The world of finance is more dynamic than ever, and the role of a Wealth Management Advisor is evolving rapidly. A Wealth Management Advisor SWOT Analysis can help uncover the strengths, weaknesses, opportunities, and threats that advisors face in this fast-paced industry. This analysis serves as a strategic tool for financial advisors to better understand their position in the market and to make informed decisions that will shape their future success. A staggering percentage of financial advisors still do not utilize a structured approach like SWOT analysis, which can be a game-changer in a competitive environment. By leveraging this analytical framework, advisors can gain a comprehensive overview of their business and develop strategies that are not just reactive but proactive in addressing market demands.

Here’s what you need to know about Wealth Management Advisor SWOT Analysis:

– A SWOT analysis provides a structured approach to evaluating a business’s internal and external environment.

– It helps identify strengths to leverage and weaknesses to address.

– Recognizing opportunities can lead to growth, while understanding threats can mitigate risks.

– This analysis can guide strategic planning and decision-making for wealth management firms.

Understanding SWOT Analysis in Wealth Management

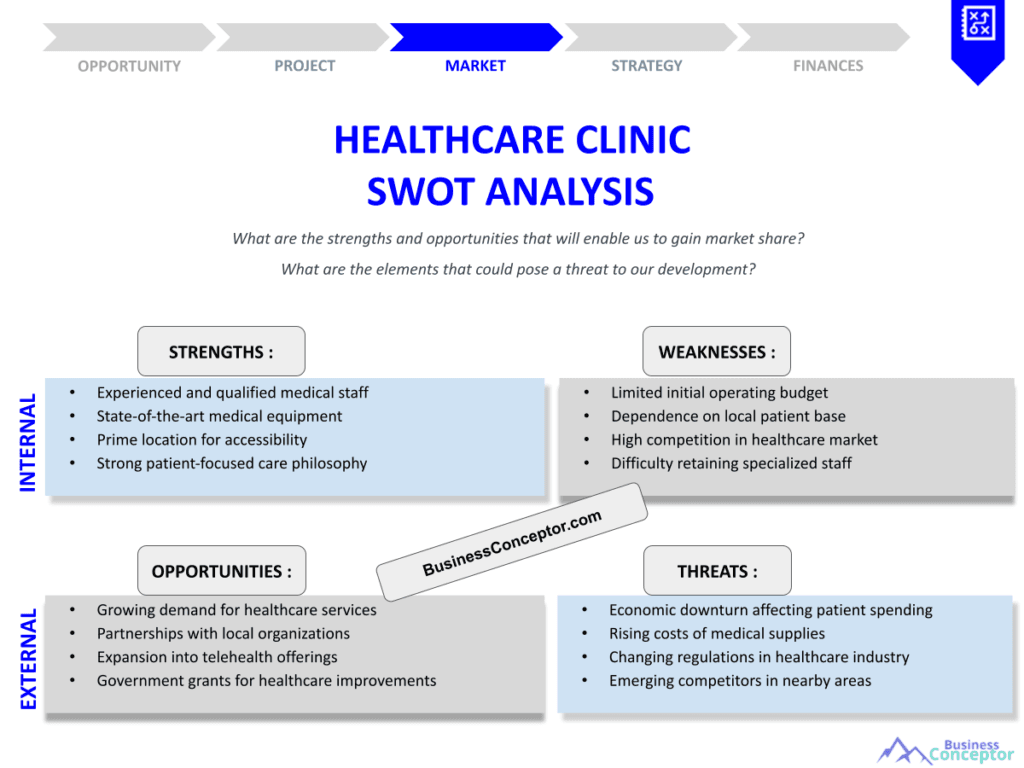

SWOT analysis is a powerful tool that allows Wealth Management Advisors to dissect their business landscape effectively. By evaluating strengths, weaknesses, opportunities, and threats, advisors can develop strategies that align with their goals and market demands. For instance, a firm known for its exceptional client service can capitalize on this strength by enhancing its referral network, thus bringing in more high-net-worth clients who value personalized attention. Such strengths not only attract new clients but also foster long-term relationships, which are crucial in wealth management.

