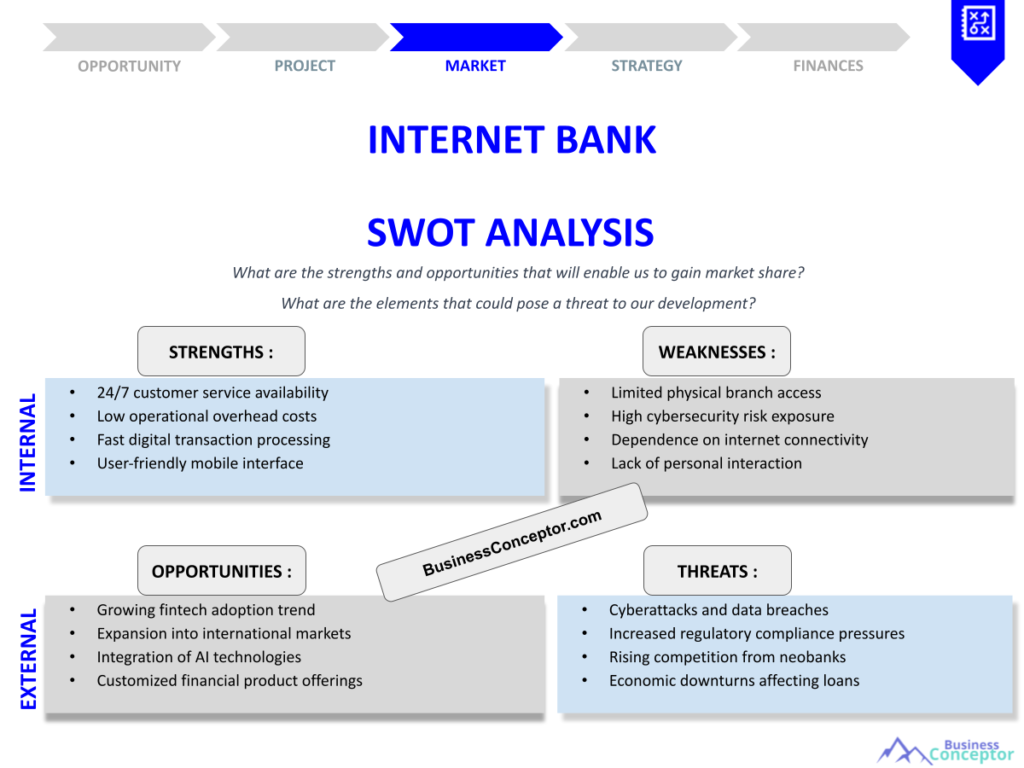

In today’s fast-paced digital world, did you know that over 70% of consumers prefer online banking over traditional banking methods? This shift is not just a trend; it represents a fundamental change in how we manage our finances. Internet Bank SWOT Analysis is essential for understanding the dynamics of this rapidly evolving sector. A SWOT analysis provides a framework for evaluating the strengths, weaknesses, opportunities, and threats faced by internet banks, enabling them to strategize effectively and optimize their offerings.

- Understanding the importance of SWOT analysis in banking.

- Exploring the strengths of internet banks.

- Identifying weaknesses that digital banks face.

- Analyzing opportunities for growth in online banking.

- Recognizing potential threats to internet banks.

- Insights into customer preferences for online banking.

- The role of technology in shaping banking strategies.

- The impact of regulations on internet banking.

- Case studies highlighting successful internet banks.

- Strategies for maximizing business potential in the digital age.

Understanding SWOT Analysis in Internet Banking

SWOT analysis serves as a vital tool for internet banks to navigate the complexities of the financial landscape. By assessing internal strengths and weaknesses alongside external opportunities and threats, banks can craft strategies that align with market demands. For instance, a bank’s strength might include a robust digital platform that provides seamless user experiences, while a weakness could be a lack of customer trust due to security concerns.

Take, for example, the rise of mobile banking apps. Many internet banks have leveraged their technological prowess to create user-friendly applications that enhance customer engagement. However, they also face the challenge of keeping these platforms secure against cyber threats. As we delve deeper into the world of internet banking, we will explore how these factors play into the overall SWOT analysis.

| Strengths | Weaknesses |

|---|---|

| Advanced technology | Security concerns |

| Cost-effective operations | Limited personal interaction |

- Internet banks often offer lower fees than traditional banks.

- They provide convenient access to financial services anytime, anywhere.

- However, they must continuously innovate to stay ahead of competitors.

– “Innovation distinguishes between a leader and a follower.” – Steve Jobs

Strengths of Internet Banks

When we talk about the strengths of internet banks, the first thing that comes to mind is their ability to offer unparalleled convenience. With 24/7 access to banking services, customers can manage their finances at their own pace. This flexibility is a significant draw for tech-savvy consumers who value time and efficiency. Moreover, many internet banks have lower operating costs, allowing them to pass savings onto customers in the form of reduced fees and better interest rates.

