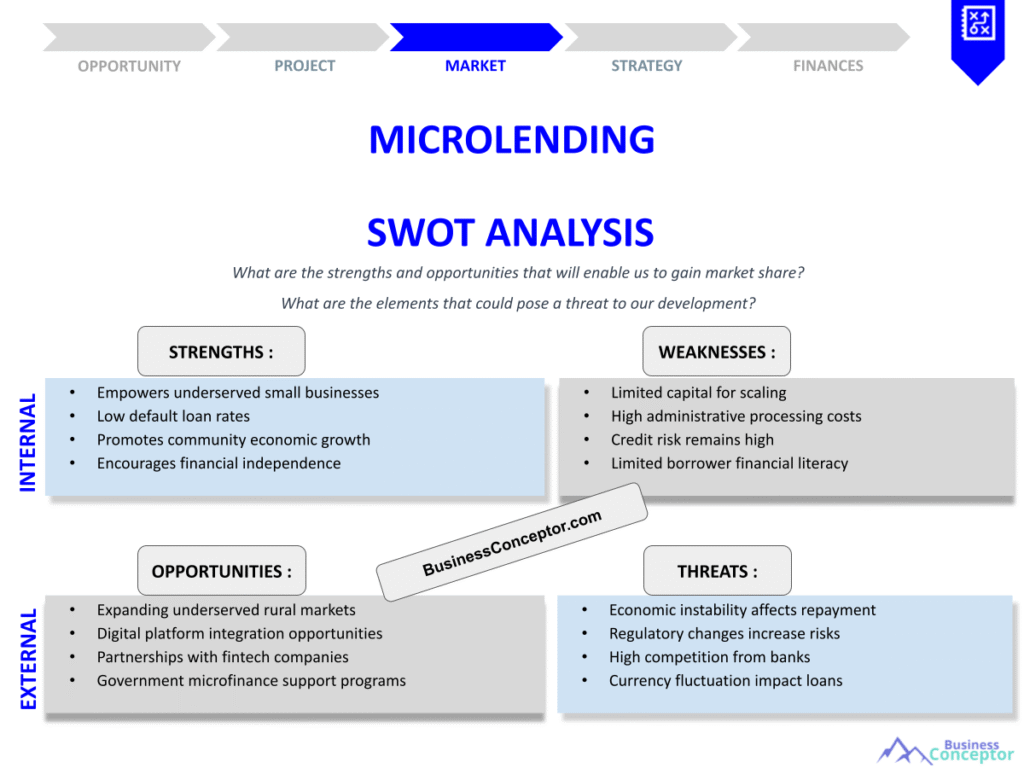

Did you know that **microlending** has lifted millions out of poverty by providing small loans to entrepreneurs in developing countries? **Microlending**, or **microfinance**, is a financial service that offers tiny loans to those who lack access to traditional banking. This powerful tool not only helps individuals start businesses but also fosters economic growth in communities where opportunities are scarce. In this article, we will delve into a comprehensive **SWOT analysis** of **microlending**, highlighting its strengths, weaknesses, opportunities, and threats. We’ll also explore the trends shaping its future, providing valuable insights into how **microlending** operates and what makes it such an essential component of modern finance. Here’s what you can expect:

– An overview of **microlending** and its significance in today’s economy.

– A detailed **SWOT analysis** highlighting key factors influencing **microlending**.

– Insights into industry trends and their implications for future growth.

Overview of Microlending and Its Importance

**Microlending** has emerged as a beacon of hope for countless individuals and communities around the world. It’s not just about giving out small loans; it’s about empowering people to create sustainable livelihoods. The concept originated with the idea that everyone, regardless of their financial background, should have access to capital. **Microlending** plays a crucial role in combating poverty, especially in developing economies where traditional banking services are often inaccessible. By offering small loans, **microlenders** enable individuals to start businesses, improve their living conditions, and invest in education.

The significance of **microlending** cannot be overstated. It serves as a lifeline for those who have been excluded from conventional financial systems. For instance, women in rural areas often face barriers to accessing funds. Through **microlending**, they can obtain the necessary capital to launch small enterprises, which not only benefits them but also their families and communities. The ripple effect of these loans leads to job creation, increased household income, and enhanced community well-being.

