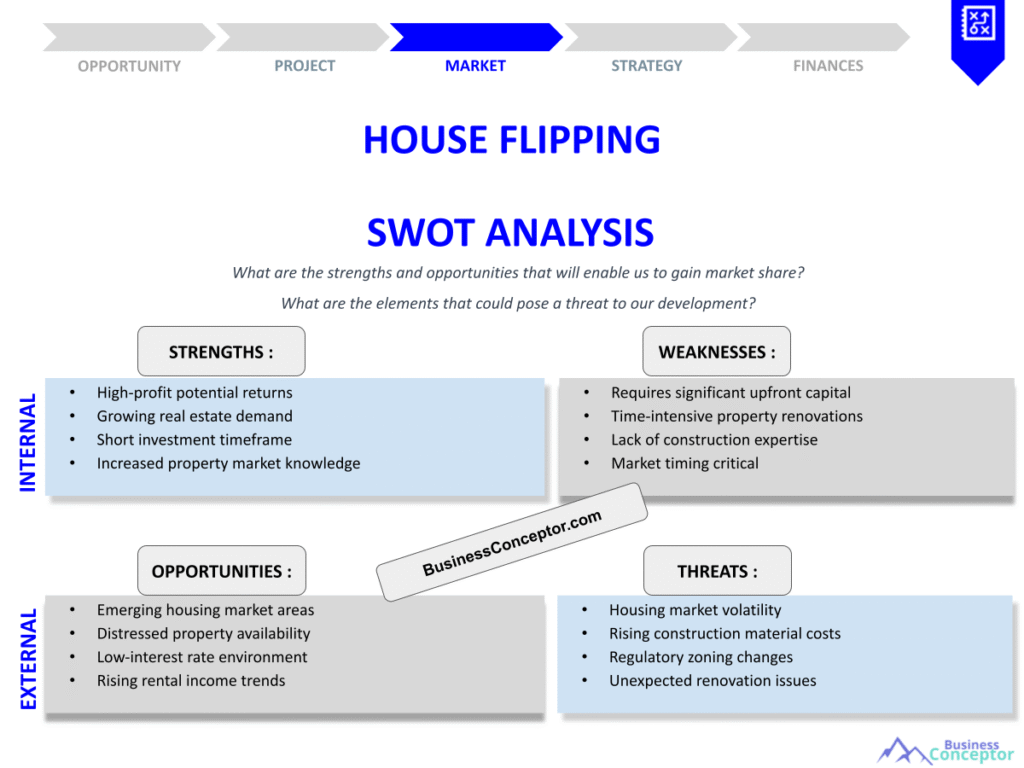

Did you know that a successful house flipping project can yield profits of 30% or more? That’s why a House Flipping SWOT Analysis is crucial for anyone looking to dive into the exciting world of real estate. A SWOT analysis helps investors identify Strengths, Weaknesses, Opportunities, and Threats associated with flipping houses. By understanding these elements, you can make informed decisions and navigate the risks involved in this competitive market.

Here’s what you’ll learn in this article:

– The importance of conducting a SWOT analysis for house flipping.

– Key strengths and weaknesses to consider.

– Opportunities and threats in the current real estate market.

– Practical tips for leveraging your findings to succeed in house flipping.

Understanding House Flipping SWOT Analysis

When you start considering house flipping, you may feel overwhelmed by all the factors at play. A House Flipping SWOT Analysis can help simplify your approach. This analytical tool allows you to dissect the various aspects of your flipping venture.

Strengths might include your experience in renovation or a strong network of contractors. Weaknesses could be a limited budget or lack of market knowledge. Understanding these elements will help you develop a strategy that plays to your strengths while mitigating risks.

For example, if you’re skilled at DIY renovations, you can save on labor costs and increase your profit margins. On the other hand, if you’re new to real estate, recognizing your lack of experience will help you seek mentorship or educational resources.

| SWOT Element | Description |

|---|---|

| Strengths | Unique skills, network, financial resources |

| Weaknesses | Inexperience, limited budget, time constraints |

| Opportunities | Market trends, distressed properties, investor networks |

| Threats | Market saturation, economic downturns, regulatory changes |

- Key Takeaways:

- Use SWOT analysis to clarify your position in house flipping.

