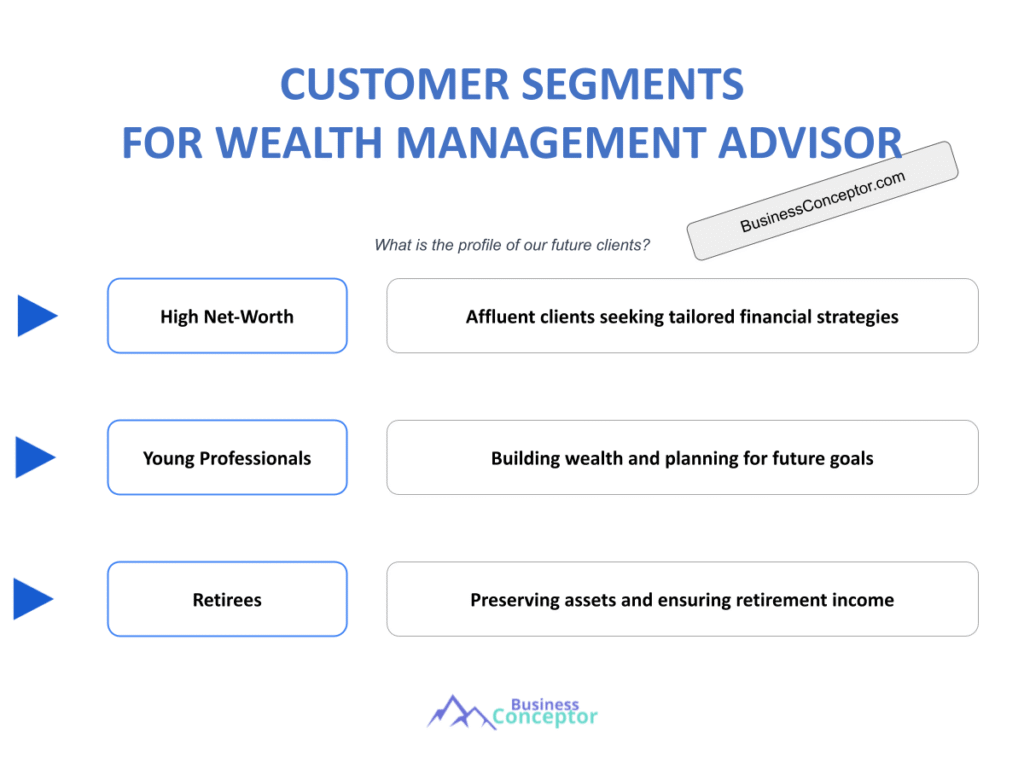

Wealth Management Advisor Customer Segments are crucial for financial advisors who want to effectively tailor their services to meet diverse client needs. Understanding these segments allows advisors to provide personalized strategies that align with clients’ financial goals and preferences. For instance, did you know that affluent individuals often have different investment behaviors compared to high-net-worth clients? This distinction is key in developing effective wealth management strategies. In this article, we will delve into various customer segments, examining their unique characteristics and how advisors can leverage this knowledge to enhance client satisfaction and retention.

Here are some key points to consider:

- Wealth management client segmentation helps in customizing financial services.

- Different customer segments have unique financial goals and risk tolerances.

- Understanding client segments leads to stronger relationships and increased satisfaction.

Types of Wealth Management Customers

In the world of wealth management, recognizing the types of wealth management customers is essential. The process of wealth management client segmentation allows advisors to tailor their strategies effectively. For example, affluent clients typically possess substantial disposable income and seek investment advice that aligns with their lifestyle and financial aspirations. They often focus on building wealth through traditional investment avenues, such as stocks, bonds, and mutual funds. On the other hand, high-net-worth clients (HNWIs) require more sophisticated financial planning services due to their complex financial situations, which may include estate planning, tax optimization, and philanthropic endeavors.

For instance, consider an affluent client who is interested in purchasing a vacation home. This client may seek advice on how to finance the property while maintaining a balanced investment portfolio. In contrast, a high-net-worth client might approach their wealth management advisor with a desire to set up a family trust to ensure their wealth is passed down efficiently to future generations. By understanding these distinctions, advisors can provide tailored advice that resonates with each client’s unique circumstances.