Here’s a summary of key aspects of **microlending**:

| Key Aspect | Description |

|---|---|

| Definition | Small loans provided to low-income individuals |

| Purpose | To promote entrepreneurship and economic growth |

| Impact | Alleviates poverty and fosters self-sufficiency |

- Microlending provides access to capital for those who are typically excluded from traditional banking.

- It fosters entrepreneurship, helping individuals start their own businesses.

- The social impact is profound, as it often leads to community development and empowerment.

“Empowerment through finance is the key to sustainable growth.” 🌍💪

In addition to its social benefits, **microlending** also has significant economic advantages. For example, it can stimulate local economies by injecting cash into communities that would otherwise remain stagnant. When people receive loans, they are likely to spend that money locally, supporting other businesses and services. This creates a positive feedback loop that can elevate entire communities out of poverty.

Moreover, **microlending** institutions often focus on building relationships with borrowers, offering them not just financial support but also guidance and education on managing their finances. This holistic approach can lead to better repayment rates and more successful businesses. It’s about creating a supportive ecosystem where individuals can thrive.

Additionally, as the world becomes increasingly interconnected, the potential for **microlending** to impact global markets grows. With the rise of digital platforms, **microlending** is now more accessible than ever. Borrowers can apply for loans online, and lenders can reach a broader audience, facilitating connections that were previously impossible. This digital transformation is not only making **microlending** more efficient but also opening doors for innovation and collaboration across borders.

As we move forward in this article, we will explore the strengths and weaknesses of **microlending**, providing a comprehensive **SWOT analysis** that highlights the unique position this financial service occupies in the world today. The insights gained will help us understand not just the challenges faced by **microlenders**, but also the immense opportunities that lie ahead for those willing to embrace this transformative approach to finance.

Microlending Strengths and Weaknesses

Understanding the strengths and weaknesses of **microlending** is crucial for anyone involved in this sector. One of the major strengths of **microlending** is its ability to reach underserved populations. By focusing on small loans, **microlenders** can cater to individuals who may not qualify for traditional loans due to lack of credit history or collateral. This inclusivity fosters a sense of community and trust between lenders and borrowers, enabling individuals to take control of their financial futures.

Moreover, **microlending** promotes entrepreneurship, particularly among women and marginalized groups. Many **microlending** programs are designed specifically to empower women, who often face greater obstacles in accessing financial resources. When women receive loans, they are more likely to invest in their families’ health, education, and well-being, creating a positive ripple effect throughout the community. This social impact is invaluable, as it contributes not only to individual success but also to the overall development of society.

Another significant strength of **microlending** is its adaptability. With the rise of technology, many **microlenders** are leveraging digital platforms to streamline their operations. This has made it easier for borrowers to access funds quickly and efficiently, breaking down barriers that once hindered access to capital. For example, mobile lending applications allow users to apply for loans from their smartphones, making the process more convenient and user-friendly.

However, there are weaknesses associated with **microlending** that need to be addressed. One of the primary concerns is the high-interest rates that some **microlenders** charge. While these rates may be necessary to cover operational costs, they can lead to over-indebtedness among borrowers. If individuals take on more debt than they can manage, it can create a cycle of financial distress that undermines the goals of **microlending**. This is particularly problematic in regions where economic stability is fragile, and borrowers may already be living on the edge.

Additionally, the lack of financial literacy among borrowers can pose challenges. Many individuals who seek **microlending** may not have the necessary skills to manage their finances effectively. This can lead to poor decision-making regarding loan usage and repayment. To combat this, some **microlenders** are incorporating educational components into their programs, offering financial literacy training alongside loans. This approach not only empowers borrowers but also improves repayment rates, creating a win-win situation for both parties.

| Strengths | Weaknesses |

|---|---|

| Access to capital for underserved | High-interest rates |

| Encourages entrepreneurship | Risk of over-indebtedness |

| Builds community trust | Lack of financial literacy |

- Microlending provides a pathway for financial inclusion.

- It can create a supportive ecosystem for small businesses.

- However, ethical lending practices must be prioritized to avoid exploitation.

“Strength lies in community; weaknesses can be turned into opportunities.” 🌟

Opportunities in Microlending

The **microlending** landscape is ripe with opportunities for growth and innovation. With the rise of technology, digital **microlending** platforms have emerged, making it easier for borrowers to access funds. This shift towards digital solutions is streamlining the process and making it more efficient. For instance, borrowers can apply for loans online, often receiving funds within a matter of hours. This speed is crucial for entrepreneurs who need immediate capital to seize business opportunities.

