and better disaster recovery options. This flexibility is especially crucial for startups that need to manage costs while scaling their operations. By leveraging cloud technology, fintech firms can focus on innovation and customer service rather than being bogged down by IT infrastructure challenges.

| Emerging Technology | Impact on Fintech |

|---|---|

| Artificial Intelligence | Personalized Financial Services |

| Blockchain | Secure and Efficient Transactions |

| Internet of Things | Real-Time Data for Personalization |

| Cloud Computing | Scalable and Cost-Effective Solutions |

- AI enhances customer interactions and operational efficiency.

- Blockchain offers secure, transparent, and cost-effective transactions.

- Cloud technology provides scalability, allowing firms to adapt quickly to market changes.

“Embracing technology is the path to innovation in fintech!” 🚀

Global Trends in Fintech

The fintech landscape is not only influenced by local market dynamics but also by global trends that shape the industry. One significant trend is the shift towards digital currencies. Central banks around the world are exploring the concept of Central Bank Digital Currencies (CBDCs), which could revolutionize how money is circulated and managed. CBDCs promise to enhance payment efficiency, reduce transaction costs, and provide a more stable alternative to cryptocurrencies. This development is vital for countries looking to modernize their financial systems and meet the evolving needs of consumers.

Another global trend is the rise of embedded finance. This concept involves integrating financial services directly into non-financial platforms, allowing users to access financial products seamlessly. For instance, e-commerce platforms are now offering payment solutions, insurance, and even credit options directly at the point of sale. This integration not only enhances the customer experience but also creates new revenue streams for businesses outside the traditional banking sector.

Moreover, the increasing focus on financial inclusion is reshaping the fintech landscape globally. Companies are developing solutions that cater to the unbanked and underbanked populations, providing access to essential financial services. Mobile banking apps, microloans, and digital wallets are making it easier for individuals in remote areas to participate in the economy. This trend is particularly important in developing countries, where traditional banking infrastructure may be lacking.

Finally, the emphasis on sustainability within fintech is gaining traction. Companies are increasingly recognizing the importance of environmental, social, and governance (ESG) factors in their operations. Fintech firms that prioritize sustainability can attract a growing demographic of eco-conscious consumers who are looking for solutions that align with their values. By offering green investment options or supporting environmentally friendly initiatives, fintech companies can differentiate themselves in a competitive market.

| Global Trend | Impact on Fintech |

|---|---|

| Digital Currencies | Revolutionizing Money Management |

| Embedded Finance | Seamless Financial Services |

| Financial Inclusion | Access for the Unbanked |

| Sustainability Focus | Attracting Eco-Conscious Consumers |

- The rise of digital currencies promises to transform the financial landscape.

- Embedded finance enhances user experiences and creates new business opportunities.

- Prioritizing financial inclusion ensures that more people can access essential financial services.

“Global trends are shaping the future of fintech—stay ahead of the curve!” 🌍

Recommendations

In summary, the Fintech Competition Study provides valuable insights into the dynamic landscape of the fintech industry. As technology continues to advance and consumer preferences evolve, understanding the key players, trends, and strategies in this space is crucial for businesses looking to thrive. To assist you in your journey, we recommend utilizing a comprehensive Fintech Business Plan Template that can guide you in developing a robust business strategy tailored to the fintech market.

Additionally, we invite you to explore our related articles that delve deeper into various aspects of fintech, providing further insights and actionable strategies:

- Fintech SWOT Analysis: Insights & Trends

- Fintech: Strategies for Maximizing Profitability

- Fintech Business Plan: Template and Tips

- Fintech Financial Plan: A Detailed Guide

- Comprehensive Guide to Launching a Fintech Business: Tips and Examples

- Create a Marketing Plan for Your Fintech Business (+ Example)

- Starting a Fintech Business Model Canvas: A Comprehensive Guide

- Identifying Customer Segments for Fintech Companies (with Examples)

- How Much Does It Cost to Establish a Fintech Business?

- What Are the Steps for a Successful Fintech Feasibility Study?

- What Are the Key Steps for Risk Management in Fintech?

- Fintech Legal Considerations: Comprehensive Guide

- How to Secure Funding for Fintech?

