Did you know that many personal trainers struggle with managing their finances effectively? A Personal Trainer Financial Plan can make all the difference in ensuring financial stability and growth in your career. This plan is essentially a roadmap that outlines your income, expenses, savings, and investments as a fitness professional. Without a clear financial strategy, many trainers find themselves overwhelmed, missing out on opportunities for growth and stability.

Here’s what you need to know about crafting your own Personal Trainer Financial Plan:

- Understanding the importance of a financial plan for personal trainers.

- Steps to create an effective financial plan.

- Tools and templates to help you stay organized.

- Common financial pitfalls and how to avoid them.

- Strategies for maximizing income and minimizing expenses.

Importance of a Personal Trainer Financial Plan

Creating a Personal Trainer Financial Plan is crucial for anyone in the fitness industry. This plan helps you visualize your financial situation and set achievable goals. For instance, when I first started as a personal trainer, I didn’t have a clear financial strategy. I was simply focusing on getting clients and delivering workouts. But soon, I found myself struggling to pay bills and save for the future. It was a tough lesson learned, but it taught me the value of financial planning.

A solid financial plan provides clarity on your income sources, whether it’s from one-on-one sessions, group classes, or online training. It allows you to track your earnings and expenses, ensuring you stay on top of your finances. Without this awareness, it’s easy to overlook how much you’re spending on things like marketing, insurance, or even continuing education. Understanding where your money is going can prevent unnecessary stress and help you make informed decisions about your career.

Here are some key points to consider when developing your Personal Trainer Financial Plan:

- Income tracking: Knowing how much you earn from different services is essential. This insight allows you to identify your most profitable offerings and focus your marketing efforts accordingly.

- Expense management: Keeping tabs on costs like insurance, marketing, and equipment can prevent overspending. It’s crucial to differentiate between necessary expenses and those that can be trimmed.

- Goal setting: Establishing short-term and long-term financial goals gives you a target to aim for. Whether it’s saving for a new certification or planning for retirement, having clear objectives helps maintain your focus.

“A goal without a plan is just a wish.” 🌟

| Aspect | Importance |

|---|---|

| Income Sources | Helps to identify all revenue streams |

| Expense Tracking | Prevents overspending |

| Financial Goals | Motivates saving and investment |

In summary, developing a Personal Trainer Financial Plan is not just about numbers; it’s about creating a foundation for a successful and sustainable career in fitness. By taking the time to assess your financial situation, track your income and expenses, and set clear goals, you’ll empower yourself to make better decisions and ultimately thrive in this competitive industry.

As you embark on this journey, remember that financial planning is an ongoing process. You’ll need to revisit and adjust your plan regularly to reflect changes in your business, income, and personal circumstances. So, let’s dive deeper into how to create an effective financial plan that works for you.

Steps to Create Your Financial Plan

Creating your Personal Trainer Financial Plan involves several essential steps that will set the foundation for your financial stability. First, start by assessing your current financial situation. This means taking a close look at all your income sources and expenses. I remember when I first began as a personal trainer, I thought I was doing well until I sat down and documented everything. It was eye-opening to see how much I was actually spending on things like gym memberships, equipment, and marketing.

Next, it’s crucial to set your financial goals. Do you want to save for a new certification, invest in new equipment, or even open your own training studio? Having clear goals will give you direction and purpose. For example, if you aim to save $5,000 for a new certification within a year, you can break that down into monthly savings. This not only makes the goal feel more attainable but also helps you prioritize your spending.

Here’s a breakdown of the steps you should take to create your financial plan:

- Assess your current finances: Track your income and expenses for at least a month. This will give you a clear picture of where your money is going and help identify areas where you can cut back.

- Set clear financial goals: Define both short-term and long-term goals. Short-term goals might include saving for a specific piece of equipment, while long-term goals could involve retirement planning or building a studio.

- Create a budget: Allocate funds for necessary expenses and savings. A well-structured budget can help you manage your cash flow and ensure you’re setting aside enough for taxes and retirement.