Additionally, partnerships with fintech companies are opening new avenues for innovation in the **microlending** space. These collaborations can enhance the efficiency of loan disbursement and risk assessment. For example, using data analytics can help **microlenders** assess creditworthiness more accurately, reducing risks for both lenders and borrowers. This technology-driven approach can lead to more informed lending decisions, benefiting the entire ecosystem.

Moreover, there is a growing trend towards social impact investing, where investors are looking to fund businesses that generate positive social outcomes alongside financial returns. **Microlending** fits perfectly into this model, as it directly contributes to poverty alleviation and community development. As more investors become aware of the potential of **microlending** to create social change, funding opportunities are likely to expand, allowing **microlenders** to reach more individuals in need.

Another significant opportunity lies in expanding into new markets. Many regions around the world still lack access to **microlending** services, particularly in rural areas or conflict-affected regions. By identifying these underserved markets, **microlenders** can tap into new client bases and create meaningful impacts. The demand for small loans in these areas is often high, presenting an opportunity for **microlenders** to establish themselves as key players in fostering economic growth.

| Opportunities | Description |

|---|---|

| Digital platforms | Easier access and streamlined processes |

| Partnerships with fintech | Enhanced data analytics for risk assessment |

| Expansion into new markets | Reaching underserved areas globally |

- Technology is transforming how **microlending** operates, making it more efficient.

- Collaborations with tech firms can enhance service delivery.

- There’s potential for growth in emerging markets.

“Innovation in finance can change lives.” 🚀💡

In summary, while **microlending** faces certain challenges, the strengths and opportunities present a compelling case for its continued growth and impact. By leveraging technology and focusing on social outcomes, **microlenders** can create sustainable business models that not only provide financial services but also contribute to the betterment of society as a whole.

Threats Facing Microlending

While there are numerous opportunities for growth in the **microlending** sector, several threats pose significant challenges to its sustainability and effectiveness. One of the most pressing threats is the **regulatory challenges** that vary significantly across different countries. Many governments impose strict regulations on lending practices, and compliance can be a burden, particularly for smaller **microlenders**. Navigating these regulations can be complex, and failure to comply can result in penalties or loss of operating licenses. This uncertainty can deter potential investors and limit the ability of **microlending** institutions to expand their reach.

Moreover, as traditional banks and new fintech startups enter the **microlending** market, competition is intensifying. These entities often have more resources and established reputations, allowing them to offer lower interest rates and more favorable terms. This competition can make it difficult for **microlenders** to attract and retain borrowers, especially if they cannot match the rates offered by larger financial institutions. To remain competitive, **microlenders** must innovate and differentiate their services, which can require significant investment and strategic planning.

Another significant threat is the economic instability that can affect borrowers’ ability to repay loans. In regions where economies are fragile, borrowers may struggle to meet their financial obligations, leading to higher default rates. This not only affects the **microlenders** financially but can also tarnish their reputations. It is crucial for **microlenders** to assess the economic conditions of the areas they serve and implement risk management strategies to mitigate these challenges.

| Threats | Description |

|---|---|

| Regulatory challenges | Varying laws and compliance burdens |

| Increased competition | Traditional banks and fintech firms entering the market |

| Economic downturns | Impact on borrowers’ ability to repay loans |

- Regulatory compliance can be complex and costly for **microlenders**.

- Competition from larger financial institutions is increasing.

- Economic instability poses risks to loan repayment.

“Adapting to change is the key to survival.” ⚠️🌊

Future Trends in Microlending

As we look to the future, several trends are shaping the **microlending** landscape, presenting exciting opportunities for growth and innovation. One significant trend is the increasing integration of technology into **microlending** practices. The advent of mobile lending applications has revolutionized how borrowers access funds, making the application process quicker and more user-friendly. With just a few taps on their smartphones, individuals can apply for loans, receive approvals, and access funds almost instantly. This convenience is particularly appealing to younger, tech-savvy entrepreneurs who are accustomed to digital solutions.

Additionally, there is a growing emphasis on sustainability within the **microlending** sector. Many **microlenders** are beginning to incorporate eco-friendly practices into their business models, aligning with global sustainability goals. This trend not only attracts socially conscious investors but also enhances the social impact of **microlending**. For instance, some **microlenders** are offering loans specifically for green projects, such as renewable energy initiatives or sustainable agriculture, which can lead to both economic and environmental benefits.

