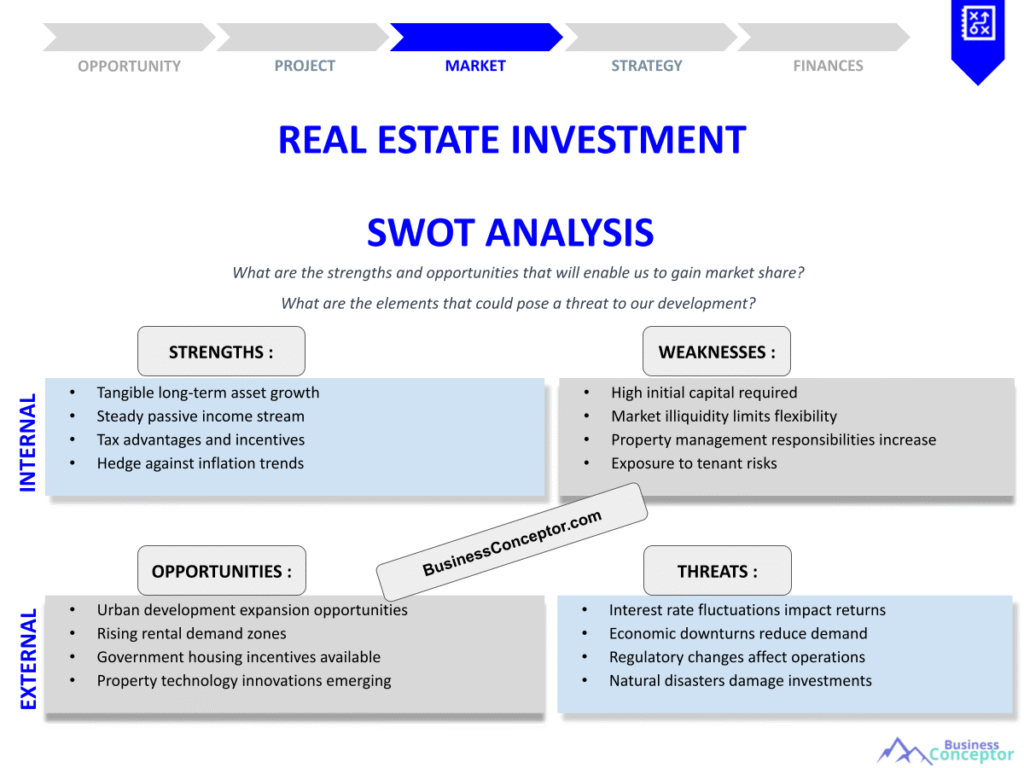

The world of real estate investment is full of opportunities, yet it’s also littered with challenges. Conducting a Real Estate Investment SWOT Analysis can be your roadmap, helping you navigate the complex landscape of property investments. A SWOT analysis focuses on Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview of your investment strategy. This framework not only helps identify what you do well but also highlights areas needing improvement, ultimately guiding you to make informed decisions that can lead to profitable outcomes.

Here’s what you need to know:

- Strengths: What advantages do you have? This could be experience, capital, or market knowledge.

- Weaknesses: Identify your limitations, such as lack of resources or market knowledge.

- Opportunities: What trends or factors can you exploit? Think about market demands or economic shifts.

- Threats: Recognize potential risks, including economic downturns or regulatory changes.

Understanding the Strengths in Real Estate Investment

When diving into real estate, understanding your strengths is crucial. These are the factors that can propel your investment strategy forward. For instance, if you have a solid financial backing or prior experience in real estate, these are substantial strengths. Imagine having inherited a property in a sought-after neighborhood. This not only gives you a strong advantage in terms of asset value but also enhances your rental potential. You can leverage this property for passive income or even sell it for a profit.

Additionally, having a diverse skill set can significantly boost your confidence and effectiveness as an investor. If you possess strong negotiation skills, for instance, you can close better deals, whether you’re buying or selling properties. Similarly, if you have a keen eye for potential renovations, you can increase the value of your investments through strategic improvements. This ability to see the potential in a property can lead to significant returns.

