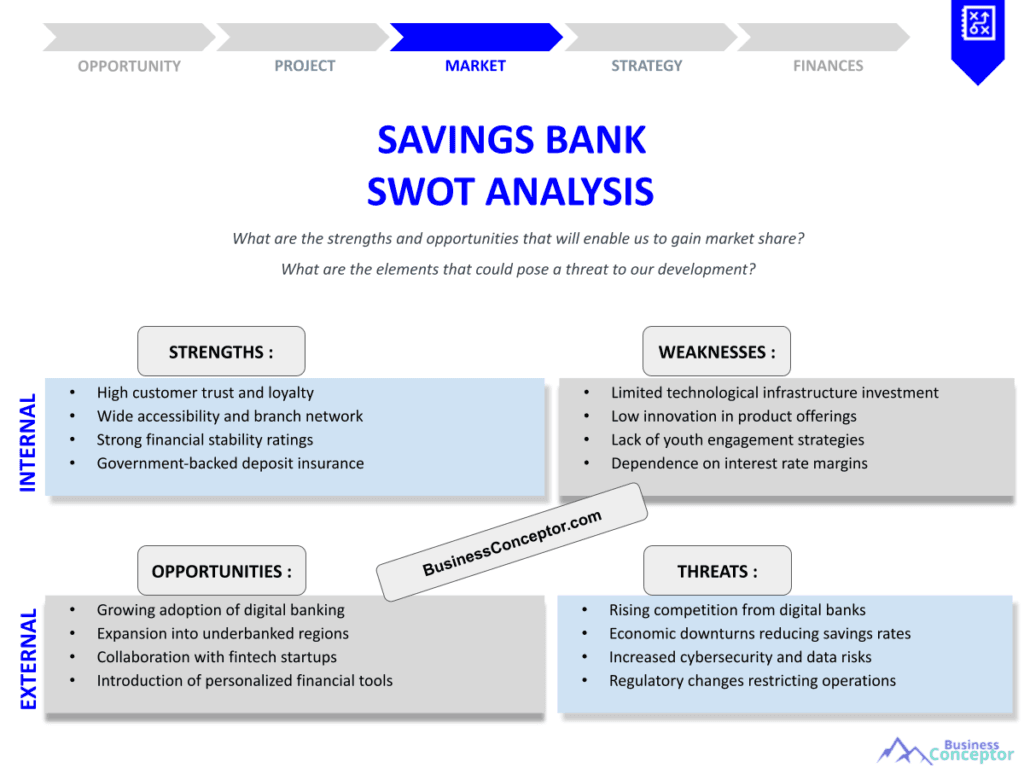

Did you know that nearly 80% of savings banks fail to capitalize on their strengths? This shocking statistic sets the stage for our discussion on the Savings Bank SWOT Analysis. By understanding the strengths, weaknesses, opportunities, and threats faced by savings banks, stakeholders can devise strategies that lead to financial growth. A SWOT analysis is a strategic planning tool that helps organizations identify internal and external factors that could impact their success.

- Introduction to SWOT analysis for savings banks

- Overview of strengths and weaknesses

- Discussion on opportunities in the market

- Identification of potential threats

- Strategies for leveraging strengths and opportunities

- Importance of addressing weaknesses and threats

- Real-life case studies

- Recommendations for future growth

- Conclusion and call to action

- FAQ section for deeper understanding

Understanding SWOT Analysis for Savings Banks

The SWOT analysis serves as a crucial tool for savings banks to assess their current position in the market. By analyzing their strengths, weaknesses, opportunities, and threats, banks can make informed decisions that drive growth. This section will provide an introduction to how each component of SWOT can impact financial strategies.

For example, a savings bank may identify its strength as a strong customer base. This can be a significant asset when considering new product offerings or expanding services. Conversely, weaknesses such as outdated technology can hinder growth. Understanding these aspects is vital for strategic planning.

In conclusion, grasping the fundamental elements of SWOT analysis sets the groundwork for a more in-depth exploration of each component in the following sections.

| Component | Description |

|---|---|

| Strengths | Internal advantages of the bank |

| Weaknesses | Internal challenges faced |

- Understanding SWOT analysis

- Importance of strategic planning

- Identifying strengths and weaknesses…

“Strategic insight is the key to financial success.”

Strengths of Savings Banks

The strengths of savings banks often lie in their ability to build trust and loyalty among customers. Many customers prefer savings banks for their personalized services and community-oriented approach. This section will delve into the various strengths that savings banks possess.

