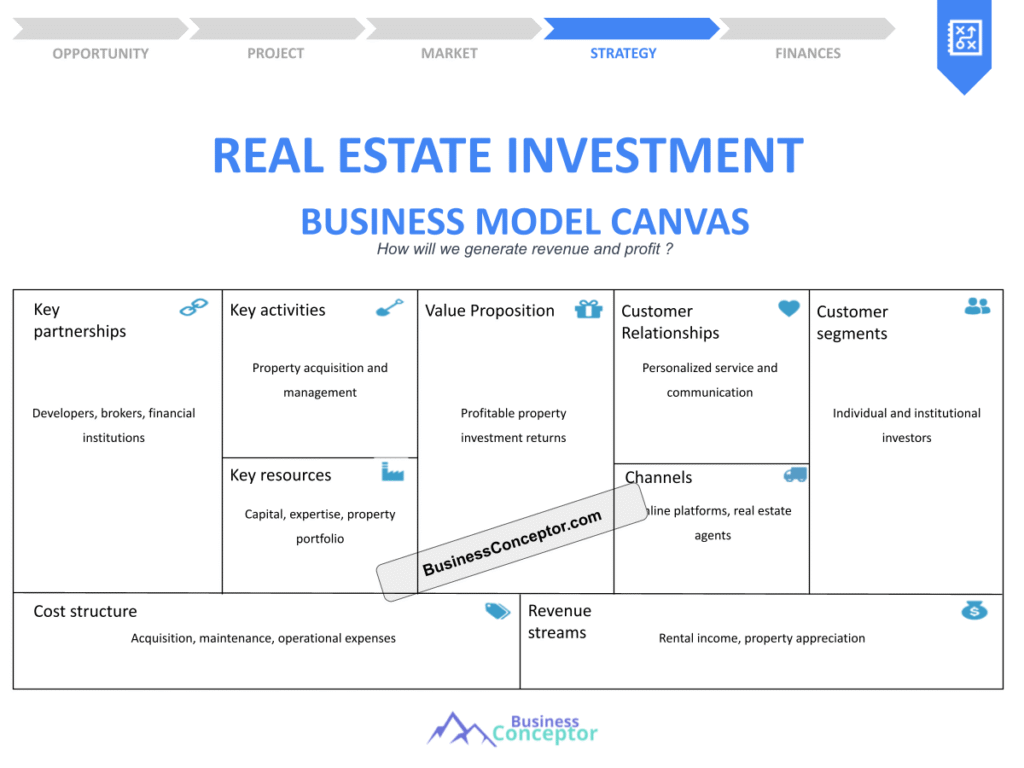

The Real Estate Investment Business Model Canvas is a powerful tool that helps investors visualize and strategize their business ventures in the property market. This canvas acts as a blueprint, providing clarity on how to create value and generate income through real estate investments. It simplifies complex concepts into manageable parts, making it easier for investors to understand their market positioning and operational strategies. Here’s what you need to know about it:

- Purpose of the Canvas: To streamline business planning and enhance decision-making in real estate investments.

