The world of Legal Consultant Funding Options is an essential topic for anyone looking to establish or expand their legal consultancy. Did you know that many legal consultants struggle to find the right funding to support their business ventures? This can often lead to missed opportunities and stunted growth. Understanding the various funding avenues available is crucial for ensuring your consultancy not only survives but thrives in a competitive landscape. Legal Consultant Funding Options encompass a range of financing methods, from traditional bank loans to innovative crowdfunding platforms. Each option has its unique set of advantages and challenges, making it vital to choose wisely based on your specific needs and goals.

Here are a few key points to consider when exploring funding for your legal consultancy:

– **Diverse Funding Avenues**: Familiarizing yourself with the various options allows you to find the best fit for your business model.

– **Financial Stability**: Securing funding can provide the necessary capital to cover operational costs, hire staff, and invest in marketing.

– **Growth Potential**: The right funding can propel your consultancy to new heights, enabling you to expand your services and reach.

Understanding Legal Consultant Funding Options

When it comes to financing a legal consultancy, understanding the different Legal Consultant Funding Options is crucial. These funding options can significantly impact your ability to grow and sustain your business. Traditional funding sources like bank loans are often the first consideration for many legal professionals. They offer a structured approach to financing, typically involving fixed repayment terms and interest rates. For example, securing a bank loan can provide the funds needed for hiring additional staff or investing in new technology.

However, the process of obtaining a bank loan can be daunting. It usually requires a solid business plan, a good credit history, and sometimes collateral. Despite these challenges, many consultants find that the benefits outweigh the drawbacks. A bank loan can provide you with a significant amount of capital that can be repaid over time, allowing you to focus on growing your practice without the immediate pressure of financial instability.

Another traditional option is the SBA loans, which are backed by the Small Business Administration. These loans often come with lower interest rates and longer repayment periods, making them a viable choice for small businesses. They can be particularly beneficial for legal consultants just starting out who may not have a robust credit history. The support from the government can also add a layer of credibility to your consultancy, making it easier to attract clients.

On the flip side, alternative funding options like crowdfunding and angel investments have gained popularity in recent years. Crowdfunding allows you to raise small amounts of money from a large number of people, typically through online platforms. This method not only helps you gather funds but also validates your business idea by demonstrating public interest. For instance, I once launched a legal tech tool through a crowdfunding platform and was amazed at the overwhelming support I received. It not only provided the necessary funds but also helped me build a community around my product.

Angel investors, on the other hand, are affluent individuals who invest in startups in exchange for equity. They can provide not just funding, but also valuable mentorship and connections that can help you navigate the complexities of the legal industry. Engaging with angel investors can open doors to networking opportunities and resources that might otherwise be inaccessible.

It’s essential to understand that each funding option comes with its own set of pros and cons. Traditional loans might offer stability, but they can also lead to debt if not managed properly. Alternative funding methods may provide more flexibility, but they often require giving up a portion of your business equity. Therefore, assessing your business goals, growth plans, and financial situation is critical in making an informed decision about which funding option to pursue.

In summary, navigating the landscape of Legal Consultant Funding Options can be challenging, but understanding the advantages and disadvantages of each option can empower you to make the best choice for your consultancy. By leveraging the right funding, you can ensure that your legal consultancy is well-positioned for success.

Traditional Funding Sources for Legal Consultants

When considering how to fund a legal consultancy, traditional funding sources often come to mind first. These options typically include bank loans and SBA loans, both of which are reliable choices for many legal professionals. Securing a bank loan can provide you with a substantial amount of capital needed for various business needs, such as hiring additional staff, investing in marketing, or upgrading your technology. One of the significant advantages of bank loans is the structured repayment plan they offer, which helps in budgeting and financial planning.

However, obtaining a bank loan can be challenging, especially for new legal consultants who may lack an established credit history. The application process usually requires a solid business plan detailing how the funds will be used and how you plan to repay the loan. I remember when I applied for my first bank loan; the process felt overwhelming, but having a clear plan made all the difference. It showed the bank that I was serious and prepared to manage the funds responsibly.

