Real Estate Investment Customer Segments are crucial for understanding the diverse types of investors in the property market. Did you know that knowing your potential customers can shape your marketing strategies significantly? In a world where investment opportunities are abundant, recognizing who your audience is can lead to better-targeted efforts and, ultimately, success in real estate investment. Investor demographics can provide insights that help tailor your offerings and communication effectively.

- Understanding investor demographics helps tailor your offerings.

- Recognizing different types of real estate investors is key to targeted marketing.

- Implementing effective segmentation strategies can enhance customer engagement and conversions.

Understanding Real Estate Investor Demographics

When diving into real estate investment customer segments, it’s essential to grasp who these investors are. Investors come from various backgrounds, and their needs can differ vastly. For instance, some may be seasoned investors looking to expand their portfolios, while others might be first-time buyers seeking guidance. Understanding these differences can provide a competitive edge.

Take, for example, a young couple eager to invest in their first home versus a retired individual seeking rental properties for passive income. Each of these demographics has distinct motivations and financial capabilities. The couple might prioritize affordability and location, while the retiree may look for properties that promise steady income. Recognizing these nuances allows you to tailor your marketing strategies effectively.

Moreover, it’s not just about age; real estate investor demographics also encompass factors like income level, education, and even geographic location. For instance, young professionals in urban areas may lean towards modern, eco-friendly apartments, while families in suburban regions might prefer spacious homes with good schools nearby. By segmenting your audience based on these characteristics, you can create more personalized and effective marketing campaigns.

| Demographic | Characteristics |

|---|---|

| Millennials | Tech-savvy, interested in sustainable properties |

| Baby Boomers | Focused on retirement income, prefer established neighborhoods |

| Gen Z | Interested in affordable housing, often first-time buyers |

| Foreign Investors | Looking for investment opportunities in stable markets |

- Key characteristics of real estate investors vary by age and experience.

- Understanding investor behavior can enhance your marketing strategies.

- Tailoring your offerings based on demographics can lead to higher conversion rates.

“Know your audience, and you will know your market.” 🌍

By investing time in understanding real estate investor demographics, you can identify trends that may influence their purchasing decisions. For example, the growing interest in sustainable living among younger generations can lead to increased demand for eco-friendly properties. This understanding can help you adjust your inventory or marketing messages to align with what your audience desires.

Moreover, recognizing the motivations of different demographics can help you craft compelling narratives that resonate with potential buyers. For instance, highlighting community amenities and accessibility for retirees or showcasing the vibrant lifestyle of urban living for young professionals can create a more engaging marketing approach. Ultimately, understanding your audience allows you to build trust and foster long-term relationships, leading to repeat business and referrals.