- Identify strengths to leverage for better outcomes.

- Recognize weaknesses to seek improvement.

- Spot opportunities and threats in the market.

“Understanding your strengths and weaknesses is the first step to success!” 🌟

Understanding your strengths is the first step to mastering the house flipping game. Strengths are the assets and advantages that you bring to the table in your house flipping journey. They can significantly influence your potential for success. For instance, if you have a background in construction or design, you can handle renovations more efficiently, ensuring quality work while saving on costs.

Moreover, having a solid financial foundation can be a major strength. This allows you to purchase properties without relying heavily on loans, which can cut down on interest payments and increase your profit margins. In fact, many successful flippers recommend having a financial cushion to absorb unexpected costs that may arise during renovations.

Consider the story of a friend of mine, who flipped a house using his skills as a contractor. He managed to renovate the property within budget and timeline, ultimately selling it for a 40% profit. His strength in construction turned out to be a game-changer! By leveraging his expertise, he avoided many common pitfalls that can lead to financial losses.

Additionally, your ability to network can also be a significant strength. Knowing reliable contractors, real estate agents, and other investors can provide you with valuable insights and opportunities. These connections can lead to off-market deals or exclusive partnerships that give you an edge in the competitive real estate flipping market.

| Strengths Examples | Benefits |

|---|---|

| Renovation skills | Cost savings, quality improvements |

| Strong financials | Lower debt, higher profits |

| Local market knowledge | Better property selection, accurate pricing |

- Key Takeaways:

- Leverage your unique skills for cost-effective renovations.

- A strong financial position enhances your buying power.

- Local market knowledge can lead to better investment choices.

“Your strengths are your best tools; use them wisely!” 💪

Identifying Weaknesses in House Flipping

While it’s essential to focus on strengths, recognizing weaknesses is equally important in the house flipping journey. Weaknesses can hinder your ability to flip houses successfully and can often be the difference between a profitable venture and a financial disaster. For instance, if you’re inexperienced in real estate, you might overlook critical factors like market trends or property valuation, leading to poor investment decisions.

A common mistake many new flippers make is underestimating renovation costs. I remember when I first started; I thought I could handle everything on my own. However, unforeseen issues with plumbing and electrical systems led to expenses that wiped out my profit margin. This experience taught me the hard way that proper planning and budgeting are crucial to success in real estate flipping.

Additionally, limited funds can be a significant weakness. If your budget is tight, you may find it challenging to cover unexpected costs that arise during renovations. This can lead to rushed decisions or cutting corners, ultimately impacting the quality of your finished product. To counteract this, it’s vital to create a detailed budget that includes a contingency fund for those unexpected expenses.

| Weaknesses Examples | Solutions |

|---|---|

| Inexperience | Seek mentorship, take courses |

| Limited budget | Create a strict budget, find funding |

| Time constraints | Prioritize tasks, hire help |

- Key Takeaways:

- Acknowledge weaknesses to develop strategies for improvement.

- Invest in education and mentorship to fill knowledge gaps.

- Create a realistic budget to avoid financial pitfalls.

“Embrace your weaknesses; they’re stepping stones to growth!” 🌱

Exploring Opportunities in House Flipping

Opportunities in the house flipping market can be abundant if you know where to look. With the right approach, you can tap into market trends and find lucrative properties to flip. For instance, distressed properties often sell for less, presenting a chance for significant profit after renovation. Investing in these properties can be a smart strategy, as they often require cosmetic updates rather than extensive structural work.

Moreover, some areas may be experiencing revitalization, making them prime for investment. By conducting thorough market research, you can identify neighborhoods on the rise, increasing your chances of a successful flip. Many flippers have found success by investing in up-and-coming areas before they become trendy, allowing them to sell at a premium once the neighborhood attracts more buyers.

