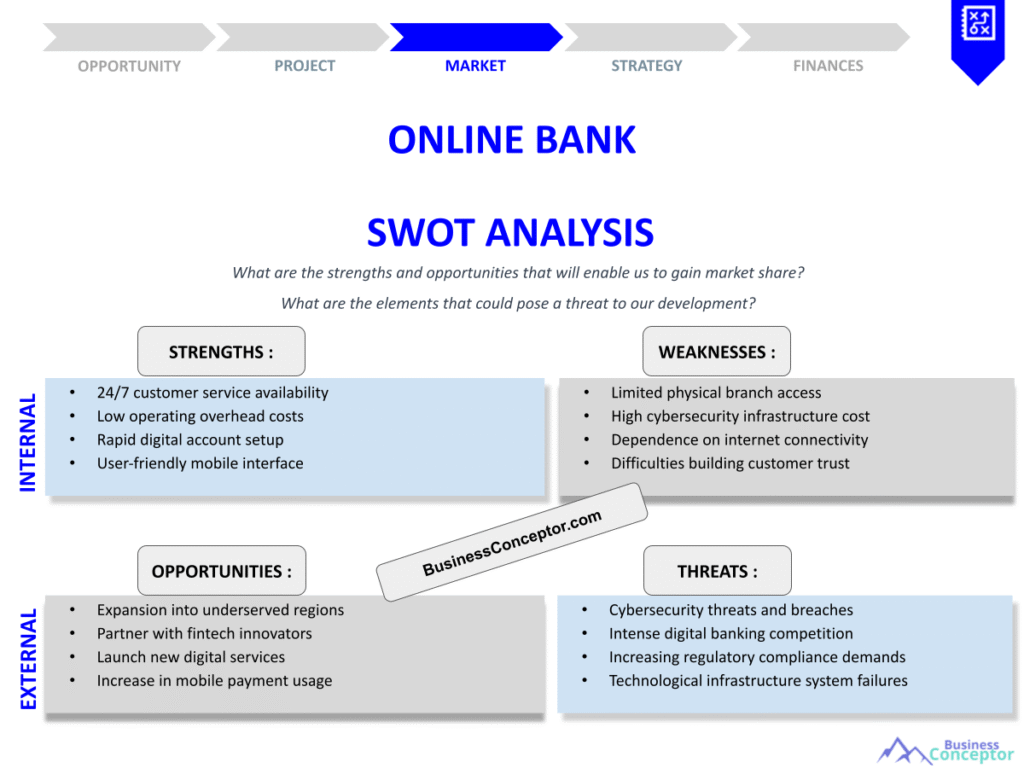

Did you know that the online banking sector is projected to grow by over 10% annually in the coming years? This rapid expansion highlights the importance of understanding the dynamics at play within the industry. Online Bank SWOT Analysis is a strategic tool that helps banks evaluate their current position and plan for future growth. Essentially, it involves examining the strengths, weaknesses, opportunities, and threats that an online bank faces in today’s competitive landscape.

- Overview of SWOT analysis in banking

- Importance of digital banking strategies

- Key strengths of online banks

- Common weaknesses in the sector

- Opportunities for market expansion

- Threats from competitors and regulations

- Real-world examples of successful online banks

- Steps to implement a SWOT analysis

- Future trends in online banking

- Conclusion and call to action

Understanding SWOT Analysis in Online Banking

SWOT analysis is a powerful framework that allows organizations to identify their internal strengths and weaknesses, as well as external opportunities and threats. In the context of online banking, this analysis can provide valuable insights into how a bank can leverage its advantages while mitigating risks. With the rise of digital finance, understanding these factors is more critical than ever.

For example, an online bank may identify its strength as offering 24/7 customer service through chatbots, which enhances customer experience. On the other hand, it might also recognize its weakness in cybersecurity measures, leaving it vulnerable to attacks. This duality of strengths and weaknesses can guide banks in developing robust strategies to improve their market position.