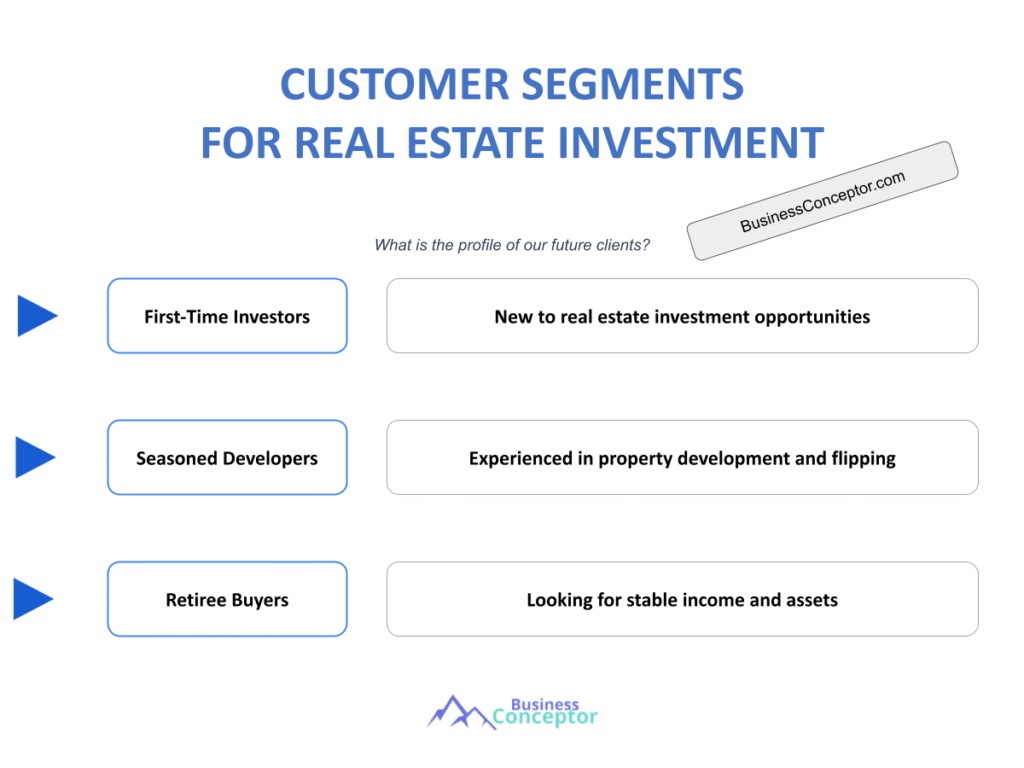

Types of Real Estate Investors

Exploring the different types of real estate investors is vital for effective market segmentation. Investors can be categorized into several segments, including residential, commercial, and industrial investors. Each segment has unique characteristics and investment strategies that can significantly affect how you market your properties and services.

For example, residential investors might focus on single-family homes or multi-family units. These investors often seek properties that appreciate over time or generate rental income. A young couple looking for their first home typically falls into this category. They are usually concerned with affordability, location, and the potential for future value appreciation. In contrast, a seasoned investor may look for multi-family units that provide consistent cash flow through rental income. Understanding these differences is crucial for tailoring your marketing strategies.

On the other hand, commercial investors generally look at office spaces, retail properties, or industrial warehouses. These investors prioritize cash flow and long-term leases, often seeking properties that can provide stable returns over time. For instance, a company looking to lease office space may prioritize location, accessibility, and amenities that can attract employees. By understanding the distinct needs of commercial investors, you can craft targeted marketing messages that address their specific concerns.

| Investor Type | Focus Area |

|---|---|

| Residential | Single-family homes, condos, rentals |

| Commercial | Office buildings, retail spaces, warehouses |

| Industrial | Manufacturing facilities, distribution centers |

| REITs | Publicly traded companies owning real estate |

- Different investor types have varying goals and risk tolerances.

- Understanding these types allows for tailored marketing efforts.

- Investors are increasingly diversifying their portfolios across segments.

“Diversity in investment can lead to a stronger portfolio.” 💪

Additionally, real estate investment customer segments can include niche investors, such as those focused on luxury properties or vacation rentals. Luxury investors often seek high-end finishes and exclusive locations, while vacation rental investors look for properties in tourist hotspots that can generate significant short-term rental income. Understanding the motivations of these niche markets can help you position your properties more effectively, ensuring that your marketing strategies resonate with the right audience.

In conclusion, identifying the various types of real estate investors can lead to more effective marketing strategies. By tailoring your approach to different investor segments, you can enhance customer satisfaction and increase your chances of closing deals.

