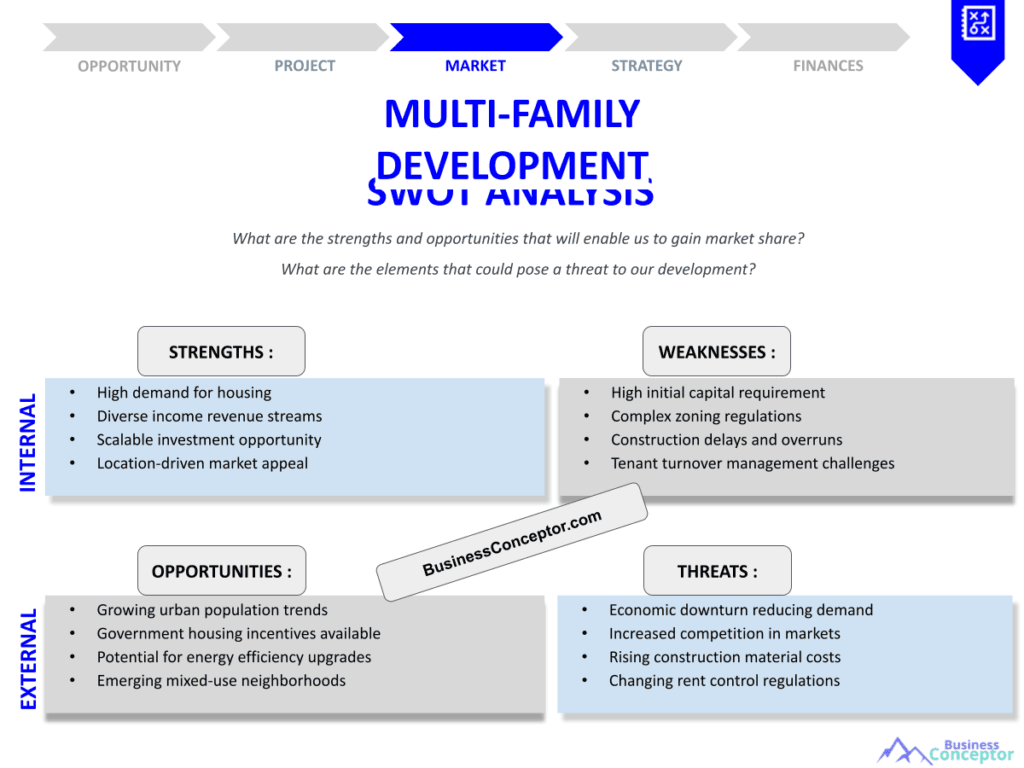

Did you know that over 60% of Americans rent their homes, highlighting the increasing demand for multi-family developments? Multi-Family Development SWOT Analysis is essential for investors and developers to understand the complex landscape of real estate. This analysis helps identify the strengths, weaknesses, opportunities, and threats associated with multi-family housing projects, allowing stakeholders to make informed decisions.

In simple terms, a SWOT analysis is a strategic planning tool that evaluates internal and external factors affecting a business. For multi-family developments, this analysis can provide invaluable insights into market positioning and investment viability. By understanding these components, developers can tailor their projects to meet the needs of tenants while maximizing financial returns.

- Overview of SWOT analysis and its relevance to multi-family developments.

- Detailed exploration of strengths such as location and amenities.

- Examination of weaknesses, including financial risks and market saturation.

- Identification of opportunities in emerging markets and demographic shifts.

- Analysis of threats like regulatory changes and economic downturns.

- Practical steps to conduct a SWOT analysis effectively.

- Case studies illustrating successful multi-family developments.

- Tips for enhancing tenant satisfaction and retention.

- Strategies to maximize ROI in multi-family projects.

- Conclusion emphasizing the importance of continuous market assessment.

Understanding SWOT Analysis in Multi-Family Developments

SWOT analysis is a strategic planning tool that helps businesses identify internal strengths and weaknesses, along with external opportunities and threats. In the realm of multi-family developments, this analysis can offer invaluable insights into market positioning and investment viability. By understanding these components, developers can tailor their projects to meet the needs of tenants while maximizing financial returns.

For example, a developer might find that their location is a significant strength due to proximity to public transport and local amenities. This can attract a diverse tenant base, from young professionals to families. However, weaknesses may arise from high construction costs or a saturated rental market, which can impact profitability. Understanding these factors is crucial for making informed decisions and ensuring project success.

In summary, a robust SWOT analysis lays the foundation for strategic planning in multi-family developments, setting the stage for further exploration of specific strengths, weaknesses, opportunities, and threats in the following sections.

| Strengths | Weaknesses |

| Strong location | High construction costs |

| Diverse amenities | Market saturation |

- Multi-family developments cater to various tenant demographics.

- Conducting a SWOT analysis is essential for informed decision-making.

- Identifying strengths can enhance competitive advantage.

Success comes from understanding your market.

Strengths of Multi-Family Developments

One of the key strengths of multi-family developments lies in their ability to generate consistent cash flow. These properties often feature multiple rental units, which means that income can be more stable compared to single-family homes. Additionally, the demand for rental units continues to grow, driven by factors like urbanization and changing demographics.

