Did you know that nearly 80% of consumers prefer to manage their banking needs online? Online Bank Customer Segments are critical for banks to tailor their services and marketing strategies effectively. With the rise of digital banking, understanding the various segments of customers who engage with these services is more important than ever. In this article, we’ll dive into the different types of online bank customers, analyze their behaviors, and provide examples to help you grasp the concept fully.

- Online banking is rapidly growing.

- Different customer segments exist within digital banking.

- Understanding these segments enhances service delivery.

- Personalized banking is a key trend.

- Customer satisfaction relies on meeting specific needs.

- Millennials and Gen Z are reshaping banking preferences.

- Security concerns affect customer engagement.

- Analytics play a role in identifying segments.

- Tailored marketing strategies are essential.

- Recognizing customer behavior can drive growth.

Understanding Online Bank Customer Segments

Online banking has transformed the financial landscape, creating a need for banks to understand their customers better. By identifying different customer segments, banks can tailor their products and services to meet specific needs. This section introduces the concept of customer segmentation in online banking and why it matters.

For instance, millennials typically prefer mobile banking solutions, while seniors may prioritize user-friendly interfaces and customer support. Each segment brings unique challenges and opportunities for banks. Recognizing these differences is vital for crafting personalized experiences that resonate with each group.

In summary, understanding online bank customer segments lays the groundwork for creating targeted marketing strategies and improving overall customer satisfaction.

| Segment Type | Characteristics |

|---|---|

| Millennials | Tech-savvy, value convenience |

| Seniors | Prefer personal interaction, require assistance |

| Small Business Owners | Need tailored financial solutions, value efficiency |

- Point 1: Customer segments enhance service delivery.

- Point 2: Personalization is key to customer satisfaction.

- Point 3: Different demographics have unique preferences.

– “Understanding your customer is the first step to success.”

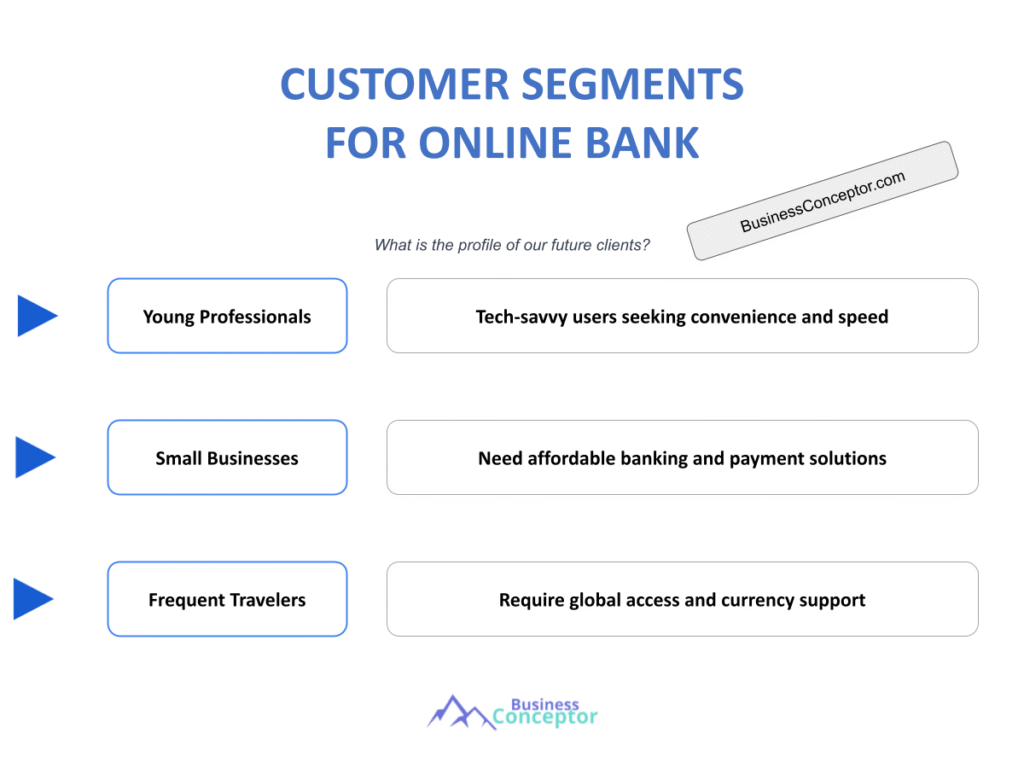

Key Customer Segments in Online Banking

When diving deeper into online bank customer segments, we can categorize them into distinct groups based on demographics and behaviors. This section will explore the primary segments and their unique characteristics.