In the wealth management sector, strengths might include a strong client base, unique investment strategies, or a well-recognized brand. An advisor with a history of consistently outperforming the market can leverage this strength to attract new clients. Moreover, having access to exclusive investment opportunities can set an advisor apart from competitors. On the flip side, weaknesses could include a lack of technological resources or a limited service offering. If an advisor doesn’t have a robust digital presence, they may struggle to compete with firms that do, especially as clients increasingly seek convenience and accessibility in their financial services.

The opportunities in wealth management could range from emerging market trends to technological advancements that streamline operations. For example, the rise of robo-advisors and digital investment platforms presents a significant opportunity for traditional advisors to enhance their service offerings. By integrating technology into their practices, advisors can offer more tailored solutions to clients, making their services more appealing. Threats, however, could come from increased competition, regulatory changes, or economic downturns that impact client investments. Understanding these threats is crucial for advisors to develop strategies that not only protect their business but also position them for growth.

| SWOT Component | Description |

|---|---|

| Strengths | Internal advantages that the advisor possesses, such as a strong reputation or unique investment strategies. |

| Weaknesses | Internal limitations that need addressing, like inadequate technological resources. |

| Opportunities | External factors that could lead to growth, such as emerging market trends. |

| Threats | External challenges that could impact success, like increased competition. |

- Identify your strengths and leverage them for competitive advantage.

- Address weaknesses to improve service delivery.

- Explore opportunities for growth in the evolving market.

- Stay vigilant about threats to mitigate risks.

“Success is where preparation and opportunity meet.” – Bobby Unser

Analyzing Strengths of Wealth Management Advisors

Every Wealth Management Advisor has a unique set of strengths that they can capitalize on to stand out in a competitive market. Recognizing and leveraging these strengths is essential for creating a sustainable business model. For instance, one of the most significant strengths an advisor can possess is a strong reputation built over years of providing exceptional service. This reputation can serve as a powerful marketing tool, as clients are more likely to trust someone who comes highly recommended by their peers. Additionally, an advisor with specialized knowledge in niche markets, such as retirement planning or tax-efficient investing, can attract clients who are looking for expert guidance in those areas.

Moreover, strong client relationships are another vital strength. Advisors who take the time to build trust and rapport with their clients often find that they not only retain these clients longer but also benefit from referrals. A personal connection can significantly enhance client loyalty, making clients more likely to return for additional services or to recommend the advisor to friends and family. For example, a financial advisor who provides personalized attention and tailors their services to fit individual client needs will likely see higher satisfaction rates and, consequently, a more robust client base.

Another aspect to consider is access to exclusive investment opportunities. Advisors who have established relationships with investment firms or have insights into unique market opportunities can offer their clients options that others may not be able to provide. This exclusivity can be a significant selling point, especially for high-net-worth clients who are seeking unique avenues for wealth growth. In this competitive landscape, advisors must continually assess their strengths and find ways to leverage them for maximum impact.

| Strengths | Examples |

|---|---|

| Reputation | Well-known for expertise in specific areas such as estate planning. |

| Client relationships | Long-term clients who trust the advisor and provide referrals. |

| Specialized knowledge | Expertise in niche markets like sustainable investing. |

| Access to unique investments | Opportunities not available to general advisors, attracting high-net-worth clients. |

- Build a strong personal brand to attract clients.

- Focus on relationship management to enhance client loyalty.

- Utilize specialized knowledge to differentiate from competitors.

“Your best asset is your own self. You bring value to the table.”

Identifying Weaknesses in Wealth Management Practices

Understanding weaknesses is crucial for Wealth Management Advisors looking to improve their services and strategies. Weaknesses can manifest in various forms, such as inadequate technological resources, limited service offerings, or a lack of marketing efforts. For instance, if an advisor is not utilizing the latest financial technology, they may struggle to compete with firms that offer advanced digital solutions. This could lead to inefficiencies in service delivery and client dissatisfaction, which can be detrimental to client retention. A financial advisor who fails to adapt to technological advancements may find themselves at a disadvantage, especially as clients increasingly demand seamless online interactions.

