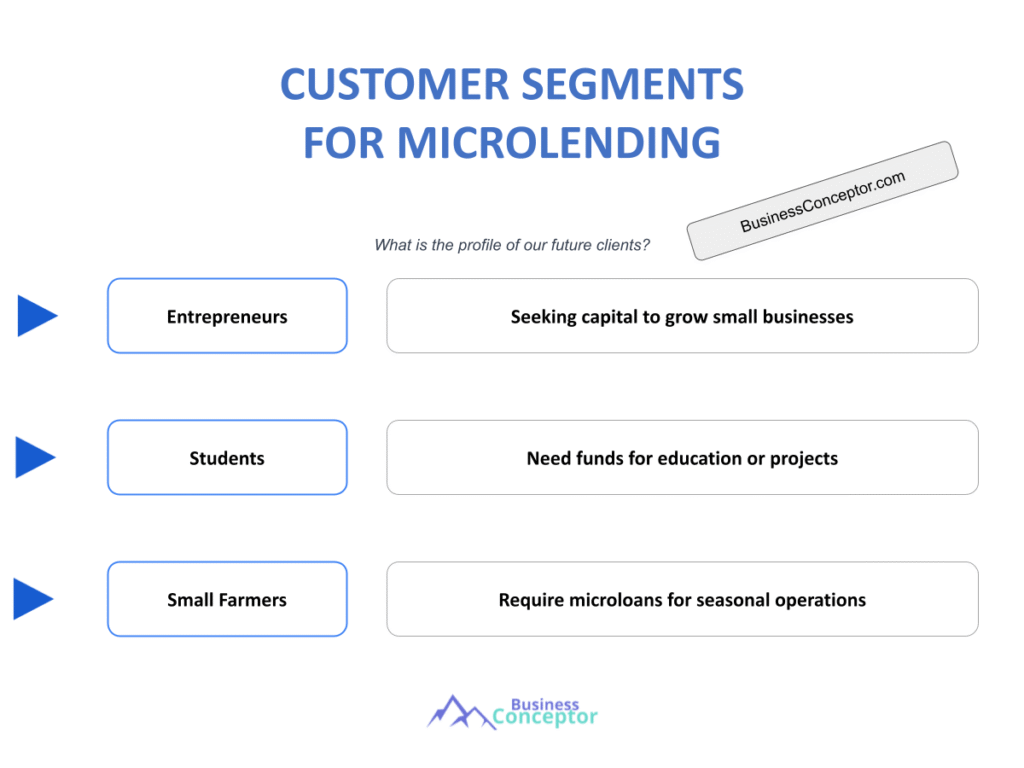

Microlending Customer Segments are a critical aspect of the financial landscape, especially for those seeking to foster economic development in underserved areas. Did you know that nearly 1.7 billion adults around the world remain unbanked? This staggering number highlights the pressing need for financial services tailored to specific groups. Microlending refers to the practice of providing small loans to individuals or businesses that typically lack access to traditional banking services. By focusing on distinct customer segments, microlending organizations can create solutions that not only meet the financial needs of borrowers but also empower them to achieve their goals. Here’s what you need to know about this vital sector of microfinance:

- Microlending targets specific demographics, including low-income individuals and small business owners.

- Understanding customer segments allows lenders to tailor their products and marketing strategies effectively.

- Key demographics include women, rural communities, youth, and entrepreneurs.

Understanding Microlending Customer Segments

Diving into the world of microlending reveals that it’s not just about giving out small amounts of money; it’s about understanding the diverse needs of various customer segments. Each group has unique characteristics, motivations, and financial behaviors. For instance, low-income borrowers often seek quick access to funds for immediate expenses, such as medical bills or emergency repairs, while aspiring entrepreneurs may be looking for capital to start or expand their small businesses. Understanding these distinctions is crucial for microlending organizations aiming to cater effectively to their target audience.

A prime example of this is Grameen Bank, which primarily focuses on women in rural Bangladesh. This organization recognized that women often face significant barriers to accessing financial services due to cultural and societal norms. By designing their lending programs around this demographic, they not only empowered women but also contributed to successful repayment rates and economic growth within their communities. By understanding the unique challenges faced by women, Grameen Bank has successfully built a sustainable model that has inspired similar initiatives worldwide.

Moreover, consider the segment of youth in microlending programs. Young people often struggle to secure funding due to a lack of credit history or collateral. However, when microlending organizations recognize this gap and develop products specifically aimed at youth, they open doors to a new generation of entrepreneurs. For instance, organizations like Accion provide tailored microloans for young adults, coupled with mentorship and business training. This holistic approach not only supports the establishment of new businesses but also instills valuable skills and confidence in young borrowers.