Furthermore, the rise of data analytics is transforming how **microlenders** assess risk and make lending decisions. By utilizing advanced data analytics, **microlenders** can gain insights into borrower behavior and creditworthiness that were previously unavailable. This allows for more accurate risk assessments and can lead to better loan terms for borrowers. As technology continues to evolve, those **microlenders** who embrace these innovations will be better positioned for success in a competitive marketplace.

| Trends | Description |

|---|---|

| Technological integration | Mobile apps and digital platforms for lending |

| Focus on sustainability | Eco-friendly practices in **microlending** |

| Growth in social impact investing | Attracting investors interested in social change |

- Technology is making **microlending** more accessible and efficient.

- Sustainability is becoming a priority for many **microlenders**.

- Social impact investing is on the rise, providing new funding sources.

“The future of finance is green and digital.” 🌱📱

In conclusion, the future of **microlending** is bright, with numerous opportunities for growth and positive social impact. By embracing technological advancements and prioritizing sustainability, **microlenders** can create innovative solutions that not only benefit their clients but also contribute to the broader goal of economic development and poverty alleviation. As the industry evolves, it is essential for **microlenders** to remain adaptable and responsive to the changing landscape, ensuring that they continue to play a vital role in empowering individuals and communities around the world.

The Role of Microlending in Economic Development

Microlending plays a pivotal role in fostering economic development, particularly in low-income and underserved communities. By providing small loans to individuals who lack access to traditional banking services, **microlending** acts as a catalyst for entrepreneurship and job creation. When individuals receive financial support, they can invest in their own businesses, which in turn generates income and employment opportunities for others in their communities. This dynamic creates a ripple effect that contributes to local economic growth.

For example, consider a woman in a rural area who wants to start a small bakery. With a **microlending** loan, she can purchase equipment, ingredients, and marketing materials. As her bakery flourishes, she may hire local staff, source ingredients from nearby farmers, and contribute to the local economy. This scenario illustrates how **microlending** not only empowers individuals but also strengthens community ties and fosters economic resilience.

Moreover, **microlending** can significantly improve living standards. As borrowers succeed in their ventures, they often reinvest in their families and communities. Increased household income can lead to better access to healthcare, education, and improved living conditions. Children of entrepreneurs may have the opportunity to attend school rather than working to support their families, breaking the cycle of poverty for future generations.

| Role | Description |

|---|---|

| Job creation | Small businesses lead to more employment opportunities |

| Economic stimulation | Increased spending boosts local economies |

| Community reinvestment | Successful borrowers support their local areas |

- Microlending is a catalyst for job creation and economic development.

- It fosters a cycle of growth and community support.

- The ripple effects can be seen across entire communities.

“Empowering individuals leads to thriving communities.” 🌍✨

Furthermore, **microlending** can help diversify local economies. In many regions, reliance on a single industry can be detrimental, especially if that industry faces downturns. By encouraging entrepreneurship through **microlending**, communities can cultivate a variety of businesses, reducing economic vulnerability. A diverse economy is more resilient and better equipped to withstand external shocks, such as natural disasters or market fluctuations.

Ultimately, the role of **microlending** in economic development is profound. It not only provides financial resources but also fosters a culture of entrepreneurship and self-sufficiency. As more individuals gain access to capital, the cumulative effect can lead to sustainable economic growth, improved quality of life, and stronger communities.

Challenges in Microlending Implementation

Despite its many benefits, implementing **microlending** programs can be fraught with challenges. One major challenge is ensuring that loans are provided responsibly. Over-lending can lead to borrowers falling into debt traps, which undermines the goals of **microlending**. It is essential for **microlenders** to conduct thorough assessments of borrowers’ financial situations to avoid putting them in a position where they cannot repay their loans.

Additionally, the lack of financial literacy among borrowers can pose significant challenges. Many individuals who seek **microlending** may not have the necessary skills to manage loans effectively. This can lead to poor decision-making regarding loan usage and repayment. To combat this, some **microlenders** are incorporating educational components into their programs, offering financial literacy training alongside loans. This approach not only empowers borrowers but also improves repayment rates, creating a win-win situation for both parties.

