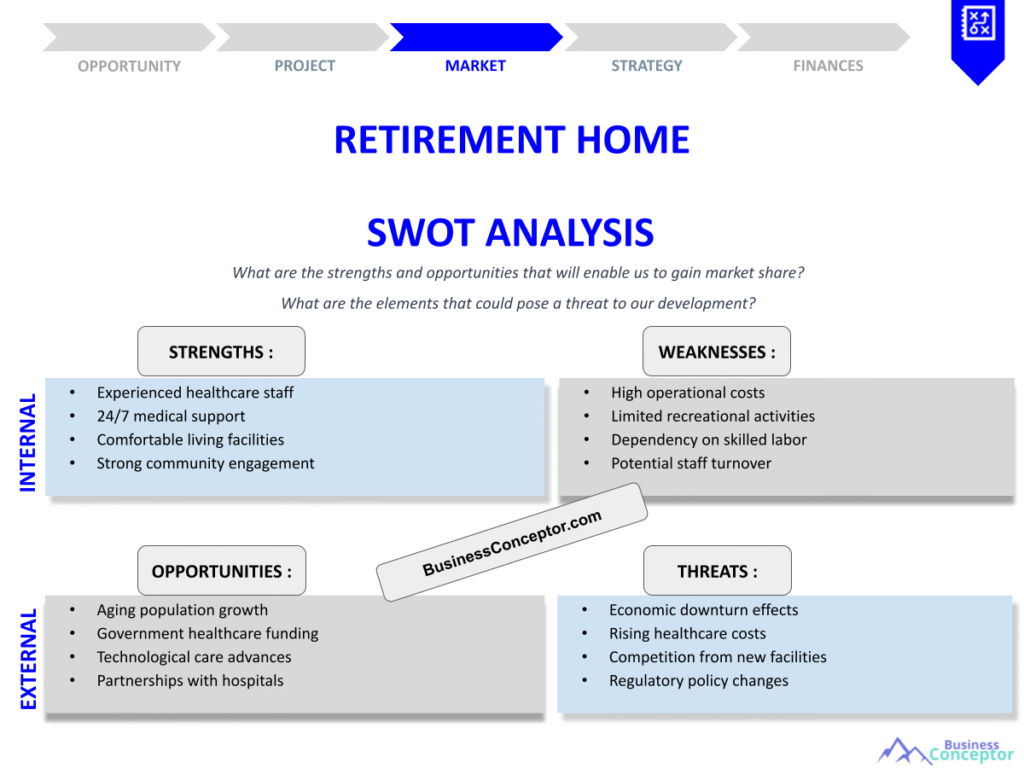

Did you know that nearly 70% of people over the age of 65 will need some form of long-term care? This staggering statistic highlights the importance of understanding the dynamics of retirement homes, and that’s where a Retirement Home SWOT Analysis comes in. A SWOT analysis is a strategic planning tool that helps organizations identify their Strengths, Weaknesses, Opportunities, and Threats. For retirement homes, this means assessing what makes them appealing, where they may fall short, and what external factors could impact their success.

Here’s a quick rundown of what this article will cover:

– The significance of conducting a SWOT analysis for retirement homes

– Key strengths and weaknesses commonly found in retirement facilities

– Opportunities for growth in the senior living market

– Potential threats that could impact the retirement home industry

– How to leverage SWOT insights for better strategic planning

Understanding the Importance of a SWOT Analysis for Retirement Homes

When it comes to running a retirement home, having a clear understanding of the business landscape is crucial. A Retirement Home SWOT Analysis provides a framework for assessing both internal and external factors affecting the facility’s performance. For instance, one retirement home might have exceptional staff training programs as a strength, while another might struggle with outdated facilities as a weakness.

Taking the time to analyze these aspects can help management make informed decisions. By recognizing strengths, facilities can promote what they do best, like offering unique recreational activities. On the flip side, understanding weaknesses can lead to improvements, such as renovating common areas to enhance resident comfort.

To illustrate, consider a retirement home that excels in providing personalized care but lacks marketing efforts. A SWOT analysis can highlight the need for a targeted marketing strategy to attract new residents while capitalizing on their strong reputation for quality care.

Moreover, conducting a SWOT analysis allows retirement homes to set clear goals based on their findings. For example, if a facility identifies that it has strong community ties, it can leverage this to foster partnerships with local organizations or businesses. This not only enhances the home’s visibility but also creates a sense of belonging for residents.

