The ride hailing financial plan is crucial for anyone looking to dive into the fast-paced world of on-demand transportation. You might be surprised to learn that the ride hailing industry has seen a surge in popularity, with millions of rides booked every day across the globe. So, what does it take to create a solid financial plan for your ride hailing business? Simply put, a financial plan outlines your business’s financial goals and the steps you need to take to achieve them. Here’s what you need to know:

- Understand your costs: From driver incentives to app development, knowing your expenses is key.

- Revenue streams: Explore how ride hailing companies make money, whether through fares, surcharges, or partnerships.

- Financial projections: Create forecasts to help you plan for growth and sustainability.

- Funding options: Identify potential sources of capital to get your business off the ground.

Understanding the Ride Hailing Business Model

Starting a ride hailing business means you need to grasp the underlying business model. Most companies in this space operate as platforms connecting drivers with passengers, taking a percentage of the fare as their revenue. This model has proven successful for major players like Uber and Lyft, but it also opens doors for smaller, regional companies that cater to specific markets.

Understanding how these models work is vital because it influences everything from your pricing strategy to your marketing approach. For instance, if you decide to follow a similar model to Uber, you’ll need to consider factors such as dynamic pricing, which adjusts fares based on demand and supply. This method can maximize earnings during peak hours while still attracting passengers during off-peak times.

Here’s a quick look at the ride hailing business model:

| Key Components | Description |

|---|---|

| Driver Partnerships | Establish agreements with drivers who will provide the service. |

| User Acquisition | Strategies for attracting passengers to your platform. |

| Revenue Model | How your company will earn money (e.g., commission, subscription). |

- Drivers earn a percentage of the fare, which creates a direct incentive for them to provide excellent service.

- User acquisition is crucial; without passengers, there’s no revenue. Consider promotional offers to attract new users.

- Your revenue model will determine your business’s long-term viability, so choose wisely.

“Success is not just about what you accomplish in your life, it’s about what you inspire others to do.” 🚀

Additionally, understanding the cost structure of ride hailing apps is essential for developing a comprehensive financial plan. Costs can include driver incentives, marketing expenses, technology development, and operational overhead. For example, if you’re planning to develop a custom app, costs could easily soar into the tens of thousands. Knowing these costs upfront can help you prepare for potential financial hurdles and avoid unexpected setbacks down the road.

In conclusion, a solid grasp of the ride hailing business model will enable you to make informed decisions and strategize effectively. By understanding how your company will operate, the costs involved, and the revenue streams available, you’ll be better equipped to navigate the complexities of this competitive industry. With the right plan in place, you can position your ride hailing business for success and growth in a rapidly evolving market.

Financial Planning for Ride Hailing Startups

Now that you’ve got a grip on the ride hailing business model, let’s talk about financial planning. It’s not just about having a budget; it’s about understanding your financial landscape in a way that allows you to make informed decisions. Effective financial planning is crucial for your success, especially in a highly competitive market like ride hailing. A comprehensive financial plan can help you identify potential risks, optimize your resource allocation, and set realistic goals for growth.

Start by outlining your startup costs. These can range from app development to marketing expenses and driver onboarding. For instance, if you’re planning to develop a custom app, costs could easily soar into the tens of thousands. Other costs may include vehicle maintenance, insurance, and operational expenses. Understanding these upfront can help you better prepare for financial hurdles and avoid potential pitfalls.

Here’s a breakdown of potential startup costs:

| Expense Category | Estimated Cost |

|---|---|

| App Development | $20,000 – $100,000 |

| Marketing & Promotion | $5,000 – $50,000 |

| Driver Incentives | Variable |

- App development is a significant upfront cost, and investing in a user-friendly interface can lead to better customer retention.

- Marketing and promotion are essential for building brand awareness and attracting new users. Consider digital marketing strategies to maximize your reach.

- Driver incentives can encourage more drivers to join your platform, which is vital for meeting passenger demand.

