Did you know that nearly 75% of consumers prefer online banking over traditional methods? Internet Bank Customer Segments are crucial for understanding the diverse needs of these digital users. With the rise of fintech and the digitalization of banking services, it’s vital for banks to identify and cater to distinct customer segments. This helps them tailor their offerings and enhance customer satisfaction, ultimately leading to higher retention and loyalty. In this article, we will explore different customer segments in internet banking, provide examples, and share effective strategies for engagement.

- Understanding the importance of customer segmentation in internet banking.

- Exploring various customer types and their specific needs.

- Analyzing user behavior and preferences in digital banking.

- Discussing strategies for effective engagement with different segments.

- Highlighting case studies of successful internet banks.

- Providing actionable steps for banks to improve customer experience.

- Examining the impact of technology on customer segmentation.

- Addressing challenges in targeting diverse customer segments.

- Sharing insights on future trends in internet banking.

- Concluding with key takeaways and a call to action.

Understanding Customer Segments in Internet Banking

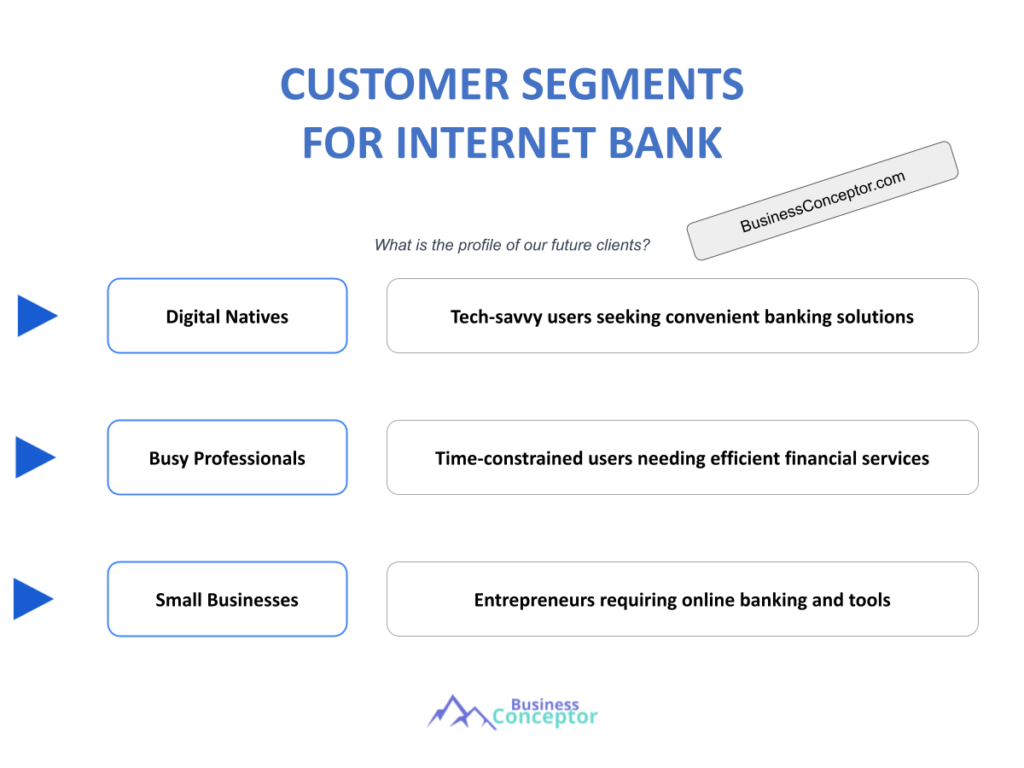

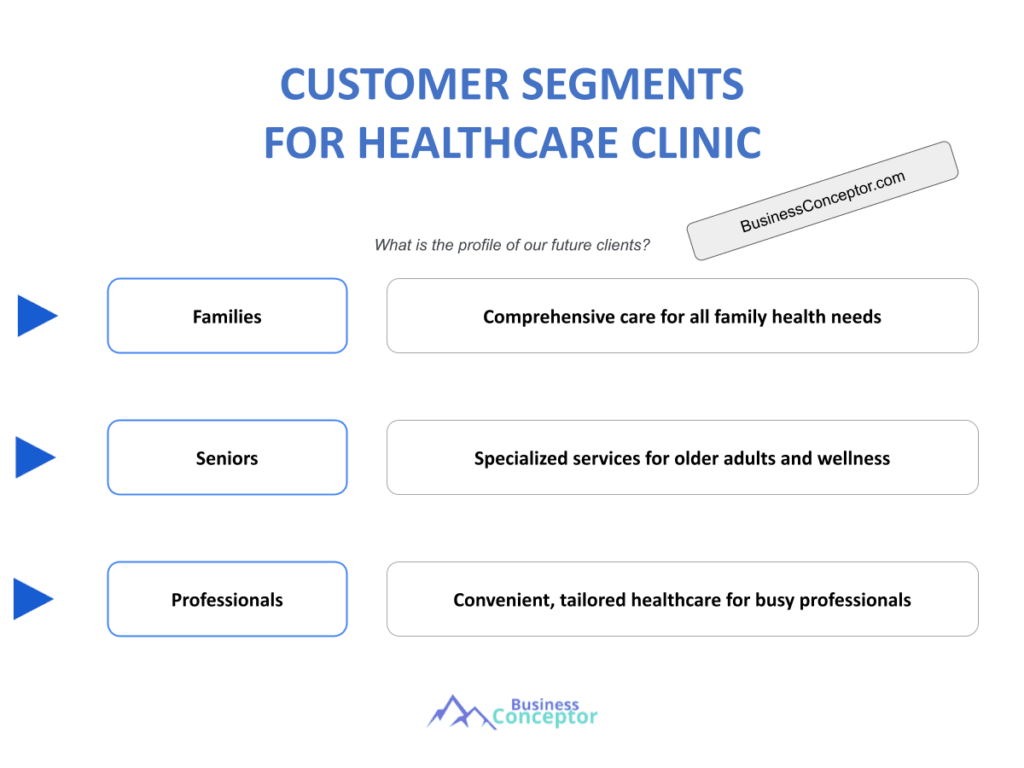

In the world of internet banking, understanding customer segments is not just a luxury; it’s a necessity. Banks must recognize that not all customers are created equal. Each segment has unique preferences, behaviors, and needs that influence how they interact with banking services. By identifying these segments, banks can tailor their marketing efforts, product offerings, and customer support to better serve their diverse clientele.

For instance, millennials may prioritize mobile banking features, while older generations might focus more on security and ease of use. Research indicates that customer preferences can vary widely based on demographics, such as age, income, and tech-savviness. Banks that take the time to analyze these differences can create more personalized experiences, leading to increased satisfaction and loyalty.

In summary, understanding customer segments allows internet banks to meet the specific needs of their users effectively. This foundational knowledge sets the stage for deeper exploration into the various customer types and the strategies that can be employed to engage them effectively.

