Wealth Management Advisor Competition Study is crucial for anyone looking to navigate the financial advisory landscape. This study helps identify key players, strategies, and market dynamics that can significantly impact a wealth management advisor’s success. Did you know that understanding your competition can lead to better client acquisition strategies and improved service offerings? In today’s competitive market, knowing what your competitors are doing and how they operate can be a game changer for your practice.

Here’s what you need to know:

– Understanding the competitive landscape can enhance your client acquisition strategies.

– Analyzing fee structures and differentiators among advisors is essential for market positioning.

– Keeping an eye on industry trends and regulatory changes is vital for staying ahead.

Understanding the Competitive Landscape of Wealth Management Advisors

The wealth management industry is more competitive than ever. With new players entering the market, it’s essential to know who your competitors are and what they’re offering. This section will dive into the current state of competition among wealth management advisors and the advantages of understanding this landscape.

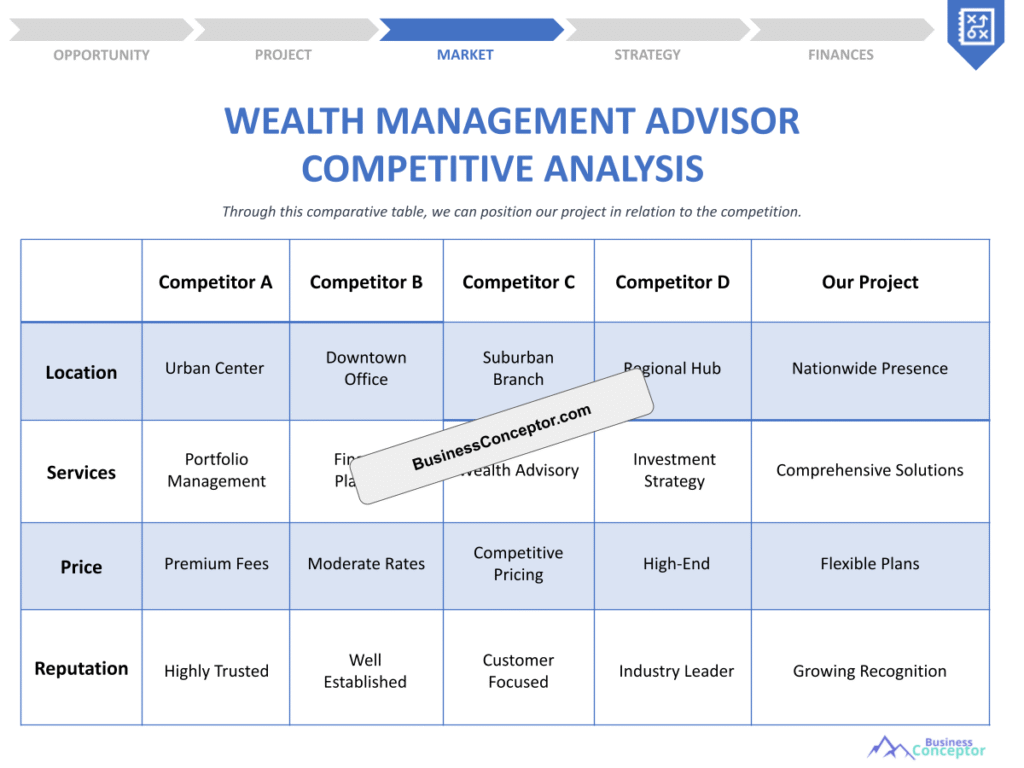

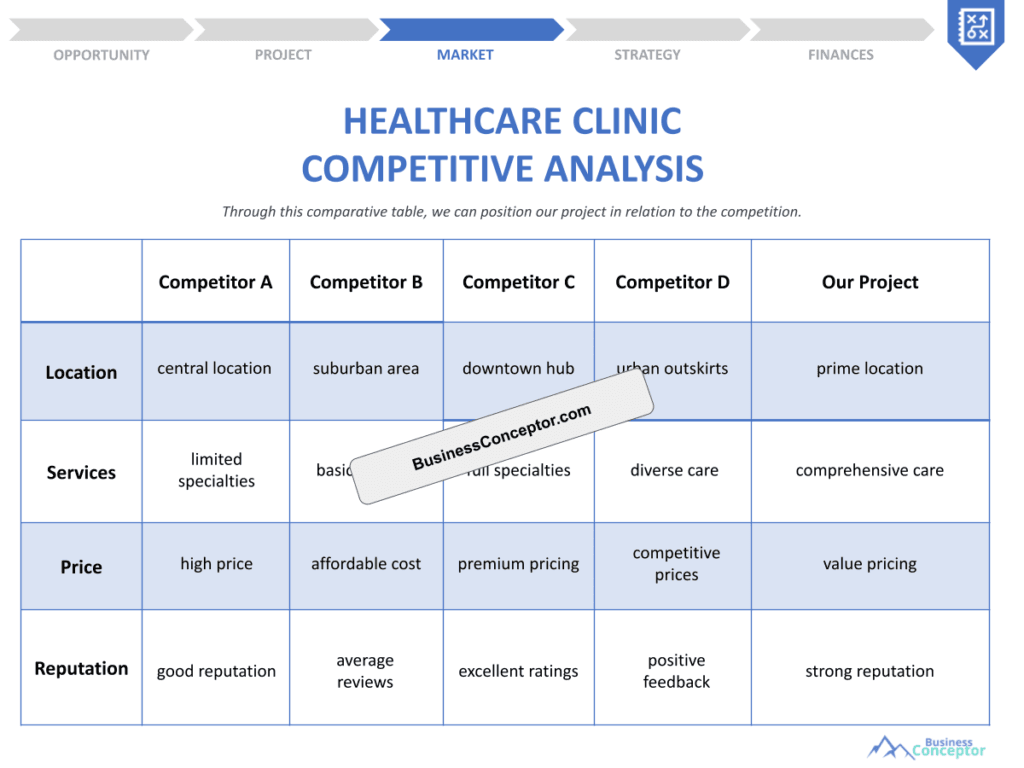

When we talk about the competitive landscape, we’re referring to the overall environment in which wealth management advisors operate. This includes understanding the market share of various firms, the services they offer, and their target demographics. For instance, many firms are now offering digital tools and services that cater to tech-savvy clients. This has led to a shift in how advisors present their services, focusing more on personalized experiences and client engagement. By analyzing these factors, you can identify opportunities to differentiate your offerings and attract more clients.