“Budgeting isn’t about limiting yourself; it’s about making the things that excite you possible.” 🎉

| Step | Action Required |

|---|---|

| Assess Finances | Track income and expenses |

| Set Goals | Define short and long-term goals |

| Create Budget | Allocate funds appropriately |

By following these steps, you’ll develop a comprehensive Personal Trainer Financial Plan that not only helps you understand your current financial standing but also paves the way for future growth. Remember, financial planning is not a one-time task but an ongoing process that requires regular review and adjustment.

Tools and Templates for Financial Planning

Once you have a plan in place, utilizing the right tools can simplify your financial management significantly. There are numerous templates available online specifically designed for personal trainers, and these can be invaluable. I remember the first time I downloaded a budgeting template; it made organizing my finances so much easier and more efficient. It allowed me to visualize my income and expenses clearly, which is essential for effective financial planning.

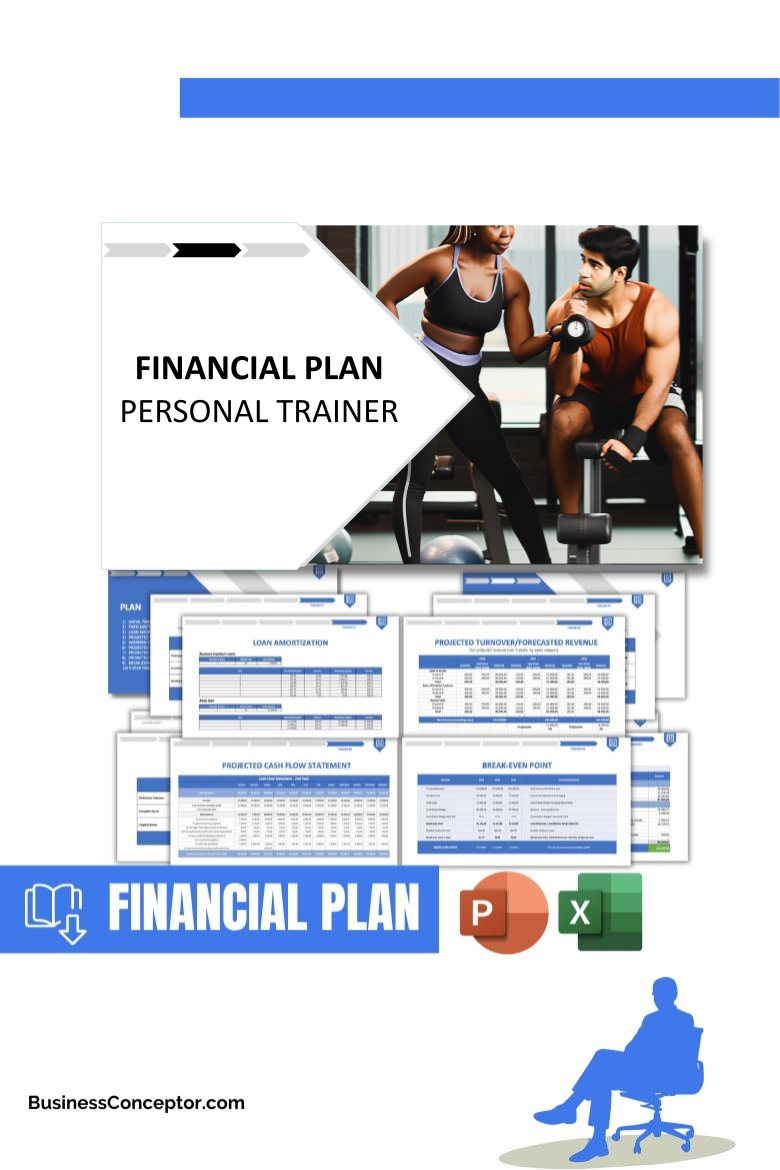

Consider using software like QuickBooks or Excel to track your income and expenses. These tools can provide valuable insights into your cash flow and help you make informed decisions. For instance, QuickBooks offers features that allow you to generate financial reports, making it easier to see your financial health at a glance. Moreover, templates can save you time and reduce the stress of managing your finances. They often come with built-in formulas that calculate totals and averages, which means you don’t have to do the math yourself.

