The Insurance Agency Competition Study is essential for any agency aiming to thrive in a crowded marketplace. It involves analyzing competitors, understanding market trends, and evaluating one’s own position within the industry. This study is crucial for identifying opportunities and threats, ultimately guiding strategic decisions. Without a thorough understanding of the competitive landscape, agencies risk falling behind and losing clients to more informed competitors. The insights gained from a competition study can lead to improved services, better marketing strategies, and ultimately, increased profitability.

Here’s what you’ll learn:

– The importance of competition analysis in insurance.

– Steps to conduct a thorough competition study.

– Tools and resources for gathering relevant data.

– How to interpret findings and implement strategies.

Understanding the Importance of an Insurance Agency Competition Study

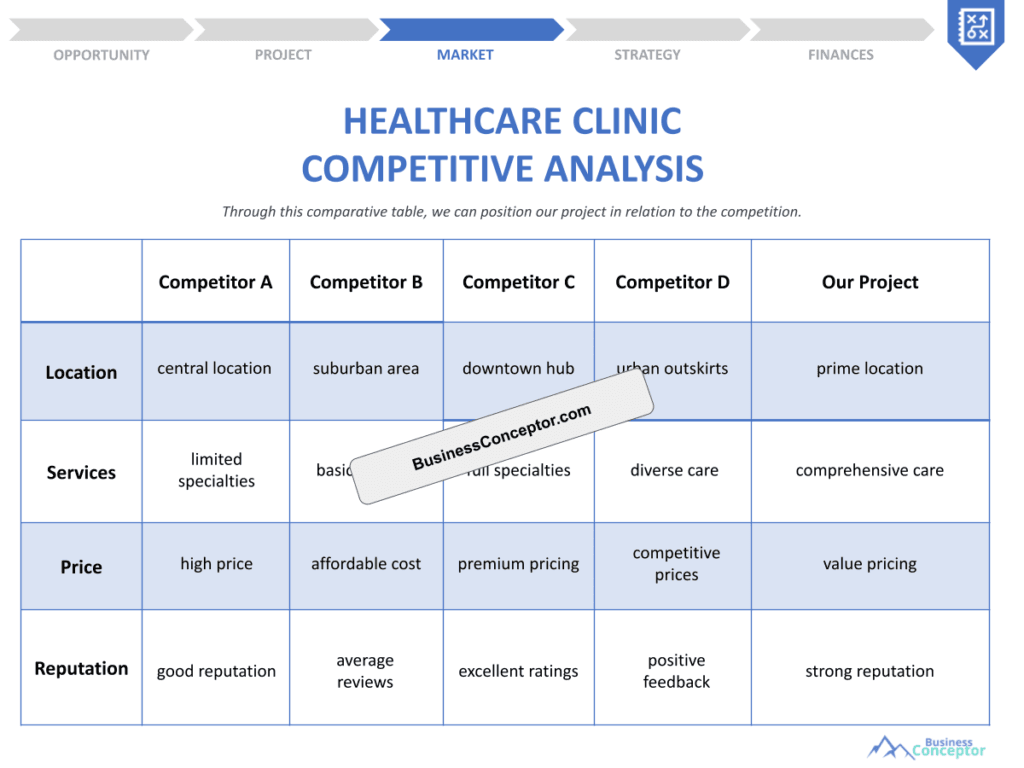

Conducting an Insurance Agency Competition Study is not just a good idea; it’s a necessity. In a landscape where numerous agencies compete for the same clientele, knowing your competition can be the difference between thriving and merely surviving. By understanding who your competitors are, what they offer, and how they market themselves, you can carve out your unique niche. This understanding enables you to identify your agency’s strengths and weaknesses compared to others in the industry, which is critical for making informed business decisions.

For example, imagine you run a small insurance agency in a bustling city. Without a clear understanding of the other agencies in your area, you might miss out on critical insights. Are they offering lower rates? Unique coverage options? Exceptional customer service? These factors can significantly influence potential clients’ decisions. By conducting a comprehensive analysis, you can uncover these important details and adjust your offerings accordingly, ensuring that your agency remains competitive.

Moreover, the advantages of performing an insurance market analysis extend beyond just identifying competitors. This study allows you to gain insights into insurance industry trends and emerging market opportunities. For instance, if you find that many competitors are expanding their services to include digital insurance solutions, it might be time for your agency to consider similar offerings. Additionally, a well-executed competition study can help identify gaps in the market that your agency can fill, allowing you to position yourself as a leader in specific niches or demographics.