“A goal without a plan is just a wish.” 💡

Once you have a clear understanding of your startup costs, the next step is to create a detailed budget. This budget should not only account for initial investments but also include ongoing operational expenses such as fuel, vehicle maintenance, and insurance. A well-structured budget can serve as your financial roadmap, guiding your spending and helping you identify areas where you can cut costs or reallocate resources.

Moreover, financial planning involves looking at your revenue streams. Understanding how ride hailing companies generate income is essential for sustainability. Most platforms rely on a commission-based model where they take a percentage of each fare. However, diversifying your revenue streams can mitigate risks and enhance profitability. Some companies offer subscription models that allow users to pay a monthly fee for discounted rides, which can stabilize cash flow.

Revenue Models in Ride Hailing

Understanding how ride hailing companies generate revenue is essential for your financial plan. Most platforms rely on a commission-based model where they take a percentage of each fare. However, there are other revenue streams to consider. For example, some companies collaborate with local businesses for advertising opportunities or provide premium services for an additional fee. This diversification can not only increase your revenue but also create a more robust business model.

Here’s a snapshot of different revenue models:

| Revenue Model | Description |

|---|---|

| Commission on Rides | A percentage of each fare goes to the platform. |

| Subscription Services | Monthly fees for discounted rides or perks. |

| Partnerships & Ads | Collaborating with businesses for advertising opportunities. |

- By implementing a commission-based model, you can ensure that your revenue scales with the number of rides completed.

- Offering subscription services not only provides a steady stream of income but also encourages customer loyalty.

- Forming partnerships with local businesses can create additional revenue channels while enhancing your brand’s visibility.

“Opportunities don't happen, you create them.” 🌟

In addition to revenue streams, it’s crucial to regularly review your financial projections. This includes forecasting revenue, expenses, and profits over the next few years. Adjust your projections based on real-world data as your business grows. For instance, if you anticipate a rise in fuel prices, factor that into your cost projections. Regularly revisiting your financial forecasts can help you stay on track and make necessary adjustments to your strategy.

With a solid understanding of financial planning and revenue models, you can better position your ride hailing business for long-term success. By focusing on your costs, diversifying your revenue streams, and continuously monitoring your financial health, you’ll be equipped to navigate the complexities of the industry and seize opportunities for growth.

Financial Projections for Sustainability

Creating financial projections is a fundamental aspect of your ride hailing financial plan. These projections serve as a roadmap, guiding your business decisions and helping you measure your progress over time. When you forecast your revenue, expenses, and profits, you gain a clearer picture of your business’s financial health and sustainability. This is particularly crucial in the dynamic and competitive landscape of the ride hailing industry.

To start, you’ll want to gather data on your current and projected costs. This includes everything from driver incentives to app maintenance and operational overhead. For example, if you plan to expand your fleet or increase marketing efforts, these costs should be reflected in your projections. Additionally, consider external factors that may impact your business, such as fuel prices, insurance rates, and regulatory changes. By including these variables, your projections will be more realistic and useful for planning.

Here’s a simplified way to visualize your financial projections:

| Year | Projected Revenue | Projected Expenses | Projected Profit |

|---|---|---|---|

| Year 1 | $100,000 | $80,000 | $20,000 |

| Year 2 | $150,000 | $90,000 | $60,000 |

- By regularly reviewing your financial projections, you can make informed decisions about scaling your operations or adjusting your pricing strategies.

- These projections help you identify potential cash flow issues before they arise, allowing you to take proactive measures.

- They also serve as a valuable tool when seeking funding options, as investors will want to see your projected growth and profitability.

“The future belongs to those who believe in the beauty of their dreams.” 🌈

In addition to forecasting, it’s essential to measure your performance against these projections. Establishing key performance indicators (KPIs) will allow you to track your progress and make necessary adjustments. For example, monitor metrics such as average fare per ride, customer retention rate, and rides per driver. These metrics will help you gauge the effectiveness of your business strategies and highlight areas for improvement.

