Did you know that nearly 75% of new mortgage banks fail within the first five years? It’s a startling statistic that underscores the importance of having a solid foundation in place before diving into the mortgage banking business. The Mortgage Bank Business Model Canvas serves as a strategic blueprint that outlines the essential components of your mortgage bank’s operations. In essence, it’s a visual chart that describes how your business creates, delivers, and captures value.

In this article, we will explore the intricacies of crafting a business model canvas specifically tailored for mortgage banks. We will delve into critical aspects such as customer segmentation, value propositions, revenue streams, key partnerships, risk management, and operational efficiency. Understanding these elements is crucial for establishing a successful mortgage bank that can thrive in today’s competitive landscape.

- Understand the components of a business model canvas.

- Learn how to apply it specifically to mortgage banking.

- Explore real-life examples of successful mortgage banks.

- Discover common pitfalls and how to avoid them.

- Gain insights into customer segmentation for mortgage banks.

- Examine the financial aspects of running a mortgage bank.

- Identify key partnerships that can enhance your model.

- Learn about the importance of value propositions.

- Understand the role of risk management in mortgage banking.

- Get actionable steps to create your own business model canvas.

Understanding the Mortgage Bank Business Model Canvas

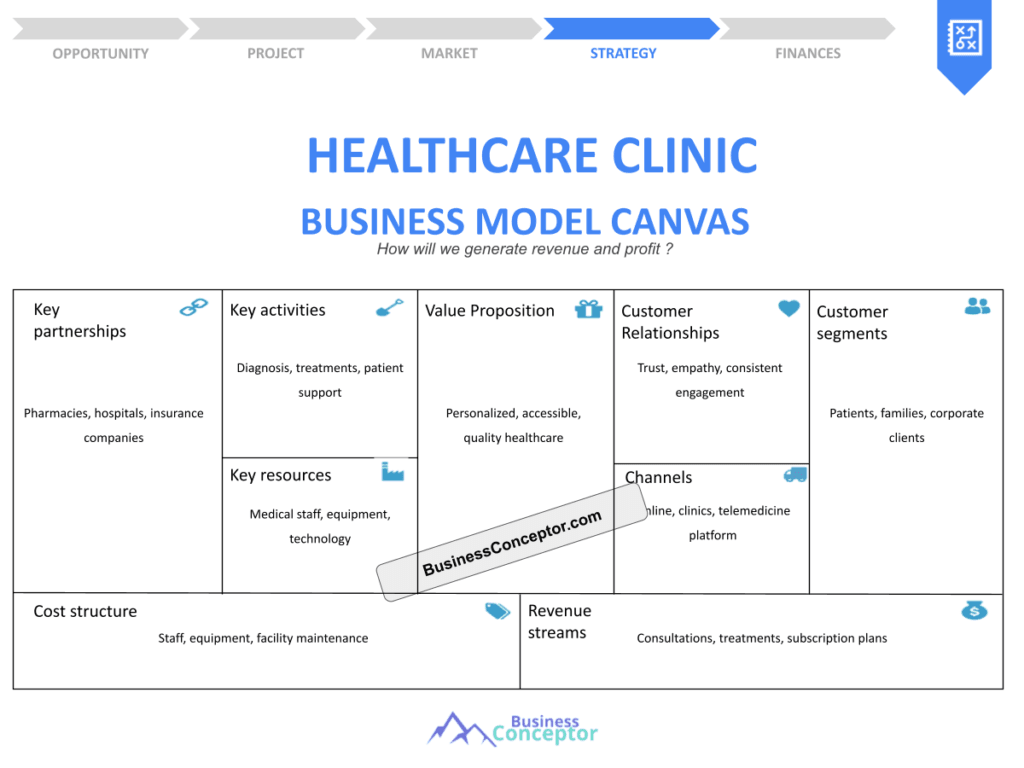

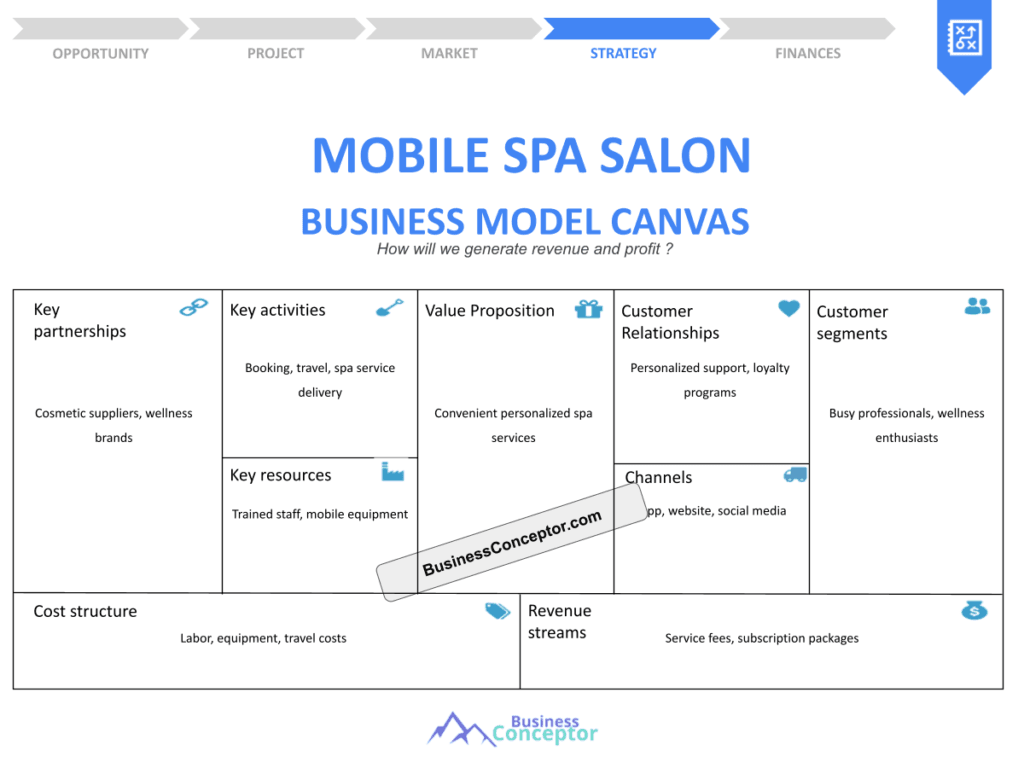

The Mortgage Bank Business Model Canvas is a unique tool that simplifies complex business strategies into a single-page visual. It breaks down various elements like customer segments, value propositions, and revenue streams, making it easier to understand how these components interact within the context of a mortgage bank. This section will explore the importance of each element in crafting a successful mortgage bank strategy.

For example, a mortgage bank might focus on first-time homebuyers as its primary customer segment. By understanding this demographic’s needs, the bank can tailor its offerings, such as lower down payment options or educational resources about the home-buying process. This targeted approach not only improves customer satisfaction but also enhances the bank’s competitive edge in the market.

By grasping the essentials of the Mortgage Bank Business Model Canvas, you set a strong foundation for your business. The next section will delve deeper into customer segmentation and how it plays a crucial role in the overall success of your mortgage bank.

| Component | Description |

|---|---|

