Did you know that over 70% of consumers prefer online banking to traditional banking methods? That’s a staggering number and a clear indication of the shifting landscape in the banking industry. With the rise of digital banking, understanding how to create an effective Online Bank Business Model Canvas is crucial for anyone looking to thrive in this space. A business model canvas is a visual tool that outlines the essential components of a business, helping entrepreneurs and established banks alike to strategize and innovate.

Creating a business model canvas for an online bank involves several key elements, from identifying customer segments to defining value propositions and revenue streams. It’s not just a static document; it’s a living tool that can evolve with your business.

- Importance of a business model canvas for online banks

- Key components of the canvas

- Steps to create your canvas

- Examples of successful online banking models

- Common pitfalls to avoid

- Importance of customer feedback

- Future trends in online banking

- Role of technology in banking innovation

- Strategies for customer acquisition and retention

- How to adapt your canvas over time

Understanding the Business Model Canvas Framework

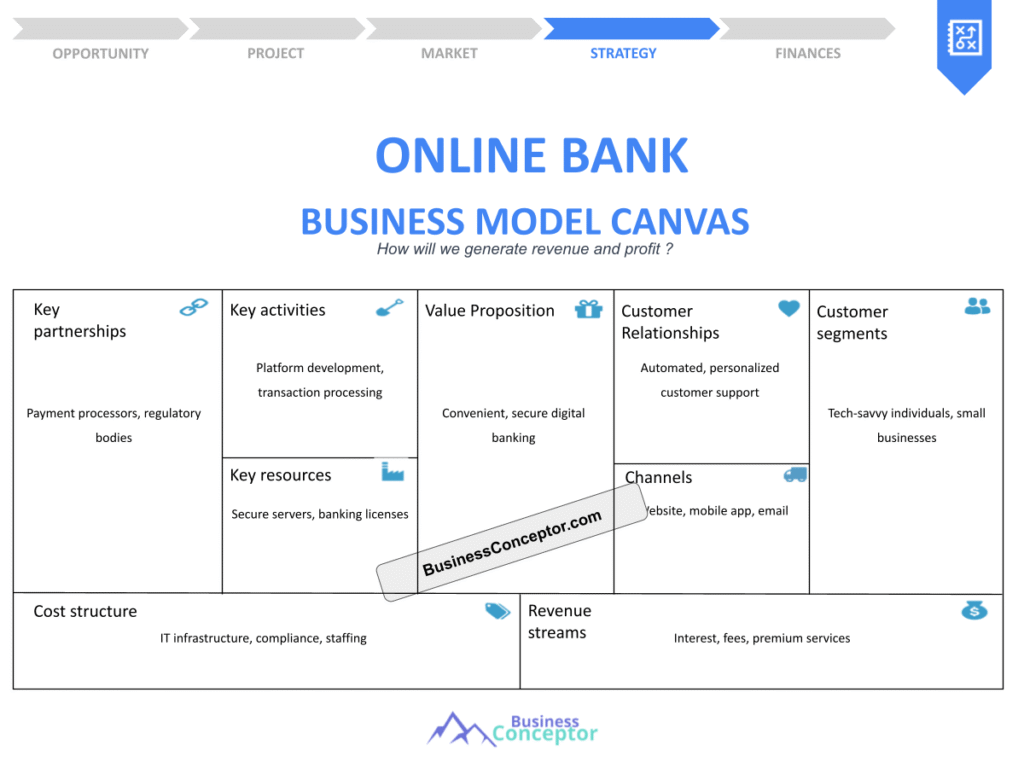

The business model canvas is a strategic management tool that allows you to visualize the various components of your online bank. This framework provides a structured way to think about your business’s value proposition, customer relationships, and revenue streams. It’s particularly beneficial in the fast-paced online banking sector, where flexibility and innovation are key.

For example, let’s break down the nine building blocks of the canvas: customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure. Each block represents a critical aspect of your business and helps you understand how they interconnect. By mapping these elements, you can identify opportunities for improvement and innovation.

By the end of this section, you’ll have a solid grasp of the business model canvas framework, setting the stage for diving deeper into each component in the following sections.

| Component | Description |

|---|---|

| Customer Segments | Different groups of people you aim to serve |

| Value Propositions | What makes your bank unique and valuable |

| Channels | How you reach your customers |

| Customer Relationships | How you interact with your customers |

| Revenue Streams | How your bank earns money |

| Key Resources | Essential assets needed for your bank |

| Key Activities | Major actions your bank must perform |

| Key Partnerships | Collaborations that enhance your business |

| Cost Structure | Expenses associated with your bank operations |

- Visualize your business model

- Identify unique value propositions

- Understand customer needs

- Define your revenue model

- Map out operational costs

– “A clear business model is the backbone of any successful venture.”

Identifying Customer Segments

The first step in creating your Online Bank Business Model Canvas is to identify your customer segments. Understanding who your customers are will guide your entire business strategy, from product offerings to marketing efforts. Think of customer segments as the different groups of people or organizations that your bank aims to serve.