For instance, banks that operate solely online can eliminate the costs associated with maintaining physical branches, making them more competitive in pricing. Statistically, customers who use internet banking report higher satisfaction rates due to the ease of access and improved service efficiency. This is a critical strength that internet banks must leverage to build customer loyalty and drive growth.

- Offer 24/7 accessibility to banking services.

- Provide lower fees and better interest rates.

- Use advanced technology for improved customer experience.

– The above steps must be followed rigorously for optimal success.

Weaknesses of Internet Banks

Despite their strengths, internet banks face several weaknesses that can hinder their growth. One major concern is the lack of personal interaction. Many customers still prefer face-to-face communication when dealing with financial matters. This can be a barrier for some consumers who are hesitant to trust an institution they cannot physically visit.

Another weakness is the ongoing risk of cyber threats. Internet banks must invest heavily in cybersecurity measures to protect customer data. Any breach can lead to a loss of trust and significant financial repercussions. For example, a well-known internet bank suffered a data breach that compromised thousands of customer accounts. This incident not only damaged their reputation but also prompted stricter regulations in the industry. Thus, understanding and addressing these weaknesses is crucial for internet banks to sustain their market presence.

| Weaknesses | Mitigation Strategies |

|---|---|

| Lack of personal interaction | Enhance customer support services |

| Vulnerability to cyber threats | Invest in robust security measures |

- “To succeed, you must first believe that you can.” – Nikos Kazantzakis

Opportunities for Internet Banks

As we look ahead, the opportunities for internet banks are vast and varied. One significant opportunity lies in the increasing adoption of digital payment systems. With more consumers opting for cashless transactions, internet banks can capitalize on this trend by offering innovative payment solutions. Furthermore, there is a growing demand for financial inclusion. Internet banks can reach underserved populations by providing accessible banking services through mobile apps and online platforms. This not only expands their customer base but also fulfills a social responsibility to provide banking access to all.

Additionally, leveraging data analytics can help internet banks better understand customer preferences and tailor their services accordingly. By offering personalized financial products, they can enhance customer satisfaction and loyalty. This proactive approach can significantly boost their competitive edge in the ever-evolving landscape of online banking.

| Opportunities | Examples |

|---|---|

| Digital payment solutions | Mobile wallets |

| Financial inclusion initiatives | Microloans for underserved communities |

- Expanding into emerging markets can provide significant growth potential.

- Partnering with fintech companies can enhance service offerings.

Threats to Internet Banks

While opportunities abound, internet banks must also navigate various threats. The competitive landscape is one of the most significant challenges. With traditional banks venturing into online services, internet banks face increased competition from established players who have loyal customer bases. Additionally, regulatory pressures continue to mount. Governments are implementing stricter regulations to protect consumers, which can pose challenges for internet banks trying to innovate quickly. Compliance with these regulations can be costly and time-consuming.

Moreover, economic fluctuations can impact consumer behavior. During economic downturns, consumers may become more risk-averse, leading to decreased demand for certain banking products. Understanding these threats is crucial for internet banks to adapt and remain resilient. By being aware of the external factors that could impact their operations, they can develop strategies to mitigate these risks effectively.

| Threats | Potential Impact |

|---|---|

| Increased competition | Loss of market share |

| Stricter regulations | Higher compliance costs |

- “The only limit to our realization of tomorrow will be our doubts of today.” – Franklin D. Roosevelt

Implementing SWOT Analysis in Strategy

To effectively implement a SWOT analysis, internet banks must integrate the insights gained into their overall strategy. This means not only identifying strengths and weaknesses but also developing actionable plans to leverage opportunities and mitigate threats. For instance, if a bank recognizes its strength in technology, it should invest in further innovations that enhance user experience. Similarly, if regulatory changes pose a threat, banks should proactively engage with regulators to stay ahead of compliance requirements.

Furthermore, regular reviews of the SWOT analysis are essential. As the market evolves, so too should the strategies of internet banks. Continuous adaptation will ensure that they remain competitive and relevant in the fast-paced digital landscape. By fostering a culture of innovation and responsiveness, internet banks can position themselves for long-term success.

| Implementation Steps | Description |

|---|---|

| Regular SWOT reviews | Adapt strategies to changing market conditions |

| Engage with regulators | Stay informed about compliance requirements |

- “The best way to predict the future is to create it.” – Peter Drucker

Real-World Examples of Internet Bank Success

Examining real-world examples can provide valuable insights into how internet banks successfully navigate their SWOT analyses. Take, for instance, a leading digital bank that thrived by focusing on customer experience. They implemented user-friendly features in their app, such as budgeting tools and personalized financial advice, which significantly boosted customer satisfaction. This approach not only attracted new customers but also retained existing ones, showcasing the importance of understanding customer needs.