Funding Options for Ride Hailing Startups

Securing funding is often one of the biggest challenges for new ride hailing businesses. Understanding your options can make a significant difference in your ability to launch and sustain your operations. There are various funding options available, each with its pros and cons. From angel investors to venture capital, the right choice will depend on your business model, growth potential, and financial needs.

One popular option is to seek out angel investors. These individuals typically invest their personal funds in startups in exchange for equity. They can provide not only capital but also valuable industry insights and connections. However, you may have to give up a portion of your ownership, which is something to consider carefully.

Another avenue is venture capital. VC firms invest larger sums of money in exchange for equity and usually expect significant returns within a few years. While this can provide the capital needed for rapid growth, it often comes with high expectations and pressure to scale quickly. You’ll need a solid business plan and clear financial projections to attract VC interest.

| Funding Source | Pros | Cons |

|---|---|---|

| Angel Investors | Quick access to funds | May require equity stake |

| Venture Capital | Larger sums available | High expectations for returns |

| Crowdfunding | Engages future customers | Time-consuming |

- Each funding option has its own set of requirements, so choose the one that aligns best with your business goals.

- Consider preparing a compelling pitch that outlines your business plan, financial projections, and growth potential to attract potential investors.

- Don’t underestimate the power of crowdfunding, which allows you to engage with your future customers while raising capital.

“Don’t wait for opportunity. Create it.” 💪

As you explore these funding options, remember to weigh the benefits against the potential drawbacks. The right funding source can provide not only the capital you need but also the support and resources to help you succeed in the competitive world of ride hailing. By understanding your financial needs and the landscape of available funding, you can make informed decisions that set your business on a path to growth and sustainability.

In summary, effective financial projections and a clear understanding of funding options are vital components of your ride hailing financial plan. By establishing realistic forecasts and exploring diverse funding avenues, you can position your ride hailing business for long-term success and resilience in a rapidly changing market.

Key Performance Indicators for Success

To gauge your ride hailing business performance effectively, you need to establish key performance indicators (KPIs). These metrics provide critical insights into how well your business is performing and where improvements can be made. In the competitive landscape of ride hailing, having a clear understanding of your KPIs can be the difference between success and failure.

Common KPIs in the ride hailing industry include rides per driver, customer retention rate, and average fare per ride. Tracking these metrics allows you to measure growth, efficiency, and profitability. For instance, a high customer retention rate indicates that your service meets customer expectations, which is essential for long-term success. Conversely, if your retention rate is low, it may signal issues that need addressing, such as driver quality or pricing strategies.

Here’s a closer look at essential KPIs:

| KPI | Description |

|---|---|

| Rides per Driver | Average number of rides completed by each driver. |

| Customer Retention Rate | Percentage of repeat customers. |

| Average Fare per Ride | Average revenue generated per ride. |

- Monitoring rides per driver helps you assess driver performance and optimize your driver recruitment strategies.

- A high customer retention rate not only indicates satisfaction but also reduces marketing costs associated with acquiring new customers.

- Understanding your average fare per ride can assist in pricing strategies and promotional offers, ensuring that you remain competitive in the market.

“Success usually comes to those who are too busy to be looking for it.” 🌟

Furthermore, these KPIs can help you make data-driven decisions. For example, if you notice that the average fare per ride is declining, you might want to analyze the factors contributing to this drop, such as increased competition or changes in passenger demand. By proactively addressing these issues, you can adapt your business strategies and improve your overall performance.

Additionally, regularly reviewing your KPIs allows you to set realistic goals and measure progress over time. This ongoing evaluation can help you refine your business strategies, ensuring that your ride hailing financial plan remains aligned with your objectives and market conditions.

Operational Metrics for Efficient Management

Operational metrics are just as important as financial metrics when running a ride hailing business. These metrics can help you streamline operations and improve service quality. By focusing on operational efficiency, you can enhance the overall customer experience and drive profitability.