For instance, many cities are experiencing a surge in young professionals seeking affordable housing options close to their workplaces. By capitalizing on this trend, developers can create attractive properties that cater to this market segment. Furthermore, amenities such as fitness centers, community spaces, and green areas can enhance tenant satisfaction and lead to higher occupancy rates.

In conclusion, understanding the strengths of multi-family developments allows investors to leverage these advantages for better market positioning and increased profitability.

- Identify strong locations for development.

- Incorporate desirable amenities.

- Focus on tenant demographics.

– The above steps must be followed rigorously for optimal success.

Weaknesses in Multi-Family Developments

Despite the potential for success, multi-family developments are not without their challenges. One significant weakness is the financial risk associated with high construction costs. Developers must carefully manage budgets to avoid overspending, which can eat into profits.

Additionally, market saturation in certain areas can lead to increased competition, making it difficult to attract tenants. For example, if a neighborhood has too many similar rental options, it can dilute demand and drive down rental prices. Developers must conduct thorough market research to identify and mitigate these weaknesses.

In summary, recognizing and addressing weaknesses is critical for the long-term success of multi-family developments, paving the way for a focus on opportunities in the next section.

| Weaknesses | Implications |

| High construction costs | Reduced profit margins |

| Market saturation | Increased competition |

- Financial risks must be managed effectively.

- Market research is essential to understand saturation levels.

- Addressing weaknesses can lead to improved project viability.

Every challenge presents an opportunity for growth.

Opportunities in Multi-Family Developments

Opportunities abound in the multi-family development sector, particularly in emerging markets. As cities expand and more people flock to urban areas, the demand for rental housing continues to rise. Developers can capitalize on this trend by identifying locations with growth potential and investing in properties that meet the needs of future tenants.

Moreover, the increasing focus on sustainability and eco-friendly construction practices presents an opportunity to differentiate projects in the market. Properties that incorporate green building practices, energy-efficient designs, and sustainable materials can attract environmentally-conscious tenants, enhancing market appeal.

In conclusion, tapping into these opportunities can lead to significant growth for developers and greater satisfaction for tenants, setting the stage for a discussion on potential threats in the next section.

| Opportunities | Strategies |

| Emerging markets | Target growth areas |

| Sustainable practices | Differentiation in the market |

- Identifying growth areas is crucial for success.

- Sustainability can enhance tenant appeal.

- Leveraging opportunities can lead to higher ROI.

Opportunities don’t happen, you create them.

Threats Facing Multi-Family Developments

While opportunities are plentiful, developers must also be aware of potential threats. One significant threat is the ever-changing regulatory landscape. Zoning laws, building codes, and rental regulations can impact project feasibility and profitability. Developers must stay informed and adaptable to navigate these challenges.

Additionally, economic downturns can pose a risk to rental income. During recessions, tenants may struggle to pay rent, leading to increased vacancies and financial strain on property owners. It’s essential for developers to have contingency plans in place to mitigate these risks.

In summary, understanding potential threats enables developers to develop strategies that protect their investments and ensure long-term success.

| Threats | Impact |

| Regulatory changes | Increased costs and delays |

| Economic downturns | Reduced rental income |

- Stay informed about regulatory changes.

- Develop contingency plans for economic downturns.

- Anticipating threats can safeguard investments.

Preparedness is the key to overcoming obstacles.

Conducting a Comprehensive SWOT Analysis

Conducting a SWOT analysis involves gathering data from various sources to paint a clear picture of the multi-family development landscape. Start by assessing internal factors, such as financial resources, location advantages, and property features. Then, move on to external factors, including market trends, competition, and the regulatory environment.

Engaging stakeholders, such as property managers and tenants, can provide valuable insights into strengths and weaknesses. For example, tenant feedback can highlight areas for improvement and guide amenity selection. Developers should also consider utilizing surveys and market research to gather comprehensive data that informs their strategies.

In conclusion, a thorough SWOT analysis is critical for informed decision-making and strategic planning in multi-family developments.

| Steps | Details |

| Gather internal data | Assess strengths and weaknesses |

| Analyze external factors | Identify opportunities and threats |

- Engage stakeholders for diverse perspectives.

- Utilize data to inform strategic decisions.

- A comprehensive analysis leads to better outcomes.

Knowledge is power when making strategic choices.

Enhancing Tenant Satisfaction

Tenant satisfaction is crucial for the success of multi-family developments. Happy tenants are more likely to renew leases and recommend the property to others. Developers can enhance satisfaction by offering desirable amenities, maintaining high standards of property management, and fostering a sense of community among residents.

For instance, organizing community events can help tenants feel more connected, leading to higher retention rates. Additionally, providing excellent customer service and timely maintenance can significantly improve tenant experiences. Implementing feedback mechanisms can also allow developers to address tenant concerns proactively.