A friend of mine invested in a neighborhood that was slowly gaining popularity. She bought a rundown property for a low price, renovated it, and sold it at a premium once the area began to attract more buyers. Her timing and market insight paid off handsomely! This illustrates the importance of staying informed about real estate trends and being ready to act quickly when opportunities arise.

| Opportunities Examples | How to Capitalize |

|---|---|

| Distressed properties | Renovate and resell |

| Emerging neighborhoods | Invest early for growth |

| Investor networks | Collaborate for better deals |

- Key Takeaways:

- Seek distressed properties for affordable investments.

- Research neighborhoods for signs of growth.

- Network with other investors for collaboration.

“Opportunities are everywhere; keep your eyes open!” 👀

Assessing Threats in House Flipping

Every investment carries risks, and house flipping is no exception. Understanding the threats you may encounter is vital for navigating the landscape and adjusting your strategy accordingly. One of the most significant threats is market saturation. When too many investors flood a specific area, competition drives prices down, making it difficult to sell properties at a profit. If you notice that many investors are flipping houses in your area, it might indicate that the market is becoming saturated, which can result in diminishing returns.

Another critical threat to consider is economic downturns. Changes in the economy can significantly affect property values, and during a recession, homes may lose value quickly. I remember a time when I was flipping a house, and suddenly, the local economy took a hit. Property values dropped, and my planned sale price became unrealistic. I had to pivot quickly, either by renting the property or holding it until the market improved. This experience taught me the importance of being prepared for economic fluctuations and having a backup plan.

Additionally, regulatory changes can pose threats to your flipping business. Local governments may introduce new laws or regulations that impact the housing market, such as stricter building codes or zoning laws. Staying informed about these changes is crucial for ensuring that your flipping projects remain compliant and profitable. Regularly checking local news and real estate reports can help you stay ahead of potential issues.

| Threats Examples | Mitigation Strategies |

|---|---|

| Market saturation | Diversify investments |

| Economic downturns | Maintain cash reserves |

| Regulatory changes | Stay informed on laws |

- Key Takeaways:

- Monitor market conditions to avoid saturation.

- Keep cash reserves for economic downturns.

- Stay updated on regulatory changes affecting real estate.

“The best defense against threats is knowledge!” 📚

Putting It All Together: Implementing Your SWOT Analysis

Now that you’ve analyzed your strengths, weaknesses, opportunities, and threats, it’s time to implement your findings into a strategic plan. This is where the real magic happens in house flipping. Start by creating a strategy that leverages your strengths while addressing your weaknesses. For instance, if your strength lies in renovation, focus on properties that need cosmetic improvements. This approach will allow you to maximize your skills and minimize the reliance on costly contractors.

Identifying potential investment opportunities is equally crucial. Use your knowledge of the market to find properties that are undervalued or in emerging neighborhoods. By investing in these areas early, you can take advantage of rising property values and increase your profit margins. A practical approach is to set specific, measurable goals based on your SWOT analysis. For example, if you identify a weakness in your market knowledge, a goal could be to attend at least three local real estate seminars within the next six months. By doing this, you can track your progress and make adjustments as needed.

Moreover, be sure to include contingency plans for the threats you’ve identified. If you’re aware of potential market saturation in your area, consider diversifying your investments to include different types of properties or even exploring new markets. This flexibility can help protect you from financial loss and ensure that you have multiple streams of income.

| Implementation Steps | Focus Areas |

|---|---|

| Leverage strengths | Renovation, networking |

| Address weaknesses | Education, budgeting |

| Explore opportunities | Market research, distressed properties |

| Mitigate threats | Contingency planning |

- Key Takeaways:

- Create a strategic plan based on your SWOT analysis.

- Set measurable goals to track progress.

- Be adaptable and ready to pivot your strategy.

“Success is where preparation meets opportunity!” 🚀

Reviewing Your House Flipping Strategy

It’s essential to regularly review your house flipping strategy. The real estate market is dynamic, and conditions can change rapidly, so staying flexible and informed is key. Conducting periodic SWOT analyses will keep you aware of your current position and help you adapt to new challenges and opportunities. For instance, if you’ve noticed a decline in the demand for properties in your area, it may be time to pivot your strategy and explore alternative markets or property types.