One major advantage of understanding your competition is the ability to identify gaps in the market. For example, if you notice that most advisors in your area are focused on high-net-worth individuals, you might consider targeting younger clients or those in underserved demographics. This strategic positioning can help you carve out a niche for yourself, making it easier to attract clients who feel their needs are not being met by existing advisors. Additionally, being aware of the services that competitors offer can inspire you to innovate and enhance your own offerings, ensuring that you stay relevant in a rapidly changing industry.

Moreover, understanding how competitors acquire clients is crucial. Many successful advisors focus on building relationships and trust with potential clients. This can involve networking, hosting seminars, or providing valuable content that addresses client needs. If you know what works for others, you can adapt those strategies to fit your style and clientele. This not only saves time but also increases the likelihood of success in your client acquisition efforts.

In summary, having a thorough understanding of the competitive landscape allows you to make informed decisions about your practice. It can guide you in developing effective marketing strategies, identifying your unique selling proposition, and improving client satisfaction. You can position yourself more effectively in the market and ultimately increase your chances of success.

“In a crowded market, the best way to stand out is to know your competition inside and out.” 🌟

| Key Insights | Details |

|---|---|

| Market Dominance | Top firms hold significant market shares. |

| Niche Opportunities | Smaller firms are finding success by targeting specific demographics. |

- Be aware of your competition’s strengths and weaknesses.

- Tailor your services to meet client needs better than your competitors.

Analyzing Fee Structures in Wealth Management

Fee structures can be a significant differentiator in the wealth management industry. Understanding how your fees compare to those of your competitors can help you position your services effectively and attract more clients. In a world where transparency is increasingly valued, clients are more likely to choose advisors who offer clear and straightforward pricing. This section will explore the different fee structures prevalent in the industry and the advantages of analyzing them.

