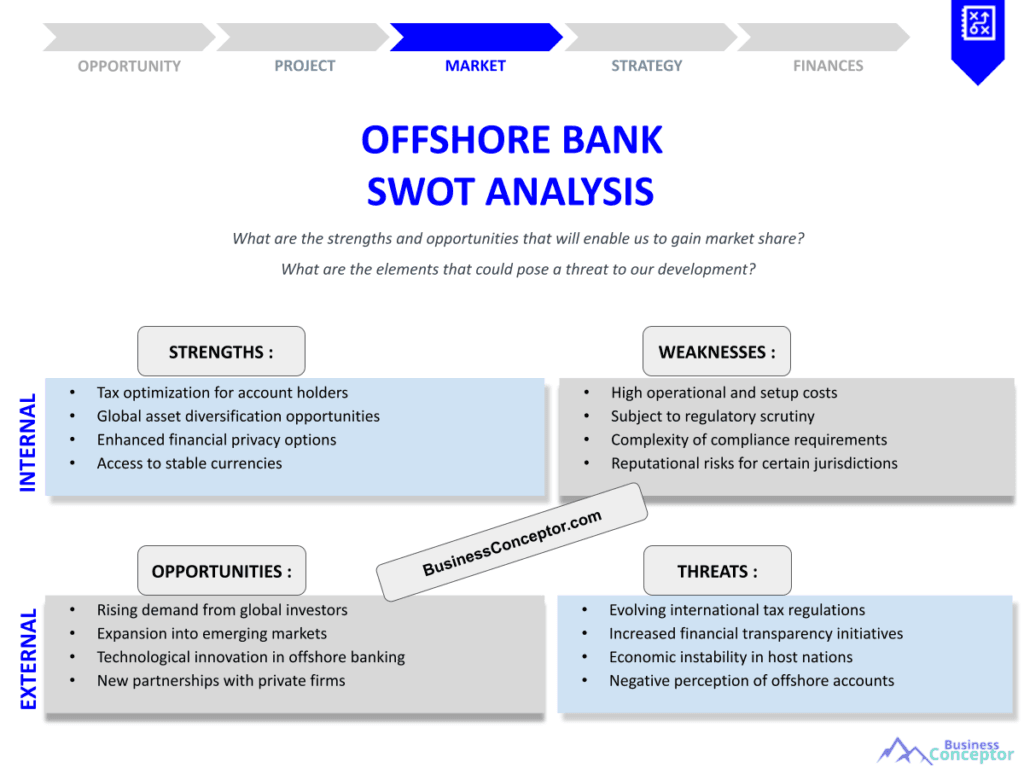

Did you know that over $21 trillion is held in offshore accounts worldwide? This staggering figure highlights the growing significance of offshore banking in today’s financial landscape. Offshore Bank SWOT Analysis is essential for understanding the dynamics of these financial institutions. Essentially, a SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats related to a business, which in this case, pertains to offshore banks. It provides a framework for assessing their strategic position in the global market.

- Definition and importance of offshore banking.

- Overview of SWOT analysis for offshore banks.

- Strengths of offshore banks and their competitive edge.

- Weaknesses faced by offshore banking institutions.

- Market opportunities available to offshore banks.

- Threats and risks that challenge offshore banks.

- Financial strategies for leveraging strengths.

- Recommendations for addressing weaknesses.

- Strategies to capitalize on market opportunities.

- Conclusion and call to action for stakeholders.

Understanding Offshore Banking and SWOT Analysis

Offshore banking refers to the process of opening bank accounts or investing in financial institutions outside of one’s country of residence. This practice is often used for asset protection, tax optimization, and investment diversification. A SWOT analysis serves as a powerful tool to dissect the offshore banking sector, helping stakeholders understand where these institutions excel and where they may falter.

For example, many offshore banks boast a high level of client confidentiality, which can be a significant strength. However, they also face challenges like increased regulatory scrutiny and negative perceptions associated with tax evasion. By conducting a thorough SWOT analysis, banks can navigate these complexities effectively.

Understanding both the strengths and weaknesses of offshore banks is crucial for stakeholders. It sets the stage for identifying market opportunities and threats, which will be explored in the following sections.

| Key Aspect | Description |

|---|---|

| Definition | Opening accounts outside one’s country |

| Purpose | Asset protection, tax optimization |

- Offshore banking explained

- Importance of SWOT analysis

- Strengths and weaknesses overview

“Knowledge is power, especially in finance.”

Strengths of Offshore Banks

One of the primary strengths of offshore banks is the high level of privacy they offer to their clients. This confidentiality can protect clients from legal and financial scrutiny, making offshore accounts attractive for those seeking financial security. Additionally, these banks often provide tailored financial products and services that cater to high-net-worth individuals.