Furthermore, understanding the competitive landscape through a SWOT analysis enables retirement homes to identify unique selling points that differentiate them from others. With the senior living market becoming increasingly competitive, knowing how to stand out is more important than ever. By effectively utilizing their strengths and addressing their weaknesses, retirement homes can improve their occupancy rates and enhance resident satisfaction.

| SWOT Component | Description |

|---|---|

| Strengths | Unique care offerings, experienced staff |

| Weaknesses | Outdated facilities, limited marketing |

| Opportunities | Growing demand for senior living, partnerships with healthcare providers |

| Threats | Increased competition, regulatory changes |

- Identify unique strengths that set your facility apart

- Recognize weaknesses that need addressing

- Explore opportunities in the market

- Be aware of potential threats to your business

“The secret of change is to focus all of your energy, not on fighting the old, but on building the new.” – Socrates 😊

Analyzing Strengths and Weaknesses in Retirement Homes

A deep dive into the strengths and weaknesses of retirement homes is essential for any comprehensive SWOT analysis. Understanding these aspects not only helps in strategic planning but also allows facilities to enhance their overall service quality. Common strengths may include factors like highly trained staff, a strong community atmosphere, and excellent amenities. For example, a retirement home that offers a variety of activities—like yoga, arts and crafts, and social events—may attract more residents due to its vibrant lifestyle options.

Furthermore, having a well-trained and compassionate staff can significantly elevate the quality of care provided. This creates a positive environment that fosters trust and satisfaction among residents and their families. A retirement home that invests in ongoing staff training and development can maintain high standards of care, which is a crucial strength in a competitive market.

On the other hand, weaknesses could encompass high staff turnover, poor facility maintenance, or inadequate marketing strategies. For instance, a home that struggles to communicate its benefits to potential residents might miss out on opportunities for growth. If a retirement community has beautiful gardens but fails to showcase them in promotional materials, they are likely missing an important marketing opportunity.

By identifying these strengths and weaknesses, management can make strategic decisions that enhance the overall quality of life for residents. A retirement home with a strong reputation for care may choose to invest in marketing efforts to attract new residents, while one with maintenance issues may prioritize renovations. In this way, a comprehensive SWOT analysis becomes a roadmap for improvement and growth.

| Strengths | Weaknesses |

|---|---|

| Trained staff | High staff turnover |

| Community atmosphere | Poor facility maintenance |

| Variety of activities | Inadequate marketing |

- Highlight strengths in marketing materials

- Address weaknesses through staff training and facility upgrades

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier 🌟

Identifying Opportunities in the Senior Living Market

The senior living market is ripe with opportunities, especially as the aging population continues to grow. A Retirement Home SWOT Analysis can help identify areas for expansion or improvement. For example, many seniors are looking for communities that offer specialized care for memory-related issues, such as Alzheimer’s. Retirement homes that recognize this demand can develop programs tailored to this demographic.

Moreover, partnerships with healthcare providers can significantly enhance the service offerings of retirement homes. By collaborating with local hospitals or clinics, facilities can ensure that residents have easier access to necessary medical care, which adds tremendous value to their living experience. For instance, a retirement home that partners with a nearby health center can offer routine check-ups and health seminars, creating a more integrated approach to senior care.

Additionally, with the rise of technology, many retirement homes can leverage digital tools to improve communication with families and enhance resident engagement. Offering virtual tours or online resources can attract tech-savvy families looking for the best care options for their loved ones. Implementing technology solutions, such as apps for scheduling activities or communicating with staff, can make a retirement home more appealing to potential residents and their families.

Identifying these opportunities through a SWOT analysis allows facilities to align their strategies with market demands. By focusing on specialized care programs and technological advancements, retirement homes can not only enhance their service offerings but also position themselves as leaders in the senior living market.

| Opportunities | Examples |

|---|---|

| Specialized care programs | Memory care units |

| Partnerships with healthcare providers | Collaboration with local hospitals |

| Technology integration | Virtual tours and online resources |

- Focus on specialized care to meet market demands

- Explore partnerships to enhance service offerings

“Opportunities don't happen. You create them.” – Chris Grosser 🚀

Addressing Potential Threats to the Retirement Home Industry

While there are numerous opportunities in the retirement home sector, it’s essential to be aware of the potential threats that could impact operations. Factors such as increasing competition can pose a significant challenge. With more retirement communities opening, standing out becomes more crucial than ever. Facilities need to identify what makes them unique and communicate that effectively to potential residents. For instance, if a retirement home excels in providing personalized care or unique recreational activities, these should be highlighted in marketing efforts.