Furthermore, understanding your competitors’ marketing strategies can provide invaluable lessons. If a competitor has successfully utilized social media to engage clients, it may inspire you to enhance your own digital marketing efforts. On the other hand, if you discover that certain marketing tactics are failing for your competitors, you can avoid those pitfalls and save time and resources.

In summary, conducting an Insurance Agency Competition Study empowers your agency to make informed decisions that lead to increased client satisfaction and loyalty. By understanding market positioning, competitor strengths and weaknesses, and the overall competitive landscape, your agency can develop effective strategies that resonate with potential clients. This proactive approach not only helps you stay ahead of the competition but also fosters a culture of continuous improvement within your organization.

Key Points:

– Understand market positioning of your agency.

– Identify strengths and weaknesses of competitors.

– Pinpoint gaps in the market that your agency can fill.

“Knowledge is power in the competitive insurance landscape! 🚀”

| Key Aspects | Importance |

|---|---|

| Market Positioning | Helps identify where you stand |

| Competitor Strengths | Learn from what others do well |

| Market Gaps | Opportunities to attract new clients |

- Analyze competitor offerings and strategies.

- Use findings to improve your agency’s services.

- Stay updated on industry trends to remain competitive.

Steps to Conducting a Successful Insurance Agency Competition Study

Embarking on an Insurance Agency Competition Study requires a systematic approach to ensure you gather the most relevant and actionable insights. The first step in this process is identifying your primary competitors. These could be local agencies that share your target market or larger national firms that dominate the industry. Knowing who your competitors are is crucial; it sets the stage for everything that follows.

Once you have a clear list of competitors, the next step is to categorize them based on various factors such as size, market share, and the specific services they offer. For instance, you might have small local agencies that focus on personalized service, while larger firms may emphasize lower rates due to their scale. This categorization will help you tailor your analysis effectively, as different types of competitors may require different strategies for evaluation.

After identifying and categorizing your competitors, it’s time to gather data on them. This can be done through multiple channels, including their websites, social media platforms, and industry reports. Look for information regarding their marketing strategies, customer reviews, and service offerings. For example, if a competitor is excelling in customer service, this might indicate that you need to enhance your own customer interactions. Similarly, if you find that another agency has received negative feedback about their claims process, this could be an opportunity for you to promote your agency’s superior claims handling.

Furthermore, don’t underestimate the power of qualitative data. Conducting informal interviews with clients or even industry insiders can yield insights that traditional data collection methods might miss. For example, asking clients why they chose a particular agency can provide invaluable insights into what clients value most in an insurance provider.

As you gather and analyze this data, it is vital to maintain an organized system. Use spreadsheets or specialized software to compile your findings. This organization will make it easier to draw comparisons and identify trends. Ultimately, the goal is to synthesize this information into actionable strategies that can give your agency a competitive edge. Regularly updating your findings will also keep you informed about shifts in the market and competitor behavior.

Key Points:

– Identify and categorize competitors based on size and services.

– Gather relevant data through various channels.

– Analyze customer feedback to gauge market perception.

“What you don’t know can hurt you—especially in business! 🔍”

| Steps to Study | Description |

|---|---|

| Identify Competitors | List out direct and indirect competitors |

| Data Collection | Use multiple sources for comprehensive data |

| Analyze Customer Feedback | Understand client perceptions of competitors |

- Leverage competitor weaknesses to your advantage.

- Develop strategies based on thorough analysis.

- Keep your findings organized for easy reference.

Analyzing Data from Your Competition Study

Once you’ve gathered your data, it’s time to analyze it. This step is where the real insights come to light. Look for patterns and trends that can inform your strategies moving forward. For example, if you notice that many of your competitors are offering similar products but at varying price points, this could indicate a market trend that you should consider when pricing your own offerings. Analyzing insurance agency performance metrics can provide a clearer picture of where your agency stands in relation to others.

Utilizing tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can help synthesize your findings into a more manageable format. This method allows you to visualize where your agency can excel and where you might face challenges. For instance, if your agency has a strong reputation for customer service, that’s a strength you can leverage in your marketing. Conversely, if you identify weaknesses in your digital presence compared to competitors, this is an area that needs immediate attention.

Moreover, interpreting data effectively means not just identifying what the numbers say, but also understanding the context behind them. For example, if a competitor has a high customer retention rate, investigate what strategies they use to achieve this. Are they employing loyalty programs? Are they more responsive to client inquiries? Understanding the “why” behind the data can guide you in implementing similar successful strategies.