For example, Gen Z customers often seek innovative banking solutions that align with their digital lifestyle. They value sustainability and social responsibility, which influences their banking choices. In contrast, high-net-worth individuals prioritize privacy and exclusive services.

Statistics show that over 60% of online banking users are millennials, highlighting the importance of focusing on this demographic. By understanding these segments, banks can develop products and marketing strategies that resonate with their target audience.

- Millennials

- Gen Z

- Seniors

- High-net-worth individuals

- Small business owners

– The above steps must be followed rigorously for optimal success.

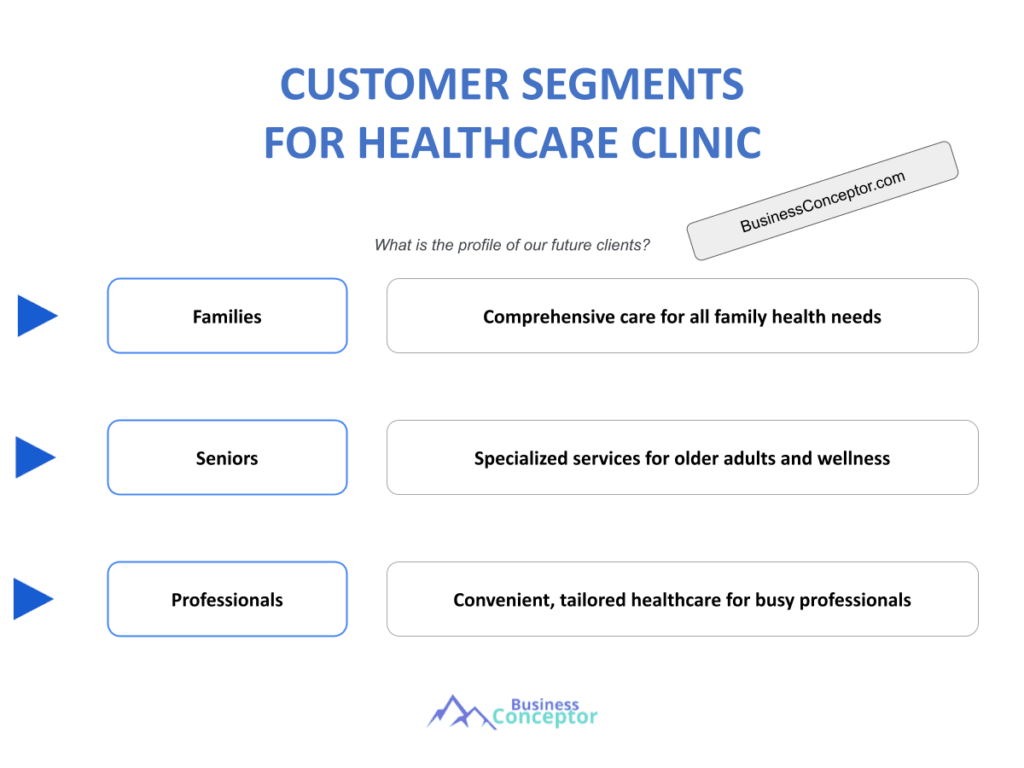

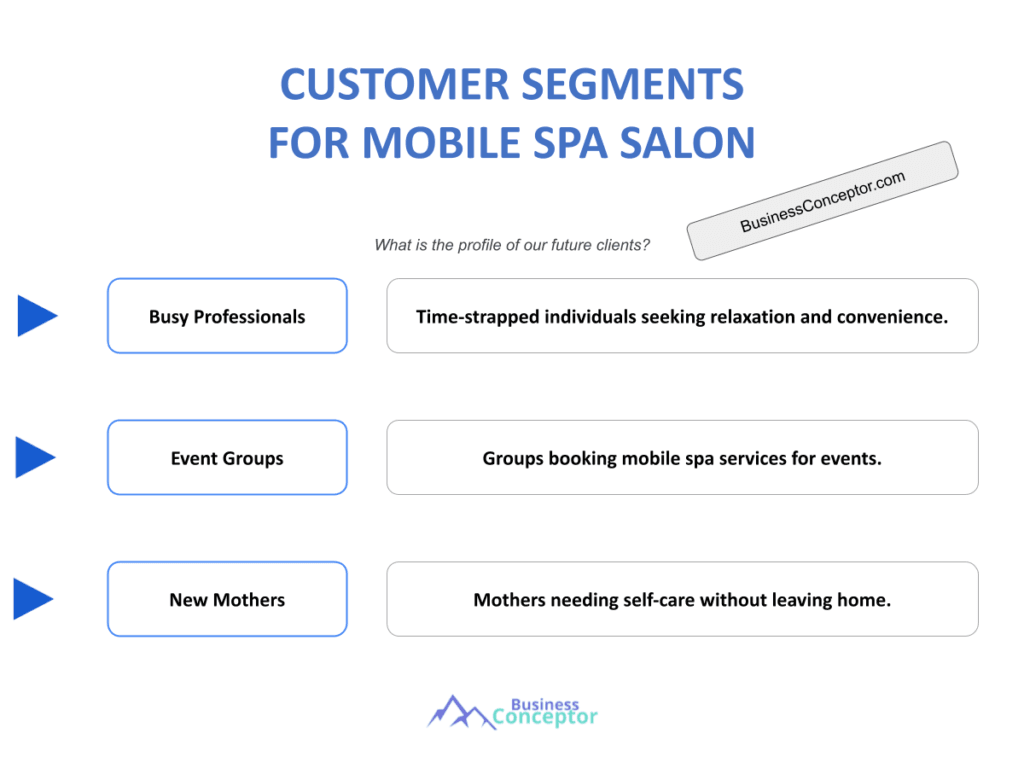

Tailoring Services for Different Segments

To effectively serve various customer segments, banks must tailor their services accordingly. This section analyzes how banks can adapt their offerings to meet the unique needs of each segment.

For example, banks can create user-friendly mobile apps for tech-savvy millennials and offer specialized financial advice for seniors. Additionally, providing personalized services for high-net-worth individuals can enhance customer loyalty and satisfaction.

A case study of a leading bank shows that by implementing targeted marketing strategies, they increased customer engagement by 30% within a year.

- Point A: Tailored services enhance customer loyalty.

- Point B: Understanding customer needs is crucial.

- Point C: Innovative solutions attract younger customers.

– “To succeed, always move forward with a clear vision.”

The Role of Technology in Segment Analysis

Technology plays a vital role in understanding and analyzing online bank customer segments. This section explores the tools and technologies that banks can use to gather insights.