In summary, focusing on tenant satisfaction can lead to increased occupancy rates and ultimately higher returns on investment.

| Strategies | Impact |

| Offer desirable amenities | Increased tenant retention |

| Organize community events | Foster a sense of belonging |

- Happy tenants lead to successful developments.

- Focus on community and service for satisfaction.

- Enhancing tenant experiences is key to retention.

Creating community is the heart of tenant satisfaction.

Maximizing ROI in Multi-Family Developments

Maximizing ROI in multi-family developments involves strategic planning and execution. Developers must focus on cost management, market positioning, and tenant retention strategies to ensure profitability. By understanding market demands and aligning their projects accordingly, developers can significantly enhance their returns.

Investing in high-demand areas with growth potential can yield substantial returns. Additionally, implementing effective marketing strategies can attract tenants and reduce vacancy rates. Keeping maintenance costs low while ensuring quality can also contribute to a healthier bottom line. Utilizing technology for property management can streamline operations and improve tenant experiences, leading to better financial outcomes.

In conclusion, a focused approach to maximizing ROI can lead to sustainable success in the multi-family housing market.

| Strategies | Impact |

| Focus on high-demand areas | Higher rental income |

| Implement effective marketing | Reduced vacancies |

- Strategic planning is essential for maximizing returns.

- Cost management plays a critical role in profitability.

- Tenant retention strategies are vital for sustained success.

ROI is not just about numbers; it’s about strategic execution.

Final Recommendations for Multi-Family Developments

To successfully navigate the multi-family development landscape, developers should consider the following recommendations: Conduct regular market assessments to stay informed about trends, invest in tenant satisfaction initiatives, and maintain strong relationships with stakeholders. Additionally, being adaptable to market changes and regulatory updates is crucial for long-term success.

By prioritizing these aspects, developers can enhance their projects’ success and ensure long-term sustainability. Continuously evaluating and adjusting strategies based on market feedback can lead to improved outcomes and greater profitability.

| Recommendations | Benefits |

| Regular market assessments | Informed decision-making |

| Prioritize tenant satisfaction | Increased retention rates |

- Stay proactive in understanding market dynamics.

- Invest in tenant relationships for sustainable success.

- Focus on long-term strategies for enduring profitability.

Success is built on strong foundations of trust and understanding.

Conclusion

In conclusion, conducting a Multi-Family Development SWOT Analysis is essential for maximizing ROI and enhancing tenant satisfaction. By understanding the strengths, weaknesses, opportunities, and threats, developers can make informed decisions that lead to successful projects. The insights gained from this analysis can be instrumental in navigating the competitive landscape of multi-family housing.

For those looking to dive deeper into the world of multi-family development, consider utilizing the Multi-Family Development Business Plan Template. This resource can provide a structured approach to planning your projects effectively.

Additionally, check out our articles for more valuable insights:

- Multi-Family Development Profitability: What You Need to Know

- Multi-Family Development Business Plan: Template and Tips

- How to Create a Financial Plan for Your Multi-Family Development: Step-by-Step Guide (+ Example)

- Starting a Multi-Family Development Business: Complete Guide with Examples

- Create a Marketing Plan for Your Multi-Family Development (+ Example)

- Start Your Multi-Family Development Right: Crafting a Business Model Canvas with Examples

- Customer Segments for Multi-Family Developments: Who Are Your Potential Tenants?

- How Much Does It Cost to Develop a Multi-Family Property?

- How to Calculate the Feasibility Study for Multi-Family Development?

- Ultimate Guide to Multi-Family Development Risk Management

- Multi-Family Development Competition Study: Essential Guide

- Multi-Family Development Legal Considerations: Detailed Overview

- Exploring Funding Options for Multi-Family Development

- Multi-Family Development Growth Strategies: Scaling Examples

FAQ Section

What is a Multi-Family Development SWOT Analysis?

A SWOT analysis for multi-family developments evaluates the strengths, weaknesses, opportunities, and threats associated with real estate investments in rental housing.

Why is tenant satisfaction important in multi-family developments?

Tenant satisfaction is crucial as it leads to higher retention rates and positive referrals, which are essential for maintaining occupancy levels.

How can I identify strengths in my multi-family project?

Assess factors like location, amenities, and property management to determine your project’s unique strengths.

What are common weaknesses in multi-family developments?

High construction costs and market saturation are prevalent weaknesses that can impact profitability.

What opportunities should I look for in the multi-family market?

Emerging markets and sustainability trends present significant opportunities for growth in multi-family developments.

What threats should developers be aware of?

Regulatory changes and economic downturns are threats that can affect rental income and project feasibility.

How do I conduct a SWOT analysis for my multi-family project?

Gather data on internal and external factors, engage stakeholders, and analyze market trends to complete a comprehensive SWOT analysis.

What strategies can enhance tenant satisfaction?

Offering desirable amenities, maintaining property quality, and fostering community engagement can significantly improve tenant satisfaction.

How can I maximize ROI in multi-family developments?

Focus on cost management, market positioning, and tenant retention strategies to ensure high returns on investment.

Why is regular market assessment important?

Regular market assessments help developers stay informed about trends, enabling them to adapt and remain competitive in the multi-family housing market.