When it comes to the production industry, having a solid production company financial plan is as crucial as having a good script. A well-structured production company financial plan not only helps you manage your resources effectively but also sets the stage for your creative vision to thrive. Think of it as your roadmap, guiding you through budgeting, forecasting, and ultimately, achieving financial success in your projects. Here’s what you need to know about creating a financial plan for your production company:

– Understand your revenue streams and costs.

– Create a detailed budget for each project.

– Monitor cash flow and adjust your plan as needed.

– Use templates and tools to streamline the planning process.

Understanding the Basics of a Production Company Financial Plan

Creating a financial plan for a production company involves several key components that are crucial for success. It’s not just about crunching numbers; it’s about strategically planning your finances to ensure your projects can come to life. A solid financial plan provides clarity and direction, allowing you to allocate resources efficiently and minimize risks. For example, when I first started my production company, I didn’t realize how important it was to break down my budget into detailed categories. I learned the hard way that having a clear understanding of every expense—like equipment, crew salaries, and marketing—was essential to avoid financial pitfalls. Without a detailed financial plan, projects can quickly spiral out of control, leading to overspending and financial stress.

A well-defined production company financial plan typically includes:

– Budget Overview: A summary of expected income and expenses.

– Cash Flow Projections: Monthly forecasts to track inflows and outflows.

– Funding Sources: Identifying where your money will come from.

– Contingency Planning: Preparing for unexpected costs.

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell

| Component | Description |

|---|---|

| Budget Overview | Summary of expected income and expenses |

| Cash Flow Projections | Monthly forecasts to track inflows and outflows |

| Funding Sources | Identifying sources of funding |

| Contingency Planning | Preparing for unexpected costs |

- Key Takeaways:

- Define all your expenses.

- Forecast your cash flow.

- Identify your funding sources.

- Prepare for the unexpected.

Understanding these components helps you create a financial strategy that not only supports your production goals but also ensures sustainability in an industry that can be unpredictable. It’s essential to approach this task with a mindset geared towards not just surviving but thriving in the competitive landscape of media production. The clearer your financial plan, the more confident you will be in making decisions about your projects. As you develop your financial plan, remember that flexibility is key. Markets change, and so do project scopes. Being able to adapt your budget and financial projections accordingly can mean the difference between a successful project and a financial disaster.

In summary, a comprehensive production company financial plan is not just a formality; it’s an essential tool for every filmmaker and producer. By laying out a detailed budget, monitoring cash flow, and preparing for the unexpected, you set the foundation for creative freedom and financial success. As we dive deeper into this guide, you’ll learn how to craft a financial plan that truly reflects your company’s vision and goals.

Crafting Your Production Company Budget Template

Now that you understand the basics of a production company financial plan, let’s dive into crafting a budget template that works for your production company. A budget template serves as a foundation for tracking all your financial activities. It’s not just about filling in numbers; it’s about creating a comprehensive tool that gives you insights into where your money is going and how it can be used more effectively. When I was developing my budget template, I realized that simplicity was key. I started with a basic structure and gradually added detailed categories. For instance, I broke down the costs into sections like pre-production, production, and post-production. This allowed me to see where I was overspending and where I could cut back, enabling me to make informed decisions that ultimately saved my projects.

Your budget template should include:

– Pre-Production Costs: This includes expenses related to script development, location scouting, and casting. It’s essential to allocate sufficient funds here to ensure you have the best possible start.

– Production Costs: These are the costs incurred during filming, such as equipment rentals, crew payments, and set design. This is typically where the bulk of your budget will go, so careful planning is crucial.

– Post-Production Costs: After filming, expenses for editing, sound design, and marketing come into play. It’s vital to ensure you have enough budgeted for this phase, as it can make or break the final product.

“Budgeting is not about limiting yourself—it’s about making the things that excite you possible.”

| Budget Category | Description |

|---|---|

| Pre-Production Costs | Expenses related to planning and preparing the shoot |

| Production Costs | Costs incurred during filming |

| Post-Production Costs | Expenses for editing and finalizing the project |

- Key Takeaways:

- Break down costs into phases.

- Track expenses meticulously.