Regularly assessing your strengths and weaknesses is also crucial. As you gain experience, you might find that your skills have improved or that you’ve developed new connections that enhance your business. On the flip side, you may discover new weaknesses, such as gaps in your knowledge about local regulations or shifts in market trends that require immediate attention. Being proactive about these changes allows you to adjust your approach and continue on the path to success.

For example, if you’ve identified that your renovation skills have significantly improved, you might decide to take on more extensive projects that you previously would have avoided. This could lead to higher profit margins as you can handle more work in-house rather than relying on contractors. Alternatively, if you realize you need to enhance your marketing strategies to attract buyers, consider investing in digital marketing or social media advertising to reach a broader audience.

| Review Steps | Benefits |

|---|---|

| Regular SWOT analysis | Stay informed |

| Market trend analysis | Identify new opportunities |

| Financial reviews | Optimize profitability |

- Key Takeaways:

- Regularly assess your strategy to stay competitive.

- Adapt to market changes to maximize profits.

- Continuous learning is key to success.

“The journey of a thousand miles begins with one step!” 🛤️

Adapting to Market Changes in House Flipping

Adapting to market changes is crucial for anyone in the house flipping business. Market dynamics can shift due to various factors, including economic conditions, consumer preferences, and local development projects. By staying informed about these changes, you can adjust your strategies to remain competitive and profitable. For example, if you notice that buyers are increasingly interested in eco-friendly homes, you might consider incorporating sustainable materials or energy-efficient upgrades into your renovations.

Additionally, keeping an eye on local development projects can provide valuable insights into potential market shifts. If a new school or shopping center is being built nearby, it may increase property values and attract more buyers to the area. By investing in properties before these developments are completed, you can capitalize on the rising demand and secure a better return on investment.

Furthermore, it’s essential to engage with your local real estate community. Networking with other investors, real estate agents, and contractors can provide you with insights into market trends and help you identify opportunities that may not be widely advertised. Attending local real estate meetups or seminars can also keep you informed and allow you to build relationships that may benefit your flipping projects.

| Adapting Strategies | Benefits |

|---|---|

| Monitor market dynamics | Stay ahead of trends |

| Invest in sustainable upgrades | Attract eco-conscious buyers |

| Engage with the real estate community | Gain valuable insights |

- Key Takeaways:

- Stay informed about local development projects.

- Incorporate market trends into your renovation plans.

- Network with industry professionals for better insights.

“Adaptability is the key to success in real estate!” 🔑

Understanding the Financial Aspects of House Flipping

Understanding the financial aspects of house flipping is crucial for anyone looking to succeed in this competitive market. The first step in managing finances effectively is to create a detailed budget that accounts for all costs associated with purchasing, renovating, and selling a property. This includes not only the purchase price but also closing costs, renovation expenses, and holding costs such as utilities, property taxes, and insurance during the renovation process.

One of the biggest mistakes many new flippers make is underestimating renovation costs. It’s easy to get caught up in the excitement of a new project and overlook potential issues that may arise. I remember my first flip; I was so focused on cosmetic changes that I failed to account for plumbing and electrical updates. These unexpected costs quickly ate into my profits. To avoid this pitfall, it’s essential to conduct a thorough inspection of the property before purchase and consult with professionals to get accurate estimates for any necessary work.

In addition to budgeting for renovations, it’s vital to consider how your financing will impact your overall profit. Many flippers opt for short-term loans or hard money loans, which can come with high-interest rates. While these loans can provide quick access to funds, they can also eat into your profits if you’re not careful. It’s essential to evaluate your financing options and select the one that aligns best with your business strategy. For instance, if you have access to personal savings or can secure a lower-interest loan, you might save significantly on interest payments, boosting your overall return on investment.

| Financial Aspects | Considerations |

|---|---|

| Detailed budgeting | Account for all costs |

| Renovation estimates | Consult with professionals |

| Financing options | Evaluate costs and benefits |

- Key Takeaways:

- Create a comprehensive budget to avoid unexpected costs.

- Conduct thorough inspections and get accurate renovation estimates.

- Choose financing options wisely to maximize profits.