It’s also essential to keep an eye on the broader industry trends that may impact your analysis. For example, if there’s a growing demand for eco-friendly insurance options, recognizing this trend early can provide your agency with a first-mover advantage. By aligning your offerings with emerging market needs, you can attract new clients who are increasingly seeking sustainable options.

Finally, once you’ve completed your analysis, it’s crucial to create a strategic plan based on your findings. Document your insights and proposed actions clearly to share with your team. This will not only ensure everyone is on the same page but will also foster a culture of continuous improvement within your agency. Regularly updating your analysis will help you stay ahead of the competition and adapt to the ever-changing market landscape.

Key Points:

– Look for trends in competitor performance.

– Use SWOT analysis for clear visualization.

– Determine actionable strategies based on data.

“Turning insights into action is key! 📈”

| Analysis Techniques | Purpose |

|---|---|

| SWOT Analysis | Identify strategic opportunities |

| Trend Analysis | Spot patterns in competitor behavior |

| Performance Metrics | Measure success against competitors |

- Create a strategic plan based on your analysis.

- Regularly update your study to reflect market changes.

- Communicate findings with your team to align efforts.

Implementing Changes Based on Your Findings

Having completed your analysis, the next step is implementation. This is where the real magic happens. Taking the insights from your Insurance Agency Competition Study and integrating them into your agency’s strategies can significantly enhance your market position. For example, if your analysis reveals that competitors are thriving due to their digital marketing efforts, it may be time for your agency to enhance its online presence. This could involve creating targeted social media campaigns or optimizing your website for search engines to attract more potential clients.

Moreover, if you discover that a competitor is successfully offering a unique insurance product that caters to a specific demographic, consider whether you can introduce a similar offering or differentiate your products in a way that appeals to that same audience. For instance, if your competitors are targeting young families with affordable life insurance plans, you could develop a marketing campaign that emphasizes family-oriented benefits or additional services such as financial planning resources.

Another critical aspect of implementation is focusing on customer service. If your analysis indicates that competitors are excelling in this area, it’s essential to refine your own customer interactions. This could involve training your staff to enhance communication skills, implementing feedback mechanisms to understand client needs better, or even adopting new technologies that improve the customer experience. For example, using a customer relationship management (CRM) system can help streamline communication and ensure that no client feels neglected.

Additionally, after implementing these changes, it is vital to monitor their impact. Set specific metrics to evaluate the effectiveness of your new strategies. This might include tracking client retention rates, measuring engagement levels on social media, or analyzing sales figures for new products. Regularly reviewing these metrics will provide valuable insights into what is working and what may need further adjustment.

Ultimately, implementing changes based on your findings empowers your agency to adapt to the competitive landscape proactively. By being responsive to market demands and competitor strategies, you can position your agency as a leader in your niche, attracting new clients and retaining existing ones more effectively. The key is to remain flexible and open to change, as the insurance market is continuously evolving.

Key Points:

– Use insights to refine your offerings.

– Focus on customer service as a differentiator.

– Monitor the impact of changes over time.

“Adaptation is the key to success! 🔑”

| Implementation Strategies | Focus Areas |

|---|---|

| Product Development | Enhance or add to your insurance offerings |

| Customer Service | Improve client interaction and support |

| Marketing Adjustments | Align marketing efforts with findings |

- Track performance metrics post-implementation.

- Encourage feedback from clients to refine services.

- Stay flexible to adjust strategies as needed.

Utilizing Technology for Your Competition Study

In today’s digital age, technology plays a pivotal role in conducting an Insurance Agency Competition Study. Utilizing the right tools can streamline the data-gathering process and enhance your analysis, making it easier to draw meaningful conclusions. For example, software like SEMrush or Ahrefs can help you analyze your competitors’ online presence, providing insights into their SEO strategies and keyword performance. This data is invaluable for identifying gaps in your own online marketing efforts.

Moreover, implementing a robust customer relationship management (CRM) system can provide you with critical insights into client interactions and preferences. By tracking client behavior, you can tailor your marketing messages and service offerings to better meet their needs. For instance, if your CRM data shows that clients are particularly interested in certain types of coverage, you can focus your marketing efforts on those areas, increasing the likelihood of conversion.