On the other hand, SBA loans are a fantastic option for small businesses, including legal consultancies. These loans are backed by the Small Business Administration, making them more accessible for startups and businesses with less-than-perfect credit. The lower interest rates and longer repayment periods associated with SBA loans can ease the financial burden on new consultants. Additionally, the backing of the government adds a layer of credibility, which can be beneficial when attracting clients.

Both bank loans and SBA loans provide the necessary funds to help legal consultants establish their practices and achieve financial stability. However, they also come with strict requirements, which can be a hurdle for some. Understanding these traditional funding sources allows you to make informed decisions that align with your business goals.

Alternative Funding Options for Legal Consultants

As the legal industry evolves, alternative funding options have gained traction and become vital for legal consultants looking to innovate and grow. These options include crowdfunding and angel investments, both of which can provide unique advantages that traditional funding sources may not offer. Crowdfunding allows you to raise small amounts of money from a large number of individuals, typically through online platforms. This method not only helps gather funds but also validates your business idea by demonstrating public interest. For instance, when I launched a legal tech startup, I turned to crowdfunding. The community support was incredible, and not only did I exceed my funding goal, but I also built a loyal customer base even before launching my product.

One of the primary advantages of crowdfunding is that it does not require repayment like traditional loans. Instead, backers often receive rewards, such as early access to products or services, which helps create a sense of community and engagement. This method can also serve as a marketing tool, generating buzz around your legal consultancy and attracting potential clients. However, it does require effective marketing strategies to reach your funding goals, and you may need to invest time and effort into promoting your campaign.

Another alternative funding source is angel investors. These are affluent individuals who invest in startups in exchange for equity. One significant benefit of working with angel investors is that they often bring more than just money to the table; they can provide valuable mentorship, industry connections, and business advice. This support can be instrumental in navigating the complexities of the legal industry. When I engaged with an angel investor for my consultancy, their insights on scaling and networking proved invaluable, helping me avoid common pitfalls that many startups face.

However, it’s essential to understand that taking on an angel investor means giving up a portion of your business equity. This can be a concern for some legal consultants who wish to maintain full control over their operations. Therefore, weighing the benefits of mentorship and funding against the potential loss of equity is crucial in making an informed decision.

In summary, both crowdfunding and angel investments offer viable alternative funding options for legal consultants. By exploring these avenues, you can find the right fit for your business model and goals, ensuring that you have the resources necessary to succeed in a competitive market. Understanding the implications of each option can empower you to make informed choices that will set your consultancy on a path to growth.

Understanding Government Grants for Legal Consultants

Government grants can be a game-changer for legal consultants seeking financial support without the burden of repayment. These funds are typically non-repayable, which means that once you secure a grant, you don’t have to worry about paying it back, unlike loans. This can significantly alleviate financial pressure, allowing you to focus on growing your consultancy. Grants are often aimed at specific initiatives, such as improving access to legal services, enhancing community outreach, or developing innovative legal technologies. Understanding government grants can provide a pathway to funding that aligns with your business goals while contributing positively to society.

For example, I applied for a government grant designed to support legal consultancies that provide services to underserved communities. The application process was rigorous, requiring a detailed proposal outlining how the funds would be used to create a meaningful impact. Although it took considerable effort, the grant I received allowed me to implement outreach programs that made a real difference in the lives of individuals who needed legal assistance but couldn’t afford it. This not only enhanced my firm’s reputation but also fulfilled a crucial need in the community.

One of the significant advantages of government grants is that they often come with fewer strings attached compared to loans or investments. You may not need to give up equity or control of your business, allowing you to maintain your consultancy’s vision and direction. Additionally, securing a government grant can enhance your credibility and attract more clients, as it demonstrates that your consultancy is recognized and supported by authoritative entities. This can lead to further opportunities and partnerships that can benefit your practice.