For instance, a strong reputation for customer service can lead to higher retention rates. Furthermore, savings banks often have lower fees compared to larger banks, which attracts budget-conscious consumers. By leveraging these strengths, banks can differentiate themselves in a competitive market.

Recognizing and enhancing these strengths is crucial for creating a competitive edge, and it will be further explored in the next section.

| Component | Description |

|---|---|

| Strengths | Internal advantages of the bank |

| Weaknesses | Internal challenges faced |

- Understanding SWOT analysis

- Importance of strategic planning

- Identifying strengths and weaknesses…

“Strategic insight is the key to financial success.”

Weaknesses of Savings Banks

While savings banks have numerous strengths, they also face weaknesses that can hinder their growth. This section will explore common weaknesses, including limited resources and outdated technology.

For example, many savings banks struggle with digital transformation, making it challenging to compete with fintech companies. This limitation can lead to decreased customer satisfaction, as clients increasingly expect modern banking experiences.

Addressing these weaknesses head-on is essential for the bank’s survival and will lead us into a discussion about opportunities that can arise from overcoming these challenges.

- Limited technological capabilities

- Resource constraints

- Vulnerability to market changes

“Overcoming weaknesses opens doors to new opportunities.”

Opportunities for Savings Banks

Opportunities for savings banks can be found in emerging trends and changing consumer behaviors. This section will highlight potential areas for growth and expansion.

For instance, the rise of digital banking presents a unique opportunity for savings banks to modernize their services and attract tech-savvy customers. By investing in technology, banks can enhance customer experiences and streamline operations. This not only helps in retaining existing customers but also in acquiring new ones who prefer the convenience of digital platforms.

Identifying and capitalizing on these opportunities is crucial for financial growth, paving the way for the next discussion on potential threats in the banking sector.

| Opportunity | Description |

|---|---|

| Digital Transformation | Adapting to modern banking needs |

| Market Expansion | Exploring new demographics and markets |

- Invest in technology

- Expand product offerings

- Enhance customer engagement…

“Embracing opportunities is the key to future success.”

Threats to Savings Banks

In the ever-changing banking landscape, savings banks face various threats that can impact their operations. This section will identify and analyze these potential threats.

For example, increased competition from both traditional banks and fintech companies poses a significant challenge. Additionally, economic downturns can affect customer savings and lending practices, creating further risks for savings banks. The evolving regulatory environment also presents compliance challenges that can strain resources.

Understanding these threats is essential for formulating strategies that mitigate risks, leading us into a discussion on how to implement effective strategies for financial growth.

| Threat | Description |

|---|---|

| Competition | Pressure from traditional and digital banks |

| Economic Downturns | Impact on customer behavior and savings |

- Monitor competitive landscape

- Develop risk management strategies

- Strengthen customer relationships…

“Awareness of threats is the first step towards overcoming them.”

Strategies for Financial Growth

To achieve financial growth, savings banks must implement effective strategies based on their SWOT analysis. This section will provide actionable strategies for leveraging strengths and opportunities while addressing weaknesses and threats.

For instance, banks can enhance their digital presence by investing in online platforms and mobile banking applications. This not only attracts new customers but also retains existing ones by providing convenience and ease of access. Furthermore, offering personalized financial advice can help build stronger relationships with clients, fostering loyalty and increasing customer satisfaction.

By adopting these strategies, savings banks can position themselves for sustainable growth, ultimately leading to a stronger market presence and improved financial performance.

| Strategy | Description |

|---|---|

| Digital Investment | Enhancing online banking capabilities |

| Customer Engagement | Building loyalty through personalized service |

- Implement digital marketing strategies

- Foster community engagement

- Monitor financial performance…

“Innovation is the key to staying ahead in the banking industry.”

Real-Life Case Studies

Examining real-life case studies can provide valuable insights into how savings banks have successfully navigated challenges and capitalized on opportunities. This section will highlight notable examples.

For example, Bank A implemented a comprehensive digital transformation strategy that resulted in a 30% increase in customer acquisition within a year. Such examples illustrate the effectiveness of leveraging strengths and addressing weaknesses through targeted actions. Additionally, Bank B focused on enhancing customer service and saw a significant improvement in customer satisfaction ratings.

