Did you know that over 70% of SaaS startups struggle to secure funding in their early stages? This startling fact highlights the importance of understanding SaaS software funding options. When you dive into the world of Software as a Service (SaaS), knowing how to navigate the funding landscape can make or break your startup. SaaS funding encompasses various strategies and sources that entrepreneurs can leverage to get the financial support they need to grow and scale their businesses.

In this article, we’ll explore the best funding options for SaaS software, from venture capital to crowdfunding, and everything in between. You’ll learn about the challenges faced by SaaS entrepreneurs, the different types of funding available, and practical tips for securing the financial backing that can propel your business forward. Understanding these nuances is essential for making informed decisions about which funding route to pursue.

- Overview of SaaS funding landscape

- Importance of funding for SaaS startups

- Types of funding options available

- Key statistics about SaaS funding

- Challenges faced by SaaS entrepreneurs

- Essential tips for securing funding

- Case studies of successful SaaS funding

- Insights from industry experts

- Future trends in SaaS funding

- Call to action for readers

Understanding SaaS Funding Landscape

The SaaS funding landscape can feel overwhelming, especially for new entrepreneurs. With so many options available, it’s crucial to understand the different types of funding that can help you launch and grow your business. From bootstrapping to venture capital, each funding type has its own set of advantages and challenges.

For example, venture capital can provide significant funding, but it often comes with strings attached, such as giving up equity. In contrast, bootstrapping allows founders to retain full control but may limit growth potential. Understanding these nuances is essential for making informed decisions about which funding route to pursue, setting the stage for a deeper exploration of specific options.

As we dive deeper into the world of SaaS funding, you’ll find that the right choice often depends on your business model, market conditions, and personal preferences. Each funding option can lead to different outcomes, and recognizing these paths is crucial for your startup’s success.

| Funding Type | Description |

|---|---|

| Venture Capital | Large investments from firms in exchange for equity |

| Bootstrapping | Self-funding through personal savings |

| Crowdfunding | Raising small amounts from a large number of people |

- Different funding types available

- Pros and cons of each funding source

- Importance of aligning funding with business goals

– “Funding is not just about money; it’s about the right partnership.”

Venture Capital vs. Angel Investors

Venture capitalists and angel investors are two popular funding sources for SaaS startups. While they both provide essential capital, their approaches and expectations differ significantly. Understanding these differences can help entrepreneurs determine which type of investor aligns best with their business vision.

For instance, venture capitalists typically invest larger sums of money and expect a higher return on investment. They often look for startups with the potential for rapid growth and scalability, making them a suitable option for SaaS companies that have a strong business model and market fit. On the other hand, angel investors may provide smaller amounts of capital, but they often bring valuable experience, mentorship, and industry connections that can be incredibly beneficial for early-stage startups.

Knowing these distinctions allows entrepreneurs to tailor their pitches effectively. By presenting a clear understanding of what each investor type seeks, you can improve your chances of securing the right investment for your SaaS business.

- Research potential venture capital firms and their investment criteria.

- Prepare a compelling pitch that highlights your unique value proposition.

- Network with angel investors to build relationships and trust.

– Following these steps can significantly improve your chances of securing the right investment.

Exploring Crowdfunding Options

Crowdfunding has gained popularity as a viable funding option for SaaS startups, allowing entrepreneurs to raise capital from a broad audience. This method democratizes the funding process, enabling small investors to participate in the growth of innovative software solutions. To succeed in this landscape, it’s crucial to create a compelling campaign that resonates with potential backers.

Platforms like Kickstarter and Indiegogo have proven effective for many, but the key lies in presenting a clear value proposition and engaging storytelling. Successful crowdfunding campaigns often leverage social media and community engagement to build momentum and trust, essential factors for reaching funding goals. The ability to showcase your SaaS product and its benefits can lead to a loyal customer base even before your official launch.

As you craft your crowdfunding strategy, remember that transparency and communication with your backers are vital. By keeping them informed and engaged, you can foster a sense of community that supports your journey.

| Key Crowdfunding Platforms | Description |

|---|---|

| Kickstarter | Platform for creative projects and innovative ideas |

| Indiegogo | Flexible funding for various projects, including SaaS |

- Key crowdfunding platforms for SaaS

- Strategies for a successful campaign

- Importance of community engagement

– “Engagement is the key to a successful crowdfunding campaign.”

