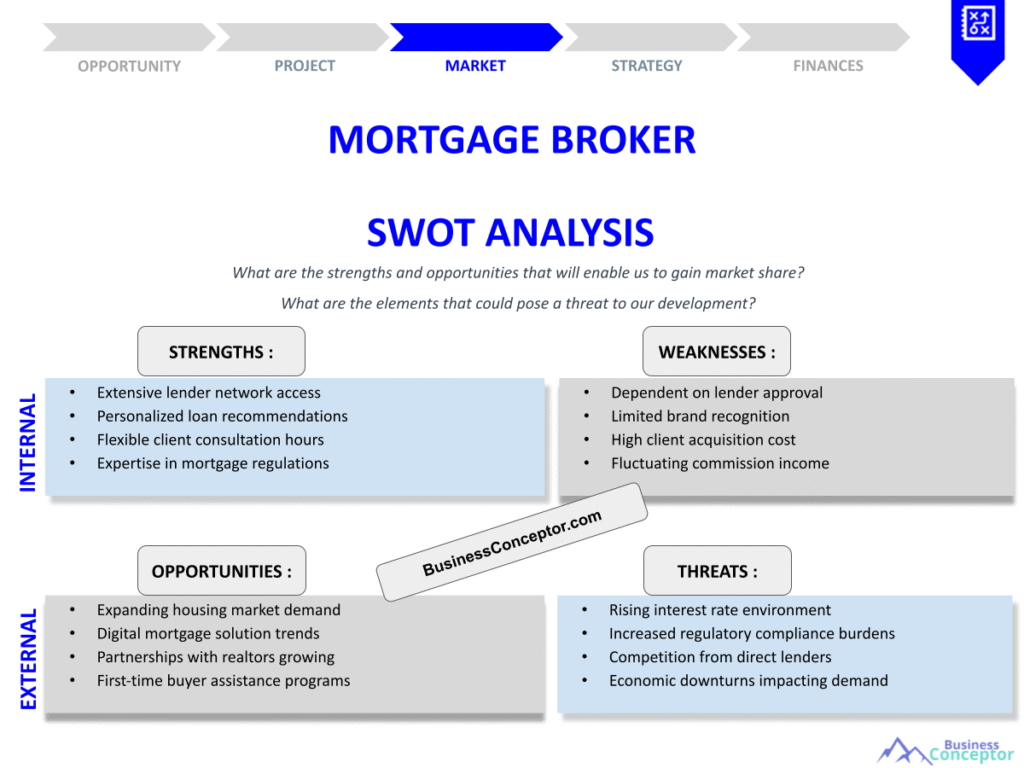

The Mortgage Broker SWOT Analysis is an essential tool that can make or break a mortgage brokerage. It’s like having a roadmap to navigate the complex landscape of mortgage lending. A SWOT analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats, helps brokers understand their position in the market. It’s not just about crunching numbers; it’s about diving deep into what makes a brokerage tick, what could derail it, and what opportunities lie ahead. By systematically evaluating these four components, brokers can gain insights that lead to informed decision-making and strategic planning.

Here’s what you can expect from this article:

- A comprehensive breakdown of the strengths and weaknesses of mortgage brokers.

- Insights into market opportunities and threats.

- Practical tips on how to conduct your own SWOT analysis.

- Real-world examples of how brokers can leverage this analysis for success.

Understanding Strengths and Weaknesses of Mortgage Brokers

When we talk about the strengths of mortgage brokers, we’re looking at what sets them apart in a crowded market. These strengths can range from personalized customer service to extensive market knowledge. For instance, a small brokerage might shine in offering tailored services to clients, building strong relationships that larger firms can’t replicate. They often have the flexibility to adapt quickly to client needs, which is a significant advantage in a fast-paced industry. This personalized touch can lead to higher customer satisfaction and loyalty, ultimately resulting in repeat business and referrals.

On the flip side, weaknesses might include limited resources or reliance on outdated technology. Many smaller firms may struggle with marketing or keeping up with the latest technology trends, which can limit their reach. This could mean missing out on potential clients who prefer online interactions or digital services. For example, if a brokerage does not have an effective online presence or user-friendly application process, they may lose clients to competitors who offer a more streamlined digital experience. It’s essential for brokers to regularly assess their weaknesses to address them proactively.

