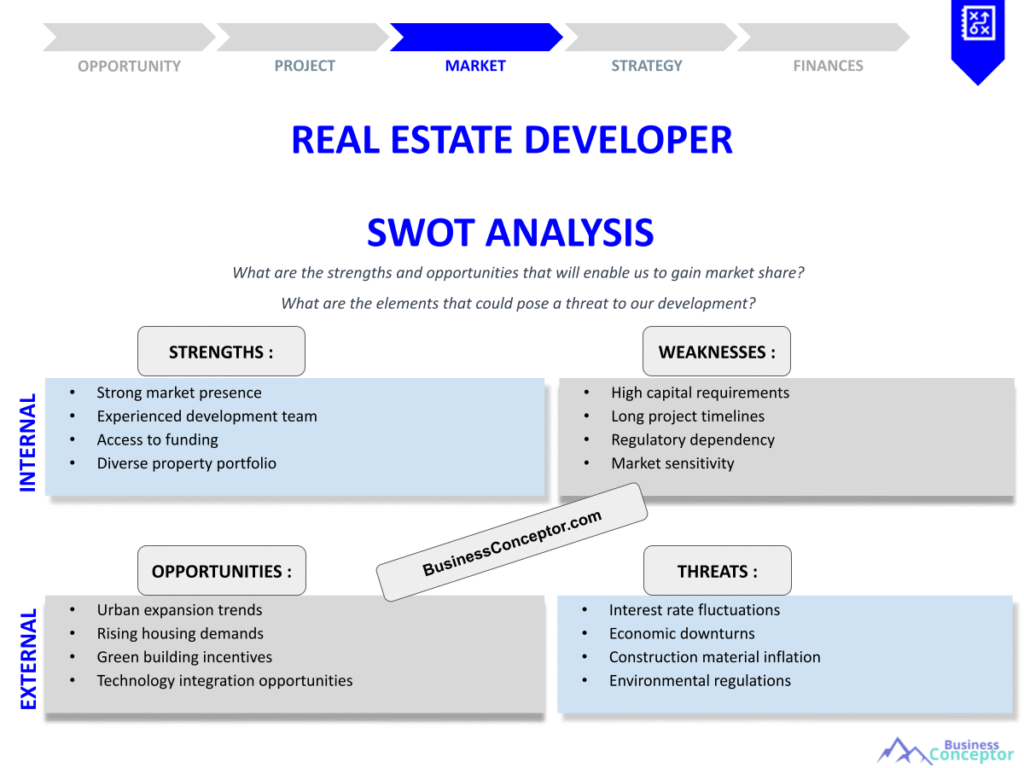

The world of real estate development can feel like a wild rollercoaster ride, full of highs and lows, and twists and turns. If you’re diving into this industry, understanding the Real Estate Developer SWOT Analysis is essential. This strategic tool helps developers assess their Strengths, Weaknesses, Opportunities, and Threats, guiding them through the complexities of property development. It’s not just a buzzword; it’s a framework that can make or break your success in this field. Here’s what you need to know:

- Strengths: Identify what sets you apart from competitors.

- Weaknesses: Acknowledge areas needing improvement.

- Opportunities: Spot emerging trends and market gaps.

- Threats: Recognize potential risks and challenges.

Understanding SWOT Analysis for Real Estate Developers

Every real estate developer should familiarize themselves with the basics of SWOT analysis. It’s like your business’s health check-up, revealing insights that can shape your strategies. So, what does each component mean?

Strengths refer to the internal advantages that give you an edge. For instance, having a solid financial backing or a skilled team can be a significant strength. A strong financial base allows you to invest in quality materials and hire skilled labor, ultimately leading to higher-quality projects. Furthermore, having a solid network can open doors to exclusive deals and partnerships. For example, developers with established connections might get first dibs on prime land before it hits the market. Another strength could be a solid reputation. If you’ve successfully completed projects in the past, it builds trust and credibility. People are more likely to invest in a developer who has a proven track record.

On the flip side, Weaknesses are the internal factors that might hold you back, like limited experience or a weak brand presence. One common weakness is a lack of experience. New developers might find it challenging to navigate complex regulations or market demands. For instance, if you’re unfamiliar with zoning laws, you might face delays or additional costs. Another weakness can be limited marketing skills. If you can’t effectively promote your projects, they might not attract the desired attention. This can lead to unsold properties and lost revenue.