Bootstrapping Your SaaS Startup

Bootstrapping is an attractive option for many SaaS entrepreneurs, especially those who want to maintain full control over their business. This approach involves funding your startup through personal savings, revenue generated from the business, or minimal external investment. While it may limit your initial growth, bootstrapping can also foster creativity and innovation as you learn to maximize limited resources.

One of the most significant advantages of bootstrapping is the ability to retain full ownership of your company. This means that you make all the decisions without external pressure from investors. However, it also means that you must be resourceful and strategic in how you allocate your funds. For example, focusing on a minimum viable product (MVP) allows you to launch quickly while minimizing costs.

As we delve deeper into bootstrapping strategies, you’ll find that this path often requires a strong commitment and resilience. Learning to adapt and pivot based on customer feedback can lead to a product that truly meets market needs, setting the stage for future growth.

| Bootstrapping Strategies | Description |

|---|---|

| Lean Operations | Minimize expenses and focus on essential features |

| Customer Feedback | Use customer input to guide product development |

- Focus on a minimum viable product (MVP)

- Leverage free tools and resources

- Build a strong community around your product

– “Success comes to those who persevere.”

Government Grants and Programs

Many entrepreneurs overlook government grants and programs that can provide significant funding opportunities for SaaS startups. These grants are designed to promote innovation and support small businesses in various sectors, including technology. Programs like the Small Business Innovation Research (SBIR) offer funding to promote innovation in tech sectors, making it a viable option for SaaS companies.

Applying for government grants often requires a well-prepared proposal that clearly outlines your business model, objectives, and how the funding will be used. While the application process can be competitive and time-consuming, the potential benefits can be substantial. Successful grant applications often highlight a startup’s innovation, market potential, and how it aligns with government objectives.

By understanding the requirements and application processes, entrepreneurs can tap into these often underutilized resources. Government funding can provide the necessary capital to develop your product and reach a broader market without the pressures associated with equity financing.

| Government Funding Programs | Description |

|---|---|

| SBIR | Funding for innovative tech startups |

| STTR | Collaboration between small businesses and research institutions |

- Research available grants for SaaS

- Prepare a detailed proposal

- Follow up with funding agencies

Revenue-Based Financing

Revenue-based financing is an emerging funding option that allows SaaS startups to raise capital based on their revenue. This model can be particularly beneficial for businesses that prefer not to give up equity while still accessing the funds needed for growth. Unlike traditional loans, where fixed payments are required regardless of revenue fluctuations, revenue-based financing adjusts payments based on your sales performance.

This flexibility can be a game-changer for SaaS companies experiencing seasonal revenue or fluctuations in cash flow. By aligning repayment with revenue, you can maintain operational stability and invest more into product development or marketing during growth phases. Understanding how to structure these deals is essential for entrepreneurs looking to navigate this innovative financing method effectively.

As you explore revenue-based financing, it’s crucial to partner with investors who understand your business model and are aligned with your long-term goals. By doing so, you can create a sustainable funding strategy that allows for growth without sacrificing ownership.

| Revenue-Based Financing Overview | Description |

|---|---|

| Flexibility | Payments adjust based on revenue |

| No equity dilution | Retain full ownership of your company |

- Key benefits of revenue-based financing

- Ideal candidates for this funding type

- How to approach revenue-based investors

Building a Compelling Pitch

Regardless of the funding route chosen, having a compelling pitch is crucial for securing the necessary support. A well-structured pitch deck should convey your business model, market opportunity, and financial projections clearly and persuasively. Investors want to see not only the potential for returns but also a deep understanding of the market and the problem your SaaS product solves.

When preparing your pitch, focus on the key elements that will grab attention. Start with a compelling problem statement that resonates with your audience, followed by a clear explanation of your solution and its unique value proposition. Including data on market size and competition can further strengthen your case. Additionally, showcasing traction, such as user growth or revenue milestones, will help build credibility.