However, it’s essential to note that the competition for government grants can be fierce, and the application process may be time-consuming. It often requires a well-prepared proposal, demonstrating not only your qualifications but also the potential impact of your project. Therefore, investing time in understanding the specific requirements and guidelines for each grant is crucial. Utilizing resources like local business development centers or online grant databases can also help streamline the process and increase your chances of success.

Financial Planning for Legal Consultants

Effective financial planning is a critical component of running a successful legal consultancy. Understanding your working capital needs and budgeting for various expenses can make a significant difference in your consultancy’s sustainability and growth. Without a clear financial strategy, even the best funding options may not suffice to keep your business afloat.

One of the first steps in financial planning is assessing your operational costs. This includes everything from rent and utilities to salaries and marketing expenses. For instance, when I first started my consultancy, I underestimated the costs associated with marketing my services. I quickly realized that without a solid marketing budget, it was challenging to attract new clients. Therefore, having a comprehensive understanding of your expenses is essential to avoid cash flow problems down the line.

Another critical aspect of financial planning is establishing a budget that aligns with your business goals. This involves creating a detailed financial forecast that includes projected income, expenses, and potential funding sources. By regularly reviewing and adjusting your budget, you can make informed decisions that will help you allocate resources effectively. For example, if you notice a consistent increase in client demand, you may decide to invest in additional staff or technology to enhance your services. Conversely, if expenses are exceeding income, it may be time to reassess your spending and cut back on non-essential costs.

Moreover, having a solid financial plan enables you to prepare for unexpected challenges, such as economic downturns or sudden changes in the legal market. Building a financial cushion can provide a safety net that allows you to navigate these uncertainties without jeopardizing your consultancy’s stability. It’s also essential to regularly monitor your cash flow, as maintaining positive cash flow is vital for any business’s health. Utilizing accounting software or hiring a financial advisor can help streamline this process and provide valuable insights into your financial health.

In conclusion, effective financial planning is essential for legal consultants to thrive in a competitive environment. By understanding your working capital needs, establishing a budget, and regularly reviewing your financial status, you can position your consultancy for long-term success. This strategic approach not only helps in choosing the right funding options but also ensures that you can effectively manage your resources to achieve your business objectives.

Choosing the Right Funding Option

Choosing the right funding option is a crucial step for any legal consultant aiming to establish or grow their practice. The landscape of Legal Consultant Funding Options is diverse, and understanding how to navigate these choices can significantly impact your business’s success. When evaluating potential funding sources, it’s essential to align them with your business model, growth objectives, and personal values.

First, consider the type of funding that best fits your consultancy’s needs. If you’re a startup looking to innovate, options like crowdfunding or angel investments might be more suitable. These funding avenues not only provide capital but also offer opportunities for mentorship and networking. For example, securing funding through an angel investor can grant you access to invaluable industry insights and connections that can help propel your consultancy forward.

On the other hand, if you are an established consultant seeking stability, traditional funding sources like bank loans or SBA loans may be more appropriate. These options can provide the structured financial support necessary for scaling your operations or investing in new technology. However, it’s important to remember that traditional loans often come with strict requirements and a lengthy application process, so being prepared with a solid business plan is vital.

Another aspect to consider is the implications of each funding option. For instance, while crowdfunding can be a great way to validate your business idea and build a community around it, it requires a robust marketing strategy to ensure success. Similarly, while angel investors can provide mentorship, they often require a stake in your business, which may not be desirable for everyone. Therefore, carefully weighing the benefits against the potential drawbacks is essential in making an informed decision.

Additionally, think about your long-term goals. If you envision growing your consultancy into a large firm, you may want to consider funding options that allow for scalability. This could involve exploring venture capital or larger institutional investors who can provide the substantial capital needed for rapid growth. Understanding your growth trajectory and funding needs will help you make strategic decisions that align with your vision.

The Future of Funding for Legal Consultants

The future of funding for legal consultants is rapidly evolving, with new trends and technologies shaping the landscape. As the legal industry adapts to changing client needs and technological advancements, understanding these trends can give you a competitive edge. Emerging funding methods, such as legal tech startups and online funding platforms, are becoming increasingly popular and accessible for legal consultants.