Moreover, a narrow focus on specific investment types can limit an advisor’s ability to meet diverse client needs. If an advisor specializes only in stocks, they may miss opportunities in bonds, real estate, or alternative investments that could benefit their clients. This lack of breadth can hinder growth and limit the advisor’s market reach. Additionally, advisors who do not invest in ongoing education may find themselves out of touch with emerging trends, such as sustainable investing or cryptocurrency, which are increasingly important to modern investors.

Weaknesses may also stem from insufficient marketing efforts. Advisors who do not actively promote their services may struggle to attract new clients. In today’s digital age, having a strong online presence is essential for reaching potential clients. A lack of visibility can hinder an advisor’s growth potential, making it imperative for them to invest in marketing strategies that effectively showcase their strengths and attract a broader audience.

| Weaknesses | Examples |

|---|---|

| Limited technology | Inefficient processes due to outdated systems, affecting client experience. |

| Narrow service offerings | Inability to meet diverse client needs across various investment types. |

| Insufficient marketing | Poor visibility and outreach to potential clients, limiting growth opportunities. |

- Invest in technology to enhance service efficiency and client experience.

- Broaden service offerings to attract a wider client base.

- Focus on marketing strategies to improve visibility and client acquisition.

“Mistakes are a fact of life. It is the response to the error that counts.” – Nikki Giovanni

Exploring Opportunities in Wealth Management

The wealth management landscape is filled with opportunities for those willing to adapt and innovate. For Wealth Management Advisors, identifying and leveraging these opportunities is essential for sustainable growth. One significant opportunity lies in the increasing demand for sustainable and socially responsible investing. Clients are becoming more aware of the impact their investments have on the world, and they often seek advisors who can guide them in aligning their portfolios with their values. By incorporating ESG (Environmental, Social, and Governance) criteria into investment strategies, advisors can attract a growing segment of clients who prioritize ethical considerations in their financial decisions.

Another area of opportunity is the technological advancements that are reshaping the wealth management industry. The rise of fintech solutions offers advisors the chance to enhance their service delivery through automation, data analytics, and improved client engagement tools. For instance, implementing customer relationship management (CRM) software can streamline communication and provide insights into client preferences, allowing advisors to offer more personalized services. This not only enhances the client experience but also improves operational efficiency, enabling advisors to focus more on strategic decision-making rather than administrative tasks.

Furthermore, the ongoing demographic shifts present opportunities for advisors to cater to an evolving client base. As younger generations, such as Millennials and Gen Z, begin to accumulate wealth, they are looking for advisors who understand their unique financial goals and challenges. By adapting their services to meet the needs of these younger clients—such as offering digital platforms for investment management—advisors can tap into a lucrative market that is often underserved. Understanding the preferences of these clients can also lead to innovative product offerings, such as flexible payment plans or education-focused investment workshops.

| Opportunities | Examples |

|---|---|

| Sustainable investing | Attracting clients interested in ESG criteria and socially responsible portfolios. |

| Technology integration | Utilizing CRM software for enhanced client engagement and operational efficiency. |

| Demographic shifts | Adapting services to meet the needs of younger generations accumulating wealth. |

- Stay updated on market trends to identify new opportunities.

- Embrace technology to improve service delivery and client satisfaction.

- Consider diversifying service offerings to meet the demands of younger clients.

“Opportunities don't happen. You create them.” – Chris Grosser

Recognizing Threats in Wealth Management

While opportunities abound, Wealth Management Advisors must also remain aware of potential threats that could impact their business. The competitive landscape is one of the most significant threats, with both traditional firms and fintech startups vying for market share. Advisors need to differentiate themselves to stand out in a crowded marketplace. This may involve developing a unique value proposition that highlights their specialized knowledge or exceptional client service. For example, an advisor who emphasizes personalized financial planning may attract clients who feel underserved by more automated solutions.