Furthermore, understanding the differences between these segments helps advisors anticipate the services their clients may require. For example, affluent clients might benefit from basic investment strategies and retirement planning, while high-net-worth clients might need advanced estate planning and risk management strategies. By effectively identifying these client needs, advisors can enhance their service offerings, fostering long-term relationships built on trust and satisfaction.

| Customer Type | Key Characteristics |

|---|---|

| Affluent Clients | Seeking personalized advice, often focused on lifestyle and growth. |

| High-Net-Worth Clients | Require sophisticated strategies and risk management tailored to complex financial needs. |

| Ultra-High-Net-Worth Clients | Demand bespoke services and family office arrangements for comprehensive wealth management. |

Understanding your client’s unique needs is the first step to success in wealth management! 💡 This knowledge allows advisors to tailor their services effectively, resulting in better client engagement and satisfaction. By recognizing the distinct characteristics of each segment, advisors can position themselves as trusted partners in their clients’ financial journeys, ultimately leading to improved outcomes and long-lasting relationships.

Affluent vs. High-Net-Worth Clients

When discussing the differences between affluent clients and high-net-worth clients (HNWIs), it’s essential to understand how these distinctions impact their financial needs and expectations. Affluent clients typically have investable assets ranging from $100,000 to $1 million. They often seek guidance on basic financial planning, investment diversification, and retirement strategies. In contrast, high-net-worth clients possess assets exceeding $1 million and require more sophisticated financial planning services, including estate planning, tax strategies, and complex investment vehicles.

Understanding these differences allows wealth management advisors to tailor their services effectively. For instance, affluent clients might be more interested in setting up a diversified investment portfolio that balances risk and growth potential. They could benefit from advice on mutual funds, ETFs, and retirement accounts that align with their lifestyle goals. On the other hand, high-net-worth clients often have more intricate financial needs. They might seek strategies for wealth preservation, tax efficiency, and legacy planning. For example, a high-net-worth individual might be interested in setting up a family trust to manage their assets and minimize estate taxes.

By recognizing these needs, advisors can create personalized strategies that resonate with each client segment. For example, an advisor might recommend a mix of traditional investments for an affluent client while suggesting alternative investments, such as private equity or hedge funds, for a high-net-worth client. This tailored approach not only enhances client satisfaction but also fosters long-term relationships built on trust and understanding.

| Client Type | Typical Needs |

|---|---|

| Affluent Clients | Basic investment strategies and retirement planning tailored to lifestyle goals. |

| High-Net-Worth Clients | Advanced estate planning, tax strategies, and risk management tailored to complex needs. |

By effectively catering to the unique requirements of each segment, advisors can differentiate their services and position themselves as trusted financial partners. This understanding can lead to better engagement and retention rates, as clients feel their specific financial goals are being addressed. The more tailored the advice, the more likely clients are to remain loyal to their advisors.

Generational Wealth Preferences

Generational wealth preferences are reshaping the landscape of wealth management. Different generations approach investing and financial planning with distinct values and priorities. For instance, younger generations, such as Millennials and Gen Z, tend to prioritize sustainability and social responsibility in their investment choices. They often seek to invest in companies that align with their values, such as those focused on ESG (Environmental, Social, and Governance) criteria.

In contrast, older generations, like Baby Boomers, often focus on wealth preservation and retirement planning. They typically prefer traditional investment vehicles and seek advice on how to maintain their wealth during retirement. For example, a Baby Boomer might prioritize annuities and fixed-income investments to ensure a steady income stream during retirement. Understanding these generational preferences allows wealth management advisors to tailor their strategies accordingly.