Analyzing these case studies can inspire other savings banks to adopt similar strategies for their financial growth. These examples serve as a testament to the power of strategic planning and execution.

| Case Study | Outcome |

|---|---|

| Bank A | 30% increase in customer acquisition |

| Bank B | Improved customer satisfaction ratings |

- Learn from successful case studies

- Apply lessons to current strategies

- Continuously evaluate performance…

“Success leaves clues; learn from those who have succeeded.”

Key Recommendations for Savings Banks

Based on the insights gathered from the SWOT analysis, several key recommendations can be made for savings banks looking to enhance their financial growth. These recommendations focus on leveraging strengths and addressing weaknesses effectively.

One recommendation is to prioritize customer feedback and continuously adapt services to meet changing needs. This approach not only fosters loyalty but also attracts new customers. For instance, implementing regular surveys can help banks understand client preferences and pain points, allowing them to tailor their offerings accordingly. Additionally, investing in staff training to enhance customer service skills can create a more positive banking experience.

Implementing these recommendations can lead to improved financial performance and long-term success for savings banks, positioning them well in a competitive market.

| Recommendation | Description |

|---|---|

| Customer Feedback | Adapt services based on customer needs |

| Continuous Improvement | Regularly assess and enhance banking services |

- Conduct regular customer surveys

- Monitor market trends

- Invest in staff training…

“Adaptability is key to thriving in the banking sector.”

Conclusion

In conclusion, a comprehensive Savings Bank SWOT Analysis provides invaluable insights that can drive financial growth. By understanding their strengths, weaknesses, opportunities, and threats, savings banks can create targeted strategies that enhance their market position. The key lies in leveraging their unique advantages while effectively addressing challenges.

| Key Takeaways | Actions to Consider |

|---|---|

| Importance of SWOT | Conduct regular SWOT analyses |

| Strategic Planning | Implement actionable strategies for growth |

Now is the time to take action! Explore the strategies discussed and implement them in your savings bank for a brighter financial future.

Conclusion

In summary, a comprehensive Savings Bank SWOT Analysis offers invaluable insights that can guide savings banks toward achieving sustainable financial growth. By recognizing their strengths, addressing weaknesses, seizing opportunities, and mitigating threats, these institutions can develop effective strategies that enhance their market presence. For those looking to create a solid foundation for their savings bank, consider exploring the Savings Bank Business Plan Template.

Additionally, you might find these articles helpful in your journey:

- Savings Bank Profitability: Tips for Maximizing Revenue

- Savings Bank Business Plan: Essential Steps and Examples

- Building a Financial Plan for Your Savings Bank: A Comprehensive Guide (+ Template)

- How to Create a Savings Bank: Complete Guide and Examples

- Create a Marketing Plan for Your Savings Bank (+ Example)

- How to Begin a Business Model Canvas for a Savings Bank: Step-by-Step Guide

- Customer Segments for Savings Banks: Examples and Analysis

- How Much Does It Cost to Establish a Savings Bank?

- How to Start a Feasibility Study for Savings Bank?

- How to Build a Risk Management Plan for Savings Bank?

- How to Start a Competition Study for Savings Bank?

- What Legal Considerations Should You Be Aware of for Savings Bank?

- What Funding Options Should You Consider for Savings Bank?

- Savings Bank Growth Strategies: Scaling Guide

FAQ

What is a SWOT analysis?

A SWOT analysis is a strategic tool that helps organizations identify their strengths, weaknesses, opportunities, and threats to develop effective strategies.

Why is a SWOT analysis important for savings banks?

It allows savings banks to understand their market position and craft strategies for financial growth.

How can savings banks leverage their strengths?

By emphasizing their customer service and community involvement to attract and retain clients.

What common weaknesses do savings banks face?

Many savings banks struggle with limited resources and outdated technology.

What opportunities are available for savings banks?

The rise of digital banking offers significant opportunities for modernization and customer acquisition.

What threats do savings banks encounter?

Increased competition from both traditional banks and fintech companies poses a substantial challenge.

How can savings banks mitigate risks?

By developing strong risk management strategies and staying informed about market trends.

What strategies can lead to financial growth for savings banks?

Investing in technology and enhancing customer engagement are effective strategies.

Can you provide examples of successful savings banks?

Yes, analyzing case studies of banks that have adapted successfully can provide valuable insights.

What key recommendations should savings banks follow?

Prioritizing customer feedback and continuous improvement can lead to better financial performance.