By conducting a thorough SWOT analysis, online banks can better align their resources and strategies with market demands. This alignment is crucial as we move into a more tech-driven future, leading us to explore specific strengths and weaknesses in the next section.

| Aspect | Description |

|---|---|

| Strengths | Advantages the bank has over competitors |

| Weaknesses | Areas where the bank lacks capabilities |

| Opportunities | Market trends that can be leveraged |

| Threats | External challenges that can impact success |

- Strengths drive customer loyalty

- Weaknesses can hinder growth

- Opportunities can lead to innovation

- Threats must be proactively managed

“In the world of finance, knowledge is power.”

Identifying Strengths of Online Banks

One of the major strengths of online banks is their ability to offer lower fees compared to traditional banks. This cost advantage allows them to attract price-sensitive customers who are looking for better deals on banking services. Moreover, the convenience of online banking services provides customers with the flexibility to manage their finances anytime, anywhere.

Statistics show that online banks have significantly lower operating costs, which enables them to pass savings onto their customers. For instance, a study revealed that online banks could offer interest rates that are up to 1.5% higher than traditional banks due to their lower overhead costs. This competitive edge is essential for attracting new customers and retaining existing ones.

Understanding these strengths is vital for online banks as they strategize for growth in a competitive environment. In the following section, we will explore common weaknesses that online banks face, which can impede their success.

- Lower operational costs

- Competitive interest rates

- Enhanced customer convenience

- 24/7 accessibility

- Innovative financial products

The above strengths should be leveraged in marketing campaigns to attract more customers.

Addressing Weaknesses in Online Banking

Despite the strengths, online banks also face several weaknesses. One of the most significant weaknesses is the lack of personal interaction, which can lead to a disconnect with customers. While technology provides convenience, some customers still prefer face-to-face interactions for complex financial decisions.

Moreover, online banks often struggle with cybersecurity issues, as they are prime targets for cybercriminals. Recent studies indicate that 60% of online banks have experienced at least one security breach in the past year. This vulnerability can damage customer trust and result in significant financial losses.

Recognizing these weaknesses is essential for online banks to develop strategies that address them effectively. This proactive approach can help mitigate risks and build a more resilient banking model, leading us to our next discussion on opportunities.

- Lack of personal interaction

- Vulnerability to cybersecurity threats

- Limited brand recognition

- Dependence on technology

“Addressing weaknesses is the first step towards growth.”

Exploring Opportunities for Online Banks

Opportunities abound for online banks, particularly in the realm of technological advancements. The rise of artificial intelligence and machine learning can enhance customer service through personalized experiences and predictive analytics. By leveraging these technologies, online banks can better understand customer needs and preferences, ultimately improving customer satisfaction.

Additionally, the growing trend of financial literacy among consumers presents an opportunity for online banks to educate their clients. By offering resources and tools for financial planning, banks can build stronger relationships with their customers and position themselves as trusted advisors in their financial journeys. A recent survey found that 75% of consumers prefer to engage with banks that provide educational content.

Exploring these opportunities can lead to innovative product offerings and improved customer satisfaction. As we delve deeper, the next section will cover potential threats that online banks must navigate to maintain their competitive edge.

| Opportunity | Description |

|---|---|

| Technological Advancements | Use of AI for personalized service |

| Financial Literacy | Educating customers on financial management |

| Market Expansion | Reaching underserved demographics |

| Strategic Partnerships | Collaborating with fintech startups |

- Invest in AI technologies

- Develop financial literacy programs

- Explore new markets

- Partner with fintech innovators

“To succeed, always move forward with a clear vision.”

Analyzing Threats to Online Banks

Online banks must also be wary of various threats that could undermine their success. One major threat is the increasing competition from traditional banks that are rapidly adopting digital services. As these banks enhance their online offerings, they pose a significant challenge to pure-play online banks.

Regulatory challenges also loom large, as governments worldwide are tightening regulations on digital banking practices. Compliance with these regulations can be costly and complex, particularly for smaller online banks. A recent report indicated that 70% of online banks have had to invest significantly in compliance measures to avoid penalties.