Let’s not forget the importance of market knowledge. Understanding the local market trends, such as which neighborhoods are up-and-coming or which types of properties are in demand, can help you make informed decisions. For example, if you notice a growing demand for rental properties in a specific area, you can focus your investments there, ensuring a steady stream of income.

Moreover, strong connections within the industry can be a tremendous advantage. Networking with real estate agents, fellow investors, and contractors can provide you with valuable insights and opportunities that others might not have access to. These relationships can also lead to partnerships that can amplify your investment efforts.

In summary, recognizing and leveraging your strengths can set you apart in the competitive real estate market. By focusing on what you do best, you can create a more effective investment strategy and position yourself for success.

| Strengths | Examples |

|---|---|

| Financial Backing | Inherited property, savings |

| Market Knowledge | Understanding local trends |

| Negotiation Skills | Closing deals effectively |

| Renovation Skills | Identifying property potential |

- Key Takeaways: Financial resources can amplify your investment opportunities.

- Skills in negotiation can lead to better deals and partnerships.

- Local market knowledge is invaluable for making informed decisions.

“Your strengths are your unique assets; leverage them wisely!” 💪

Identifying Weaknesses in Real Estate Investing

Now, let’s flip the coin and examine weaknesses. Acknowledging these is vital for mitigating risks in your real estate investment journey. Weaknesses can include lack of experience, insufficient capital, or even poor market knowledge. Understanding these limitations allows you to strategize effectively and seek out necessary resources to improve your position.

For example, if you’re new to real estate and don’t fully grasp market dynamics, you might invest in a declining area, leading to financial losses instead of gains. This scenario often occurs when novice investors are drawn to properties that seem appealing on the surface without conducting a thorough analysis of the surrounding market conditions.

Another common pitfall is overestimating your abilities. Many new investors believe they can manage properties without professional help, only to find themselves overwhelmed by the complexities of property management. From dealing with tenants to navigating legal issues, the challenges can quickly become daunting. Recognizing this weakness early on can save you a lot of headaches and financial stress. Hiring a property management company can be a wise decision if you lack the time or expertise to manage your investments effectively.

Furthermore, a lack of financial resources can also hinder your ability to seize opportunities. If you find yourself without sufficient capital for down payments or renovations, you may miss out on lucrative deals. This limitation can often be addressed by exploring various financing options, such as partnerships or real estate investment loans, which can provide you with the necessary funds to grow your portfolio.

In addition to personal limitations, external factors can also impact your investment success. For instance, changes in the economy, such as rising interest rates or shifts in employment rates, can pose significant threats to your investments. Staying informed about these economic indicators can help you prepare and adjust your strategy accordingly.

| Weaknesses | Examples |

|---|---|

| Lack of Experience | New to property management |

| Insufficient Capital | Limited funds for investment |

| Poor Market Knowledge | Not understanding trends |

| Overconfidence | Believing you can handle everything alone |

- Key Takeaways: Recognizing your weaknesses allows you to seek help and avoid costly mistakes.

- Consider hiring a consultant if you lack experience.

- Continuous education in real estate can enhance your understanding.

“Admitting your weaknesses is the first step to overcoming them!” 🌱

Exploring Opportunities in Property Investment

Opportunities in real estate can be abundant, especially in a fluctuating market. Identifying these chances is key to maximizing your investment returns. A well-executed Real Estate Investment SWOT Analysis can reveal hidden opportunities that you might otherwise overlook.

For instance, a booming job market in a city can lead to increased demand for rental properties. If you can spot this trend early, you might invest in properties that cater to new arrivals. This approach not only ensures a steady stream of rental income but also positions you as a key player in an emerging market.

Another opportunity lies in the rise of remote work. Many people are relocating from urban centers to suburban areas for more space and affordability. This shift can create a demand for single-family homes, presenting a golden opportunity for investors. By recognizing this trend, you can focus your investments on properties in suburban areas, which may yield higher returns as more families seek out these living arrangements.

Moreover, the increasing emphasis on sustainable living is another avenue for investment. Properties that incorporate green features or energy-efficient systems are becoming increasingly attractive to buyers and renters alike. Investing in eco-friendly properties not only aligns with current market demands but can also lead to higher rental rates and property values over time.

Additionally, government incentives for real estate investors can create lucrative opportunities. Many local governments offer tax breaks, grants, or subsidies for property development and renovation projects. Staying informed about these incentives can provide you with financial advantages that make your investments even more profitable.