| Key Customer Segments | Characteristics |

|---|---|

| Millennials | Tech-savvy, value convenience |

| Baby Boomers | Focus on security, prefer personal interaction |

| Gen Z | Seek innovative features, socially conscious |

| Small Business Owners | Require tailored business solutions |

- Understanding unique customer needs

- Tailoring products and services

- Enhancing customer engagement strategies

– “Understanding your customer is the key to success.”

Identifying Key Customer Types

When it comes to internet banking, identifying key customer types is essential for developing effective strategies. Banks should segment their customers into distinct categories based on various criteria, such as age, income level, and banking habits. This segmentation allows banks to create targeted marketing campaigns that resonate with each group.

For example, young professionals may be more inclined to use budgeting tools and mobile payment options, while retirees might prioritize access to financial advisors. According to studies, 58% of customers express a desire for personalized banking experiences tailored to their specific needs. By analyzing user data and conducting market research, banks can pinpoint these key segments and adjust their offerings accordingly.

Ultimately, identifying key customer types empowers banks to enhance user satisfaction and retention. This brings us to the next section, where we will delve into effective engagement strategies that resonate with these diverse segments.

- Conduct market research to identify customer segments.

- Analyze user behavior and preferences.

- Tailor marketing messages to each segment.

– The above steps must be followed rigorously for optimal success.

Engagement Strategies for Different Segments

Engaging different customer segments in internet banking requires a strategic approach. Each segment has distinct preferences and behaviors that must be addressed through targeted engagement strategies. Banks must leverage digital tools and personalized marketing to create meaningful interactions with their customers.

For instance, offering tailored financial advice through chatbots can significantly enhance the customer experience for tech-savvy users. On the other hand, providing educational resources about internet banking can help less tech-savvy customers feel more comfortable navigating digital platforms. A report from Deloitte shows that banks implementing personalized engagement strategies see a 20% increase in customer satisfaction.