As you refine your pitch, practice delivering it with confidence and clarity. Engaging storytelling combined with solid data can make your pitch memorable and compelling, increasing your chances of attracting the right investors for your SaaS business.

| Pitch Deck Essentials | Description |

|---|---|

| Problem Statement | Clearly define the issue your SaaS solves |

| Market Analysis | Present data on market size and competition |

- Outline your business model

- Include financial projections

- Practice your delivery

Navigating Funding Challenges

Securing funding for a SaaS startup is fraught with challenges. Entrepreneurs often face hurdles such as market competition, investor skepticism, and the pressure to deliver quick results. Recognizing these challenges early can help you develop strategies to overcome them and position your SaaS business for success.

One common challenge is differentiating your product in a crowded market. With numerous SaaS solutions available, it’s crucial to articulate what makes your offering unique. This could involve emphasizing specific features, customer service, or pricing models that set you apart. Additionally, investors may be skeptical about your business model, especially if you lack traction or a proven track record. Addressing these concerns head-on in your pitch can help build trust.

Lastly, the pressure to achieve rapid growth can lead to poor decision-making. It’s essential to balance growth ambitions with sustainable practices. By focusing on long-term goals and maintaining a clear vision, you can navigate these challenges effectively and build a resilient SaaS company.

| Common Funding Challenges | Solution |

|---|---|

| Competition | Differentiation and unique value proposition |

| Investor Skepticism | Build credibility with data and traction |

- Recognize and address funding challenges

- Develop resilience and adaptability

- Seek mentorship and support

Learning from Successful SaaS Funding Stories

Looking at successful SaaS funding stories can provide valuable lessons for aspiring entrepreneurs. Case studies of companies like Slack and Zoom illustrate how different funding strategies can lead to significant growth. These examples not only inspire but also offer practical insights into what works and what doesn’t in the world of SaaS funding.

For instance, Slack initially bootstrapped its development before seeking venture capital to scale rapidly. This strategic approach allowed them to refine their product based on user feedback before making significant investments. Similarly, Zoom focused on delivering exceptional user experience, which attracted both users and investors, ultimately leading to a successful IPO.

By studying these success stories, you can identify applicable strategies for your own startup. Whether it’s focusing on customer feedback, building a strong community, or refining your pitch, these insights can help shape your funding journey and position your SaaS business for success.

– “Every success story is built on lessons learned from failures.”

- Research successful SaaS case studies

- Identify applicable strategies for your startup

- Stay adaptable and open to new ideas

Conclusion

In summary, understanding SaaS software funding options is vital for any entrepreneur looking to launch or grow a business in this competitive landscape. With various funding sources available, from venture capital to government grants, it’s essential to align your funding strategy with your business goals. Don’t hesitate to explore multiple options and learn from the experiences of others in the industry.