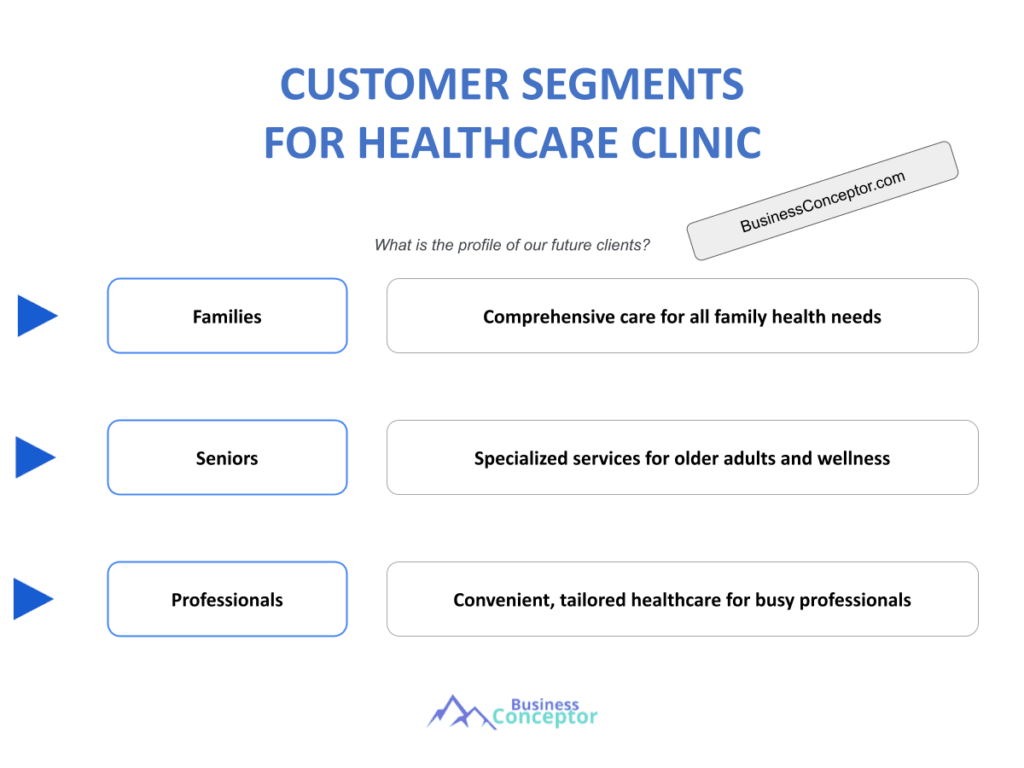

Target Audience for Real Estate Investment

Identifying your target audience is a game-changer in real estate investment. Knowing who your potential customers are allows you to tailor your marketing efforts and property offerings effectively. For instance, if your target audience consists of millennials, you might want to emphasize modern amenities and eco-friendly features in your listings. Conversely, if you’re targeting retirees, highlighting accessibility features and community amenities would be more beneficial.

To illustrate this, let’s consider a few target audiences. First-time buyers often prioritize affordability and financing options, making it essential to provide them with clear information about mortgage assistance and first-time buyer programs. Luxury investors, on the other hand, are more concerned with high-end finishes, exclusive locations, and privacy, so your marketing should reflect that sophistication and exclusivity.

| Target Audience | Key Preferences |

|---|---|

| First-time Buyers | Affordability, location, and financing options |

| Luxury Investors | High-end finishes, exclusive locations, and privacy |

| Foreign Investors | Stable markets, legal assistance, and ROI potential |

- Identifying your target audience helps in crafting focused marketing strategies.

- Tailoring communication to specific segments can enhance engagement.

- Understanding preferences allows for better property presentation.

“Target the right audience, and success will follow.” 🎯

Understanding the motivations of different demographics can help you craft compelling narratives that resonate with potential buyers. For instance, highlighting community amenities and accessibility for retirees or showcasing the vibrant lifestyle of urban living for young professionals can create a more engaging marketing approach. Ultimately, understanding your audience allows you to build trust and foster long-term relationships, leading to repeat business and referrals.

In summary, recognizing your target audience for real estate investment is vital for effectively reaching and engaging potential customers. By tailoring your marketing strategies to address the unique needs and preferences of different segments, you can significantly improve your chances of success in the competitive real estate market.