For example, the rise of legal tech startups has opened up new avenues for funding, particularly through venture capital. Investors are increasingly interested in supporting innovative solutions that improve efficiency and access to legal services. If you’re developing a unique legal tech solution, seeking venture capital can provide not only the funds needed to scale your business but also the expertise and network of seasoned investors who understand the legal landscape.

Moreover, online funding platforms have democratized access to capital, allowing legal consultants to connect with a broader audience of potential investors. These platforms enable you to present your business idea to many individuals who can contribute small amounts, collectively providing significant funding. This trend not only helps in raising capital but also allows you to build a community of supporters and advocates for your consultancy.

Staying informed about these emerging trends can help you identify new opportunities for funding and growth. Engaging with industry networks, attending legal tech conferences, and participating in webinars can provide valuable insights into the future of funding in the legal sector. Additionally, leveraging social media and online marketing can enhance your visibility and attract potential investors who resonate with your mission and vision.

In conclusion, the future of funding for legal consultants is bright and full of opportunities. By understanding the evolving landscape of Legal Consultant Funding Options, you can position your consultancy for success. Whether you choose traditional funding sources or explore innovative avenues, being proactive and informed will empower you to make the best decisions for your business. The right funding can set the foundation for growth, allowing you to focus on delivering exceptional legal services while securing the financial stability necessary for long-term success.

Evaluating the Risks of Financing Legal Consulting Business

When exploring Legal Consultant Funding Options, it’s essential to evaluate the risks associated with financing your legal consulting business. Every funding source comes with its own set of challenges and potential pitfalls. Understanding these risks can help you make informed decisions that align with your business goals and financial stability.

One of the primary risks involves taking on debt, particularly when utilizing traditional funding sources such as bank loans or SBA loans. While these loans can provide necessary capital, they also require regular repayments, which can strain your cash flow, especially in the early stages of your consultancy. If your revenue fluctuates or if you experience a downturn in business, meeting these repayment obligations can become challenging. This risk underscores the importance of having a solid financial plan and a buffer to manage unexpected expenses.

Additionally, if you opt for alternative funding options like crowdfunding, there are risks associated with public perception and the need for effective marketing strategies. A poorly executed crowdfunding campaign can result in failing to meet your funding goals, which can not only leave you without the necessary capital but also damage your reputation. It’s crucial to develop a comprehensive marketing plan that resonates with your target audience to mitigate this risk. Engaging with your supporters throughout the campaign can help build trust and encourage contributions.

Another risk to consider is the potential loss of control over your business when seeking funding from angel investors or venture capitalists. These investors often seek equity in your business in exchange for their financial support, which can dilute your ownership and influence over business decisions. While having an investor can provide valuable mentorship and resources, it’s essential to ensure that their vision aligns with yours. Conducting thorough due diligence on potential investors can help you find partners who share your values and objectives.

In summary, evaluating the risks of financing your legal consulting business is a vital step in the funding process. By understanding the implications of each funding option and preparing for potential challenges, you can navigate the complexities of financing with confidence. This proactive approach not only protects your business but also positions you for long-term success in the competitive legal industry.

Exploring Funding Trends in the Legal Services Industry

Staying informed about the latest funding trends in the legal services industry is crucial for legal consultants seeking to thrive in a rapidly changing environment. The legal landscape is evolving, and emerging trends can significantly impact how legal services are funded and delivered. By understanding these trends, you can position your consultancy to take advantage of new opportunities and stay ahead of the competition.

One of the most notable trends is the increasing interest in legal tech startups and innovative solutions that enhance efficiency and accessibility. Investors are keen to support technologies that streamline legal processes, improve client experiences, and reduce costs. If you’re involved in developing legal technology or software, seeking funding through venture capital or angel investments can provide the necessary capital to scale your operations and bring your ideas to market.