Opportunities are the external factors that can benefit your business, such as a growing demand for housing in a particular area or favorable government policies. The real estate market is ever-evolving, and with change comes opportunity. Recognizing these opportunities can set you apart from competitors. One major opportunity lies in urbanization. As cities expand, there’s a growing demand for housing and commercial spaces. Developers who can identify these trends early can capitalize on them effectively. Sustainability is another significant opportunity. With increasing awareness about climate change, eco-friendly developments are gaining traction. Offering green buildings can attract a new segment of environmentally-conscious buyers.

However, Threats are the risks that can harm your business, like economic downturns or increasing competition. While opportunities abound, threats also lurk in the shadows. Understanding these threats is crucial for mitigating risks. Economic downturns can severely impact the real estate market. When the economy falters, people are less likely to invest in new homes. For example, during a recession, luxury developments might struggle to find buyers. Competition is another significant threat. The real estate market can be saturated, and standing out becomes increasingly difficult. If competitors are offering similar properties at lower prices, it can cut into your market share.

| SWOT Component | Description |

|---|---|

| Strengths | Internal advantages that give you an edge |

| Weaknesses | Internal limitations that may hinder growth |

| Opportunities | External factors that could benefit your business |

| Threats | External challenges that could impact success |

- Recognizing your strengths can boost confidence.

- Acknowledging weaknesses allows for strategic improvement.

- Spotting opportunities can lead to innovative projects.

- Being aware of threats can prepare you for challenges ahead.

“In the world of real estate, knowledge is power.” 💪

Strengths of Real Estate Developers

When it comes to real estate, strengths can be diverse and significantly impact your ability to succeed in the competitive landscape. Recognizing and leveraging these strengths is crucial for any developer looking to make their mark. One of the most significant strengths is having a strong financial foundation. This allows developers to invest in quality materials, hire skilled labor, and execute high-quality projects without financial strain. For instance, developers with robust financing can afford to take on larger projects or invest in innovative technologies that enhance the quality and sustainability of their developments.

Another key strength lies in having a skilled and experienced team. A talented team can navigate the complexities of the real estate market, ensuring that projects stay on schedule and within budget. For example, experienced project managers can foresee potential challenges and proactively address them, minimizing delays and cost overruns. Additionally, a diverse team brings varied perspectives and expertise, which can foster creativity and innovation in project design and execution.

Furthermore, a solid network is a valuable asset. Developers who have established relationships with local authorities, contractors, and suppliers can benefit from smoother project approvals and better pricing on materials. This network can also provide insights into market trends and opportunities that may not be readily apparent to those outside the industry. For instance, having good rapport with city planners can help developers understand zoning changes or upcoming infrastructure projects that may affect property values.

Lastly, a strong reputation built on successful past projects enhances credibility in the eyes of investors and buyers. When potential clients see a history of quality work, they are more likely to trust your capabilities and invest in your projects. This reputation can be a powerful marketing tool, as satisfied clients often provide referrals and testimonials that can lead to new business opportunities.

| Strengths | Examples |

|---|---|

| Financial Stability | Access to funds for large projects |

| Skilled Team | Experienced professionals ensuring project success |

| Solid Network | Established relationships with key industry players |

| Strong Reputation | Trust from clients based on past successes |

- A solid financial base enables larger projects.

- Experienced teams navigate complexities effectively.

- Strong networks open doors to exclusive opportunities.

- A good reputation fosters trust and repeat business.

“Your reputation is your greatest asset.” 🌟

Weaknesses in Real Estate Development

No one likes to talk about weaknesses, but recognizing them is essential for growth. Being aware of your shortcomings allows you to address them proactively. One common weakness in the real estate sector is a lack of experience. New developers might find it challenging to navigate complex regulations or market demands. For instance, if you’re unfamiliar with zoning laws, you might face delays or additional costs that could have been avoided with proper knowledge. This experience gap can lead to costly mistakes that not only affect the current project but can also tarnish your reputation in the long run.

Another significant weakness can be limited marketing skills. If you can’t effectively promote your projects, they might not attract the desired attention. This can lead to unsold properties and lost revenue. For example, a beautiful new development might go unnoticed if it isn’t marketed properly. In today’s digital age, understanding how to leverage social media, online listings, and targeted advertising is crucial. Developers lacking these skills may find themselves at a disadvantage compared to competitors who effectively utilize these tools.