Here are some useful tools you should consider incorporating into your Personal Trainer Financial Plan:

- Excel or Google Sheets: These tools allow for customizable budgeting and expense tracking. You can create your own spreadsheets tailored to your specific needs, making them flexible and versatile.

- QuickBooks: This software is great for comprehensive financial tracking. It can help you manage invoices, track expenses, and even prepare for tax season.

- Personal Trainer Financial Templates: Many websites offer free templates specifically designed for fitness professionals. These can help you get started quickly and ensure you’re covering all your bases.

“The right tools can make all the difference.” 🔧

| Tool | Purpose |

|---|---|

| Excel/Google Sheets | Custom budgeting and tracking |

| QuickBooks | Comprehensive financial management |

| Financial Templates | Ready-to-use budgeting resources |

By leveraging these tools and templates, you’ll not only streamline your financial planning process but also gain greater insights into your financial situation. Remember, effective financial management is key to a successful career as a personal trainer. Don’t underestimate the power of having the right resources at your fingertips!

Common Financial Pitfalls to Avoid

Many personal trainers fall into common financial traps that can be avoided with a solid Personal Trainer Financial Plan. One major pitfall is underestimating expenses. When I first started my career, I thought I had a good grasp on my costs, but I quickly realized I was overlooking some significant expenses like marketing, insurance, and equipment maintenance. This lack of awareness led to financial stress that could have been easily avoided with better planning.

Another common mistake is neglecting to save for taxes. As self-employed individuals, personal trainers must set aside a portion of their income for tax season. Failing to do so can lead to a financial crunch when it’s time to pay up. I remember one year when I didn’t save enough for taxes, and it put me in a tough spot. I had to scramble to find funds, which was stressful and overwhelming. It’s crucial to calculate your tax obligations and create a savings plan that allows you to meet these obligations without breaking a sweat.

Here are some pitfalls to watch out for in your financial journey:

- Underestimating expenses: Always account for all costs, including hidden ones like software subscriptions or continuing education. Keeping a detailed budget can help you identify these expenses.

- Neglecting taxes: Make it a habit to set aside funds for tax payments. A good rule of thumb is to save around 25-30% of your income for taxes.

- Ignoring retirement savings: Many trainers focus on immediate income and neglect long-term savings. Starting a retirement account early can significantly benefit you due to compound interest.

“Failing to plan is planning to fail.” 📉

| Pitfall | How to Avoid |

|---|---|

| Underestimating Costs | Keep a detailed budget |

| Neglecting Taxes | Set aside funds for tax payments |

| Ignoring Retirement | Start a retirement account early |

By being aware of these pitfalls and proactively addressing them, you can create a more stable financial future for yourself. Financial planning is not just about making money; it’s about managing it wisely to ensure long-term success in your personal training career.

Strategies for Maximizing Income

To boost your earnings as a personal trainer, consider diversifying your income streams. This could mean offering online coaching, creating fitness programs, or even writing an eBook. I started offering online training during the pandemic, and it opened up a whole new revenue stream for me. It was a fantastic way to reach clients beyond my local area and generate additional income, which is crucial in the ever-changing fitness landscape.

Don’t underestimate the power of networking either. Building relationships with other fitness professionals can lead to referrals and collaborations that increase your visibility and client base. For instance, teaming up with a nutritionist could allow you to offer comprehensive packages that attract more clients. Additionally, consider hosting workshops or group classes. These not only provide additional income but also enhance your reputation as an expert in your field.

Here are some effective strategies to maximize your income:

- Offer online training: Expanding your reach to clients beyond your immediate area can significantly increase your income. You can offer video sessions, personalized workout plans, or group classes online.