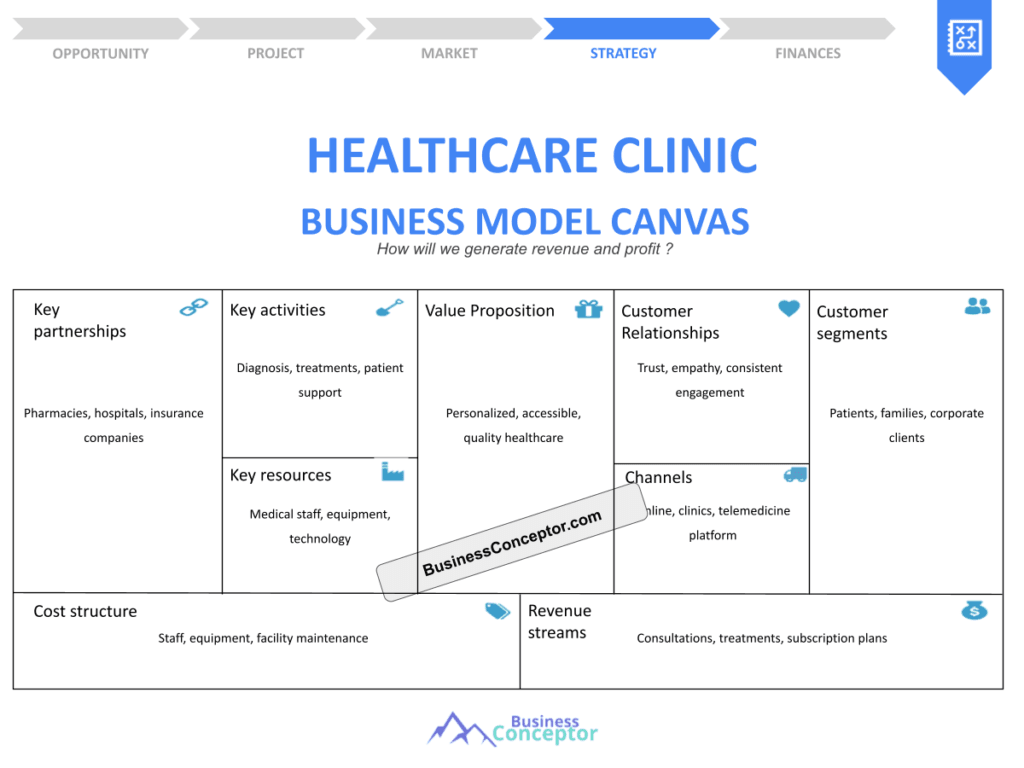

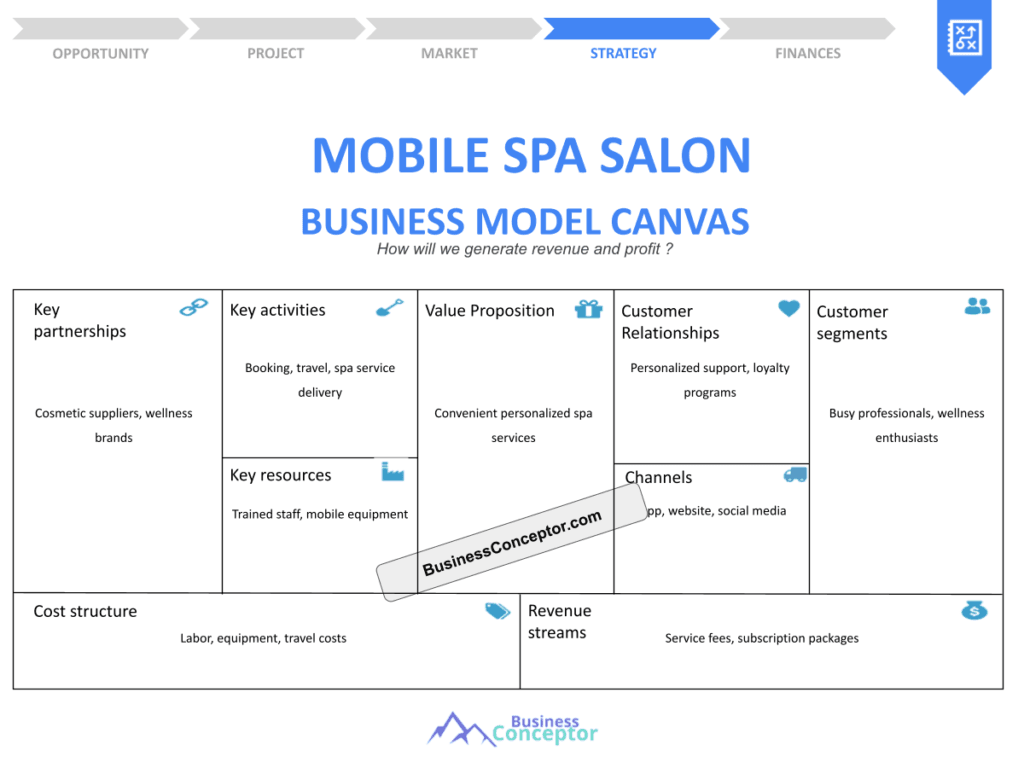

- Key Components: It includes customer segments, value propositions, channels, key activities, key partners, cost structures, and revenue streams.

- Benefits: It helps identify strengths, weaknesses, opportunities, and threats in real estate ventures.

Understanding the Real Estate Investment Business Model Canvas

The Real Estate Investment Business Model Canvas is a visual framework that outlines the essential components of a real estate business. By breaking down the business into manageable parts, investors can identify what works, what doesn’t, and where improvements can be made. Think of it as a roadmap guiding you through the complex world of real estate.

For instance, when I first started in real estate, I was overwhelmed by the various factors to consider—financing, property management, and market analysis, to name a few. I stumbled upon the Business Model Canvas, and it changed my approach entirely. It helped me clarify my goals and streamline my focus, ultimately leading to more successful investments.