Additionally, leveraging data visualization tools can make it easier to present your findings in an understandable format. These tools can transform complex data sets into visual representations, making it simpler to identify trends and patterns. For example, using graphs to showcase customer satisfaction ratings over time can help you quickly determine the impact of any changes you’ve implemented based on your competition study.

Another technology to consider is business analytics tools that can help you measure the effectiveness of your strategies over time. These tools can provide insights into market trends and consumer behavior, enabling you to make data-driven decisions that enhance your agency’s competitive edge. By staying informed about industry developments and technological advancements, your agency can remain agile and responsive to changes in the market.

Ultimately, incorporating technology into your Insurance Agency Competition Study not only enhances your analytical capabilities but also allows you to implement strategies more effectively. The right tools can provide you with the insights needed to make informed decisions, ensuring that your agency remains competitive and relevant in an ever-evolving landscape.

Key Points:

– Leverage technology to enhance your study.

– Use analytics tools for deeper insights.

– Invest in CRM systems for better client management.

“Tech tools can make your analysis more effective! 💻”

| Technology Tools | Benefits |

|---|---|

| SEO Analysis Tools | Understand online competition |

| CRM Systems | Manage customer relationships effectively |

| Data Visualization Tools | Present data in an understandable format |

- Explore new tools regularly to stay ahead.

- Train your team on effective use of technology.

- Utilize data visualization for clear communication.

Reviewing and Updating Your Competition Study Regularly

An Insurance Agency Competition Study is not a one-time task; it should be an ongoing process that evolves with the market. The insurance industry is characterized by constant change, driven by factors such as new regulations, emerging technologies, and shifting consumer preferences. Regularly reviewing and updating your competition study ensures that your agency remains informed and can adapt its strategies accordingly. This proactive approach can significantly enhance your competitive edge.

Establishing a review schedule is crucial. You might choose to revisit your competition study quarterly, biannually, or annually, depending on the dynamics of your market. Frequent reviews allow you to keep an eye on new competitors entering the field, changes in existing competitors’ strategies, and the overall market landscape. For instance, if you notice a new agency gaining traction due to innovative marketing tactics or unique product offerings, understanding their approach can help you refine your own strategies to stay competitive.

Moreover, updating your study regularly helps you identify shifts in customer behavior. For example, if you observe that consumers are increasingly seeking digital solutions for their insurance needs, this insight can prompt your agency to invest in technology or enhance your online services. By being responsive to market changes, you can better meet client expectations and improve customer satisfaction, which is crucial for retention and growth.

It’s also important to document the changes you make based on your findings. By keeping track of how your strategies evolve in response to your competition study, you can evaluate the effectiveness of your decisions over time. This documentation serves as a valuable resource for future reference, allowing you to learn from past successes and setbacks.

Finally, involving your team in the review process can foster a culture of collaboration and continuous improvement within your agency. Sharing insights and discussing findings can lead to innovative ideas and strategies that might not have emerged in isolation. Encourage team members to contribute their perspectives on the competition and suggest areas for improvement. This collaborative approach not only enhances your competition study but also promotes a sense of ownership among your staff.

Key Points:

– Establish a review schedule for your study.

– Stay updated on market changes and competitor movements.

– Adjust strategies based on fresh insights.

“Consistency is key to staying competitive! 🔄”

| Review Frequency | Purpose |

|---|---|

| Quarterly Review | Stay aligned with market dynamics |

| Biannual Update | Refresh insights and strategies |

| Annual Comprehensive Study | Reassess overall market position |

- Document changes and their impacts on your agency.

- Share insights with your team for collaborative growth.

- Be proactive in addressing potential challenges.

Creating a Strategic Plan Based on Your Findings

Once you have gathered insights from your Insurance Agency Competition Study, the next crucial step is to create a strategic plan that aligns with your agency’s goals. This plan should be informed by the data you’ve collected and the trends you’ve identified. By translating your findings into actionable strategies, you can enhance your agency’s performance and competitiveness in the market.

Start by defining clear objectives based on your analysis. For instance, if your study revealed that competitors are gaining clients through aggressive digital marketing, one objective might be to increase your online presence and engagement. This could involve setting specific targets for website traffic, social media followers, or lead generation through online channels. Having measurable goals will help you track progress and make necessary adjustments along the way.

Next, outline the specific actions needed to achieve these objectives. This could include investing in new marketing tools, hiring additional staff for your digital marketing team, or launching targeted advertising campaigns. Additionally, consider the resources required for each action, such as budget, personnel, and technology. Planning these aspects in advance will ensure that you have a well-rounded approach to implementing your strategies.