Additionally, the rise of online funding platforms has transformed how legal consultants access capital. These platforms allow you to showcase your business ideas to a global audience, enabling you to raise funds from individuals who resonate with your mission. This democratization of funding not only increases your chances of securing capital but also helps you build a community of supporters who can advocate for your consultancy. Engaging with these platforms can also serve as a valuable marketing tool, generating interest in your services before they launch.

Another trend worth noting is the growing emphasis on social responsibility and community impact in funding decisions. Many investors are increasingly interested in supporting businesses that prioritize social justice, access to legal services, and community engagement. If your consultancy focuses on providing legal assistance to underserved populations or addressing social issues, you may find more opportunities for grants and funding from organizations that align with these values. Highlighting your commitment to social impact can enhance your appeal to potential investors and clients alike.

Furthermore, as remote work becomes more prevalent, there is a shift towards flexible funding solutions that cater to the needs of virtual legal practices. This trend includes the rise of subscription-based models for legal services, which can provide a steady stream of income and reduce reliance on traditional billing methods. Understanding these shifts can help you adapt your funding strategies and business models to better align with current market demands.

In conclusion, exploring the latest funding trends in the legal services industry can provide valuable insights and opportunities for your consultancy. By staying informed and adaptable, you can leverage emerging trends to secure the necessary funding and position your business for long-term success. Embracing innovation and social responsibility in your funding strategies can not only enhance your consultancy’s reputation but also contribute positively to the legal profession and society as a whole.