Using the canvas allows you to visualize your entire business model on a single page, making it easier to communicate your strategy to partners, investors, or team members. This clarity can also facilitate decision-making processes by highlighting key areas that need attention or adjustment. Plus, having everything laid out in front of you can spark creativity and innovation as you think about how to enhance different aspects of your business.

| Component | Description |

|---|---|

| Customer Segments | Who are your target clients? |

| Value Propositions | What unique value do you offer? |

| Channels | How do you reach your customers? |

| Key Activities | What activities are crucial for your business? |

| Key Partners | Who are your essential partners? |

| Cost Structure | What are the major costs? |

| Revenue Streams | How do you earn money? |

- Key Takeaway: The Business Model Canvas simplifies complex business planning into clear, actionable components.

- Inspirational Quote:

“The best way to predict the future is to create it.” - Peter Drucker 🌟

In the world of real estate investment, understanding your business model is crucial for success. The Real Estate Investment Business Model Canvas not only helps you define your business strategy but also allows you to adapt and pivot as the market changes. As you build your canvas, consider the unique challenges and opportunities within your target market. This proactive approach can be a game-changer, helping you stay ahead of competitors and better serve your clients.

Moreover, using the Business Model Canvas can enhance collaboration among team members. When everyone is on the same page regarding the business strategy, it fosters teamwork and accountability. Each member can understand their role in achieving the overall objectives, which can lead to increased productivity and satisfaction.

So, whether you’re a seasoned investor or just starting, the Real Estate Investment Business Model Canvas is an essential tool for navigating the complexities of the real estate market. It provides a comprehensive overview that can guide your decisions and drive your business forward.

Customer Segments in Real Estate Investment

When creating a Business Model Canvas for real estate investment, understanding your customer segments is crucial. Customer segments refer to the different groups of people or organizations that your business aims to serve. These can range from first-time homebuyers to seasoned investors seeking commercial properties. Identifying your customer segments allows you to tailor your services and marketing strategies effectively, which can lead to increased satisfaction and loyalty.

In my experience, pinpointing the right customer segment can make all the difference. For example, when I focused on first-time homebuyers, I tailored my marketing strategies to address their unique needs, such as educational content about the buying process. This approach not only attracted more clients but also built trust and loyalty, as they felt supported throughout their journey. Understanding the specific pain points and desires of each segment enables you to provide targeted solutions that resonate with them.

There are several key customer segments in the real estate investment landscape:

| Segment | Description |

|---|---|

| First-time Homebuyers | Individuals or families purchasing their first property. |

| Real Estate Investors | Buyers looking for rental or investment properties. |

| Commercial Buyers | Businesses seeking commercial real estate for operations. |

| Developers | Companies or individuals developing new properties. |

| Renters | Individuals looking for rental properties. |

- Key Insight: Tailoring your strategies to specific customer segments can enhance your effectiveness.

- Inspirational Quote:

“Understanding your customer is the key to success.” 📈

Value Propositions in Real Estate Investment

A strong value proposition is essential for attracting and retaining customers in the competitive real estate market. It’s what sets your business apart and explains why customers should choose you over others. This could be anything from offering competitive pricing, providing exceptional customer service, or specializing in a unique property type. A well-defined value proposition can significantly impact your marketing efforts and overall business success.

For instance, I once worked with a real estate agency that focused on eco-friendly homes. Their value proposition highlighted sustainable living, which resonated with environmentally conscious buyers. This niche market allowed them to thrive despite tough competition. By clearly articulating their unique offerings, they were able to attract a loyal customer base that valued their commitment to sustainability.

Here’s how to craft a compelling value proposition in the realm of real estate investment:

| Value Proposition | Example |

|---|---|

| Competitive Pricing | Offering lower commission rates than competitors. |

| Exceptional Customer Service | Providing personalized service throughout the buying process. |

| Niche Specialization | Focusing on luxury homes or eco-friendly properties. |

| Comprehensive Market Analysis | Offering detailed reports and insights to buyers. |

- Key Takeaway: A well-defined value proposition is key to standing out in the market.

- Inspirational Quote:

“Make a customer, not a sale.” - Katherine Barchetti 💡

In summary, focusing on customer segments and crafting a strong value proposition are foundational steps in developing your Real Estate Investment Business Model Canvas. By understanding who your customers are and what unique value you provide, you can create targeted marketing strategies that resonate with potential buyers and investors. This approach not only enhances customer satisfaction but also drives growth and profitability in your real estate ventures.

