Did you know that the waterpark industry generates over $2 billion annually in the United States alone? This staggering figure highlights the immense potential for success in this sector. However, to tap into this lucrative market, crafting a robust waterpark financial plan is absolutely crucial. A waterpark financial plan outlines the necessary steps and strategies to manage expenses, forecast revenues, and ultimately drive profitability. By laying down a solid foundation, you can ensure that your waterpark thrives in a competitive landscape.

- Importance of a financial plan for waterparks

- Key components of a waterpark financial plan

- Steps to create a financial plan

- Example of a successful waterpark financial plan

- Common pitfalls to avoid in financial planning

- Tools and resources for financial management

- Importance of market research and analysis

- Revenue streams to consider for your waterpark

- How to manage operating costs effectively

- Final thoughts on financial sustainability

Understanding the Basics of a Waterpark Financial Plan

Crafting a financial plan for your waterpark is more than just a spreadsheet filled with numbers. It’s about understanding the unique aspects of the waterpark industry, including seasonal fluctuations, customer demographics, and operational costs. A well-thought-out waterpark financial plan serves as a roadmap that guides you through the complexities of running a waterpark, ensuring you allocate resources effectively and make informed decisions.

For instance, consider the various expenses involved in running a waterpark, from staffing and maintenance to utilities and insurance. Knowing how to budget for these costs can mean the difference between a thriving business and one that struggles to stay afloat. Moreover, understanding your target audience can help tailor your offerings and pricing, ultimately boosting your revenue.

In summary, having a solid grasp of what goes into a waterpark financial plan is essential for long-term success. As we move forward, we’ll dive deeper into specific components and strategies that will help you create a comprehensive financial plan.

| Key Components | Description |

|---|---|

| Importance of Financial Plan | Guides resource allocation |

| Key Expenses | Staffing, maintenance, utilities |

| Target Audience | Helps tailor offerings and pricing |

- Understanding the waterpark industry

- Importance of budgeting

- Target audience insights

- Revenue vs. expenses

- Long-term planning

- "A financial plan is a roadmap to success."

Steps to Create a Comprehensive Financial Plan

The first step in crafting your waterpark financial plan is conducting thorough market research. Understanding your competitors, customer preferences, and industry trends will provide valuable insights that shape your strategy. Market research informs your pricing structure, promotional strategies, and operational decisions, ensuring you stay competitive.

Statistics show that waterparks that invest in market research see a 15% increase in customer satisfaction and retention. By identifying gaps in the market, you can tailor your offerings to meet customer needs better. For example, if your research reveals a demand for family-friendly attractions, you can prioritize those in your planning.

After conducting market research, the next logical step is to outline your revenue streams. Identifying all potential income sources, such as ticket sales, food and beverage, and merchandise, will provide a clearer picture of your financial outlook. This leads us to the importance of forecasting in your financial plan.

- Conduct market research

- Identify revenue streams

- Outline operating costs

- Create financial projections

- Develop a budget

- The above steps must be followed rigorously for optimal success.