Understanding these factors is crucial for any mortgage brokerage aiming for success. By identifying their strengths, brokers can leverage them in marketing and client interactions, while acknowledging their weaknesses allows them to seek solutions or improvements. Here’s a summary of strengths and weaknesses:

| Strengths | Weaknesses |

|---|---|

| Personalized service | Limited resources |

| Strong local knowledge | Outdated technology |

| Flexible business models | Difficulty in scaling operations |

| Established client relationships | Inconsistent marketing efforts |

- Key Takeaways:

- Understand your brokerage’s unique strengths.

- Acknowledge weaknesses to create improvement plans.

“Knowing your strengths is the first step to leveraging them!” 💪

Opportunities in the Mortgage Brokerage Landscape

The mortgage industry is evolving, and with that comes a plethora of opportunities for brokers who are willing to adapt and innovate. One significant opportunity lies in the advancements in technology. The rise of online mortgage applications has revolutionized how brokers interact with clients, making it easier for them to reach a wider audience. Brokers can leverage digital platforms to streamline the application process, enhancing client satisfaction and engagement. This tech-driven approach not only saves time but also allows brokers to handle more clients efficiently, ultimately leading to increased revenue.

Another promising avenue is the focus on niche markets. By catering to specific segments, such as first-time homebuyers, veterans, or those seeking eco-friendly housing options, brokers can differentiate themselves from competitors. For example, developing tailored products or marketing strategies for first-time homebuyers can attract a demographic that may feel overwhelmed by the mortgage process. By providing education, resources, and personalized service, brokers can establish themselves as trusted advisors, which can significantly boost client loyalty and referrals.

Partnerships also present valuable opportunities for mortgage brokers. Collaborating with real estate agents, financial advisors, and even local businesses can create a mutually beneficial ecosystem. These partnerships can lead to referrals and increased visibility in the community. For instance, a mortgage broker teaming up with a real estate agent can offer clients a comprehensive package that simplifies the home buying process, making it more attractive to potential buyers. This collaboration not only enhances the client experience but also positions both parties as experts in their respective fields.

Here’s a summary of potential opportunities for mortgage brokers:

| Opportunities | Description |

|---|---|

| Technology integration | Using apps for seamless client experiences |

| Niche market focus | Catering to specific client needs |

| Strategic partnerships | Collaborating with real estate agents |

| Enhanced digital marketing | Utilizing social media effectively |

- Key Takeaways:

- Stay informed about industry trends.

- Explore partnerships for mutual growth.

“Every challenge is an opportunity in disguise!” 🌟

Threats Facing Mortgage Brokers

While opportunities abound, there are also significant threats that can impact mortgage brokers. Economic downturns can lead to higher default rates, and regulatory changes may impose additional compliance burdens. For instance, a sudden change in interest rates can affect borrowers’ ability to secure loans, leading to a decrease in business for brokers. Additionally, the housing market’s volatility can deter potential buyers, further complicating the landscape for mortgage brokers.

Competition from fintech companies is another growing concern. These companies often provide faster and more cost-effective solutions, which can lure clients away from traditional brokers. The convenience of online platforms and automated services may appeal to tech-savvy consumers who prioritize speed and efficiency. As a result, mortgage brokers must continuously evaluate their offerings and adapt to meet changing consumer preferences. This could involve investing in technology to streamline processes or enhancing customer service to create a more personalized experience.

Moreover, changing consumer behavior poses a threat as well. Today’s consumers are more informed and have higher expectations for transparency and service. If brokers fail to meet these expectations, they risk losing clients to competitors who are more attuned to the needs of modern borrowers. For example, if a broker does not provide clear information about fees or the loan process, clients may choose to work with a broker who prioritizes transparency. It’s essential for brokers to stay ahead of these trends and actively seek feedback from clients to improve their services.

Here’s a summary of potential threats facing mortgage brokers:

| Threats | Impact |

|---|---|

| Economic instability | Increased defaults and lower demand |

| Regulatory changes | Higher compliance costs |

| Competition from fintech | Loss of market share |

| Changing consumer preferences | Need to adapt services accordingly |

- Key Takeaways:

- Monitor economic indicators closely.

- Be proactive in compliance and competitive strategies.

“Adaptability is the key to survival in a changing market!” 🔑

Conducting Your Own SWOT Analysis

Now that we’ve covered the basics of a Mortgage Broker SWOT Analysis, it’s time to dive into how you can conduct one for your brokerage. The first step in this process is gathering your team for a brainstorming session. Involving different perspectives is crucial to obtaining a well-rounded view of your brokerage’s position in the market. Each team member can provide unique insights based on their experiences, which can significantly enrich the analysis.