Understanding these threats is crucial for online banks to formulate strategies that protect their interests. The next section will focus on actionable steps that can be taken to mitigate these threats and enhance overall business resilience.

| Threat | Description |

|---|---|

| Increased Competition | Traditional banks enhancing digital services |

| Regulatory Challenges | Stricter compliance requirements |

| Cybersecurity Risks | Growing incidents of cyber attacks |

| Market Saturation | Limited growth opportunities in mature markets |

- Monitor competitor strategies

- Invest in compliance technology

- Strengthen cybersecurity measures

- Diversify service offerings

Strategies for Mitigating Threats

To navigate the threats faced by online banks, developing robust strategies is essential. One effective approach is to enhance cybersecurity measures to protect customer data and maintain trust. This can involve regular security audits, investing in the latest security technologies, and training staff to recognize potential security breaches.

Additionally, creating a strong brand identity can help differentiate an online bank from its competitors. By focusing on unique selling propositions and customer-centric services, banks can foster loyalty and reduce the impact of competition. A recent survey found that 80% of customers are more likely to stay with a brand that they trust, highlighting the importance of brand perception in the banking sector.

Implementing these strategies can lead to a stronger market position and better customer retention. As we wrap up this analysis, the following section will highlight key actions that online banks should take moving forward to ensure sustained growth and success.

| Strategy | Description |

|---|---|

| Enhance Cybersecurity | Invest in advanced security technologies |

| Build Brand Identity | Differentiating through unique offerings |

| Foster Customer Loyalty | Implementing customer engagement programs |

| Regular Compliance Checks | Staying ahead of regulatory changes |

- Conduct regular security audits

- Develop a strong marketing strategy

- Engage customers through loyalty programs

- Stay updated on regulatory changes

Actionable Recommendations for Online Banks

In conclusion, online banks must proactively address their strengths, weaknesses, opportunities, and threats to maximize their business potential. By leveraging their strengths, such as lower operational costs and enhanced convenience, they can attract and retain customers.

Simultaneously, addressing weaknesses like cybersecurity vulnerabilities and lack of personal interaction is crucial. By adopting innovative technologies and educating customers, online banks can capitalize on emerging opportunities while mitigating threats from increased competition and regulatory pressures.

By following these actionable recommendations, online banks can position themselves for long-term success in an ever-evolving market landscape. As we transition to our final section, we’ll summarize the main points and provide a call to action.

| Recommendation | Description |

|---|---|

| Leverage Strengths | Use cost advantages in marketing |

| Address Weaknesses | Invest in cybersecurity and customer service |

| Capitalize on Opportunities | Innovate and educate customers |

| Mitigate Threats | Develop strong compliance and security strategies |

- Focus on customer experience

- Invest in technology and education

- Stay competitive and compliant

- Build a strong brand presence

Identifying Key Actions for Online Banks

As online banks navigate the complex landscape of digital finance, identifying key actions is crucial for sustained success. First, online banks should prioritize enhancing their cybersecurity measures. This not only protects customer data but also builds trust, which is fundamental in the banking sector. Implementing multi-factor authentication and regular security audits can significantly reduce the risk of data breaches.

Second, investing in customer relationship management (CRM) systems can help online banks personalize their services. By analyzing customer data, banks can tailor their offerings to meet specific needs, enhancing overall customer satisfaction. A personalized approach can lead to increased customer loyalty and retention, which is vital in a competitive market.

Lastly, online banks should engage in continuous market research to stay ahead of trends and consumer preferences. This proactive approach allows banks to adapt quickly to changes in the industry, ensuring they remain relevant and competitive. By implementing these key actions, online banks can strengthen their market position and foster long-term growth.

| Key Action | Description |

|---|---|

| Enhance Cybersecurity | Implement multi-factor authentication and regular audits |

| Invest in CRM Systems | Personalize services based on customer data |

| Conduct Market Research | Stay ahead of trends and consumer preferences |

- Prioritize cybersecurity measures

- Utilize CRM for personalized offerings

- Engage in ongoing market research

“Success comes to those who persevere.”