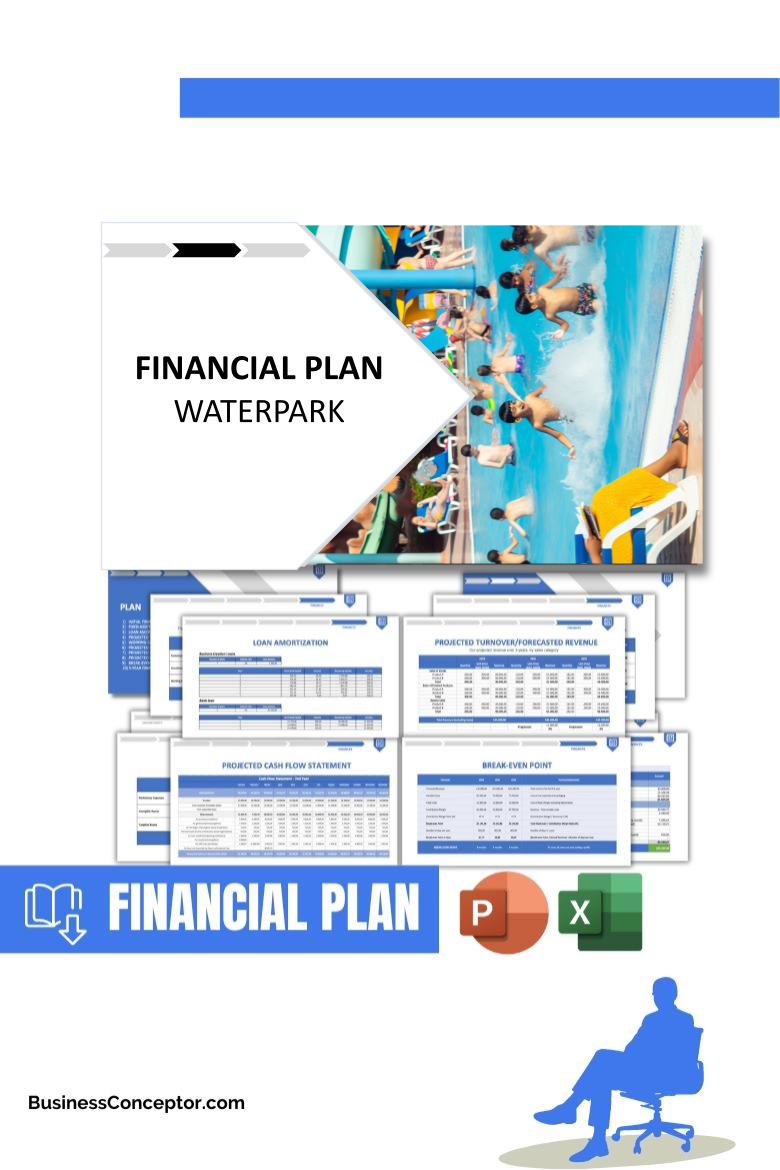

Financial Projections and Budgeting

Once you have a solid understanding of the market and your potential revenue streams, it’s time to create financial projections. This involves estimating future revenues and expenses based on historical data, market trends, and your planned offerings. Financial projections should cover at least three years and include various scenarios to account for uncertainties.

A unique approach to financial projections involves creating different scenarios, such as best-case, worst-case, and most likely. This allows you to prepare for potential challenges and adjust your strategy accordingly. For example, if you anticipate a rainy season affecting visitor numbers, having a contingency plan can help mitigate losses.

With accurate financial projections, you can develop a detailed budget that outlines your expected income and expenses. This budget will guide your financial decisions and help you track your performance over time. Now, let’s discuss how to manage your operating costs effectively.

| Key Components | Description |

|---|---|

| Importance of Accurate Financial Projections | Guides budgeting and operational decisions |

| Scenario Planning | Prepares for uncertainties |

| Creating a Detailed Budget | Outlines expected income and expenses |

- Importance of accurate financial projections

- Scenario planning for uncertainties

- Creating a detailed budget

- Tracking performance over time

- Adjusting strategy based on data

- "Good budgeting is the foundation of financial health."

Managing Operating Costs Effectively

Managing operating costs is crucial for maintaining profitability in your waterpark. This involves identifying all expenses associated with running your park, including utilities, maintenance, staffing, and marketing. By keeping a close eye on these costs, you can make informed decisions that enhance efficiency and reduce waste.

For instance, investing in energy-efficient equipment can significantly lower your utility bills over time. Additionally, scheduling regular maintenance can prevent costly repairs down the line. Understanding your operating costs not only helps with budgeting but also plays a vital role in pricing your offerings competitively.

By continuously monitoring and optimizing your operating costs, you can ensure your waterpark remains profitable even during slower seasons. This brings us to the next section, where we’ll explore strategies for maximizing revenue.

| Key Operating Costs | Strategies for Management |

|---|---|

| Utilities | Invest in energy-efficient equipment |

| Maintenance | Schedule regular checks |

| Staffing | Optimize staff scheduling |

- Identifying all operating costs

- Investing in efficiency

- Regular maintenance practices

- Pricing strategies

- Monitoring for continuous improvement

- "Effective cost management is key to success."

Maximizing Revenue Streams

To achieve financial success, it’s essential to explore various revenue streams beyond just ticket sales. While admission fees are significant, ancillary revenue sources can provide a substantial boost to your bottom line. These may include food and beverage sales, merchandise, and special events.

For example, many successful waterparks host seasonal events or themed nights that attract more visitors and create additional revenue opportunities. By diversifying your revenue streams, you not only enhance customer experience but also create a buffer against fluctuations in ticket sales.

As you develop your strategies for maximizing revenue, remember to continuously analyze their effectiveness. This ensures you’re making the most of your offerings and adapting to changing consumer preferences. Next, we’ll discuss the importance of financial risk management.

| Revenue Streams | Description |

|---|---|

| Ticket Sales | Primary income source |

| Food and Beverage | High-margin additional revenue |

| Special Events | Seasonal promotions for extra income |

- Exploring ancillary revenue streams

- Hosting events for increased attendance

- Diversifying offerings for customer satisfaction

- Continuous analysis of revenue sources

- Adapting to market changes

- "Diversity in revenue is a shield against uncertainty."

Financial Risk Management

Financial risk management is a critical aspect of any waterpark financial plan. It involves identifying potential risks that could impact your financial stability and developing strategies to mitigate these risks. This can include everything from economic downturns to unexpected maintenance costs.

For instance, consider how seasonal weather patterns can affect visitor numbers. Having contingency funds or insurance can help you weather these downturns. Additionally, regularly reviewing your financial plan can help you adapt to new challenges as they arise, ensuring that your waterpark can withstand unexpected events.