Finally, networking with other investors and industry professionals can uncover additional opportunities. Engaging in real estate groups, attending seminars, and joining online forums can connect you with individuals who share insights and leads on properties that may not be widely advertised. This collaborative approach can significantly enhance your investment portfolio.

| Opportunities | Examples |

|---|---|

| Job Market Growth | Increased rental demand |

| Shift to Remote Work | Demand for suburban homes |

| Urban Development Projects | New construction areas |

| Government Incentives | Tax breaks for investors |

- Key Takeaways: Stay informed about market trends to capitalize on new opportunities.

- Investigate government incentives that can benefit your investments.

- Look for emerging markets before they become saturated.

“Every opportunity is a chance to grow; seize them!” 🚀

Recognizing Threats to Real Estate Portfolios

While opportunities abound, so do threats in the realm of real estate investment. Understanding potential risks can safeguard your investments and help you make informed decisions. Economic downturns, regulatory changes, and market saturation are significant threats that investors should be acutely aware of.

For instance, economic fluctuations can greatly impact property values. When a recession hits, the demand for housing often decreases, leading to lower prices and rental rates. If you own properties during such downturns, you may find it challenging to maintain your cash flow or sell your assets at a profit. This is why it’s crucial to stay informed about macroeconomic indicators, such as employment rates and consumer confidence, which can provide early warnings about potential downturns.

Moreover, regulatory changes can pose a threat to your investment strategy. New zoning laws, rental regulations, or property taxes can affect your ability to develop, manage, or profit from your properties. For example, if a city introduces stricter rent control laws, your potential rental income could be capped, reducing your overall return on investment. Staying updated on local government decisions and engaging with real estate associations can help you anticipate and navigate these changes effectively.

Market saturation is another threat that investors must consider. If too many investors flock to a particular area, competition can drive prices down, making it harder to sell or rent properties at profitable rates. This often occurs in popular neighborhoods where demand initially drives prices up, attracting more investors. To combat this threat, diversifying your portfolio and investing in emerging markets can help mitigate the risks associated with market saturation.

Lastly, natural disasters can also threaten your real estate investments. Properties located in areas prone to flooding, earthquakes, or hurricanes are at risk of significant damage, leading to costly repairs and potential loss of income. Investing in comprehensive insurance policies and understanding the risks associated with your property’s location can help protect your investments from such unforeseen events.

| Threats | Examples |

|---|---|

| Economic Downturns | Decreased property values |

| Regulatory Changes | New zoning laws |

| Market Saturation | Overinvestment in a single area |

| Natural Disasters | Damage to properties |

- Key Takeaways: Keep a close eye on economic indicators to anticipate downturns.

- Be aware of local regulations that could impact your investments.

- Diversifying your portfolio can help mitigate risks associated with market saturation.

“Anticipate threats to stay ahead of the game!” 🛡️

Conducting a SWOT Analysis for Real Estate

Conducting a SWOT analysis is a straightforward process but requires careful consideration and a structured approach. Start by gathering relevant information about your investments and the broader market. This foundational knowledge will provide you with a solid base for your analysis.

Begin with identifying your strengths and weaknesses. List out what you excel at, such as having ample financial resources, strong negotiation skills, or in-depth market knowledge. Recognizing these strengths allows you to leverage them effectively in your investment strategy. On the other hand, acknowledging your weaknesses—like lack of experience or insufficient capital—enables you to seek assistance or additional education, setting you up for success.

Next, move on to identifying opportunities and threats. Research market trends, economic factors, and any regulatory changes that could affect your investments. For example, if you find that urban areas are experiencing a surge in demand for rental properties due to a growing job market, this presents a significant opportunity for you to invest in those locations. Conversely, if you identify potential threats, such as rising interest rates or increased competition, you can develop strategies to mitigate those risks.

Once you’ve completed your SWOT analysis, it’s essential to apply those insights to your investment decisions. This means using your strengths to capitalize on opportunities while addressing weaknesses and preparing for threats. For instance, if your analysis reveals a strong understanding of the rental market, you might focus on acquiring multi-family units in high-demand areas. Conversely, if you identify a weakness in property management, consider hiring a professional management company to handle your investments effectively.