For instance, you might target tech-savvy millennials who prefer mobile banking or small business owners needing tailored financial services. Each segment has unique needs and preferences, and recognizing these differences can help you craft personalized value propositions. By clearly defining your customer segments, you set the groundwork for all other components of your business model. This understanding will be crucial as you explore how to engage and retain these customers in the next section.

- Conduct market research to understand potential customers.

- Segment your audience based on demographics, behaviors, and needs.

- Create customer personas for each segment.

– Knowing your customers is half the battle; tailor your offerings accordingly for optimal success.

Crafting Your Value Proposition

Now that you’ve identified your customer segments, it’s time to craft your value proposition. This is essentially what makes your online bank attractive to customers. A strong value proposition clearly articulates the benefits of your services and why customers should choose you over competitors.

For example, if your target segment is young professionals, your value proposition might focus on convenience, low fees, and advanced mobile features. On the other hand, if you’re targeting small businesses, you might emphasize personalized service and tailored financial products. A compelling value proposition not only helps in attracting customers but also in retaining them. It sets the tone for your marketing efforts and can significantly impact your revenue streams.

- Define what sets your bank apart

- Tailor your value proposition to each customer segment

- Test and refine your value proposition based on feedback

– “Your value proposition is the heart of your business model.”

Determining Revenue Streams

Understanding your revenue streams is crucial for the sustainability of your online bank. Revenue streams are the sources from which your bank generates income, and they can vary widely depending on your business model. Common revenue streams for online banks include transaction fees, subscription fees, interest from loans, and fees for premium services. By analyzing your customer segments and their needs, you can identify which revenue streams will be most effective for your business.

Additionally, it’s important to monitor and adapt your revenue streams as your business evolves. Economic conditions, customer preferences, and competitive dynamics can all impact your revenue model, so staying agile is key. By regularly reviewing your revenue streams, you can ensure that your bank remains profitable while providing value to your customers.

| Revenue Stream | Description |

|---|---|

| Transaction Fees | Charges for processing transactions |

| Subscription Fees | Monthly or annual fees for premium services |

| Interest Income | Earnings from loans provided to customers |

| Advertising Revenue | Income from advertising partnerships |

- Diversify your revenue sources to reduce risk.

- Offer tiered service levels to capture different customer segments.

- Regularly review and adjust fees based on market conditions.

– The above steps must be followed rigorously for optimal success.

Key Activities and Resources

The success of your online bank hinges on the key activities and resources that support your business model. Key activities are the essential actions that your bank must perform to deliver its value proposition, maintain customer relationships, and generate revenue.

For example, if your bank focuses on providing exceptional customer service, key activities might include training staff, developing a robust customer support system, and creating engaging content for customer education. Similarly, key resources—such as technology infrastructure, skilled personnel, and partnerships—are crucial for executing these activities. By clearly identifying and optimizing these components, you can enhance operational efficiency and improve customer satisfaction, which are vital for long-term success.

| Key Activities | Key Resources |

|---|---|

| Customer Support | Skilled support team |

| Marketing Campaigns | Budget for advertising |

| Technology Development | IT infrastructure |

- Identify essential actions for your bank’s success

- Invest in key resources that support your activities

- Optimize operations for better customer experiences

Building Customer Relationships

Building strong customer relationships is vital for the growth and sustainability of your online bank. This involves not just acquiring customers but also retaining them over time. The way you engage with customers can significantly impact their loyalty and overall satisfaction. Techniques for building strong relationships may include personalized communications, loyalty programs, and regular feedback collection.

For instance, using customer feedback to improve services shows that you value their input and are committed to meeting their needs. Additionally, creating a seamless experience across all channels can enhance customer satisfaction. By fostering positive relationships, you can enhance customer retention and even turn satisfied customers into advocates for your brand, helping you attract new clients through word-of-mouth.

| Strategy | Description |

|---|---|

| Personalized Marketing | Tailor communications based on customer data |

| Loyalty Programs | Reward customers for continued business |

| Feedback Mechanisms | Regularly collect and act on customer input |

- Use CRM tools to manage customer interactions.

- Provide multiple channels for customer support.

- Regularly communicate updates and new offerings.

– “Your customer relationships are the foundation of your success.”

Key Partnerships for Success

In the competitive landscape of online banking, establishing key partnerships can provide a significant advantage. Collaborations with technology providers, payment processors, and financial institutions can enhance your service offerings and operational capabilities. For example, partnering with fintech companies can give you access to innovative technologies that improve customer experience and streamline operations.