By proactively managing financial risks, you can protect your waterpark’s profitability and ensure long-term sustainability. As we conclude this discussion, we’ll summarize the key takeaways and provide actionable recommendations.

| Financial Risks | Mitigation Strategies |

|---|---|

| Seasonal fluctuations | Contingency funds |

| Unexpected maintenance costs | Regular financial reviews |

| Economic downturns | Diversified revenue streams |

- Identifying potential financial risks

- Developing mitigation strategies

- Regularly reviewing financial plans

- Protecting profitability

- Ensuring long-term sustainability

- "A proactive approach to risk can safeguard your success."

Final Recommendations for Your Waterpark Financial Plan

In conclusion, crafting a comprehensive financial plan for your waterpark requires careful consideration of various factors, including market research, revenue streams, operating costs, and risk management. Each component plays a vital role in ensuring your waterpark’s financial health and longevity.

Practical advice includes continuously monitoring your financial performance and adapting your strategies as necessary. This flexibility allows you to respond to changing market conditions and customer preferences effectively. Remember, a successful financial plan is not a one-time effort but an ongoing process that evolves with your business.

As you embark on creating your waterpark financial plan, keep these key points in mind. By doing so, you’ll be well on your way to achieving financial success in this exciting industry.

| Key Components | Importance |

|---|---|

| Market research | Informs strategic decisions |

| Revenue diversification | Protects against fluctuations |

| Ongoing financial monitoring | Ensures adaptability |

- Importance of a comprehensive financial plan

- Continuous monitoring and adaptability

- Responding to market changes

- Engaging with your target audience

- Commitment to long-term success

- "Success is a journey, not a destination."

Conclusion

In summary, crafting a comprehensive financial plan for your waterpark is essential for navigating the complexities of this exciting industry. From conducting thorough market research to managing operating costs and maximizing revenue streams, each step plays a crucial role in ensuring your waterpark’s profitability and long-term success. Additionally, proactive financial risk management will help safeguard your investment against unexpected challenges.

To further support your journey, consider utilizing the Waterpark Business Plan Template, which provides a solid foundation for your planning efforts. Also, check out our related articles for more insights on various aspects of operating a waterpark:

- SWOT Analysis for Waterpark: Maximizing Business Potential

- Waterpark Profitability: Key Factors to Consider

- Developing a Business Plan for Your Waterpark: Comprehensive Guide

- Building a Waterpark: A Comprehensive Guide

- Create a Waterpark Marketing Plan: Tips and Example

- How to Create a Business Model Canvas for a Waterpark: Examples and Tips

- Identifying Customer Segments for Waterparks: Examples and Tips

- How Much Does It Cost to Start a Waterpark?

- How to Calculate the Feasibility Study for Waterpark?

- How to Calculate Risks in Waterpark Management?

- Waterpark Competition Study: Detailed Insights

- How to Address Legal Considerations in Waterpark?

- Waterpark Funding Options: Detailed Analysis

- Waterpark Growth Strategies: Scaling Examples

FAQ Section

Here are some frequently asked questions regarding your waterpark financial plan:

Question: What is a waterpark investment strategy?

Answer: A waterpark investment strategy involves planning and executing financial decisions that will optimize returns and manage risks associated with opening and operating a waterpark.

Question: How do I conduct a waterpark feasibility study?

Answer: A waterpark feasibility study assesses the viability of a proposed park by analyzing market demand, location, financial projections, and potential risks.

Question: What are typical waterpark operating costs?

Answer: Typical waterpark operating costs include staffing, maintenance, utilities, insurance, and marketing expenses.

Question: How can I improve waterpark profitability?

Answer: Improving waterpark profitability can be achieved by diversifying revenue streams, enhancing customer experience, and effectively managing operating costs.

Question: What are some funding options for waterparks?

Answer: Funding options for waterparks may include bank loans, private investors, grants, and crowdfunding.

Question: How do I identify customer demographics for my waterpark?

Answer: Identifying customer demographics involves analyzing visitor data, conducting surveys, and researching local population trends to tailor offerings effectively.

Question: What are key legal considerations for operating a waterpark?

Answer: Key legal considerations include compliance with safety regulations, obtaining necessary permits, and liability insurance.

Question: How do I calculate financial projections for a waterpark?

Answer: Calculating financial projections involves estimating revenues and expenses based on historical data, market analysis, and anticipated growth.

Question: What is the significance of risk management in a waterpark business plan?

Answer: Risk management is crucial in a waterpark business plan to identify potential threats and develop strategies to mitigate them, ensuring financial stability.

Question: How can I perform a competition study for my waterpark?

Answer: A competition study involves researching other local waterparks, analyzing their offerings, pricing strategies, and customer feedback to identify opportunities for differentiation.