Many firms offer a variety of fee structures, from commission-based to fee-only models. Fee-only advisors often attract clients seeking transparency and trust. This model means that clients pay a flat fee for services, which can be appealing for those who want to avoid hidden charges or conflicts of interest. In contrast, commission-based advisors earn a commission on products sold, which can lead to potential biases in the recommendations made to clients. By understanding the pros and cons of each structure, you can tailor your pricing strategy to meet the expectations of your target audience.

One major advantage of analyzing fee structures is that it allows you to identify where you stand in the market. For instance, if you find that most of your competitors are charging significantly higher fees, you might consider adjusting your pricing to be more competitive. This doesn’t necessarily mean you have to lower your fees; it could also mean offering more value through additional services or features that justify your pricing. Furthermore, knowing how competitors structure their fees can help you communicate your value proposition more effectively to potential clients, demonstrating why your services are worth the investment.

Additionally, clients often have specific expectations regarding fees based on their experiences and research. By understanding these expectations, you can design a fee structure that not only meets their needs but also enhances their overall experience. This could involve offering tiered pricing, where clients can choose from different levels of service based on their budget and requirements. This flexibility can make your services more accessible and appealing to a wider range of clients.

“Transparency is key in building trust with your clients.” 🔑

| Fee Structure | Description |

|---|---|

| Fee-Only | Clients pay a flat fee for services. |

| Commission-Based | Advisors earn commissions on products sold. |

- Compare your fee structures with competitors regularly.

- Consider offering tiered pricing to cater to different client needs.

The Role of Digital Tools in Wealth Management

Digital tools are revolutionizing the wealth management industry. Advisors who leverage technology can streamline operations and enhance client experiences. Understanding how your competitors use these tools can give you a competitive edge and improve your overall service delivery. This section will explore the various digital tools available and the advantages of incorporating them into your practice.

Many firms are adopting customer relationship management (CRM) systems and robo-advisors to improve service delivery. CRM systems help advisors manage their client relationships more effectively, allowing for better communication and personalized service. This leads to higher client satisfaction and retention rates. Robo-advisors, on the other hand, provide automated investment services that cater to clients who prefer a hands-off approach. By offering both traditional and digital advisory services, you can appeal to a broader audience and meet the diverse needs of your clients.

Moreover, utilizing data analytics can significantly enhance your decision-making process. By analyzing client data, you can identify trends and preferences that inform your service offerings. For example, if you notice that a significant portion of your clients is interested in sustainable investing, you can adjust your portfolio offerings to include more ESG investing options. This not only keeps your services relevant but also positions you as an expert in emerging trends, which can attract new clients.

Another advantage of adopting digital tools is the efficiency they bring to your practice. By automating routine tasks, you free up more time to focus on building relationships with clients and providing high-quality advisory services. This efficiency can lead to increased productivity and ultimately, higher revenues. Plus, clients appreciate the convenience that technology offers, making it a win-win situation for both parties.

“In the digital age, the right tools can make all the difference.” 💻

| Digital Tool | Purpose |

|---|---|

| CRM Systems | Manage client relationships efficiently. |

| Robo-Advisors | Provide automated investment services. |

- Stay updated on the latest technology trends in wealth management.

- Invest in tools that enhance your service delivery and client engagement.

Understanding Client Acquisition Strategies

Client acquisition is the lifeblood of any wealth management advisory firm. Knowing how your competitors attract and retain clients can inform your own strategies and enhance your ability to grow your practice. In this section, we will explore various client acquisition strategies and discuss the advantages of implementing effective techniques to attract new clients.

Many successful advisors focus on building relationships and trust with potential clients. This can involve networking, hosting seminars, or providing valuable content that addresses client needs. For instance, consider hosting a free financial planning workshop to showcase your expertise and provide potential clients with actionable insights. This not only positions you as an authority in your field but also gives potential clients a taste of the value you can offer. By creating a welcoming environment where clients feel comfortable asking questions, you can foster trust and establish long-term relationships.

Another effective strategy for client acquisition is leveraging digital marketing. In today’s tech-savvy world, having a strong online presence is essential. This can include maintaining an informative website, engaging in social media marketing, and utilizing search engine optimization (SEO) techniques to improve your visibility. By creating valuable content that resonates with your target audience, you can attract potential clients who are actively seeking financial advice. For example, writing blog posts on topics like fee structures in wealth management or demographic trends in financial advising can help establish your expertise and draw in clients who are looking for guidance in those areas.