Behavioral Segmentation for Real Estate

Behavioral segmentation plays a significant role in understanding real estate investors. By analyzing how different segments behave, such as their purchasing patterns and property preferences, businesses can create more effective marketing strategies that resonate with their audience. Understanding what motivates investors and how they make decisions is crucial for tailoring your offerings.

For instance, some investors prioritize short-term gains through flipping properties, while others focus on long-term rental investments. Flippers are typically more hands-on, often seeking properties that require renovations and can be sold quickly for a profit. They tend to be risk-takers and are often more knowledgeable about the market dynamics. On the other hand, long-term holders prefer stability and consistent income, looking for properties in desirable areas that will appreciate over time. Recognizing these behaviors allows you to tailor your marketing messages to address the specific concerns of each group.

Additionally, understanding behavioral patterns can help you identify trends within specific investor segments. For example, investors may be influenced by external factors like economic conditions, interest rates, and market fluctuations. By staying informed about these trends, you can adjust your strategies accordingly. If you notice a rise in interest for rental properties due to shifting demographics or economic conditions, you can focus your marketing efforts on that segment.

| Behavior Type | Characteristics |

|---|---|

| Flippers | Quick transactions, renovation-focused |

| Long-term Holders | Focused on appreciation and steady income |

| Passive Investors | Seek hassle-free management, prefer REITs |

- Behavioral segmentation allows for precise targeting and messaging.

- Understanding investor behaviors can enhance customer satisfaction.

- Tailoring offerings based on behavior can lead to increased loyalty.

“Understanding behavior is the key to unlocking potential.” 🔑

Moreover, behavioral segmentation can help you identify the best channels to reach your audience. For instance, flippers might respond better to online listings that highlight potential renovations, while long-term investors may prefer detailed reports on neighborhood trends and property values. By using tailored content and communication strategies, you can effectively engage with each segment and drive conversions.

In conclusion, behavioral segmentation for real estate is essential for understanding your customers and developing targeted marketing strategies. By analyzing how different investor segments behave, you can create personalized approaches that resonate with their specific needs, ultimately leading to higher satisfaction and improved business outcomes.

Current Real Estate Investment Trends

Staying updated on current real estate investment trends is crucial for targeting the right customer segments. Trends can significantly influence investor behavior and preferences, making it essential to adapt your strategies accordingly. For example, the rise of remote work has led many individuals to seek properties in suburban areas, favoring space over proximity to urban centers. This shift presents new opportunities for investors and real estate professionals alike.

Additionally, sustainability is becoming a significant factor for many investors, especially millennials and Gen Z. These younger generations are increasingly interested in eco-friendly properties and sustainable living. They often look for homes that feature energy-efficient appliances, solar panels, and green building materials. By understanding this trend, you can position your properties to attract these environmentally conscious investors.

| Trend | Impact on Investors |

|---|---|

| Remote Work | Increased demand for suburban properties |

| Sustainability | Preference for eco-friendly developments |

| Technology Adoption | Use of virtual tours and online transactions |

- Keeping abreast of trends helps tailor marketing strategies.

- Trends can shift investor focus, impacting property types in demand.

- Awareness of trends can enhance competitive advantage.

“Trends shape the future; stay ahead of the curve.” 📈

Furthermore, the impact of technology on real estate investment cannot be overlooked. The increasing use of digital tools, such as virtual tours and online transactions, has transformed how investors search for and purchase properties. Embracing these technologies can streamline your processes and enhance the customer experience, making it easier for potential investors to engage with your offerings.

In summary, staying updated on current real estate investment trends is vital for effectively targeting your audience and adapting your strategies. By understanding how trends influence investor behavior and preferences, you can create marketing messages that resonate with your audience, ultimately leading to increased engagement and conversions.

Real Estate Marketing Automation for Investors

In today’s digital age, leveraging marketing automation can significantly enhance your reach to various real estate investment customer segments. Automated tools allow for targeted communication, streamlined processes, and improved customer engagement. By utilizing these tools, real estate professionals can focus on building relationships while technology handles repetitive tasks.