Furthermore, it’s essential to establish key performance indicators (KPIs) to evaluate the success of your strategic plan. These KPIs will serve as benchmarks for measuring your agency’s performance over time. For example, if one of your objectives is to improve customer retention, you might track metrics such as customer satisfaction scores, renewal rates, and client feedback. Regularly reviewing these KPIs will allow you to assess the effectiveness of your strategies and make data-driven decisions moving forward.

Finally, communicate your strategic plan to your team. Involving your staff in the planning process not only fosters a sense of ownership but also ensures that everyone is aligned with the agency’s goals. Encourage feedback and open dialogue, as this can lead to further refinements and improvements to your plan. By creating a collaborative environment, you can harness the collective expertise of your team to drive your agency’s success.

Key Points:

– Define clear objectives based on your analysis.

– Outline specific actions needed to achieve these objectives.

– Establish KPIs to evaluate the success of your plan.

“Turning insights into action is crucial for growth! 🚀”

| Strategic Planning Steps | Description |

|---|---|

| Define Objectives | Set measurable goals based on findings |

| Outline Actions | Plan specific steps to achieve objectives |

| Establish KPIs | Track performance and measure success |

- Communicate your plan to your team effectively.

- Encourage feedback and open dialogue for refinements.

- Utilize collective expertise to drive success.

Creating a Sense of Urgency in Your Strategies

In the competitive world of insurance, creating a sense of urgency is crucial for driving client action and engagement. When conducting your Insurance Agency Competition Study, understanding how to implement urgency in your marketing and service delivery can significantly influence your agency’s success. The goal is to motivate potential clients to act quickly, whether that means signing up for a policy, requesting a quote, or engaging with your agency in some capacity.

One effective way to create urgency is by highlighting time-sensitive offers. For instance, if you discover that competitors are running seasonal promotions or limited-time discounts, you can respond with your own offers that encourage clients to act promptly. This could be a special rate for new clients who sign up within a certain timeframe or an added benefit for those who choose to renew their policies before a deadline. By emphasizing these limited-time opportunities, you make potential clients feel they could miss out if they don’t act quickly.

Another strategy involves using language that conveys urgency in your communications. Phrases like “Act now,” “Limited spots available,” or “Don’t miss out” can prompt immediate responses from clients. In your marketing materials, whether through email campaigns, social media posts, or website banners, incorporating this type of language can effectively drive home the message that now is the time to take action.

Additionally, utilizing scarcity can also create urgency. If you are offering a particular type of insurance coverage that is in high demand, make it known that there are only a limited number of policies available. This tactic can prompt clients to feel they need to secure their coverage before it runs out. For example, you could say, “Only 50 policies available at this exclusive rate!” This not only encourages clients to act quickly but also positions your agency as a desirable option in a competitive market.

Moreover, following up with potential clients can reinforce this sense of urgency. For example, if someone has shown interest in your services but hasn’t yet made a decision, sending a follow-up email that highlights the benefits of acting quickly can be effective. You might include a reminder of the time-sensitive offer and reiterate the advantages of choosing your agency over competitors. This personalized approach not only fosters a sense of urgency but also demonstrates your commitment to client service.

Key Points:

– Highlight time-sensitive offers to prompt client action.

– Use urgent language in communications.

– Create scarcity to encourage quick decisions.

“Act now to secure your future! ⏳”

| Urgency Strategies | Benefits |

|---|---|

| Time-Sensitive Offers | Encourage immediate client action |

| Urgent Language | Prompt quick responses from potential clients |

| Scarcity Tactics | Increase perceived value and demand |

- Follow up with potential clients to reinforce urgency.

- Personalize communications to enhance client engagement.

- Utilize multiple channels to convey urgency effectively.

Evaluating the Effectiveness of Your Competition Study

After implementing your findings from the Insurance Agency Competition Study, it’s crucial to evaluate the effectiveness of your strategies. This evaluation will help you understand what works and what doesn’t, allowing you to refine your approach continually. The goal is not only to assess the immediate impact of your changes but also to establish a framework for ongoing improvement.

Begin by analyzing the key performance indicators (KPIs) that you established when creating your strategic plan. These metrics should align with your objectives, providing clear benchmarks for success. For example, if one of your goals was to increase client retention rates, measure how those rates have changed since implementing your new strategies. If retention has improved, analyze which specific actions contributed to this success.