Regularly revisiting and updating your SWOT analysis can help you stay aligned with your goals and adapt to changing market conditions. The real estate market is dynamic, and being proactive in your approach can make all the difference in your success.

| SWOT Components | Key Points |

|---|---|

| Strengths | Leverage your advantages |

| Weaknesses | Address limitations |

| Opportunities | Explore market trends |

| Threats | Prepare for potential risks |

- Key Takeaways: A SWOT analysis provides a clear roadmap for your investment strategy.

- Regularly update your analysis to reflect market changes.

- Use insights from your SWOT to inform your investment decisions.

“A well-done SWOT analysis is your roadmap to success!” 🗺️

Real Estate Market Analysis Trends

Staying abreast of current real estate market analysis trends is essential for any investor. This knowledge not only informs your SWOT analysis but also shapes your overall investment strategy. Understanding the dynamics of the market can significantly enhance your decision-making process, leading to more successful investments.

For instance, one of the most significant trends affecting real estate today is the demand for sustainable living. As more people become environmentally conscious, properties that incorporate green features or energy-efficient systems are becoming increasingly attractive to buyers and renters alike. Investing in eco-friendly properties not only aligns with current market demands but can also lead to higher rental rates and property values over time. This trend presents a unique opportunity for investors to differentiate their properties in a competitive market.

Additionally, the shift toward remote work has dramatically changed the landscape of residential real estate. Many people are relocating from urban centers to suburban areas in search of larger living spaces and more affordable housing options. This migration trend creates a demand for single-family homes in suburbs, making it a lucrative investment opportunity for those who can identify and act on these changes early. By focusing your investments on suburban properties, you can tap into this growing market and potentially secure higher returns.

Moreover, technological advancements are revolutionizing the real estate industry. Tools such as real estate data analytics and property management software are enabling investors to make more informed decisions based on data-driven insights. For example, data analytics can help you identify emerging neighborhoods with high growth potential, allowing you to invest before the market becomes saturated. Utilizing technology not only streamlines your operations but also enhances your overall investment strategy, giving you a competitive edge.

Furthermore, macroeconomic factors such as interest rates and inflation play a crucial role in shaping the real estate market. When interest rates are low, borrowing becomes more affordable, encouraging more people to purchase homes. Conversely, rising interest rates can deter buyers, leading to a slowdown in the market. Keeping a close eye on these economic indicators can help you anticipate market shifts and adjust your investment strategy accordingly. By staying informed, you can position yourself to capitalize on favorable market conditions while mitigating risks during downturns.

| Market Trends | Implications |

|---|---|

| Demand for Eco-Friendly Homes | Invest in sustainable properties |

| Urban to Suburban Migration | Focus on suburban investments |

| Technological Advancements | Utilize data analytics tools |

| Remote Work Flexibility | Consider properties near amenities |

- Key Takeaways: Keep an eye on emerging trends to capitalize on new opportunities.

- Monitor economic indicators that affect the real estate market.

- Use technology to analyze market data for informed decision-making.

“Knowledge is power; stay informed to thrive!” 📈

Applying SWOT Insights to Investment Decisions

Once you’ve completed your SWOT analysis, it’s time to apply those insights to your investment decisions. This means using your strengths to capitalize on opportunities while addressing weaknesses and preparing for threats.

For instance, if your analysis reveals a strong understanding of the rental market, you might focus on acquiring multi-family units in high-demand areas. These properties often yield consistent rental income, making them a smart investment choice. Furthermore, if you have identified specific neighborhoods experiencing growth, acting quickly can position you to benefit from rising property values.

Conversely, if you identify a weakness in property management, consider hiring a professional management company. This can alleviate the burden of day-to-day operations and ensure your properties are maintained to a high standard, ultimately preserving their value. Additionally, investing in property management software can streamline your operations, making it easier to track expenses, manage tenant communications, and oversee maintenance requests.

Utilizing your opportunities effectively is also crucial. For example, if your SWOT analysis highlights a growing demand for eco-friendly homes, you might consider investing in properties that incorporate sustainable features. This not only aligns with market trends but can also attract environmentally conscious tenants willing to pay a premium for green living.