- Adjust categories based on project needs.

Having a detailed budget template not only keeps your finances organized but also gives you a clear view of your project’s financial health. By tracking your expenses against your budget, you can identify areas where you may need to cut costs or where you might be able to allocate more resources for a better outcome. This proactive approach helps prevent financial surprises and ensures that your projects remain on track, both creatively and financially. Additionally, a well-structured budget template serves as a communication tool when discussing funding with potential investors or partners, showcasing your professionalism and preparedness.

Financial Forecasting for Filmmakers

Financial forecasting is an essential aspect of any production company financial plan. It helps you predict your future revenue and expenses based on historical data and market trends. This forward-thinking approach allows you to make informed decisions about your projects and ensures that you’re prepared for any financial challenges that may arise. In my experience, accurate forecasting can make or break a project. I once underestimated the costs of a film due to lack of proper forecasting, which led to a scramble for funds later. To avoid such situations, I now use historical data from previous projects to inform my forecasts. By analyzing past budgets and outcomes, you can create realistic projections that serve as a guide for your financial planning.

Key elements of financial forecasting include:

– Revenue Projections: Estimating income from various sources like ticket sales, streaming rights, and merchandise. Understanding your potential revenue streams is crucial for determining how much you can spend on production.

– Expense Projections: Predicting costs based on historical data and industry standards. This involves looking at both fixed and variable costs to get a complete picture of your financial landscape.

– Break-Even Analysis: Determining the point at which your revenues cover your costs. Knowing your break-even point allows you to set realistic financial goals and gauge the success of your projects.

“Forecasting is not about predicting the future; it’s about understanding the present.”

| Forecast Element | Description |

|---|---|

| Revenue Projections | Estimating income from various sources |

| Expense Projections | Predicting costs based on past data |

| Break-Even Analysis | Determining when revenues will cover costs |

- Key Takeaways:

- Use past data to inform future projections.

- Consider multiple revenue streams.

- Perform break-even analysis to assess project viability.

By incorporating financial forecasting into your planning process, you can create a roadmap that not only outlines your immediate financial needs but also prepares you for long-term success. This proactive approach allows you to navigate the often-volatile nature of the production industry with confidence. Ultimately, financial forecasting empowers you to take control of your production company’s financial destiny, ensuring that you can focus on what you do best—creating compelling content.

Managing Cash Flow in Production

Cash flow management is another critical area of focus for production companies. It’s about ensuring that you have enough cash on hand to meet your financial obligations as they arise. In the fast-paced world of media production, understanding and managing your cash flow can be the difference between a successful project and a financial disaster. During one of my earlier projects, I faced cash flow issues that nearly derailed the entire production. I learned that timely invoicing and keeping a close eye on expenses were crucial. Now, I prioritize cash flow management by setting up a schedule for invoicing and payments, which has significantly improved my financial stability.

Key strategies for managing cash flow include:

– Regular Monitoring: Keeping track of cash inflows and outflows regularly is essential. I recommend setting up a weekly or bi-weekly review to assess your cash position. This allows you to identify trends and make adjustments before problems arise.

– Invoice Promptly: Sending invoices as soon as work is completed can dramatically improve your cash flow. Delaying invoices can lead to cash shortages, so I’ve made it a habit to invoice immediately after project milestones are met.

– Establish a Reserve Fund: Setting aside a portion of your budget for emergencies is a smart strategy. This reserve can help you cover unexpected costs or delays in payments, providing a safety net that keeps your projects on track.

“Cash flow is the lifeblood of any business.”

| Cash Flow Strategy | Description |

|---|---|

| Regular Monitoring | Track cash inflows and outflows frequently |

| Invoice Promptly | Send invoices immediately after project milestones |

| Establish a Reserve Fund | Save a portion of the budget for unexpected expenses |

- Key Takeaways:

- Monitor cash flow regularly.

- Invoice as soon as possible.

- Have a reserve fund for emergencies.