- Fintech Growth Strategies: Scaling Examples

FAQ

What is a fintech market analysis?

A fintech market analysis involves examining the current trends, competitive landscape, and consumer behavior within the fintech industry. This analysis helps businesses understand market opportunities, identify key players, and develop strategies to navigate the competitive environment.

What are the latest fintech industry trends?

Recent fintech industry trends include the rise of artificial intelligence for personalized services, the expansion of open banking, the increasing focus on sustainability, and the adoption of blockchain technology for secure transactions. These trends are reshaping how financial services are delivered and consumed.

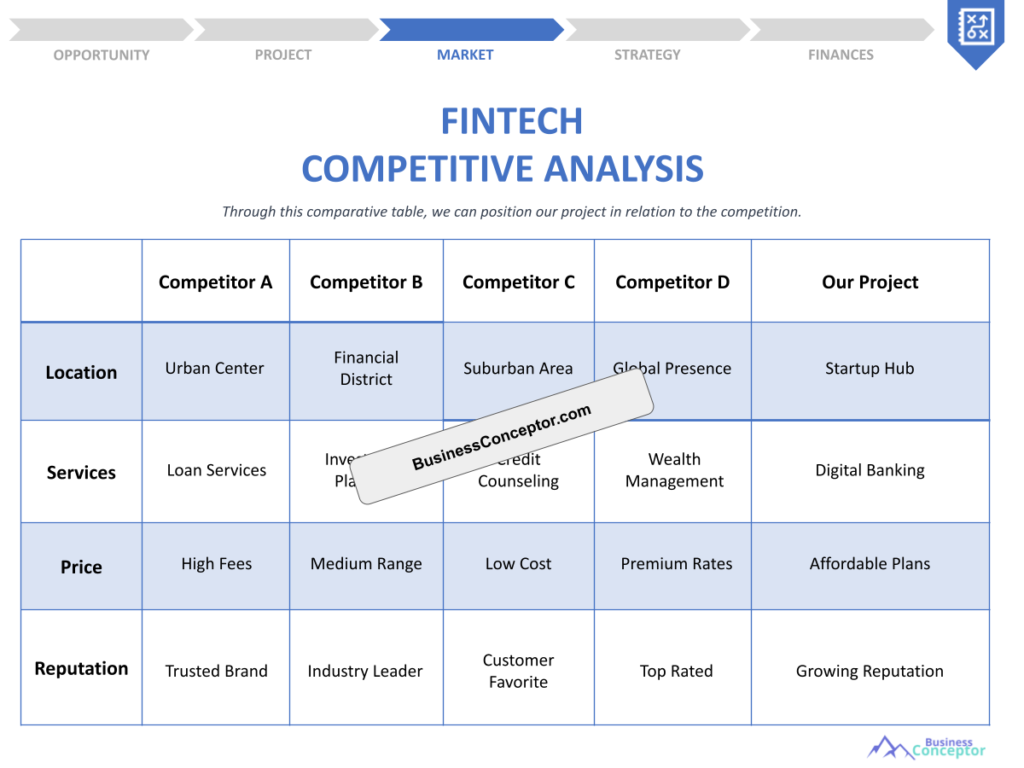

How do fintech competitors compare?

When comparing fintech competitors, it’s essential to consider factors such as market share, technological innovation, customer experience, and service offerings. Understanding these elements can help businesses identify their strengths and weaknesses relative to their competitors.

What are the key players in the fintech ecosystem?

The fintech ecosystem comprises various players, including traditional banks, neobanks, payment processors, and fintech startups. Each player contributes to the overall landscape by offering unique services that cater to different consumer needs.

What is the impact of fintech disruption in banking?

Fintech disruption in banking has led to increased competition, improved customer services, and lower fees. Traditional banks are being challenged to innovate and adapt to meet the demands of tech-savvy consumers who expect more convenient and efficient financial solutions.

How can I stay updated on fintech adoption statistics?

To stay updated on fintech adoption statistics, follow industry reports, subscribe to fintech news outlets, and engage with fintech communities on social media. These resources provide valuable insights into consumer behavior and emerging trends within the industry.