| Customer Segments | Target demographics for mortgage loans |

| Value Proposition | Unique offerings to attract clients |

- Understanding customer needs is key.

- A well-defined value proposition attracts clients.

- Revenue streams must align with customer segments.

– “A business model is the blueprint of your success.”

Customer Segmentation in Mortgage Banking

Customer segmentation is a critical aspect of the Mortgage Bank Business Model Canvas. By identifying specific groups within the market, mortgage banks can tailor their services to meet unique needs. This section will explore the various customer segments and how mortgage banks can effectively target them.

For instance, millennials are now a significant segment in the housing market. According to recent studies, over 50% of first-time homebuyers are millennials. Mortgage banks can appeal to this group by offering tech-savvy solutions, such as online applications and digital communication channels, which align with their preferences for convenience and speed. Understanding the unique characteristics of this demographic allows banks to craft specific marketing messages that resonate with their values and lifestyle.

Understanding customer segmentation allows mortgage banks to refine their marketing strategies and enhance customer engagement. The next section will focus on creating a compelling value proposition that resonates with your target audience.

- Identify your target demographics.

- Analyze their unique needs and preferences.

- Tailor your services accordingly.

– The above steps must be followed rigorously for optimal success.

Crafting a Compelling Value Proposition

A compelling value proposition is essential for any mortgage bank. It answers the fundamental question: why should a customer choose your bank over competitors? This section will discuss how to create a value proposition that stands out in a crowded marketplace.

For example, a mortgage bank may offer unique features such as zero closing costs or personalized mortgage consultations. By highlighting these benefits in marketing materials, the bank can attract potential clients looking for the best mortgage options tailored to their needs. Moreover, a strong value proposition not only differentiates your bank but also builds trust and loyalty among customers.

A strong value proposition not only attracts customers but also fosters loyalty. As we move to the next section, we will examine the various revenue streams available to mortgage banks and how to optimize them for profitability.

- A unique value proposition differentiates your bank.

- Highlighting benefits attracts potential clients.

- Customer loyalty stems from meeting expectations.

– “To succeed, always move forward with a clear vision.”