For instance, an advisor working with Millennial clients may incorporate ESG investment options into their portfolios, emphasizing the importance of social responsibility. They might also utilize technology-driven platforms that allow for easy access to investment information and real-time portfolio tracking. On the other hand, an advisor working with Baby Boomers might focus on comprehensive retirement planning, including strategies for healthcare costs and estate planning.

| Generation | Investment Preferences |

|---|---|

| Baby Boomers | Focus on retirement and wealth preservation through traditional investments. |

| Millennials | Interested in ESG and socially responsible investing that aligns with their values. |

| Gen Z | Seeking tech-driven financial solutions and investment options. |

By understanding these generational differences, advisors can create more effective communication strategies and service offerings. For example, engaging Millennials through social media and digital marketing can enhance connection and build trust. For Baby Boomers, providing detailed reports and personal consultations can foster a sense of security and reliability. Ultimately, adapting to the unique preferences of each generation can lead to stronger relationships and higher client satisfaction.

The Role of Technology in Client Segmentation

In today’s digital landscape, the role of technology in client segmentation for wealth management has become increasingly vital. Advisors are leveraging advancements in AI and data analytics to better understand their clients’ preferences and behaviors. This technological integration allows for a more personalized approach to wealth management, which can significantly enhance client satisfaction and engagement.

For example, AI-driven tools can analyze large datasets to identify trends and patterns in client behavior. This enables advisors to segment their clients more effectively based on various factors such as investment preferences, risk tolerance, and financial goals. By utilizing these insights, advisors can tailor their recommendations and create customized financial plans that resonate with each client segment. For instance, an advisor might discover that a segment of their clients is particularly interested in impact investing, prompting them to develop a specialized portfolio that aligns with these values.

Moreover, technology enhances communication between advisors and clients. Digital platforms allow for real-time updates and interactive tools that make it easier for clients to track their investments and engage with their advisors. This level of transparency fosters trust and strengthens the advisor-client relationship. For example, providing clients with a user-friendly app that showcases their portfolio performance can enhance their confidence in the advisor’s management. As a result, clients are more likely to remain loyal and refer others to the advisor.

| Technology Use | Benefits |

|---|---|

| AI in Client Analysis | Helps identify investment patterns and preferences, enabling tailored strategies. |

| Digital Platforms | Enhance communication and provide clients with real-time updates on their portfolios. |

By embracing technology, wealth management advisors can not only improve their service offerings but also gain a competitive edge in the market. As clients increasingly expect personalized experiences, those advisors who leverage technology to meet these demands will stand out. Ultimately, this can lead to increased client retention and satisfaction, as well as a more robust client base.

