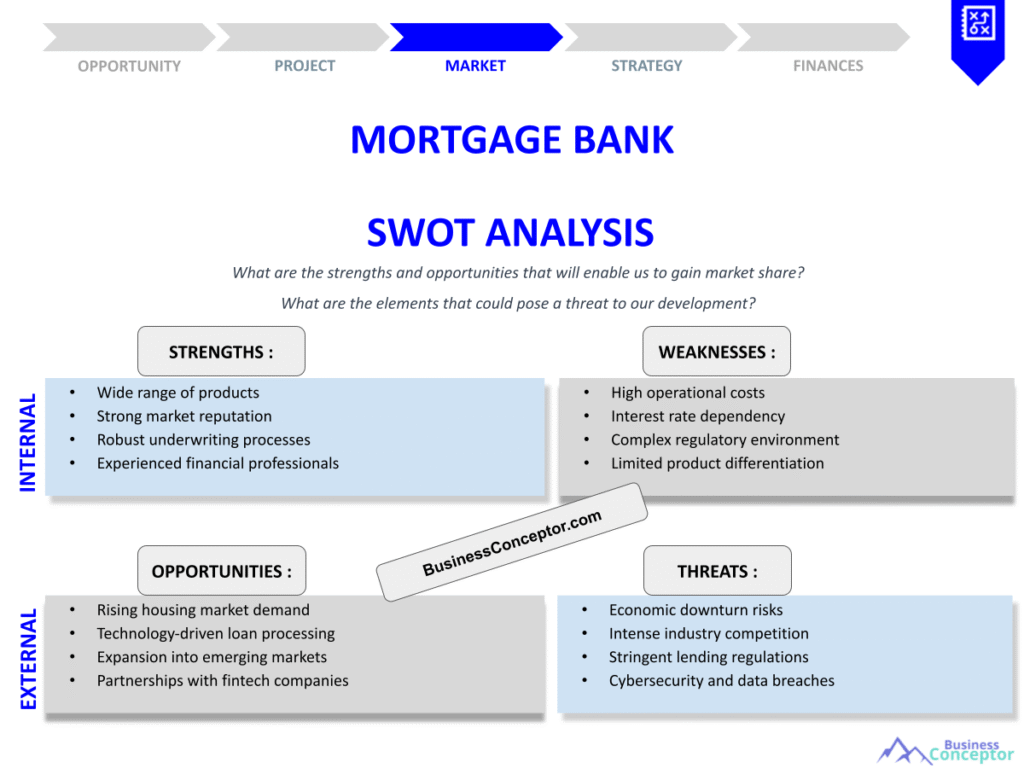

Did you know that nearly 70% of mortgage banks struggle to maintain profitability in a competitive market? This shocking statistic highlights the importance of a thorough Mortgage Bank SWOT Analysis for any financial institution looking to thrive. A SWOT analysis is a strategic planning tool that helps organizations identify their strengths, weaknesses, opportunities, and threats in the marketplace. By understanding these factors, mortgage banks can develop strategies that capitalize on their strengths and mitigate risks.

- Understanding the importance of SWOT analysis in mortgage banking

- Identifying strengths and weaknesses of mortgage banks

- Exploring opportunities for growth in the industry

- Recognizing threats and challenges faced by mortgage banks

- Strategic recommendations based on SWOT findings

- Case studies of successful mortgage banks

- Practical steps for conducting a SWOT analysis

- Importance of ongoing analysis in a changing market

- Future trends in mortgage banking

- Call to action for implementing SWOT insights

Understanding SWOT Analysis in Mortgage Banking

A SWOT analysis is crucial for mortgage banks as it offers a structured approach to evaluating their current standing in the financial landscape. By examining internal and external factors, banks can gain valuable insights into how they can position themselves for success. This section will explore the components of SWOT analysis, emphasizing its relevance in the mortgage banking sector.