Revenue Streams in Mortgage Banking

Revenue streams are the lifeblood of any mortgage bank. Understanding where your income comes from is vital for sustainability and growth. In this section, we will explore the various revenue streams available to mortgage banks and how to maximize them.

For instance, mortgage banks typically generate income through interest on loans, origination fees, and servicing fees. By analyzing the profitability of each stream, banks can make informed decisions about where to focus their efforts for maximum revenue generation. Additionally, exploring secondary markets for selling loans can provide an additional source of income, allowing banks to free up capital for new lending opportunities.

Recognizing and optimizing revenue streams is crucial for long-term success in mortgage banking. The next section will discuss the importance of key partnerships in building a robust mortgage banking business model.

| Revenue Stream | Description |

|---|---|

| Interest Income | Earnings from loans |

| Origination Fees | Fees charged for processing loans |

- Review your current revenue streams.

- Identify high-performing segments.

- Optimize pricing strategies accordingly.

– Regular assessments of revenue streams can lead to increased profitability.

Key Partnerships in Mortgage Banking

Key partnerships can significantly enhance a mortgage bank’s business model. Collaborating with other businesses can lead to increased efficiency and expanded service offerings. In this section, we will explore the types of partnerships that are beneficial for mortgage banks.

For example, partnering with real estate agents can create a referral system that benefits both parties. By providing agents with incentives for referring clients, mortgage banks can increase their customer base while offering agents a reliable financing option for their clients. This mutually beneficial relationship can lead to a steady stream of business and enhance the bank’s reputation in the market.

Establishing strategic partnerships can help mortgage banks thrive in a competitive landscape. In the next section, we will discuss risk management and its vital role in ensuring the stability of your mortgage bank.

| Partnership Type | Benefit |

|---|---|

| Real Estate Agents | Increased customer referrals |

| Financial Advisors | Access to new client segments |

- Identify potential partners in your area.

- Establish mutually beneficial agreements.

- Monitor partnership performance regularly.

– Strategic partnerships can enhance your market presence.

Risk Management in Mortgage Banking

Risk management is a crucial aspect of running a successful mortgage bank. Given the fluctuating nature of the housing market, understanding and mitigating risks is essential. This section will delve into the key risks faced by mortgage banks and strategies to manage them.

For instance, credit risk is a significant concern for mortgage banks. Implementing stringent underwriting standards and using technology to assess borrower risk can help mitigate this issue. Additionally, maintaining a diversified loan portfolio can further reduce exposure to market fluctuations, ensuring that the bank remains stable even during economic downturns. Regular stress testing and scenario analysis can also be effective tools in identifying potential vulnerabilities.

By effectively managing risks, mortgage banks can ensure their long-term viability. The next section will provide insights into the operational aspects of running a mortgage bank efficiently, highlighting the importance of operational efficiency.

| Risk Type | Mitigation Strategy |

|---|---|

| Credit Risk | Strict underwriting standards |

| Market Risk | Diversification of loan portfolios |

- Assess your current risk management strategies.

- Implement new technologies for risk assessment.

- Regularly review and update risk policies.

– Proactive risk management is essential for sustainable success.

Operational Efficiency in Mortgage Banking

Operational efficiency is vital for the success of any mortgage bank. Streamlining processes can lead to reduced costs and improved customer satisfaction. In this section, we will discuss best practices for enhancing operational efficiency in mortgage banking.

For example, automating the loan application process can significantly speed up approval times and reduce human error. By leveraging technology, mortgage banks can provide a smoother experience for customers while freeing up staff to focus on more complex tasks. Additionally, implementing a robust training program for employees can ensure that they are well-equipped to handle customer inquiries and provide excellent service.

Improving operational efficiency not only boosts profitability but also enhances customer experience. As we move to the next section, we will explore the importance of compliance in the mortgage banking industry and how it impacts overall operations.

| Efficiency Aspect | Improvement Strategy |

|---|---|

| Loan Processing | Automation of application procedures |

| Customer Service | Enhanced training for staff |

- Evaluate your current operational processes.

- Identify areas for automation.

- Train staff on new systems and procedures.

– Streamlined operations lead to a more profitable mortgage bank.

Compliance in Mortgage Banking

Compliance is a critical component of mortgage banking that cannot be overlooked. Adhering to regulatory requirements is essential to avoid penalties and maintain a good reputation. This section will discuss the key compliance issues mortgage banks must navigate.

For instance, the Dodd-Frank Act imposes strict regulations on mortgage lending practices. Staying updated on these regulations and ensuring all employees are trained in compliance can help mortgage banks avoid costly legal issues. Additionally, implementing a compliance management system can streamline processes, making it easier to monitor adherence to regulations and respond to any changes in the legal landscape.