Diversity in Financial Advising

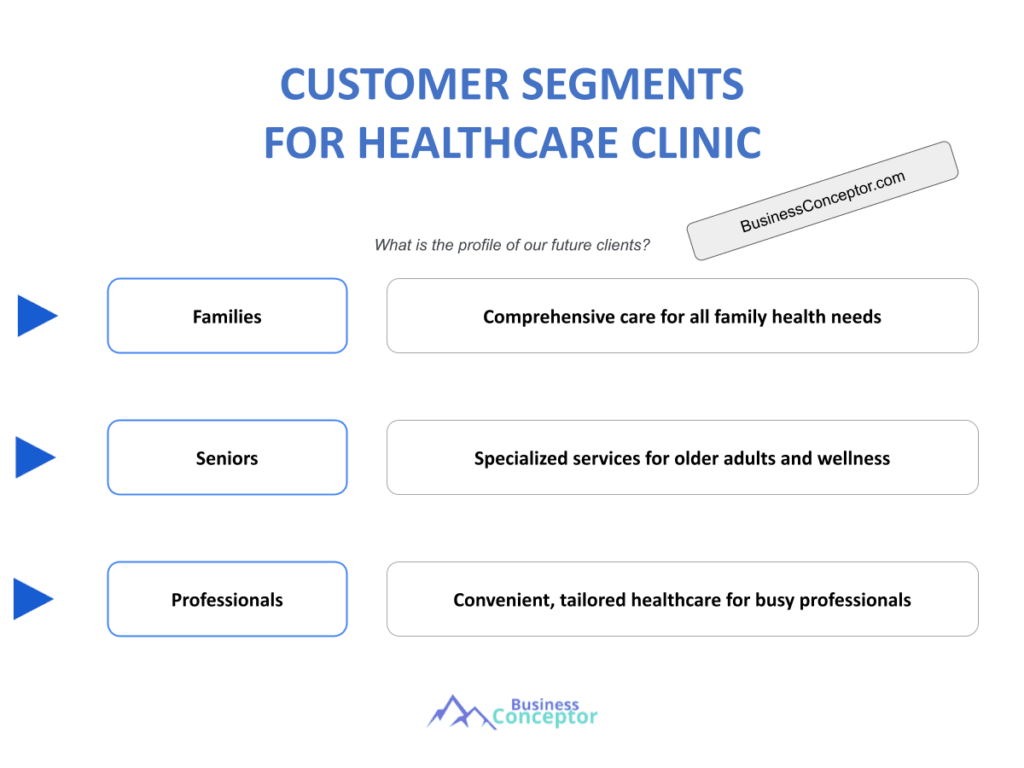

Diversity in financial advising is becoming more important than ever. As the demographics of clients evolve, wealth management firms must recognize the need to cater to a diverse clientele. This includes understanding the unique financial needs of different ethnicities, genders, and backgrounds. By embracing diversity, advisors can provide more inclusive services that resonate with a broader audience.

For example, women are increasingly becoming key players in wealth management. They often have different financial priorities compared to their male counterparts, such as focusing on family planning, career transitions, and retirement savings. Advisors who understand these specific needs can tailor their services to better meet the expectations of female clients. Offering workshops or seminars that address women’s financial concerns can significantly enhance engagement and build trust.

Furthermore, diversity in financial advising can also lead to improved decision-making. A team with diverse backgrounds can bring various perspectives and insights, resulting in more innovative solutions for clients. For instance, advisors from different cultural backgrounds may have unique insights into how cultural values influence financial decisions. This understanding can be instrumental in creating customized financial plans that align with clients’ beliefs and practices.

| Diversity Aspect | Importance |

|---|---|

| Gender | Women often have different financial priorities and goals that need to be addressed. |

| Ethnicity | Cultural backgrounds influence financial decisions and investment preferences. |

By fostering a diverse and inclusive environment, wealth management firms can attract a wider range of clients and enhance their overall service offerings. This not only helps in meeting the needs of diverse clients but also positions the firm as a leader in the industry. As clients feel understood and valued, they are more likely to remain loyal and recommend the firm to others.

In summary, embracing diversity in financial advising is not just a trend; it’s a necessity for successful wealth management. By understanding the unique financial needs of various demographic groups, advisors can create more personalized and effective strategies that lead to enhanced client satisfaction and long-term relationships.

Emerging Affluent Market Trends

The emerging affluent market is a segment that wealth management advisors should not overlook. This group includes individuals who are beginning to accumulate wealth but may not yet be classified as high-net-worth clients. They often seek guidance on how to manage their growing assets effectively, and their needs can differ significantly from those of more established clients.

One of the key characteristics of the emerging affluent is their desire for financial education. Many of these individuals are young professionals who are just starting their careers and are eager to learn about investing, retirement planning, and wealth accumulation strategies. Advisors who can provide educational resources, such as workshops or online seminars, can effectively engage this demographic. By offering valuable insights into investment options, tax strategies, and financial planning, advisors can establish themselves as trusted sources of information and guidance.

Additionally, technology plays a significant role in reaching the emerging affluent. This demographic is typically tech-savvy and prefers digital platforms for managing their finances. Wealth management firms that utilize user-friendly apps and online tools to facilitate communication and portfolio tracking can attract these clients. For example, providing an interactive platform that allows clients to view their investments in real-time can enhance their experience and foster loyalty. As these clients see their wealth grow and understand their financial landscape better, they are more likely to remain engaged and committed to their financial advisor.

| Market Segment | Characteristics |

|---|---|

| Emerging Affluent | Individuals beginning to accumulate wealth, seeking guidance on financial management. |

| Tech-Savvy | Prefer digital platforms for managing finances and accessing financial information. |

By focusing on the emerging affluent market, wealth management advisors can tap into a growing client base and position themselves for long-term success. As these clients build their wealth, they will likely transition into higher net-worth categories, creating opportunities for advisors to deepen their relationships and expand their services. This proactive approach not only enhances client acquisition but also fosters a sense of loyalty, as clients appreciate the personalized attention and educational resources provided by their advisors.