- Create fitness programs: Develop and sell downloadable workout plans or nutrition guides. This not only generates passive income but also establishes you as an authority in your niche.

- Network: Attend fitness events, workshops, and seminars to build relationships within the industry. Networking can lead to collaborations, referrals, and new client opportunities.

“Opportunities don’t happen. You create them.” 🌟

| Strategy | Potential Impact |

|---|---|

| Online Training | Access to a wider audience |

| Fitness Programs | Passive income from sales |

| Networking | Increased referrals and partnerships |

By implementing these strategies, you can enhance your earning potential and build a more secure financial future. Remember, the fitness industry is constantly evolving, and adapting your business model to include multiple income streams will not only help you survive but thrive in a competitive market.

Financial Goals for Personal Trainers

Setting financial goals is essential for personal trainers who want to ensure long-term success and stability in their careers. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of simply saying, “I want to save money,” you could specify, “I want to save $5,000 in the next year for my studio.” This specificity not only gives you a clear target to aim for but also helps you stay motivated and focused on your financial journey.

Having clear financial goals helps you prioritize your spending and savings. When I first started, I didn’t have a clear idea of what I wanted to achieve financially, which led to scattered efforts and wasted resources. Once I established specific goals, such as saving for a new certification or investing in marketing, I found it much easier to allocate my budget effectively. This structured approach allows you to make informed decisions about where to invest your time and money.

Here’s how to set effective financial goals:

- Specific: Define exactly what you want to achieve. Instead of vague objectives, write down precise goals like “increase monthly income by 20% within six months.”

- Measurable: Set criteria for tracking progress. This could involve keeping a spreadsheet that shows your income and expenses or tracking how much you save each month.

- Achievable: Ensure your goals are realistic. While it’s great to aim high, setting unattainable goals can lead to frustration. Make sure you assess your current financial situation before setting targets.

- Relevant: Align your goals with your overall career vision. If your goal is to open a studio, then saving for a down payment should be a priority.

- Time-bound: Set a deadline for achieving your goals. This creates a sense of urgency and helps keep you accountable.

“Setting goals is the first step in turning the invisible into the visible.” 🎯

| Goal Type | Example |

|---|---|

| Short-term | Save for a certification |

| Long-term | Open your own training studio |

By setting SMART goals, you can create a clear roadmap for your financial future as a personal trainer. Regularly revisiting these goals and adjusting them as needed will ensure that you stay on track and continue to make progress toward achieving your dreams.

Strategies for Building a Sustainable Financial Future

Building a sustainable financial future as a personal trainer involves more than just earning money; it requires a strategic approach to managing your finances effectively. One key strategy is to diversify your income streams. This could mean offering various services, such as one-on-one coaching, group classes, online training, or even nutritional guidance. By having multiple sources of income, you reduce the risk of relying on just one revenue stream.

For instance, when I expanded my offerings to include online coaching, I noticed a significant increase in my overall income. This not only allowed me to reach clients outside my local area but also provided financial stability during slower months. Additionally, creating passive income streams, such as selling workout plans or eBooks, can further enhance your financial security.

Another important strategy is to invest in your professional development. Continuing education and certifications can set you apart from other trainers and justify higher rates for your services. I invested in specialized certifications that allowed me to offer unique training programs, which attracted more clients and increased my earnings. It’s essential to view these investments as long-term benefits rather than immediate costs.

Here are some effective strategies to build a sustainable financial future:

- Diversify income streams: Consider offering online training, group classes, and nutrition coaching to expand your reach and client base.

- Invest in professional development: Pursue additional certifications or training to enhance your skills and increase your earning potential.

- Implement effective marketing strategies: Utilize social media and online platforms to promote your services and attract new clients. A strong online presence can significantly increase your visibility.