Regulatory changes can also impact how retirement homes operate. Staying informed about new legislation and adapting quickly is vital for compliance and maintaining a good reputation. For example, changes in healthcare policies could affect staffing requirements or funding for certain services. Retirement homes that proactively monitor these changes can adjust their operations accordingly, ensuring they remain compliant and avoid potential fines or sanctions.

Additionally, economic downturns can lead to reduced demand for retirement homes as families may opt for more affordable living arrangements. Understanding these threats allows facilities to prepare and adapt their strategies accordingly. For instance, during economic uncertainty, a retirement home might introduce flexible pricing options or special promotions to attract residents who are more budget-conscious.

By recognizing and addressing these threats, retirement homes can develop contingency plans that help them navigate challenging situations. This proactive approach not only safeguards the facility’s reputation but also ensures that residents continue to receive the quality care they deserve, even in turbulent times.

| Threats | Impact |

|---|---|

| Increased competition | Need for unique offerings |

| Regulatory changes | Compliance costs and operational shifts |

| Economic downturns | Reduced demand for services |

- Monitor industry trends to stay ahead of the competition

- Develop contingency plans for economic challenges

“In the middle of every difficulty lies opportunity.” – Albert Einstein 🌈

Leveraging SWOT Insights for Strategic Planning

Once you’ve gathered insights from your Retirement Home SWOT Analysis, it’s time to leverage that information for strategic planning. By understanding your strengths, weaknesses, opportunities, and threats, you can create a comprehensive strategy that maximizes your retirement home’s potential.

For instance, if your facility has a strong community atmosphere, consider marketing this aspect to attract new residents. Testimonials from satisfied residents and their families can be powerful tools in showcasing your home’s positive environment. Additionally, if you’ve identified weaknesses in staff training, developing a robust training program could enhance care quality and improve staff retention. Investing in staff development not only benefits the residents but also fosters a sense of loyalty and satisfaction among employees, reducing turnover rates.

Opportunities, such as expanding specialized care programs, should be prioritized in your strategic plan. If a growing number of seniors require memory care, for example, introducing a dedicated memory care unit could be a game-changer for your facility. Conversely, being aware of threats, like increasing competition, allows you to craft strategies that differentiate your facility from others. This could include offering unique activities or services that are not available in nearby retirement homes.

Ultimately, the goal of leveraging SWOT insights is to create a living document that guides your facility’s growth and adaptation in an ever-changing market. Regularly revisiting your SWOT analysis ensures that your strategic planning remains relevant and aligned with the needs of your residents and the demands of the industry.

| Strategic Focus | Action Items |

|---|---|

| Strengthen marketing efforts | Highlight community atmosphere |

| Improve staff training | Develop comprehensive training programs |

| Expand specialized care | Introduce memory care programs |

- Use SWOT insights to inform your strategic planning

- Focus on actions that align with your strengths and opportunities

“The future depends on what you do today.” – Mahatma Gandhi ⏳

Continual Assessment and Adaptation in Retirement Home Operations

The retirement home landscape is constantly evolving, which means that conducting a SWOT analysis shouldn’t be a one-time event. Regular assessments allow facilities to stay aligned with market trends and resident needs. For example, if new regulations impact staffing requirements, a retirement home should adjust its staffing strategies accordingly. This ongoing evaluation ensures that the facility remains compliant and can effectively meet the needs of its residents.

Moreover, as the preferences of seniors change, retirement homes must adapt their offerings. Regularly soliciting feedback from residents can help identify areas for improvement and ensure that services remain relevant and appealing. For instance, a facility might discover that residents are interested in more fitness classes or cultural activities. By responding to these requests, the home can enhance resident satisfaction and foster a sense of community.

Incorporating a culture of continuous improvement can lead to better resident satisfaction and ultimately, higher occupancy rates. Facilities that prioritize adaptability are more likely to thrive in an increasingly competitive market. By establishing regular review periods for the SWOT analysis, retirement homes can make informed decisions that reflect current trends and resident preferences. This proactive approach not only enhances the quality of care provided but also strengthens the home’s reputation as a leading choice for senior living.