Additionally, referrals can be a powerful tool for client acquisition. Happy clients often lead to new business opportunities through word-of-mouth recommendations. To encourage referrals, consider implementing a referral program that rewards existing clients for bringing in new business. This could be as simple as offering a small discount on services or providing a gift card to a local business. By incentivizing your clients to spread the word about your services, you can tap into their networks and expand your reach.

“Your network is your net worth.” 🤝

| Client Acquisition Strategy | Description |

|---|---|

| Networking | Building relationships through events and workshops. |

| Digital Marketing | Utilizing online platforms to attract potential clients. |

- Develop a clear client acquisition strategy based on competitor analysis.

- Foster relationships with existing clients to encourage referrals.

The Impact of Regulatory Changes on Wealth Advisors

Regulatory changes can significantly affect how wealth management advisors operate. Staying informed about these changes is vital for compliance and maintaining a competitive advantage. This section will explore the various regulatory changes affecting the industry and the advantages of adapting to these shifts.

One major regulatory focus is the fiduciary responsibility that advisors have towards their clients. The fiduciary rule emphasizes that advisors must act in their clients’ best interests, which can enhance trust and credibility. Understanding how your competitors are adapting to these regulations can provide insights into best practices and help you align your services accordingly. For instance, being transparent about your fee structures and investment strategies can reassure clients that you prioritize their interests above your own.

Another important regulatory consideration is compliance with financial laws and guidelines. As regulations evolve, firms must adapt their practices to remain compliant, which can involve updating policies, investing in training, or even adopting new technologies. Being proactive in your approach to compliance not only protects your firm from potential penalties but also positions you as a trustworthy advisor. Clients are more likely to choose advisors who prioritize compliance, as this demonstrates a commitment to ethical practices and client protection.

Moreover, understanding regulatory changes can help you identify new opportunities. For example, as the demand for ESG investing continues to grow, regulatory bodies may introduce guidelines that promote sustainable investment practices. By staying ahead of these trends and aligning your services with regulatory changes, you can attract clients who are increasingly concerned about sustainability and ethical investing.

“Regulations are not just hurdles; they are opportunities for trust.” 📜

| Regulatory Change | Impact |

|---|---|

| Fiduciary Rule | Increased focus on client interests and transparency. |

| Compliance Costs | Rising operational costs for advisors to meet regulatory standards. |

- Regularly review how regulatory changes impact your services.

- Communicate clearly with clients about compliance and fiduciary responsibilities.

The Importance of Market Trends in Wealth Management

Market trends play a critical role in shaping the strategies of wealth management advisors. Understanding these trends can help you anticipate changes in client preferences and adapt your services accordingly. This section will explore various market trends affecting the industry and the advantages of staying informed about these shifts.

One of the most significant trends in recent years is the rise of ESG investing (Environmental, Social, and Governance). More clients are seeking investment options that align with their values, particularly younger generations who prioritize sustainability and ethical practices. By incorporating ESG options into your portfolio offerings, you can attract clients who are increasingly concerned about the impact of their investments on the world. This not only meets client demand but also positions you as a forward-thinking advisor who is attuned to the values of modern investors.

Additionally, the shift towards digitalization in the wealth management industry cannot be overlooked. Many clients now prefer online platforms for managing their investments and accessing financial advice. By offering digital solutions, such as mobile apps or online consultations, you can cater to this growing demographic of tech-savvy clients. This convenience enhances the client experience and can lead to higher satisfaction and retention rates. Moreover, adopting digital tools can streamline your operations, allowing you to serve more clients effectively.

Another trend to watch is the increasing importance of personalized services. Clients are looking for tailored financial advice that addresses their unique circumstances and goals. By understanding market trends, you can better customize your offerings to meet the specific needs of different client segments. For example, you might create specialized services for high-net-worth individuals, families, or young professionals. This level of personalization can differentiate you from competitors and enhance your reputation as a trusted advisor.

“In finance, change is the only constant.” 🔄

| Market Trend | Impact on Advisors |

|---|---|

| ESG Investing | Shifts client investment preferences towards sustainable options. |

| Digitalization | Increases demand for online platforms and services. |

- Monitor market trends to inform your service offerings.