“A penny saved is a penny earned!” 💰

Leveraging Technology in House Flipping

In today’s digital age, leveraging technology can significantly enhance your house flipping strategy. From using property analysis software to manage your finances to employing virtual reality tools for staging homes, technology can streamline processes and improve your overall efficiency. One of the most impactful tools available to real estate investors is the use of house flipping software. These programs can help you analyze potential properties, estimate renovation costs, and even project your potential return on investment based on market trends.

For example, platforms like Zillow and Redfin offer valuable data on property values and trends, helping you make informed decisions about where to invest. Additionally, property management software can help you keep track of expenses and manage budgets effectively, reducing the chances of overspending. I personally found that using these tools saved me countless hours and helped me stay organized throughout the renovation process.

Furthermore, marketing your flipped properties has also become easier with technology. Utilizing social media platforms and online listings can increase visibility and attract a larger pool of potential buyers. High-quality photos and virtual tours can showcase your renovated properties effectively, allowing buyers to visualize themselves in the space. This is particularly important in today’s market, where many buyers begin their home search online. The more appealing your online presence, the higher the chances of selling quickly and at a desirable price.

| Technology Tools | Benefits |

|---|---|

| Property analysis software | Streamline financial management |

| Online listing platforms | Increase visibility |

| Virtual tours | Enhance buyer engagement |

- Key Takeaways:

- Use technology to streamline your house flipping process.

- Leverage online platforms to reach potential buyers.

- Invest in tools that enhance your financial management.

“Technology is the future; embrace it!” 🌐

Recommendations

In summary, conducting a House Flipping SWOT Analysis is essential for anyone looking to succeed in the competitive world of real estate investment. By understanding your strengths, weaknesses, opportunities, and threats, you can make informed decisions that lead to higher profits and reduced risks. To further enhance your success in house flipping, consider utilizing a comprehensive House Flipping Business Plan Template that can help you structure your approach and keep you organized throughout the process.

Additionally, here are some related articles that can provide you with further insights and strategies for your house flipping journey:

- House Flipping: Secrets to High Profit Margins

- House Flipping Business Plan: Comprehensive Guide

- House Flipping Financial Plan: Step-by-Step Guide with Template

- How to Start a House Flipping Business: A Detailed Guide with Examples

- Building a House Flipping Marketing Plan: Step-by-Step Guide with Examples

- How to Begin Crafting a Business Model Canvas for Your House Flipping Business

- House Flipping Customer Segments: Examples and Effective Strategies

- How Much Does It Cost to Establish a House Flipping Business?

- How to Calculate the Feasibility Study for a House Flipping Business?

- House Flipping Risk Management: Detailed Analysis

- House Flipping Competition Study: Comprehensive Analysis

- How to Address Legal Considerations in House Flipping?

- Exploring Funding Options for House Flipping

- How to Scale House Flipping with Effective Growth Strategies

FAQ

What are the strengths and weaknesses of house flipping?

The strengths of house flipping often include unique skills, strong financial backing, and market knowledge, allowing investors to make informed decisions. Conversely, weaknesses may involve limited experience, financial constraints, or time limitations, which can hinder project success.

What are the key opportunities in the house flipping market?

Opportunities in house flipping include investing in distressed properties that can be renovated for profit, exploring emerging neighborhoods where property values are set to rise, and leveraging connections within investor networks for better deals.

What threats should house flippers be aware of?

Common threats in the real estate flipping market include market saturation, economic downturns that can affect property values, and regulatory changes that may impose new restrictions on renovations or sales.

How can I improve my house flipping strategy?

Improving your house flipping strategy involves regularly reviewing your SWOT analysis, staying informed about market trends, and adapting to changes in buyer preferences. Engaging with the real estate community can also provide valuable insights and networking opportunities.

What financial aspects should I consider when flipping houses?

When flipping houses, it’s crucial to create a detailed budget that includes all costs, such as purchase price, renovation expenses, and holding costs. Additionally, consider your financing options, as high-interest loans can significantly impact your overall profits.

How can technology aid in house flipping?

Technology plays a vital role in house flipping by offering tools for property analysis, financial management, and marketing. Utilizing property analysis software can streamline decision-making, while online platforms can enhance visibility and attract potential buyers.