Additionally, strategic alliances can help you expand your reach and tap into new customer segments. Evaluating potential partners based on their strengths and alignment with your business goals is essential. The right partnerships can help you scale your operations and offer more comprehensive services to your customers, ultimately enhancing your business model.

| Partner Type | Benefits |

|---|---|

| Technology Providers | Access to advanced banking solutions |

| Payment Processors | Facilitate secure and efficient transactions |

| Financial Institutions | Enhance credibility and expand service range |

- Identify potential partners that align with your business

- Leverage partnerships to enhance service offerings

- Regularly review partnership performance for optimal results

Adapting to Market Trends

The banking industry is constantly evolving, and staying ahead of market trends is crucial for your online bank‘s success. Understanding emerging trends allows you to adapt your business model and remain competitive. For instance, trends such as increased mobile banking usage, the rise of artificial intelligence in customer service, and a growing emphasis on sustainability are reshaping the landscape.

By monitoring these trends, you can adjust your strategies and offerings accordingly. Being proactive in adapting to market changes not only keeps your bank relevant but also positions you as a leader in innovation. This can attract new customers and enhance loyalty among existing ones, ultimately contributing to your long-term growth.

| Trend | Implications for Online Banks |

|---|---|

| Mobile Banking Growth | Increased demand for user-friendly apps |

| AI in Customer Service | Enhanced personalization and efficiency |

| Sustainability Focus | Shift towards eco-friendly banking practices |

- Regularly conduct market research to identify emerging trends.

- Invest in technology that supports innovation.

- Engage with customers to understand their evolving needs.

– Staying informed about market trends is essential for maintaining a competitive edge.

Measuring Success and Performance

Finally, measuring the success of your online bank is essential for continuous improvement. Establishing key performance indicators (KPIs) allows you to track progress and make informed decisions. KPIs can include metrics such as customer acquisition costs, customer lifetime value, and transaction volumes.

By analyzing these metrics, you can identify areas for growth and implement strategies to enhance performance. Regular performance reviews help ensure that your business model remains effective and aligned with your goals. As you refine your strategies based on performance data, you can achieve greater success in the competitive online banking landscape.

– “Data-driven decisions lead to sustained success.”

- Set clear KPIs to measure performance

- Regularly analyze data to identify trends

- Adjust strategies based on performance insights

Conclusion

In summary, creating a comprehensive Online Bank Business Model Canvas is essential for navigating the complexities of digital banking. By understanding customer segments, defining value propositions, and establishing revenue streams, you can build a robust framework that supports growth and innovation. This structured approach enables your online bank to remain competitive in a rapidly changing industry.

To further assist you in your journey, consider utilizing the Online Bank Business Plan Template. This template provides a solid foundation for developing your business strategy. Additionally, explore our other articles that delve into various aspects of establishing and running an online bank:

- SWOT Analysis for Online Bank: Maximizing Business Potential

- Online Bank Profitability: Maximizing Revenue

- Crafting a Business Plan for Your Online Bank: Step-by-Step Guide

- How to Create a Financial Plan for Your Online Bank: Step-by-Step Guide (+ Template)

- Guide to Starting an Online Bank: Steps and Examples

- Building an Online Bank Marketing Plan: Strategies and Examples

- Customer Segments for Online Banks: Examples and Analysis

- How Much Does It Cost to Start an Online Bank?

- Online Bank Feasibility Study: Comprehensive Guide

- Online Bank Risk Management: Comprehensive Strategies

- How to Start a Competition Study for Online Bank?

- What Are the Key Legal Considerations for Online Bank?

- Online Bank Funding Options: Comprehensive Guide

- Online Bank Growth Strategies: Scaling Success Stories

FAQ Section

What is an Online Bank Business Model Canvas?

A business model canvas for an online bank is a visual tool that outlines key components such as customer segments, value propositions, and revenue streams necessary for strategic planning.

How do I identify customer segments for my online bank?

To identify customer segments, conduct market research, segment your audience based on demographics and behaviors, and create detailed customer personas.

What are some common revenue streams for online banks?

Common revenue streams include transaction fees, subscription fees for premium services, interest income from loans, and advertising revenue.

Why is customer relationship management important for online banks?

Customer relationship management is crucial because it helps retain customers, enhances satisfaction, and fosters loyalty, leading to increased profitability.

How can I adapt to market trends in the banking industry?

Stay informed about emerging market trends through regular research, invest in innovative technologies, and engage with customers to adapt your offerings effectively.

What key activities should I focus on for my online bank?

Key activities include providing exceptional customer support, marketing campaigns, and technology development to enhance service delivery.

What partnerships should I consider for my online bank?

Consider partnering with technology providers, payment processors, and financial institutions to enhance your service offerings and operational capabilities.

How do I measure success for my online bank?

Measure success using key performance indicators (KPIs) such as customer acquisition costs, customer lifetime value, and transaction volumes to track progress and make informed decisions.

What is the importance of a business plan for an online bank?

A business plan provides a roadmap for your online bank, outlining your strategy, goals, and operational plan, which is essential for attracting investors and guiding your business.

What are the key legal considerations for starting an online bank?

Key legal considerations include regulatory compliance, licensing requirements, and ensuring that your services meet the legal standards set by financial authorities.