Final Recommendations for Online Banks

To wrap up, online banks must not only understand their SWOT analysis but also take actionable steps based on the insights gained. Focusing on their strengths, such as lower fees and improved customer service, allows them to attract a larger client base. However, they must remain vigilant in addressing weaknesses, like cybersecurity vulnerabilities, to maintain customer trust.

Practical advice includes investing in technology that enhances both security and customer experience. Online banks should also explore partnerships with fintech companies to innovate and expand their service offerings. By continuously adapting to market demands and customer needs, online banks can thrive in an increasingly competitive environment.

Ultimately, the key to success lies in a proactive approach—one that embraces change and prioritizes customer satisfaction. By following these final recommendations, online banks can position themselves for a prosperous future in the digital banking landscape.

| Final Recommendation | Description |

|---|---|

| Focus on Strengths | Utilize lower fees and customer service in marketing |

| Address Weaknesses | Invest in cybersecurity and user experience |

| Innovate through Partnerships | Collaborate with fintech for expanded services |

- Prioritize proactive customer engagement

- Adapt to changing market conditions

- Embrace technological advancements

Conclusion

In conclusion, understanding the SWOT analysis for online banks is essential for maximizing business potential. By recognizing their strengths, addressing weaknesses, seizing opportunities, and navigating threats, banks can position themselves effectively in the digital landscape. Implementing key strategies such as enhancing cybersecurity, personalizing customer experiences, and conducting continuous market research will empower online banks to thrive in a competitive environment.

If you are looking to develop a robust business strategy, check out our Online Bank Business Plan Template for a comprehensive approach to planning your online bank.

Additionally, explore these informative articles that can further enhance your understanding of online banking:

- Article 1: Online Bank Profitability: Maximizing Revenue

- Article 2: Crafting a Business Plan for Your Online Bank: Step-by-Step Guide

- Article 3: How to Create a Financial Plan for Your Online Bank: Step-by-Step Guide (+ Template)

- Article 4: Guide to Starting an Online Bank: Steps and Examples

- Article 5: Building an Online Bank Marketing Plan: Strategies and Examples

- Article 6: How to Create a Business Model Canvas for an Online Bank: Step-by-Step Guide

- Article 7: Customer Segments for Online Banks: Examples and Analysis

- Article 8: How Much Does It Cost to Start an Online Bank?

- Article 9: Online Bank Feasibility Study: Comprehensive Guide

- Article 10: Online Bank Risk Management: Comprehensive Strategies

- Article 11: How to Start a Competition Study for Online Bank?

- Article 12: What Are the Key Legal Considerations for Online Bank?

- Article 13: Online Bank Funding Options: Comprehensive Guide

- Article 14: Online Bank Growth Strategies: Scaling Success Stories

FAQ

What is a SWOT analysis for online banks?

A SWOT analysis for online banks is a strategic assessment that identifies their strengths, weaknesses, opportunities, and threats in the digital banking landscape.

How can online banks leverage their strengths?

Online banks can leverage their strengths by promoting lower fees and superior customer service to attract and retain clients.

What are common weaknesses in online banking?

Common weaknesses include a lack of personal interaction with customers and vulnerabilities related to cybersecurity.

What opportunities exist for online banks?

Opportunities for online banks include advancements in technology and an increasing demand for financial literacy among consumers.

How do threats affect online banks?

Threats such as competition from traditional banks and regulatory challenges can significantly impact the success of online banks.

What strategies can mitigate threats in online banking?

Strategies to mitigate threats include enhancing cybersecurity measures and building a strong brand identity.

How can online banks improve customer loyalty?

Online banks can improve customer loyalty by offering personalized services and engaging customers through loyalty programs.

Why is compliance important for online banks?

Compliance is crucial for online banks to avoid penalties and maintain customer trust in the banking industry.

What role does technology play in online banking?

Technology is essential for enhancing customer experience, providing services, and ensuring security in online banking.

How can online banks stay competitive?

Online banks can stay competitive by continuously innovating and adapting to market trends and customer preferences.