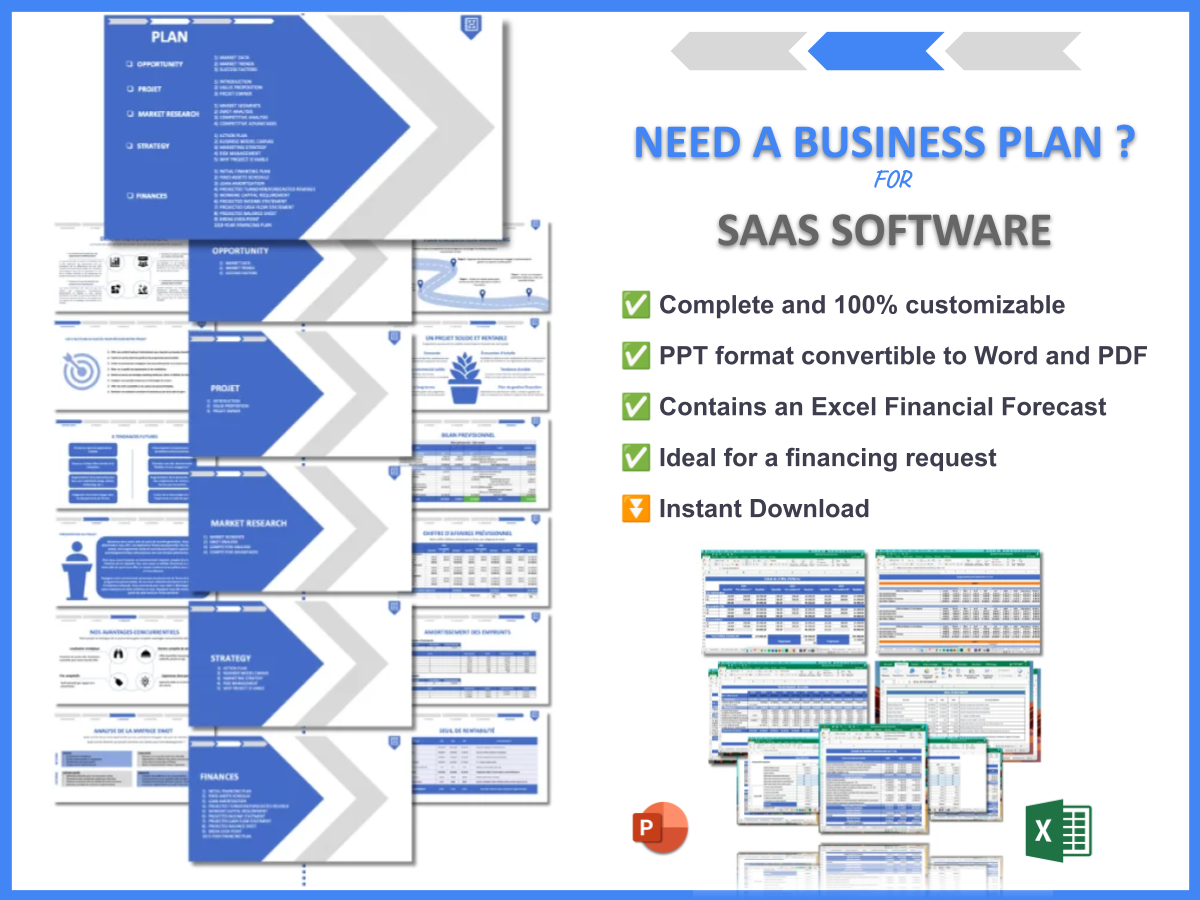

To assist you in creating a solid foundation for your SaaS business, consider using the SaaS Software Business Plan Template. This resource can help you structure your ideas effectively and set the stage for success.

Additionally, you may find these articles helpful in furthering your knowledge about SaaS software:

- SWOT Analysis for SaaS Software: Maximizing Business Potential

- How to Create a Business Plan for Your SaaS Software: Example Included

- Building a Financial Plan for Your SaaS Software: A Comprehensive Guide (+ Template)

- Building a Successful SaaS Software Business: Complete Guide with Example

- Begin Your SaaS Software Marketing Plan with This Example

- Building a Business Model Canvas for SaaS Software: A Comprehensive Guide

- Customer Segments for SaaS Software: Who Are Your Ideal Users?

- SaaS Software Profitability: Maximizing Your Revenue

- How Much Does It Cost to Develop SaaS Software?

- Ultimate SaaS Software Feasibility Study: Tips and Tricks

- How to Start a Competition Study for SaaS Software?

- How to Start Risk Management for SaaS Software?

- What Legal Considerations Should You Be Aware of for SaaS Software?

- SaaS Software Growth Strategies: Scaling Success Stories

FAQ Section

What are the primary funding options for SaaS startups?

The main funding options for SaaS startups include venture capital, angel investors, crowdfunding, bootstrapping, government grants, and revenue-based financing.

How do I approach venture capital firms for funding?

To approach venture capital firms, research potential investors, prepare a compelling pitch, and build relationships through networking.

What is the difference between angel investors and venture capitalists?

Angel investors typically invest smaller amounts and offer mentorship, while venture capitalists invest larger sums with higher return expectations.

Can I bootstrap my SaaS startup successfully?

Yes, many successful SaaS companies have been bootstrapped by focusing on lean operations and reinvesting profits.

Are there specific government grants for SaaS startups?

Yes, programs like the Small Business Innovation Research (SBIR) offer funding for innovative tech startups, including SaaS.

What is revenue-based financing?

Revenue-based financing allows startups to raise capital based on their revenue without giving up equity.

How can I create a compelling pitch for my SaaS startup?

Focus on your problem statement, market analysis, and financial projections in your pitch deck.

What challenges do SaaS startups face when securing funding?

Common challenges include market competition, investor skepticism, and the pressure to deliver results quickly.

How can I learn from successful SaaS funding stories?

Research case studies of successful companies and identify strategies that can apply to your startup.

What are the key actions to take when seeking SaaS funding?

Research funding options, prepare your pitch, and network with potential investors and mentors.