For instance, a mortgage bank may identify its robust customer service as a strength, while outdated technology might be recognized as a weakness. On the external front, rising interest rates could pose a threat, while increasing demand for digital services presents an opportunity. Understanding these dynamics can help banks create strategies that leverage their strengths and address their weaknesses.

As we delve deeper into the specifics of each component of the SWOT analysis, mortgage banks can better prepare for the challenges ahead and seize opportunities that align with their strategic goals.

| Component | Description |

|---|---|

| Strengths | Internal attributes that enhance success |

| Weaknesses | Internal attributes that hinder success |

| Opportunities | External factors that can be exploited |

| Threats | External factors that pose challenges |

- Importance of SWOT analysis

- Components of SWOT analysis

- Examples from mortgage banking industry…

– “In every challenge lies an opportunity.”

Identifying Strengths and Weaknesses

Identifying the strengths and weaknesses of a mortgage bank is a vital step in the SWOT analysis process. Strengths could include strong brand recognition, a diverse range of mortgage products, or a loyal customer base. Conversely, weaknesses might encompass high operational costs or limited technological capabilities. Understanding these internal dynamics helps banks tailor their strategies effectively.

For example, a bank with a solid online presence may attract younger clients, while another bank may struggle with outdated practices. Statistics show that banks leveraging technology often see a 30% increase in customer satisfaction, highlighting the importance of recognizing these factors in the analysis. By evaluating both strengths and weaknesses, mortgage banks can create a balanced view of their operational landscape.

Understanding these internal dynamics sets the stage for exploring the opportunities and threats in the next section, ensuring that mortgage banks can develop well-rounded strategies.

- Assess internal capabilities

- Evaluate customer feedback

- Analyze financial performance

- The above steps must be followed rigorously for optimal success.

Exploring Opportunities for Growth

Opportunities for growth in the mortgage banking sector are vast and varied. As the market evolves, banks must stay attuned to emerging trends and consumer preferences. This section will explore how mortgage banks can identify and capitalize on these opportunities.

For instance, the rise of remote work has increased the demand for home purchases, creating a unique opportunity for mortgage banks to expand their offerings. Additionally, the integration of advanced technology can enhance customer experience and streamline operations, making it easier for banks to attract and retain clients. These trends present a significant chance for banks to grow and innovate in a competitive environment.

By understanding these opportunities, mortgage banks can better position themselves for future growth, setting the stage for a deeper dive into potential threats in the next section.

- Market trends driving growth

- Technological advancements as opportunities

- Changing consumer behavior…

– “Adaptability is key in a rapidly changing environment.”

Recognizing Threats in the Market

While opportunities abound, mortgage banks also face significant threats that can impact their growth and profitability. Recognizing these threats is essential for developing effective strategies to navigate the competitive landscape. This section will delve into the various threats that mortgage banks may encounter.

Examples of threats include regulatory changes, fluctuating interest rates, and increased competition from non-traditional lenders. Each of these factors can pose challenges that banks must address proactively to safeguard their market position. For instance, regulatory changes can impose additional compliance costs, while rising interest rates may reduce the affordability of loans, impacting the overall demand for mortgage products.

By understanding these external threats, mortgage banks can develop contingency plans that ensure they remain competitive and resilient in the face of adversity. This proactive approach not only helps banks navigate the current landscape but also prepares them for future challenges and opportunities.

| Threats | Description |

|---|---|

| Regulatory changes | New laws affecting lending practices |

| Interest rates | Fluctuations impacting affordability |

| Competition | Rise of alternative lending options |

- Monitor regulatory developments

- Analyze interest rate trends

- Assess competitive landscape…

Strategic Recommendations Based on SWOT Findings

After conducting a thorough SWOT analysis, mortgage banks can formulate strategic recommendations that leverage their strengths, address weaknesses, capitalize on opportunities, and mitigate threats. This section will outline actionable strategies that banks can implement based on their findings.