Implementing these strategies can lead to improved financial health for your production company. Regular monitoring helps you stay ahead of any cash flow issues, while prompt invoicing ensures that your revenue is collected in a timely manner. The establishment of a reserve fund not only provides peace of mind but also empowers you to take on new projects without fear of financial strain. Overall, effective cash flow management allows you to focus on your creative work, knowing that your financial foundation is secure.

Exploring Funding Options for Production Companies

Finding the right funding options can be a game-changer for your production company. There are several avenues to explore, from traditional loans to crowdfunding, and each has its advantages and challenges. When I was starting out, I didn’t realize how many funding sources were available. I initially relied solely on personal savings, but once I explored options like grants and private investors, my projects became more feasible. Understanding the landscape of funding options is crucial for any filmmaker looking to bring their vision to life.

Common funding sources include:

– Grants: Look for grants specifically for filmmakers and media projects. Many organizations and foundations are dedicated to supporting the arts, and applying for these grants can provide significant financial support without the need for repayment.

– Private Investors: Pitching your projects to individuals or companies looking to invest can yield substantial funding. Building relationships with potential investors can open doors to not just financial support but also valuable industry connections.

– Crowdfunding: Using platforms like Kickstarter or Indiegogo to raise funds from the public has become increasingly popular. This approach allows you to gauge interest in your project while securing the necessary funds. Engaging with your audience in this way can also build a loyal fan base even before your project is completed.

“The best way to predict the future is to create it.” – Peter Drucker

| Funding Source | Description |

|---|---|

| Grants | Financial support from organizations for specific projects |

| Private Investors | Individuals or companies looking to invest in films |

| Crowdfunding | Raising small amounts from many people through online platforms |

- Key Takeaways:

- Research available grants.

- Network with potential investors.

- Consider crowdfunding for community support.

By exploring these funding options, you can find the best fit for your production company and its unique needs. Grants can provide financial relief without the burden of repayment, allowing you to focus on your creative work. Engaging with private investors not only brings in funds but can also lead to mentorship and industry insights that are invaluable for your growth. Crowdfunding, on the other hand, not only raises money but also builds community support and excitement around your project. Ultimately, diversifying your funding sources can create a more stable financial environment for your production endeavors, giving you the freedom to pursue your artistic vision with confidence.

Utilizing Budgeting Software for Efficiency

In today’s digital age, utilizing budgeting software can significantly streamline your financial planning process for your production company. These tools can help you manage your budget, track expenses, and forecast future financial performance. The right software not only saves time but also reduces the risk of human error, making it an essential component of your financial strategy. I remember struggling with spreadsheets early on. They were cumbersome and often led to errors. Once I switched to budgeting software, I found it much easier to manage my finances. It allowed me to focus more on the creative aspects of my projects while ensuring that my financials were in order.

Popular budgeting software options include:

– Movie Magic Budgeting: Specifically designed for film and TV production budgets, this software offers a user-friendly interface and customizable templates that cater to the unique needs of filmmakers.

– Excel Templates: While not software in the traditional sense, customizable templates in Excel can serve as a powerful tool for those who prefer a more hands-on approach. They can be tailored to fit your specific budgeting needs, allowing for flexibility.

– QuickBooks: A comprehensive accounting software that can also handle budgeting, QuickBooks is ideal for production companies looking for an all-in-one solution to manage finances, invoicing, and payroll.

“Technology is best when it brings people together.” – Matt Mullenweg

| Budgeting Software | Description |

|---|---|

| Movie Magic Budgeting | Tailored for film and TV production budgets |

| Excel Templates | Customizable for various budgeting needs |

| QuickBooks | Comprehensive accounting software for budgeting |

- Key Takeaways:

- Explore different software options.

- Choose tools that fit your specific needs.

- Leverage technology to simplify budgeting.

Implementing budgeting software into your workflow can lead to increased efficiency and accuracy in your financial planning. These tools can automate calculations, generate reports, and even provide visualizations that help you better understand your financial status at a glance. For instance, with software like Movie Magic Budgeting, you can quickly create detailed budgets that reflect the complexities of your projects, ensuring that no costs are overlooked. Additionally, using software allows for real-time updates and collaboration with your team, which can be invaluable during the fast-paced production process. Overall, leveraging budgeting software empowers you to take control of your financial management, freeing up more time for your creative endeavors.