Custom Portfolio Management Services

Custom portfolio management services are essential for meeting the diverse needs of different client segments. In an era where personalization is key, wealth management advisors must create tailored investment strategies that align with each client’s financial goals and risk tolerance. This approach is particularly beneficial for clients who have specific preferences or unique financial situations.

For instance, a young professional may prefer a growth-oriented portfolio that emphasizes equities and emerging market investments, seeking higher returns to accelerate their wealth accumulation. On the other hand, a retiree may prioritize income generation and stability, opting for a portfolio that includes fixed-income securities and dividend-paying stocks. By understanding these varying preferences, advisors can craft portfolios that resonate with their clients, enhancing satisfaction and retention.

Moreover, the ability to provide custom portfolio management services allows advisors to differentiate themselves in a competitive market. Clients are increasingly seeking personalized experiences, and those advisors who can offer tailored solutions are more likely to attract and retain clients. Additionally, custom portfolios can adapt over time as clients’ financial situations and goals evolve. For example, an advisor might adjust a client’s investment strategy based on changes in their life circumstances, such as marriage, children, or retirement.

| Service Type | Target Client Type |

|---|---|

| Growth-Oriented Portfolios | Young professionals seeking higher returns and capital appreciation. |

| Income-Generating Portfolios | Retirees focused on stable income and wealth preservation. |

Ultimately, by offering custom portfolio management services, advisors can build stronger relationships with their clients, leading to increased loyalty and satisfaction. Clients who feel that their unique financial needs are being addressed are more likely to remain engaged and refer others to their advisor. This personalized approach not only enhances the client experience but also contributes to the advisor’s long-term success in the wealth management industry.

The Future of Wealth Management

The future of wealth management holds exciting opportunities for advisors who are prepared to adapt to changing market dynamics and client needs. As the financial landscape continues to evolve, understanding wealth management advisor customer segments will be crucial in developing effective strategies that resonate with a diverse clientele. This adaptability will be key to not only attracting new clients but also retaining existing ones in an increasingly competitive environment.

One of the most significant trends shaping the future of wealth management is the increasing demand for personalized services. Clients today are not just looking for investment options; they want tailored solutions that reflect their individual goals, values, and lifestyles. This is particularly true for younger generations, such as Millennials and Gen Z, who prioritize social responsibility and sustainability in their investment choices. Advisors who can incorporate ESG (Environmental, Social, and Governance) criteria into their portfolios will be better positioned to meet the expectations of these clients.

Furthermore, advancements in technology are transforming how wealth management services are delivered. The rise of digital wealth management platforms and robo-advisors is making financial services more accessible and affordable. These platforms allow clients to manage their investments online, offering convenience and transparency. However, while technology can enhance client experiences, the human touch remains irreplaceable. Advisors who can effectively blend technology with personal interactions will stand out in this evolving landscape. For instance, using data analytics to understand client behavior while still providing personalized advice can create a winning combination.

| Future Trends | Implications |

|---|---|

| Personalized Services | Clients seek tailored solutions reflecting individual goals and values. |

| Technology Integration | Enhances client experience and makes services more accessible. |

Moreover, the increasing focus on financial literacy presents an opportunity for advisors to educate their clients. As individuals become more aware of the importance of financial planning and investment strategies, advisors can position themselves as educators and trusted partners. Offering workshops, webinars, and informative content can not only attract new clients but also empower existing clients to make informed financial decisions. This educational approach fosters trust and strengthens the advisor-client relationship.

Conclusion: Embracing Change in Wealth Management

In summary, the wealth management industry is on the brink of significant transformation. As client expectations evolve, advisors must be willing to embrace change and adapt their strategies accordingly. By focusing on personalized services, leveraging technology, and enhancing financial literacy, advisors can better serve their clients and position themselves for success in a competitive landscape.