For example, a bank may decide to invest in technology upgrades to enhance customer experience and streamline operations while also focusing on marketing campaigns that highlight its strengths. These strategic initiatives can significantly impact the bank’s overall performance, positioning it favorably in a competitive market.

This proactive approach ensures that mortgage banks can navigate the challenges they face and effectively seize the opportunities available to them. By continuously refining their strategies based on SWOT findings, banks can achieve sustainable growth and resilience in an ever-changing landscape.

| Recommendation | Description |

|---|---|

| Invest in technology | Enhance customer experience |

| Marketing strategy | Promote strengths to attract clients |

- Actionable strategies for growth

- Importance of continuous analysis

- Case studies of successful implementations…

The Importance of Continuous SWOT Analysis

The mortgage banking industry is dynamic and constantly evolving, making continuous SWOT analysis crucial for long-term success. By regularly revisiting their SWOT analysis, mortgage banks can stay ahead of market trends and consumer preferences. This ongoing process ensures that they remain competitive and relevant in the industry.

For instance, banks that frequently assess their market position are better equipped to adapt to regulatory changes or shifts in consumer behavior. This adaptability allows mortgage banks to implement timely strategies that address emerging challenges and opportunities. Moreover, consistent SWOT analysis helps banks identify new strengths and weaknesses as their operations and the market landscape evolve.

As we conclude this analysis, it’s essential to recognize that the insights gained from SWOT analysis are not static but should evolve as the market does. Continuous evaluation fosters a culture of improvement and innovation within mortgage banks, ultimately driving success.

| Continuous Analysis | Description |

|---|---|

| Regular updates | Ensures relevance in a changing market |

| Adaptive strategies | Allows for quick responses to challenges |

- Schedule regular SWOT reviews

- Involve stakeholders in the process

- Update strategies based on findings…

Future Trends in Mortgage Banking

Looking ahead, the mortgage banking industry is poised for significant changes driven by technology, consumer preferences, and economic factors. Understanding these trends is essential for mortgage banks aiming to stay ahead of the curve. This section will explore the key trends that are likely to shape the future of the industry.

Trends such as the increasing use of artificial intelligence for loan processing and the growing demand for personalized mortgage solutions are shaping the future of the industry. Banks that embrace these changes will likely have a competitive advantage. For instance, implementing AI can streamline the application process, reducing the time it takes for customers to receive loan approvals and enhancing their overall experience.

By anticipating these trends, mortgage banks can prepare themselves for the future, ensuring they remain leaders in the industry. Adapting to these changes not only positions banks for success but also allows them to better serve their customers in an ever-evolving market.

| Future Trends | Description |

|---|---|

| AI in lending | Streamlining processes and improving accuracy |

| Personalization | Catering to individual customer needs |

- Key trends to watch

- Importance of adaptability

- Strategies for leveraging trends…

Practical Steps for Conducting a SWOT Analysis

Conducting a SWOT analysis is a structured process that requires careful consideration and data analysis. This section will outline practical steps that mortgage banks can follow to perform an effective SWOT analysis. By adhering to these steps, banks can ensure that they derive valuable insights from their evaluations.

Steps include gathering data on internal capabilities, analyzing market trends, and consulting with stakeholders for diverse perspectives. This collaborative approach enhances the analysis and ensures comprehensive insights. For instance, involving team members from different departments can provide a holistic view of the bank’s operations and market position, revealing strengths and weaknesses that might be overlooked.

By following these steps, mortgage banks can gain a clear understanding of their position and develop effective strategies for growth. A well-executed SWOT analysis not only identifies current challenges but also opens doors to future opportunities.

| Step | Description |

|---|---|

| Data collection | Gather internal and external data |

| Stakeholder input | Involve team members in the analysis |

- Essential steps for effective analysis

- Importance of collaboration

- Tools and resources for conducting SWOT analysis…

Key Actions and Recommendations

As we wrap up our discussion on Mortgage Bank SWOT Analysis, it’s vital to highlight key actions that banks should take based on the insights gained. These actions will help ensure that banks remain competitive and successful in the evolving landscape of the mortgage banking industry.