Begin the process by creating a simple template for your SWOT analysis. Write down your brokerage’s strengths, weaknesses, opportunities, and threats as they pertain to your specific situation. This exercise is not merely about listing items; it’s about diving deep into what makes your brokerage unique and what challenges it faces. For instance, while discussing strengths, you might discover that your team has exceptional customer service skills or that you have established strong relationships with local real estate agents. These insights can help you leverage your strengths in your marketing strategies.

After identifying strengths and weaknesses, shift your focus to opportunities and threats. For example, if your analysis reveals a growing demand for eco-friendly housing options, you can create targeted marketing campaigns to attract clients interested in sustainable living. Conversely, if you identify a potential threat from a new fintech competitor offering lower fees, you can strategize on how to enhance your services or differentiate your offerings to maintain your competitive edge. By recognizing these elements, you can better position your brokerage in the market.

Here’s a summary of how to conduct your own SWOT analysis:

| Category | Notes |

|---|---|

| Strengths | Identify what your brokerage excels at. |

| Weaknesses | Recognize areas for improvement. |

| Opportunities | Explore new markets or trends. |

| Threats | Evaluate external challenges. |

- Key Takeaways:

- Collaborate with your team for comprehensive insights.

- Use a template to organize your thoughts effectively.

“A SWOT analysis is not just a task; it’s a journey to understanding your business!” 🌈

Leveraging SWOT Analysis for Strategic Planning

Once you’ve completed your SWOT analysis, the next step is to leverage this information for strategic planning. Use the insights gained from your analysis to create actionable strategies that can help you capitalize on your strengths and opportunities, while also addressing your weaknesses and threats. This proactive approach can significantly enhance your brokerage’s chances for success.

For instance, if your analysis reveals that you have strong client relationships but lack an online presence, consider investing in digital marketing strategies. Establishing a robust online platform can help you reach a broader audience and attract tech-savvy clients. Alternatively, if you identify a growing opportunity in a niche market, such as loans for first-time homebuyers, you can develop targeted services and marketing strategies tailored to meet their specific needs. This focus not only attracts clients but also positions your brokerage as an expert in that area.

Moreover, it’s essential to set measurable goals based on your SWOT analysis. For example, if you aim to improve your online presence, establish specific targets such as increasing website traffic by a certain percentage or generating a specific number of leads through online channels. Regularly review your progress against these goals and adjust your strategies as necessary. This iterative process allows you to remain agile and responsive to changes in the market.

Here’s how to translate your SWOT analysis into action:

| Action Item | Description |

|---|---|

| Strengths enhancement | Focus on customer service training and development. |

| Address weaknesses | Invest in technology upgrades and training. |

| Opportunity exploration | Develop niche marketing strategies. |

| Threat mitigation | Create a risk management plan to address potential challenges. |

- Key Takeaways:

- Turn insights into actionable strategies.

- Monitor progress and adapt as necessary.

“Planning is bringing the future into the present!” 🗓️

Continuous Review and Adaptation of Your SWOT Analysis

A Mortgage Broker SWOT Analysis isn’t a one-time event; it should be revisited regularly to ensure its relevance and effectiveness. As the market changes, so will your brokerage’s strengths, weaknesses, opportunities, and threats. Continuous review allows you to stay relevant and competitive in a fast-paced industry. By scheduling regular check-ins, you can update your analysis and adapt your strategies based on new information or changes in the market.

One effective approach is to conduct quarterly reviews of your SWOT analysis. During these sessions, gather your team to discuss any significant changes that have occurred in your brokerage or the broader mortgage market. For example, if a new competitor enters the market or if there’s a shift in consumer preferences towards digital services, it’s crucial to recognize these developments and adjust your strategies accordingly. This proactive stance not only helps in identifying potential risks but also allows you to seize new opportunities as they arise.

Additionally, gathering feedback from clients can provide valuable insights for your analysis. Conducting surveys or informal discussions with your clients can help you understand their evolving needs and expectations. This feedback can inform your understanding of your brokerage’s strengths and weaknesses. For instance, if clients express a desire for more digital interaction, it may highlight a weakness in your current offerings, prompting you to invest in technology upgrades or enhanced online services.