Regulatory changes pose another substantial threat. The financial industry is heavily regulated, and compliance requirements can change frequently. Advisors must stay informed about these changes to avoid penalties and maintain client trust. A failure to comply with regulations can not only result in financial repercussions but can also damage an advisor’s reputation, making it crucial for them to have a robust compliance strategy in place.

Economic fluctuations also represent a critical threat to wealth management practices. Market volatility can significantly affect investment performance, leading to client dissatisfaction if advisors do not manage expectations effectively. During economic downturns, advisors must be proactive in communicating with clients about market conditions and demonstrating how they are managing risk. This transparency can help build trust and maintain client relationships, even in challenging times. Additionally, advisors should consider developing contingency plans to address potential economic challenges, ensuring they are prepared to navigate turbulent waters.

| Threats | Examples |

|---|---|

| Increased competition | Emergence of new fintech solutions that offer lower fees. |

| Regulatory changes | New compliance requirements affecting operations and client interactions. |

| Economic downturns | Market volatility impacting investment returns and client satisfaction. |

- Monitor the competitive landscape to identify threats and adapt strategies.

- Stay informed about regulatory changes to ensure compliance and client trust.

- Implement proactive communication strategies to manage client expectations during economic fluctuations.

“In the middle of difficulty lies opportunity.” – Albert Einstein

Strategic Planning for Wealth Management Advisors

Effective strategic planning is essential for Wealth Management Advisors to navigate the complexities of the industry successfully. Conducting a thorough SWOT analysis enables advisors to identify actionable strategies that align with their strengths and address their weaknesses. For instance, an advisor with a strong reputation for client service can focus on expanding their referral network, thus bringing in new clients who value personalized attention. Leveraging existing strengths can lead to increased client acquisition and retention, which is crucial in a competitive market.

Moreover, strategic planning allows advisors to set clear, measurable goals. By establishing specific objectives, such as increasing assets under management by a certain percentage or expanding their service offerings, advisors can create a roadmap for achieving success. This focused approach not only enhances accountability but also provides a framework for evaluating progress. For example, an advisor might aim to add a new service, like estate planning, within a year, and track their progress through client feedback and performance metrics.

In addition to goal-setting, advisors should regularly revisit their SWOT analysis to adapt to changing market conditions. The financial landscape is constantly evolving, and what worked a year ago may no longer be effective. By staying agile and willing to adjust strategies, advisors can remain competitive and responsive to their clients’ needs. This iterative process ensures that advisors not only maintain their relevance in the market but also capitalize on new opportunities as they arise.

| Strategic Planning Steps | Description |

|---|---|

| Conduct SWOT analysis | Regularly assess strengths, weaknesses, opportunities, and threats to inform strategy. |

| Develop actionable strategies | Create specific plans to leverage strengths and address weaknesses effectively. |

| Monitor market trends | Stay updated on industry changes and client preferences to adapt strategies. |

- Use SWOT analysis as a dynamic tool for ongoing strategic planning.

- Adapt strategies based on market changes and client feedback.

- Foster a culture of continuous improvement within the advisory firm.

“Plans are nothing; planning is everything.” – Dwight D. Eisenhower

Implementing Change in Wealth Management Firms

Once strategies are developed, the next critical step is implementation. Wealth Management Advisors must create a clear roadmap for executing their plans effectively. This involves ensuring that all team members understand the strategic goals and their roles in achieving them. Effective communication is paramount; when everyone is on the same page, the chances of successful execution increase significantly. For instance, an advisor may hold regular team meetings to discuss progress and address any obstacles that may arise during implementation.

Training and development are also crucial during this phase. Advisors should invest in ongoing education to equip their teams with the skills necessary to adapt to new strategies. This could include workshops on the latest investment trends or training on new technologies that enhance service delivery. By fostering a culture of learning, advisors can empower their teams to excel in their roles and adapt to evolving client needs. For example, providing training on digital tools can help advisors improve client interactions and streamline operations.