Resource limitations can also hinder a developer’s growth potential. Smaller firms may struggle to compete with larger companies that have more substantial resources for marketing, technology, and project management. This can create a cycle where limited resources lead to fewer projects, which in turn restricts growth. Without the ability to scale operations, developers may miss out on lucrative opportunities in the market.

| Weaknesses | Implications |

|---|---|

| Lack of Experience | Risk of costly mistakes and project delays |

| Poor Marketing Strategies | Low visibility for projects, leading to unsold properties |

| Limited Resources | Inability to scale operations and compete effectively |

- Experience gaps can lead to regulatory issues.

- Ineffective marketing can stifle project visibility.

- Resource limitations can hinder growth potential.

“Acknowledging weaknesses is the first step to overcoming them.” 🌱

Opportunities in the Real Estate Market

The real estate market is ever-evolving, and with change comes opportunity. Recognizing these opportunities can set you apart from competitors and significantly boost your business. One major opportunity lies in the trend of urbanization. As cities continue to expand and populations grow, there is an increasing demand for housing and commercial spaces. Developers who can identify these trends early can capitalize on them effectively. For instance, urban areas often experience a surge in demand for mixed-use developments, which combine residential, commercial, and recreational spaces. By positioning yourself to meet this demand, you can tap into a lucrative market.

Another significant opportunity in real estate is the shift towards sustainable development. With growing awareness about climate change and environmental issues, more buyers are seeking eco-friendly homes and commercial spaces. Developers who incorporate sustainable practices into their projects, such as using renewable energy sources, energy-efficient materials, and sustainable landscaping, can attract a new segment of environmentally-conscious buyers. For example, offering homes with solar panels or LEED certification can enhance your market appeal and potentially lead to higher sales prices.

Technological advancements also present exciting opportunities for real estate developers. The rise of smart home technology has created a demand for properties that integrate advanced technology features. Homes equipped with smart thermostats, security systems, and automated lighting not only appeal to tech-savvy buyers but can also increase property value. Additionally, utilizing technology in project management and marketing can streamline operations and enhance efficiency. For instance, using virtual reality for property tours can provide prospective buyers with an immersive experience, making it easier to market and sell properties.

| Opportunities | Examples |

|---|---|

| Urbanization | Growing demand for mixed-use developments |

| Sustainable Development | Eco-friendly homes attracting buyers |

| Technological Advancements | Smart homes increasing property value |

- Urbanization creates a need for new developments.

- Eco-friendly projects can attract modern buyers.

- Technology can enhance property value and appeal.

“Opportunities don’t happen; you create them.” 🚀

Threats in Real Estate Development

While opportunities abound, threats also lurk in the shadows. Understanding these threats is crucial for mitigating risks in your real estate ventures. One of the most significant threats is the potential for economic downturns. When the economy falters, consumer confidence decreases, and people are less likely to invest in new homes or commercial properties. For instance, during a recession, luxury developments might struggle to find buyers, leading to increased vacancies and financial losses. Developers must be prepared for such economic fluctuations by diversifying their portfolios and considering projects that cater to different market segments.

Another notable threat is the increasing competition in the real estate market. As the industry becomes more attractive, new developers enter the field, leading to saturation in certain areas. Standing out becomes increasingly difficult, especially if competitors are offering similar properties at lower prices. This competitive pressure can force developers to reduce prices, impacting profit margins. To combat this, it’s essential to continuously innovate and differentiate your offerings. Highlighting unique features, superior quality, or exceptional customer service can help set your projects apart from the competition.

Additionally, regulatory changes can pose significant threats to real estate developers. New laws and regulations regarding zoning, environmental standards, and building codes can impact project timelines and costs. For example, if a city enacts stricter zoning laws, it could limit the types of developments that can be built in certain areas. Developers need to stay informed about potential regulatory changes and adapt their strategies accordingly. Engaging with local government and industry associations can provide valuable insights into upcoming regulations and help you navigate these challenges.

| Threats | Implications |

|---|---|

| Economic Downturns | Reduced demand for new developments |

| Increased Competition | Pressure on pricing and sales |

| Regulatory Changes | New laws impacting development costs |

- Economic downturns can lead to decreased sales.

- High competition may force price reductions.

- Regulatory changes can increase operational costs.

“Every threat is an opportunity in disguise.” 🕵️♂️

Conducting a Real Estate Developer SWOT Analysis

Now that you’ve got a grasp on the components of a SWOT analysis, it’s time to discuss how to conduct one effectively. This analysis is not just a formality; it’s a vital exercise that can significantly impact your strategic planning and decision-making process. Start by gathering your team for a brainstorming session. Including a diverse group of individuals—such as project managers, financial analysts, and marketing professionals—ensures that you capture a wide range of insights and perspectives.