Reviewing and Adjusting Your Financial Plan

Finally, it’s essential to regularly review and adjust your financial plan. The production landscape is ever-changing, and your financial strategy should be flexible enough to adapt. I’ve learned that sticking rigidly to a plan can be detrimental. After a few projects, I realized the importance of revisiting my budget and forecasts to account for any changes in the market or unexpected expenses. Regularly assessing your financial plan allows you to identify areas for improvement and ensures that your projects remain financially viable.

Key steps for reviewing your financial plan include:

– Regular Check-Ins: Schedule monthly reviews to assess your financial status. This practice helps you stay informed about your cash flow and overall budget health, allowing for timely adjustments if needed.

– Adjust Budgets as Needed: Be willing to reallocate funds based on project needs. For instance, if a particular area of production is exceeding its budget, consider where you can cut costs elsewhere to maintain overall financial balance.

– Seek Feedback: Collaborate with your team to identify areas for improvement. Getting insights from those involved in the production process can provide valuable perspectives on where adjustments may be necessary.

“The only constant in life is change.” – Heraclitus

| Review Step | Description |

|---|---|

| Regular Check-Ins | Monthly assessments of financial status |

| Adjust Budgets | Reallocate funds based on project requirements |

| Seek Feedback | Collaborate with team members for insights |

- Key Takeaways:

- Conduct monthly financial reviews.

- Be flexible with your budget.

- Collaborate with your team for better insights.

By incorporating regular reviews and adjustments into your financial management process, you can ensure that your production company remains agile and responsive to changing circumstances. This proactive approach not only helps you stay on top of your finances but also fosters a culture of accountability within your team. As you adapt your financial strategies, you’ll find that you can not only survive in the competitive production landscape but thrive, ultimately leading to greater creative freedom and success in your projects.

Creating a Comprehensive Financial Plan Template

Creating a comprehensive financial plan template for your production company is a pivotal step in ensuring financial stability and success. A well-structured template not only provides a clear framework for budgeting but also serves as a dynamic tool that adapts to the unique needs of each project. When I first started out, I didn’t fully appreciate the value of having a detailed template. It wasn’t until I faced unexpected costs that I realized how essential it was to have a financial plan that I could customize and update regularly.

Your financial plan template should include several key components to ensure thorough coverage of all financial aspects:

– Executive Summary: A brief overview of your financial goals, funding sources, and the financial health of your company. This section sets the tone and provides context for the details that follow.

– Detailed Budget Breakdown: Clearly categorize expenses into pre-production, production, and post-production phases. This allows you to see where funds are allocated and identify areas where adjustments may be needed.

– Revenue Forecasts: Include projections for income from various sources, such as ticket sales, merchandise, and streaming rights. Understanding potential revenue is crucial for setting realistic budgets.

– Cash Flow Projections: Monthly estimates of cash inflows and outflows help you manage liquidity and ensure that you have enough cash to cover expenses at all times.

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

| Template Component | Description |

|---|---|

| Executive Summary | Overview of financial goals and health |

| Detailed Budget Breakdown | Categorization of expenses into phases |

| Revenue Forecasts | Projections for income from various sources |

| Cash Flow Projections | Monthly estimates of cash inflows and outflows |

- Key Takeaways:

- Include an executive summary for context.

- Break down budgets into detailed categories.

- Forecast revenue to set realistic budgets.

- Project cash flow to manage liquidity.

By developing a comprehensive financial plan template, you can ensure that you are prepared for every aspect of your production’s financial journey. This template acts as a living document that evolves as your projects progress, allowing you to adjust and refine your financial strategies. Moreover, a well-structured template can facilitate communication with stakeholders, providing them with clear insights into your financial planning process. Investors and partners are more likely to support your projects when they see that you have a robust financial framework in place, reinforcing your credibility in the industry.

Implementing Your Financial Plan for Success

Implementing your financial plan effectively is just as important as creating it. A well-thought-out plan is only as good as its execution, and there are several strategies you can employ to ensure that your production company stays on track financially. One of the first steps is to establish clear roles and responsibilities within your team regarding financial management. Assigning specific tasks related to budgeting, forecasting, and cash flow monitoring can help distribute the workload and ensure accountability.