Here’s a quick overview of the key microlending customer segments and their characteristics:

| Customer Segment | Key Characteristics |

|---|---|

| Women | Often face barriers to traditional banking; high repayment rates. |

| Rural Communities | Limited access to financial institutions; often rely on local support. |

| Youth | Interested in entrepreneurship but lack capital and credit history. |

| Small Business Owners | Need funds for expansion or inventory; crucial for local economies. |

- Key Takeaways:

- Different segments have specific financial needs that must be addressed.

- Tailored services lead to higher customer satisfaction and loyalty.

- Understanding demographics and behaviors improves loan performance and success rates.

“Empowerment through finance is the key to sustainable growth.” 🌱

The Role of Women in Microlending

Women play a pivotal role in the world of microlending, representing a crucial customer segment that can significantly impact economic development. Traditionally, women have faced numerous barriers to accessing financial services, often due to cultural norms, lack of collateral, and limited financial literacy. However, by focusing on women as a primary demographic, microlending organizations can create tailored solutions that empower them and lead to remarkable outcomes.

For example, organizations like Kiva have successfully harnessed the power of microlending to support women entrepreneurs around the globe. By providing microloans specifically designed for women, Kiva enables them to start small businesses, invest in education, and improve their households. This not only uplifts individual women but also creates a ripple effect in their communities. Research shows that when women earn income, they are more likely to invest in their families and communities, promoting overall economic growth.

Moreover, the advantages of focusing on women in microlending extend beyond individual success stories. When women gain financial independence, they challenge traditional gender roles and contribute to changing societal norms. This shift can lead to improved health and education outcomes for their children, as women are often more inclined to allocate their earnings toward these essential areas. For instance, in many communities, female borrowers have reported using their loans to fund their children’s education, thereby breaking the cycle of poverty.

Here’s a brief overview of the impact of microlending on women:

| Impact on Women | Description |

|---|---|

| Financial Independence | Access to funds enables women to start and grow businesses. |

| Community Empowerment | Women invest in family and local projects, enhancing community welfare. |

| Improved Education | Increased income allows for better educational opportunities for children. |

- Key Takeaways:

- Women benefit significantly from targeted microlending programs.

- Empowering women leads to broader societal benefits and economic growth.

- Programs tailored for women often yield higher repayment rates.

“Investing in women is investing in the future.” 🌍

Rural Microlending Strategies

Rural communities represent another essential customer segment in the microlending landscape. These areas often face unique challenges, including geographical isolation, limited access to financial institutions, and lower levels of financial literacy. Understanding the specific needs of rural borrowers is vital for developing effective microlending strategies that can truly make a difference.

Organizations like BRAC have implemented innovative rural microlending programs that go beyond simply providing loans. They recognize that to be effective, microlending must include education and support. By offering financial literacy training, BRAC equips rural borrowers with the skills necessary to manage their finances effectively, ensuring that they can make the most of the funds they receive. This approach not only increases the likelihood of loan repayment but also fosters long-term financial stability.

One successful strategy for rural microlending is the use of mobile banking. In many rural areas, access to traditional banking infrastructure is limited, making it difficult for borrowers to obtain loans. By leveraging mobile technology, microlending organizations can reach remote borrowers, allowing them to apply for loans, receive funds, and make repayments directly from their mobile devices. This convenience significantly enhances access to financial services and empowers rural communities to take control of their economic futures.

Additionally, community involvement plays a crucial role in the success of rural microlending initiatives. Many organizations utilize a group lending model, where borrowers come together to support one another in their repayment efforts. This fosters a sense of accountability and community, making it more likely that loans will be repaid. For example, borrowers in rural settings often have strong ties to their communities, and leveraging these relationships can enhance the effectiveness of microlending programs.

Here’s a summary of effective rural microlending strategies:

| Strategy | Description |

|---|---|

| Mobile Banking | Utilizing mobile apps to reach remote borrowers and facilitate transactions. |

| Community Training | Workshops on financial literacy and business skills to empower borrowers. |

| Group Lending | Encouraging peer support and accountability among borrowers. |

- Key Takeaways:

- Rural borrowers require tailored approaches to meet their unique needs.

- Education enhances the effectiveness of microlending initiatives.

- Community involvement boosts success rates and repayment likelihood.