By prioritizing compliance, mortgage banks can build trust with customers and regulators alike. The next section will highlight key actions and recommendations for successfully implementing a Mortgage Bank Business Model Canvas, ensuring that all components work harmoniously.

| Compliance Issue | Importance |

|---|---|

| Regulatory Adherence | Avoiding legal penalties |

| Consumer Protection | Building customer trust |

- Regularly review compliance policies.

- Conduct training sessions for staff.

- Stay informed about changes in regulations.

– A strong compliance framework enhances your mortgage bank’s credibility.

Implementing Your Mortgage Bank Business Model Canvas

Successfully implementing your Mortgage Bank Business Model Canvas requires careful planning and execution. This section will summarize the key components of the canvas and provide actionable steps for implementation.

For example, ensure that all stakeholders are aligned on the business model and understand their roles in its execution. Regular reviews and adjustments based on market feedback will also help keep the model relevant and effective. Additionally, creating a feedback loop with customers can provide valuable insights that drive continuous improvement in your offerings.

By following these steps, you can create a robust foundation for your mortgage bank that is adaptable to changing market conditions. Now, let’s explore some key actions and recommendations that will help solidify your approach to building a successful mortgage bank.

- Align stakeholders with the business model vision.

- Conduct regular market assessments.

- Be prepared to pivot based on performance data.

– A well-implemented business model canvas paves the way for success in mortgage banking.

Conclusion

In summary, crafting a Mortgage Bank Business Model Canvas is an essential step in building a successful mortgage bank. By focusing on key components such as customer segmentation, value propositions, revenue streams, key partnerships, risk management, and operational efficiency, you can create a comprehensive strategy tailored to your specific needs. Now is the time to take action! For a solid foundation, consider using the Mortgage Bank Business Plan Template to guide your efforts.

Additionally, you may find these articles helpful as you navigate the complexities of the mortgage banking industry:

- Article 1: SWOT Analysis for Mortgage Bank: Strategies for Growth

- Article 2: Mortgage Bank Profitability: Maximizing Revenue

- Article 3: Crafting a Business Plan for Your Mortgage Bank: Step-by-Step Guide

- Article 4: How to Create a Financial Plan for Your Mortgage Bank: Step-by-Step Guide (+ Template)

- Article 5: Comprehensive Guide to Launching a Mortgage Bank

- Article 6: Create a Mortgage Bank Marketing Plan: Tips and Examples

- Article 7: Identifying Customer Segments for Mortgage Banks: Examples and Insights

- Article 8: How Much Does It Cost to Start a Mortgage Bank?

- Article 9: Mortgage Bank Feasibility Study: Expert Insights

- Article 10: Mortgage Bank Risk Management: Expert Insights

- Article 11: Mortgage Bank Competition Study: Expert Tips

- Article 12: Mortgage Bank Legal Considerations: Detailed Overview

- Article 13: Mortgage Bank Funding Options: Detailed Analysis

- Article 14: Mortgage Bank Scaling: Comprehensive Growth Strategies

FAQ Section

What is a Mortgage Bank Business Model Canvas?

A Mortgage Bank Business Model Canvas is a strategic framework that outlines how a mortgage bank creates, delivers, and captures value, focusing on key components like customer segments and revenue streams.

How do I identify customer segments for my mortgage bank?

Identifying customer segments involves analyzing demographic data, understanding market needs, and segmenting based on characteristics such as age, income, and home-buying experience.

What are common revenue streams for mortgage banks?

Common revenue streams include interest income from loans, origination fees, and servicing fees charged to clients.

Why is risk management essential in mortgage banking?

Risk management is vital as it helps mortgage banks identify, assess, and mitigate potential risks that could impact their financial stability and reputation.

How do partnerships enhance mortgage banking operations?

Partnerships can increase service offerings, customer referrals, and create synergies that improve operational efficiency and profitability.

What regulatory requirements must mortgage banks comply with?

Mortgage banks must adhere to various regulations, including those related to fair lending practices, consumer protection, and financial disclosures.

How can I improve operational efficiency in my mortgage bank?

You can enhance operational efficiency by automating processes, streamlining workflows, and providing staff training to enhance service delivery.

What should be included in a mortgage bank’s value proposition?

Your value proposition should highlight what makes your mortgage bank unique, such as competitive rates, exceptional customer service, or specialized loan products.

How often should I review my mortgage bank’s business model?

It’s advisable to review your business model regularly, at least annually or when significant market changes occur, to ensure it remains relevant and effective.

What are the key components of a successful mortgage bank business model?

Key components include customer segments, value propositions, revenue streams, key activities, key resources, key partnerships, and cost structure.