Moreover, being aware of potential threats allows you to take proactive measures. If you recognize that rising interest rates could impact your financing options, you might want to secure loans sooner rather than later. Additionally, diversifying your portfolio can help mitigate risks associated with market saturation or economic downturns. By investing in a mix of residential and commercial properties, you can create a more balanced portfolio that is less vulnerable to fluctuations in any single market segment.

Regularly revisiting and updating your SWOT analysis can help you stay aligned with your goals and adapt to changing market conditions. The real estate market is dynamic, and being proactive in your approach can make all the difference in your success. By leveraging the insights gained from your SWOT analysis, you can make informed investment decisions that maximize your potential for growth and profitability.

| Application | Strategies |

|---|---|

| Capitalizing on Strengths | Focus on areas of expertise |

| Addressing Weaknesses | Seek professional help |

| Leveraging Opportunities | Invest in trending markets |

| Mitigating Threats | Diversify your portfolio |

- Key Takeaways: Make informed decisions based on your SWOT analysis.

- Adapt your strategy as market conditions change.

- Regularly review your strengths and weaknesses to stay competitive.

“Adaptability is key in real estate; let your SWOT guide you!” 🔑

Real Estate Market Analysis Tools

Utilizing effective real estate market analysis tools is essential for any investor aiming to make informed decisions. These tools can provide valuable insights into market trends, property values, and investment opportunities, allowing you to stay ahead of the competition.

One of the most popular tools among real estate investors is data analytics software. This technology allows you to analyze large sets of data to identify patterns and trends that may not be immediately visible. For example, by examining historical sales data, you can identify which neighborhoods are experiencing growth and which ones are declining. This information is invaluable when deciding where to invest your capital.

Another critical tool is real estate valuation software. These programs can help you determine the fair market value of a property based on various factors, such as location, size, and condition. Understanding the true value of a property is crucial for making sound investment decisions. If you overpay for a property, it can significantly impact your potential returns.

Additionally, property management software can streamline your operations, making it easier to manage your investments. This type of software typically includes features for tracking expenses, managing tenant communications, and overseeing maintenance requests. By automating these tasks, you can save time and reduce the stress associated with property management, allowing you to focus on growing your portfolio.

Furthermore, utilizing online platforms that aggregate real estate listings can also provide valuable insights. Websites that compile property data allow you to compare prices, analyze market trends, and even access neighborhood statistics. This information can help you make informed decisions about where to invest and which properties to target.

Staying updated with the latest technological advancements in real estate is crucial for maintaining a competitive edge. As the industry continues to evolve, leveraging these tools can provide you with the insights necessary to capitalize on emerging opportunities and navigate potential risks effectively.

| Market Analysis Tools | Benefits |

|---|---|

| Data Analytics Software | Identify market trends |

| Real Estate Valuation Software | Determine fair market value |

| Property Management Software | Streamline operations |

| Online Listing Platforms | Access comprehensive data |

- Key Takeaways: Use data analytics to spot trends and opportunities.

- Valuation software helps ensure you pay a fair price for properties.

- Property management tools can save you time and reduce stress.

“The right tools can elevate your investment strategy!” 🛠️

Leveraging Professional Expertise in Real Estate Investment

In the complex world of real estate investment, leveraging professional expertise can be a game-changer. While self-education and research are essential, collaborating with experienced professionals can provide invaluable insights and significantly enhance your investment strategy.

One of the most beneficial partnerships is with a real estate agent who specializes in your target market. These professionals possess extensive knowledge about local trends, pricing strategies, and available properties. By working with a skilled agent, you can gain access to off-market listings and receive guidance on negotiating deals that align with your investment goals. This expertise can save you time and help you avoid costly mistakes.

Additionally, hiring a real estate consultant can provide a fresh perspective on your investment strategy. These consultants often have years of experience and can help you identify areas for improvement, whether it’s optimizing your portfolio or advising on market entry strategies. Their outside perspective can help you see opportunities that you might have overlooked.

Furthermore, collaborating with a property management firm can streamline your operations and ensure your properties are well-maintained. These firms can handle everything from tenant screenings to maintenance requests, allowing you to focus on expanding your portfolio. Effective property management is crucial for maintaining the value of your investments and ensuring a steady cash flow.