- Be proactive in adapting to changes in client preferences.

Building a Unique Value Proposition

In a crowded market, having a unique value proposition (UVP) is essential for standing out. Understanding what makes your services unique compared to competitors can help attract clients and build lasting relationships. This section will delve into the importance of a strong UVP and the advantages it brings to your practice.

Your UVP should clearly articulate why clients should choose you over others. This could be based on your expertise, personalized service, or innovative tools. For instance, if you specialize in family office services, highlighting your experience in managing complex family wealth can set you apart from generalist advisors. By showcasing your specific strengths, you can attract clients who are looking for specialized knowledge and tailored solutions.

Another key aspect of a strong UVP is clear messaging. Ensure that your marketing materials, website, and client communications effectively communicate your UVP. This clarity not only helps potential clients understand what you offer but also reinforces your brand identity. A well-defined UVP can lead to increased client trust and loyalty, as clients feel confident that they are making an informed choice.

Moreover, regularly revisiting your UVP is essential to ensure it remains relevant. As the market evolves, so do client expectations and preferences. By staying attuned to these changes and adjusting your UVP accordingly, you can maintain your competitive edge. For example, if you notice a growing interest in tax-efficient wealth management services, incorporating this into your UVP can attract clients who are looking for ways to minimize their tax liabilities.

“Your uniqueness is your strength.” 🌈

| Unique Value Proposition | Example |

|---|---|

| Personalized Service | Offering tailored financial plans for each client. |

| Innovative Tools | Using cutting-edge technology for investment management. |

- Regularly revisit your UVP to ensure it remains relevant.

- Communicate your UVP clearly in all client interactions.

Leveraging Insights from Your Competition Analysis

Analyzing your competition is not just about gathering information; it’s about using that information to improve your own services and strategies. In the wealth management industry, understanding what your competitors are doing can provide invaluable insights that help you position yourself effectively. This section will explore how to leverage these insights for your benefit and the advantages of doing so.

One of the primary benefits of analyzing your competitors is the ability to identify best practices in client acquisition and retention. By studying successful firms, you can discover innovative marketing strategies, service offerings, and client engagement techniques that resonate with clients. For example, if you notice that a competitor excels in hosting educational webinars, you might consider implementing similar strategies to build trust and showcase your expertise. This not only helps you attract new clients but also positions you as a thought leader in your field.

Moreover, understanding the strengths and weaknesses of your competitors allows you to differentiate your services. If you find that many advisors in your area focus solely on investment management, you could emphasize comprehensive financial planning, including tax strategies and estate planning. This unique angle can attract clients who are looking for a holistic approach to their financial well-being. By capitalizing on gaps in the market, you can establish a niche that sets you apart from the competition.

Additionally, leveraging competitive insights can inform your pricing strategy. By analyzing how your competitors structure their fees, you can adjust your pricing to remain competitive without compromising on service quality. This might involve offering tiered pricing or unique service packages that cater to different client segments. For instance, if most firms charge a flat percentage fee, consider introducing a performance-based fee structure that aligns your interests with those of your clients. This transparency can build trust and attract clients who appreciate a more aligned approach.

“Knowledge is power, but applied knowledge is freedom.” 🚀

| Action Steps | Description |

|---|---|

| Identify Best Practices | Learn from successful competitors to improve your strategies. |

| Differentiation | Highlight unique services that set you apart from others. |

- Use insights from competitors to refine your service offerings.

- Continuously monitor your competition for ongoing improvement.

Implementing Continuous Improvement Strategies

In the fast-paced world of wealth management, implementing continuous improvement strategies is essential for long-term success. By regularly evaluating your services and adapting to market changes, you can ensure that your firm remains competitive and relevant. This section will discuss the importance of continuous improvement and the advantages it brings to your practice.

One of the key aspects of continuous improvement is soliciting feedback from clients. Regularly asking for client input on your services can provide valuable insights into what is working and what needs enhancement. For instance, consider conducting client satisfaction surveys to gather feedback on various aspects of your service, such as communication, responsiveness, and overall satisfaction. This feedback can help you identify areas for improvement and make necessary adjustments to enhance the client experience.