In conclusion, effectively engaging with diverse customer segments involves understanding their unique preferences and delivering tailored solutions. This leads us to the next section, where we will explore the role of technology in enhancing customer segmentation.

- Tailored marketing messages

- Personalized financial advice

- Educational resources for less tech-savvy users

– “To succeed, always move forward with a clear vision.”

The Role of Technology in Customer Segmentation

Technology plays a pivotal role in modern customer segmentation for internet banks. With advanced data analytics tools, banks can gather and analyze vast amounts of customer data to identify trends and preferences. This technological advantage allows banks to create more accurate customer profiles and segment their audience effectively.

For example, machine learning algorithms can analyze customer behavior on banking apps and websites, providing insights into user preferences and habits. This data can then be used to tailor marketing strategies and improve user experience. According to a report from Accenture, banks utilizing data-driven segmentation strategies can increase their marketing ROI by up to 15%.

In summary, leveraging technology for customer segmentation not only enhances the accuracy of customer profiles but also enables banks to create more personalized experiences. Next, we will discuss how banks can overcome challenges in targeting diverse customer segments.

| Technology Tools | Benefits |

|---|---|

| Data Analytics | Improved customer insights |

| Machine Learning | Enhanced personalization |

| Customer Relationship Management (CRM) | Streamlined customer interactions |

- Invest in data analytics tools

- Utilize machine learning for insights

- Implement CRM systems for better interactions

Overcoming Challenges in Targeting Diverse Segments

While targeting diverse customer segments presents opportunities, it also comes with challenges. Banks must navigate varying preferences, behaviors, and levels of financial literacy among their customers. Understanding these challenges is crucial for developing effective strategies that resonate with each segment.

For instance, some customers may feel overwhelmed by digital banking tools, leading to frustration and disengagement. To address this, banks can offer user-friendly interfaces and provide customer support to guide users through the digital landscape. A survey found that 40% of customers abandon their online banking due to complexity, highlighting the need for banks to simplify their offerings.

In conclusion, overcoming challenges in targeting diverse segments requires a commitment to understanding customer needs and providing accessible solutions. This brings us to the next section, where we will explore case studies of successful internet banks that have effectively engaged their customer segments.

| Challenges | Solutions |

|---|---|

| Varying preferences | Tailored offerings |

| Complexity of tools | User-friendly interfaces |

- Simplify digital banking tools

- Provide customer support

- Regularly gather customer feedback

Case Studies of Successful Internet Banks

Examining case studies of successful internet banks can provide valuable insights into effective customer segmentation strategies. These banks have successfully identified and engaged various customer segments, leading to increased satisfaction and loyalty.

For example, Chime, an online banking platform, has effectively targeted millennials by offering no-fee accounts and budgeting tools. Their marketing campaigns resonate with younger audiences, focusing on financial wellness and transparency. As a result, Chime has experienced rapid growth, attracting millions of users in a short time frame.

In summary, case studies like Chime’s illustrate the importance of understanding customer segments and tailoring strategies accordingly. This sets the stage for our next section, where we will discuss future trends in internet banking and customer segmentation.

| Bank Name | Key Strategies |

|---|---|

| Chime | No-fee accounts, budgeting tools |

| Ally Bank | High-interest savings accounts, customer education |

- Identify target segments

- Tailor offerings to meet their needs

- Monitor engagement and adjust strategies

Future Trends in Internet Banking

As the digital banking landscape continues to evolve, several future trends are emerging that will impact customer segmentation strategies. Banks must stay ahead of these trends to remain competitive and effectively serve their customers.

One notable trend is the rise of artificial intelligence in banking, which can enhance personalization and improve customer interactions. Additionally, the growing focus on sustainability and ethical banking practices is influencing consumer preferences, particularly among younger generations. Banks that align their values with those of their customers will likely see increased loyalty and engagement.

In conclusion, staying attuned to future trends is essential for internet banks to adapt their customer segmentation strategies. This leads us to the final section, where we will summarize the key takeaways and provide actionable recommendations.

| Future Trend | Impact on Segmentation |

|---|---|

| Artificial Intelligence | Enhanced personalization |

| Sustainability Focus | Increased customer loyalty |

- Monitor industry trends

- Embrace new technologies

- Align with customer values

Key Takeaways and Recommendations

Understanding customer segments for internet banks is vital for creating tailored experiences that enhance satisfaction and loyalty. By recognizing the unique needs and preferences of different customer types, banks can develop strategies that resonate with their audience.