Moreover, tracking progress is vital for ensuring that the implemented strategies are effective. Advisors should establish metrics to measure the success of their strategies and make adjustments as needed. Regular reviews and feedback loops will help ensure that the firm remains on track to achieve its objectives. For instance, if an advisor finds that a new marketing strategy is not yielding the expected results, they can quickly pivot and explore alternative approaches. This adaptability not only enhances the firm’s resilience but also reinforces the importance of continuous improvement in the wealth management landscape.

| Implementation Steps | Description |

|---|---|

| Communicate clearly | Ensure all team members understand the strategic goals and their roles. |

| Invest in training | Provide ongoing education to enhance skills and adapt to new strategies. |

| Monitor progress | Use metrics to track success and make necessary adjustments. |

- Foster a culture of open communication during implementation.

- Encourage team collaboration to enhance strategy execution.

- Regularly review progress to stay aligned with goals.

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.” – Socrates

Measuring Success in Wealth Management

Measuring success is essential for Wealth Management Advisors to evaluate the effectiveness of their strategies and to ensure that they are meeting their clients’ needs. Establishing key performance indicators (KPIs) is a fundamental step in this process. Advisors should select KPIs that align with their specific goals and objectives, such as client retention rates, assets under management, or growth in new client acquisitions. These metrics provide a clear picture of how well the firm is performing and highlight areas that may need improvement.

For example, a financial advisor might track client retention rates to understand how satisfied their clients are with the services provided. A high retention rate indicates that clients are happy and trust the advisor, while a low retention rate may signal issues that need addressing, such as communication gaps or dissatisfaction with investment performance. Similarly, monitoring assets under management can help advisors gauge their business growth. If this metric is increasing, it suggests that clients are confident in the advisor’s ability to manage their investments effectively.

Regularly reviewing these metrics not only provides insights into what is working but also allows advisors to make data-driven decisions. For instance, if an advisor notices that a particular marketing strategy is leading to a high number of new clients, they can allocate more resources to that strategy to maximize its effectiveness. On the other hand, if certain services are underperforming, the advisor can reevaluate those offerings and make necessary adjustments to better meet client expectations. This proactive approach to measuring success fosters a culture of continuous improvement and helps advisors stay competitive in a constantly evolving market.

| Measuring Success Metrics | Description |

|---|---|

| Client retention rates | Percentage of clients retained over time, indicating satisfaction and trust. |

| Assets under management | Total value of client assets managed, reflecting business growth. |

| New client acquisitions | Growth in the number of new clients, showcasing effective marketing efforts. |

- Establish clear KPIs to measure success and performance.

- Regularly review metrics to evaluate strategy effectiveness.

- Gather client feedback to inform future improvements and service offerings.

“What gets measured gets managed.” – Peter Drucker

Adapting to Change in Wealth Management

The wealth management industry is continuously evolving, and Wealth Management Advisors must be prepared to adapt to change. This adaptability is crucial for maintaining relevance and competitiveness in a landscape that is influenced by technological advancements, regulatory shifts, and changing client preferences. Staying informed about industry trends and emerging technologies is vital for advisors who want to provide cutting-edge services that meet the needs of their clients.

For instance, the rise of digital platforms and robo-advisors has transformed how clients interact with their investments. Advisors who embrace these technologies can enhance their service delivery and improve client engagement. Implementing digital tools, such as client portals or mobile apps, allows clients to access their accounts easily, track performance, and communicate with their advisors in real time. This level of accessibility and transparency can significantly boost client satisfaction and loyalty.

Moreover, fostering a culture of continuous learning within the firm is essential for adapting to change. Advisors should encourage team members to pursue professional development opportunities, such as certifications or workshops, to stay updated on industry best practices and emerging trends. This investment in education not only enhances the skill set of the team but also positions the firm as a knowledgeable and trustworthy resource for clients. By prioritizing adaptability and learning, advisors can navigate the complexities of the wealth management landscape and seize new opportunities as they arise.

| Adapting to Change Strategies | Description |

|---|---|

| Stay informed | Keep up with industry trends and developments to anticipate changes. |

| Embrace technology | Integrate new tools to enhance service delivery and client experience. |

| Foster continuous learning | Encourage professional development for team members to ensure competitiveness. |

- Stay proactive in seeking out industry knowledge and advancements.