Key operational metrics might include average wait time, driver utilization rate, and cancellation rate. Monitoring these metrics enables you to identify bottlenecks in your service and make necessary adjustments to improve efficiency. For example, if your average wait time is high, it may indicate that you need to recruit more drivers in certain areas to meet demand.

Here’s a breakdown of essential operational metrics:

| Metric | Importance |

|---|---|

| Average Wait Time | Impacts customer satisfaction. |

| Driver Utilization Rate | Measures how effectively drivers are being used. |

| Cancellation Rate | High rates can indicate issues with service. |

- Keeping an eye on average wait time can significantly impact customer satisfaction and retention.

- A high driver utilization rate indicates that you are effectively using your resources, leading to better service delivery and increased profitability.

- A high cancellation rate may suggest problems with your app, driver availability, or customer service, all of which need to be addressed promptly.

“The only way to do great work is to love what you do.” ❤️

By regularly assessing these operational metrics, you can enhance your service quality and operational efficiency. For instance, if you find that the cancellation rate is rising, you may want to investigate the reasons behind it. Are drivers canceling due to long wait times? Are customers unhappy with the service? Addressing these issues can improve your overall service quality and customer satisfaction.

In summary, focusing on both key performance indicators and operational metrics is essential for the success of your ride hailing business. By measuring performance across these areas, you can make informed decisions that drive growth, enhance customer satisfaction, and ultimately lead to increased profitability. By integrating these metrics into your financial plan, you will ensure that your business remains competitive and responsive to market demands.

Creating a Financial Plan Template

Having a financial plan template can make it easier to organize your financial goals and strategies for your ride hailing business. A well-structured template acts as a roadmap, guiding you through the essential elements of your financial plan and ensuring you don’t overlook any critical areas. This document will not only help you set clear objectives but will also serve as a living guide as your business evolves.

Your template should include several key sections, each designed to address different aspects of your financial planning. For example, an executive summary can provide an overview of your financial goals and the strategies you intend to implement to achieve them. This section sets the tone for the rest of the document and allows you to summarize your vision succinctly.

Here’s a closer look at some crucial sections to include in your financial plan template:

| Section | Description |

|---|---|

| Executive Summary | Overview of your financial goals. |

| Market Analysis | Insights into your target market. |

| Financial Projections | Detailed revenue and expense forecasts. |

- The executive summary should encapsulate your vision and provide a snapshot of your financial goals, ensuring that anyone reading it understands your business direction immediately.

- A thorough market analysis can help you identify your target audience, competitors, and market trends, allowing you to tailor your services to meet consumer demands effectively.

- Incorporating financial projections into your template will help you visualize your business’s future, making it easier to identify growth opportunities and potential challenges.

“Plans are nothing; planning is everything.” 📈

Additionally, consider including sections on funding strategies and risk management. In the funding strategies section, outline potential sources of capital, whether through investments, loans, or partnerships. This clarity will make it easier to identify the best paths for securing the necessary funds to launch and grow your business.

The risk management section should identify potential risks and the strategies you plan to implement to mitigate them. This proactive approach not only prepares you for challenges but also demonstrates to potential investors that you have considered the risks involved in your business.

With a comprehensive financial plan template, you can approach your ride hailing business with confidence, knowing that you have a clear strategy in place. This template will serve as a valuable tool for tracking your progress and making adjustments as needed, ensuring your business remains adaptable in a constantly changing environment.

Final Thoughts on Your Ride Hailing Financial Plan

As you embark on your journey in the ride hailing industry, remember that a solid financial plan is your roadmap to success. By understanding your costs, revenue models, and operational metrics, you can set your business up for long-term viability. A comprehensive financial plan template will guide you through the complexities of financial planning, helping you to stay organized and focused on your goals.

Moreover, continuously revisiting and updating your financial plan is essential as your business grows and market conditions change. This adaptability will help you identify new opportunities and respond to challenges effectively. For instance, if you notice shifts in consumer behavior or competition, you can quickly adjust your strategies to maintain your competitive edge.