Data analytics and customer relationship management (CRM) systems allow banks to segment their customer base effectively. By analyzing transaction patterns and customer feedback, banks can identify trends and preferences within each segment.

For example, utilizing machine learning algorithms can help banks predict customer behaviors, enabling them to offer personalized services proactively.

| Technology | Benefit |

|---|---|

| Data Analytics | Identifies trends and patterns |

| CRM Systems | Enhances customer engagement |

- Action 1: Invest in data analytics tools.

- Action 2: Utilize CRM systems for better insights.

Challenges in Serving Diverse Customer Segments

While understanding customer segments is crucial, banks face challenges in effectively serving these diverse groups. This section discusses some common obstacles and how to overcome them.

One significant challenge is ensuring security and privacy, especially for high-net-worth individuals who prioritize confidentiality. Additionally, banks must address the varying levels of financial literacy among different segments, particularly seniors who may require more support.

By implementing robust security measures and offering financial education resources, banks can build trust and enhance customer satisfaction across all segments.

| Challenge | Solution |

|---|---|

| Security Concerns | Implement strong security protocols |

| Varying Financial Literacy | Provide educational resources |

- Action 1: Strengthen security measures.

- Action 2: Offer financial literacy programs.

Measuring Success in Customer Segmentation

To ensure effective customer segmentation, banks must measure their success. This section examines key performance indicators (KPIs) that can help evaluate the effectiveness of segmentation strategies.

Metrics such as customer satisfaction scores, retention rates, and engagement levels are essential for assessing performance. By continuously monitoring these KPIs, banks can adjust their strategies to better serve their customers.