“Your future is created by what you do today, not tomorrow.” 🌈

| Strategy | Potential Impact |

|---|---|

| Diversify Income | Increased financial security |

| Professional Development | Higher earning potential |

| Effective Marketing | Attract more clients |

By implementing these strategies, you can create a robust financial future as a personal trainer. Remember, it’s not just about making money; it’s about managing it wisely and investing in yourself to ensure long-term success in your career. The journey may require hard work and dedication, but the rewards are well worth the effort.

Financial Tools for Personal Trainers

Utilizing the right financial tools can significantly enhance the effectiveness of your Personal Trainer Financial Plan. These tools not only help you manage your finances more efficiently but also provide valuable insights into your overall financial health. One of the most essential tools for any personal trainer is accounting software. Programs like QuickBooks or FreshBooks offer robust features that simplify bookkeeping, invoicing, and expense tracking. When I first started using accounting software, I found it drastically reduced the time I spent on financial tasks, allowing me to focus more on my clients and training.

Another invaluable resource is budgeting apps. Tools like YNAB (You Need a Budget) or Mint can help you create and maintain a budget tailored specifically for your personal training business. These apps allow you to set spending limits, track your income, and categorize expenses, making it easier to see where your money is going. I remember feeling overwhelmed trying to keep track of my expenses manually, but once I started using a budgeting app, I had a clear view of my financial situation at all times. This clarity is essential for making informed decisions about your business.

Here are some essential financial tools to consider for your Personal Trainer Financial Plan:

- Accounting Software: Programs like QuickBooks can help you manage invoices, track expenses, and prepare for tax season. They provide a comprehensive overview of your financial health, making it easier to identify trends and areas for improvement.

- Budgeting Apps: Use apps like YNAB or Mint to create a personalized budget. These tools allow you to categorize your spending and set financial goals, making it simpler to stay on track.

- Financial Templates: There are many free templates available online specifically designed for personal trainers. These can help you get started quickly and ensure you’re covering all your financial bases.

“The right tools can make all the difference.” 🔧

| Tool | Purpose |

|---|---|

| Accounting Software | Streamline bookkeeping and invoicing |

| Budgeting Apps | Track expenses and manage budget |

| Financial Templates | Organize finances and track goals |

Incorporating these financial tools into your practice can lead to better organization and financial awareness. The more informed you are about your financial situation, the more confident you will feel in making decisions that affect your business. This proactive approach can ultimately lead to increased profitability and growth.

Reviewing and Adjusting Your Financial Plan

Creating a Personal Trainer Financial Plan is just the first step; regularly reviewing and adjusting it is equally important. As your business evolves, so should your financial strategies. Life changes, market trends, and new opportunities can all impact your financial goals. For instance, when I first began my training business, my focus was primarily on one-on-one sessions. However, as I expanded into online training and group classes, I needed to revisit my financial plan to accommodate these changes.

One effective approach is to schedule regular financial check-ins, perhaps quarterly or bi-annually. During these reviews, assess your income, expenses, and savings goals. Are you on track to meet your financial objectives? If not, what adjustments can you make? This proactive approach allows you to identify potential issues before they become significant problems. For example, if you notice that your marketing expenses are increasing without a corresponding rise in clients, you might need to rethink your marketing strategy or explore more cost-effective options.

Additionally, consider seeking advice from a financial advisor who specializes in working with fitness professionals. They can provide valuable insights and help you navigate complex financial decisions, from tax planning to retirement savings. Investing in professional advice can pay off significantly in the long run, ensuring you’re making the best choices for your financial future.

Here are some tips for reviewing and adjusting your financial plan:

- Schedule Regular Check-Ins: Set aside time to review your financial status regularly. This helps you stay aware of your progress and make necessary adjustments.

- Assess Goals: Are your financial goals still relevant? If not, update them to reflect your current situation and aspirations.

- Seek Professional Advice: Don’t hesitate to consult a financial advisor who understands the fitness industry. Their expertise can help you make informed decisions.