Additionally, engaging with stakeholders, including investors and partners, can provide valuable feedback on your financial plan. Their insights can help you refine your strategies and ensure that your business remains aligned with market demands. This collaboration can also foster stronger relationships and open doors to new opportunities.

| Key Considerations | Importance |

|---|---|

| Continuous Evaluation | Ensures your plan remains relevant and effective. |

| Stakeholder Engagement | Provides valuable insights and fosters collaboration. |

- By embracing continuous evaluation, you can keep your financial strategies sharp and responsive to changes in the market.

- Engaging with stakeholders not only enriches your financial planning but also builds a supportive network that can help drive your business forward.

“Success is where preparation and opportunity meet.” 🌟

In conclusion, developing a thorough ride hailing financial plan is essential for navigating the complexities of the industry. By creating a detailed financial plan template and continuously evaluating your strategies, you can position your business for long-term success. With the right planning and execution, your ride hailing venture can thrive in a competitive landscape, delivering value to customers and achieving your financial goals.

Recommendations

In summary, developing a comprehensive ride hailing financial plan is essential for anyone looking to succeed in the competitive world of on-demand transportation. By understanding your costs, revenue models, and operational metrics, you can set your business up for long-term viability. A well-structured financial plan template can guide you through the complexities of financial planning, ensuring that you remain organized and focused on your goals.