During this session, encourage open dialogue about each component of the SWOT analysis. For example, ask questions like, “What do we do better than others?” for strengths, or “What challenges are we currently facing?” for weaknesses. This collaborative approach not only helps in identifying the internal and external factors affecting your business but also fosters a sense of ownership among team members. Each participant can contribute their unique experiences and insights, which can lead to a more comprehensive understanding of your organization’s position in the market.

Once you have a list of strengths, weaknesses, opportunities, and threats, it’s crucial to prioritize these items based on their potential impact. This prioritization allows you to focus on the most critical areas first. For instance, if you identify a significant opportunity in sustainable development but also recognize a major weakness in marketing, you might choose to allocate resources to improve your marketing strategies while simultaneously exploring eco-friendly project options. By aligning your actions with your SWOT analysis, you can make informed decisions that drive your business forward.

| Steps to Conduct SWOT Analysis | Description |

|---|---|

| Gather Your Team | Include diverse perspectives to enrich the analysis |

| Brainstorm Each Component | Encourage open dialogue for comprehensive insights |

| Prioritize Insights | Focus on the most critical factors impacting your business |

- Team collaboration can yield diverse insights.

- Open discussions foster a comprehensive analysis.

- Prioritizing helps in addressing the most pressing issues.

“Collaboration is the key to innovation.” 🔑

Utilizing SWOT Analysis for Strategic Planning

Once you’ve completed your SWOT analysis, it’s time to put it into action. Your insights should directly inform your strategic planning. For instance, if your analysis reveals a strong reputation but identifies marketing as a weakness, you might decide to invest in a marketing consultant. This way, you can leverage your strengths while addressing weaknesses head-on. Furthermore, aligning your opportunities with your strengths is essential for maximizing potential. If you notice a demand for sustainable housing and have a reputation for quality, consider launching a green development project that showcases your commitment to environmental responsibility.

Moreover, using your SWOT analysis to set specific, measurable goals can enhance your strategic planning efforts. For example, if your analysis indicates a significant opportunity in urban development, set a goal to acquire a specific number of properties in targeted urban areas within a defined timeframe. This goal-oriented approach ensures that your strategies are actionable and aligned with your overall vision for the business.

Additionally, regularly revisiting your SWOT analysis can help you stay responsive to changing market conditions. The real estate industry is dynamic, and what may be a strength today could become a weakness tomorrow. By keeping your SWOT analysis up to date, you can adjust your strategies accordingly. Engaging with industry trends, attending conferences, and networking with other professionals can provide valuable insights that inform your ongoing analysis.

| Utilizing SWOT for Strategy | Action Steps |

|---|---|

| Address Weaknesses | Invest in marketing resources to enhance visibility |

| Leverage Strengths | Launch projects that align with core competencies |

| Align Opportunities with Strengths | Create targeted developments based on market demands |

- Aligning strengths with opportunities can drive growth.

- Addressing weaknesses can enhance competitiveness.

- Strategic planning based on SWOT can lead to innovative projects.

“Strategy is about making choices.” 🎯

Revisiting Your SWOT Analysis Regularly

Real estate development is not a one-and-done deal; the market evolves, and so should your SWOT analysis. Making it a habit to revisit and update your SWOT analysis regularly is essential for maintaining your competitive edge. Changes in the market, like new competitors entering or shifts in consumer preferences, can alter your standing. For example, if a new trend emerges in urban living, such as the increasing popularity of mixed-use developments, you’ll want to reassess your opportunities and possibly pivot your strategy.

Regular updates keep your strategies relevant and effective. It’s about staying ahead of the curve and being ready to adapt. For instance, if your analysis shows that sustainability is becoming a significant concern among buyers, you might choose to prioritize eco-friendly projects. Engaging with your team to gather fresh insights and perspectives can provide clarity on emerging trends and potential challenges that may not have been apparent previously.

Additionally, utilizing technology to track industry trends and consumer behavior can enhance your SWOT analysis. Tools like market research software and data analytics platforms can provide valuable insights into changing market dynamics. By incorporating this data into your SWOT analysis, you can make informed decisions that align with market demands. For instance, if data shows a rising interest in affordable housing, you can adjust your project pipeline to include more budget-friendly options, thus meeting the market need while maximizing your profitability.

| Revisiting SWOT Analysis | Benefits |

|---|---|

| Regular Updates | Ensures relevance in a changing market |

| Continuous Improvement | Identifies new opportunities and challenges |

| Enhanced Competitive Edge | Keeps you ahead of competitors |

- Regular updates ensure relevance in a changing market.