Moreover, operational costs associated with **microlending** programs can be high. Conducting credit assessments, managing loan disbursement, and providing ongoing support to borrowers require significant resources. For smaller **microlenders**, these costs can be a barrier to entry. It is crucial for organizations to develop efficient operational models that allow them to serve clients effectively while maintaining financial sustainability.

| Challenges | Description |

|---|---|

| Responsible lending | Avoiding over-indebtedness among borrowers |

| Financial literacy | Educating borrowers on loan management |

| Operational costs | High costs associated with **microlending** programs |

- Ensuring responsible lending practices is vital for success.

- Education and support can empower borrowers.

- Operational efficiency is key to sustaining **microlending** programs.

“Knowledge is power; empower your borrowers.” 📚💪

In conclusion, while **microlending** offers significant advantages in terms of economic development and empowerment, it also faces various challenges that must be addressed. By focusing on responsible lending practices, enhancing financial literacy, and streamlining operations, **microlenders** can maximize their impact and ensure that they continue to play a vital role in transforming lives and communities.

The Impact of Digital Transformation on Microlending

Digital transformation is revolutionizing the landscape of **microlending**, making it more accessible and efficient than ever before. With the rapid advancement of technology, **microlenders** are leveraging digital platforms to streamline their operations, enhancing the overall borrower experience. Mobile applications and online portals have made it incredibly easy for individuals to apply for loans, receive approvals, and manage their repayments—all from the comfort of their own homes.

One of the most significant advantages of this digital shift is the speed at which funds can be disbursed. Traditional lending processes can be lengthy and cumbersome, often requiring extensive paperwork and in-person visits to banking institutions. In contrast, digital **microlending** platforms can process applications in real-time, allowing borrowers to receive funds within hours or even minutes. This immediacy is crucial for entrepreneurs who may need quick access to capital to seize business opportunities or address urgent financial needs.

Moreover, digital transformation enables **microlenders** to reach a broader audience. Geographic barriers that once limited access to financial services are rapidly diminishing. By utilizing online platforms, **microlenders** can connect with potential borrowers in remote or underserved areas, ensuring that financial support is available to those who need it most. This increased reach not only expands the client base for **microlenders** but also contributes to greater financial inclusion on a global scale.

| Impact | Description |

|---|---|

| Enhanced accessibility | Online platforms simplify the lending process for borrowers |

| Improved communication | Digital tools foster transparency and trust |

| Increased efficiency | Streamlined processes reduce operational costs for lenders |

- Technology is making **microlending** more accessible and efficient.

- Transparency is essential for building trust in the lending process.

- Embracing technology will help **microlenders** thrive.

“Digital is not the future; it’s the now.” 💻🚀

Additionally, the use of data analytics in digital **microlending** is transforming how lenders assess risk and make lending decisions. By analyzing various data points, including credit history, transaction behavior, and even social media activity, **microlenders** can gain insights into borrowers’ creditworthiness that traditional methods may overlook. This data-driven approach allows for more informed lending decisions, reducing the risk of default and ensuring that loans are granted to those who are most likely to repay them.

Furthermore, the integration of digital tools can enhance communication between lenders and borrowers. Automated messaging systems and customer support chatbots can provide borrowers with real-time updates about their loan applications, repayment schedules, and any changes to terms. This transparency fosters trust and encourages borrowers to engage more actively with their lenders, ultimately leading to better repayment rates and stronger relationships.

The Importance of Ethical Practices in Microlending

Ethical practices in **microlending** are essential for maintaining trust and ensuring long-term success in the industry. As **microlenders** strive to support underserved populations, they must prioritize the well-being of their borrowers and avoid predatory lending practices that can lead to financial distress. This commitment to ethical lending not only protects borrowers but also enhances the reputation of the entire **microlending** sector.

One of the core principles of ethical **microlending** is transparency. Borrowers should have a clear understanding of the loan terms, including interest rates, repayment schedules, and any associated fees. When **microlenders** provide clear and straightforward information, they empower borrowers to make informed decisions about their financial futures. This transparency builds trust and can lead to stronger relationships between lenders and borrowers.

Moreover, responsible lending practices are crucial for preventing over-indebtedness among borrowers. **Microlenders** should conduct thorough assessments of borrowers’ financial situations to ensure that loans are provided responsibly and that borrowers can manage their repayments. This involves not only evaluating creditworthiness but also considering the borrower’s overall financial health and ability to repay the loan without sacrificing essential needs.

| Importance | Description |

|---|---|

| Building trust | Transparency fosters client relationships and loyalty |

| Enhancing reputation | High standards attract socially conscious clients and investors |

| Long-term sustainability | Ethical practices ensure the longevity of **microlending** |

- Ethical lending practices are crucial for client trust.