Recommendations

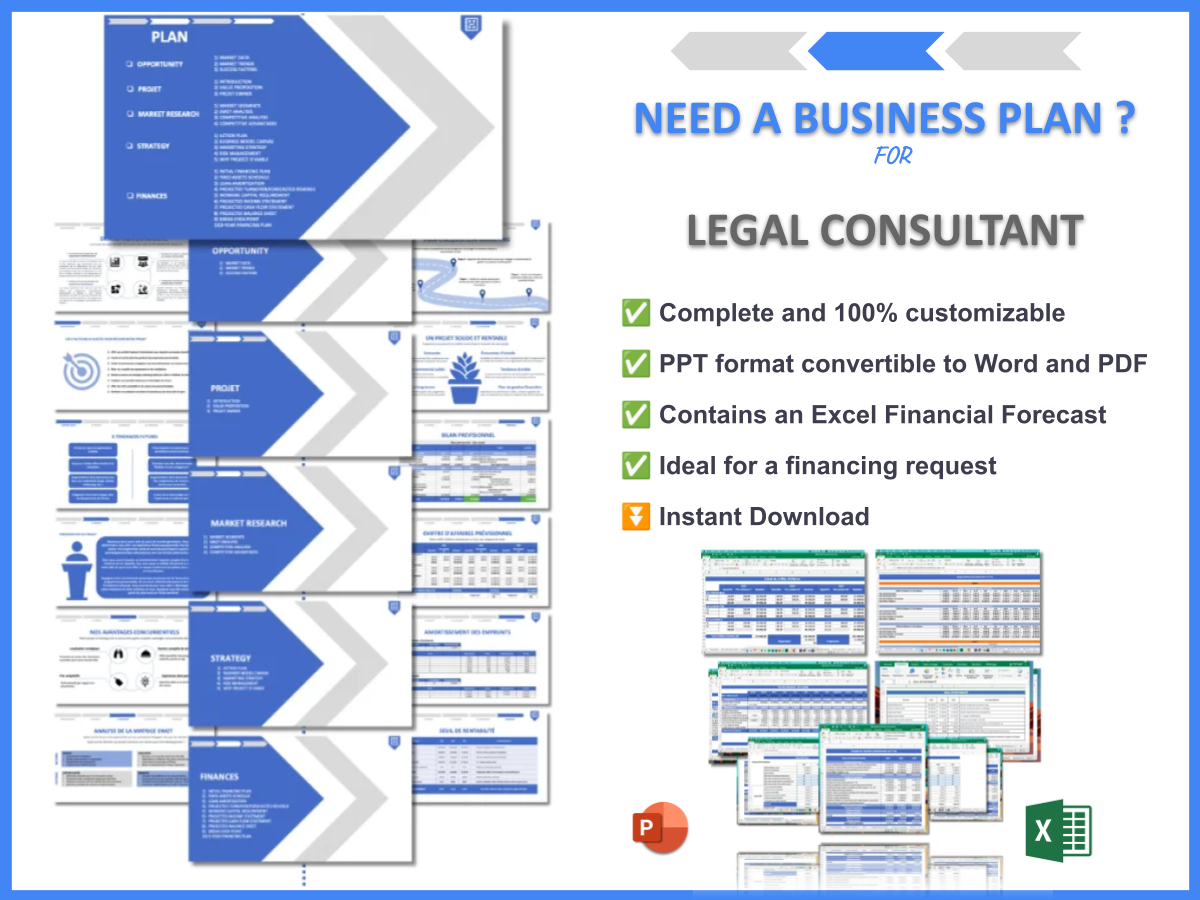

In summary, exploring Legal Consultant Funding Options is crucial for establishing and growing your consultancy. Understanding the various funding sources, evaluating the associated risks, and staying informed about industry trends can empower you to make informed decisions that align with your business goals. For those looking to create a solid foundation for their consultancy, consider utilizing the Legal Consultant Business Plan Template. This template provides a comprehensive framework to help you articulate your vision and secure funding effectively.

Additionally, we encourage you to explore our related articles that offer valuable insights and strategies for legal consultants:

- Legal Consultant SWOT Analysis: Key Insights

- Legal Consultants: How to Maximize Profits

- Legal Consultant Business Plan: Template and Examples

- Legal Consultant Financial Plan: Essential Steps and Example

- The Ultimate Guide to Starting a Legal Consulting Business: Step-by-Step Example

- Building a Marketing Plan for Legal Consultant Services (+ Example)

- Create a Business Model Canvas for Legal Consultant: Examples and Tips

- Customer Segments for Legal Consultants: Examples and Strategies

- How Much Does It Cost to Start a Legal Consultant Business?

- How to Calculate the Feasibility Study for Legal Consultant?

- How to Calculate Risks in Legal Consultant Management?

- How to Analyze Competition for Legal Consultant?

- How to Address Legal Considerations in Legal Consultant?

- Legal Consultant Growth Strategies: Scaling Examples

FAQ

What are the best options for funding a legal consultancy?

When considering Legal Consultant Funding Options, the best choices depend on your business model and goals. Traditional sources like bank loans and SBA loans offer structured repayment plans. In contrast, crowdfunding and angel investments can provide capital without immediate repayment obligations, though they may require giving up equity in your business.

How can I secure government grants for my legal consultancy?

Securing government grants involves identifying programs that align with your consultancy’s mission. Research available grants and prepare a detailed proposal outlining how the funds will be used to create a positive impact. Emphasizing your commitment to community service can enhance your chances of receiving funding.

What are the risks associated with financing a legal consulting business?

Risks of financing a legal consulting business include the potential for debt from traditional loans, loss of control from equity financing, and the challenges of running a successful crowdfunding campaign. Understanding these risks and preparing a solid financial plan can help mitigate their impact on your consultancy.

How can I effectively manage cash flow in my legal consultancy?

Managing cash flow is crucial for the sustainability of your consultancy. Regularly tracking income and expenses, creating a budget, and preparing for fluctuations in revenue can help maintain positive cash flow. Utilizing accounting software can also streamline this process and provide valuable insights.

What funding trends should legal consultants be aware of?

Legal consultants should be aware of emerging trends such as the rise of legal tech startups, which attract venture capital, and the increasing popularity of online funding platforms. Understanding these trends can help you identify new opportunities for funding and growth in the legal sector.

How can I create a solid business plan for my legal consultancy?

Creating a solid business plan involves outlining your consultancy’s vision, market analysis, financial projections, and funding strategies. Utilizing a Legal Consultant Business Plan Template can provide a structured framework to articulate your goals and secure necessary funding effectively.