For example, automated email marketing campaigns can nurture leads and keep potential investors informed about new listings or market trends. By segmenting your audience based on their interests and behaviors, you can send personalized messages that resonate with each group. A first-time buyer might appreciate information about financing options and local market conditions, while a seasoned investor may want insights into the latest property investment opportunities. This level of personalization not only increases engagement but also builds trust, as investors feel understood and valued.

Additionally, using Customer Relationship Management (CRM) systems can help manage your leads more effectively. A robust CRM can track interactions, preferences, and behaviors, allowing you to tailor your follow-up strategies accordingly. For instance, if a lead has shown interest in eco-friendly properties, your follow-up communication can focus on sustainable options in your inventory. By being proactive and relevant, you enhance the chances of converting leads into successful transactions.

| Tool | Functionality |

|---|---|

| CRM Systems | Customer management and segmentation |

| Email Automation | Targeted campaigns based on investor behavior |

| Social Media Tools | Scheduled posts and targeted ads |

- Automation enhances efficiency and reach in marketing efforts.

- Personalized communication can lead to higher conversion rates.

- Utilizing data-driven strategies can improve overall performance.

“Automate to elevate your marketing game!” 🚀

Moreover, social media platforms can also benefit from automation. By scheduling posts and targeting ads to specific demographics, you can maximize your visibility among potential investors. Engaging content, such as virtual tours or informative articles about market trends, can attract the attention of your audience and drive traffic to your listings. Social media automation tools allow you to maintain a consistent online presence, which is crucial for brand recognition in the competitive real estate market.

In conclusion, implementing real estate marketing automation can significantly enhance your ability to connect with various investor segments. By leveraging automated tools, you can create personalized experiences, streamline your processes, and ultimately improve your conversion rates. The right automation strategy not only saves time but also positions you as a knowledgeable and trustworthy resource in the eyes of potential investors.

Consulting Services for Investor Segmentation

For many real estate firms, consulting services can provide valuable insights into customer segmentation strategies. Expert consultants can analyze data, identify trends, and suggest tailored approaches to effectively reach specific investor segments. Engaging with consultants can be particularly beneficial for businesses looking to refine their marketing strategies and improve their overall performance.

One of the key advantages of working with a consultant is their ability to conduct thorough market analysis. This analysis can uncover hidden opportunities within the market, enabling you to identify untapped investor segments. For example, a consultant may find that there is a growing demand for vacation rentals in a particular area, prompting you to adjust your property offerings or marketing strategies to cater to that segment. By leveraging expert insights, you can make informed decisions that drive growth.

Additionally, consulting services can aid in developing targeted marketing strategies tailored to different investor segments. Consultants can help you create comprehensive marketing plans that address the unique needs and preferences of each group. This tailored approach can significantly enhance your outreach efforts, ensuring that your messaging resonates with potential investors.

| Service Type | Benefits |

|---|---|

| Market Analysis | Insights into current trends and opportunities |

| Strategy Development | Tailored plans for specific investor segments |

| Training Workshops | Educating teams on effective segmentation |

- Consulting services can enhance knowledge and strategy development.

- Expert insights can lead to more effective marketing approaches.

- Tailored strategies can improve overall business performance.

“Consulting can illuminate the path to success.” 💡

Furthermore, training workshops provided by consultants can empower your team with the knowledge and skills needed to implement effective segmentation strategies. By equipping your staff with the right tools, you foster a culture of continuous improvement and adaptability, which is crucial in the ever-evolving real estate market.

In summary, engaging consulting services for investor segmentation can significantly enhance your ability to understand and target various investor segments effectively. By leveraging expert insights and tailored strategies, you can improve your marketing efforts, capitalize on new opportunities, and ultimately drive growth in your real estate business.