For instance, many offshore banks have established themselves in stable jurisdictions, providing clients with a sense of security against economic fluctuations. According to a recent study, over 60% of offshore bank clients cite privacy as their main reason for choosing these institutions, highlighting its importance in the decision-making process.

While the strengths of offshore banks present a compelling case for their use, they must also be aware of the weaknesses that could undermine their advantages. This leads us to explore the weaknesses in the next section.

| Strength | Description |

|---|---|

| High level of privacy | Protects clients from scrutiny |

| Tailored financial products | Meets specific client needs |

- High level of client confidentiality

- Tailored financial products

- Presence in stable jurisdictions

“Embrace change to overcome challenges.”

Weaknesses of Offshore Banks

Despite their advantages, offshore banks face several weaknesses that can hinder their growth. One significant weakness is the perception of being associated with tax evasion and illegal activities, which can deter potential clients. This stigma has led to increased regulatory scrutiny, impacting their operations.

Additionally, compliance with international regulations requires significant resources. According to recent reports, offshore banks spend up to 20% of their revenue on compliance-related expenses, which can affect their profitability. This financial burden highlights the need for these banks to innovate and improve their operational efficiency.

Addressing these weaknesses is vital for offshore banks looking to enhance their reputation and attract new clients. The subsequent section will delve into the opportunities that these banks can capitalize on.

| Weakness | Description |

|---|---|

| Stigma associated with offshore banking | Perceived as tax evasion |

| High compliance costs | Affects profitability |

- Stigma associated with offshore banking

- High compliance costs

- Resource allocation challenges

“To succeed, always move forward with a clear vision.”

Market Opportunities for Offshore Banks

Offshore banks are presented with numerous market opportunities, particularly in emerging markets. As economies grow, there is an increasing demand for wealth management services. This trend offers offshore banks a chance to expand their client base and diversify their service offerings.

Moreover, advancements in technology have enabled offshore banks to provide digital banking services, making it easier for clients to manage their accounts remotely. According to industry analysts, the digital banking sector is expected to grow by 25% over the next five years, presenting a lucrative opportunity for offshore banks to innovate and reach a broader audience.

By capitalizing on these market opportunities, offshore banks can strengthen their competitive position. The next section will focus on the threats that could impact their success.

| Opportunity | Description |

|---|---|

| Emerging markets | Growing demand for wealth management |

| Digital banking growth | Expansion of services through technology |

- Explore emerging markets

- Invest in digital banking technology

- Tailor services to meet client needs

The above steps must be followed rigorously for optimal success.

Threats to Offshore Banks

Offshore banks must navigate various threats that could undermine their operations. One significant threat is the increasing regulatory pressure from governments worldwide. Authorities are tightening laws to combat money laundering and tax evasion, making compliance more challenging for offshore banks.

Additionally, geopolitical instability can pose risks to offshore banking operations. For instance, changes in government policies in key jurisdictions can lead to unfavorable conditions for banks operating in those regions. A recent report highlighted that 30% of offshore banks have faced operational disruptions due to such changes.

Recognizing these threats is essential for offshore banks to develop strategies that mitigate risks. In the following section, we will discuss the financial strategies that can be employed to enhance stability and growth.

| Threat | Description |

|---|---|

| Regulatory pressure | Increased compliance requirements |

| Geopolitical instability | Risk of operational disruptions |

- Monitor regulatory changes

- Assess geopolitical risks

- Develop contingency plans

Financial Strategies for Offshore Banks

To thrive in a competitive landscape, offshore banks must adopt effective financial strategies. One critical strategy is diversifying their service offerings. By providing a range of financial products, including investment advisory and wealth management services, banks can cater to various client needs.

Furthermore, investing in technology can streamline operations and enhance customer experiences. For instance, implementing advanced data analytics can help banks better understand client behaviors and preferences, allowing for more personalized services. In fact, banks that adopt technology-driven solutions see a 15% increase in client satisfaction, which is crucial for retaining clients in the long run.

By focusing on these financial strategies, offshore banks can improve their market positioning and adapt to changing client demands. The next section will highlight additional strategies for success.

| Strategy | Description |

|---|---|

| Diversify service offerings | Cater to various client needs |

| Invest in technology | Enhance operational efficiency |

- Expand service range

- Implement data analytics

- Focus on customer experience

Implementing Effective Solutions

Implementing effective solutions is crucial for offshore banks to navigate their challenges successfully. A proactive approach to regulatory compliance is essential. By investing in compliance technology, banks can streamline processes and minimize the risk of penalties. This investment not only reduces costs but also enhances the bank’s reputation among clients and regulators.

Additionally, fostering strong relationships with clients can lead to increased trust and loyalty. This can be achieved through regular communication and transparency regarding fees and services. A satisfied client is more likely to refer others, creating a positive cycle of growth. Studies show that loyal clients can contribute up to 50% more revenue than new clients, making relationship management a key focus area.