For instance, a bank that tracks customer satisfaction may find that personalized marketing campaigns lead to higher engagement rates, prompting them to invest further in these initiatives.

| KPI | Importance |

|---|---|

| Customer Satisfaction Score | Indicates overall happiness |

| Retention Rate | Measures customer loyalty |

- Action 1: Regularly monitor KPIs.

- Action 2: Adjust strategies based on findings.

Future Trends in Online Bank Customer Segments

As the banking landscape continues to evolve, so do customer segments. This section explores emerging trends that banks should be aware of to stay ahead.

The rise of digital wallets and cryptocurrency is reshaping how younger customers engage with banking services. Additionally, a growing emphasis on sustainability and ethical banking is influencing customer choices across all demographics.

By keeping an eye on these trends, banks can adapt their strategies and ensure they meet the changing needs of their customers.

| Trend | Impact |

|---|---|

| Digital Wallets | Increased convenience for users |

| Cryptocurrency | New opportunities for younger customers |

- Action 1: Stay updated on industry trends.

- Action 2: Innovate services to align with changing preferences.

Conclusion

In summary, understanding Online Bank Customer Segments is essential for banks looking to enhance customer satisfaction and drive growth. By identifying the unique needs and preferences of different segments, banks can tailor their services and marketing strategies effectively. Embracing technology, measuring success, and adapting to emerging trends are critical steps in maintaining competitiveness in the dynamic landscape of digital banking.

To help you get started on your journey, consider exploring the Online Bank Business Plan Template for a structured approach to launching your online banking services.

Additionally, check out these articles that provide valuable insights into various aspects of online banking:

- SWOT Analysis for Online Bank: Maximizing Business Potential

- Online Bank Profitability: Maximizing Revenue

- Crafting a Business Plan for Your Online Bank: Step-by-Step Guide

- How to Create a Financial Plan for Your Online Bank: Step-by-Step Guide (+ Template)

- Guide to Starting an Online Bank: Steps and Examples

- Building an Online Bank Marketing Plan: Strategies and Examples

- How to Create a Business Model Canvas for an Online Bank: Step-by-Step Guide

- How Much Does It Cost to Start an Online Bank?

- Online Bank Feasibility Study: Comprehensive Guide

- Online Bank Risk Management: Comprehensive Strategies

- How to Start a Competition Study for Online Bank?

- What Are the Key Legal Considerations for Online Bank?

- Online Bank Funding Options: Comprehensive Guide

- Online Bank Growth Strategies: Scaling Success Stories

FAQ Section

Question 1: What are the main customer segments for online banks?

Answer: The primary customer segments for online banks include millennials, Gen Z, seniors, high-net-worth individuals, and small business owners.

Question 2: How can banks personalize services for different segments?

Answer: Banks can personalize their offerings by analyzing customer data and adapting services to meet the specific preferences of each segment.

Question 3: What role does technology play in customer segmentation?

Answer: Technology aids in analyzing customer data, allowing banks to identify trends and develop targeted marketing strategies.

Question 4: What challenges do banks face when serving diverse customer segments?

Answer: Major challenges include addressing security concerns and ensuring adequate financial literacy support for varying customer groups.

Question 5: How can banks measure the success of their segmentation strategies?

Answer: Banks can track their performance using key performance indicators (KPIs) like customer satisfaction scores, retention rates, and engagement levels.

Question 6: What future trends should banks keep in mind?

Answer: Emerging trends include the growing popularity of digital wallets, the rise of cryptocurrency, and a heightened focus on sustainability within banking practices.

Question 7: Why is customer segmentation important for online banks?

Answer: Understanding customer segmentation allows banks to tailor services effectively, enhancing overall satisfaction and fostering loyalty.

Question 8: How can banks enhance customer satisfaction?

Answer: Banks can boost customer satisfaction by providing personalized services, ensuring security, and offering comprehensive educational resources.

Question 9: What strategies can banks employ to attract younger customers?

Answer: To attract younger customers, banks should focus on innovative solutions like mobile banking apps and digital wallet offerings.

Question 10: How can banks ensure privacy for high-net-worth individuals?

Answer: Banks can maintain privacy by implementing robust security measures and providing exclusive, tailored services to meet their specific needs.