Moreover, networking with other investors can provide additional insights and support. Joining local real estate investment groups or attending industry seminars can connect you with like-minded individuals who share their experiences and knowledge. This collaboration can lead to partnerships, joint ventures, or even mentorship opportunities that can accelerate your growth as an investor.

In summary, leveraging professional expertise in real estate investment is essential for maximizing your success. By surrounding yourself with knowledgeable individuals and utilizing their insights, you can navigate the complexities of the market more effectively and make informed decisions that lead to profitable outcomes.

| Professional Expertise | Benefits |

|---|---|

| Real Estate Agents | Access to market knowledge |

| Real Estate Consultants | Strategic guidance |

| Property Management Firms | Efficient operations |

| Networking Opportunities | Shared insights and partnerships |

- Key Takeaways: Collaborate with agents to access local market knowledge.

- Consultants provide strategic insights that can enhance your strategy.

- Networking with other investors can lead to valuable partnerships.

“Surround yourself with expertise to elevate your investments!” 🌟

Recommendations

In summary, conducting a Real Estate Investment SWOT Analysis is essential for understanding your strengths, weaknesses, opportunities, and threats in the ever-evolving real estate market. By leveraging this analysis, you can make informed decisions that enhance your investment strategy and maximize your profitability. For those looking to take their real estate investment endeavors to the next level, we recommend utilizing a comprehensive Real Estate Investment Business Plan Template that can guide you in structuring your business effectively.

Additionally, to deepen your understanding of real estate investment, consider exploring the following articles:

- Article 1 on Real Estate Investment: The Key to High Profitability

- Article 2 on Real Estate Investment Business Plan: Template and Tips

- Article 3 on Real Estate Investment Financial Plan: Step-by-Step Guide with Template

- Article 4 on Launching a Real Estate Investment Business: A Complete Guide with Practical Examples

- Article 5 on Crafting a Real Estate Investment Marketing Plan: Strategies and Examples

- Article 6 on Building a Business Model Canvas for Real Estate Investment: Examples Included

- Article 7 on Real Estate Investment Customer Segments: Examples and Best Practices

- Article 8 on How Much Does It Cost to Operate a Real Estate Investment Business?

- Article 9 on Real Estate Investment Feasibility Study: Comprehensive Guide

- Article 10 on Real Estate Investment Risk Management: Comprehensive Strategies

- Article 11 on Real Estate Investment Competition Study: Detailed Insights

- Article 12 on How to Navigate Legal Considerations in Real Estate Investment?

- Article 13 on What Funding Options Should You Consider for Real Estate Investment?

- Article 14 on How to Scale Real Estate Investment: Proven Growth Strategies

FAQ

What are the strengths in real estate investment?

The strengths in real estate investment often include financial resources, market knowledge, and negotiation skills. Having adequate capital allows investors to seize opportunities quickly, while understanding local market dynamics can guide informed decisions. Strong negotiation skills can lead to better deals, enhancing profitability.

What are common weaknesses in real estate investing?

Common weaknesses in real estate investing may include lack of experience, insufficient capital, and poor market understanding. New investors might struggle with property management or fail to recognize market trends, leading to poor investment decisions. Identifying these weaknesses allows investors to seek help or further education.

What opportunities exist in property investment?

Opportunities in property investment can arise from market trends such as urban development, shifts in demographics, and the increasing demand for sustainable housing. Recognizing these trends can help investors target lucrative markets and properties that align with consumer preferences.

What threats should real estate investors be aware of?

Real estate investors should be aware of threats such as economic downturns, regulatory changes, and market saturation. Economic shifts can lead to declining property values, while new regulations may impact rental income. Being aware of these threats helps investors prepare and adjust their strategies accordingly.

How can I conduct a SWOT analysis for real estate investment?

To conduct a SWOT analysis for real estate investment, start by identifying your strengths, weaknesses, opportunities, and threats. Gather data on your investments and market conditions. Use this information to evaluate your current strategy and make informed decisions that align with your investment goals.

What tools can help in real estate market analysis?

Effective real estate market analysis tools include data analytics software, property valuation tools, and property management software. These tools help investors analyze market trends, determine property values, and streamline operations, ultimately leading to more informed investment decisions.