- Embrace new technologies to improve efficiency and client satisfaction.

- Foster a culture of learning and adaptability within the firm.

“Change is the law of life. And those who look only to the past or present are certain to miss the future.” – John F. Kennedy

Recommendations

In summary, conducting a Wealth Management Advisor SWOT Analysis is essential for understanding the strengths, weaknesses, opportunities, and threats that impact the wealth management business. By leveraging this analytical framework, advisors can develop effective strategies that align with their goals and client needs. For those looking to formalize their approach, consider using the Wealth Management Advisor Business Plan Template, which offers a comprehensive guide to creating a robust business plan tailored specifically for wealth management.

Additionally, we have several articles related to the Wealth Management Advisor field that can provide further insights and valuable tips:

- Wealth Management Advisors: Profitability Tips

- Wealth Management Advisor Business Plan: Template and Tips

- Wealth Management Advisor Financial Plan: Step-by-Step Guide with Template

- How to Start a Wealth Management Advisor Business: A Detailed Guide with Examples

- Crafting a Marketing Plan for Your Wealth Management Advisor Business (+ Example)

- Create a Business Model Canvas for Wealth Management Advisor: Examples and Tips

- Customer Segments for Wealth Management Advisors: Examples and Analysis

- How Much Does It Cost to Start a Wealth Management Advisor Business?

- Travel Agency Feasibility Study: Detailed Analysis

- Travel Agency Risk Management: Detailed Analysis

- How to Analyze Competition for Wealth Management Advisor?

- How to Address Legal Considerations in Wealth Management Advisor?

- Wealth Management Advisor Funding Options: Expert Insights

- Wealth Management Advisor Growth Strategies: Scaling Success Stories

FAQ

What is a Wealth Management Advisor SWOT Analysis?

A Wealth Management Advisor SWOT Analysis is a strategic tool that helps advisors evaluate their internal strengths and weaknesses, as well as external opportunities and threats. This analysis allows advisors to understand their market position and develop strategies that enhance their service offerings and client satisfaction.

What are the strengths of a Wealth Management Advisor?

The strengths of a Wealth Management Advisor can include a solid reputation, strong client relationships, specialized knowledge in certain investment areas, and access to exclusive investment opportunities. These strengths can help advisors attract and retain clients, thus enhancing their business growth.

How can weaknesses be addressed in Wealth Management?

Weaknesses such as limited technological resources or narrow service offerings can be addressed by investing in technology upgrades, expanding service lines, and providing ongoing training for staff. By doing so, advisors can improve efficiency and better meet the diverse needs of their clients.

What opportunities exist for Wealth Management Advisors?

Opportunities for Wealth Management Advisors include the growing demand for sustainable investing, advancements in technology that enhance service delivery, and the ability to cater to younger generations who are accumulating wealth. Advisors can leverage these trends to attract new clients and expand their services.

What threats do Wealth Management Advisors face?

Threats include increased competition from both traditional firms and fintech startups, regulatory changes that could impact operations, and economic fluctuations that can affect investment performance. Advisors must stay informed and adaptable to navigate these challenges effectively.

How can success be measured in Wealth Management?

Success in Wealth Management can be measured through key performance indicators (KPIs) such as client retention rates, assets under management, and the growth of new client acquisitions. Regularly reviewing these metrics allows advisors to assess their performance and make informed decisions to improve their business strategies.

Why is adapting to change important for Wealth Management Advisors?

Adapting to change is crucial for Wealth Management Advisors because the industry is constantly evolving due to technological advancements, regulatory shifts, and changing client preferences. Staying flexible and informed enables advisors to remain competitive and responsive to their clients’ needs.