Segmentation-Based Pricing Models in Real Estate

Implementing segmentation-based pricing models can be a powerful strategy in real estate investment. By understanding the different segments and their willingness to pay, businesses can create pricing strategies that maximize revenue while still appealing to investors. This approach allows you to tailor your pricing to meet the specific needs and preferences of various customer segments, ultimately enhancing your competitiveness in the market.

For example, high-net-worth individuals typically seek luxury properties with premium features. For this segment, implementing a premium pricing strategy makes sense, as these investors often prioritize exclusivity and high-quality finishes. By positioning your properties as exclusive and desirable, you can justify higher price points, thus maximizing profit margins. On the other hand, first-time buyers may be more price-sensitive, requiring competitive pricing strategies to attract them. Offering financing options or incentives can also help make properties more accessible to this demographic.

Moreover, understanding the financial capabilities of different investor segments allows you to implement tiered pricing models. For instance, you could offer a range of properties at varying price points, catering to both budget-conscious buyers and those seeking luxury options. This not only broadens your market appeal but also increases the likelihood of closing deals across different segments. By tailoring your pricing strategy to the specific characteristics and preferences of each segment, you can enhance customer satisfaction and drive sales.

| Pricing Model | Target Audience |

|---|---|

| Premium Pricing | High-net-worth individuals |

| Competitive Pricing | First-time buyers and budget-conscious investors |

| Tiered Pricing | Diverse investor segments |

- Pricing strategies should align with customer segments and their preferences.

- Understanding willingness to pay can enhance profitability.

- Tailoring pricing models can lead to increased market share.

“Price smartly, and watch your investments thrive.” 💰

Additionally, utilizing data analytics can significantly improve your pricing strategies. By analyzing market trends, competitor pricing, and customer behavior, you can make data-driven decisions that align your pricing with current market demands. This adaptability is crucial in a fluctuating real estate market, where investor preferences can change rapidly. For instance, if data indicates a surge in demand for eco-friendly properties, you might adjust your pricing strategy to reflect this trend, ensuring that your offerings remain competitive and appealing.

In conclusion, implementing segmentation-based pricing models in real estate allows for a more tailored approach to pricing strategies. By understanding your audience and their willingness to pay, you can maximize revenue while ensuring customer satisfaction. This strategic approach not only enhances your market positioning but also drives growth and profitability in your real estate business.

Segmentation-Driven Upsell Tactics in Real Estate

Using segmentation-driven upsell tactics can significantly enhance your sales strategies in real estate investment. By understanding the specific needs and preferences of different investor segments, you can effectively present additional offerings that resonate with their interests. Upselling is not just about increasing sales; it’s about providing value that meets the unique demands of your customers.

For instance, if you are working with a first-time buyer who is interested in a starter home, you might suggest home improvement services or warranties that could enhance their purchase. By doing so, you not only increase the value of the transaction but also provide peace of mind to the buyer. On the other hand, when dealing with seasoned investors, you could offer property management services or investment analysis tools. These additional services can streamline their investment process and improve their overall experience, making them more likely to return for future purchases.

Moreover, understanding customer behavior and preferences enables you to craft personalized upsell offers. For example, if you know a client is particularly interested in eco-friendly features, you could highlight properties with sustainable designs or suggest upgrades that enhance energy efficiency. This targeted approach not only increases the likelihood of a successful upsell but also reinforces the relationship with the client, as they feel understood and valued.

| Upsell Tactic | Target Audience |

|---|---|

| Home Improvement Services | First-time buyers |

| Property Management Services | Seasoned investors |

| Investment Analysis Tools | Experienced real estate investors |

- Understanding customer segments enhances the effectiveness of upsell tactics.

- Providing value through upselling can lead to increased customer loyalty.

- Personalized offers can improve customer satisfaction and drive repeat business.

“Upsell with purpose, and watch your business grow!” 🌱

Additionally, leveraging technology can aid in implementing effective upsell strategies. Utilizing CRM systems can help track customer interactions and preferences, allowing you to identify opportunities for upselling. For example, if a customer has shown interest in certain property features, your follow-up communications can highlight additional services that align with their interests. This level of personalization not only enhances the customer experience but also increases the chances of successful upsells.