In summary, the key to success in the retirement home industry lies in the ability to adapt and evolve. By making continual assessment a part of the operational strategy, facilities can ensure that they not only meet but exceed the expectations of their residents.

| Ongoing Strategies | Benefits |

|---|---|

| Regular SWOT assessments | Stay aligned with market trends |

| Resident feedback mechanisms | Enhance resident satisfaction |

| Continuous training programs | Improve care quality and staff retention |

- Foster a culture of continuous improvement

- Regularly solicit feedback to adapt offerings

“Change is the end result of all true learning.” – Leo Buscaglia 📚

Identifying Key Performance Indicators for Retirement Homes

To effectively leverage the insights gained from a Retirement Home SWOT Analysis, it is crucial to identify and monitor key performance indicators (KPIs). These metrics help retirement homes evaluate their success and make data-driven decisions. Common KPIs in the industry include resident satisfaction scores, occupancy rates, and staff turnover rates. Each of these indicators provides valuable information about the overall health of the facility.

For example, high resident satisfaction scores can indicate that a retirement home is successfully meeting the needs of its residents. Facilities can gather this data through surveys or feedback sessions, allowing management to identify areas for improvement. If a home notices a dip in satisfaction, it can investigate further to understand the underlying issues, such as staff responsiveness or the quality of meals provided.

Occupancy rates are another critical KPI, as they directly impact a retirement home’s revenue. By analyzing trends in occupancy, management can determine whether their marketing strategies are effective or if adjustments are needed to attract new residents. For instance, if occupancy rates are declining, it may be time to enhance outreach efforts or offer promotional packages to entice prospective residents.

Staff turnover rates also play a significant role in the success of retirement homes. High turnover can lead to inconsistencies in care quality and negatively impact resident satisfaction. By tracking this metric, facilities can identify patterns and implement strategies to improve staff retention, such as offering competitive salaries, benefits, and ongoing training opportunities.

Incorporating KPIs into the operational strategy allows retirement homes to make informed decisions based on concrete data. This data-driven approach ensures that facilities remain competitive and continue to provide high-quality care to their residents.

| Key Performance Indicators | Importance |

|---|---|

| Resident satisfaction scores | Indicates the quality of care provided |

| Occupancy rates | Directly impacts revenue |

| Staff turnover rates | Affects care quality and resident satisfaction |

- Monitor KPIs to evaluate success

- Use data to inform strategic decisions

“What gets measured gets managed.” – Peter Drucker 📊

Implementing Marketing Strategies Based on SWOT Insights

Once a Retirement Home SWOT Analysis has been conducted, the next step is to implement targeted marketing strategies that reflect the insights gained. Effective marketing is crucial for attracting new residents and retaining current ones. By leveraging the identified strengths and opportunities, retirement homes can create compelling narratives that resonate with potential residents and their families.

For example, if a facility has a strong community atmosphere and offers various engaging activities, these aspects should be highlighted in marketing materials. This could include testimonials from satisfied residents or success stories that showcase the vibrant life within the community. Utilizing social media platforms to share these stories can significantly increase visibility and engagement. Additionally, hosting open house events allows prospective residents and their families to experience the community firsthand.

Furthermore, understanding the local demographics is essential for tailoring marketing efforts. For instance, if a retirement home is located in an area with a growing population of seniors, marketing campaigns can be adjusted to emphasize the unique services offered to cater to this demographic. This might include specialized care programs or wellness initiatives that address the specific needs of older adults.

Moreover, incorporating digital marketing strategies can enhance outreach efforts. Developing a user-friendly website that provides essential information about services, amenities, and pricing can make a significant difference. Search engine optimization (SEO) techniques can also help the facility appear in relevant online searches, driving traffic to the website. By ensuring that the marketing strategies align with the findings of the SWOT analysis, retirement homes can position themselves effectively within the competitive landscape.

| Marketing Strategies | Benefits |

|---|---|

| Highlight community atmosphere | Attract potential residents |

| Utilize social media | Increase visibility and engagement |

| Tailor campaigns to local demographics | Address specific needs of seniors |

- Leverage strengths in marketing materials

- Implement digital marketing strategies

“Marketing is no longer about the stuff you make, but about the stories you tell.” – Seth Godin 📖

Measuring Success and Adjusting Strategies Over Time

Implementing marketing strategies is only the beginning; measuring success and adjusting strategies over time is crucial for ongoing effectiveness. Utilizing data analytics tools can provide valuable insights into the performance of marketing campaigns, allowing retirement homes to understand what works and what doesn’t. Key performance indicators (KPIs) such as lead generation rates, conversion rates, and resident retention rates are essential metrics to monitor.