As the market continues to shift, those who remain proactive and responsive to client needs will thrive. The future of wealth management is not just about managing assets; it’s about building relationships, understanding diverse client segments, and providing solutions that align with individual values and goals. Advisors who recognize and adapt to these trends will not only secure their place in the industry but also create lasting impacts on their clients’ financial journeys.

Ultimately, the key to thriving in the future of wealth management lies in understanding the diverse customer segments and tailoring services to meet their unique needs. By doing so, advisors can build stronger relationships, enhance client satisfaction, and ensure long-term success in an ever-evolving financial landscape.

Recommendations

In summary, understanding wealth management advisor customer segments is crucial for delivering tailored services that meet the diverse needs of clients. By leveraging technology, embracing diversity, and focusing on personalized strategies, advisors can enhance client satisfaction and foster long-term relationships. To support your journey as a wealth management advisor, consider using the Wealth Management Advisor Business Plan Template, which offers a comprehensive framework to help you establish and grow your business.

Additionally, we invite you to explore more articles related to Wealth Management Advisors that can provide valuable insights and guidance:

- Article 1 on Wealth Management Advisor SWOT Analysis Essentials

- Article 2 on Wealth Management Advisors: Profitability Tips

- Article 3 on Wealth Management Advisor Business Plan: Template and Tips

- Article 4 on Wealth Management Advisor Financial Plan: Step-by-Step Guide with Template

- Article 5 on How to Start a Wealth Management Advisor Business: A Detailed Guide with Examples

- Article 6 on Crafting a Marketing Plan for Your Wealth Management Advisor Business (+ Example)

- Article 7 on Create a Business Model Canvas for Wealth Management Advisor: Examples and Tips

- Article 8 on How Much Does It Cost to Start a Wealth Management Advisor Business?

- Article 9 on Travel Agency Feasibility Study: Detailed Analysis

- Article 10 on Travel Agency Risk Management: Detailed Analysis

- Article 11 on How to Analyze Competition for Wealth Management Advisor?

- Article 12 on How to Address Legal Considerations in Wealth Management Advisor?

- Article 13 on Wealth Management Advisor Funding Options: Expert Insights

- Article 14 on Wealth Management Advisor Growth Strategies: Scaling Success Stories

FAQ

What are the different types of wealth management customers?

The types of wealth management customers generally include affluent clients, high-net-worth clients (HNWIs), and ultra-high-net-worth clients (UHNWIs). Each segment has unique financial needs and expectations, making it essential for advisors to tailor their services accordingly. Affluent clients typically seek basic investment advice, while HNWIs require more sophisticated strategies involving estate planning and tax optimization.

How do generational preferences impact wealth management?

Generational wealth preferences significantly influence how clients approach financial planning and investing. For instance, younger generations, like Millennials and Gen Z, prioritize socially responsible investing and sustainability. In contrast, older generations, such as Baby Boomers, often focus on wealth preservation and retirement planning. Understanding these differences allows advisors to cater to the specific values and goals of each generation.

What role does technology play in wealth management?

Technology plays a pivotal role in wealth management by enabling advisors to analyze client data, automate processes, and enhance communication. Tools such as AI and digital platforms allow for better client segmentation and personalized services. Advisors who leverage these technologies can provide a more engaging experience, fostering client loyalty and satisfaction.

Why is diversity important in financial advising?

Diversity in financial advising is crucial as it allows firms to address the unique financial needs of various demographic groups. A diverse team can bring different perspectives and insights, resulting in more innovative solutions for clients. By understanding cultural and gender-specific financial priorities, advisors can create tailored strategies that resonate with a broader audience.

What are the benefits of custom portfolio management services?

Custom portfolio management services enable advisors to create tailored investment strategies that align with individual client goals and risk tolerances. This personalized approach enhances client satisfaction and retention, as clients feel their unique financial needs are being addressed. Furthermore, as clients’ financial situations evolve, advisors can adjust these portfolios to ensure continued alignment with their goals.