In summary, employing segmentation-driven upsell tactics in real estate can significantly enhance your sales strategies. By understanding your audience and tailoring your upsell offers to meet their specific needs, you can increase revenue while providing valuable services that improve customer satisfaction. This strategic approach fosters long-term relationships and positions your business for sustained growth in the competitive real estate market.

Recommendations

In summary, understanding real estate investment customer segments is essential for tailoring your marketing strategies and maximizing your success in the property market. By recognizing the different types of investors, their preferences, and behaviors, you can implement effective segmentation and upselling tactics that resonate with your audience. To further enhance your business approach, consider utilizing a comprehensive Real Estate Investment Business Plan Template, which can guide you in structuring your investment strategies effectively.

Additionally, we invite you to explore our related articles on real estate investment to deepen your understanding and strengthen your strategies:

- Article 1 on Real Estate Investment SWOT Analysis Insights

- Article 2 on Real Estate Investment: The Key to High Profitability

- Article 3 on Real Estate Investment Business Plan: Template and Tips

- Article 4 on Real Estate Investment Financial Plan: Step-by-Step Guide with Template

- Article 5 on Launching a Real Estate Investment Business: A Complete Guide with Practical Examples

- Article 6 on Crafting a Real Estate Investment Marketing Plan: Strategies and Examples

- Article 7 on Building a Business Model Canvas for Real Estate Investment: Examples Included

- Article 8 on How Much Does It Cost to Operate a Real Estate Investment Business?

- Article 9 on Real Estate Investment Feasibility Study: Comprehensive Guide

- Article 10 on Real Estate Investment Risk Management: Comprehensive Strategies

- Article 11 on Real Estate Investment Competition Study: Detailed Insights

- Article 12 on How to Navigate Legal Considerations in Real Estate Investment?

- Article 13 on What Funding Options Should You Consider for Real Estate Investment?

- Article 14 on How to Scale Real Estate Investment: Proven Growth Strategies

FAQ

What are the different types of real estate investors?

The types of real estate investors vary widely, including residential, commercial, and industrial investors. Residential investors focus on single-family homes or rental properties, while commercial investors target office spaces and retail properties. Understanding these distinctions helps tailor marketing strategies effectively.

How can I identify my target audience in real estate investment?

Identifying your target audience involves analyzing demographics, preferences, and behaviors. By understanding who your potential customers are—such as first-time buyers or seasoned investors—you can create targeted marketing campaigns that resonate with their specific needs and motivations.

What is behavioral segmentation in real estate?

Behavioral segmentation refers to categorizing investors based on their purchasing behaviors and preferences. This approach helps real estate professionals tailor their marketing strategies and offerings to meet the unique needs of different investor segments, ultimately improving engagement and conversions.

What are current trends in real estate investment?

Current trends in real estate investment include the rise of remote work, which has increased demand for suburban properties, and the growing interest in sustainable living among younger generations. Staying updated on these trends allows investors to adjust their strategies and offerings accordingly.

How can marketing automation benefit real estate investors?

Marketing automation can streamline communication and improve customer engagement for real estate investors. By utilizing automated tools for email campaigns, social media, and CRM systems, businesses can target specific investor segments more effectively, leading to higher conversion rates and enhanced customer satisfaction.

What are segmentation-based pricing models in real estate?

Segmentation-based pricing models allow real estate businesses to tailor their pricing strategies according to different investor segments. By understanding the willingness to pay among various demographics, businesses can implement tiered pricing, premium pricing, or competitive pricing to maximize revenue while meeting customer needs.

How can upselling be effectively implemented in real estate?

Segmentation-driven upsell tactics involve understanding the specific needs of different investor segments to present additional offerings that resonate with them. By providing relevant upsell options, such as property management services or home improvement solutions, you can enhance the overall customer experience and increase transaction value.