Channels in Real Estate Investment

Channels refer to the means through which a business delivers its value proposition to its customers. In the realm of real estate investment, selecting the right channels is critical for reaching your target audience effectively. These channels can include online listings, social media marketing, open houses, and networking events. Each channel has its unique advantages, and understanding how to leverage them can lead to significant growth in your business.

When I first started, I relied heavily on traditional methods like newspaper ads. However, as I learned more about digital marketing, I shifted my focus to social media platforms. This transition not only increased my visibility but also allowed for more direct interaction with potential clients. Platforms like Facebook and Instagram enable you to showcase properties with stunning visuals and reach a broader audience without geographical limitations.

Here’s a breakdown of effective channels for real estate investment:

| Channel | Description |

|---|---|

| Online Listings | Websites like Zillow and Realtor.com for property visibility. |

| Social Media | Platforms like Facebook and Instagram for targeted advertising. |

| Email Marketing | Sending newsletters and listings to potential buyers. |

| Open Houses | In-person events to showcase properties. |

| Networking Events | Engaging with other real estate professionals and potential clients. |

- Key Insight: The right channels can significantly enhance your reach and engagement with customers.

- Inspirational Quote:

“The goal is to turn data into information, and information into insight.” - Carly Fiorina 📊

Utilizing a mix of channels allows you to create a comprehensive marketing strategy that can adapt to changing market conditions. For instance, online listings are great for attracting buyers actively searching for properties, while social media allows you to engage with a broader audience and build brand awareness. Additionally, email marketing can nurture leads over time, keeping your business top-of-mind for potential clients. Each channel complements the others, creating a robust system for generating leads and closing deals.

Key Activities in Real Estate Investment

Key activities encompass the essential actions your business must take to operate successfully in the real estate investment sector. These activities can include property management, market research, client relationship management, and marketing strategies. Identifying these activities ensures that your business model is robust and effective, ultimately leading to better outcomes.

When I first ventured into property management, I underestimated the time required for maintenance and tenant relations. By prioritizing these key activities, I was able to improve tenant satisfaction and retention, ultimately boosting my bottom line. Effective property management involves not just keeping the property in good condition but also fostering positive relationships with tenants, which can lead to longer leases and fewer vacancies.

Here’s a summary of key activities in real estate investment:

| Key Activity | Description |

|---|---|

| Property Management | Overseeing rental properties and tenant relations. |

| Market Research | Analyzing trends and data to inform investment decisions. |

| Marketing Strategies | Implementing campaigns to attract buyers or renters. |

| Financial Management | Managing budgets, expenses, and revenue streams. |

| Networking | Building relationships with other industry professionals. |

- Key Insight: Focusing on key activities ensures your business runs smoothly and efficiently.

- Inspirational Quote:

“Success usually comes to those who are too busy to be looking for it.” - Henry David Thoreau ⏳

By concentrating on these key activities, you can streamline operations and enhance overall productivity. For example, conducting regular market research allows you to stay ahead of trends and make informed decisions about property acquisitions or sales. Additionally, effective financial management ensures that you are maximizing your revenue while keeping expenses under control. When all these activities are aligned with your business model, you create a solid foundation for growth and success in the competitive real estate market.

Key Partners in Real Estate Investment

Identifying key partners is crucial for any real estate investment business. These partners can include lenders, contractors, real estate agents, and property management companies. Building strong relationships with these partners can lead to increased opportunities and resources, ultimately enhancing your business model and expanding your reach in the market.

When I first entered the real estate field, I quickly realized the importance of collaborating with reliable contractors. A good contractor can make or break a property renovation project. By partnering with the right people, I’ve been able to enhance my offerings and expand my business. For example, having a trusted contractor allows for quicker turnaround times on renovations, which can significantly affect rental income or property resale value.

Here’s a breakdown of potential key partners in real estate investment:

| Key Partner | Description |

|---|---|

| Lenders | Financial institutions providing funding for purchases. |

| Contractors | Companies or individuals responsible for renovations. |

| Real Estate Agents | Professionals who facilitate property transactions. |

| Property Management Firms | Companies managing rental properties and tenant relations. |

| Legal Advisors | Lawyers specializing in real estate law. |

- Key Insight: Strong partnerships can provide valuable resources and expertise.