- A good reputation can attract more business.

- Sustainability in **microlending** depends on ethical standards.

“Trust is the foundation of any successful relationship.” 🤝💖

Furthermore, by adopting ethical practices, **microlenders** can contribute to broader social change. Many **microlending** institutions are dedicated to promoting social impact alongside financial returns. This dual focus attracts investors who are interested in supporting businesses that prioritize positive social outcomes. By aligning with socially responsible investment trends, **microlenders** can secure funding while also making a meaningful difference in the lives of their clients.

In conclusion, the importance of ethical practices in **microlending** cannot be overstated. By prioritizing transparency, responsible lending, and social impact, **microlenders** can build trust with their clients and ensure the long-term sustainability of their operations. As the industry evolves, maintaining high ethical standards will be essential for fostering growth and empowering individuals and communities through **microlending**.

Recommendations

In summary, **microlending** serves as a powerful tool for economic development, empowering individuals and communities by providing access to capital. By understanding the strengths, weaknesses, opportunities, and threats associated with **microlending**, stakeholders can make informed decisions that foster growth and sustainability in this sector. To support your journey in **microlending**, consider utilizing a comprehensive resource such as the Microlending Business Plan Template. This template will guide you in developing a solid business plan tailored to the unique needs of the **microlending** industry.

Additionally, you can deepen your understanding of **microlending** by exploring the following related articles:

- Article 1 on Microlending: Profitability and Business Strategies

- Article 2 on Microlending Business Plan: Template and Tips

- Article 3 on Microlending Financial Plan: A Detailed Guide

- Article 4 on Starting a Microlending Business: A Comprehensive Guide with Examples

- Article 5 on Begin Your Microlending Marketing Plan with This Example

- Article 6 on Crafting a Business Model Canvas for Microlending: Step-by-Step Guide

- Article 7 on Identifying Customer Segments for Microlending Services (with Examples)

- Article 8 on How Much Does It Cost to Start a Microlending Business?

- Article 9 on Microlending Feasibility Study: Essential Guide

- Article 10 on Microlending Risk Management: Essential Guide

- Article 11 on Microlending Competition Study: Essential Guide

- Article 12 on Microlending Legal Considerations: Ultimate Guide

- Article 13 on Microlending Funding Options: Ultimate Guide

- Article 14 on Microlending Growth Strategies: Scaling Examples

FAQ

What is a Microlending SWOT Analysis?

A **microlending SWOT analysis** is a framework used to evaluate the strengths, weaknesses, opportunities, and threats related to **microlending** institutions. This analysis helps stakeholders understand the internal and external factors that can impact the success and sustainability of their operations in the **microlending** sector.

What are the strengths of microlending?

The strengths of **microlending** include its ability to provide access to capital for underserved populations, promote entrepreneurship, and build community trust. By focusing on small loans, **microlenders** can empower individuals, particularly women and marginalized groups, to start their own businesses and improve their living conditions.

What are the weaknesses of microlending?

Some weaknesses of **microlending** include high-interest rates that can lead to over-indebtedness among borrowers, as well as the potential for a lack of financial literacy, which can hinder effective loan management. These issues can create challenges for both borrowers and **microlenders**, affecting the overall success of the program.

What opportunities exist in the microlending sector?

Opportunities in the **microlending** sector include leveraging digital platforms for increased accessibility, forming partnerships with fintech companies for enhanced risk assessment, and expanding into underserved markets. Additionally, the growing trend of social impact investing presents new avenues for funding and growth.

What threats does microlending face?

**Microlending** faces several threats, including regulatory challenges that vary across regions, increased competition from traditional banks and fintech startups, and economic instability that can affect borrowers’ ability to repay loans. Addressing these threats is crucial for the sustainability of **microlending** institutions.

How does digital transformation impact microlending?

Digital transformation significantly impacts **microlending** by enhancing accessibility through online platforms, improving communication between lenders and borrowers, and increasing operational efficiency. This shift allows **microlenders** to process applications more quickly and reach a wider audience, ultimately promoting financial inclusion.

Why are ethical practices important in microlending?

Ethical practices are essential in **microlending** to maintain trust and ensure long-term success. By prioritizing transparency, responsible lending, and the well-being of borrowers, **microlenders** can foster positive relationships and contribute to the overall reputation of the industry, attracting socially conscious clients and investors.