Additionally, consider conducting regular client surveys to gather feedback on their experiences with your agency. This qualitative data can provide insights into how clients perceive your service offerings and the changes you’ve made. For instance, if clients express satisfaction with the new digital tools you’ve implemented, this feedback can validate your decision to invest in technology.

Furthermore, it’s important to keep an eye on competitor movements as part of your evaluation process. If you notice that a competitor has adjusted their strategies in response to market changes, it may be time for you to reassess your approach as well. Staying informed about competitor actions ensures that your agency remains agile and responsive to the ever-evolving insurance landscape.

Finally, document your findings and adjustments in a centralized location. This documentation will serve as a valuable resource for future reference and can help you identify trends over time. By maintaining a record of what strategies have been effective, you can make more informed decisions moving forward. The key is to create a culture of learning within your agency, where continuous improvement is embraced as part of your operational philosophy.

Key Points:

– Analyze KPIs to measure the success of your strategies.

– Gather client feedback through surveys for qualitative insights.

– Document findings for future reference and trend analysis.

“Continuous improvement leads to lasting success! 📊”

| Evaluation Steps | Purpose |

|---|---|

| Analyze KPIs | Measure success against objectives |

| Client Surveys | Gather feedback on service experiences |

| Document Findings | Maintain a record for future reference |

- Stay informed about competitor movements for agility.

- Create a culture of learning and adaptation.

- Utilize insights for strategic decision-making.

Recommendations

In summary, conducting a thorough Insurance Agency Competition Study is crucial for any agency looking to thrive in a competitive market. By understanding your competitors, utilizing technology, and implementing strategies based on your findings, you can position your agency for success. To assist you in developing a comprehensive approach, consider utilizing the Insurance Agency Business Plan Template, which offers a structured framework for planning and executing your agency’s strategies.

Additionally, we invite you to explore our related articles that provide further insights into the world of insurance agencies:

- Insurance Agency SWOT Analysis Essentials

- Insurance Agencies: How Profitable Can They Be?

- Insurance Agency Business Plan: Comprehensive Guide with Examples

- Insurance Agency Financial Plan: Essential Steps and Example

- Starting an Insurance Agency: A Comprehensive Guide with Examples

- Create a Marketing Plan for Your Insurance Agency (+ Example)

- Building a Business Model Canvas for an Insurance Agency: Examples and Tips

- Customer Segments for Insurance Agencies: Examples and Analysis

- How Much Does It Cost to Operate an Insurance Agency?

- What Are the Steps for a Successful Insurance Agency Feasibility Study?

- What Are the Key Steps for Risk Management in Insurance Agency?

- How to Navigate Legal Considerations in Insurance Agency?

- How to Secure Funding for Insurance Agency?

- Insurance Agency Growth Strategies: Scaling Guide

FAQ

What is an Insurance Agency Competition Study?

An Insurance Agency Competition Study is a comprehensive analysis that evaluates the strengths and weaknesses of competing agencies within the insurance market. This study helps agencies understand their position relative to competitors, identify market trends, and develop strategies to improve performance and client engagement.

Why is a Competition Study important for insurance agencies?

Conducting a competition study is vital as it provides insights into insurance industry trends, competitor offerings, and client preferences. By understanding these factors, agencies can adapt their strategies, enhance customer service, and ultimately increase their market share.

What are the key components of a successful competition study?

A successful insurance market analysis includes identifying primary competitors, gathering relevant data on their marketing strategies and customer feedback, and analyzing this information to identify strengths, weaknesses, opportunities, and threats (SWOT analysis). This comprehensive approach allows agencies to make informed decisions.

How can technology aid in conducting a competition study?

Technology plays a crucial role in facilitating an Insurance Agency Competition Study. Tools such as SEO analysis software, customer relationship management (CRM) systems, and data visualization tools help agencies collect and analyze data efficiently, enabling them to make data-driven decisions.

How often should an insurance agency review its competition study?

It is recommended that insurance agencies review their Insurance Agency Competition Study regularly, whether quarterly, biannually, or annually. Frequent reviews allow agencies to stay updated on market changes, competitor strategies, and shifts in consumer preferences, ensuring they remain competitive.

What steps should be taken after completing a competition study?

After completing a competition study, agencies should create a strategic plan based on their findings. This includes defining clear objectives, outlining specific actions to achieve those objectives, and establishing key performance indicators (KPIs) to measure success over time. Continuous evaluation and adaptation are crucial for long-term success.