Another crucial aspect of implementation is setting regular financial reviews. Scheduling monthly or quarterly check-ins allows you to assess your financial health, compare actual performance against your forecasts, and make necessary adjustments. This practice not only keeps your team informed but also fosters a culture of transparency and proactive problem-solving. Additionally, utilizing software tools for tracking and reporting can streamline this process, making it easier to access real-time data and insights.

Moreover, effective communication with your team is essential. Regularly discussing financial goals and progress keeps everyone aligned and motivated. I’ve found that involving my team in financial discussions not only enhances their understanding of the business but also encourages them to contribute ideas for cost savings and revenue generation.

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier

| Implementation Strategy | Description |

|---|---|

| Establish Roles | Assign specific financial management tasks |

| Set Regular Reviews | Schedule monthly or quarterly financial assessments |

| Utilize Software Tools | Streamline tracking and reporting processes |

| Encourage Team Communication | Discuss financial goals and progress regularly |

- Key Takeaways:

- Assign roles for financial management.

- Conduct regular financial reviews.

- Use software for efficient tracking.

- Foster communication about financial goals.

Ultimately, the successful implementation of your financial plan requires dedication and collaboration. By actively engaging your team in the financial management process and maintaining open lines of communication, you can create a culture of financial awareness that empowers everyone to contribute to the success of your projects. With a solid financial plan in place and a commitment to regular review and adjustment, your production company will be well-positioned to navigate the complexities of the industry, ensuring that you can focus on what you do best—creating outstanding content.