- Inspirational Quote:

“Alone we can do so little; together we can do so much.” - Helen Keller 🤝

Having a network of reliable key partners can also provide you with a competitive edge. For instance, a good relationship with lenders can lead to better financing options, which can be crucial in a competitive market. Similarly, collaborating with experienced real estate agents can help you gain insights into market trends and property values, allowing you to make informed investment decisions. By leveraging these partnerships, you can create a more efficient and effective business model that maximizes your potential for success.

Cost Structure in Real Estate Investment

Understanding your cost structure is essential for ensuring profitability in real estate investment. This includes all costs associated with running your business, such as acquisition costs, renovation expenses, marketing costs, and operational expenses. A clear grasp of your cost structure helps you make informed financial decisions and develop strategies for cost management.

When I first started investing, I overlooked some hidden costs, like maintenance and property taxes. By mapping out my cost structure, I was able to create a more accurate budget and avoid unexpected financial pitfalls. For instance, I learned to allocate funds for routine maintenance and emergency repairs, which ultimately saved me from costly surprises down the line. Understanding these costs allows you to create a more resilient business model that can weather market fluctuations.

Here’s a summary of common costs in real estate investment:

| Cost Type | Description |

|---|---|

| Acquisition Costs | Purchase price and closing costs for properties. |

| Renovation Expenses | Costs associated with improving properties. |

| Marketing Costs | Expenses for advertising and promotional efforts. |

| Operational Expenses | Day-to-day costs like utilities and property management fees. |

| Legal and Administrative | Costs for legal services and permits. |

- Key Insight: A clear understanding of your cost structure helps in budgeting and financial planning.

- Inspirational Quote:

“Beware of little expenses; a small leak will sink a great ship.” - Benjamin Franklin 🚢

By maintaining a detailed overview of your cost structure, you can identify areas where you can cut costs or improve efficiency. For example, if you notice that your renovation expenses are consistently higher than projected, it may be time to evaluate your contractors or consider alternative materials. Additionally, understanding your operational costs can help you make informed decisions about whether to hire property management services or manage properties independently. This knowledge empowers you to optimize your business model, ensuring that you maximize profits while minimizing expenses.

In summary, focusing on key partners and understanding your cost structure are foundational steps in developing your Real Estate Investment Business Model Canvas. By fostering strong relationships with partners and maintaining a clear view of your financial landscape, you can create a robust business strategy that supports sustainable growth and success in the competitive real estate market.

Revenue Streams in Real Estate Investment

Identifying revenue streams is crucial for any real estate investment business. This could involve income from rental properties, property sales, or investment in real estate investment trusts (REITs). Understanding these streams can help you diversify your income and reduce risk, ensuring a more stable financial foundation for your business.

In my experience, relying solely on rental income can be risky. Market fluctuations, changes in tenant demand, and unexpected vacancies can all impact your bottom line. I’ve found that incorporating other revenue streams, like flipping houses or investing in REITs, has provided a buffer during slower rental periods. This diversification not only enhances financial stability but also opens up new opportunities for growth.

Here’s a summary of potential revenue streams in real estate investment:

| Revenue Stream | Description |

|---|---|

| Rental Income | Money earned from leasing properties to tenants. |

| Property Sales | Income from selling properties at a profit. |

| REIT Investments | Earnings from investing in real estate funds. |

| Property Management Fees | Income from managing properties for other owners. |

| Consulting Services | Revenue from providing advice or services to other investors. |

- Key Insight: Diversifying revenue streams can enhance financial stability and growth.

- Inspirational Quote:

“Don’t put all your eggs in one basket.” - Spanish Proverb 🥚

Having multiple revenue streams allows you to adapt to changing market conditions and reduce your overall risk. For instance, if rental income is down due to economic factors, you can rely on profits from property sales or management fees. Additionally, engaging in property management services for other investors can create a steady income flow, especially in times when your own properties are underperforming. This flexibility can be a lifesaver in the unpredictable world of real estate investment.

Crafting Your Real Estate Investment Business Model Canvas

Creating your Real Estate Investment Business Model Canvas is a practical step towards organizing your real estate business. By considering the components we’ve discussed—customer segments, value propositions, channels, key activities, key partners, cost structures, and revenue streams—you can develop a clear picture of your business strategy. This comprehensive view enables you to identify areas for improvement and potential growth.

When I first constructed my canvas, it felt overwhelming. But breaking it down into these components made it manageable. I began by identifying my target customers and what unique value I could offer them. This clarity not only helped in planning but also in executing my strategies effectively. For example, once I understood my customer segments, I could tailor my marketing efforts to directly address their needs, which resulted in higher conversion rates.