For example, if a particular campaign results in a high number of inquiries but low conversion rates, this may indicate that the messaging needs to be refined or that the follow-up process is lacking. Conversely, a campaign that generates both high inquiries and conversions can be a model for future marketing efforts. Regularly assessing these metrics enables facilities to make data-driven decisions that enhance their marketing effectiveness.

Additionally, conducting regular reviews of the SWOT analysis can help retirement homes stay aligned with changing market conditions. As trends evolve, so too should marketing strategies. For instance, if a new competitor enters the market, a retirement home might need to adjust its pricing or enhance its service offerings to maintain its competitive edge.

Moreover, feedback from residents and their families can provide qualitative insights that quantitative data may not capture. Surveys and focus groups can reveal how residents perceive the community and its services, offering valuable information that can guide marketing adjustments. By staying responsive to both data and resident feedback, retirement homes can continuously improve their marketing strategies and ensure they effectively meet the needs of their target audience.

In summary, measuring success and adapting marketing strategies based on insights from the SWOT analysis and resident feedback is essential for long-term success in the retirement home industry. This ongoing process not only enhances the facility’s reputation but also fosters a thriving community for residents.

| Success Measurement Strategies | Benefits |

|---|---|

| Utilize data analytics tools | Gain insights into campaign performance |

| Monitor key performance indicators | Inform data-driven decisions |

| Gather resident feedback | Enhance understanding of community perception |

- Regularly assess marketing effectiveness

- Adapt strategies based on insights and feedback

“Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful.” – Albert Schweitzer 😊

Recommendations

In summary, conducting a thorough Retirement Home SWOT Analysis is vital for understanding the unique dynamics of retirement homes. This analysis allows facilities to identify their strengths, weaknesses, opportunities, and threats, which can inform strategic planning and enhance operational effectiveness. To assist you in developing a comprehensive strategy for your retirement home, consider using the Retirement Home Business Plan Template. This template provides a structured framework to help you outline your goals and operational strategies effectively.

Additionally, if you’re interested in further reading about retirement homes, here are some valuable articles that you may find beneficial:

- Retirement Homes: Tips for Achieving High Profits

- Retirement Home Business Plan: Template and Examples

- Retirement Home Financial Plan: Comprehensive Guide

- How to Start a Retirement Home Business: A Detailed Guide with Examples

- Building a Marketing Plan for Retirement Home Services (+ Example)

- How to Build a Business Model Canvas for Retirement Home?

- Understanding Customer Segments for Retirement Homes (with Examples)

- How Much Does It Cost to Start a Retirement Home?

- How to Calculate the Feasibility Study for Retirement Home?

- How to Calculate Risks in Retirement Home Management?

- Retirement Home Competition Study: Essential Guide

- Essential Legal Considerations for Retirement Home

- How to Choose the Right Funding for Retirement Home?

- Retirement Home Growth Strategies: Scaling Success Stories

FAQ

What are the strengths and weaknesses of retirement homes?

Understanding the strengths and weaknesses of retirement homes is crucial for effective management. Common strengths include highly trained staff, a strong community atmosphere, and a variety of engaging activities. Conversely, typical weaknesses might involve high staff turnover, outdated facilities, or inadequate marketing strategies.

What opportunities exist in the senior living market?

The senior living market is filled with opportunities such as increasing demand for specialized care programs, especially for conditions like Alzheimer’s. Additionally, forming partnerships with healthcare providers can enhance service offerings, while technological advancements can improve communication and engagement with residents and their families.

What threats should retirement homes be aware of?

Retirement homes face several threats that can impact their operations. These include increased competition from new facilities, regulatory changes that may impose additional costs, and economic downturns that can reduce demand for services. Staying informed and proactive about these threats is essential for successful management.

How can a SWOT analysis benefit retirement homes?

A SWOT analysis provides a framework for retirement homes to assess their internal strengths and weaknesses alongside external opportunities and threats. This analysis enables facilities to make informed strategic decisions, enhance operational effectiveness, and improve overall resident satisfaction.

What are key performance indicators for retirement homes?

Key performance indicators (KPIs) for retirement homes include resident satisfaction scores, occupancy rates, and staff turnover rates. Monitoring these metrics allows management to evaluate success, inform decision-making, and identify areas for improvement.

How can retirement homes adapt their marketing strategies?

Retirement homes can adapt their marketing strategies by leveraging insights gained from the SWOT analysis. This includes highlighting unique strengths, tailoring campaigns to local demographics, and utilizing digital marketing techniques to reach a wider audience. Regular assessment of marketing effectiveness is also essential for ongoing success.