As offshore banks implement these solutions, they will be better equipped to face the future. The following section will provide a summary of key actions and recommendations.

| Solution | Description |

|---|---|

| Invest in compliance technology | Streamline regulatory processes |

| Foster client relationships | Build trust and loyalty |

- Prioritize compliance measures

- Enhance client communication

- Encourage referrals through satisfaction

Future Trends in Offshore Banking

The offshore banking industry is evolving, and staying ahead of future trends is essential for success. One prominent trend is the rise of sustainable banking practices. As clients become more environmentally conscious, offshore banks can differentiate themselves by offering green investment options. This not only attracts a new demographic of clients but also aligns with global sustainability goals.

Moreover, the integration of artificial intelligence (AI) in banking operations is expected to increase. AI can enhance fraud detection, improve customer service through chatbots, and streamline processes, ultimately leading to greater efficiency and client satisfaction. In fact, studies show that banks utilizing AI technology can reduce operational costs by up to 30%.

By embracing these future trends, offshore banks can position themselves as leaders in the industry. The final section will summarize the key points discussed throughout the article.

| Trend | Description |

|---|---|

| Sustainable banking | Offering environmentally-friendly options |

| AI integration | Enhancing efficiency and client service |

- Adopt sustainable practices

- Explore AI technologies

- Stay informed on market changes

Key Actions and Recommendations

To ensure success in the offshore banking sector, stakeholders must focus on key actions and recommendations. First and foremost, a thorough understanding of the market landscape is essential. Regularly conducting SWOT analyses can help banks stay ahead of potential challenges and capitalize on opportunities. This proactive approach can lead to informed decision-making and strategic growth.

Additionally, ongoing training and development for staff can enhance service quality and operational efficiency. Empowering employees with knowledge and skills will foster a culture of excellence within the institution. Investing in employee development not only boosts morale but also translates into better client service, which is crucial for retention.

By implementing these recommendations, offshore banks can create a robust foundation for growth and stability in a competitive market.

| Key Action | Description |

|---|---|

| Conduct regular SWOT analyses | Essential for strategic planning |

| Invest in staff training | Enhance service quality |

- Conduct regular SWOT analyses

- Invest in staff training

- Foster a culture of adaptability

Conclusion

In summary, the offshore banking sector presents a wealth of opportunities and challenges that require strategic management. By leveraging strengths, addressing weaknesses, capitalizing on market opportunities, and mitigating threats, offshore banks can thrive in a competitive environment. To further assist you in navigating this landscape, consider utilizing our Offshore Bank Business Plan Template, which provides a comprehensive framework for your banking endeavors.

- Offshore Bank Profitability: Key Considerations

- Offshore Bank Business Plan: Template and Tips

- How to Create a Financial Plan for Your Offshore Bank: Step-by-Step Guide (+ Example)

- Launching an Offshore Bank: Complete Guide and Examples

- Crafting a Marketing Plan for Your Offshore Bank (+ Example)

- Start Your Offshore Bank Right: Crafting a Business Model Canvas with Examples

- Customer Segments for Offshore Banks: Who Are Your Ideal Clients?

- How Much Does It Cost to Establish an Offshore Bank?

- Offshore Bank Feasibility Study: Essential Guide

- Cafe Risk Management: Detailed Analysis

- How to Analyze Competition for Offshore Bank?

- Essential Legal Considerations for Offshore Bank

- Cafe Funding Options: Expert Insights

- Offshore Bank Growth Strategies: Scaling Examples

FAQ

What is offshore banking?

Offshore banking involves opening bank accounts or investing in financial institutions located outside of one’s country of residence, primarily for asset protection and tax optimization.

What does a SWOT analysis entail?

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats associated with a business, providing a comprehensive overview of its strategic position.

Why are offshore banks considered confidential?

Offshore banks provide high levels of client confidentiality, safeguarding clients from legal and financial scrutiny.

What are the main strengths of offshore banks?

Key strengths include privacy, tailored financial products, and stability in favorable jurisdictions.

What weaknesses do offshore banks face?

Common weaknesses involve regulatory scrutiny and the stigma associated with tax evasion.

What market opportunities exist for offshore banks?

Offshore banks can expand into emerging markets and leverage the growth of digital banking.

What threats do offshore banks encounter?

Offshore banks face threats from increased regulatory pressure and geopolitical instability.

What financial strategies should offshore banks implement?

Diversifying services and investing in technology are critical strategies for success.

How can offshore banks mitigate risks?

By developing strong client relationships and monitoring regulatory changes, banks can better navigate risks.

What future trends should offshore banks watch?

Sustainable banking practices and the integration of artificial intelligence are key trends shaping the future of offshore banking.