Here’s a checklist for creating your Real Estate Investment Business Model Canvas:

| Step | Action |

|---|---|

| Identify Customer Segments | Determine who your target customers are. |

| Define Value Propositions | Articulate what makes your business unique. |

| Choose Channels | Select the best ways to reach your customers. |

| Outline Key Activities | List the crucial actions needed for your business. |

| Identify Key Partners | Recognize essential partners and resources. |

| Map Cost Structure | Understand all costs associated with your business. |

| Determine Revenue Streams | Identify how your business will generate income. |

- Key Insight: A well-crafted Business Model Canvas provides a roadmap for your real estate investment journey.

- Inspirational Quote:

“The journey of a thousand miles begins with one step.” - Lao Tzu 🚀

By maintaining a detailed overview of your Business Model Canvas, you can quickly adjust your strategies as market conditions change. For example, if you notice a decline in one revenue stream, you can pivot to focus on others or innovate new offerings. This proactive approach is crucial in the fast-paced world of real estate investment and can be the difference between success and failure.

In summary, focusing on revenue streams and crafting your Real Estate Investment Business Model Canvas are essential steps in developing a successful strategy. By diversifying your income sources and maintaining a clear business model, you position yourself for long-term success in the competitive real estate market.

Recommendations

In this article, we explored the essential components of the Real Estate Investment Business Model Canvas, including customer segments, value propositions, channels, key activities, key partners, cost structures, and revenue streams. Understanding these elements is crucial for anyone looking to thrive in the real estate investment sector. To help you take the next step in your journey, consider using our Real Estate Investment Business Plan Template. This template provides a comprehensive framework that simplifies the planning process and sets you up for success.

Additionally, here are some related articles that can enhance your understanding of real estate investment:

- Article 1 on Real Estate Investment SWOT Analysis Insights

- Article 2 on Real Estate Investment: The Key to High Profitability

- Article 3 on Real Estate Investment Business Plan: Template and Tips

- Article 4 on Real Estate Investment Financial Plan: Step-by-Step Guide with Template

- Article 5 on Launching a Real Estate Investment Business: A Complete Guide with Practical Examples

- Article 6 on Crafting a Real Estate Investment Marketing Plan: Strategies and Examples

- Article 7 on Real Estate Investment Customer Segments: Examples and Best Practices

- Article 8 on How Much Does It Cost to Operate a Real Estate Investment Business?

- Article 9 on Real Estate Investment Feasibility Study: Comprehensive Guide

- Article 10 on Real Estate Investment Risk Management: Comprehensive Strategies

- Article 11 on Real Estate Investment Competition Study: Detailed Insights

- Article 12 on How to Navigate Legal Considerations in Real Estate Investment?

- Article 13 on What Funding Options Should You Consider for Real Estate Investment?

- Article 14 on How to Scale Real Estate Investment: Proven Growth Strategies

FAQ

What is a Real Estate Investment Business Model Canvas?

The Real Estate Investment Business Model Canvas is a strategic tool that helps investors outline the essential components of their business. It includes elements like customer segments, value propositions, channels, key activities, key partners, cost structures, and revenue streams. This framework provides a clear visual representation of how a real estate business operates and helps identify areas for improvement.

How do I identify customer segments in real estate investment?

Identifying customer segments in real estate investment involves analyzing the different groups of people or organizations that your business aims to serve. This can include first-time homebuyers, seasoned investors, commercial buyers, and renters. Understanding the specific needs and preferences of each segment allows you to tailor your marketing strategies and offerings effectively.

What are the key activities in a real estate investment business?

Key activities in a real estate investment business include property management, market research, client relationship management, and marketing strategies. These activities are essential for ensuring smooth operations and achieving your business goals. Focusing on these key activities can enhance efficiency and increase profitability.

How can I diversify revenue streams in real estate investment?

Diversifying revenue streams in real estate investment can be achieved by incorporating various income sources. This may include rental income, property sales, REIT investments, and consulting services. By having multiple revenue streams, you can reduce risk and enhance financial stability, allowing your business to thrive even during challenging market conditions.

What are the advantages of using a Business Model Canvas for real estate?

The Business Model Canvas provides a structured approach to developing your real estate investment strategy. It helps clarify your business model, identify key components, and visualize how they interact. This clarity fosters better decision-making and allows you to adapt quickly to changing market conditions, ultimately leading to greater success in your investment endeavors.