“Together, we can bridge the financial gap.” 🌉

The Impact of Microlending on Small Businesses

Small businesses are often referred to as the backbone of local economies, and the role of microlending in supporting these enterprises cannot be overstated. Many small business owners struggle to secure funding through traditional banking channels due to lack of credit history or collateral. Here’s where microlending steps in, providing essential financial support to help entrepreneurs turn their ideas into reality.

Consider the case of a small café owner who needs a microloan to purchase equipment and stock. With the funds provided through a microlending program, the owner can invest in necessary improvements, which can lead to increased sales and profitability. This not only benefits the business owner but also contributes to job creation within the community. When small businesses thrive, they create employment opportunities, stimulate local economies, and enhance community well-being.

Moreover, microlending has the added advantage of fostering innovation. Many entrepreneurs who seek microloans are often working on unique ideas or products that might not fit into the conventional banking model. By supporting these innovators, microlending organizations can contribute to a more diverse and dynamic economy. For example, a small business that develops eco-friendly products might not only succeed in generating profit but also play a role in promoting sustainable practices.

Here’s a quick overview of the impact of microlending on small businesses:

| Impact on Small Businesses | Description |

|---|---|

| Increased Sales | Access to funds leads to growth opportunities and higher revenues. |

| Job Creation | Small businesses create local employment, reducing unemployment rates. |

| Community Development | Successful businesses contribute to local economies and enhance community welfare. |

- Key Takeaways:

- Microlending is vital for small business growth and sustainability.

- Successful small businesses create jobs and stimulate economic activity.

- Innovative entrepreneurs benefit from tailored microlending solutions.

“Small businesses are the heartbeat of our communities.” ❤️

Cultural Factors in Microlending

Cultural factors play a significant role in the effectiveness of microlending initiatives. Understanding the values, beliefs, and practices of different customer segments is crucial for developing programs that resonate with borrowers. When microlending organizations take cultural considerations into account, they can enhance their outreach and improve repayment rates.

For instance, in many cultures, family support is paramount. Microlending programs that incorporate family members into the borrowing process often see better repayment rates. This can involve encouraging borrowers to involve family members in financial discussions or even having family members co-sign loans. By recognizing the importance of family dynamics, lenders can create a more supportive environment for borrowers, which can lead to improved outcomes.

Additionally, cultural sensitivity is essential in designing marketing strategies and communication. For example, understanding local customs and traditions can help lenders create promotional materials that resonate with potential borrowers. This might include using local languages, showcasing success stories from the community, or highlighting the benefits of financial education tailored to cultural contexts. By fostering a sense of trust and familiarity, microlending organizations can establish stronger relationships with their borrowers.

Here’s a summary of cultural factors affecting microlending:

| Cultural Factor | Description |

|---|---|

| Family Involvement | Including family members in financial decisions enhances support. |

| Community Trust | Building relationships with local leaders fosters credibility. |

| Cultural Sensitivity | Tailoring programs to align with local customs increases effectiveness. |

- Key Takeaways:

- Cultural understanding enhances the effectiveness of microlending initiatives.

- Family and community ties are crucial in decision-making processes.

- Programs should respect and adapt to local customs to build trust.

“Culture shapes the way we view finance.” 🌏

The Importance of Youth in Microlending Programs

The youth demographic represents a vital segment in the landscape of microlending. Young entrepreneurs often face significant barriers when trying to access traditional financing options, primarily due to their lack of credit history, collateral, and experience. However, microlending can bridge this gap, offering young individuals the opportunity to pursue their entrepreneurial dreams and contribute positively to their communities.

Organizations like Accion have recognized the potential of youth in microlending and have tailored their programs accordingly. By providing microloans specifically designed for young adults, they enable them to launch small businesses or pursue educational opportunities. This financial support not only helps young entrepreneurs gain practical experience but also instills a sense of confidence and independence, which is crucial for personal and professional growth.

Moreover, microlending aimed at youth can foster innovation and creativity. Young people often bring fresh ideas and unique perspectives to the market. By supporting these innovators, microlending organizations can contribute to a more dynamic and diverse economy. For instance, a young entrepreneur might develop a tech startup that addresses local needs, creating jobs and stimulating economic activity in their community.

Here’s a brief overview of the significance of youth in microlending programs:

| Significance | Description |

|---|---|

| Entrepreneurship Skills | Programs teach valuable business management skills to young borrowers. |

| Financial Literacy | Youth gain knowledge about handling finances effectively. |

| Job Creation | New businesses contribute to local economies and employment. |

- Key Takeaways:

- Youth represent a promising market for microlending initiatives.