“Your future is created by what you do today, not tomorrow.” 🌈

| Action | Purpose |

|---|---|

| Regular Check-Ins | Stay on track with financial goals |

| Assess Goals | Ensure goals remain relevant |

| Professional Advice | Make informed financial decisions |

By regularly reviewing and adjusting your Personal Trainer Financial Plan, you’ll ensure that you are always aligned with your financial goals and prepared for any changes that come your way. This proactive approach will help you build a sustainable and successful career in the personal training industry.

Recommendations

In summary, creating a comprehensive Personal Trainer Financial Plan is vital for anyone looking to thrive in the fitness industry. By understanding your income sources, managing expenses, setting financial goals, and utilizing the right tools, you can pave the way for a successful career. For those seeking a structured approach, consider checking out the Personal Trainer Business Plan Template. This template offers a solid foundation to help you establish your business goals and financial strategies.

Additionally, here are some related articles that can further enhance your knowledge and help you succeed as a personal trainer:

- Personal Trainer SWOT Analysis – Uncover Strengths

- Personal Training: Maximizing Your Profit Potential

- Personal Trainer Business Plan: Comprehensive Guide

- The Complete Guide to Opening a Personal Trainer Business: Tips and Examples

- Building a Marketing Plan for Personal Trainer Services (+ Example)

- How to Create a Business Model Canvas for Personal Trainer Services?

- Understanding Customer Segments for Personal Trainers (with Examples)

- How Much Does It Cost to Operate a Personal Trainer Business?

- Personal Trainer Feasibility Study: Comprehensive Guide

- Personal Trainer Risk Management: Comprehensive Strategies

- What Are the Steps for a Successful Personal Trainer Competition Study?

- How to Navigate Legal Considerations in Personal Trainer?

- Personal Trainer Funding Options: Comprehensive Guide

- Personal Trainer Growth Strategies: Scaling Guide

FAQ

How do I create a financial plan as a personal trainer?

Creating a financial plan as a personal trainer involves assessing your current financial situation, setting clear financial goals, and developing a budget. Start by tracking your income and expenses for a month, then categorize them to identify areas for improvement. Set both short-term and long-term financial goals to guide your progress. Finally, create a budget that allocates funds for necessary expenses and savings.

What are some budgeting tips for personal trainers?

Effective budgeting for personal trainers includes tracking all income sources, such as one-on-one sessions, group classes, and online coaching. It’s crucial to keep a detailed record of your expenses, including marketing costs, insurance, and equipment. Consider using budgeting apps or software to help you manage your finances more effectively. Setting aside a percentage of your income for taxes is also a smart move to avoid financial surprises later on.

How much do personal trainers make annually?

The annual income of personal trainers can vary widely based on factors such as location, experience, and the types of services offered. On average, personal trainers can earn between $30,000 to $70,000 per year. Those who offer specialized training, have a strong client base, or provide online coaching may see higher earnings. It’s essential to diversify your income streams to maximize your profit potential.

What are the expenses to track as a personal trainer?

As a personal trainer, it’s vital to track various expenses, including gym membership fees, liability insurance, marketing and advertising costs, equipment purchases, and continuing education. Additionally, consider tracking expenses related to transportation, software subscriptions, and any other costs associated with running your business. Keeping detailed records will help you manage your finances more effectively and prepare for tax season.

How can I maximize my income as a personal trainer?

To maximize your income as a personal trainer, consider diversifying your offerings by providing online training, group classes, or nutritional coaching. Create passive income streams by selling workout programs or eBooks. Networking with other fitness professionals can lead to referrals and collaborative opportunities. Lastly, continuously invest in your professional development to enhance your skills and justify higher rates for your services.

What financial goals should personal trainers set?

Personal trainers should set both short-term and long-term financial goals. Short-term goals may include saving for certifications or equipment, while long-term goals could involve retirement savings or expanding your business. Ensure your goals are specific, measurable, achievable, relevant, and time-bound (SMART) to keep you motivated and on track.