Here’s a quick checklist for ongoing SWOT analysis:

| Review Frequency | Action Item |

|---|---|

| Quarterly | Update strengths and weaknesses |

| Bi-Annually | Reassess opportunities and threats |

| Annually | Comprehensive review and planning |

- Key Takeaways:

- Make SWOT analysis a regular part of your strategy.

- Foster adaptability and continuous improvement.

“The only constant in life is change—embrace it!” 🌊

Final Thoughts on Mortgage Broker SWOT Analysis

Wrapping up our journey through the Mortgage Broker SWOT Analysis, remember that this tool is your ally in navigating the complexities of the mortgage industry. By understanding your brokerage’s position, you can make informed decisions that pave the way for success. Engaging your team in the process of conducting a SWOT analysis encourages collaboration and fosters a culture of open communication, which is vital for any business.

As you implement the strategies derived from your SWOT analysis, keep in mind the importance of agility. The mortgage market is continually evolving, and those who can adapt quickly will thrive. For example, if you notice a trend towards increased online applications, investing in a user-friendly platform can set you apart from competitors. Additionally, by maintaining strong relationships with clients and partners, you can build a loyal customer base that will sustain your business through challenging times.

Ultimately, the insights gained from a thorough SWOT analysis can lead to innovative strategies that not only meet current demands but also anticipate future trends. This proactive approach ensures that your brokerage remains competitive and relevant in an ever-changing landscape. By regularly reviewing and adapting your analysis, you can stay ahead of the curve and position your brokerage for long-term success.

- Key Takeaways:

- Use SWOT analysis as a strategic tool.

- Engage your team for comprehensive insights.

“Success is where preparation meets opportunity!” 🌟

Creating a Comprehensive SWOT Analysis for Mortgage Brokers

Creating a comprehensive SWOT analysis for mortgage brokers is not just about filling out a template; it’s about understanding the nuances of your business and the market landscape. To effectively craft this analysis, start by engaging your team in a collaborative environment. Each member can bring valuable insights based on their unique experiences and perspectives. This team approach can help uncover hidden strengths and weaknesses that may not be immediately obvious to one individual.

Begin by clearly defining your brokerage’s strengths. What does your team excel at? Is it exceptional customer service, extensive local market knowledge, or perhaps innovative technology use? Document these strengths in detail. For example, if your brokerage has a reputation for outstanding customer service, consider how you can leverage this in your marketing efforts. Highlight testimonials from satisfied clients on your website and social media platforms, showcasing the personal touch that sets your brokerage apart from competitors.

Next, identify your weaknesses. This is often the most challenging part of the process, as it requires honesty and self-reflection. Perhaps your brokerage struggles with outdated technology or inconsistent marketing efforts. Recognizing these weaknesses is crucial for improvement. For instance, if you find that your online presence is lacking, it might be time to invest in a user-friendly website or digital marketing strategies that can enhance your visibility and attract more clients.

After analyzing strengths and weaknesses, shift your focus to identifying opportunities. The mortgage industry is constantly evolving, and new trends can create avenues for growth. For example, the increasing demand for eco-friendly homes can be an opportunity for brokers to specialize in green financing options. By offering tailored services for this niche market, your brokerage can attract environmentally-conscious buyers and differentiate itself from competitors. Additionally, consider the potential for partnerships with real estate agents or financial planners, which can lead to a steady stream of referrals.

Finally, assess the threats facing your brokerage. These can include economic fluctuations, regulatory changes, or increased competition from fintech companies. It’s important to stay informed about these threats so that you can develop strategies to mitigate their impact. For example, if economic instability is a concern, consider diversifying your offerings to include various types of loans that cater to different client needs. This can help stabilize your revenue streams during uncertain times.

Here’s a summary of how to create a comprehensive SWOT analysis:

| Category | Notes |

|---|---|

| Strengths | Document your unique advantages and capabilities. |

| Weaknesses | Identify areas needing improvement. |

| Opportunities | Explore emerging trends and markets. |

| Threats | Evaluate external challenges and competition. |

- Key Takeaways:

- Engage your team for a collaborative analysis.

- Use the analysis to guide strategic planning.

“A well-crafted SWOT analysis is the foundation of strategic success!” 🏆

Implementing Strategies Based on Your SWOT Analysis

Once you have created your SWOT analysis, the next step is to implement strategies based on your findings. This process transforms theoretical insights into actionable plans that can drive your brokerage’s success. Start by prioritizing the strategies that align with your identified strengths and opportunities. For instance, if your analysis shows that your brokerage excels in customer service, consider launching a referral program that rewards clients for recommending your services to friends and family. This not only leverages your strength but also capitalizes on the opportunity for growth through word-of-mouth marketing.