- Supportive programs lead to successful business outcomes.

- Investing in youth fosters long-term economic growth and community development.

“The youth are the architects of their own futures.” 🏗️

Understanding Agricultural Microlending Insights

Agricultural microlending is another critical area within the broader context of microlending customer segments. Farmers, especially in developing countries, often face unique challenges, including seasonal income fluctuations, lack of access to technology, and limited financial services. Microlending can provide essential support to this demographic, enabling them to invest in their farms, improve yields, and ultimately enhance their livelihoods.

Organizations focusing on agricultural microlending have developed tailored solutions that meet the specific needs of farmers. For example, a farmer may require a microloan to purchase seeds, fertilizers, or equipment. By providing these funds, microlending organizations help farmers increase productivity and income, which can lead to improved food security and community stability. Furthermore, successful agricultural practices can have a positive ripple effect, benefiting entire communities through increased employment and economic activity.

Additionally, agricultural microlending often includes educational components, such as training on sustainable farming practices and financial management. These programs equip farmers with the knowledge and skills they need to make informed decisions and maximize the impact of their loans. For instance, a farmer who learns about crop rotation and sustainable practices can significantly improve soil health and productivity, leading to long-term benefits for both their farm and the environment.

Here’s a summary of insights related to agricultural microlending:

| Insight | Description |

|---|---|

| Access to Resources | Microloans provide essential funds for seeds, fertilizers, and equipment. |

| Increased Productivity | Financial support enables farmers to enhance yields and incomes. |

| Education and Training | Programs offer training on sustainable practices and financial literacy. |

- Key Takeaways:

- Agricultural microlending addresses the specific needs of farmers.

- Supporting farmers leads to improved food security and community stability.

- Education enhances the effectiveness of agricultural lending initiatives.

“Investing in agriculture is investing in the future of our planet.” 🌾

Microlending and Financial Inclusion

Microlending plays a crucial role in promoting financial inclusion, particularly for marginalized and underserved communities. Financial inclusion means ensuring that individuals and businesses have access to useful and affordable financial products and services that meet their needs. Many people around the world, especially in developing countries, lack access to traditional banking services, making microlending an essential tool for bridging this gap.

By providing small loans to those who typically do not qualify for traditional bank loans, microlending organizations empower individuals to start businesses, improve their living conditions, and invest in education and healthcare. For instance, a single microloan can allow a family to buy livestock, start a small shop, or pay for a child’s school fees. This access to capital enables borrowers to enhance their economic status and achieve greater stability.

Moreover, microlending is particularly effective in supporting women, youth, and rural populations. Women, who often face systemic barriers to accessing financial services, benefit significantly from microlending initiatives. Studies show that when women have control over financial resources, they tend to invest in their families and communities, leading to broader social and economic improvements. Similarly, youth borrowers are given the chance to explore entrepreneurship, fostering innovation and economic growth.

Additionally, microlending can contribute to social empowerment by encouraging financial literacy and responsibility. Many microlending programs include educational components, teaching borrowers how to manage their finances, budget effectively, and make informed business decisions. This education not only helps individuals manage their loans but also instills valuable skills that can be beneficial throughout their lives.

Here’s a summary of how microlending contributes to financial inclusion:

| Contribution | Description |

|---|---|

| Access to Capital | Provides funds for individuals and small businesses that lack traditional financing options. |

| Empowerment of Marginalized Groups | Supports women, youth, and rural communities in achieving financial independence. |

| Financial Literacy | Educates borrowers on managing finances and making informed decisions. |

- Key Takeaways:

- Microlending is essential for promoting financial inclusion.

- Empowering marginalized groups leads to broader economic growth.

- Financial education enhances the effectiveness of microlending initiatives.

“Financial inclusion is a key to unlocking potential.” 🔑

Innovations in Microlending

As the landscape of microlending continues to evolve, innovations in technology and service delivery are transforming how these financial services are offered. One of the most significant advancements is the rise of fintech companies that leverage technology to provide more efficient and accessible microlending solutions. These innovations are making it easier for borrowers to apply for loans, receive funds, and manage repayments.

For example, mobile banking applications have revolutionized the microlending sector by allowing borrowers in remote areas to access financial services directly from their smartphones. This technology eliminates the need for physical bank branches, making it easier for individuals in rural or underserved communities to obtain loans. By streamlining the application process, fintech companies can reduce the time it takes for borrowers to receive funds, which is crucial for those facing immediate financial needs.