- Continuous improvement fosters adaptability.

- Staying informed enhances competitive positioning.

“Adaptability is the key to survival.” 🔄

Integrating SWOT Analysis into Long-term Planning

Incorporating your SWOT analysis into long-term planning is vital for the sustainability and growth of your real estate development business. When you integrate the insights gained from your SWOT analysis into your strategic framework, you create a roadmap that aligns your goals with the realities of the market. This alignment ensures that your business remains agile and responsive to both opportunities and threats.

For instance, if your SWOT analysis reveals that you have strong financial backing but also identifies regulatory challenges as a threat, you can develop a long-term strategy that includes engaging with local governments to stay ahead of regulatory changes. This proactive approach not only mitigates risks but also positions your company as a responsible and informed player in the industry, enhancing your reputation.

Moreover, integrating your SWOT analysis into your business model can guide investment decisions. If opportunities for sustainable development emerge, you might allocate resources toward training your team in green building practices or invest in technology that supports eco-friendly construction. This strategic investment not only prepares your business for future market demands but also establishes you as a leader in sustainable real estate development.

| Integrating SWOT into Planning | Action Steps |

|---|---|

| Align Goals with SWOT Insights | Create a roadmap that reflects market realities |

| Proactive Risk Management | Engage with local governments to anticipate changes |

| Strategic Investment | Allocate resources to meet emerging market demands |

- Aligning goals with SWOT insights ensures strategic focus.

- Proactive risk management mitigates potential threats.

- Strategic investment prepares your business for future opportunities.

“Strategy is about making choices.” 🎯

Recommendations

In summary, understanding and utilizing the Real Estate Developer SWOT Analysis is crucial for navigating the complexities of the real estate market. By identifying your strengths, weaknesses, opportunities, and threats, you can make informed decisions that drive your business forward. To further assist you in your journey, consider utilizing the Real Estate Developer Business Plan Template. This resource can help you craft a comprehensive plan that aligns with your strategic goals.

Additionally, we encourage you to explore our related articles that provide valuable insights for real estate developers:

- Real Estate Development: How Profitable Is It Really?

- Real Estate Developer Business Plan: Comprehensive Guide with Examples

- Real Estate Developer Financial Plan: Essential Steps and Example

- The Complete Guide to Opening a Real Estate Developer Business: Tips and Examples

- Begin Your Real Estate Developer Marketing Plan: Examples Included

- Crafting a Business Model Canvas for a Real Estate Developer: Step-by-Step Guide

- Real Estate Developer Customer Segments: Tips and Examples for Success

- How Much Does It Cost to Establish a Real Estate Development Company?

- Real Estate Developer Feasibility Study: Essential Guide

- How to Build a Risk Management Plan for Real Estate Developer?

- How to Start a Competition Study for Real Estate Developer?

- Real Estate Developer Legal Considerations: Ultimate Guide

- How to Choose the Right Funding for Real Estate Developer?

- Real Estate Developer Growth Strategies: Scaling Success Stories

FAQ

What is a SWOT analysis for property developers?

A SWOT analysis for property developers is a strategic planning tool that helps identify the strengths, weaknesses, opportunities, and threats related to a real estate development business. By evaluating these factors, developers can make informed decisions to enhance their competitiveness in the market.

How do strengths impact real estate development?

Strengths in real estate development, such as financial stability and a skilled workforce, enable developers to execute projects efficiently and effectively. These advantages can lead to higher quality developments, better market positioning, and increased profitability.

What are some common weaknesses in real estate development?

Common weaknesses in real estate development include a lack of experience, limited marketing capabilities, and insufficient resources. These factors can hinder a developer’s ability to compete effectively and may result in missed opportunities or increased project costs.

What opportunities are currently available in the real estate market?

Current opportunities in the real estate market include the growing demand for sustainable developments, urbanization, and technological advancements. Developers who recognize and act on these trends can position themselves for success and capitalize on emerging market needs.

What threats should real estate developers be aware of?

Threats to real estate developers include economic downturns, increased competition, and regulatory changes. Being aware of these challenges allows developers to proactively manage risks and adapt their strategies to maintain a competitive edge.

How often should a real estate developer conduct a SWOT analysis?

A real estate developer should conduct a SWOT analysis regularly—ideally at least annually or whenever significant changes occur in the market or within the business. Regular updates ensure that strategies remain relevant and effective in a dynamic industry.