Recommendations

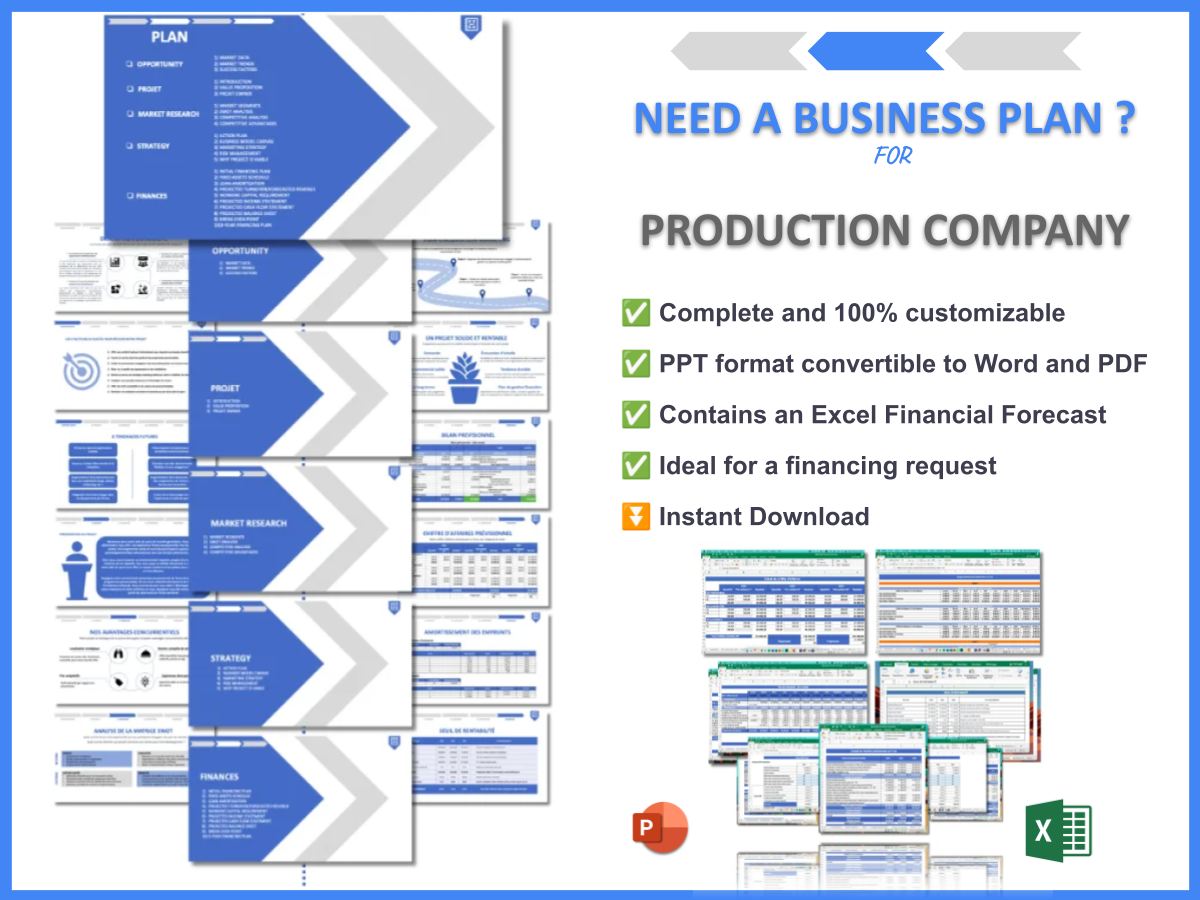

In summary, crafting a robust production company financial plan is essential for ensuring the success and sustainability of your projects. By focusing on budgeting, cash flow management, and financial forecasting, you can create a solid foundation that allows your creative vision to flourish. For those looking to take their planning to the next level, we recommend checking out the Production Company Business Plan Template, which offers a comprehensive framework to guide you through the intricacies of financial planning for your business.

Additionally, we have a wealth of resources available that can further assist you in navigating the production industry. Here are some related articles that you may find beneficial:

– Article 1 on Production Company SWOT Analysis Insights

– Article 2 on Production Companies: Strategies for High Profitability

– Article 3 on Production Company Business Plan: Comprehensive Guide with Examples

– Article 4 on Launching a Production Company: Complete Guide and Examples

– Article 5 on Begin Your Production Company Marketing Plan with This Example

– Article 6 on Building a Business Model Canvas for a Production Company: A Comprehensive Guide

– Article 7 on Identifying Customer Segments for Production Companies: Examples and Strategies

– Article 8 on How Much Does It Cost to Establish a Production Company?

– Article 9 on Production Company Feasibility Study: Detailed Analysis

– Article 10 on How to Start Risk Management for Production Company?

– Article 11 on Production Company Competition Study: Detailed Insights

– Article 12 on Production Company Legal Considerations: Expert Analysis

– Article 13 on What Are the Best Funding Options for Production Company?

– Article 14 on Scaling a Production Company: Essential Growth Strategies

FAQ

How do I create a financial plan for a production company?

Creating a financial plan for a production company involves several steps. Start by defining your budget categories, including pre-production, production, and post-production costs. Utilize templates to outline your revenue streams and cash flow projections. Regularly monitor your financial status and adjust your plan based on actual performance to ensure you stay on track.

What are the key components of a production company budget template?

A comprehensive production company budget template typically includes sections for executive summary, detailed budget breakdown, revenue forecasts, and cash flow projections. These components provide a clear overview of your financial health and help in making informed decisions about resource allocation.

Why is cash flow management important for production companies?

Cash flow management is crucial for production companies as it ensures that there are sufficient funds available to cover operational costs and unexpected expenses. Effective cash flow management helps avoid financial pitfalls and keeps projects on schedule, allowing for smoother production processes.

What funding options are available for production companies?

Production companies can explore various funding options, including grants from arts organizations, private investors interested in film projects, and crowdfunding platforms like Kickstarter. Each option offers unique advantages, and diversifying funding sources can enhance financial stability.

How can I forecast revenue for my production company?

To forecast revenue for your production company, analyze historical data from previous projects and consider potential income from ticket sales, streaming rights, and merchandise. Create realistic projections based on market trends and industry benchmarks to set achievable financial goals.

What is the significance of a contingency plan in financial management?

A contingency plan is vital in financial management as it prepares you for unexpected costs or changes in the market. By setting aside a reserve fund and outlining alternative strategies, you can mitigate risks and ensure your production remains financially viable even in challenging circumstances.