Moreover, the use of data analytics and artificial intelligence (AI) in microlending is enabling lenders to make more informed decisions. Traditional credit scoring methods often leave out many potential borrowers, particularly those without formal credit histories. However, by analyzing alternative data sources, such as payment history for utilities or mobile phone bills, lenders can gain a more comprehensive view of a borrower’s creditworthiness. This approach allows microlending organizations to extend credit to a broader range of individuals, further promoting financial inclusion.

Additionally, the integration of social impact assessments into microlending practices is gaining traction. Lenders are increasingly looking at the potential social benefits of their loans, not just the financial returns. This focus on social impact can lead to more responsible lending practices and greater community benefits, as organizations prioritize projects that contribute positively to local economies and social structures.

Here’s a summary of innovations shaping the microlending landscape:

| Innovation | Description |

|---|---|

| Mobile Banking | Allows borrowers to access loans via smartphones, increasing accessibility. |

| Data Analytics | Utilizes alternative data sources to evaluate creditworthiness more effectively. |

| Social Impact Assessment | Focuses on the social benefits of lending, promoting responsible practices. |

- Key Takeaways:

- Innovations in technology are transforming the microlending landscape.

- Fintech solutions enhance accessibility and efficiency for borrowers.

- Focus on social impact fosters responsible lending practices.

“Innovation is the key to unlocking new opportunities in finance.” 🚀

Recommendations

In summary, understanding the various microlending customer segments is essential for developing effective strategies that promote financial inclusion and empower individuals. Whether focusing on women, youth, or rural communities, tailored microlending programs can drive economic growth and social change. To assist you in your journey toward establishing a successful microlending operation, we recommend checking out the Microlending Business Plan Template. This template provides a comprehensive framework to help you outline your goals, strategies, and financial projections.

Additionally, we invite you to explore our related articles on microlending for more insights and information:

- Article 1 on Microlending SWOT Analysis Insights & Trends

- Article 2 on Microlending: Profitability and Business Strategies

- Article 3 on Microlending Business Plan: Template and Tips

- Article 4 on Microlending Financial Plan: A Detailed Guide

- Article 5 on Starting a Microlending Business: A Comprehensive Guide with Examples

- Article 6 on Begin Your Microlending Marketing Plan with This Example

- Article 7 on Crafting a Business Model Canvas for Microlending: Step-by-Step Guide

- Article 8 on How Much Does It Cost to Start a Microlending Business?

- Article 9 on Microlending Feasibility Study: Essential Guide

- Article 10 on Microlending Risk Management: Essential Guide

- Article 11 on Microlending Competition Study: Essential Guide

- Article 12 on Microlending Legal Considerations: Ultimate Guide

- Article 13 on Microlending Funding Options: Ultimate Guide

- Article 14 on Microlending Growth Strategies: Scaling Examples

FAQ

What is microlending?

Microlending refers to the practice of providing small loans to individuals or businesses that typically lack access to traditional banking services. This financial approach aims to empower underserved communities and promote economic development by enabling borrowers to start or expand their businesses.

Who are the typical customers of microlending?

The typical customers of microlending include low-income individuals, women, youth, and small business owners. These demographics often face barriers to accessing conventional financing, making microlending a crucial resource for them.

How does microlending work?

Microlending works by providing small amounts of money to borrowers who may not qualify for traditional loans. Lenders assess the borrower’s ability to repay based on alternative data sources and personal relationships rather than conventional credit scores.

What are the benefits of microlending?

The benefits of microlending include increased access to capital for underserved populations, empowerment of women and youth, and promotion of entrepreneurship. It also contributes to financial inclusion and economic growth within communities.

How does microlending impact small businesses?

Microlending has a significant impact on small businesses by providing them with the necessary funding to start or expand operations. This financial support enables business owners to purchase inventory, hire employees, and improve their services, ultimately contributing to local economic development.

What role does technology play in microlending?

Technology plays a crucial role in microlending by facilitating mobile banking solutions, data analytics for assessing creditworthiness, and streamlined application processes. Fintech innovations enhance accessibility and efficiency for borrowers.

How can microlending promote financial inclusion?

Microlending promotes financial inclusion by providing access to financial services for marginalized groups who typically lack banking options. By empowering individuals with loans, microlending helps them improve their economic situations and invest in their futures.

What are some challenges faced by microlending organizations?

Challenges faced by microlending organizations include managing risks associated with lending, ensuring loan repayment, and reaching remote communities. Additionally, they must balance social impact with financial sustainability.