Addressing weaknesses is equally important. If you identified outdated technology as a weakness, develop a plan to upgrade your systems. This could involve investing in a modern Customer Relationship Management (CRM) system that streamlines operations and enhances client interactions. By improving your technological capabilities, you not only boost efficiency but also enhance the client experience, making your brokerage more competitive.

When it comes to seizing opportunities, it’s crucial to stay agile and responsive. For example, if you identify a rising trend in demand for online mortgage applications, quickly adapt your processes to incorporate digital tools. This can involve creating an intuitive online application platform that simplifies the mortgage process for clients. The faster you respond to market trends, the better positioned your brokerage will be to attract new clients and retain existing ones.

Finally, addressing potential threats requires proactive planning. If regulatory changes are on the horizon, ensure that your brokerage stays compliant by regularly reviewing and updating your policies and procedures. Consider conducting training sessions for your team to keep everyone informed about new regulations and how they affect your business operations. This proactive approach not only mitigates risks but also instills confidence in your clients, knowing that you are committed to maintaining high standards of compliance and service.

- Key Takeaways:

- Prioritize strategies that leverage strengths and opportunities.

- Be proactive in addressing weaknesses and threats.

“Implementation is the bridge between strategy and success!” 🌉

Recommendations

In summary, conducting a thorough Mortgage Broker SWOT Analysis is crucial for understanding your brokerage’s position in the market and making informed strategic decisions. By identifying your strengths, weaknesses, opportunities, and threats, you can develop actionable plans that enhance your competitive advantage. To further assist you in your journey, consider utilizing the Mortgage Broker Business Plan Template, which provides a comprehensive framework for structuring your business effectively.

Additionally, explore our related articles that offer valuable insights and strategies for mortgage brokers:

- Mortgage Brokers: Secrets to High Profitability

- Mortgage Broker Business Plan: Essential Steps and Examples

- Mortgage Broker Financial Plan: Essential Steps and Example

- Building a Mortgage Broker Business: A Complete Guide with Practical Examples

- Crafting a Marketing Plan for Your Mortgage Broker Business (+ Example)

- Building a Business Model Canvas for Mortgage Broker: Examples and Tips

- Customer Segments for Mortgage Brokers: Who Are Your Potential Clients?

- How Much Does It Cost to Establish a Mortgage Broker Business?

- How to Conduct a Feasibility Study for Mortgage Broker?

- How to Implement Effective Risk Management for Mortgage Broker?

- Mortgage Broker Competition Study: Comprehensive Analysis

- Mortgage Broker Legal Considerations: Comprehensive Guide

- What Funding Options Are Available for Mortgage Broker?

- How to Scale a Mortgage Broker: Proven Growth Strategies

FAQ

What are the main strengths of a mortgage broker?

The main strengths of a mortgage broker include personalized customer service, strong local market knowledge, and the ability to offer various loan products tailored to client needs. By leveraging these strengths, brokers can build lasting relationships with clients and enhance their reputation in the market.

How can I identify the weaknesses of my mortgage brokerage?

Identifying weaknesses involves a thorough self-assessment of your brokerage’s operations. This can include analyzing customer feedback, evaluating marketing efforts, and assessing technology usage. By understanding these weaknesses, you can develop strategies to improve your services and overall client satisfaction.

What opportunities exist for mortgage brokers in the current market?

Opportunities for mortgage brokers include the increasing demand for online services, niche markets such as first-time homebuyers or eco-friendly housing, and potential partnerships with real estate agents. By capitalizing on these opportunities, brokers can expand their client base and improve profitability.

What are the common threats facing mortgage brokers?

Common threats include economic downturns, regulatory changes, and competition from fintech companies. Being aware of these threats allows brokers to implement proactive strategies to mitigate risks and maintain a competitive edge in the market.

How often should I conduct a SWOT analysis for my brokerage?

It is advisable to conduct a SWOT analysis at least quarterly. This regular review allows you to adapt to market changes, assess new opportunities and threats, and ensure that your brokerage remains competitive and aligned with industry trends.

What should I include in my mortgage broker business plan?

Your mortgage broker business plan should include an executive summary, market analysis, marketing strategies, financial projections, and a detailed SWOT analysis. This comprehensive approach helps ensure that you are well-prepared to navigate the challenges and opportunities in the mortgage industry.