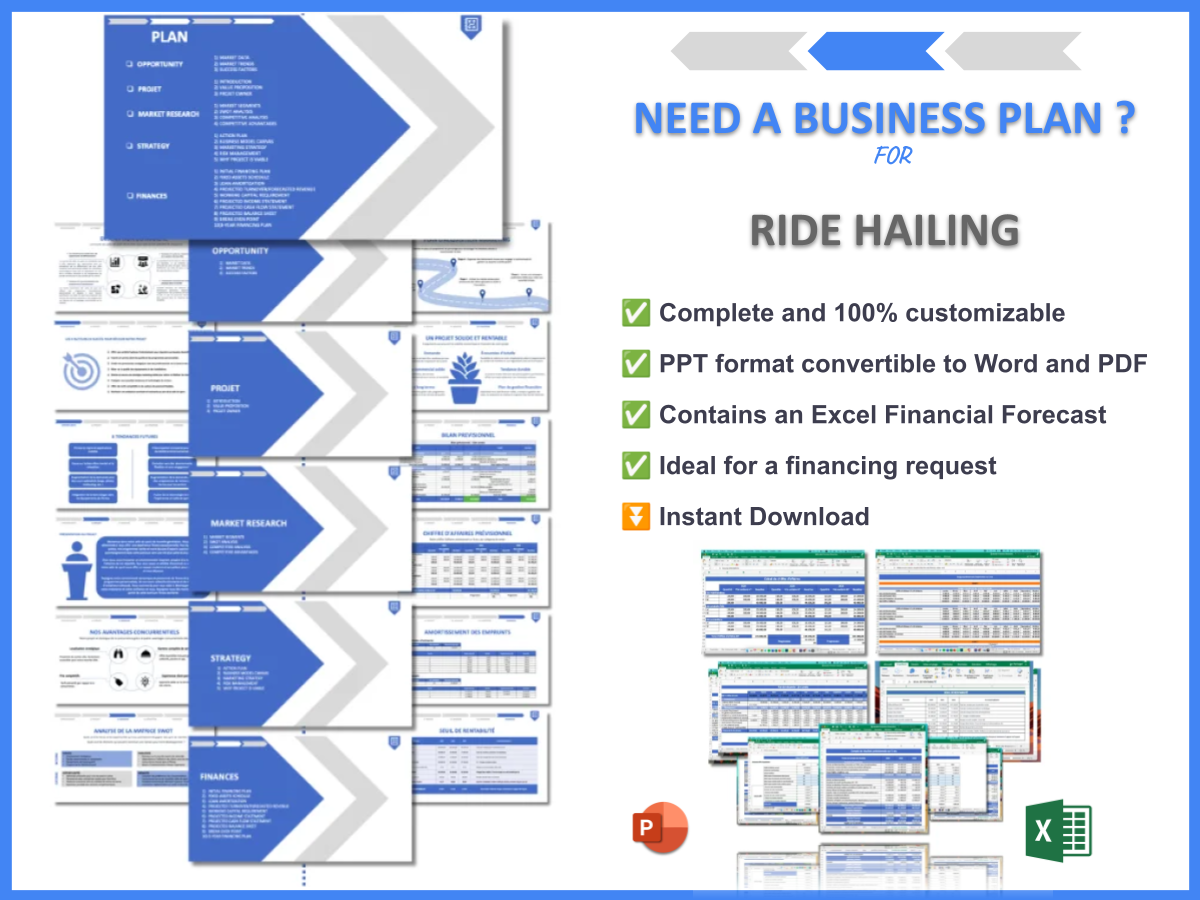

For those seeking a more detailed approach, consider utilizing our Ride Hailing Business Plan Template. This resource offers a comprehensive framework to help you outline your business strategy effectively.

Additionally, explore our related articles on Ride Hailing to further enhance your understanding and strategy:

- SWOT Analysis of Ride Hailing Industry Trends

- Ride Hailing: Strategies for Maximizing Profitability

- Ride Hailing Business Plan: Template and Examples

- The Ultimate Guide to Starting a Ride Hailing Business with Examples

- Crafting a Comprehensive Marketing Plan for Your Ride Hailing Business (+ Example)

- Crafting a Business Model Canvas for Ride Hailing: A Step-by-Step Guide with Examples

- Identifying Customer Segments for Ride Hailing: Examples and Strategies

- How Much Does It Cost to Start a Ride Hailing Business?

- How to Conduct a Feasibility Study for Ride Hailing?

- How to Implement Effective Risk Management for Ride Hailing?

- How to Conduct a Competition Study for Ride Hailing?

- What Legal Considerations Should You Know for Ride Hailing?

- What Funding Options Are Available for Ride Hailing?

- How to Scale a Ride Hailing Business: Proven Growth Strategies

FAQ

What is a ride hailing business model?

A ride hailing business model refers to the framework through which companies connect drivers with passengers using a mobile app. This model typically involves taking a commission from each fare, allowing for a scalable and profitable operation. Understanding this model is crucial for developing a successful financial plan.

How do I start a ride hailing business?

To start a ride hailing business, you need to conduct thorough market research, create a detailed business plan, and secure the necessary funding. Additionally, developing a user-friendly app and establishing partnerships with drivers are essential steps to ensure a smooth launch.

What are the startup costs for ride hailing companies?

The startup costs for ride hailing companies can vary significantly based on factors such as app development, marketing, and driver incentives. Typically, these costs can range from thousands to hundreds of thousands of dollars, making it crucial to have a comprehensive financial plan in place.

What revenue streams are available for ride hailing services?

Ride hailing services can generate revenue through various streams, including commissions on rides, subscription services for regular customers, and partnerships with local businesses for advertising. Diversifying revenue sources can enhance profitability and sustainability.

How can I conduct a feasibility study for my ride hailing business?

Conducting a feasibility study involves analyzing market demand, competition, and potential financial outcomes. This study will help you assess whether your ride hailing business idea is viable and guide your planning efforts.

What are some key performance indicators for ride hailing businesses?

Key performance indicators (KPIs) for ride hailing businesses include rides per driver, customer retention rate, and average fare per ride. Monitoring these metrics allows you to evaluate your business performance and make informed decisions for improvement.

What funding options are available for ride hailing startups?

Funding options for ride hailing startups include angel investors, venture capital, crowdfunding, and traditional bank loans. Each option has its advantages and disadvantages, so it’s essential to choose the one that aligns best with your business goals and needs.