Practical advice includes regularly updating the SWOT analysis, investing in technology, and fostering a culture of adaptability within the organization. By implementing these recommendations, mortgage banks can position themselves for long-term success and resilience. For example, adopting a technology-first approach can streamline processes and enhance customer satisfaction, leading to increased loyalty and market share.

Ultimately, the goal of a SWOT analysis is to provide actionable insights that drive growth and enhance competitiveness in the mortgage banking sector. By focusing on these key actions, banks can navigate challenges effectively and capitalize on emerging opportunities.

– “Success comes to those who persevere.”

- Conduct regular SWOT analyses

- Invest in new technologies

- Focus on customer experience improvement…

Conclusion

In summary, conducting a Mortgage Bank SWOT Analysis is essential for identifying strengths, weaknesses, opportunities, and threats. By leveraging these insights, mortgage banks can develop effective strategies that promote growth and adaptability in a competitive market. To further support your efforts, consider utilizing a comprehensive Mortgage Bank Business Plan Template that can guide you in structuring your business effectively.

Additionally, we invite you to explore our other articles that provide valuable insights into various aspects of mortgage banking:

- Article 1: Mortgage Bank Profitability: Maximizing Revenue

- Article 2: Crafting a Business Plan for Your Mortgage Bank: Step-by-Step Guide

- Article 3: How to Create a Financial Plan for Your Mortgage Bank: Step-by-Step Guide (+ Template)

- Article 4: Comprehensive Guide to Launching a Mortgage Bank

- Article 5: Create a Mortgage Bank Marketing Plan: Tips and Examples

- Article 6: Crafting a Business Model Canvas for Your Mortgage Bank: Examples

- Article 7: Identifying Customer Segments for Mortgage Banks: Examples and Insights

- Article 8: How Much Does It Cost to Start a Mortgage Bank?

- Article 9: Mortgage Bank Feasibility Study: Expert Insights

- Article 10: Mortgage Bank Risk Management: Expert Insights

- Article 11: Mortgage Bank Competition Study: Expert Tips

- Article 12: Mortgage Bank Legal Considerations: Detailed Overview

- Article 13: Mortgage Bank Funding Options: Detailed Analysis

- Article 14: Mortgage Bank Scaling: Comprehensive Growth Strategies

FAQ Section

What is a Mortgage Bank SWOT Analysis?

A Mortgage Bank SWOT Analysis is a strategic tool used to evaluate a bank’s strengths, weaknesses, opportunities, and threats to develop effective growth strategies.

Why is SWOT analysis important for mortgage banks?

SWOT analysis helps mortgage banks identify internal and external factors that can impact their performance, guiding strategic planning and decision-making.

How often should mortgage banks conduct a SWOT analysis?

Mortgage banks should conduct a SWOT analysis regularly, ideally annually or semi-annually, to stay relevant in a changing market.

What are common strengths of mortgage banks?

Common strengths include strong brand recognition, a loyal customer base, and a diverse range of mortgage products.

What weaknesses might mortgage banks face?

Weaknesses can include high operational costs, outdated technology, or limited market presence.

What opportunities exist for growth in the mortgage banking industry?

Opportunities include increasing demand for digital services, rising home ownership rates, and new market segments.

What are some potential threats to mortgage banks?

Potential threats may include regulatory changes, economic downturns, and increasing competition from non-traditional lenders.

How can mortgage banks leverage technology for growth?

By investing in advanced technology, mortgage banks can enhance customer experience, streamline operations, and improve efficiency.

What role does customer feedback play in SWOT analysis?

Customer feedback provides valuable insights into strengths and weaknesses, helping banks tailor their services to meet client needs.

What is the ultimate goal of a SWOT analysis for mortgage banks?

The ultimate goal is to provide actionable insights that drive growth and enhance competitiveness in the mortgage banking sector.