Another example is an internet bank that capitalized on the trend of financial inclusion by offering microloans to small business owners in underserved communities. This not only expanded their customer base but also built goodwill and a positive reputation in the market. These success stories demonstrate that a well-executed SWOT analysis can lead to innovative strategies that drive growth and establish a competitive edge.

| Success Stories | Key Takeaways |

|---|---|

| Digital bank improving customer experience | Focus on user-friendly technology |

| Internet bank offering microloans | Addressing financial inclusion needs |

- “Success is not the key to happiness. Happiness is the key to success.” – Albert Schweitzer

Key Recommendations for Internet Banks

For internet banks to maximize their potential, several key recommendations should be followed. First, investing in customer education is essential. By helping customers understand the benefits of online banking, banks can build trust and encourage adoption. This can be achieved through informative webinars, tutorials, and customer support that addresses common concerns and questions.

Additionally, banks should prioritize cybersecurity measures. Ensuring robust security can protect customer data and enhance their reputation. Regularly updating security protocols and educating customers on safe online practices will foster a secure banking environment. Furthermore, embracing new technologies, such as artificial intelligence and machine learning, can streamline operations and improve service delivery, making banking more efficient and user-friendly.

| Recommendations | Actions |

|---|---|

| Invest in customer education | Host webinars and workshops |

| Prioritize cybersecurity | Regularly update security protocols |

- “The future belongs to those who believe in the beauty of their dreams.” – Eleanor Roosevelt

Final Thoughts on Internet Bank SWOT Analysis

To conclude, a thorough Internet Bank SWOT Analysis can be a game-changer for digital banks looking to enhance their business potential. By understanding their internal strengths and weaknesses, as well as external opportunities and threats, internet banks can formulate effective strategies that align with market demands. This structured approach not only aids in strategic planning but also helps in anticipating market shifts and adapting accordingly.

Practical advice for internet banks includes regularly reviewing their SWOT analysis, being proactive about customer engagement, and investing in technology. These actions can lead to improved customer experiences and sustained growth in a competitive landscape. By embracing change and focusing on innovation, internet banks can secure their place in the future of banking.

- “Success comes to those who persevere.”

- Regularly update the SWOT analysis.

- Engage customers for feedback.

- Invest in cybersecurity and technology.

Conclusion

In summary, conducting a thorough Internet Bank SWOT Analysis is crucial for maximizing business potential in today’s digital banking landscape. By understanding their internal strengths and weaknesses, as well as external opportunities and threats, internet banks can formulate effective strategies that drive growth and improve customer satisfaction. This structured approach enables banks to adapt to market changes and stay competitive.

For those looking to start or improve their internet banking venture, consider using our Internet Bank Business Plan Template for a solid foundation. Additionally, you can explore these related articles to enhance your understanding and strategies:

- Internet Bank Profitability: Ensuring Financial Success

- How to Create a Business Plan for Your Internet Bank: Example Included

- Developing a Financial Plan for Internet Bank: Key Steps (+ Template)

- Guide to Starting an Internet Bank

- Create an Internet Bank Marketing Plan: Tips and Example

- Building a Business Model Canvas for an Internet Bank: A Comprehensive Guide

- Understanding Customer Segments for Internet Banks: Examples and Strategies

- How Much Does It Cost to Start an Internet Bank?

- Internet Bank Feasibility Study: Comprehensive Guide

- Internet Bank Risk Management: Comprehensive Strategies

- Internet Bank Competition Study: Comprehensive Analysis

- Internet Bank Legal Considerations: Comprehensive Guide

- Internet Bank Funding Options: Expert Insights

- Internet Bank Growth Strategies: Scaling Guide

FAQ Section

What is an Internet Bank SWOT Analysis?

An Internet Bank SWOT Analysis is a strategic tool used to assess the strengths, weaknesses, opportunities, and threats that internet banks face, helping them to develop effective business strategies.

How do strengths help internet banks succeed?

Strengths such as advanced technology and lower operational costs allow internet banks to provide better services and attract more customers, leading to increased profitability.

What are common weaknesses of internet banks?

Common weaknesses include a lack of personal interaction and vulnerability to cyber threats, which can hinder customer trust and satisfaction.

What opportunities exist for digital banks today?

Opportunities for digital banks include the growing demand for financial inclusion and the increasing adoption of digital payment systems, which can expand their customer base.

How do threats affect internet banks?

Threats such as increased competition and stricter regulations can impact the market share and operational costs of internet banks, making it essential for them to adapt quickly.

What role does technology play in internet banking?

Technology is a key driver for internet banks, enabling them to offer innovative services, enhance customer experiences, and improve operational efficiency.

How can customer feedback improve online banking services?

Engaging customers for feedback allows internet banks to identify areas for improvement, tailor their services, and foster customer loyalty.

What are the key trends in internet banking?

Key trends include the rise of mobile banking, the shift towards cashless transactions, and the increasing importance of cybersecurity in maintaining customer trust.

How do regulations impact internet banks?

Regulations can impose compliance costs on internet banks, but they also protect consumers and promote fair competition in the banking industry.

What strategies can internet banks implement for growth?

Strategies for growth may include investing in marketing, enhancing customer service, and exploring partnerships with fintech companies to expand their offerings.