Moreover, staying informed about industry trends and regulatory changes is crucial for continuous improvement. By keeping abreast of new developments in the wealth management landscape, you can adapt your services to meet evolving client needs. For example, if there is a growing demand for tax-efficient wealth management services, you can enhance your offerings to include strategies that minimize tax liabilities. This proactive approach not only keeps your services relevant but also positions you as an expert who is attuned to client concerns.

Furthermore, investing in professional development and training for your team can significantly enhance your firm’s capabilities. By providing ongoing education and training opportunities, you can equip your advisors with the latest knowledge and skills needed to excel in the industry. This not only improves the quality of your services but also boosts employee morale and retention. A knowledgeable and well-trained team can better serve clients, ultimately leading to higher satisfaction and loyalty.

“The journey of a thousand miles begins with one step.” 🌍

| Continuous Improvement Strategy | Description |

|---|---|

| Client Feedback | Regularly gather input to enhance services. |

| Industry Awareness | Stay informed about trends and regulations. |

- Solicit client feedback to identify areas for improvement.

- Invest in ongoing education and training for your team.

Recommendations

In this article, we explored various aspects of the Wealth Management Advisor Competition Study, including understanding the competitive landscape, analyzing fee structures, leveraging digital tools, and implementing effective client acquisition strategies. By applying the insights gained from this study, you can enhance your practice and position yourself for success in a competitive market.

To take your business to the next level, consider utilizing the Wealth Management Advisor Business Plan Template. This comprehensive template can guide you in crafting a solid business plan tailored to your specific needs and goals.

Additionally, we have a wealth of articles related to Wealth Management Advisor that can further enhance your knowledge and strategies:

- Wealth Management Advisor SWOT Analysis Essentials

- Wealth Management Advisors: Profitability Tips

- Wealth Management Advisor Business Plan: Template and Tips

- Wealth Management Advisor Financial Plan: Step-by-Step Guide with Template

- How to Start a Wealth Management Advisor Business: A Detailed Guide with Examples

- Crafting a Marketing Plan for Your Wealth Management Advisor Business (+ Example)

- Create a Business Model Canvas for Wealth Management Advisor: Examples and Tips

- Customer Segments for Wealth Management Advisors: Examples and Analysis

- How Much Does It Cost to Start a Wealth Management Advisor Business?

- Travel Agency Feasibility Study: Detailed Analysis

- Travel Agency Risk Management: Detailed Analysis

- How to Address Legal Considerations in Wealth Management Advisor?

- Wealth Management Advisor Funding Options: Expert Insights

- Wealth Management Advisor Growth Strategies: Scaling Success Stories

FAQ

What are the current trends in the wealth management industry?

Staying updated on wealth management industry trends is crucial for advisors. Key trends include the rise of ESG investing, increasing digitalization, and a focus on personalized services. By aligning your offerings with these trends, you can better meet client expectations and attract a wider audience.

How can I differentiate my services from competitors?

To stand out in the competitive landscape, focus on creating a unique value proposition (UVP). Highlight what makes your services distinct, whether it’s specialized knowledge, personalized financial planning, or innovative tools. This differentiation can help you attract clients who are looking for specific solutions that competitors may not offer.

What role do digital tools play in wealth management?

Digital tools are transforming the wealth management sector by enhancing client engagement and streamlining operations. Implementing customer relationship management (CRM) systems and robo-advisors can improve service delivery and client satisfaction, making your practice more efficient and appealing to tech-savvy clients.

How can I improve my client acquisition strategies?

Effective client acquisition strategies involve a mix of networking, digital marketing, and referrals. Hosting educational events, utilizing social media, and providing exceptional service can help you build trust and attract new clients. Additionally, consider implementing a referral program to incentivize existing clients to recommend your services to others.

What are the key regulatory changes affecting wealth advisors?

Regulatory changes, such as the fiduciary rule, require advisors to act in their clients’ best interests. Staying informed about these regulations is essential for compliance and can help build trust with clients. Understanding how to navigate these changes can give you a competitive advantage in the industry.

What are the advantages of a strong business plan for wealth management advisors?

A strong business plan provides a roadmap for success. It outlines your goals, strategies, and operational plans, helping you stay focused and organized. Utilizing resources like the Wealth Management Advisor Business Plan Template can simplify this process, ensuring you cover all essential aspects of your practice.