Additionally, leveraging technology and data analytics is crucial for effective segmentation. Banks that invest in these areas will be better equipped to understand their customers and deliver personalized services that meet their expectations.

In summary, the journey to understanding customer segments in internet banking involves continuous learning and adaptation. As we wrap up, let’s highlight some final recommendations for banks looking to enhance their customer engagement strategies.

| Recommendation | Importance |

|---|---|

| Invest in customer research | Understand unique needs |

| Utilize technology for insights | Enhance personalization |

| Provide ongoing support | Build trust and loyalty |

- Conduct regular market research

- Embrace technology for better insights

- Focus on customer education and support

Final Thoughts on Internet Bank Customer Segments

In conclusion, understanding customer segments for internet banks is not merely a strategy; it’s a commitment to serving customers better. By recognizing the unique needs of each segment, banks can create tailored experiences that foster loyalty and satisfaction.

Practical advice includes regularly updating customer profiles, leveraging data analytics for insights, and maintaining open lines of communication with customers. These efforts will not only enhance customer experience but also drive business growth in an increasingly competitive landscape.

Ultimately, the key to success in internet banking lies in understanding and addressing the diverse needs of customers. As we move forward, let’s keep these principles in mind to create a banking experience that truly resonates with users.

– “Success comes to those who persevere.”

- Regularly update customer segmentation data.

- Leverage technology for personalized experiences.

- Engage with customers through educational resources.

Conclusion

To sum it up, understanding customer segments for internet banks is crucial for developing effective strategies that cater to diverse user needs. By leveraging technology and continuously adapting to market trends, banks can create personalized experiences that enhance customer satisfaction and loyalty. For those looking to establish a solid foundation for their internet banking business, consider utilizing our Internet Bank Business Plan Template to streamline your planning process.

- Article 1: SWOT Analysis for Internet Bank: Maximizing Business Potential

- Article 2: Internet Bank Profitability: Ensuring Financial Success

- Article 3: How to Create a Business Plan for Your Internet Bank: Example Included

- Article 4: Developing a Financial Plan for Internet Bank: Key Steps (+ Template)

- Article 5: Guide to Starting an Internet Bank

- Article 6: Create an Internet Bank Marketing Plan: Tips and Example

- Article 7: Building a Business Model Canvas for an Internet Bank: A Comprehensive Guide

- Article 8: How Much Does It Cost to Start an Internet Bank?

- Article 9: Internet Bank Feasibility Study: Comprehensive Guide

- Article 10: Internet Bank Risk Management: Comprehensive Strategies

- Article 11: Internet Bank Competition Study: Comprehensive Analysis

- Article 12: Internet Bank Legal Considerations: Comprehensive Guide

- Article 13: Internet Bank Funding Options: Expert Insights

- Article 14: Internet Bank Growth Strategies: Scaling Guide

FAQ Section

What are internet bank customer segments?

Internet bank customer segments refer to the various groups of users classified based on their unique needs, preferences, and behaviors in the realm of digital banking.

How can banks identify their customer segments?

Banks can identify their customer segments through comprehensive market research, analysis of user behavior, and gathering customer feedback.

Why is customer segmentation important for internet banks?

Customer segmentation is important for internet banks because it enables them to tailor their services and marketing efforts, ultimately improving customer satisfaction and loyalty.

What tools can banks use for customer segmentation?

Banks can utilize tools such as data analytics software, machine learning algorithms, and customer relationship management (CRM) systems to effectively segment their customers.

How can banks engage different customer segments?

Banks can engage different customer segments by offering personalized marketing, tailored products, and educational resources that cater to the specific needs of each group.

What challenges do banks face in targeting diverse segments?

Challenges include navigating varying preferences, levels of financial literacy, and the complexity of digital banking tools, which may lead to customer frustration.

What are some effective engagement strategies for banks?

Effective engagement strategies include delivering tailored marketing messages, providing personalized financial advice, and making educational resources available for less tech-savvy users.

How does technology impact customer segmentation in banking?

Technology enhances customer segmentation by providing valuable data insights, enabling personalized experiences, and streamlining customer interactions.

What future trends should banks be aware of?

Banks should pay attention to trends such as the rise of artificial intelligence, the increasing demand for sustainability, and evolving consumer preferences to remain competitive.

What are the key takeaways for banks looking to improve customer segmentation?

Key takeaways include investing in customer research, leveraging technology for better insights, and focusing on customer education and support.